RNS Number:4075E

TriVest VCT PLC

30 May 2001

TriVest VCT Plc

Chairman's Interim Statement

I am very pleased to present my first Interim Report of the

Company for the period from 2nd November 2000 to 31st March,

2001.

Our Offer for Subscription opened on 18th October 2000 and

as at 31st March 2001 had raised #32,905,800. The Offer

closed on 6th April 2001 having raised a total of

#41,801,516.

Trading in our shares commenced on 15th November 2000.

As anticipated, at this stage in its life, the Company's

portfolio is comprised mainly of short-dated Gilt-edged

securities, which are managed by Cazenove Fund Management

Limited. Nevertheless, in the period under review, each of

the three Venture Capital Fund Managers has been active in

identifying suitable companies in which TriVest can

participate as an investor. It is already apparent that the

Multi-Manager approach to selecting venture capital

situations is producing a well diversified investment

portfolio.

At 31st March, 2001, LICA Development Capital Limited had

made five investments in i-documentsystems group plc

(Electronic Document Management), LeSac Limited (Industrial

Packaging), MAST Limited (Industrial Heavy Machine Tools),

Watkins Books Limited (Retail and Publishing) and Zynergy

Group Limited (Meditech) respectively.

VCF Partners had made three investments in Heritage Image

Partnership Limited (Image Library), iDesk plc (Technical

Help Desks) and Xpert Client Systems Limited (Software Asset

Management).

GLE Development Capital Limited had invested in T.J Brent

Limited (Water Utility).

Full descriptions of each of these investments are provided

later in my report.

In all, #5,717,625 had been invested in venture capital

companies by 31st March, 2001 with a further #705,000 now

earmarked for another investment.

As stated in our Prospectus, the Board anticipates having

between 80 and 90 per cent of the net funds raised in the

recent issue of shares invested in Qualifying Companies

within three years, or by April 2004, at the latest.

At 31st March, 2001 revenue reserves available for

distribution to shareholders were #135,510. The Board does

not propose to declare an interim dividend but expects to be

able to propose a final dividend for the period to 30th

September 2001.

I am pleased that the Company has made such positive

progress already and I look forward to keeping shareholders

informed on developments in our Company.

David Atterton, Chairman.

30th May, 2001.

Investment Portfolio Summary

Cost Date of

investment

GLE Development Capital Limited #

T J Brent Limited 900,000 December 2000

Specialist contractor to water

utility sector

-------

900,000

-------

LICA Development Capital Limited

i-documentsystems group plc 517,625 December 2000

Electronic Document Management

LeSac Limited 999,999 February 2001

Manufactures plastic packaging

for powder/granular products and

liquids

Machinery & Automated Systems 1,000,000 February 2001

Technology Limited (MAST)

Development of Vertical Turning

and Machining Centres

Zynergy Group Limited 1,000,000 February 2001

Commercialising new materials

for medical devices

Watkins Books Limited 500,000 March 2001

Supplier of books in Alternative

Sciences, Health, Philosophy

and related sectors

-----------

#4,017,624

-----------

VCF Partners

iDesk plc 250,000 November 2000

Technical Help Desks

Heritage Image Partnership Limited 300,000 March 2001

Internet Image Library

Xpert Client Systems Limited 250,000 March 2001

Software Asset Management

--------

#800,000

--------

Fixed Interest Securities #16,726,000

-----------

TOTAL #22,443,624

-----------

NOTE:

All the above venture capital investments have been valued at

cost except for i-documentsystems group plc which is listed on

AIM and has been valued at #583,334 in line with the mid-market

price as at 31st March 2001.

Completed Investments as at 31st March 2001

GLE Development Capital Limited

T J Brent

T J Brent is a specialist contractor, primarily to the water

utility sector, and is involved in the laying and

refurbishment of pipes, mains connection of houses and

installation and replacement of water meters. The company

also has divisions engaged in the management of mechanical

and electrical products and the construction of water

pumping and sewage treatment plants. Based in Bodmin, the

company has operations throughout the West Country and

elsewhere in the UK.

TriVest invested #900,000 alongside other institutional

investors in December 2000 to finance the management buy-out

of the company from its parent, Pennon Group plc. The

investment has been valued at cost as it was completed less

than a year ago and there have been no audited accounts

available since investment.

LICA Development Capital Limited

i-documentsystems group plc

i-documentsystems group plc is an established and fast

growing software company which specialises in the

development of products for document, content and

information management.

The Group's principal product is Image-gen a sophisticated

web-based software package which allows a complex paper-

based process to be converted into a straightforward and

robust electronic process leading to significant savings in

cost and time. TriVest invested #517,625 in December 2000.

The company is now listed on AiM, and at 29th May 2001 (the

latest practicable date prior to the publication of this

announcement), the value of TriVest's investment was

#562,500.

LeSac Limited

LeSac is commercialising a unique packaging system that

offers significant advantages over existing solutions

through a combination of lower material content, increased

space utilisation and lower environmental tax levies.

During 1999 and early 2000, LeSac was restricted to the 10

litre liquid/solid product while the third generation

machine was under development, so major potential customers'

needs could not be satisfied during this development phase.

The third generation machine, however, has now been fully

developed. The pre-production machine has also been fully

commissioned and now gives LeSac capacity to receive major

orders. There are presently a number of large enquiries

including Cerol, Brookleman, Dow Chemicals and Rau, any of

which would be a significant step for LeSac. TriVest made an

investment of #1,000,000 in February 2001.

Machinery & Automated Systems Technology Limited (MAST)

MAST is engaged in developing and manufacturing specialist

machine tools, including a Vertical Turning & Machining

Centre and LeSac's third generation packaging machinery.

These machines are now moving from design/launch and pre-

production prototypes, respectively, into full production in

the current year. The first two orders for LeSac machines

have been received and are currently being built. TriVest

made an investment of #1,000,000 in February 2001.

Zynergy Group Limited

Zynergy Group is a rapidly developing global bio-meditech

organisation exploiting its fully-developed materials,

coatings and other similar technologies. These revolutionary

technologies enable and enhance Zynergy's existing

proprietary products in high-value sectors, namely minimally-

invasive cardiology, balloons, stents and orthopaedics as

well as other critical areas, with respiratory and urology

products to follow.

Its US subsidiary, ZCV Inc has obtained FDA and CE Mark

approval for the majority of its first generation of electro-

physiological catheters. Sales have now commenced and are

starting to grow. Progress on a conformal catheter continues

and it is the intention to seek FDA approval in 2001. Sales

in the orthopaedics division continue to grow and are

running at an annual rate in excess of #1.0million. TriVest

made an investment of #1,000,000 in February 2001.

Watkins Books Limited

Watkins is the pre-eminent UK supplier of books and

information in the Alternative Sciences, Health, Philosophy

and related sectors.

Watkins is doubling its retail space in Cecil Court in

Central London. It will launch its first publishing list in

the spring of 2001 and is developing a global Internet

strategy and website. It has expansion plans to become the

pre-eminent global provider in this growing sector. During

the first year under new ownership, the existing and new

management have done much necessary work to reposition the

company for expansion. TriVest made an investment of

#500,000 in March 2001.

VCF Partners

iDesk plc

In November 2000, the Company invested #250,000 in iDesk

plc. iDesk provides telcos, ISPs and other blue chip

customers with outsourced technical help desks, operated

from a call centre in London. iDesk has recently launched

complementary new ASP services based on its proprietary and

licensed CRM and electronic billing software.

Heritage Image Partnership Limited

In March 2001, TriVest invested #300,000 in Heritage Image

Partnership Limited (HIP). HIP is creating a library of

images available to customers over the Internet and has

exclusive access to content from five heritage institutions

including the British Library and the Science Museum. The

images will be sold to media companies and advertising and

design companies.

Xpert Client Systems Limited

In March 2001, TriVest invested #250,000 in Xpert Client

Systems Limited (XCS), a provider of Software Asset

Management tools, with over 100 customers. XCS has developed

software that automatically builds a profile of software

usage on a PC and compares this with the inventory of

software installed on each PC and the licenses owned. As a

result, savings are achievable on licence costs by removing

unused software, administration costs and IT support time.

Unaudited Statement of Total Return

(incorporating the Revenue Account of the Company from 2nd

November 2000 to 31st March 2001)

Notes Period

to 31st

March 2001

(unaudited)

Revenue Capital Total

# # #

Realised gains and - - -

losses on investments

Unrealised gains and - 63,709 63,709

losses on investments

Income 374,689 - 374,689

Investment management 3 (56,396) (169,187)(225,583)

fees

Other expenses (134,303) - (134,303)

------- -------- -------

Return on ordinary 183,990 (105,478)78,512

activities before taxation

Tax on ordinary activities (48,480) 33,837 (14,643)

activities

------- -------- -------

Return attributable to 135,510 (71,641) 63,869

equity shareholders

Dividends in respect of - - -

equity shares

------- -------- --------

Transfer to/(from) reserves #135,510 #(71,641) #63,869

reserves

------- -------- --------

Return per share 5 0.645p (0.341p) 0.304p

Unaudited Balance Sheet

as at 31st March 2001

Notes 31st March

2001

(unaudited)

# #

Fixed Assets

Investments 7 22,507,333

----------

22,507,333

Current Assets

Debtors and prepayments 442,813

Cash at Bank 12,962,032

-----------

13,404,845

Creditors: amounts falling (4,697,503)

due within one year

-----------

Net current assets 8,707,342

----------

Net assets #31,214,675

-----------

Capital and reserves 8

Called up share capital 329,058

Share premium account 30,821,748

Capital reserves - realised (135,350)

Capital reserves - unrealised 63,709

Revenue reserves 135,510

----------

Equity shareholders' funds #31,214,675

----------

Net asset value per share 94.8p

Summarised Cash flow Statement

Period to

31st March

2001

#

Operating activities

Net revenue on activities before taxation 183,990

Capitalised management fees (169,187)

Decrease/(Increase) in creditors (442,813)

Increase in creditors 4,682,860

------------

Net cash inflow/(outflow) from operating 4,254,850

activities

Acquisitions and disposals (22,443,624)

Financing - issue of shares 31,150,806

------------

Increase in cash for period #12,962,032

------------

Reconciliation of net cash flow to movement

in net debt

Increase in cash for the period 12,962,032

Net funds at the start of the period -

------------

Net funds at the end of the period #12,962,032

------------

Notes

1. The revenue column of the statement of total return is

the profit and loss account of the Company.

2. All revenue and capital items in the above statement of

total return derive from continuing operations.

3. In accordance with the policy statement published under

'Management Administration' in the Company's prospectus

dated 13th October 2000, the Directors have charged 75% of

the investment management expenses to capital reserve.

4. Earnings for the period to 31st March 2001 should not

be taken as a guide to the results for the full year.

5. Basic return per Ordinary Share is based on the net

revenue on ordinary activities after taxation and is based

on a weighted average of 21,000,380 Ordinary Shares.

6. The financial information for the period to 31st March

2001 has not been audited, nor does it comprise full

financial statements within the meaning of section 240 of

the Companies Act 1985.

7. Summary of investments during the period.

Fixed Traded Unlisted Loan Total

interest on AIM or Stock

securities traded

on OFEX

# # # # #

Cost/valuation - - - - -

at 2nd November

2000

Purchases at 16,726,000 517,625 1,998,991 3,201,009 22,443,624

cost

Sales - proceeds - - - - -

- realised - - - - -

gains /

(losses)

Increase/decrease (2,000) 65,709 - - 63,709

in unrealised

gains / (losses)

--------- ------ ------- ----------- -----------

Cost/valuation #16,724,000 #583,334 #1,998,991 #3,201,008 #22,507,333

at 31st March

2001 --------- ------ ------- ----------- -----------

Book cost at 16,726,000 517,625 1,998,991 3,201,008 22,443,624

31st March 2001

Unrealised gains (2,000) 65,709 - - 63,709

/ (losses) at

31st March 2001

---------- -------- ---------- ---------- -----------

#16,724,000 #583,334 #1,998,991 #3,201,008 #22,507,333

---------- -------- ---------- --------- -----------

Gains on

investments

Net movement in #(2,000) #65,709 - - #63,709

unrealised

appreciation /

(depreciation)

in the period

--------- ------- ------- ------- --------

Gains / (losses) #(2,000) #65,709 - - #63,709

on investments

at 31st March

2001

--------- ------- ------- ------- --------

8. Capital and reserves

Called Share Realised Unrea- Revenue Total

up premium capital lised reserve

share account reserve capital

capital reserve

At 2nd - - - - - -

November 2000

Net proceeds 329,058 30,821,748 - - - 31,150,806

from issue of

shares

Realised - - - - - -

losses for

period

Transfer on - - - - - -

disposal of

investment

Net capital - - (135,350) - - (135,350)

for period

Increase in - - - 63,709 - 63,709

unrealised

appreciation

on

investments

Retained net - - - - 135,510 135,510

revenue for

period

-------- ----------- ---------- ------- -------- -----------

At 31st March #329,058 #30,821,748 #(135,350) #63,709 #135,510 #31,214,675

2001

-------- ----------- ---------- ------- -------- -----------

9. The interim statement will be posted to shareholders in

due course and will be available to members of the public at

the Company's registered office: Gossard House, 7-8 Savile

Row, London W1S 3PE.

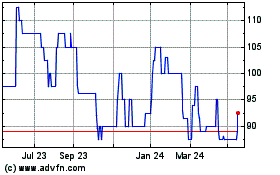

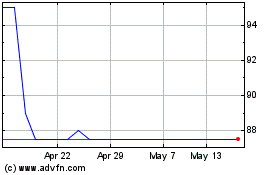

Touchstar (LSE:TST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Touchstar (LSE:TST)

Historical Stock Chart

From Jul 2023 to Jul 2024