TIDMTRX

RNS Number : 7382X

Tissue Regenix Group PLC

02 September 2020

Tissue Regenix Group plc

Unaudited Interim Results for the six months to 30 June 2020

Leeds, 2 September 2020 - Tissue Regenix Group (AIM:TRX)

("Tissue Regenix" or the "Group") the regenerative medical devices

company today announces its unaudited interim results for the six

months to 30 June 2020.

Financial highlights

-- Group revenues of GBP6.1m (H1 2019: GBP6.1m, at constant currency GBP6.2m)

-- Reduction in overhead cost base of GBP1.6m (GBP1.7m excluding

exceptionals) to GBP5.5m (H1 2019: GBP7.1m, at constant currency

GBP7.3m)

-- Significantly reduced Group EBITDA* loss of GBP2.1m (H1 2019:

GBP3.6m, at constant currency GBP3.7m)

-- Cash position of GBP13.7m (H1 2019: GBP10.1m) following

successful equity fundraise of GBP13.8m (net) completed in June

2020.

*EBITDA is a non-IFRS measure that the Group uses to assess its

performance. It is defined as earnings before interest, taxation,

depreciation and amortization.

Commercial highlights

-- Entered a collaboration with a top 10 global healthcare

company for white label manufacturing of a new soft tissue

orthopaedic product

-- Secured additional distribution agreements for Matrix OI,

DentalFix and AmnioWorks to diversify sales portfolio

-- Achieved CE mark certification for OrthoPure(R) XT.

Operational highlights

-- Successfully implemented initiatives to allow minimal

disruption to processing at the facility in San Antonio throughout

COVID-19, enabling the facility to remain fully operational.

Post balance sheet events

-- Phase one of the capacity expansion project commenced at the

US facility, expected to come on-stream in H1 2021

-- Announced relocation of UK facility to Garforth, Leeds as

part of the ongoing overhead cost saving initiatives

-- Entered into a UK distribution agreement with a specialty

supplier of orthopaedic and biologic products for OrthoPure(R)

XT.

Gareth Jones, interim Chief Executive Officer, Tissue Regenix

Group plc, commented: "The first half of 2020 presented a number of

challenges but, despite this, we achieved a number of milestones

which will strengthen our market positioning going forward.

Delivering revenues for the first half of the year comparable to

the same 2019 period demonstrates that, despite COVID-19 related

market disruption, demand for our products remains strong. The

recent fundraising has positioned us to capitalise on these

opportunities, in particular, enabling us to commence the US

facility capacity expansion project and to support our ongoing

working capital requirements. Moreover, the launch of new products,

in conjunction with an ever-increasing customer base, provides us

with greater access to new markets and opportunities in the

future.

Over the past year, we have focused on our programme to

streamline our supply chain and operations and to appropriately

size our overhead cost base. We have continued with this and

reduced our overhead spend by a further GBP1.7m (excluding

exceptionals) during the first half of the year. This, coupled with

an anticipated increase in revenue, is expected to drive the Group

towards its target of achieving a position of break-even.

Due to the ongoing uncertainty around the COVID-19 restrictions,

it remains difficult for the Board to provide forward looking

guidance however, I am pleased with the progress that the Company

continues to make and remain confident in the future prospects of

the business."

For more Information:

Tissue Regenix Group plc Tel: 0330 430 3073

Caitlin Pearson Head of Communications / 07920 272 441

------------------------------------------ --------------------

Stifel Nicolaus Europe Limited (Nominated Tel: 0207 710 7600

Adviser and Broker)

Ben Maddison / Alex Price

------------------------------------------ --------------------

About Tissue Regenix

Tissue Regenix is a leading medical devices company in the field

of regenerative medicine. Tissue Regenix was formed in 2006 when it

was spun-out from the University of Leeds, UK. The Company's

patented decellularisation ('dCELL(R) ') technology removes DNA and

other cellular material from animal and human soft tissue leaving

an acellular tissue scaffold which is not rejected by the patient's

body and can then be used to repair diseased or worn out body

parts. Current applications address many critical clinical needs

such as sports medicine, heart valve replacement and wound

care.

In November 2012 Tissue Regenix Group plc set up a subsidiary

company in the United States - 'Tissue Regenix Wound Care Inc.',

January 2016 saw the establishment of joint venture GBM-V, a multi-

tissue bank based in Rostock, Germany.

In August 2017 Tissue Regenix acquired CellRight Technologies(R)

, a biotech company that specializes in regenerative medicine and

is dedicated to the development of innovative osteoinductive and

wound care scaffolds that enhance healing opportunities of defects

created by trauma and disease. CellRight's human osteobiologics may

be used in spine, trauma, general orthopaedic, foot & ankle,

dental, and sports medicine surgical procedures.

Interim Non-Executive Chairman, Jonathan Glenn

Despite the unprecedented backdrop of the COVID-19 pandemic and

the additional challenges that this presented, during the first six

months of 2020 the Group achieved a number of operational and

commercial milestones and it is encouraging to see progress on a

number of fronts.

Throughout this period, where lockdown restrictions were in

place in both the US and Europe, our US facility remained fully

operational enabling us to continue to supply our customer base.

Although, the postponement of elective surgical procedures has been

felt across the industry, encouragingly we have delivered revenues

for the first half of the year which are in line with the

comparative 2019 period.

We remain focused on our programme to rationalise the Company's

cost base, which was initiated in 2019. This process has continued

into 2020, including the plan to relocate the UK head office and

manufacturing facility and, in conjunction with careful management

of costs across the Group, we have continued to make significant

reductions to our overall cash requirements and overhead base.

In June 2020, the Group secured GBP13.8m (net) of funding via an

equity placing to support the Group's expansion plans and working

capital requirements. Capacity constraints have historically

restricted the ability of the business to meet customer demand and

these additional funds will enable the Group to implement a

capacity expansion programme at its US facility. I am happy to

report that the first phase of this commenced in July 2020 and it

is anticipated to come on-stream in H1 2021. I would like to take

this opportunity to thank both our existing and new shareholders

who have supported us in the fundraise.

Outlook

Having secured the required financing to support the capacity

expansion project and working capital requirements, the business is

focussed on delivering the additional production capabilities in a

timely manner and, once operational, we will be positioned to

achieve future growth potential as markets stabilise following the

COVID-19 pandemic.

Given the uncertainty around the current COVID-19 situation, the

potential for a second wave and the time it will take for postponed

surgeries to be undertaken, it is difficult for the Board to

provide forward looking guidance for the second half of 2020 and

beyond. However, in spite of this uncertainty, the Board is

encouraged by the progress we have made in the first half of the

year, with the start of the expansion programme at the San Antonio

facility, attaining the CE mark certification for OrthoPure(R) XT

and a reduction in the overhead base whilst maintaining revenues,

and as such remain confident about the future prospects for the

Group.

Business Review, Gareth Jones, Interim Chief Executive

Officer

Revenue

During H1 the Group continued to make operational and commercial

progress, despite the backdrop of COVID-19, ending the first half

with year-on-year sales maintained in-line with the first six

months of the prior year at GBP6.1m (H1 2019: GBP6.1m).

The BioRinse portfolio, under the Orthopaedics and Dental

division, returned sales of GBP3.4m (H1 2019: GBP3.0m) a GBP0.4m

year-on-year increase (GBP0.3m at constant currency), despite the

challenging market conditions; highlighting the demand for our

product portfolio and its potential once more normalised market

conditions return.

DermaPure sales, under the BioSurgery division, were impacted by

the postponement of elective surgical procedures in the US as a

result of the COVID-19 pandemic. This was primarily related to

urogynecology procedures and the North East region of the US which

was particularly badly affected during H1. Overall sales for the

first 6 months of the year were down by GBP0.3m year-on-year to

GBP1.7m (H1 2019: GBP2.0m, GBP2.0.m at constant currency).

In Germany, our business was impacted by the lockdown

restrictions imposed early in the pandemic. Although a more

normalised level of business has now returned, the impact of this

lockdown was still felt with sales of GBP1.0m (H1 2019: GBP1.1m)

for the first six months of the year.

During this period, the business was also able to secure a

number of additional customers and as restrictions implemented as

part of the pandemic are relaxed, in conjunction with enhanced

operational capabilities coming on stream, the Group will be well

placed to capitalise on these opportunities.

Commercial development

During the first half of the year, the Group achieved a number

of commercial milestones which will support our strategic growth

drivers and provide the basis for additional opportunities in the

future.

In May 2020, we announced a strategic collaboration with a top

10 global healthcare company for white label manufacturing of a new

soft tissue orthopaedic product, which was the result of an R&D

collaboration between the two companies. We have seen a positive

market response to this launch and anticipate that this product

line will make a material contribution to our top line revenue

growth across the next two years.

In addition, we received the CE mark for OrthoPure(R) XT in June

2020, and in August 2020 we announced our first distribution

agreement with a specialist supplier of orthopaedic and biologic

products covering the UK market. The first modest order has been

received and we expect that the initial delivery will take place

during Q4 2020.

Operations

Throughout the first six months of the year we were able to

fully maintain operations at our San Antonio facility. During this

time, we were also granted US Government backed loans of c.$1m to

support the employee payroll, healthcare, utilities and rent

payments in the US. As these funds were used in the required

manner, under the terms of the loans, we anticipate that the loans

will be forgiven and will not require repayment. In the UK,

operations and technical staff were furloughed for a period in line

with the UK Government advice. With the UK business gearing up its

operational capabilities to ensure the supply of OrthoPure(R) XT

and recommencing various clinical programmes, all furloughed staff

were re-engaged in July.

Having identified the need to expand our processing facility in

San Antonio, TX, to meet the increasing demand for our products, a

second shift was implemented in the current facility during 2019

and we began to see the benefits of this during Q4 2019 and into H1

2020. Furthermore, in August 2019, additional operational

capabilities were secured via a lease with an option to buy on a

21,000 sq. ft facility adjacent to the current plot. Proceeds from

the GBP13.8m equity fundraise completed in June 2020 will enable

this facility to be fitted out, with the first phase of the

expansion programme initiated in July 2020.

This capacity expansion project will be undertaken in phases in

order to deploy the investment capital in the most efficient manner

and bring the new capacity onstream in a staged process to meet the

increasing demand. Phase one will involve moving freezer and

distribution functions into the new facility which will in turn

allow space for additional sterile packaging clean rooms to be

installed in the existing facility. Phase two of the project will

provide a further 10 additional clean rooms in the new

facility.

Funding and cost savings

In June 2020, the Group raised net funds of GBP13.8m through an

accelerated book build and PrimaryBid offering. This capital will

be used to fund the required investment programme and to provide

working capital to support the business.

During 2019, the business commenced a review of its cost base

with a view to appropriately sizing its overhead expenditure whilst

continuing to support operational and commercial activities. This

has continued into 2020 the latest results of which are considered

in the post balance sheet events section. Overall, in the first six

months of the year this programme has contributed to the business

being able to report a reduction in overheads, excluding

exceptional costs, of GBP1.7m in comparison to the first six months

of 2019.

Financial Overview

Revenue

During the first six months of the year revenue remained in line

with the first six months of 2019 at GBP6.1m (H1 2019: GBP6.1m,

GBP6.2m on a constant currency basis).

The Orthopaedic and Dental division recorded an increase in

revenues at GBP3.4m (H1 2019: GBP3.0m, GBP3.1m at constant

currency), as the delays in elective surgeries caused by the

pandemic, particularly in the dental sector, were more than offset

by demand elsewhere. In contrast, the BioSurgery division recorded

a decrease in revenues to GBP1.7m (H1 2019: GBP2.0m, GBP2.0m at

constant currency) also caused by the impact of the COVID-19

pandemic on elective surgeries, particularly in urogynaecology and

the North East region of the USA. The impact of the pandemic also

affected output in Germany where revenues were reported at GBP1.0m

(H1 2019: GBP1.1m, GBP1.1m at constant currency).

Margin

Margin has increased slightly for the period from 47% to 48%

largely due to product mix as BioRinse products from the

Orthopaedics and Dental division made up a greater proportion of

revenues.

Loss for the year

Operating loss in the six months ended 30 June 2020 reduced to

GBP2.5m (H1 2019: GBP4.5m). The cost restructuring programme

commenced at the end of 2019 reduced administrative expenses by

GBP1.7m (excluding exceptionals) during the first six months

compared with the comparable period in 2019. Whilst a small part of

the reduction was COVID-19 related given travel restrictions and

furloughed staff, the majority of these reductions are permanent

and anticipated to continue into the second half of the year.

R&D tax credits of GBP0.2m (H1 2019: GBP0.4m) represent the

estimated tax credit receivable, together with a premium of 40%, on

development costs. The anticipated decrease is expected to arise as

more resources are directed away from the development phase and the

business looks to commercialise more products.

Exceptional costs of GBP0.1m for 2020 represent the costs

incurred in relation to the cyber security incident in the USA.

Cash position

Cash position for the Group at 30 June 2020 was GBP13.7m (H1

2018: GBP10.1m). The Group raised net proceeds of GBP13.8m through

a placing in June 2020.

Post balance sheet events

Phase one of the capacity expansion project was commenced in

July 2020 and it is expected to take approximately six months to

complete. We expect to see the first uplift to the output in

processing from this investment in Q2 2021, following the

three-month lead time for the osteoinductive testing required for

the BioRinse products.

In August 2020, we announced that the UK head office and

manufacturing facility will be relocated to Garforth, Leeds in

November 2020 from the current site in Swillington, Leeds. This

decision was made as part of the ongoing initiatives to

appropriately size the overhead cost base. This move is expected to

reduce the Group's overhead costs by over GBP0.4m on an annualised

basis from 2021. As part of the relocation programme, the Group

will outsource elements of the production cycle, including testing

and packaging. It will retain its processing functions, including

the processing of OrthoPure(R) XT, enabling the Group to meet its

initial order due in Q4 2020, and future demand following the

agreement signed in August 2020 for UK distribution.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(UNAUDITED)

FOR THE SIX MONTHS TO 30 JUNE 2020

6 months 6 months Year

30 Jun 2020 30 Jun 2019 31 Dec

2019

Notes (Unaudited) (Unaudited) Audited

GBP'000 GBP'000 GBP'000

---------------------------------------- ------- ------------- ------------- ----------

Revenue 2 6,085 6,069 13,033

Cost of sales (3,150) (3,225) (7,014)

---------------------------------------- ------- ------------- ------------- ----------

Gross Profit 2,935 2,844 6,019

Administrative expenses before

exceptional items (5,355) (7,024) (13,198)

Exceptional items (106) (40) (21)

Total administrative expenses (5,461) (7,064) (13,219)

Operating loss (2,526) (4,220) (7,200)

Finance income 3 11 17

Finance Charges (173) (183) (477)

---------------------------------------- ------- ------------- ------------- ----------

Loss before tax (2,696) (4,392) (7,660)

Taxation 3 297 311 554

---------------------------------------- ------- ------------- ------------- ----------

Loss after tax (2,399) (4,081) (7,106)

---------------------------------------- ------- ------------- ------------- ----------

Attributable to:

Equity holders of the parent (2,345) (4,055) (6,973)

Non-controlling (54) (26) (133)

---------------------------------------- ------- ------------- ------------- ----------

(2,399) (4,081) (7,106)

---------------------------------------- ------- ------------- ------------- ----------

Other comprehensive income/(expense):

Foreign currency translation

differences - foreign operations 444 122 (724)

---------------------------------------- ------- ------------- ------------- ----------

TOTAL COMPREHENSIVE EXPENSE

FOR THE YEAR (1,955) (3,959) (7,830)

---------------------------------------- ------- ------------- ------------- ----------

Attributable to:

Equity holders of the parent (1,901) (3,933) (7,697)

Non-controlling interests (54) (26) (133)

(1,955) (3,959) (7,830)

Loss per share

Basic and diluted on loss attributable

to equity holders of the parent 4 (0.16p) (0.35p) (0.60)p

---------------------------------------- ------- ------------- ------------- ----------

The loss for the period arises from the Group's continuing

operations.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(UNAUDITED)

FOR THE SIX MONTHS TO 30 JUNE 2020

Attributable to equity holders

of parent

---------------------------------------------------------

Reserve Share

Reverse For Own Based Retained Non-controlling Total

Share Share Merger Acquisition Shares Payment Earnings Interests Equity

Capital Premium Reserve Reserve GBP000 Reserve Deficit Total GBP000 GBP000

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

At 31 December

2018 5,859 86,398 10,884 (7,148) (831) 1,129 (63,239) 33,052 (482) 32,570

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss for

the period - - - - - - (4,055) (4,055) (26) (4,081)

Other

comprehensive

expense - - - - - - 122 122 - 122

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss and

total

comprehensive

expense for

the period - - - - - - (3.933) (3,933) (26) (3,959)

Share based

payment

expense - - - - - 18 - 18 - 18

At 30 June

2019 5,859 86,398 10,884 (7,148) (831) 1,147 (67,172) 29,137 (508) 28,629

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss for

the period - - - - - - (2,918) (2,918) (107) (3,025)

Other

comprehensive

expense - - - - - - (846) (846) - (846)

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss and

total

comprehensive

expense for

the period - - - - - - (3,764) (3,764) (107) (3,871)

Exercise

of share

options - 1 - - - - - 1 - 1

Share based

payment

expense - - - - - (164) - (164) - (164)

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

At 31 December

2019 5,859 86,399 10,884 (7,148) (831) 983 (70,936) 25,210 (615) 24,595

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss for

the period - - - - - - (2,345) (2,345) (54) (2,399)

Other

comprehensive

expense - - - - - - 444 444 - 444

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

Loss and

total

comprehensive

expense for

the period - - - - - - (1,901) (1,901) (54) (1,955)

Issue of

shares 5,860 8,790 - - - - - 14,650 - 14,650

Expenses

on issue

of shares (899) - (899) - (899)

Exercise

of share

options 1 - - - - - - 1 - 1

Share based

payment

expense - - - - - 18 - 18 - 18

At 30 June

2020 11,720 94,290 10,884 (7,148) (831) 1,001 (72,837) 37,079 (669) 36.410

--------------- --------- --------- --------- ------------- --------- -------- ---------- -------- ----------------- --------

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(UNAUDITED)

AS AT 30 JUNE 2020

30 June 30 June 31 Dec

Notes 2020 2019 2019

GBP'000 GBP'000 GBP'000

------------------------------- -------- --------- --------- ---------

Non-current assets

Property, plant and equipment 2,456 2,917 2,357

Intangible assets 17,865 19,614 17,999

------------------------------- -------- --------- --------- ---------

Total non-current assets 20,321 22,531 20,356

------------------------------- -------- --------- --------- ---------

Current assets

Inventory 6,288 2,738 4,185

Trade and other receivables 2,628 3,041 2,539

Corporation tax receivable 684 900 1,035

Cash and cash equivalent 13,667 10,076 2,380

------------------------------- -------- --------- --------- ---------

Total current assets 23,267 16,755 10,139

------------------------------- -------- --------- --------- ---------

Total assets 43,588 39,286 30,495

------------------------------- -------- --------- --------- ---------

Non-current liabilities

Borrowings (2,222) (5,790) (2,115)

Deferred tax (714) (755) (670)

------------------------------- -------- --------- --------- ---------

Total non-current liabilities (2,936) (6,545) (2,785)

------------------------------- -------- --------- --------- ---------

Current liabilities

Borrowings (850) - (171)

Trade and other payables (3,392) (4,112) (2,944)

------------------------------- -------- --------- --------- ---------

Total current liabilities (4,242) (4,112) (3,115)

------------------------------- -------- --------- --------- ---------

Total liabilities (7,178) (10,657) (5,900)

------------------------------- -------- --------- --------- ---------

Net assets 36,410 28,629 24,595

------------------------------- -------- --------- --------- ---------

Equity

Share capital 5 11,720 5,859 5,859

Share premium 5 94,290 86,398 86,399

Merger Reserve 5 10,884 10,884 10,884

Reverse acquisition reserve 5 (7,148) (7,148) (7,148)

Reserve for own shares (831) (831) (831)

Share based payment reserve 1,001 1,147 983

Retained earnings deficit (72,837) (67,172) (70,936)

------------------------------- -------- --------- --------- ---------

Equity attributable to equity

holders of parent 37,079 29,137 25,210

Non-controlling interests (669) (508) (615)

------------------------------- -------- --------- --------- ---------

Total equity 36,410 28,629 24,595

------------------------------- -------- --------- --------- ---------

Approved by the Board and authorised for issue on 2 September

2020

Gareth Jones (Interim Chief Executive Officer)

CONDENSED CONSOLIDATED CASH FLOW STATEMENT (UNAUDITED)

FOR THE SIX MONTHSED 30 JUNE 2020

6 months 6 months 12 months

to to to

30 June 30 June 31 Dec 2019

2020 2019 GBP'000

GBP'000 GBP'000

-------------------------------------------- ---------- ---------- -------------

Operating Activities

Loss before Tax (2,696) (4,392) (7,660)

Adjustment for:

Depreciation of property, plant &

equipment 101 273 476

Amortisation of intangible assets 319 282 570

Impairment of intangible and property,

plant and equipment - - 1,311

Share based payment 18 18 (146)

Interest receivable (3) (11) (17)

Interest payable 173 194 477

-------------------------------------------- ---------- ---------- -------------

Operating cash outflow (2,088) (3,636) (4,989)

-------------------------------------------- ---------- ---------- -------------

(Increase) in inventory (2,103) (408) (1,855)

(Increase)/decrease in trade & other

receivables (90) 258 1,076

Increase/(decrease) in trade & other

payables 665 (466) (1,567)

-------------------------------------------- ---------- ---------- -------------

Cash outflows from operations (3,616) (4,252) (7,335)

-------------------------------------------- ---------- ---------- -------------

Research and Development Tax Credits

received 649 653 653

-------------------------------------------- ---------- ---------- -------------

Net cash outflow from operations (2,967) (3,599) (6,682)

-------------------------------------------- ---------- ---------- -------------

Investing activities

Interest received 3 11 17

Purchase of property, plant & equipment (53) (366) (438)

Capitalised development expenditure - - (213)

Net cash outflow from investing activities (50) (355) (634)

-------------------------------------------- ---------- ---------- -------------

Financing activities

Interest paid (173) - (384)

Proceeds from issue of share capital 13,752 - -

Proceeds from exercised share options - - 1

Proceeds from new loans 850 6,114 6,479

Repayment of loans (237) - (4,193)

Net cash inflow from financing activities 14,192 6,114 1,903

-------------------------------------------- ---------- ---------- -------------

Increase/(decrease) in cash and cash

equivalents 11,175 2,160 (5,413)

Foreign exchange translation movement 112 100 (23)

Cash and cash equivalents at start

of period 2,380 7,816 7,816

-------------------------------------------- ---------- ---------- -------------

Cash and cash equivalents at end of

period 13,667 10,076 2,380

-------------------------------------------- ---------- ---------- -------------

NOTES TO THE CONDENSED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE SIX MONTHSED 30 JUNE 2020

1. Basis of preparation

The unaudited condensed consolidated interim financial

information does not constitute statutory accounts within the

meaning of Section 434 of the Companies Act 2006. The interim

financial statements, which are unaudited and have not been

reviewed by the Company's auditors, have been prepared in

accordance with the policies set out in the 2019 Annual Report and

Accounts.

The comparative figures for the year ended 31 December 2019 do

not constitute full financial statements and have been abridged

from the full accounts for the year ended on that date, on which

the auditors gave an unqualified report, but did contain an

emphasis of matter paragraph in respect of the Group's ability to

continue as a going concern due to the fundraise being conditional

on shareholder approval. They did not contain any statement under

Section 498 of the Companies Act 2006. The 2019 accounts have been

delivered to the Registrar of Companies. The Company has chosen not

to adopt IAS 34 'Interim Financial Statements'.

2. Segmental reporting

The following table provides disclosure of the Group's revenue

by geographical market based on location of the customer:

6 months 6 months 12 months

to to to

Notes 30 June 30 June 31 Dec

2020 2019 2019

GBP'000 GBP'000 GBP'000

--------------- --------- --------- --------- ----------

USA 5,050 4,961 10,679

Rest of world 1,035 1,108 2,354

-------------------------- --------- --------- ----------

6,085 6,069 13,033

6 months to BioSurgery Orthopaedics Cardiac GBM-V Central Total

30 June 2020 & Dental

------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ----------- ------------- -------- -------- -------- --------

Revenue 1,710 3,418 - 957 - 6,085

Cost of sales (1,021) (1,569) - (560) - (3,150)

------------------ ----------- ------------- -------- -------- -------- --------

Gross Profit 689 1,849 - 397 - 2,935

Administrative

costs (1,417) (2,112) (164) (320) (1,342) (5,355)

Exceptional

costs (22) (84) - - - (106)

------------------ ----------- ------------- -------- -------- -------- --------

Operating

profit/(loss) (750) (347) (164) 77 (1,342) (2,526)

Finance income - - - - 3 3

Finance charges - - - - (173) (173)

------------------ ----------- ------------- -------- -------- -------- --------

Profit/(loss)

before taxation (750) (347) (164) 77 (1,512) (2,696)

Taxation 27 163 59 - 48 297

------------------ ----------- ------------- -------- -------- -------- --------

Profit/(loss)

for the period (723) (184) (105) 77 (1,464) (2,399)

------------------ ----------- ------------- -------- -------- -------- --------

6 months to BioSurgery Orthopaedics Cardiac GBM-V Central Total

30 June 2019 & Dental

------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ----------- ------------- -------- -------- -------- --------

Revenue 1,963 3,049 - 1,057 - 6,069

Cost of sales (1,095) (1,430) - (700) - (3,225)

------------------ ----------- ------------- -------- -------- -------- --------

Gross Profit 868 1,619 - 357 - 2,844

Administrative

costs (2,018) (2,319) (193) (289) (2,205) (7,024)

Exceptional

costs - - - (40) (40)

------------------ ----------- ------------- -------- -------- -------- --------

Operating

profit/(loss) (1,150) (700) (193) 68 (2,245) (4,220)

Finance income - - - - 11 11

Finance charges - - - - (183) (183)

------------------ ----------- ------------- -------- -------- -------- --------

Profit/(loss)

before taxation (1,150) (700) (193) 68 (2,417) (4,392)

Taxation 80 191 40 - - 311

------------------ ----------- ------------- -------- -------- -------- --------

Profit/(loss)

for the period (1,070) (509) (153) 68 (2,417) (4,081)

------------------ ----------- ------------- -------- -------- -------- --------

12 months BioSurgery Orthopaedics Cardiac GBM-V Central Total

to 31 December & Dental

2019

------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ----------- ------------- -------- -------- -------- ---------

Revenue 4,233 6,724 - 2,076 - 13,033

Cost of sales (2,535) (3,076) - (1,403) - (7,014)

------------------ ----------- ------------- -------- -------- -------- ---------

Gross Profit 1,698 3,648 - 673 - 6,019

Administrative

costs (3,729) (4,553) (328) (663) (3,925) (13,198)

Exceptional

costs (1,124) 1,523 - (152) (268) (21)

------------------ ----------- ------------- -------- -------- -------- ---------

Operating

profit/(loss) (3,155) 618 (328) (142) (4,193) (7,200)

Finance income - - - - 17 17

Finance charges - - - - (477) (477)

------------------ ----------- ------------- -------- -------- -------- ---------

Profit/(loss)

before taxation (3,155) 618 (328) (142) (4,653) (7,660)

Taxation 159 283 80 - 32 554

------------------ ----------- ------------- -------- -------- -------- ---------

Profit/(loss)

for the period (2,996) 901 (248) (142) (4,621) (7,106)

------------------ ----------- ------------- -------- -------- -------- ---------

3. Taxation

6 months 6 months 12 months

to to to

30 June 30 June 31 Dec 2019

2020 2019 GBP'000

GBP'000 GBP'000

---------------------------------- --------- --------- -------------

Current Tax:

UK corporation tax credit

on research and development

costs in the period (249) (353) (488)

US corporation tax - 42 29

(249) (311) (459)

Deferred tax:

Origination and reversal

of temporary timing differences (48) - (95)

----------------------------------- --------- --------- -------------

Tax credit on loss on ordinary

activities (297) (311) (554)

----------------------------------- --------- --------- -------------

The Group has accumulated losses available to carry forward

against future trading profits.

4. Loss per share (basic and diluted)

Basic loss per share is calculated by dividing the loss

attributable to equity holders of the parent by the weighted

average number of ordinary shares in issue during the period

excluding own shares held jointly by the Tissue Regenix Employee

Share Trust and certain employees. Diluted loss per share is

calculated by adjusting the weighted average number of ordinary

shares in issue during the period to assume conversion of all

dilutive potential ordinary shares.

6 months 6 months 12 months

to to to

30 June 30 June 31 Dec

2020 2019 2019

GBP'000 GBP'000 GBP'000

---------------------------------- ---------------- ---------------- ----------------

Total loss attributable to

the equity holders of the

parent (2,345) (4,055) (6,973)

----------------------------------- ---------------- ---------------- ----------------

No. No. No.

---------------------------------- ---------------- ---------------- ----------------

Weighted average number of

ordinary shares in issue during

the period 1,493,073,354 1,171,534,448 1,171,867,216

----------------------------------- ---------------- ---------------- ----------------

Loss per share

Basic and diluted on loss

for the period (0.16)p (0.35)p (0.60)p

----------------------------------- ---------------- ---------------- ----------------

The Company has issued employees options over 10,419,817

ordinary shares and there are 16,112,800 jointly owned shares which

are potentially dilutive. There is, however, no dilutive effect of

these issued options as there is a loss for each of the periods

concerned.

5. Share capital

30 June 30 June 31 Dec 2019

2020 2019 GBP'000

GBP'000 GBP'000

------------------------------ --------- --------- ------------

Ordinary shares of 0.1 pence 7,033 - -

Deferred shares of 0.4 pence 4,687 - -

Ordinary shares of 0.5 pence - 5,859 5,859

------------------------------- --------- --------- ------------

11,720 5,859 5,859

------------------------------ --------- --------- ------------

Movements on share capital during the period were as

follows:

Ordinary shares Deferred shares

Number GBP'000 Number GBP'000

------------------------ -------------- -------- -------------- --------

At 31 December 2018 1,171,730,823 5,859 - -

Issued on exercise of - - - -

share options

At 30 June 2019 1,171,730,823 5,859 - -

Issued on exercise of 240,499 - - -

share options

At 31 December 2019 1,171,971,322 5,859 - -

Sub-division of shares 1,171,971,322 (4,687) 1,171,971,322 4,687

Issued on exercise of

share options 1,388,222 1 - -

Issue of shares 5,859,626,212 5,860 - -

------------------------ -------------- -------- -------------- --------

At 30 June 2020 7,032,985,756 7,033 1,171,971,322 4,687

------------------------ -------------- -------- -------------- --------

On the 9(th) June a special resolution was passed at the general

meeting for the 1,171,971,322 Ordinary Shares of 0.5 pence each in

the issued share capital of the Company be sub-divided into

1,171,971,322 Ordinary Shares of 0.1 pence each in the capital of

the Company and 1,171,971,322 Deferred Shares of 0.4 pence each in

the capital of the Company.

On the 9(th) June the Company also completed a successful

fundraise of GBP14.6m gross.

6. Interim financial report

A copy of this interim report will be available on the Company's

website at www.tissueregenix.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VFLFBBKLBBBV

(END) Dow Jones Newswires

September 02, 2020 02:03 ET (06:03 GMT)

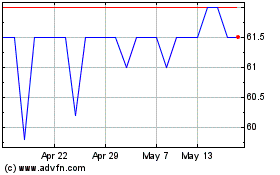

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Jul 2023 to Jul 2024