TIDMTRX

RNS Number : 8417C

Tissue Regenix Group PLC

22 January 2015

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO, THE UNITED STATES OF AMERICA (INCLUDING ITS

TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES AND THE

DISTRICT OF COLUMBIA), AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN

Tissue Regenix Group plc

("Tissue Regenix" or the "Company")

Proposed placing of new Ordinary Shares at a price of 19p per

share to raise

approximately GBP20 million

Highlights

-- Tissue Regenix is a leading medical devices company in the

field of regenerative medicine. It commercialises academic research

conducted by its partners globally.

-- Tissue Regenix has patented "dCELL" technology which uses

animal and human tissue to create a tissue scaffold which can be

used to repair diseased or worn out body parts.

-- The Company's first product: "DermaPure", which is used in

the treatment of chronic wounds, was launched in 2014. Sales of

DermaPure are building momentum with initial revenues now being

recognised as anticipated.

-- Further products are in development, including applications

for meniscus repair, ligament repair and heart valve

replacement.

-- The Company intends to raise GBP20 million through an

accelerated bookbuilding process aimed at new and existing

institutional investors.

-- The proceeds of this fund-raising will be used to allow the

development and launch of these new products, and to expand the

direct salesforce for DermaPure in the US.

Antony Odell, Chief Executive of Tissue Regenix, commented:

"Our latest fundraising represents a milestone for the company.

Having launched our first product, the time has now come to build

up our US direct sales network to ensure we build coverage of

hospitals in this key market. Initial responses by potential

customers to DermaPure have been extremely positive and we are very

excited by the potential that this product offers. In addition, we

have new products and applications in development, that give us the

potential to address new markets - including knee injury - which

have massive potential. This fundraising will allow us to achieve

these goals."

Enquiries:

Tissue Regenix Group plc Tel: 019 0443 5176

Antony Odell, Chief Executive Officer

Ian Jefferson, Chief Financial Officer

Jefferies International Limited (Nomad, broker and bookrunner) Tel: 020 7029 8000

Simon Hardy

Harry Nicholas

Tulchan Communications Tel: 020 7353 4200

Tom Buchanan / Victoria Huxster

Information on the Company

Tissue Regenix is a leading medical devices company in the field

of regenerative medicine. Tissue Regenix was formed in 2006 when it

was spun-out from the University of Leeds. Tissue Regenix

commercialises academic research conducted by its partners globally

including National Health Service Blood and Transplant ("NHSBT") in

the UK and the Pontifical University of Parana in Curitiba, Brazil.

Tissue Regenix's patented decellularisation ("dCELL(R)") technology

removes DNA and other cellular material from animal and human

tissue leaving an acellular tissue scaffold, which is not rejected

by the patient's body and which can then be used to repair diseased

or worn out body parts. The potential applications of this process

are diverse and address many critical clinical needs such as

chronic wounds, heart valve replacement and knee repair.

Details of the proposed Placing

Tissue Regenix (AIM: TRX) announces its intention to raise gross

proceeds of approximately GBP20 million pursuant to a placing of

new Ordinary Shares (the "Placing Shares") in the Company at a

price of 19p per Placing Share (the "Placing Price") with both new

and existing institutional investors (the "Placing"), to allow the

development and launch of Tissue Regenix's human meniscus and human

ligament products, the expansion of the direct salesforce for

DermaPure(R), in addition to the continued development and

commercialisation of the Company's porcine-derived products.

The Placing is being conducted through an accelerated

bookbuilding process to be carried out by Jefferies International

Limited ("Jefferies") which shall determine the exact number of the

Placing Shares in accordance with the terms and conditions set out

in the Appendix to this announcement. Jefferies is acting as the

sole bookrunner in connection with the Placing.

The book will open with immediate effect and is expected to

close no later than 4.30 p.m. today (22 January 2015). The timing

of the closing of the book and allocations is at Jefferies'

discretion in consultation with the Company. The number of Placing

Shares to be allocated and issued pursuant to the Placing is

subject to agreement between the Company and Jefferies at the close

of the bookbuilding process. Details of the final terms of the

Placing, including its completion, will be announced as soon as

practicable after the close of the bookbuilding process.

Participation in the Placing will be limited to institutional

investors. Members of the general public are not eligible to take

part in the Placing.

For the Placing of 105,263,158 new Ordinary Shares to proceed,

the Company requires shareholders' approval to authorise the

directors to allot the Placing Shares and to disapply pre-emption

rights in relation to the issue of the Placing Shares on a non

pre-emptive basis. A general meeting of the Company is expected to

be held at the offices of DLA Piper UK LLP at Princes Exchange,

Princes Square, Leeds LS1 4BY at 10.00 a.m. on 9 February 2015 (the

"General Meeting"). A Circular containing details of the proposed

Placing and the notice of the General Meeting will be sent to

shareholders shortly.

In the event that the Resolutions are not passed, the Company,

in consultation with Jefferies, may elect to proceed with the

Placing of a smaller number of Ordinary Shares on the basis of the

authority to allot Ordinary Shares and disapplication of

pre-emption rights granted at the last annual general meeting of

the Company.

Application will be made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM. It is expected

that, subject to, inter alia, the passing of the resolutions at the

General Meeting, admission to AIM will become effective in respect

of, and that dealings on AIM will commence in, the Placing Shares,

on or around 10 February 2015.

The Placing is conditional upon, amongst other things, the

resolutions being passed, the Admission becoming effective and the

Placing Agreement between the Company and Jefferies becoming

unconditional and not being terminated, in accordance with its

terms.

The Appendix to this announcement (which forms part of this

announcement) sets out the terms and conditions of the Placing. By

choosing to participate in the Placing and by making an oral and

legally binding offer to acquire Placing Shares, institutional

investors will be deemed to have read and understood this

announcement in its entirety, including the Appendix, and to be

making such offer on the terms and subject to the conditions

contained herein and to be making the representations, warranties,

undertakings and acknowledgements contained in the Appendix to this

announcement.

background to and reasons for the placing

The net proceeds of the Placing are intended to be used to allow

the development and launch of Tissue Regenix's human meniscus and

human ligament products, the expansion of the direct salesforce for

DermaPure(R), in addition to the continued development and

commercialisation of the Company's porcine-derived products.

The Board believes that raising equity finance using the

flexibility provided by a non pre-emptive placing is the most

appropriate and optimal structure for the Company at this time.

This allows both existing institutional holders and new

institutional investors the opportunity to participate in the

Placing and avoids the requirement for a prospectus, which is a

costly and time consuming process.

Use of Proceeds

As reported in the Company's interim results announced on 29

October 2014, the Company had existing cash resources as at 31 July

2014 of GBP15 million. As at 31 December 2014, the Company had cash

resources of GBP11 million. As planned, the Company expects to

continue to use its cash resources to fund its development

programmes, and expects cash utilisation to increase over the

coming years as the programmes progress through pre-clinical and

clinical trials.

The Company currently envisages the following specific areas to

which the net proceeds of the Placing will be applied, split

broadly evenly between those areas, to be as follows:

-- to further commercialise the wound care products with

additional direct sales representatives being hired to deploy

DermaPure(R), and to fund the launch of the porcine general

surgical patch product, SurgiPure(R), in the US.

-- to fund the development, manufacturing set-up, launch, sales

& marketing and working capital build of the human meniscus

product in the US.

-- to fund the development, manufacturing set-up, launch, sales

& marketing and working capital build of the human ligament

product in the US.

Tissue Regenix's strategic progress

Tissue Regenix's current strategy is centered on the development

and application of its dCELL(R) technology, using human and

porcine-derived products both in the US and EU, with a

concentration on the core focus areas of wound care and

orthopaedics.

Underpinning the development and commercialisation strategy is

Tissue Regenix's intellectual property portfolio. The core

decellularisation process, which encompasses all of the Company's

products, is covered by a process patent. The Company also files,

where possible, individual product patents. In addition,

significant know-how is retained within the Company.

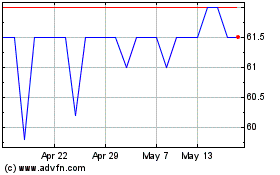

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Sep 2024 to Oct 2024

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Oct 2023 to Oct 2024