Third Point Investors Ltd Monthly Update: August 2023 NAV Performance

September 07 2023 - 2:01AM

UK Regulatory

TIDMTPOU TIDMTPOS

7 September 2023

Third Point Investors Limited

Monthly Update: August 2023 NAV Performance

August 2023 Performance Highlights

· Third Point Investors Limited returned -0.2% on a NAV basis in August 2023,

compared with a

-2.3% return for the MSCI World Index and a -1.6% return for the S&P 500 Index.

· During the month the Company's share price returned 0.0%, reflecting a

narrowing in the discount to NAV from 17.9% to 17.7%.

· The top contributors for the month included financial services company UBS

Group AG, diversified life sciences and diagnostics company Danaher Corp, and e

-commerce company Amazon.com Inc.

· The top detractors for the month included utility company Pacific Gas and

Electric Co., industrials and materials company International Flavors &

Fragrances Inc., and e-commerce company Alibaba Group Holding Ltd.

Full portfolio detail is available at

https://www.thirdpointlimited.com/resources/portfolio-updates

Net Performance

+-----------------------------------+-----+----+-----+

| |MTD |QTD |YTD |

+-----------------------------------+-----+----+-----+

|Third Point Investors Ltd. (NAV)1 |-0.2%|2.3%|-1.6%|

+-----------------------------------+-----+----+-----+

|Third Point Investors Ltd. (Price)2|0.0% |0.3%|-4.3%|

+-----------------------------------+-----+----+-----+

|MSCI World Index (Total Return) |-2.3%|1.0%|16.6%|

+-----------------------------------+-----+----+-----+

|S&P 500 (Total Return) |-1.6%|1.6%|18.7%|

+-----------------------------------+-----+----+-----+

Key Statistics and AUM Summary

+-----------------------------------+-------+

|Premium/(Discount) to NAV |(17.7%)|

+-----------------------------------+-------+

|Third Point Investors Ltd. Net AUM3|$0.6 B |

+-----------------------------------+-------+

Portfolio Detail4

The net weightings of the strategy at period-end were 71.8% in Equity, 38.9% in

Credit, 8.4% in Privates and 0.0% in Other. A breakdown of positions, including

major contributors and detractors, is provided below. For further detail please

visit: https://www.thirdpointlimited.com/resources/portfolio-updates.

EXPOSURE GROSS MTD P&L5 NET MTD P&L6 GROSS YTD

P&L5 NET YTD P&L6

LONG SHORT NET LONG SHORT NET NET LONG SHORT

NET NET

Equity 89.6% -17.8% 71.8% -0.9% 0.7% -0.2% -0.3% 4.9%

-7.0% -2.1% -3.0%

Credit 39.3% -0.4% 38.9% 0.0% 0.0% 0.1% 0.0% 2.7%

0.5% 3.2% 2.7%

Privates 8.4% 0.0% 8.4% 0.0% 0.0% 0.0% 0.0% -0.5%

0.0% -0.5% -0.6%

Other7 0.0% 0.0% 0.0% 0.0% 0.0% -0.2% -0.2% -0.1%

-0.2% -0.4% -0.5%

Total 137.2% -18.2% 119.0% -0.9% 0.7% -0.3% -0.5% 7.0%

-6.7% 0.1% -1.4%

Portfolio Detail

MTD Contributors8

UBS Group AG (financial services company)

Danaher Corp. (diversified life sciences and diagnostics company)

Amazon.com Inc. (e-commerce company)

Jacobs Solutions Inc (industrials and materials company)

Vistra Corp (energy company)

MTD Detractors8

Pacific Gas and Electric Co. (utility company)

International Flavors & Fragrances Inc. (industrials and materials company)

Alibaba Group Holdings Ltd (e-commerce company)

Fidelity National Info Services (financials company)

LVMH Moet Hennessy Louis Vuitton (luxury consumer goods company)

YTD Contributors8

Amazon.com Inc. (e-commerce company)

UBS Group AG (financials company)

Salesforce Inc. (software company)

ABS Interest Rate Hedges

Microsoft Corp. (infrastructure software company)

YTD Detractors8

Fidelity National Info Services (financials company)

International Flavors & Fragrances Inc. (industrials and materials company)

Bath & Body Works Inc. (consumer goods company)

Glencore International PLC (materials company)

American International Group Inc. (insurance company)

Top Gross Equity Longs8

Pacific Gas and Electric Co. (utility company)

Microsoft Corp (infrastructure software company)

Amazon.com Inc. (e-commerce company)

Danaher Corp. (diversified life sciences and diagnostics company)

Bath & Body Works Inc. (consumer goods company)

Top Gross Corporate Credit Longs8,9

Frontier Communications Holdings (telecommunications company)

Radiate Holdco LLC (cable company)

PNC Financial Services Group (financials company)

Comstock Resources Inc (energy company)

Community Health Systems Inc. (healthcare company)

Press Enquiries

Buchanan PR

Charles Ryland

charlesr@buchanan.uk.com (fiona@quillpr.com)

Tel: +44 (0)20 7466 5107

Henry Wilson

henryw@buchanan.uk.com

Tel: +44 (0)20 7466 5111

Notes to Editors

About Third Point Investors Limited

www.thirdpointlimited.com

Third Point Investors Limited (LSE: TPOU)

was listed on the London Stock Exchange in

2007 and is a feeder fund that invests in

the Third Point Offshore Fund (the Master

Fund), offering investors a unique

opportunity to gain direct exposure to

founder Daniel S. Loeb's investment

strategy. The Master Fund employs an event

-driven, opportunistic strategy to invest

globally across the capital structure and in

diversified asset classes to optimize risk

-reward through a market cycle. TPIL's

portfolio is 100% aligned with the Master

Fund, which is Third Point's largest

investment strategy. TPIL's assets under

management are currently $600 million.

About Third Point LLC

Third Point LLC is an institutional

investment manager that actively engages

with companies across their lifecycle, using

dynamic asset allocation and an ethos of

continuous learning to drive long-term

shareholder return. Led by Daniel S. Loeb

since its inception in 1995, the Firm has a

42-person investment team, a robust

quantitative data and analytics team, and a

deep, tenured business team. Third Point

manages approximately $11.7 billion in

assets for sovereign wealth funds,

endowments, foundations, corporate & public

pensions, high-net-worth individuals, and

employees.

Footnotes

1 Reflects the NAV return of Third Point

Investors Limited inclusive of

gearing the Company introduced in 2021

and chose to discontinue as of

June 2023.

2 Reflects the total share price return of

Third Point Investors Limited.

3 The net AUM figure for Third Point

Investors Limited is included in the

AUM of Third Point Offshore Fund, Ltd.

4 The sum of long and short exposure

percentages and the sum of gross long

and short MTD and YTD P&L percentages may

not visually add to the

corresponding net figure due to rounding.

Subtotals of long, short,

and/or net exposure percentages and MTD

and YTD P&L percentages may not

visually match the corresponding subtotal

in another section of the

report due to rounding.

5 Gross P&L attribution does not reflect

the deduction of management fees,

incentive allocations and any other

expenses which may be incurred in the

management of the fund. An investor's

actual return will be reduced by

such fees and expenses. See Part 2A of

the Adviser's Form ADV for a

complete description of the management

fees and incentive allocations

customarily charged by Adviser.

6 The net P&L figures are included because

of the SEC's new marketing rule

and guidance. Third Point does not

believe that this metric accurately

reflects net P&L for the referenced sub

-portfolio group of investments as

explained more fully below. Specifically,

net P&L attribution reflects

the allocation of the highest management

fee (2% per annum), in addition

to leverage factor multiple, if

applicable, and incentive allocation rate

(20%), and an assumed operating expense

ratio (0.3%), to the aggregate

underlying positions in the referenced

sub-portfolio group's gross P&L.

The management fees and operating

expenses are allocated for the period

proportionately based on the average

gross exposure of the aggregate

underlying positions of the referenced

sub-portfolio group. The implied

incentive allocation is based on the

deduction of management fee and

expense ratio from the Fund level gross

P&L attribution for the period.

The incentive allocation is accrued for

each period to only those

positions within the referenced sub

-portfolio group with i) positive P&L

and, ii) if during the current MTD period

there is an incentive

allocation. In MTD periods where there is

a reversal of previously

accrued incentive allocation, the impact

of the reversal will be based on

the previous month's YTD accrued

incentive allocation. The assume

operating expense ratio noted herein is

applied uniformly across all

underlying positions in the referenced

sub-portfolio group given the

inherent difficulty in determining and

allocating the expenses on a sub

-portfolio group basis. If expenses were

to be allocated on a sub

-portfolio group basis, the net P&L would

likely be different for each

referenced sub-portfolio group, as

applicable.

7 Includes broad-based market and equity

-based hedges.

8 Excludes any confidential positions,

portfolio level equity hedges and EU

MAR related positions.

9 Does not include private debt.

Important Notes and Disclaimers

Third Point Investors Limited (the

"Company") is a feeder fund listed on the

London Stock Exchange that invests

substantially all of its assets in Third

Point Offshore Fund, Ltd ("Third Point

Offshore"). Third Point Offshore is managed

by Third Point LLC ("Third Point" or

"Investment Manager"), an SEC-registered

investment adviser headquartered in New

York.

Unless otherwise stated, information relates

to the Third Point Offshore Master Fund L.P.

(the "Fund") inclusive of legacy private

investments. Exposures are categorized in a

manner consistent with the Investment

Manager's classifications for portfolio and

risk management purposes in its sole

discretion.

Performance results include the performance

of legacy private investments and are

presented net of management fees, brokerage

commissions, administrative expenses, and

accrued incentive allocation, if any, and

include the reinvestment of all dividends,

interest, and capital gains. While incentive

allocations are accrued monthly, they are

deducted from investor balances only

annually or upon withdrawal. From Fund

inception through December 31, 2019, Third

Point Offshore Fund, Ltd.'s historical

performance has been calculated using the

actual management fees, incentive

allocations, and expenses paid by the Fund.

The actual management fees and incentive

allocations paid by the Fund reflect a

blended rate of management fees and

incentive allocations based on the weighted

average of amounts invested in different

share classes subject to different

management fee and/or incentive allocation

terms. Such management fee rates have ranged

over time from 1.25% to 3% per annum. The

amount of incentive allocations applicable

to any one investor in the Fund will vary

materially depending on numerous factors,

including without limitation: the specific

terms, the date of initial investment, the

duration of investment, the date of

withdrawal, and market conditions. As such,

the net performance shown for the Fund from

inception through December 31, 2019 is not

an estimate of any specific investor's

actual performance. During this period, had

the highest management fee and incentive

allocation been applied solely, performance

results would likely be lower. For the

period beginning January 1, 2020, the Fund's

historical performance shows indicative

performance for a new issues eligible

investor in the highest management fee (2%

per annum) and incentive allocation rate

(20%) class of the Fund, who has

participated in all side pocket private

investments (as applicable) from March 1,

2021 onward. Net performance reflects the

deduction of operating expenses paid by the

Fund during the period. An individual

investor's performance may vary based on

timing of capital transactions. The

inception date for Third Point Offshore

Fund, Ltd. is December 1, 1996. All

performance results are estimates and past

performance is not necessarily indicative of

future results. All information provided

herein is for informational purposes only

and should not be deemed as a recommendation

to buy or sell securities. All investments

involve risk including the loss of

principal. This transmission is confidential

and may not be redistributed without the

express written consent of Third Point LLC

and does not constitute an offer to sell or

the solicitation of an offer to purchase any

security or investment product. Any such

offer or solicitation may only be made by

means of delivery of an approved

confidential offering memorandum. The Funds'

performance information shown within

includes net gains and losses from "new

issues." The market price for new issues is

often subject to significant fluctuation,

and investors who are eligible to

participate in new issues may experience

significant gains or losses. An investor who

invests in a class of Interests that does

not participate in new issues may experience

performance that is different, perhaps

materially, from the performance reflected

above. All performance results are estimates

and should not be regarded as final until

audited financial statements are issued.

While the performance of the Fund has been

compared here with the performance of well

-known and widely recognized indices, whose

performance reflects the investment of

dividends, the indices have not been

selected to represent an appropriate

benchmark for the Fund whose holdings,

performance and volatility may differ

significantly from the securities that

comprise the indices. Historical net

performance for Third Point Offshore Fund,

Ltd. is available upon request. Past

performance is not necessarily indicative of

future results. All information provided

herein is for informational purposes only

and should not be deemed as a

recommendation, offer or solicitation to buy

or sell securities including those of the

Company in the United States or in any other

jurisdiction, nor shall it, or the fact of

its distribution, form the basis of, or be

relied upon, in connection with any contract

therefor. All investments involve risk

including the loss of principal. This

transmission is confidential and may not be

redistributed without the express written

consent of Third Point LLC and does not

constitute an offer to sell or the

solicitation of an offer to purchase any

security or investment product. Any such

offer or solicitation may only be made by

means of delivery of an approved

confidential offering memorandum.

The Company has not been and will not be

registered under the US Investment Company

Act of 1940, as amended (the "Investment

Company Act"). In addition, the shares in

the Company have not been and will not be

registered under the US Securities Act of

1933, as amended (the "Securities Act").

Consequently, shares in the Company may not

be offered, sold or otherwise transferred

within the United States or to, or for the

account or benefit of, US Persons (as

defined in the Securities Act). No public

offering of any shares in the Company is

being, or has been, made in the United

States.

Information provided herein, or otherwise

provided with respect to a potential

investment in the Funds, may constitute non

-public information regarding Third Point

Investors Limited, a feeder fund listed on

the London Stock Exchange, and accordingly

dealing or trading in the shares of the

listed instrument on the basis of such

information may violate securities laws in

the United Kingdom, United States and

elsewhere.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

September 07, 2023 02:01 ET (06:01 GMT)

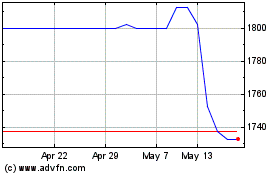

Third Point Investors (LSE:TPOS)

Historical Stock Chart

From Jun 2024 to Jul 2024

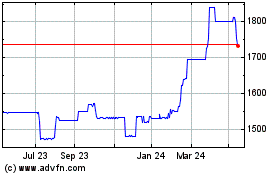

Third Point Investors (LSE:TPOS)

Historical Stock Chart

From Jul 2023 to Jul 2024