TIDMTAM

RNS Number : 6776S

Tatton Asset Management PLC

27 June 2018

27 June 2018

Tatton Asset Management PLC

Preliminary Results

For the year ended 31 March 2018

"Excellent debut - Strong growth across all businesses"

Tatton Asset Management plc ("TAM" or the "Company" and together

with its subsidiaries, the "Group") (AIM: TAM), the on-platform

discretionary fund management (DFM) and support services business

for independent financial advisers (IFAs), today issues its

Preliminary Results for the year ended 31 March 2018.

Financial Highlights

-- Tatton's discretionary assets under

management ("AUM") increased 25.6% to

GBP4.9bn (2017: GBP3.9bn)

-- Average AUM inflows of over GBP80m per

month maintained

-- Group Revenue increased 30.7% to GBP15.5m

(2017: GBP11.9m)

-- Adjusted Operating profit(1) up 44.7%

to GBP6.5m (2017: GBP4.5m)

-- Adjusted Operating profit(1) margin

increased to 42.1% (2017: 38.0%)

-- Reported profit before tax increased

to GBP3.6m (2017: GBP2.0m), after charging

exceptional items of GBP2.0m and share

option costs of GBP1.0m

-- Final dividend of 4.4p giving a full

year dividend of 6.6p

-- Adjusted EPS(2) increased 49.5% to 9.6p

(2017: 6.5p)

-- Strong financial position, with net

cash of GBP10.6m (2017: GBPnil)

Business Highlights

-- Successful IPO on AIM completed on 6

July 2017 raising GBP51.6m

-- TIML, the Group's investment management

business, has continued to expand, delivering

strong organic growth in AUM and introduced

three new blended funds

-- TIML increased its member firms to 341

(2017: 237) and number of accounts to

48.8k (2017: 39.6k)

-- PPL, the Group's compliance services

business, increased new members 4.5%

to 368 (2017: 352)

-- PMS, the Group's mortgage and protection

distribution business, performed strongly,

with gross lending via its channels

during the period of GBP6.8bn (2017:

GBP4.8bn), an increase of 41.7%. PMS

now has 1,220 mortgage firms using its

services (2017: 1,069), up 14.1%

1. Operating profit before exceptional items and IFRS2

share-based costs

2. Adjusted earnings per share is calculated by dividing the

adjusted operating profit less cash interest, less tax on operating

activities by the number of ordinary shares in issue during the

year

Paul Hogarth, Chief Executive Officer, commented:

"I am delighted to report our maiden results since our

successful IPO in July last year. We have continued the strong

growth we announced at the half year, delivering a valuable 25.6%

increase in discretionary assets under management and a strong

underlying performance across each of our three businesses. Post

the year-end, we have surpassed a significant milestone - GBP5

billion of discretionary AUM - which is a considerable achievement

for the team.

"There is unprecedented demand for a low cost DFM service to the

mass affluent served by the IFA sector, and we continue to

capitalise on this. We are challenging existing off platform,

traditional incumbents, and working closely with increasing numbers

of IFAs in providing the mass affluent with an investment portfolio

management service that is pushing the envelope. We are pleased

with the progress we are making and excited at the opportunities

ahead. The outlook for the Group remains positive and l look

forward to providing a further update in due course."

For further information please contact:

Tatton Asset Management plc +44 (0) 161 486 3441

Paul Hogarth (Chief Executive

Officer)

Paul Edwards (Chief Financial

Officer)

Lothar Mentel (Chief Investment

Officer)

Nomad and Broker

Zeus Capital +44 (0) 20 3829 5000

Martin Green

Dan Bate

Pippa Underwood

Media Enquiries

Powerscourt +44 (0) 20 7250 1446

Justin Griffiths

Mazar Masud

For more information, please visit:

www.tattonassetmanagement.com

Analyst presentation

An analyst briefing is being held at 10.30am on 27 June 2018 at

the offices of Powerscourt, 1 Tudor Street, London, EC4Y 0AH.

Chairman's Statement

Roger Cornick, Chairman

As an element of the process that preceded our IPO on 6 July

last year, I became Chairman of Tatton Asset Management plc (TAM)

having been attracted by the quality of the people involved, and

their achievements, up until that time. Happily, in reporting on

the year ended 31 March 2018, I'm able to highlight a performance

that has built on the pre-IPO success and delivered a strong set of

results for our first year of trading as a public listed

company.

Results

The Group has delivered results that have met the exacting

objectives set out for the first full year following the Company's

listing on the AIM - London Stock Exchange last year. Tatton

Investments continued to leverage its competitive position as an

on-platform discretionary asset management provider, increasing

assets under management by 25.6% to GBP4.9 billion (2017: GBP3.9

billion). Paradigm Partners, the Group's IFA trusted adviser and

support services business continues to grow and attract new members

with partner firms increasing by 4.5% to 368. Paradigm Mortgage

Services, the Group's mortgage distribution and support services

business, continues to grow with membership rising by 14.1% to

1,220. This has resulted in Group revenue for the year increasing

by 30.7% to GBP15.5m (2017: GBP11.9m) and underlying earnings

before interest and tax increasing by 44.7% to GBP6.5m (2017:

GBP4.5m). Profit before tax after incurring exceptional costs and

share based charges was GBP3.6m (2017: GBP2.0m). The resulting

impact on adjusted earnings per share is an increase of 49.5% to

9.6p (2017: 6.5p). Basic earnings per share was 4.1p (2017:

2.1p).

Strategy

The Group's strategic objective remains focused on organic

growth through the provision of all major products and services

that an IFA requires to service its clients. We will continue to

develop the opportunities that exist in this space and, through

carefully selected acquisitions, seek to strengthen and deepen our

service proposition and expertise where appropriate.

Our people

We believe our strongest competitive advantage is our people and

our culture. Our strong business performance would not be achieved

without their hard work and commitment across the whole Group. We

have made good progress in our first year as an AIM listed business

and on behalf of the Board, I would like to thank all our employees

who have contributed to a successful year.

Board Changes

Following the retirement of Noel Stubley at the end of April

2018, we would like to welcome our new Chief Financial Officer

(CFO), Paul Edwards who has been in place since the beginning of

May 2018. Paul brings considerable listed public company experience

to the role which allied to his broad range of financial and

operational expertise will greatly strengthen the management

team.

Dividends

Given the strong financial performance and growth prospects of

the Group, the Board is recommending a final dividend of 4.4p per

share which will be payable on the 10 August 2018 to shareholders

who are on the register as at the 6 July 2018. The ex-dividend date

will be 5 July 2018. This when combined with the interim dividend

of 2.2p pence per share, gives a full year dividend of 6.6p (2017:

nil).

Outlook

As we look to the year ahead, each part of the Group is well

placed to continue to take advantage of the opportunities that

exist in their respective markets. The Board remains focused on

creating long-term value for stakeholders and we have been

encouraged by our business performance to date. We remain

optimistic regarding the future opportunities for the Group.

Chief Executive's Statement

Paul Hogarth, Chief Executive Report

I am very pleased to be able to report a very successful first

year as an AIM listed entity. All three divisions within the group

have performed well and indeed have benefited from the improved

profile afforded to a listed business. As a management team we are

energised by the success of our IPO and of the performance of the

group over our first year on AIM.

We remain committed to our group strategy of growing our

business as a service provider of choice to Directly Authorised

Financial Advisers across all of their major products and services.

We champion the Independent Financial Advice sector. Working

closely with advisers makes us very different to the majority of

our competitors. As a business, our ability to grow is largely

dependent on the success of the IFA sector we support which I am

delighted to report is in rude health. The IFA Community has

benefited from both the Retail Distribution Review and Treating

Customers Fairly. We support the IFA in the provision of financial

advice and wealth management services to their clients and in

particular the mass affluent.

Market overview

The cost of an ageing population has both forced companies to

close occupational pensions and the state to withdraw from

retirement and care support except for the most needy. The market

demand for financial advice and guidance of some form has grown and

will continue to grow, in particular for the mass affluent.

This demand is being met by the financial services industry

through technology adoption in broadly two ways: a near complete

reliance on the use of artificial intelligence decision making

through robo-advice or enhancing the benefits of face to face

intermediated financial advice.

Core to our strategy is to make it easier for Financial Advisers

to build better, bigger businesses. The use of technology and

infrastructure to support, not replace, financial advice is central

to that. This will help to improve Financial Advisers' business and

service and also create a carried benefit to the financial lives of

their clients.

The market demand for financial advice is growing, however the

ability of Financial Advisers to meet this demand has been

challenged due to widely acknowledged increase in business costs,

increased regulatory pressures and competitive forces on fees. Put

simply its more expensive in cost and time to provide the same

service.

The increased complication of managing and operating as a

Financial Adviser is further compounded by the complexity in the

provision of financial advice and Financial Advisers' ability to

provide their clients with an understanding of their investment

options based on their risk tolerance. This, in practical terms is

burdened, by the construction, monitoring and rebalancing of

investment portfolios - brought into focus by the regulatory

requirement of investors both large and small to achieve comparable

outcomes and received service.

Financial Advisers are increasingly seeing investment fulfilment

as non-core and expensive due to the cost, regulatory exposure and

professional commitment to offer their clients high levels of

holistic financial advice and service rather than investment

management.

Therefore, the key driver for Financial Advisers is to focus

where they can truly add value in the eyes of their clients which

is a personalised advice and financial planning service while

increasing their business' scalability through streamlining the

provision of the required financial instruments.

For Tatton, if we make it easier for IFAs to succeed and it

becomes a virtuous circle; the group benefits by supporting and

facilitating a better, more efficient supply of financial advice to

satisfy increasing consumer demand for professional financial

advice.

All of the group businesses adhere to this strategy of simply

improving IFA businesses efficiency by realising time and cost

benefits of delegating those tasks where scale and quality benefits

can be realised for both the adviser and their clients, the mass

affluent financial consumer.

Our services

Our first year as an AIM listed entity has consolidated our

strategy. As an independent, financially robust, profitable and

operationally transparent business we are able to develop deeper

and more strategic relationships with our Financial Adviser clients

across the group businesses. I am very pleased that all of the

group businesses can function as standalone operations but together

create a company ideally placed to benefit from developing the

professionalism and sophistication of financial advice within the

UK.

Paradigm Partners

I can announce that Paradigm Partners is being rebranded to

Paradigm Consulting a name that reflects the nature of the business

in the provision of compliance advice and audit, business strategy

consultancy and a new academy to help our advisers cope with the

increased demand for advice.

Paradigm Partners, the foundation firm of Tatton Asset

Management continually develops its service taking advantage of

opportunities whilst creating deeper relationships with Financial

Adviser businesses and indeed extending the general reach of the

group.

The impact and benefits of our service is reflected in the

incredibly hard work undertaken by our compliance consultants in

order to prepare our IFA firms for MiFID 2 and latterly GDPR.

Paradigm Mortgages

For most of the UK population, the home they own is their

largest single asset and assisting in its purchase and protection

is an essential service of Financial Advisers and therefore clearly

an area of opportunity for Tatton Asset Management. In aggregating

mortgage lending and life insurance, Paradigm Mortgages enables

Financial Advisers to benefit from the economies of scale in

lending and insurance provision, evidence of the carried benefit to

private clients of the Financial Adviser using our services.

The effect is that we have grown our membership by over 14% in

the last 12 months, showing that there is a greater awareness of

the collective strengths of working in partnership with the IFA

community.

Tatton Investment Management

The quality of investment performance delivered across our

assets under management has demonstrated that we have been able to

successfully combine a business that significantly lowers the cost

of investing and adheres to the highest investment management

standards to deliver against given investment objectives.

The adoption of our size and platform agnostic discretionary

portfolio management service as a centralised investment

proposition for Financial Advisers has increased access to

discretionary asset management to more investors and delivered on

our strategy of helping to create scalable advice businesses. We

now have over 341 adviser firms (2017: 237) and over 48,800 client

accounts (2017: 39,610) with an average portfolio size of

GBP100,000.

I am very pleased to report that over the last year we have been

able to launch the Tatton Blended Funds investment range to allow

non-platform access to our investment approach that utilise the

same cost model resulting in some of the lowest charging multi

asset, multi manager funds in the market. Due to increasing popular

demand, we have also extended our Ethical/ESG range of portfolios

across all the main UK investor risk profiles.

Our pipeline of potential new IFA businesses looking to utilise

Tatton Investment Management's services continues to grow, as they

look to benefit from our enhanced investment proposition and our

greater understanding of their needs.

Outlook

The outlook for the group is positive. We are uniquely able to

develop our offering because of the knowledge base created though

Paradigm Partners, as evidenced by the success of Tatton Investment

Management. Being able to anticipate and accommodate the future

business environment of the UK's financial advice sector is a key

element to ensure continued organic growth, future product

development and potential strategic relationships and

acquisitions.

As we have shown across the three businesses within the group

what we have done and will continue to do is improve and increase

the day to day business of a Financial Adviser.

Chief Financial Officer Statement

Paul Edwards, Chief Financial Officer

Overview

The 2017/18 financial year was an excellent year for the Group.

Following the successful IPO on the 6 July 2017 the Group has

continued to make good progress and deliver a set of strong results

for its first year as a public company. We have seen strong growth

in revenue, profits and margins in each of our three markets. Good

underlying cash generation supports our increased dividend and the

Group's financial position remains strong.

Record revenue and profits

Group revenue increased by 30.7% to GBP15.5m (2017: GBP11.9m);

Tatton Investment Management revenue increased by 46.5% to GBP6.3m

(2017: GBP4.3m) as assets under management increased over the year

and totalled GBP4.9bn at the year end (2017: GBP3.9bn), Paradigm

Partners continued to attract new clients and revenue was GBP6.8m

(2017: GBP5.8m), an increase of 17.9%. Paradigm Mortgages revenue

grew by 31.9% to GBP2.4m (2017: GBP1.8m).

The Group delivered a record year for Adjusted Operating

Profit*, which increased by 44.7% to GBP6.5m (2017: GBP4.5m) and

Adjusted Operating Profit* margin improved to 42.1% (2017: 38.0%).

Tatton Investment Management contributed GBP3.0m (2017: GBP1.2m)

improving its margin to 47.8% (2017: 28.3%). Paradigm Partners

contributed Adjusted Operating Profit* of GBP3.6m (2017: GBP2.9m)

with an improved margin of 52.7% (2017: 50.1%), and Paradigm

Mortgages Adjusted Operating Profit* contributed GBP1.4m (2017:

GBP0.8m) improving the margin to 57.9% (2017: 46.2%).

Total Group operating profit was GBP3.6m (2017: GBP2.0m) after

charging IPO exceptional costs of GBP2.0m and share based payments

of GBP1.0m of which GBP0.8m related to exceptional share-based

charges incurred as a consequence of the IPO. Operating profit has

been adjusted for these items to give better clarity of the

underlying performance of the Group.

Net finance costs

The Group generates strong cash flow and has net cash on its

balance sheet. The Group does however have access to a small

short-term overdraft facility. The net finance costs relating to

this facility were GBP26k (2017: GBP36k) a small decrease in the

year. The facility extends to 30 September 2018 however it is the

intention of the Group to review the ongoing facility arrangements

in the new financial year.

Taxation

Our tax arrangements are driven by commercial transactions,

managed in a responsible manner based on compliance, transparency

and co-operation with tax authorities.

The Group's tax charge of GBP1.1m (2017: GBP0.8m) includes a

GBP0.7m charge (2017: GBP0.4m) on trading activities. The effective

tax rate excluding adjusted items and the change in rate of UK

corporation tax has decreased to 18.4% (2017: 18.6%). The Group's

cash tax payment in the year was GBP1.4m (2017: GBP0.1m), or 19.2%

of underlying profit before tax.

Improvement in underlying earnings per share

Basic earnings per share increased to 4.1p (2017: 2.1p).

Adjusted earnings per share* increased by 49.5% to 9.6p (2017:

6.5p).

Cash flow

The Group continued to see healthy cash generation and closing

net cash was GBP10.6m (2017: GBPnil).

*Adjusted for separately disclosed items of exceptional costs

and share based charges.

Net cash generated from operating activities before exceptional

costs was GBP5.6m (2017: GBP6.2m). Exceptional costs totalled

GBP2.0m and in the main related to the IPO. Net cash generated from

operating activities was GBP2.3m (2017: GBP3.6m).

Net cash interest paid in the year was GBP26k (2017: GBP36k) and

relates to the short-term overdraft facility in place. Income tax

paid was GBP1.4m (2017: GBP0.1m) with the increase being as a

consequence of enhanced profits in the year, and dividends paid in

the year included both the interim dividend and a pre-IPO dividend

which in total was GBP1.6m.

At the time of the successful IPO earlier in the year the Group

raised an additional GBP10.0m. This cash remains in place and will

be utilised for future capital investments to support growth and

any potential acquisitions that fit the profile and strategic

direction of the Group.

Dividends and capital allocation

The Board is recommending a final dividend of 4.4p. When added

to the interim dividend of 2.2p gives a full year dividend of 6.6p.

This proposed dividend reflects both our cash performance in the

period and our underlying confidence in our business. Dividend

cover (being the ratio of earnings per share before exceptional

items and share based charges), is 1.4 times. If approved at the

Annual General Meeting the final dividend will be paid on 10 August

2018 to shareholders on the register on 6 July 2018. The ex-

dividend will be. Our objective is to maximise long-term

shareholder returns through a disciplined deployment of cash. To

support this, we have adopted a cash allocation policy that allows

for: investment in capital projects that support growth, regular

returns to shareholders from our free cash flow, acquisitions to

supplement our existing portfolio of business and an efficient

Balance Sheet appropriate to the Company's investment

requirements.

Risk management and the year ahead

Risk is managed closely and is spread across our businesses and

managed to individual materiality. Our key risks have been

referenced in the annual report. We choose key performance

indicators that reflect our strategic priorities of investment,

growth and profit. These KPIs are part of our day-to-day management

of the business and in the year ahead we will focus on growth and

value creation. In this way we aim to deliver continued value to

shareholders.

Availability of the Report and Accounts

A copy of the report and accounts for the year ended 31 March

2018 will be available on the company's website

(www.tattonassetmanagement.com) on 27 June 2018 and will be sent to

the Company's shareholders on the 9 July 2018.

Annual General Meeting

The Company's Annual General Meeting will be held at DWF LLP

offices in Manchester on 31 July 2018.

Consolidated statement of

total comprehensive income

31-Mar 31-Mar

2018 2017

Note GBP'000 GBP'000

--------- --------

Revenue 15,507 11,864

Administrative expenses (8,981) (7,354)

--------- --------

Adjusted operating profit

(before separately disclosed

items)(1) 6,526 4,510

- Share-based payment costs 4 (986) (75)

- Exceptional items 4 (1,964) (2,412)

Total administrative expenses (11,931) (9,841)

Operating profit 3,576 2,023

Finance costs 5 (26) (36)

--------- --------

Profit before tax 3,550 1,987

Taxation charge 6 (1,110) (834)

--------- --------

Profit for the year on continuing

operations 2,440 1,153

========= ========

Loss related to disposal (164) -

of discontinued operations

Profit attributable to shareholders 2,276 1,153

Earnings per share - Basic 7 4.07p 2.06p

--------- --------

Earnings per share - Diluted 7 3.85p 2.06p

--------- --------

Adjusted earnings per share

- Basic(2) 7 9.64p 6.45p

--------- --------

Adjusted earnings per share

- Diluted(2) 7 9.12p 6.45p

--------- --------

(1) Adjusted for exceptional items and share

based payments.

(2) Adjusted for exceptional items and share

based payments and the tax thereon.

There were no other recognised gained or losses

other than those recorded above in the current

or prior year and therefore a statement of other

comprehensive income has not been presented.

Consolidated Balance Sheet

31-Mar 31-Mar

2018 2017

Note GBP'000 GBP'000

Non-current assets

Goodwill 9 4,917 4,917

Property, plant and equipment 10 104 75

Investments in joint venture 11 - (31)

Total non-current assets 5,021 4,961

--------- ---------

Current assets

Trade and other receivables 12 2,452 3,148

Cash and cash equivalents 10,630 687

--------- ---------

Total current assets 13,082 3,835

Total assets 18,103 8,796

--------- ---------

Current liabilities

Trade and other payables 13 (3,922) (4,154)

Corporation tax (605) (860)

Borrowings 15 - (697)

--------- ---------

Total current liabilities (4,527) (5,711)

--------- ---------

Non-current liabilities

Deferred tax liabilities 16 (15) (12)

--------- ---------

Total non-current liabilities (15) (12)

Total liabilities (4,542) (5,723)

Net assets 13,561 3,073

Equity attributable to equity

holders of the company

Share capital 18 11,182 11,182

Share premium account 8,718 8,718

Other reserve 2,041 2,133

Merger reserve (28,968) (18,960)

Retained earnings 20,588 -

--------- ---------

Total equity 13,561 3,073

========= =========

Consolidated statement of changes

in equity

Share Share Other Merger Retained Total

capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April

2016 11,182 8,718 3,578 (17,112) - 6,366

-------- -------- -------- --------- --------- --------

Profit and total

comprehensive income - - 1,152 - - 1,152

Dividends - - (2,672) - - (2,672)

Share based

payments - - 75 - - 75

Adjustments related

to merger accounting - - - (1,848) - (1,848)

At 31 March

2017 11,182 8,718 2,133 (18,960) - 3,073

-------- -------- -------- --------- --------- --------

Profit and total

comprehensive income - - 598 - 1,678 2,276

Dividends - - (1,564) - (1,230) (2,794)

Share based

payments - - 846 - 140 986

Adjustments related

to merger accounting - - 28 (20,008) 20,000 20

Issue of share

capital - - - 10,000 - 10,000

At 31 March

2018 11,182 8,718 2,041 (28,968) 20,588 13,561

-------- -------- -------- --------- --------- --------

Consolidated statement of

cash flows

31 Mar 31 Mar

Note 2018 2017

GBP'000 GBP'000

Operating activities

Profit for the year 2,276 1,153

Adjustments:

Income tax expense 1,110 834

Depreciation of property,

plant and equipment 53 43

Share-based payment expense 986 75

Share of (profit)/loss from

joint venture (31) 24

Changes in:

Change in trade & other receivables (544) 1,471

Change in trade & other payables (188) 180

--------

Cash generated from operations 3,662 3,780

-------- --------

Cash generated from operations

before exceptional costs 5,626 6.192

Exceptional costs 4 (1,964) (2,412)

-------- --------

Cash generated from operations 3,662 3,780

-------- --------

Income tax paid (1,374) (131)

-------- --------

Net cash from operating activities 2,288 3,649

-------- --------

Investing activities

Purchase of property, plant

and equipment (82) (51)

--------

Net cash used in investing

activities (82) (51)

-------- --------

Financing activities

Proceeds from the issue of 10,000 -

shares

Stamp duty paid on share

transfer (10)

Dividends paid (1,556) (2,672)

Net cash used in financing

activities 8,434 (2,672)

-------- --------

Net increase in cash and

cash equivalents 10,640 926

Cash and cash equivalents

at beginning of period (10) (936)

-------- --------

Cash and cash equivalents

at end of period 10,630 (10)

-------- --------

The accompanying notes are an integral part of the annual

financial statements.

1 Accounting policies

The principal accounting policies applied in the presentation of

the annual financial statements are set out below.

1.2. Basis of preparation

The preliminary announcement has been prepared in accordance

with the Listing Rules of the FCA and is based on the consolidated

financial statements for the year ended 31 March 2018 which have

been prepared under IFRS as adopted by the European Union and those

parts of the Companies Act 2006 applicable to companies under

IFRS.

The accounting policies applied in preparing the preliminary

announcement are consistent with those used in preparing the

statutory financial statements for the year ended 31 March

2018.

The consolidated financial statements have been prepared on a

going concern basis and prepared on the historical cost basis.

The preliminary announcement does not constitute the statutory

financial statements of the group within the meaning of section 434

of the Companies Act 2006.

The preliminary announcement has been agreed with the company's

auditor for release.

The consolidated financial statements are presented in sterling

and have been rounded to the nearest thousand (GBP000). The

functional currency of the company is sterling.

The preparation of financial information in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual events may ultimately differ from those

estimates.

The Group has not previously prepared annual consolidated

financial statements in accordance with EU endorsed IFRSs. However,

three years of consolidated financial statements prepared under

IFRS 1 "First time adoption of International Financial Reporting

Standards" are presented in the Group's AIM Admission document

dated 6 July 2017. Reconciliations of how the Group's transition

from UK GAAP to IFRS affected its reported financial position,

financial performance and cash flows are presented in that

document.

2 Segment reporting

The following is an analysis of the Group's revenue and results

by reportable segment:

Period ended

31 March 2018

Paradigm

Paradigm Mortgage

Tatton Partners Services Central Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 6,325 6,780 2,366 36 15,507

Administrative

expenses (3,302) (3,207) (996) (1,476) (8,981)

-------- ---------- ---------- -------- --------

Adjusted operating

profit 3,023 3,573 1,370 (1,440) 6,526

IFRS2 share based

payments - (846) - (140) (986)

Exceptional charges - - - (1,964) (1,964)

-------- ---------- ---------- -------- --------

Operational profit 3,023 2,727 1,370 (3,544) 3,576

Finance (costs)/income - (19) (9) 2 (26)

Profit/(loss)

before tax 3,023 2,708 1,361 (3,542) 3,550

======== ========== ========== ======== ========

Period ended

31 March 2017

Paradigm

Paradigm Mortgage

Tatton Partners Services Central Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 4,317 5,753 1,794 - 11,864

Administrative

expenses (3,095) (2,870) (966) (423) (7,354)

-------- ---------- ---------- -------- --------

Adjusted operating

profit 1,222 2,883 828 (423) 4,510

IFRS2 share based

payments - (75) - - (75)

Exceptional charges (233) (373) (1,251) (555) (2,412)

-------- ---------- ---------- -------- --------

Operating profit 989 2,435 (423) (978) 2,023

Finance costs - (33) (3) - (36)

Profit before

tax 989 2,402 (426) (978) 1,987

-------- ---------- ---------- -------- --------

All turnover arose in the United Kingdom.

3 Operating profit

The operating loss and the loss before taxation are stated

after:

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

-------- --------

Operating lease rentals - land

and buildings 210 179

Operating lease rentals - equipment

and vehicles 9 11

Depreciation: property, plant

and equipment 53 43

Separately disclosed items (note

4) 2,950 2,487

Services provided to the Group's

auditor

Audit of the statutory consolidated

and company financial statements

of Tatton Asset Management PLC 31 -

Audit of subsidiaries 37 49

Other fees payable to auditor:

Tax services 225 10

Non-audit services 443 -

Total audit fees were GBP68,000 (2017: GBP49,000) Total

non-audit fees payable to the auditor were GBP668,000 (2017:

GBP10,000). Non-audit services relate mainly to IPO in 2017.

4 Separately disclosed items

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

-------- --------

Non-recurring costs

relating to corporate

transactions - 9

Product launch

costs - 143

IPO

costs 1,964 625

Provisions against

related entity loans - 1,635

Total exceptional

costs 1,964 2,412

Share based payments 986 75

Total separately disclosed

items 2,950 2,487

-------- --------

Separately disclosed items included within administrative

expenses reflects costs and income that do not relate to the

Group's normal business operations and that they are considered

material (individually or in aggregate if of a similar type) due to

their size of frequency.

Various legal and professional costs incurred in relation to the

IPO of the Group in July 2017 are shown as part of separately

disclosed items within administrative expenses in the Combined

Income Statement.

5 Finance costs

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

-------- --------

Bank interest (paid) / income (1) 2

Bank charges (25) (38)

(26) (36)

======== ========

6 Taxation

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

-------- --------

Current tax expense

Current tax on profits for the

period 1,107 829

Adjustment for under provision - -

in prior periods

-------- --------

1,107 829

-------- --------

Deferred tax expense

Origination and reversal of temporary

differences 3 5

Total tax expense 1,110 834

======== ========

The reasons for the difference

between the actual tax charge

for the year and the standard

rate of corporation tax in the

United Kingdom applied to profit

for the year as follows:

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

Profit before taxation 3,550 1,987

Tax at UK corporation tax rate

of 19% (2017: 20%) 675 397

Expenses not deductible for tax

purposes 279 506

Capital allowances in excess of

deprecation (5) (2)

Chargeable gains 161 -

LLP members of group not subject

to corporation tax - (67)

Total tax expense 1,110 834

======== ========

The UK corporation tax rate was 20% between the period 1 April

2015 to 31 March 2017. The rate reduced to 19% with effect from 1

April 2017 and will reduce to 17% with effect from 1 April 2020.

This will reduce the Company's future current tax credit/charge

accordingly. The deferred tax liability as at 31 March 2018 has

been calculated based on a rate of 17% based on when the Company

expects the deferred tax liability to reverse.

7 Earnings per share and dividends

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary Shareholder by the weighted average number

of ordinary shares during the year.

For diluted earnings per share the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. The dilutive shares are those

share options granted to employees where the exercise price is less

than the average market price of the Company's ordinary shares

during the year.

Number of shares

2018 2017

----------- -----------

Basic

Weighted average number of shares

in issue 55,907,513 55,907,513

Diluted 4,394,259 -

Share options

Weighted average number of shares

(diluted) 59,121,943 55,907,513

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

----------- -----------

Earnings attributable to ordinary

shareholders

Basic and diluted profit for the

period 2,276 1,153

Share based payments - IFRS2 option

charges 986 75

Exceptional costs - see note 4 1,964 2,412

Tax impact of adjustments - (35)

Adjusted basic and diluted profits

for the period and attributable

earnings 5,226 3,605

=========== ===========

Earnings per share (pence) (basic) 4.07p 2.06p

=========== ===========

Earnings per share (pence) (diluted) 3.85p 2.06p

=========== ===========

Adjusted earnings per share (pence)

(basic) 9.64p 6.45p

=========== ===========

Adjusted earnings per share (pence)

(diluted) 9,12p 6.45p

=========== ===========

Dividends

During the year, Tatton Asset Management PLC paid an interim

dividend of GBP1,229,965 (2017: GBPnil) to its equity

shareholders.

This represents a payment of 2.2p per share.

Dividends of GBP1,563,575 (2017: GBP2,671,867) were relating to

the Groups pre-IPO activity were paid prior to the IPO, which

occurred on 7 July 2017.

8 Staff costs

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

Wages, salaries

and bonuses 3,788 3,001

Social security

costs 510 270

Pension costs 86 82

Share-based payments 986 75

-------- --------

5,370 3,428

======== ========

31-Mar 31-Mar

2018 2017

Administration 72 62

Key management 3 3

-------- --------

75 65

======== ========

Key management

compensation

The remuneration of the statutory directors who are the key

management of the Group is set out below in aggregate for each of

the key categories specified in IAR 24 Related Party

Disclosures.

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

Wages, salaries and bonuses 875 344

Social security costs 111 39

Pension costs 20 7

Benefits in kind 3 4

-------- --------

1,009 394

======== ========

In addition to the remuneration above, the

non-executive Chairman and non-executive director

have submitted invoices for their fees as follows:

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

-------- --------

Total fees 118 -

======== ========

The remuneration of the highest

paid director was:

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

-------- --------

Total 474 257

======== ========

9 Goodwill and intangibles

Goodwill

GBP'000

Cost

Balance at 1

April 2016 4,917

Adjustment for provisional

fair value of consideration -

---------

Balance at 31

March 2017 4,917

Adjustment for provisional

fair value of consideration -

Balance at 31

March 2018 4,917

---------

Carrying value

Balance at 1

April 2016 4,917

---------

Balance at 31

March 2017 4,917

---------

Balance at 31

March 2018 4,917

---------

The goodwill of GBP4.9 million relates to GBP2.9m arising from

the acquisition in 2014 of an interest in Tatton Oak Limited by

Tatton Capital Limited consists of the future synergies and

forecast profits of the Tatton Oak business and GBP2.0m arising

from the acquisition in 2017 of an interest in Tatton Capital Group

Limited. None of the goodwill is expected to be deductible for

income tax purposes.

Impairment loss and subsequent reversal

Goodwill is subject to an annual impairment review based on an

assessment of the recoverable amount from future trading. Where, in

the opinion of the Directors, the recoverable amount from future

trading does not support the carrying value of the goodwill

relating to a subsidiary company an impairment charge is made. Such

impairment is charged to the Combined Statement of Comprehensive

Income.

Impairment testing

For the purpose of impairment testing, goodwill is allocated to

the Group's operating companies which represents the lowest level

within the Group at which the goodwill is monitored for internal

management accounts purposes.

Goodwill acquired in a business combination is allocated, at

acquisition, to the cash generating units (CGUs) or group of units

that are expected to benefit from that business combination. The

Directors test goodwill annually for impairment, or more frequently

if there are indicators that goodwill might be impaired. The

Directors have considered the carrying value of goodwill at 31

March 2018 and do not consider that it is impaired.

Growth rates

The value in use is calculated from cash flow projections based

on the Group's forecasts for the year ending 31 March 2019 which

are extrapolated for a further 4 years. The Group's latest

financial forecasts which cover a 3 year period, are reviewed by

the board.

Discount rates

The pre-tax discount rate used to calculate value is 8.3% (2017:

4%). The discount rate is derived from a benchmark calculated from

a basket of comparable businesses.

Cash flow assumptions

The key assumptions used for the value in use calculations are

those regarding discount rate, growth rates and expected changes in

margins. Changes in prices and direct costs are based on past

experience and expectations of future changes in the market. The

growth rate used in the calculation reflects the average growth

rate experienced by the Group for the industry.

The headroom compared to the carrying value of goodwill as at 31

March 2018 is GBP223m. Increasing the discount rate to 177% and

leaving all other factors the same would lead to the recoverable

amount being equal to the carrying value of the goodwill attributed

to the cash generating unit.

10 Property, Plant and Equipment

Computer, Fixtures Total

office and fittings

equipment

and motor

vehicles

GBP'000 GBP'000 GBP'000

Cost

Balance at 1 April 2016 303 214 517

Additions 50 - 50

----------- -------------- --------

Balance at 31 March

2017 and 1 April 2017 353 214 567

Additions 82 - 82

Balance at 31 March

2018 435 214 649

=========== ============== ========

Accumulated depreciation

and impairment

Balance at 1 April 2016 (235) (214) (449)

Charge for the period (43) - (43)

----------- -------------- --------

Balance at 31 March

2017 and 1 April 2017 (278) (214) (492)

Charge for the period (53) - (53)

----------- -------------- --------

Balance at 31 March

2018 (331) (214) (545)

=========== ============== ========

Carrying amount

As at 1 April 2016 68 - 68

----------- -------------- --------

As at 31 March 2017 75 - 75

----------- -------------- --------

As at 31 March 2018 104 - 104

----------- -------------- --------

All depreciation charges are included within administrative

expenses in the consolidated statement of comprehensive income.

11 Investments in Joint Ventures

The Group held the following investments

in Joint Ventures during the period:

Business Country

Name Activity of Incorporation Holding

Software England

Adviser Cloud Limited Company & Wales 50%

Carrying value as at:

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

At beginning of year (31) (7)

Share of retained (loss)

for the year 31 (24)

------------------ ----------

At end of year - (31)

================== ==========

The historical cost of the joint venture was

GBP1, when it was acquired in December 2015,

and has not changed since.

12 Trade and other receivables

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

Trade receivables 172 170

Amounts due

from related

parties 50 100

Prepayments

and accrued

income 1,602 1,289

Other receivables 227 1,188

Loan notes 401 401

2,452 3,148

======== ========

All trade receivable amounts are short term. All of the Group's

trade and other receivables have been reviewed for indicators of

impairment and where necessary, a provision for impairment

provided. The carrying value is considered a fair approximation of

their fair value. The value of the impairment charged to the income

statement is GBPnil: (2017: GBP1,601,000).

Trade receivable amounts are all held in Sterling.

13 Trade and other payables

Group Group

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

Trade payables 277 222

Amounts due to

related parties 32 -

Accruals 1,261 1,326

Deferred

income 216 158

Other payables 2,136 2,448

-------- --------

3,922 4,154

======== ========

The carrying values to trade payables, amounts due to related

parties, accruals and deferred income are considered reasonable

approximation of fair value.

14 Provisions

At 31 March 2017, Paradigm Mortgage Services LLP made a full

provision of GBP1,251,000 against the recoverability of amounts due

from Jargon Free Benefits LLP. Also as at 31 March 2017, Paradigm

Partners Limited made full provision of GBP350,000 against the

recoverability of amounts due from Amber Financial Investments

Limited, an entity controlled by Paul Hogarth.

The carrying value of the provision as at 31 March 2018 was

GBP1,601,000. (2017: GBP1,601,000) There has been no movement in

the carrying value during the year.

15 Borrowings

Group Group

31-Mar 31-Mar

2018 2017

GBP'000 GBP'000

Borrowings within

one year

Bank overdrafts - 697

----- --------

- 697

============================= ========

Bank overdrafts are repayable on demand. The bank overdrafts are

secured by a fixed and floating charge over all property and assets

present and future.

The average effective interest rate on bank overdrafts

approximates nil per cent per annum (2017: 3.2 per cent; 2016: 3.2

per cent). The Group is not subject to covenants under the terms of

its debt agreements.

16 Deferred taxation

GBP'000

At 1 April 2017 12

Recognised in profit or loss 3

At 31 March 2018 15

--------

At 1 April 2016 7

Recognised in profit or loss 5

At 31 March 2017 12

--------

17 Reconciliation of liabilities arising from financing activities

The changes in the Group's liabilities arising from financing

activities can be classified as follows:

Long-term Short-term Total

borrowings borrowings GBP000's

GBP000's GBP000's

At 1 April 2017 - 697 697

Cash flows:

* Repayment - (697) (697)

- - -

* Proceeds

Non-cash:

- - -

* Reclassification

At 31 March 2018 - - -

18 Equity

31-Mar 31-Mar

2018 2017

Number Number

Authorised, called up and fully

paid

GBP0.20

Ordinary

shares 55,907,513 55,907,513

55,907,513 55,907,513

=========== ===========

Each share in Tatton Asset Management PLC carries 1 vote and the

right to a dividend. Of the shares in issue, 49,497, 257 were

issued in June 2017 prior to the IPO in order to acquire the three

trading divisions and the remaining 6,410,256 were issued at the

IPO in July 2017.

As noted above, the 55,907,513 Ordinary shares were issued in

the current period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FFMPTMBBTBLP

(END) Dow Jones Newswires

June 27, 2018 02:00 ET (06:00 GMT)

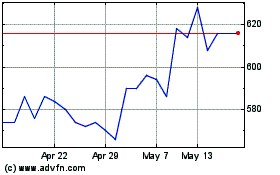

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

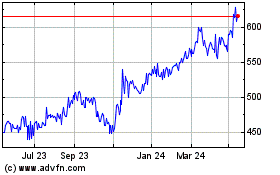

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024