TIDMTAM

RNS Number : 1696D

Titanium Asset Management Corp

18 March 2011

Titanium Asset Management Corp.

Reports 2010 Fourth Quarter and Annual Results

Milwaukee, WI, March 18, 2011 - Titanium Asset Management Corp.

(AIM - TAM) today reported results for the fourth quarter and year

ended December 31, 2010.

Highlights for the fourth quarter are as follows:

-- Managed and distributed assets decreased by 5.7% from

$9,560.3 million to $9,019.4 million during the fourth quarter of

2010 primarily reflecting negative asset flows and market losses on

fixed income strategies as interest rates increased.

-- Average managed and distributed assets of $9,306.8 million

for the fourth quarter of 2010, an increase of 1.1% over $9,208.2

million for the same period last year.

-- Operating revenues of $6,506,000 for the fourth quarter of

2010, a 4.9% decrease over operating revenues of $6,840,000 for the

same period last year primarily due to lower incentive fees.

-- Adjusted EBITDA(1) of $473,000 for the fourth quarter of 2010

compared to an Adjusted EBITDA deficit of $310,000 for the same

period last year.

-- Net investment income of $257,000 for the fourth quarter of

2010 compared to $269,000 for the same period last year.

-- Net loss of $6,032,000, or $0.29 per diluted common share,

for the fourth quarter of 2010 compared to a net loss of

$12,235,000, or $0.60 per diluted common share, for the fourth

quarter of 2009.

Highlights for the year are as follows:

-- Average managed and distributed assets of $9,325.8 million

for 2010, an increase of 6.9% over $8,726.2 million for the same

period last year.

-- Operating revenues of $23,570,000 for 2010, a 4.9% increase

over operating revenues of $22,471,000 for the same period last

year.

-- Adjusted EBITDA(1) deficit of $592,000 for 2010 compared to

an Adjusted EBITDA deficit of $2,894,000 for the same period last

year. Excluding severance costs, Adjusted EBITDA was $326,000 for

2010.

-- Net investment income of $1,266,000 for 2010 compared to

$398,000 for 2009.

-- Net loss of $13,602,000, or $0.66 per diluted common share,

for 2010 compared to a net loss of $21,169,000, or $1.03 per

diluted common share, for 2009.

(1) See the accompanying table on page 10 for a definition of

Adjusted EBITDA, a non-GAAP financial measure. The table provides a

description of this non-GAAP financial measure and a reconciliation

to the most directly comparable GAAP measure.

Commenting on these results, Robert Brooks, CEO of Titanium

Asset Management Corp. said:

"We are pleased to report positive EBITDA for the fourth quarter

of 2010 and for the full year, excluding severance costs. The

improved operating performance reflects the benefits of the

reorganization and integration activities undertaken throughout

2010. These changes resulted in significant reductions in our

structural administrative expenses, while we continued to grow

revenues."

"Since the acquisition of Boyd Watterson at the end of 2008, we

have reduced headcount from 97 to 82 and have reduced our

annualized administrative expenses from approximately $25.1 million

to $22.8 million. We believe these reductions position us to be

able to achieve significant growth in profitability as we achieve

revenue growth."

"In the fourth quarter, we continued to achieve excellent

investment performance, with 72% of our managed assets

outperforming their benchmarks. In addition, several of our

significant strategies are now in the upper deciles of our peer

group rankings for three year investment performance. We believe

these strong performance rankings should position us for strong

growth over the next year."

"While our investment performance remained strong, we had a

challenging fourth quarter as we lost a significant managed client

that decided to change to an indexing strategy, we had partial

redemptions of TALF assets, and we experienced a reduction in

distributed assets. We are working to overcome these challenges,

and we remain optimistic that 2011 will be a much better year for

new business, as we are already seeing increased

opportunities."

For further information please contact:

Titanium Asset Management Corp.

Robert Brooks, CEO 312-335-8300

Seymour Pierce Ltd

Jonathan Wright +44 20 7107 8000

Assets Under Management

Our managed and distributed assets totaled $9,019.4 million at

December 31, 2010, a decrease of 5.7% from the amount at September

30, 2010, and a decrease of 1.1% from the amount at December 31,

2009. Distributed assets are those managed by a hedge fund advisor

on which we earn referral fees. The changes in managed and

distributed assets over the three months ended December 31, 2010

were as follows:

Distributed

Managed Assets Assets Total

(in millions)

-----------------------------------------

Balance at September 30,

2010 $ 8,562.8 $ 997.5 $ 9,560.3

Net flows (435.0) (127.9) (562.9)

Market value change (2.8) 24.8 22.0

------------ ----------

Balance at December 31,

2010 $ 8,125.0 $ 894.4 $ 9,019.4

=============== ============ ==========

Average assets under management $ 8,343.9 $ 962.9 $ 9,306.8

=============== ============ ==========

Net flows are a combination of new and lost accounts plus

contributions and withdrawals from existing accounts.

For managed assets, the net outflows for the quarter were

primarily the result of the loss of a $170 million multiemployer

pension fund client that decided to change to an indexing strategy,

a partial unwinding of the TALF assets under management, and

continued softness in the retail distribution channel. The market

value change for managed assets reflects the increase in interest

rates during the quarter, which negatively impact the value of

fixed income holdings.

The distributed assets managed by the hedge fund advisor came

under significant pressure in the fourth quarter of 2010 as a

result of several factors, including its overall fee rates, its

investment performance relative to other hedge fund performance,

and certain changes within its management. The combination of these

factors resulted in client asset withdrawals totaling approximately

$125 million (representing approximately $260,000 of annualized

referral fees) during the fourth quarter of 2010. Starting January

1, 2011, the hedge fund advisor has reduced its average fee rates

that we estimate will reduce our annualized referral fees by an

additional $325,000.

Subsequent to our year end, the hedge fund advisor informed us

that it had received further redemption requests that can be

effected at the end of the first and second quarters of 2011. The

redemption requests totaled approximately $90 million (representing

approximately $300,000 of annualized referral fees) for the first

quarter and approximately $60 million (representing approximately

$100,000 of annualized referral fees) for the second quarter.

The hedge fund advisor has been actively communicating with its

clients regarding its investment strategies, the changes in its

management, and the reduction in its fees in efforts to limit the

redemptions. In addition, we continue to monitor the situation and

are assisting the hedge fund advisor in communicating with our

mutual clients. However, there can be no assurances that any of the

hedge fund advisor's activities or our actions will limit

redemptions.

The changes in managed and distributed assets for 2010 were as

follows:

Distributed

Managed Assets Assets Total

(in millions)

-----------------------------------------

Balance at December 31,

2009 $ 8,151.4 $ 974.9 $ 9,126.3

Net flows (561.1) (103.7) (664.8)

Market value change 534.7 23.2 557.9

------------ ----------

Balance at December 31,

2010 $ 8,125.0 $ 894.4 $ 9,019.4

=============== ============ ==========

Average assets under management $ 8,350.6 $ 975.2 $ 9,325.8

=============== ============ ==========

The net outflow of managed assets for the year ended December

31, 2010 was primarily due to the loss of the multiemployer pension

fund client during the fourth quarter, continued withdrawals by

multiemployer pension clients due to generally weak economic

conditions, the partial redemption of TALF assets in the fourth

quarter, and the continued softness in our retail distribution

channel, all of which more than offset new business during 2010.

The net outflows for managed assets also include the elimination of

approximately $100 million of advisory-only accounts whose fees are

not asset-based. The market value change reflects solid performance

for fixed income assets, which comprise approximately 88% of our

assets under management, and strong returns for equity assets.

For the year ended December 31, 2010, 72% of our managed and

distributed assets with defined performance benchmarks outperformed

their respective benchmarks.

Our assets under management by major investment strategy were as

follows:

December 31, 2010 December 31, 2009

--------------------------- ---------------------------

(in millions) % of total (in millions) % of total

-------------- ----------- -------------- -----------

Fixed income $ 7,137.4 87.9% $ 7,242.4 88.8%

Equity 781.3 9.6% 869.2 10.7%

Real estate 206.3 2.5% 39.8 0.5%

Balance at end of

period $ 8,125.0 100.0% $ 8,151.4 100.0%

============== =========== ============== ===========

Our assets under management by broad client type were as

follows:

December 31, 2010 December 31, 2009

(in millions) % of total (in millions) % of total

-------------- ----------- -------------- -----------

Institutional $ 6,902.8 85.0% $ 6,371.8 78.2%

Retail 1,222.2 15.0% 1,779.6 21.8%

Balance at end of

period $ 8,125.0 100.0% $ 8,151.4 100.0%

============== =========== ============== ===========

Operating Results

Three Months Ended Year Ended

December 31, December 31,

--------------------------- ----------------------------

2010 2009 2010 2009

------------ ------------- ------------- -------------

Average assets

under

management (in

millions) $ 8,343.9 $ 8,235.8 $ 8,350.6 $ 7,865.3

Average fee rate

(basis points) 25 25 25 24

Operating revenue $ 6,506,000 $ 6,840,000 $ 23,570,000 $ 22,471,000

Adjusted EBITDA

(deficit)(1) 473,000 (310,000) (592,000) (2,894,000)

Impairment of

goodwill 5,900,000 3,642,000 11,000,000 8,489,000

Operating loss (6,289,000) (6,667,000) (14,868,000) (17,551,000)

Net loss (6,032,000) (12,235,000) (13,602,000) (21,169,000)

Earnings per

share:

Basic $ (0.29) $ (0.60) $ (0.66) $ (1.03)

Diluted $ (0.29) $ (0.60) $ (0.66) $ (1.03)

(1) See the accompanying table on page 10 for a definition of

Adjusted EBITDA, a non-GAAP financial measure. The table provides a

description of this non-GAAP financial measure and a reconciliation

to the most directly comparable GAAP measure.

Our fourth quarter revenues decreased $334,000, or 4.9%,

relative to the fourth quarter of 2009 due to a decrease in

incentive fee revenue. Recurring fee revenue increased to

$5,817,000 in the fourth quarter of 2010, a 4.2% increase over the

recurring fee revenue of $5,584,000 in the fourth quarter of 2009,

largely based on the increase in average assets under management.

The increase in average assets under management reflects asset

gains from our participation in the TALF program and from our real

estate investment advisory business, as well as strong market

returns for fixed income assets. For the year, our 2010 revenues

increased by $1,099,000, or 4.9%, relative to 2009, despite the

decrease in incentive fee revenue. Our recurring fee revenue for

2010 increased to $22,881,000, a 7.9% increase over the recurring

fee revenue of $21,215,000 for 2009, largely based on the increase

in average assets under management.

Our Adjusted EBITDA of $473,000 for the fourth quarter of 2010

reflects an improvement of $783,000 over the prior year amount as a

result of the significant reduction in administrative expenses that

we achieved during 2010. For the fourth quarter of 2010, we reduced

administrative expenses to $6,066,000 from $7,317,000 in the year

earlier period, a 17.1% decrease.

Our Adjusted EBITDA deficit of $592,000 for 2010 includes

$918,000 of severance costs. Excluding severance costs, our

Adjusted EBITDA would have been $326,000, an improvement of

$3,220,000 over the prior year amount. The improvement reflects the

4.9% increase in revenues and a 10.5% decrease in administrative

expenses, excluding severance costs. Our administrative expenses,

excluding severance costs, declined $2,721,000, as a result of the

ongoing integration activities and reduced operating staff.

Since the first quarter of 2009, we have reduced our headcount

from 97 to 82 and we have reduced annualized administrative

expenses of approximately $25.1 million to approximately $22.8

million at December 31, 2010.

Goodwill Impairment

Based on interim results through the third quarter of 2010,

initial work on our 2011 budget, and some trading activity in our

common stock, we determined that we should complete a goodwill

impairment test as of September 30, 2010. As a result of that

testing, we concluded that our goodwill was impaired and recorded

an impairment charge of $5,100,000.

During the fourth quarter of 2010, we recognized an additional

$8,000,000 of goodwill from the resolution of the contingent

consideration for the acquisition of Boyd Watterson. In completing

our annual assessment test for impairment, we concluded that the

adjusted goodwill balance was impaired and recorded an additional

impairment charge of $5,900,000, bringing the total impairment

charge for 2010 to $11,000,000.

During 2009, we incurred impairment charges of $8,489,000, of

which $4,847,000 was recognized in the third quarter of 2009 and

$3,642,000 was recognized in the fourth quarter of 2009.

Forward-looking Statements

Statements in this press release which are not historical facts

may be "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

are subject to a number of assumptions, risks, and uncertainties,

many of which are beyond our control.

Any forward-looking statements made in this press release speak

as of the date made and are not guarantees of future performance.

Actual results or developments may differ materially from the

expectations expressed or implied in the forward-looking

statements, and we undertake no obligation to update any such

statements. Results may differ significantly due to market

fluctuations that alter our assets under management; a further

decline in our distributed assets; termination of investment

advisory agreements; impairment of goodwill and other intangible

assets; our inability to compete; market pressure on investment

advisory fees; ineffective management of risk; changes in interest

rates, equity prices, liquidity of global markets and international

and regional political conditions; or actions taken by Clal Finance

Ltd., as our significant stockholder. Additional factors that could

influence Titanium's financial results are included in its

Securities and Exchange Commission filings, including its Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K.

The Company's Annual Report on Form 10-K for the fiscal year

ended December 31, 2010, is expected to be filed with the

Securities and Exchange Commission on or before March 31, 2011. The

report will be available on the SEC's website at www.sec.gov and on

the Company's website at www.ti-am.com.

Titanium Asset Management Corp.

Condensed Consolidated Balance Sheets

December

31, December

2010 31, 2009

------------- -------------

(unaudited)

Assets

Current assets

Cash and cash equivalents $ 4,698,000 $ 4,773,000

Investments 3,354,000 12,549,000

Accounts receivable 4,783,000 5,030,000

Other current assets 1,179,000 1,162,000

------------- -------------

Total current assets 14,014,000 23,514,000

Investments in affiliates 5,898,000 2,179,000

Property and equipment, net 455,000 427,000

Goodwill 25,147,000 28,147,000

Intangible assets, net 21,605,000 24,920,000

Total assets $ 67,119,000 $ 79,187,000

============= =============

Liabilities and Stockholders' Equity

Current liabilities

Accounts payable $ 42,000 $ 237,000

Acquisition payments due 4,000,000 1,746,000

Other current liabilities 3,539,000 3,504,000

------------- -------------

Total current liabilities 7,581,000 5,487,000

Acquisition payments due - 960,000

------------- -------------

Total liabilities 7,581,000 6,447,000

Commitments and contingencies

Stockholders' equity

Common stock, $0.0001 par value;

54,000,000 shares authorized;

20,442,232 and 20,689,478 shares

issued and outstanding at December 31,

2010 and 2009, respectively 2,000 2,000

Restricted common stock, $0.0001 par

value; 720,000 shares authorized;

612,716 issued and outstanding at

December 31, 2010 and 2009 - -

Preferred stock, $0.0001 par value;

1,000,000 shares authorized; none

issued - -

Additional paid-in capital 100,971,000 100,332,000

Accumulated deficit (41,368,000) (27,766,000)

Other comprehensive income (67,000) 172,000

Total stockholders' equity 59,538,000 72,740,000

------------- -------------

Total liabilities and

stockholders' equity $ 67,119,000 $ 79,187,000

============= =============

Titanium Asset Management Corp.

Condensed Consolidated Statements of Operations

(unaudited)

Three Months Ended Year Ended

December 31, December 31,

------------------------------- --------------------------------

2010 2009 2010 2009

-------------- --------------- --------------- ---------------

Operating revenues $ 6,506,000 $ 6,840,000 $ 23,570,000 $ 22,471,000

Operating

expenses:

Administrative 6,066,000 7,317,000 24,123,000 25,926,000

Amortization of

intangible

assets 829,000 1,019,000 3,315,000 4,078,000

Impairment of

goodwill 5,900,000 3,642,000 11,000,000 8,489,000

Impairment of

intangible

assets - 1,529,000 - 1,529,000

Total

operating

expenses 12,795,000 13,507,000 38,438,000 40,022,000

Operating loss (6,289,000) (6,667,000) (14,868,000) (17,551,000)

Other income

Interest income 43,000 96,000 276,000 429,000

Net realized

gain (loss) on

investments 39,000 9,000 220,000 (151,000)

Income from

equity

investees 175,000 179,000 786,000 179,000

Interest

expense - (15,000) (16,000) (59,000)

Loss before taxes (6,032,000) (6,398,000) (13,602,000) (17,153,000)

Income tax expense - 5,837,000 - 4,016,000

Net loss $ (6,032,000) $ (12,235,000) $ (13,602,000) $ (21,169,000)

============== =============== =============== ===============

Earnings (loss)

per share

Basic $ (0.29) $ (0.60) $ (0.66) $ (1.03)

Diluted $ (0.29) $ (0.60) $ (0.66) $ (1.03)

Weighted average

number of common

shares

outstanding:

Basic 20,660,913 20,506,389 20,680,157 20,536,382

Diluted 20,660,913 20,506,389 20,680,157 20,536,382

Titanium Asset Management Corp.

Condensed Consolidated Statements of Cash Flows

(unaudited)

Year Ended

December 31,

--------------------------------

2010 2009

--------------- ---------------

Cash flows from operating activities

Net loss $ (13,602,000) $ (21,169,000)

Adjustments to reconcile net loss

to net cash used in operating

activities:

Amortization of intangible assets 3,315,000 4,078,000

Impairment of intangible assets - 1,529,000

Impairment of goodwill 11,000,000 8,489,000

Depreciation 100,000 141,000

Share compensation expense (credit) (139,000) 420,000

Loss (gain) on investments (220,000) 151,000

Income from equity investees (786,000) (179,000)

Income distributions from equity

investees 552,000 -

Accretion of acquisition payments 16,000 55,000

Deferred income taxes - 4,016,000

Changes in assets and liabilities:

Decrease (increase) in

accounts receivable 247,000 (900,000)

Increase in other current

assets (17,000) (257,000)

Decrease in accounts

payable (195,000) (432,000)

Increase (decrease) in

other current

liabilities (165,000) 1,633,000

--------------- ---------------

Net cash provided by (used in) operating

activities 106,000 (2,425,000)

--------------- ---------------

Cash flows from investing activities

Purchases of investments (13,294,000) (20,139,000)

Sales and redemptions of

investments 22,470,000 19,315,000

Investments in equity investees (5,000,000) (2,000,000)

Capital distributions from equity

investees 1,515,000 -

Purchases of property and equipment (128,000) (130,000)

Acquisitions of subsidiaries, net

of cash acquired (5,744,000) (8,601,000)

--------------- ---------------

Net cash used in investing activities (181,000) (11,555,000)

--------------- ---------------

Net decrease in cash and cash equivalents (75,000) (13,980,000)

Cash and cash equivalents:

Beginning 4,773,000 18,753,000

--------------- ---------------

Ending $ 4,698,000 $ 4,773,000

=============== ===============

Titanium Asset Management Corp.

Reconciliation of Adjusted EBITDA

(unaudited)

Three Months Ended Year Ended

December 31, December 31,

------------------------------ --------------------------------

2010 2009 2010 2009

-------------- -------------- --------------- ---------------

Operating loss $ (6,289,000) $ (6,667,000) $ (14,868,000) $ (17,551,000)

Amortization of

intangible assets 829,000 1,019,000 3,315,000 4,078,000

Impairment of

intangible assets - 1,529,000 - 1,529,000

Impairment of

goodwill 5,900,000 3,642,000 11,000,000 8,489,000

Depreciation expense 33,000 61,000 100,000 141,000

Share compensation

expense (credit) - 106,000 (139,000) 420,000

Adjusted EBITDA

(EBITDA

deficit)(1) $ 473,000 $ (310,000) $ (592,000) $ (2,894,000)

============== ============== =============== ===============

Notes:

(1) Adjusted EBITDA is defined as operating income or loss

before non-cash charges for amortization and impairment of

intangible assets and goodwill, depreciation, and share

compensation expense. We believe Adjusted EBITDA is useful as an

indicator of our ongoing performance and our ability to service

debt, make new investments, and meet working capital obligations.

Adjusted EBITDA, as we calculate it may not be consistent with

computations made by other companies. We believe that many

investors use this information when analyzing the operating

performance, liquidity, and financial position of companies in the

investment management industry.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UBANRAAAOAAR

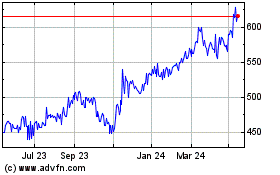

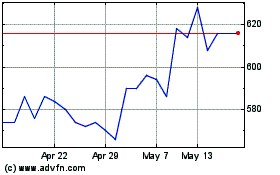

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024