TIDMTAM

RNS Number : 0604S

Titanium Asset Management Corp

12 May 2009

Titanium Asset Management Corp.

Reports First Quarter 2009 Results

Milwaukee, WI, May 12, 2009 - Titanium Asset Management Corp. (AIM - TAM) today

reported results for the first quarter of 2009.

Highlights are as follows:

* Revenues were $4,896,000 for the first quarter of 2009, a 120% increase over the

same period last year.

* Managed and fee paying assets up from $8,379.4million to $8,398.0 million,

* AUM up marginally from $7.572.2 to $7.573.2million

* Net loss of $(1,541,000), or ($0.08) per diluted common share, compared to

$4,000, or $0.00 per diluted common share, for the first quarter of 2008.

Commenting on these results, Nigel Wightman, Chairman and CEO of Titanium Asset

Management Corporation said:

"After completing the acquisition of Boyd Watterson Asset Management LLC at year

end, our efforts have been focused on integrating the activities of our four

acquired operating subsidiaries. During the first quarter, we completed the

staffing and reorganization of our sales team to better position us to sell the

full range of our strategies to our existing customers as well as to prospects.

"During the first quarter of 2009, our assets under management were stable

despite the challenging financial environment. We are encouraged by the strong

pipeline of new business opportunities at the end of the quarter and by the

general recovery in the financial markets since the end of the quarter.

We also continue to focus on the integration of operational and administrative

functions and expect to achieve significant expense reductions over the balance

of 2009."

For further information please contact:

Titanium Asset Management Corp.

Nigel Wightman, Chairman and CEO+44 20 7822 1881 or + 44 7789 277849

Seymour Pierce Ltd

Jonathan Wright +44 20 7107 8000

Penrose Financial

Gay Collins/Elisha Vincent+44 20 7786 4882 or +44 7798

626282

titanium@penrose.co.uk

Titanium Asset Management Corp. Reports First Quarter 2009 Results

Milwaukee, WI, May 12, 2009 - Titanium Asset Management Corp. (AIM - TAM) today

reported results for the first quarter of 2009.

The net loss for the first quarter of 2009 was $(1,541,000), or ($0.08) per

diluted common share, compared to $4,000, or $0.00 per diluted common share, for

the first quarter of 2008. Revenues were $4,896,000 for the first quarter of

2009, a 120% increase over the same period last year.

Assets Under Management

Our managed and fee paying assets were modestly higher for the quarter

ended March 31, 2009, notwithstanding the continuing difficult economic and

market environment:

+--------------------------------+-------------+-------------+

| | Managed |Distributed |

| | Assets | Assets |

+--------------------------------+-------------+-------------+

| | (in millions) |

+--------------------------------+---------------------------+

| | | |

+--------------------------------+-------------+-------------+

| Balance at December 31, 2008 | $ | $ |

| | 7,573.2 | 806.2 |

+--------------------------------+-------------+-------------+

| Net assets won/lost | 50.1 | 2.7 |

+--------------------------------+-------------+-------------+

| Market effect | (51.1) | 16.9 |

+--------------------------------+-------------+-------------+

| Balance at March 31, 2009 | $ | $ |

| | 7,572.2 | 825.8 |

+--------------------------------+-------------+-------------+

Distributed assets are those assets managed by a hedge fund advisor on which we

earn referral fees. Net assets won/lost are a combination of new and lost

accounts plus additions and withdrawals from existing accounts. Market effect is

a combination of the change in financial market plus the effect (positive or

negative) of active management.

At March 31, 2009 managed and fee paying assets totaled $8,398.0 million.

During the quarter to March 31, 2009, 71% of our managed and fee paying assets

with defined benchmarks outperformed their respective benchmarks.

Our assets under management by major investment strategy were as follows:

+--------------------------------+-------------+-----------+--------------+-----------+

| | March 31, 2009 | December 31, 2008 |

+--------------------------------+-------------------------+--------------------------+

| | (in | % of | (in | % of |

| | millions) | total | millions) | total |

+--------------------------------+-------------+-----------+--------------+-----------+

| | | | | |

+--------------------------------+-------------+-----------+--------------+-----------+

| U.S. fixed income | $ | 89.7% | $ | 88.2% |

| | 6,795.0 | | 6,674.8 | |

+--------------------------------+-------------+-----------+--------------+-----------+

| U.S. equity | 758.5 | 10.0% | 874.6 | 11.5% |

+--------------------------------+-------------+-----------+--------------+-----------+

| International equity | 18.7 | 0.3% | 23.8 | 0.3% |

+--------------------------------+-------------+-----------+--------------+-----------+

| Balance at end of period | $ | 100.0% | $ | 100.0% |

| | 7,572.2 | | 7,573.2 | |

+--------------------------------+-------------+-----------+--------------+-----------+

Our assets under management by broad client type were substantially unchanged

and were as follows:

+--------------------------------+-------------+-----------+-------------+-----------+

| | March 31, 2009 | December 31, 2008 |

+--------------------------------+-------------------------+-------------------------+

| | (in | % of | (in | % of |

| | millions) | total | millions) | total |

+--------------------------------+-------------+-----------+-------------+-----------+

| | | | | |

+--------------------------------+-------------+-----------+-------------+-----------+

| Institutional - Retirement | $ | 46.2% | $ | 48.0% |

| plans | 3,498.9 | | 3,633.3 | |

+--------------------------------+-------------+-----------+-------------+-----------+

| Institutional - Other | 2,359.1 | 31.2% | 2,197.3 | 29.0% |

+--------------------------------+-------------+-----------+-------------+-----------+

| Retail - Broker/dealer | 968.9 | 12.8% | 948.6 | 12.5% |

| accounts | | | | |

+--------------------------------+-------------+-----------+-------------+-----------+

| Retail - Other | 745.3 | 9.8% | 794.0 | 10.5% |

+--------------------------------+-------------+-----------+-------------+-----------+

| Balance at end of period | $ | 100.0% | $ | 100.0% |

| | 7,572.2 | | 7,573.2 | |

+--------------------------------+-------------+-----------+-------------+-----------+

Operating Results

Our revenues increased as a result of the acquisitions of National Investment

Services and Boyd Watterson Asset Management during 2008, offset in part by

decreased revenues at our Wood Asset Management and Sovereign Holdings

subsidiaries. Their decreases in revenues were primarily driven by the loss of

customer accounts in 2008 and the impact of the decrease in equity values over

the second half of 2008.

Our operating loss of $2,064,000 for the first quarter of 2009 was primarily the

result of the decrease in revenues at Wood and Sovereign and significant

professional fees incurred during the first quarter of 2009 associated with our

annual audit and the preparation of our various annual reports. We continue to

focus on the integration of operational and administrative functions and expect

to achieve significant expense reductions over the balance of 2009.

During the first quarter of 2009, we also incurred a nonrecurring $381,000 loss

related to our investment in the Plurima Titanium U.S. Equity Fund, to which we

were serving as an investment advisor. In March 2009, our board of directors

determined that additional investments from other parties were likely not to be

forthcoming and as a result, they decided to commence actions to liquidate our

investment in the commingled stock fund.

Titanium Asset Management Corp. is a multiproduct asset management company

developed through the integration of four long established companies serving

both institutional and retail clients. Titanium acquired Wood Asset Management,

Inc. and Sovereign Holdings, LLC in October 2007, National Investment Services,

Inc. in March 2008 and Boyd Watterson Asset Management, LLC in December 2008.

Forward-looking Statements

This press release contains certain statements that are "forward-looking

statements" within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are subject to a number of assumptions, risks, and

uncertainties, many of which are beyond the control of Titanium.

Any forward-looking statements made in this press release speak as of the date

made and are not guarantees of future performance. Actual results or

developments may differ materially from the expectations expressed or implied in

the forward-looking statements, and the Company undertakes no obligation to

update any such statements. Additional factors that could influence Titanium's

financial results are included in its Securities and Exchange Commission

filings, including its Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K.

The Company's Quarterly Report on Form 10-Q for the three months ended March 31,

2009, is expected to be filed with the Securities and Exchange Commission on or

before May 15, 2009. The report will be available on the SEC's website at

www.sec.gov and on the Company's website at www.ti-am.com.

+------------------------------------------------------------------------------+

| Titanium Asset Management Corp. |

| Condensed Consolidated Balance Sheets |

+------------------------------------------------------------------------------+

+-----------------------------------------------------------------------+-------------+-------------+

| | March 31, | December |

| | 2009 | 31, 2008 |

+-----------------------------------------------------------------------+-------------+-------------+

| |(unaudited) | |

+-----------------------------------------------------------------------+-------------+-------------+

| Assets | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Current assets | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Cash and cash | $ | $ |

| equivalents | 8,212,000 | 18,753,000 |

+-----------------------------------------------------------------------+-------------+-------------+

| Securities available | 12,209,000 | 10,683,000 |

| for sale | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Accounts receivable | 3,727,000 | 4,041,000 |

+-----------------------------------------------------------------------+-------------+-------------+

| Other current assets | 1,441,000 | 1,420,000 |

+-----------------------------------------------------------------------+-------------+-------------+

| Total | 25,589,000 | 34,897,000 |

| current | | |

| assets | | |

+-----------------------------------------------------------------------+-------------+-------------+

| | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Securities available for sale | 587,000 | 672,000 |

+-----------------------------------------------------------------------+-------------+-------------+

| Property and equipment, net | 501,000 | 456,000 |

+-----------------------------------------------------------------------+-------------+-------------+

| Goodwill | 32,731,000 | 32,757,000 |

+-----------------------------------------------------------------------+-------------+-------------+

| Intangible assets, net | 31,263,000 | 32,206,000 |

+-----------------------------------------------------------------------+-------------+-------------+

| Deferred income taxes | 4,883,000 | 4,202,000 |

+-----------------------------------------------------------------------+-------------+-------------+

| Total | $ | $ |

| assets | 95,554,000 | 105,190,000 |

+-----------------------------------------------------------------------+-------------+-------------+

| | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Liabilities and Stockholders' Equity | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Current liabilities | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Accounts payable | $ | $ |

| | 448,000 | 663,000 |

+-----------------------------------------------------------------------+-------------+-------------+

| Acquisition payments | 939,000 | 8,145,000 |

| due | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Other current | 1,755,000 | 1,789,000 |

| liabilities | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Total current | 3,142,000 | 10,597,000 |

| liabilities | | |

+-----------------------------------------------------------------------+-------------+-------------+

| | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Acquisition payments due | 960,000 | 1,889,000 |

+-----------------------------------------------------------------------+-------------+-------------+

| Total | 4,102,000 | 12,486,000 |

| liabilities | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Commitments and contingencies | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Stockholders' equity | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Common stock, $0.0001 | 2,000 | 2,000 |

| par value; 54,000,000 | | |

| shares authorized; | | |

| 20,509,502 and | | |

| 20,464,002 shares | | |

| issued and outstanding | | |

| at March 31, 2009 and | | |

| December 31, 2008, | | |

| respectively | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Restricted common | - | - |

| stock, $0.0001 par | | |

| value; 720,000 shares | | |

| authorized; 612,716 | | |

| issued and outstanding | | |

| at March 31, 2009 and | | |

| December 31, 2008 | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Preferred stock, | - | - |

| $0.0001 par value; | | |

| 1,000,000 shares | | |

| authorized; none issued | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Additional paid-in | 99,560,000 | 99,462,000 |

| capital | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Accumulated deficit | (8,138,000) | (6,597,000) |

+-----------------------------------------------------------------------+-------------+-------------+

| Other comprehensive | 28,000 | (163,000) |

| income (loss) | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Total | 91,452,000 | 92,704,000 |

| stockholders' | | |

| equity | | |

+-----------------------------------------------------------------------+-------------+-------------+

| Total | $ | $ |

| liabilities | 95,554,000 | 105,190,000 |

| and | | |

| stockholders' | | |

| equity | | |

+-----------------------------------------------------------------------+-------------+-------------+

+------------------------------------------------------------------------------+

| Titanium Asset Management Corp. |

| Condensed Consolidated Statement of Operations |

| (unaudited) |

+------------------------------------------------------------------------------+

+------------------------------------------------------+-------------+-------------+

| | Three | Three |

| | Months | Months |

| | Ended | Ended |

| | March 31, | March 31, |

| | 2009 | 2008 |

+------------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------------+-------------+-------------+

| Fee income | $ | $ |

| | 4,896,000 | 2,220,000 |

+------------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------------+-------------+-------------+

| Operating expenses: | | |

+------------------------------------------------------+-------------+-------------+

| Administrative | 6,017,000 | 1,893,000 |

+------------------------------------------------------+-------------+-------------+

| Amortization of intangible assets | 943,000 | 809,000 |

+------------------------------------------------------+-------------+-------------+

| Total operating | 6,960,000 | 2,702,000 |

| expenses | | |

+------------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------------+-------------+-------------+

| Operating loss | (2,064,000) | (482,000) |

+------------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------------+-------------+-------------+

| Other income | | |

+------------------------------------------------------+-------------+-------------+

| Interest income | 120,000 | 496,000 |

+------------------------------------------------------+-------------+-------------+

| Interest expense | (14,000) | - |

+------------------------------------------------------+-------------+-------------+

| Recognized loss on investment in | (381,000) | - |

| commingled fund | | |

+------------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------------+-------------+-------------+

| Income (loss) before taxes | (2,339,000) | 14,000 |

+------------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------------+-------------+-------------+

| Income tax expense (benefit) | (798,000) | 10,000 |

+------------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------------+-------------+-------------+

| Net income (loss) | $ | $ |

| | (1,541,000) | 4,000 |

+------------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------------+-------------+-------------+

| Earnings (loss) per share | | |

+------------------------------------------------------+-------------+-------------+

| Basic | $ | $ - |

| | (0.08) | |

+------------------------------------------------------+-------------+-------------+

| Diluted | $ | $ - |

| | (0.08) | |

+------------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------------+-------------+-------------+

| Weighted average number of common shares | | |

| outstanding: | | |

+------------------------------------------------------+-------------+-------------+

| Basic | 20,546,491 | 20,451,501 |

+------------------------------------------------------+-------------+-------------+

| Diluted | 20,546,491 | 26,267,104 |

+------------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------------+-------------+-------------+

+------------------------------------------------------------------------------+

| Titanium Asset Management Corp. |

| Condensed Consolidated Statement of Cash Flows |

| (unaudited) |

+------------------------------------------------------------------------------+

+-----------------------------------------------------------------------+--------------+--------------+

| | Three | Three |

| | Months | Months |

| | ended | ended |

| | March 31, | March 31, |

| | 2009 | 2008 |

+-----------------------------------------------------------------------+--------------+--------------+

| | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Cash flows from operating activities | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Net income (loss) | $ | $ |

| | (1,541,000) | 4,000 |

+-----------------------------------------------------------------------+--------------+--------------+

| Adjustments to | | |

| reconcile net income | | |

| (loss) to net cash | | |

| provided by (used in) | | |

| operating activities: | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Depreciation and | 972,000 | 812,000 |

| amortization | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Noncash share | 98,000 | - |

| compensation | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Accretion of | 10,000 | - |

| acquisition payments | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Recognized loss on | 381,000 | - |

| investment | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Deferred income taxes | (798,000) | (59,000) |

+-----------------------------------------------------------------------+--------------+--------------+

| Changes in assets and | | |

| liabilities: | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Decrease | 403,000 | 82,000 |

| in | | |

| accounts | | |

| receivable | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Increase | (24,000) | (256,000) |

| in other | | |

| current | | |

| assets | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Decrease | (221,000) | (70,000) |

| in | | |

| accounts | | |

| payable | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Increase | (63,000) | 656,000 |

| in other | | |

| current | | |

| liabilities | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Net cash provided by (used in) operating activities | (783,000) | 1,169,000 |

+-----------------------------------------------------------------------+--------------+--------------+

| | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Cash flows from investing activities | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Purchases of property | (93,000) | - |

| and equipment | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Cash and cash | - | 55,587,000 |

| equivalents held in | | |

| (released from) trust | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Net purchases of | (1,514,000) | - |

| short-term securities | | |

| available for sale | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Cash paid for | (6,000) | (31,226,000) |

| acquisition of | | |

| subsidiaries, net of | | |

| cash acquired | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Net cash provided by (used in) investing activities | (1,613,000) | 24,361,000 |

+-----------------------------------------------------------------------+--------------+--------------+

| | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Cash flows from financing activities | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Payment of deferred acquisition | (8,145,000) | - |

| payments | | |

+-----------------------------------------------------------------------+--------------+--------------+

| | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Net increase (decrease) in cash and cash equivalents | (10,541,000) | 25,530,000 |

+-----------------------------------------------------------------------+--------------+--------------+

| | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Cash and cash equivalents: | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Beginning | 18,753,000 | 19,388,000 |

+-----------------------------------------------------------------------+--------------+--------------+

| Ending | $ | $ |

| | 8,212,000 | 44,918,000 |

+-----------------------------------------------------------------------+--------------+--------------+

| | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Supplemental disclosure of cash flow information | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Income taxes paid | $ - | $ |

| | | 598,000 |

+-----------------------------------------------------------------------+--------------+--------------+

| | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Supplemental disclosure of non-cash investing and | | |

| financing activities | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Paid-in capital | $ - | $ |

| attributed to common | | 55,587,000 |

| stock repurchase rights | | |

| not executed | | |

+-----------------------------------------------------------------------+--------------+--------------+

| Payable for common | $ - | $ |

| stock repurchases | | 12,017,000 |

+-----------------------------------------------------------------------+--------------+--------------+

| Payments due in | $ - | $ |

| connection with | | 1,903,000 |

| acquisitions | | |

+-----------------------------------------------------------------------+--------------+--------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

QRFEASSFFSLNEFE

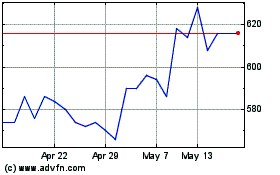

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

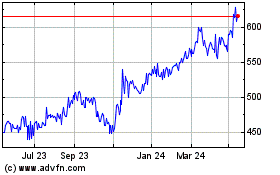

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024