RNS Number : 7808H

Titanium Asset Management Corp

10 November 2008

Titanium Asset Management Corp.

Interim report and unaudited accounts for the Nine Months Ended September 30, 2008

I attach unaudited financial statements for the nine months to September 30th 2008.

Like all fund management companies, we have been impacted by the extreme volatility in financial markets. Our fee generating assets at

September 30th 2008 were U$5.7bn, a decline of 6.6% from the figure of U$6.1bn at June 30th 2008. We have been quite well protected from the

worst of the financial crisis by our current emphasis on fixed income management and by a lack of any non-dollar assets. We are currently

seeing a positive flow of net new business and have a strong pipeline, particularly in fixed income.

During the quarter we filed a Form 10 Registration Statement with the Securities and Exchange Commission and are now a US public

reporting company. This exercise incurred significant one-off costs in fees to our professional advisers. Revenues from our equity

management and hedge fund distribution activities also fell during the quarter as a result of sharp declines in markets.

In the year to date our EBITDA was positive by US$428,000 and in the quarter to September 30th 2008 it was negative by US$1,091,000.

During the quarter we have been engaged in a number of discussions about potential acquisitions. I expect to make a separate

announcement to shareholders on that subject.

N.D.Wightman

Chairman and Chief Executive Officer

Titanium Asset Management Corp.

Consolidated Balance Sheets

(in thousands except for shares)

September 30, December 31, 2007

2008

Assets (unaudited)

Current assets

Cash and cash equivalents $ 30,574 $ 19,388

Cash and cash equivalents held in - 55,587

trust fund

Accounts receivable 2,810 388

Prepaid expenses and other assets 531 115

Total current assets 33,915 75,478

Property and equipment

Office furniture, fixtures and 238 19

equipment

Less accumulated depreciation 51 16

Property and equipment, net 187 3

Goodwill 29,420 21,987

Intangibles, net 33,541 15,340

Deferred income taxes 1,908 377

Investments 893

Total assets $ 99,863 $ 113,185

Liabilities and Stockholders' Equity

Current liabilities

Accounts payable $ 281 $ 149

Accrued expenses:

Income taxes 95 657

Other 584 206

Guaranteed payment for acquisition 1,000 -

Deferred revenues 205 -

Other current liabilities - 249

Total current liabilities 2,165 1,261

Guaranteed payment for acquisition 915 -

Total liabilities 3,080 1,261

Commitments and contingencies

Common stock, subject to possible - 55,587

conversion 20,000,000 shares

at conversion value

Stockholders' equity

Common stock, $0.0001 par value; 2 2

authorized 54,000,000

shares; 20,451,502 and 22,993,731

shares issued and outstanding at

September 30, 2008 and December 31,

2007, respectively

Restricted shares, $0.0001 par value; - -

authorized 720,000

shares; 612,716 and 696,160 shares

issued and outstanding at September

30, 2008 and December 31, 2007,

respectively

Preferred stock, $0.0001 par value, - -

authorized 1,000,000

shares; none issued

Other comprehensive income (loss) (33) -

Additional paid-in capital 99,461 55,892

Retained earnings (deficit) (2,647) 443

Total stockholders' equity 96,783 56,337

Total liabilities and stockholders' $ 99,863 $ 113,185

equity

See notes to consolidated financial statements.

Titanium Asset Management Corp.

Consolidated Statements of Income

(in thousands except for shares)

Nine Months Ended Period from February 2, 2007

September 30, 2008 (inception) through September 30,

2007)

(unaudited) (unaudited)

Fee income $ 10,592 $ -

Operating expenses:

Administrative 10,965 370

Amortization of intangibles 3,096 -

Write off of intangibles 1,792 -

Total operating expenses 15,853 370

Operating loss (5,261) (370)

Other income

-

Interest income 774 1,432

Investment income (loss) (38) -

Miscellaneous income 65 -

Interest expense (14) -

Income (loss) before taxes

(4,474) 1,062

Taxes (expense) benefit on 1,384

income (403)

Net income (loss) $ (3,090) $ 659

Net (loss) income per share

Basic $ (0.15) $0.06

Diluted $(0.15) $0.05

Nine Months Ended Period from February 2, 2007 (inception) through

September 30, 2008 September 30, 2007

(unaudited) (unaudited)

Cash flows from operating

activities

Net (loss) income $ (3,090) $ 659

Adjustments to reconcile net

income to

net cash provided by operating

activities:

Depreciation and amortization 3,131 -

Deferred income taxes (1,531) -

Recognize impairment of 1,792 -

intangible asset

Changes in assets and

liabilities:

Decrease (increase) in:

Accounts receivable (396) -

Prepaid expenses and other 412 (32,373)

assets

Increase (decrease) in: -

Accounts payable 134 -

Accrued expenses and other

current liabilities (580) 5,419

Net cash provided by (used in)

operating (128) (26,295)

activities

Cash flows from investing

activities

Purchases of property and (103) -

equipment

Cash and cash equivalents held 55,587

in (55,011)

(released from) trust

Long-term investments (893) -

Net unrealized loss on (34) -

long-term investments

Cash paid for acquisition of (31,226) -

subsidiaries,

net of cash acquired

Net cash provided by (used in)

23,331 (55,011)

investing activities

Cash flows from financing

activities

Issuance of common stock units - 120,025

Costs associated with share - (9,652)

issue

Common stock redeemed (12,017) (3,892)

Net (used in) cash provided by

financing (12,017) 106,481

activities

Net (decrease) increase in

cash and cash 11,186 25,175

equivalents

Cash and cash equivalents:

Beginning 19,388 -

Ending $ 30,574 $ 25,175

Supplemental disclosure of

non-cash

financing activities

Fair value of placement agent $ - $ 2,091

warrant

Income taxes paid $ 630 $ -

Paid-in capital attributed to

common stock repurchase

rights not executed $ 55,587 $ -

Guaranteed payment issued in $ 1,915 $ -

connection with acquisition

See notes to consolidated financial statements.

Note 1 - General

Titanium Asset Management Corp. (the "Company") was incorporated on February 2, 2007 as a special purpose acquisition vehicle. On

October 1, 2007, the Company acquired all of the voting common stock of Wood Asset Management, Inc. ("Wood") and all of the membership

interests of Sovereign Holdings, LLC ("Sovereign"), two asset management firms. On March 31, 2008, the Company acquired all of the

outstanding capital stock of National Investment Services, Inc. ("NIS"), a third asset management firm. After such business combinations,

the Company ceased to act as a special purpose acquisition vehicle. See Note 3 - Acquisitions.

The accompanying unaudited consolidated financial statements have been prepared by the Company, in accordance with accounting principles

generally accepted in the United States and pursuant to the rules and regulations of the Securities and Exchange Commission (the "SEC") and,

in the opinion of management, include all adjustments (all of which were of a normal and recurring nature) necessary for a fair statement of

the information for each period contained therein.

The preparation of financial statements in accordance with generally accepted accounting principles requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as

of the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. These estimates are

based on information available as of the date of these financial statements. Actual results could differ materially from those estimates.

The information included in this Quarterly Report on Form 10-Q should be read in conjunction with Management's Discussion and Analysis

and the consolidated financial statements and the notes thereto included in the Company's Registration Statement on Form 10.

Note 2 - Adoption of New Accounting Standards

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements ("SFAS 157") which provides guidance for measuring assets and

liabilities at fair value. Generally, SFAS 157 is effective for financial statements issued for fiscal years beginning after November 15,

2007. The adoption of SFAS 157 did not have a material impact on the Company's consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities, Including an

Amendment of FASB Statement No. 115 ("SFAS 159"). SFAS 159 allows companies to measure at fair value most financial assets and liabilities

that are currently required to be measured in a different manner, such as based on their carrying amount. SFAS 159 is effective for fiscal

years beginning after November 15, 2007. The adoption of SFAS 159 did not have a material impact on the Company's consolidated financial

statements.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), Business Combinations ("SFAS 141(R)") and SFAS No. 160, Noncontrolling

Interests in Consolidated Financial Statements, an amendment of Accounting Research Bulletin No. 51 ("SFAS 160"). SFAS 141(R) will change

how business acquisitions are accounted for and SFAS 160 will change the accounting and reporting for minority interests, which will be

recharacterized as noncontrolling interests and classified as a component of equity. SFAS 141(R) and SFAS 160 are effective for fiscal years

beginning on or after December 15, 2008 (January 1, 2009 for the Company). The adoption of SFAS 141(R) and SFAS 160 is not expected to have

a material impact on the Company's consolidated financial statements.

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB

Statement No. 133 ("SFAS 161"). SFAS 161 amends and expands disclosures about derivative instruments and hedging activities. SFAS 161

requires qualitative disclosures about the objectives and strategies of derivative instruments, quantitative disclosures about the fair

value amounts of and gains and losses on derivative instruments, and disclosures of credit risk related contingent features in hedging

activities. SFAS 161 is effective for fiscal years beginning after November 15, 2008 and will be effective for the Company in fiscal year

2009. Early adoption is prohibited; however, presentation and disclosure requirements must be retrospectively applied to comparative

financial statements. The Company has not yet determined the effect, if any, that the adoption of this standard will have on its

consolidated financial position or results of operations.

In May 2008, the FASB issued SFAS No. 162, The Hierarchy of Generally Accepted Accounting Principles ("SFAS 162"). SFAS 162 identifies

the sources of accounting principles and the framework for selecting the principles used in the preparation of financial statements for

non-governmental entities that are presented in conformity with accounting principles generally accepted in the United States of America.

SFAS 162 will be effective 60 days after the SEC approves the Public Company Accounting Oversight Board's amendments to AU Section 411. The

Company does not anticipate the adoption of SFAS 162 will have an impact its consolidated financial statements.

In February 2008, the FASB issued FASB Staff Position No. 157-2, Effective Date of FASB Statement No. 157 ("FSP No. 157-2"), to

partially defer SFAS 157. FSP No. 157-2 defers the effective date of SFAS 157 for non-financial assets and non-financial liabilities, except

those that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually), to fiscal years,

and interim periods within those fiscal years, beginning after November 15, 2008. The Company is currently evaluating the impact of adopting

the provisions of FSP No. 157-2.

Note 3 - Acquisitions

Acquisition of Wood

On October 1, 2007, the Company completed the acquisition of all of the voting common stock of Wood, an asset management firm in the

equity and fixed-income markets.

In consideration for the sale and purchase of the voting common stock of Wood, the sellers received $27,500 in cash and 727,273 shares

of common stock of the Company, with a fair value of $4,000. The sellers may receive additional payments should Wood achieve certain revenue

and assets under management milestones during the three-year period after closing. The maximum payments that may be made under the sale and

purchase agreement is $6,000 in cash and common stock.

The aggregate purchase price of Wood was approximately $33,164, including acquisition cost of $1,664. The following summarizes the fair

values of the assets acquired at the date of acquisition. Goodwill recorded from this transaction is tax deductible.

Goodwill $ 19,865

Intangible asset - customer relationships 12,026

Intangible asset - non-compete covenant 829

Intangible asset - brand 444

$ 33,164

Acquisition of Sovereign

On October 1, 2007, the Company completed the acquisition of all of the membership units of Sovereign, an asset management firm in the

equity and fixed-income markets. Pursuant to the sale and purchase agreement, the Company purchased the operations of Sovereign primarily

for its customer relationships and other intangibles.

In consideration for the sale and purchase of the membership units of Sovereign, the sellers received $4,500 in cash and 181,818 shares

of common stock, with a fair value of $1,000. The sellers may also receive up to $5,000 should Sovereign achieve certain revenue and assets

under management milestones during the three-year period after closing.

The aggregate purchase price was approximately $5,801, including acquisition cost of $301. The following summarizes the fair values of

the assets acquired at the date of acquisition. Goodwill recorded from this transaction is tax deductible.

Goodwill $ 2,122

Intangible asset - customer relationships 2,665

Intangible asset - non-compete covenant 833

Intangible asset - brand 181

$ 5,801

Acquisition of NIS (unaudited)

On March 31, 2008, the Company completed the acquisition of all of the outstanding common stock of NIS. NIS is an asset management firm

in the fixed-income and equity markets.

In consideration for the sale and purchase of the common stock of NIS, the sellers received $29,684 in cash. The sellers will also

receive guaranteed deferred payments of $1,000 in 2009 and $1,000 in 2010. These guaranteed payments are reflected in the consolidated

balance sheet as a current obligation and a long-term obligation discounted to its net present value of $915. As part of the sale and

purchase agreement, the sellers may also receive up to an additional $4,900 either all in cash or, at the sole discretion of the Company, a

mix of cash and up to 50% in common stock, should NIS achieve certain revenue milestones during the two-year period after closing.

The aggregate purchase price was approximately $33,100, including acquisition cost of $1,542. The following summarizes the estimated

fair values of the assets acquired at the date of acquisition. The estimated fair values are subject to change pending a final analysis of

the total purchase price and the fair value of the assets acquired and liabilities assumed. Goodwill recorded from this transaction will be

tax deductible.

Current assets $ 3,123

Property and equipment 115

Goodwill 7,432

Intangible asset - customer relationships 23,088

Current liabilities (629)

$ 33,129

Note 4 - Goodwill and intangibles

Goodwill at September 30, 2008, includes the excess of the purchase price over the fair value of tangible and identifiable intangible

assets associated with the acquisitions of Wood, Sovereign and NIS (see Note 3). Goodwill at September 30, 2008, consists of the following:

Wood acquisition $19,865

Sovereign acquisition 2,122

NIS acquisition 7,432

Goodwill at September 30, 2008 $29,419

Identifiable intangible assets, net of amortization at September 30, 2008 are as follows:

Average

Accumulated Useful Life in

Cost Amortization Net Months

Wood customer relationships $ 12,026 $ 3,796 $ 8,230 60

Wood brand 444 110 334 48

Sovereign customer 2,665 683 1,982 84

relationships

Sovereign non-compete 833 278 555 36

agreement

Sovereign brand 181 60 121 36

NIS client referral 23,088 770 22,318 180

relationship

Intangible assets $ 39,237 $ 5,697 $ 33,540

Amortization expense for the nine-month period ended September 30, 2008 totaled approximately $3,096. In addition to the amortization

expense recognized, an impairment charge of $1,792 has been recorded.

Note 5 - Income taxes

Significant components of the benefit (provision) for income taxes are as follows:

Nine Months

Ended

September 30, 2008

(unaudited)

Current

Federal $ -

State -

-

Deferred

Federal 1,384

State -

1,384

Taxes on income $ 1,384

A reconciliation between the income tax benefit and the expected tax benefit using the federal statutory tax rate (34 percent) is as

follows:

Nine Months

Ended

September 30, 2008

(unaudited)

Income taxes at federal statutory rate $ 1,531

State income taxes, net of federal tax benefit (95)

Other (52)

$ 1,384

The Company's deferred tax asset and liabilities relate to the following temporary differences between financial accounting and tax

bases as follows:

September 30, 2008

(unaudited)

Goodwill and intangibles $ 1,912

Property and equipment (4)

Total deferred tax asset $ 1,908

No valuation allowance was established since in management's opinion it is more likely than not the deferred asset will be realized.

Note 6 - Line of credit

In connection with the acquisition of NIS (Note 3), the Company acquired a $950 line of credit with a financial institution secured by a

general business lien, as defined by the agreement. The line of credit is payable upon demand and bears interest at 5.00% at September 30,

2008. No amounts were outstanding under the line of credit at September 30, 2008.

Note 7 - Retirement plan

The Company, through its wholly owned subsidiary NIS, maintains a defined contribution pension plan covering substantially all NIS

employees. NIS matches 50% of employee elective deferrals up to 6.0% of compensation. The plan also provides a profit-sharing component

whereby NIS can make a discretionary contribution to the plan that is allocated based on the compensation of eligible employees.

Note 8 - Contingencies

During the course of an internal investigation, management of NIS found evidence suggesting that certain of its customer's plan assets

were invested in a manner inconsistent with the plan's authorized investment policy. Management is currently in the discovery stages of its

investigation and is assessing the potential impact to the Company and NIS's level of responsibility. NIS has voluntarily settled with one

of its affected customers and there is liability in the amount of approximately $60 which is accrued at September 30, 2008 (unaudited). Due

to the uncertainties involved, the Company is unable to reasonably estimate the amount, or range of amounts, of possible additional losses

associated with the resolution of this matter beyond what has been recorded. While management cannot estimate the amount, or range of

amounts, of potential losses, if any, the maximum exposure regardless of the outcome would be limited to NIS's professional liability and

directors and officers liability insurance policy deductible, which is $500.

During the nine months ended September 30, 2008 the Company received an invoice for $536 from the lawyers who worked on the placement of

the Company's shares on London's AIM market in June 2007. The Company is in dispute with the lawyers with respect to this invoice and at the

current time believes there is no liability. Accordingly no provision has been made in these accounts for the invoice. In the event that a

liability does arise the income statement will be unaffected and the Company does not expect its financial position to materially change.

The Company is from time to time involved in legal matters incidental to the conduct of its business and such matters can involve

current and former employees and vendors. Management does not expect these to have a material effect on the Company's consolidated financial

position or results of operations.

Note 9 - Earnings per Share

Basic earnings per share ("EPS") are calculated based on the weighted average shares outstanding during the period. Diluted earnings per

share included the dilutive effects of the warrants and restricted stock. There were warrants to purchase 20,000,000 common shares that were

outstanding during the nine-month period ended September 30, 2008 and during the period from June 21, 2007 (date of warrant deed) to

September 30, 2007, which had an exercise price which was less than the average market price. There were no securities excluded from diluted

EPS for the period from February 2, 2007 to September 30, 2007 due to their anti-dilutive effect. Since the Company was in a net loss

position for the nine months ended September 30, 2008, it excluded the dilutive effects of the warrants and restricted stock due to their

anti-dilutive effect

The computation of basic and diluted EPS is as follows:

Nine months Period from

ended February 2, 2007

(inception)

September 30, 2008 to September 30,

2007

Basic EPS:

Net income (loss) $ (3,090) $ 659

Weighted average shares outstanding 21,205,373 10,549,370

Basic EPS $ (0.15) $ 0.06

Diluted EPS:

Net income $ (3,090) $ 659

Weighted average number of common

shares outstanding 21,205,373 10,549,370

Dilutive warrants 3,901,682 3,177,723

Restricted stock 695,963 696,160

Dilutive weighted average shares 25,803,018 14,423,253

Diluted EPS $ (0.15) $ 0.05

Note 10 - Restatement of Financial Statements

The Company's previously issued unaudited balance sheet as of June 30, 2008 and the related unaudited statements of income, changes in

stockholder equity and cash flows for the six months then ended have been restated to correct the Company's carrying value of intangible

assets. The Company performed an impairment assessment under SFAS 144. The Company determined that an impairment of its intangible assets

had occurred which resulted in an impairment charge of $1,792.

The Company's unaudited financial statements at June 30, 2008 have also been adjusted for the finalization of the purchase price

adjustment (PPA) relating to the NIS acquisition on March 31, 2008. As a result of the final PPA, the Company re-classified $9,862 out of

goodwill into amortizable intangible assets. The final PPA established the estimated useful lives of the amortizable intangible assets

resulting in a decrease in amortization expense of $317 for the six-month period ended June 30, 2008.

The Company also re-classified short-term investments of $15,216 to cash and cash equivalents since the funds were being held in a money

market account and met the definition of a cash equivalent at June 30, 2008.

The following is the effect of this restatement:

Balance sheet:

June 30, 2008 Adjustments June 30, 2008

(unaudited) (unaudited)

As reported Restated

Current assets

Cash and cash equivalents $16,922 $ 15,216 $32,138

Short -term investment 15,216 (15,216) -

Accounts receivable 2,426 2,426

Prepaid expenses and other 1,302 1,302

assets

Total current assets 35,866 - 35,866

Property and equipment - net 190 - 190

Goodwill 39,281 (9,862) 29,419

Intangibles, net 26,246 8,388 34,634

Deferred income taxes 610 518 1,128

Total assets 102,193 (956) $ 101,237

Liabilities and Stockholders'

Equity

Current liabilities

Accounts payable and accrued $660 $ - $ 660

expenses

Guaranteed payment for 1,000 - 1,000

acquisition

Deferred revenues 218 - 218

Other current liabilities 34 3 37

Total current liabilities 1,912 1,915

Guaranteed payment for 903 903

acquisition

Total liabilities 2,815 3 2,818

Commitments and contingencies - - -

Stockholders' equity

Common stock 2 2

Restricted shares - -

Preferred stock - -

Additional paid-in capital 99,462 99,462

Retained earnings (deficit) (86) (959) (1,045)

Total stockholders' equity 99,378 98,409

Total liabilities and

stockholders' equity $ 102,193 $ (956) $101,237

Statement of Income:

Six months ended Six months ended

June 30, 2008 June 30, 2008

(unaudited) (unaudited)

As reported Adjustments Restated

Fee income $ 6,706

$ 6,706 -

Operating expenses:

Administrative 5,987 1 5,988

Amortization of intangibles 2,319 (317) 2,002

Write off of intangibles - 1,792 1,792

Total operating expenses 9,782

8,306 1,476

Operating loss (3,076)

(1,600) (1,476)

Other income

Interest 868 - 868

Loss before taxes

(732) (1,476) (2,208)

Income tax benefit 720

203 517

Net loss $ (1,488)

$ (529) $ (959)

Net loss per share $ (0.07)

basic

diluted

$ (0.07)

$ (0.02) $ (0.05)

$ (0.02) $ (0.05)

Statement of Cash flows:

Six months ended Six months ended

June 30, 2008 June 30, 2008

(unaudited) (unaudited)

As reported Adjustments Restated

Cash flows from operating

activities

Net income $ (529) $ (959) $ (1,488)

Adjustments to reconcile net

income to net cash provided by

operating activities:

Depreciation and amortization 2,322 (320) 2,002

Deferred income taxes (233) (518) (751)

Write off of intangible asset 1,792 1,792

Changes in operating assets (1,080) 3 (1,077)

and liabilities

Net cash provided by (used in) 478

operating

activities

480 (2)

Cash flows from investing

activities

Purchases of property and (73) (72)

equipment

1

Cash and cash equivalents held 55,587 55,587

in

(released from) trust

Short term investments (15,216) 15,216 -

Cash paid for acquisition of (31,226) (31,226)

subsidiaries,

net of cash acquired

Net cash provided by investing 9,072 24,289

activities 15,217

Cash flows from financing

activities

Common stock redeemed (12,017) - (12,017)

Net cash (used in) provided by (12,017) - (12,017)

financing

activities

Net increase (decrease) in (2,465) 12,750

cash and cash equivalents 15,215

Cash and cash equivalents:

Beginning 19,388 - 19,388

Ending $ 16,923 15,215 $ 32,138

Supplemental disclosure of

non-cash

financing activities

Income taxes paid $ 598 $ 598

Paid-in capital attributed to $ 55,587

common stock repurchase

rights not executed $ 55,587

Guaranteed payment issued in $ 1,903 $ 1,903

connection with acquisition

This information is provided by RNS

The company news service from the London Stock Exchange

END

QRTDGMMMVGMGRZG

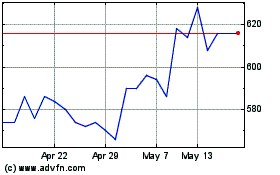

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

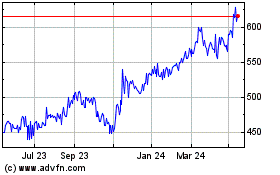

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024