RNS Number : 2585H

Titanium Asset Management Corp

03 November 2008

Titanium Asset Management Corp.

("Titanium" or the "Company")

Restated Interim Accounts

Titanium has restated its interim accounts for the six months ended 30 June 2008 followings its filing of a Form 10 registration

statement with the SEC in July 2008 and as part of the process of that registration statement becoming effective, which occurred in

September 2008.

On October 29, 2008, the Board of Directors of Titanium, including its Audit Committee, concluded that, as a result of losses of certain

investment advisory accounts at Wood Asset Management, Inc. following the death of Gary Wood and the loss of an institutional account at

Sovereign Holdings, LLC, its customer relationship intangible assets associated with the acquisitions were impaired. The impairment of these

intangible assets is expected to result in a non-cash charge of approximately $1.8 million for the quarter ended June 30, 2008. None of the

impairment charge will result in future cash expenditures.

For further information:

Titanium Asset Management Corp.

Nigel Wightman, Chairman and CEO + 44 7789 277849

Seymour Pierce Ltd

Jonathan Wright +44 20 7107 8000

Titanium Asset Management Corp.

Interim report and unaudited accounts for the period from

January 1, 2008 to June 30, 2008

(Restated)

BALANCE SHEET as at June 30, 2008 (Unaudited)

(amounts in thousands)

June 30, June 30, 2007

Note 2008

(restated)

ASSETS

Current Assets

Debtors - trade debtors $ 2,426 -

- prepaids and other 1,302 -

receivables

Cash and cash equivalents 31,138 25

Total Current Assets 35,866 25

Other Assets

Goodwill 29,419 -

Intangible assets 34,634 -

Property and equipment -

190

Deferred tax asset 1,128 -

Total Other Assets 65,371 -

Total Assets $ 101,237 25

LIABILITIES AND SHAREHOLDERS' EQUITY

Current Liabilities

Accrued expenses $ 537 -

Income taxes 31 -

Accounts payable 92 -

Deferred revenue 218 -

Guaranteed payment for acquisition 1,000 -

Other creditors 37 -

Total Current Liabilities 1,915 -

Guaranteed payment for acquisition 903 -

COMMITMENTS

Stockholders' Equity -

Share capital 4 2 1

Additional paid in capital 5 99,462 24

Profit and loss account 5 (1,045) -

Total Stockholders' Equity 98,419 25

Total Liabilities and $ 101,237 25

Stockholders' Equity

Titanium Asset Management Corp.

Interim report and unaudited accounts for the period from January 1 , 2008 to June 30, 2008

STATEMENT OF OPERATIONS

For the period from January 1,2008 to June 30, 2008

(amounts in thousands except per share amounts)

6 months to Inception

June 30, (2 Feb 2007) to June 30,2008

2008

(Restated)

Turnover $ 6,706 -

Amortisation and depreciation -

Impairment of intangible (2,002)

(1,792)

Other operating expenses (5,988) -

Operating Loss (3,076) -

Interest receivable 868 -

Loss before taxes (2,208) -

Income tax (expense) benefit 720 -

Net Loss $ (1,488) -

Net Loss Per Share, Basic (0.07) -

Net Loss Per Share, Fully (0.07) -

Diluted

Weighted Average Shares 20.45mn 2.88 mn

Outstanding, Basic

Weighted Average Shares 20.45mn 2.88 mn

Outstanding, Fully Diluted

Titanium Asset Management Corp.

Interim report and unaudited accounts for the period from January 1, 2008 to June 30, 2008

STATEMENT OF CASH FLOWS

For the period from January 1, 2008 to June 30, 2008

(amounts in thousands)

Inception (February

Jan 1, 2008 to June 30, 2008 2, 2007) to

(Restated) June 30,2007

Net loss $ (1,488) -

Adjustments to reconcile net income to net cash

and cash equivalents provided by operating

activities:

Depreciation and amortisation charges 3,794 -

Changes in operating assets and liabilities:

(Increase) in debtors (102) -

(increase) in deferred tax asset (751)

(Decrease) in current liabilities (975) -

Net Cash generated by Operating Activities 478 -

Cash flows from investing activities

Cash paid for acquisitions less cash acquired (31,226) -

Purchase of property and equipment (72) -

Release of restricted cash 55,587

Net cash generated from investing activities 24,289 -

Cash Flows from Financing Activities

Cash paid for the repurchase of shares (12,017) -

Proceeds from issuance of share capital - 25

Net Increase in Cash $ 12,750 25

Cash and cash equivalents, Beginning of Period $ 19,388 Nil

Cash and cash equivalents, End of Period $ 32,138 25

Titanium Asset Management Corp.

Interim report and unaudited accounts for the period from January 1, 2008 to June 30, 2008

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - Organization, business and operations

Titanium Asset Management Corp. (the "Company") was incorporated in Delaware on February 2, 2007 as a blank check company, the objective

of which is to acquire one or more operating companies engaged in the asset management industry.

The Company was successfully listed on the London Alternative Investment Market on 21 June 2007. The listing raised net proceeds of

$110.4 million. The Company completed its third acquisition on March 31, 2008 and as a result has become an operating company. The Company

intends to seek a registration statement with the SEC within 120 days of the period end with a view to obtaining a listing on NASDAQ.

NOTE 2 - Basis of Preparation

These report and accounts have been prepared in accordance with accounting principles generally accepted in the United States of

America.

The following accounting policies have been applied consistently in dealing with items which are material in realation to the financial

information of Titanium Asset Management Corp. set out in this report.

NOTE 3 - Summary of Significant Accounting Policies

Use of Estimates The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the

period in which the estimate is revised if the revision affects only that period, or in the period of the revision and future periods if the

revision affects both current and future periods.

Income per common share Income per common share is computed by dividing net income by the weighted average number of shares of common

stock and restricted stock outstanding during the period. As the earnings per share are nil no separate estimate of the impact of dilution

has been prepared.

Goodwill and intangibles Goodwill is the excess of the amount paid to acquire a business over the fair value of the net assets acquired.

Pursuant to SFAS No. 142, Goodwill and Other Intangible Assets, the carrying amount of goodwill is reviewed for impairment annually or

whenever events or changes in circumstances indicate that the carrying amount might not be recoverable. If the fair value of the operations

to which the goodwill relates is less than the carrying amount of the unamortized goodwill, the carrying amount will be reduced with a

corresponding charge to expense.

The Company will test goodwill for impairment at least annually (first day of our fourth quarter), or more often if deemed necessary

based on certain circumstances. The goodwill impairment test will be a two-step process: Step 1 - test for potential impairment by comparing

the fair value of each reporting unit with its carrying amount; if the fair value of the reporting unit is greater than its carrying amount

(including recorded goodwill), then no impairment exists and Step 2 is not performed; Step 2 - if the

NOTE 3 - Summary of Significant Accounting Policies (cont)

carrying amount of the reporting unit (including recorded goodwill) is greater than its fair value, then the amount of the impairment,

if any, is measured and recorded as needed.

Intangible assets with definite lives are amortized over their estimated useful life and reviewed for impairment in accordance with SFAS

144. Intangible assets with definite lives are amortized using the straight-line method over their estimated useful lives.

Option granted in relation to stock issuance The fair value of the option granted to Sunrise Securities Corp. has been credited to

additional paid in capital. The cost of the option has been netted off against reserves along with the other costs of admission.

Income taxes The Company accounts for income taxes in accordance with SFAS No. 109, "Accounting for Income Taxes." Deferred tax assets

and liabilities are recognized for the future tax consequences attributable to differences between financial statement carrying amounts of

existing assets and liabilities and their respective tax bases and operating loss and other loss carryforwards. Deferred tax assets and

liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are

expected to be recovered or settled.

Interim report and unaudited accounts for the period from January 1 , 2008 to June 30, 2008

NOTES TO FINANCIAL STATEMENTS

(amounts in thousands except number of shares)

NOTE 4 - Share Capital

Authorized Called up and fully paid

Number $ Number $

Common Stock $0.0001 54,000,000 5,400 21,117,723 2,266

Restricted Shares $0.0001 720,000 72 529,272 61

Preferred Stock $0.0001 1,000,000 100 0

5,572 2,327

The holders of Common Stock arising from the issue of units on 21 June 2007 were entitled to require the Company to repurchase their

shares if at the time the Company seeks approval for a business combination the stockholder votes against the proposal. In April 2008

2,208,452 common shares representing 9.75% of the issued share capital were repurchased for a total consideration of approximately $12

million. As a result of this repurchase, 333,777 shares of Common Stock and 83,444 shares of Restricted Stock were cancelled. Following the

acquisition of NIS on March 31, 2008 shareholders no longer have the right to require the Company to repurchase their shares.

The Restricted Shares carry no rights to dividends except in the case of a winding up of the Company. They convert on a one for one

basis to Common Stock if at any time within five years of their issue,

and subsequent to a Business Combination, the ten day average share price of the Common Stock exceeds $6.90.

No Preferred Stock had been issued at the balance sheet date and accordingly the rights attaching to the Preferred Stock have not been

set.

There were 20 million warrants in issue at the balance sheet date. Each warrant entitles the holder to subscribe for Common Stock at

$4.00 per share subsequent to a Qualifying Business Combination. There were 20 million warrants in issue at the balance sheet date.

The Company issued an option over 2 million Units to the placing agent. The option is exercisable at $6.60 following a Qualifying

Business Combination.

Titanium Asset Management Corp.

Interim report and unaudited accounts for the period from January 1, 2008 to June 30, 2008

NOTES TO FINANCIAL STATEMENTS

(amounts in thousands)

NOTE 5 - Reserves

Profit & Loss $000s Additional Paid in Capital $000s Total $000s

Brought forward at 1 January 443 55,892 56,335

2008

Net loss for the period (1,488) - (1,488)

Reallocation of temporary 55,587 55,587

equity

Shares repurchased - (12,017) (12,017)

(1,045) 99,462 98,417

NOTE 6 - Acquisition

The financial statements include assets acquired from National Investment Services Inc. on March 31, 2008. At March 31, 2008 Titanium

Asset Management Corp held 100% of the issued share capital of National Investment Services Inc. The goodwill related to the acquisition

will be fully deductible for tax purposes.

Details Consideration Fair value Goodwill

Cash $29,684 $- $-

Accrued acquisition costs 1,542 - -

Debtors - 3,123 -

Other current assets - 115 -

Property and equipment - (629) -

Current liabilities - 23,088 -

Existing customers 1,903 - -

Guaranteed payments - - -

_______ _______ _______

$33,129 $25,697 $7,432

Titanium Asset Management Corp.

Interim report and unaudited accounts for the period from January 1, 2008 to June 30, 2008

NOTES TO FINANCIAL STATEMENTS

(amounts in thousands)

NOTE 7 - Intangible assets

Goodwill Customers Non-compete Brands Total

Cost

At January 1, 2008 21,987 14,691 1,662 625 38,965

Additions (see note 6) 7,432 23,088 30,520

At June 30, 2008 29,419 37,779 1,662 625 69,485

Amortization

At January 1, 2008 697 898 43 1,638

Impairment 1,792 1,792

Charge for period 1,778 139 85 2,002

At June 30, 2008 4,267 1,037 128 5,432

Net book amount

At June 30, 2008 $29,419 $33,512 $625 $497 $64,053

Useful life (in months) N/A 60-180 36 36-48

NOTE 8 - Contingency

During the six months ended June 30, 2008 the Company received an invoice for $536,000 from the lawyers who worked on the placement of

the Company's shares on London's AIM market in June 2007. The Company is in dispute with the lawyers with respect to this invoice and at the

current time believes there is no liability. Accordingly no provision has been made in these accounts for the invoice. In the event that a

liability does arise the income statement will be unaffected and the Company does not expect its financial position to materially change.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR FKNKKFBDKQDK

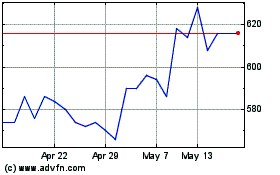

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

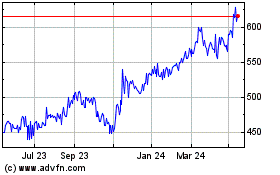

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024