Re-admission to AIM

October 01 2007 - 3:02AM

UK Regulatory

RNS Number:8074E

Titanium Asset Management Corp

01 October 2007

Titanium Asset Management Corp.

1 October 2007

Not for release, publication or distribution in whole or in part in or into the

United States, Canada, Australia, Republic of South Africa or Japan

TITANIUM ASSET MANAGEMENT CORP.

COMPLETION OF ACQUISITIONS OF WOOD ASSET MANAGEMENT INC, SOVEREIGN HOLDINGS,

LLC AND CERTAIN CLIENT MANDATES OF SIESTA KEY CAPITAL, LLC

RE-ADMISSION TO AIM

HIGHLIGHTS

* Titanium completes its first acquisitions since admission to AIM in June 2007

* Stockholders representing an overwhelming majority of the Company's Shares

voted in favour of approving the acquisitions

* Titanium has acquired Wood Asset Management Inc, Sovereign Holdings, LLC and

will acquire certain client mandates of Siesta Key Capital, LLC

* Following completion of the acquisitions, the Company will have approximately

U.S.$3.33 billion of assets under management

For further information:

Titanium Asset Management Corp.

John Sauickie, Chief Executive Officer +1 941 524 5672

Nigel Wightman, Executive Director + 44 7789 277849

Seymour Pierce Ltd

Jonathan Wright +44 20 7107 8000

Penrose Financial

Gay Collins +44 7798 626 282

Kay Larsen +44 7747 631 614

Titanium Asset Management Corp. ("Titanium" or the "Company") (AIM: TAM) is

pleased to announce it has completed the acquisitions of the entire issued and

outstanding capital stock of Wood Asset Management Inc ("Wood") and Sovereign

Holdings, LLC ("Sovereign") and the proposed acquisition of certain client

mandates from Siesta Key Capital LLC ("SKC") can now proceed following the

approval of these transactions (the "Acquisition") at the Special Meeting of

the Company on 27 September 2007.

In aggregate, following completion of the Acquisition, the Company will have

approximately U.S.$3.33 billion of assets under management ("AUM").

The entire issued Shares and Warrants of the Company, amounting to 22,993,731

Shares (trade symbol: TAM.L) and 20,000,000 Warrants (trade symbol: TAMW.L),

have been admitted to AIM this morning.

In accordance with Titanium's Certificate of Incorporation, a total of 119,200

Founding Shares (comprising 95,360 Shares and 23,840 Restricted Shares) are to

be purchased by Titanium at par value so that the aggregate number of Founding

Shares shall not exceed 15.2% of the issued share capital of the Company

(excluding those Shares to be issued as consideration on the Acquisitions).

The interests (which are beneficial unless otherwise stated) of the Directors

and their related parties (as that term is defined in the AIM Rules) in the

Shares on Admission (assuming completion of (i) the redemption of Shares of

those holders who voted AGAINST AND REDEEM and (ii) the purchase of a total

119,200 Founding Shares) are as follows:

Number of Percentage of

Outstanding Shares Held Outstanding Issued Shares

Name

Thomas Anglin Hamilton 116,027 0.50

Nazuk, LLC (1) 493,113 2.14

Mark Adam Parkin 137,782 0.60

Nigel David Wightman 174,040 0.75

Whitewater Place, LLC (2) 1,283,544 5.58

SKC TRUST SHARES, LLC (3) 203,047 0.88

Titanium Incentive Plan, LLC (4) 348,080 1.51

Red Earth Holdings Ltd (5) 50,000 0.22

Clal Finance Ltd (6) 10,100,000 43.92

Total: 12,905,633 56.1

Notes:

(1) NAZUK, LLC is wholly owned by Mr. Kuzan, the Company's Chairman, and

members of his family.

(2) Whitewater Place, LLC is wholly owned by Mr. Sauickie, the Company's Chief

Executive Officer, and members of his family; it is intended that some of the

Shares held by Whitewater Place LLC will be distributed to current or future

directors or executives of the Company.

(3) SKC TRUST SHARES, LLC is owned by membership interest holders of SKC,

including Mr. Sauickie, the Company's Chief Executive Officer; it is intended

that the Shares held by SKC TRUST SHARES, LLC will be distributed to executives,

membership interest holders and consultants of SKC, an affiliate of Mr. Sauickie

(4) Titanium Incentive Plan, LLC is wholly owned by Mr. Sauickie, the Company's

Chief Executive Officer; it is intended that the Shares held by Titanium

Incentive Plan, LLC will be distributed to employees of the Target Businesses

acquired by the Company. It is intended that 60,000 Shares will be distributed

to JARE, INC., a shareholder of Sovereign, following Admission.

(5) Red Earth Holdings Ltd. is managed by Parkfield Capital LLP, an affiliate

of Messrs Parkin and Wightman. Mr. Wightman is a director of Red Earth Holdings

Ltd.

(6) Mr. Kaplan is Chairman of the board of directors of Clal Finance Ltd. and

Mr. Abramovich is CEO of Clal Finance Ltd.

For further information:

Titanium Asset Management Corp.

John Sauickie, Chief Executive Officer +1 941 524 5672

Nigel Wightman, Executive Director + 44 7789 277849

Seymour Pierce Ltd

Jonathan Wright +44 20 7107 8000

Penrose Financial

Gay Collins +44 7798 626 282

Kay Larsen +44 7747 631 614

This announcement does not constitute, or form part of, an offer or an

invitation to purchase any securities or to carry on any investment activity

whatsoever.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCMGGZLNRVGNZM

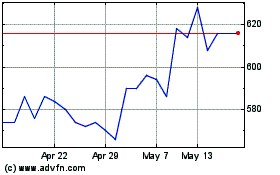

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

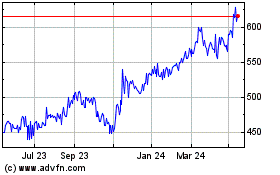

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024