Schedule 1 - Titanium Asset

September 13 2007 - 7:04AM

UK Regulatory

RNS Number:7994D

AIM

13 September 2007

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES

("AIM RULES")

COMPANY NAME:

Titanium Asset Management Corp.

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY TRADING ADDRESS (INCLUDING POSTCODES) :

Registered address:

16192 Coastal Highway

Lewes

Delaware 19958

USA

Trading address from Admission:

Two North Tamiami Trail

STE 1200

Sarasota

Florida 34236

USA

COUNTRY OF INCORPORATION:

Incorporated in Delaware, USA, under the General Corporation Law of the State of Delaware

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED BY AIM RULE 26:

www.ti-am.com

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR, IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

STRATEGY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE TAKE-OVER

UNDER RULE 14, THIS SHOULD BE STATED:

The Company was admitted to trading on AIM as an investing company to pursue acquisitions of one or more operating

companies engaged in the asset management industry. Pursuant to a reverse

takeover, the Company is to acquire:

- the entire issued and outstanding capital stock of Wood Asset Management Inc ("Wood");

- the entire issued and outstanding capital stock of Sovereign Holdings, LLC ("Sovereign"); and

- certain client mandates from Siesta Key Capital LLC ("SKC")

(collectively, the "Acquisition").

In aggregate, following completion of the Acquisition, the Company will have approximately U.S.$3.33 billion of assets

under management ("AUM").

Wood

Wood is a Registered Investment Adviser with the SEC under the Investment Advisers Act of 1940 and is located in

Sarasota, Florida. It was founded by Gary Wood in 1994. Wood manages U.S.$1.49

billion of equity, balanced, fixed income and convertible investments. Its principal activity is the management of mid

and large cap U.S. equities using a relative value style based on its own

fundamental research. Wood's clients include high net-worth individuals, foundations, pension plans and brokerage

firms.

Sovereign

Sovereign, trading as Sovereign Advisers, is a Registered Investment Adviser with the SEC under the Investment Advisers

Act of 1940 and is located in Charlotte, North Carolina. Sovereign manages

U.S.$1.74 billion of fixed income investments. Sovereign's clients include high net-worth individuals, municipalities,

companies, brokerage firms, and charities.

SKC

SKC is a Registered Investment Adviser with the SEC under the Investment Advisers Act of 1940 and is located in Sarasota

Florida. It has assets under management of approximately U.S.$150

million and manages equity portfolios for pension plans, charities, corporations and high net worth individuals. Mr.

John Sauickie founded SKC in 2004 and currently is the majority shareholder,

Managing Partner and Chief Executive Officer of SKC. It is anticipated that approximately U.S.$100 million AUM will be

transferred to the Company.

Following completion of Acquisition, the Company will no longer be an investing company for the purposes of the AIM

Rules. After such time, Titanium will continue as a normal operating company.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS AS TO TRANSFER OF THE SECURITIES (i.e. where known,

number and type of shares, nominal value and issue price to which it seeks

admission and the number and type to be held as treasury shares):

23,789,091 shares of common stock of US$0.0001 per share (the "Shares") and 20,000,000 warrants (the "Warrants"), each

Warrant entitling the holder to subscribe for one Share.

The Shares and Warrants will be subject to stringent requirements with respect to transferability as follows:

Securities Act of 1933

The Shares and Warrants will not have been registered under the U.S. Securities Act of 1933, as amended, (the

"Securities Act") and will be ''restricted securities'' as defined in Rule 144

promulgated under the Securities Act.

Category 3 Offering - Compliance Period

The Shares and Warrants offered under Regulation S will be subject to the conditions listed under section 903(b)(3), or

Category 3, of Regulation S of the Securities Act.

CAPITAL TO BE RAISED ON ADMISSION (IF APPLICABLE) AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

No capital to be raised on admission. Market capitalisation will be US$130.8 million, based on the deemed issued price

of US$5.50 for consideration shares to be issued as part of the

consideration for the Acquisition.

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

55.5%

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS (underlining the first name by which each is known or

including any other name by which each is known):

John Michael Kuzan, Chairman of the Board

John Joseph Sauickie, Chief Executive Officer and Director

Nigel David Wightman, Executive Director

Thomas Anglin Hamilton, Non-Executive Director

Mark Adam Parkin, Non-Executive Director

Avigdor Kaplan (Non-executive Clal Director)

Yehoshua (''Shucky'') Abramovich (Non-executive Clal Director)

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND

AFTER ADMISSION (underlining the first name by which each is known or

including any other name by which each is known):

Before admission:

CLAL Finance Ltd - 44.1%

Whitewater Place, LLC - 5.8%

Cyrus Opportunities Master Fund II Ltd. - 4.8%

Schroder & Co AG - 5.9%

JLF Asset Management (Note 1) - 3.5%

Millennium Partners L.P. - 4.4%

Wellington Management Company (Note 1) - 13.1%

After admission:

Clal Finance Ltd - 42.5%

Whitewater Place, LLC - 5.6%

Cyrus Opportunities Master Fund II Ltd. - 4.6%

Schroder & Co AG - 5.7%

JLF Asset Management (Note 1) - 3.4%

Millennium Partners L.P. - 4.2%

Wellington Management Company (Note 1) - 12.6%

Note 1- held as portfolio manager in nominee accounts

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE 2, PARAGRAPH (H) OF THE AIM RULES:

Novantas, a New York based research and consultancy firm in the financial services industry

Mr Avishay Ephrati

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION DOCUMENT HAS BEEN PREPARED

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS PURSUANT TO AIM RULES 18 AND 19:

(i) 31 December

(ii) No financial information on the Company is included in the admission document (in accordance with

AIM Rule 28) as the information has already been published. The information

on Wood and Sovereign is to 31 December 2006

(iii) by 30 June 2008; 30 September 2008; and 30 June 2009

EXPECTED ADMISSION DATE:

1 October 2007

NAME AND ADDRESS OF NOMINATED ADVISER:

Seymour Pierce Limited

20 Old Bailey

London

EC4M 7EN

NAME AND ADDRESS OF BROKER:

Seymour Pierce Limited

20 Old Bailey

London

EC4M 7EN

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE (POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL

BE AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL DETAILS

ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

The Admission Document containing full details about the applicant and the admission of its securities to AIM will be

available from:

Seymour Pierce Limited

20 Old Bailey

London

EC4M 7EN

DATE OF NOTIFICATION:

13 September 2007

NEW/ UPDATE:

NEW

This information is provided by RNS

The company news service from the London Stock Exchange

END

PAALJMBTMMMBBTR

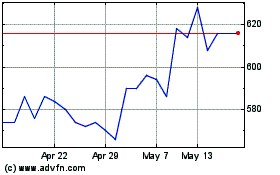

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

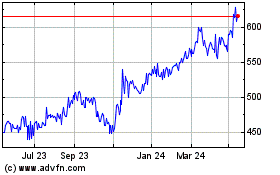

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024