Interim Results

August 08 2007 - 3:00AM

UK Regulatory

RNS Number:6941B

Titanium Asset Management Corp

08 August 2007

Titanium Asset Management Corp.

Interim report and unaudited accounts for the period from February 2, 2007

(inception) to June 30, 2007

Chairman's Statement

We are delighted to have concluded successfully our placing of 20,000,000 units

at US$6.00 and to have listed our shares and warrants on the London Stock

Exchange's AIM Market ("AIM") on June 21st 2007. Titanium now has a strong

shareholder base of major institutional investors and the management team is

already implementing the business strategy that we have described to

shareholders.

John Kuzan, Chairman

Chief Executive Officer's Statement

Titanium's business strategy is to acquire a small number of investment

management firms with complementary strategies and to manage the acquired firms

on an integrated basis. As our shareholders are aware, we have signed Letters Of

Intent with three firms prior to admission. Discussions are now proceeding with

those firms to conclude binding purchase contracts, subject to shareholder

approval. We are also meeting other firms and their advisors to identify other

target businesses.

John Sauickie, Chief Executive Officer

BALANCE SHEET as at June 30, 2007 (Unaudited)

Note June 30, 2007

$000s

ASSETS

Current Assets

Debtors - amounts due from brokers 8 10,989

- prepayments and accrued income 203

Cash at bank and in hand 4 101,348

Total Current Assets 112,540

Total Assets 112,540

LIABILITIES AND SHAREHOLDERS' EQUITY

Current Liabilities

Accrued expenses 214

Accounts payable 482

Notes payable related parties 435

Total Current Liabilities 1,131

Non - current liabilities - amounts due to brokers 3,178

COMMITMENTS

Temporary Equity 55,000

Stockholders' Equity

Share capital 5 2

Additional paid in capital 6 53,289

Profit and loss account 6 (60)

Total Stockholders' Equity 53,231

Total Liabilities and Stockholders' Equity 112,540

The accompanying notes are an integral part of these financial statements.

STATEMENT OF OPERATIONS

For the period from February 2, 2007 (inception) to June 30, 2007

February 2, 2007

(inception) to

June 30, 2007

$000s

Operating Costs 263

Operating Loss (263)

Interest receivable 203

----------

Net Loss for the Period (60)

==========

Net Loss Per Share, Basic 1.6 cents

Net Loss Per Share, Fully Diluted 1.6 cents

==========

Weighted Average Shares Outstanding, Basic 3.66 million

Weighted Average Shares Outstanding, Fully Diluted 3.66 million

There were no recognized gains and losses other than those shown in the

statement of operations.

All of the operating costs related to new activities.

STATEMENT OF CASH FLOWS

For the period from February 2, 2007 (inception) to June 30, 2007

February 2, 2007

(inception) to

June 30, 2007

$000s

Cash Flows from Operating Activities

Operating loss 263

Changes in operating assets and liabilities:

Increase in accrued expenses (213)

Increase in Notes payable related party (50)

Net Cash Used in Operating Activities Nil

Cash Flows from Financing Activities

Proceeds from issuance of share capital 109,036

Costs paid in relation to share issue (7,688)

Net Cash Provided by Financing Activities 101,348

Net Increase (Decrease) in Cash 101,348

Cash, Beginning of Period Nil

Cash, End of Period 101,348

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - Organization, business and operations

Titanium Asset Management Corp. (the "Company") was incorporated in Delaware on

February 2, 2007 as a blank check company, the objective of which is to acquire

one or more operating companies engaged in the asset management industry.

The Company was successfully listed on London Alternative Investment Market on

21 June 2007. The listing raised net proceeds of $110.5 million of which $11

million has been retained by the listing broker for stabilisation purposes. The

Company expects to make its first acquisition within the next six months.

NOTE 2 - Basis of Preparation

These report and accounts have been prepared in accordance with accounting

principles generally accepted in the United States of America.

The following accounting policies have been applied consistently in dealing with

items which are material in realation to the financial information of Titanium

Asset Management Corp. set out in this report.

NOTE 3 - Summary of Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of

the financial statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis.

Revisions to accounting estimates are recognized in the period in which the

estimate is revised if the revision affects only that period, or in the period

of the revision and future periods if the revision affects both current and

future periods.

Loss per common share Loss per common share is computed by dividing net loss by

the weighted average number of shares of common stock and restricted stock

outstanding from March 3, 2007, being the first date of issue, to June 30, 2007.

Potentially dilutive common shares have not been treated as dilutive because

their conversion would decrease the loss per share.

Common shares subject to repayment rights The proceeds from the issue of common

shares bearing the right to require repayment as explained in Note 5 have been

split as to 50% temporary shares and 50% stockholders equity to reflect the

potential for stockholders to require repurchase of their shares.

Option granted in relation to share issue

The fair value of the option granted to Sunrise Securities Corp. has been

credited to non-current liabilities. The cost of the option has been netted off

against reserves along with the other costs of admission.

Allocation of consideration for issue of units in the placing

The proceeds from the issue of shares in the placing on 21 June 2007, net of all

related costs, were allocated first to share capital in an amount equal to the

nominal value of shares issued, secondly to temporary equity in an amount equal

to 50% of the prospective value of the trust fund (including funds withheld for

stabilisation purposes) and the remainder to additional paid in capital.

NOTE 4 - Cash at bank and in hand

$000s

Cash held by the Company 2,337

Cash held in trust for the Company 99,011

---------

Cash at bank and in hand 101,348

---------

The trust amount is held in a trust fund at a branch of J.P. Morgan Chase Bank,

N.A. maintained by Continental Stock Transfer and Trust Company, as trustee,

pursuant to an investment management agreement. The proceeds held in the trust

fund will not be released except upon a number of events as set out in the

document published by the Company in connection with its admission to AIM.

NOTE 5 - Share Capital

Authorized Called up and fully paid

Number $ Number $

Common Stock $0.0001 54,000,000 5,400 22,880,000 2,288

Restricted Shares $0.0001 720,000 72 720,000 72

Preferred Stock $0.0001 1,000,000 100 0

-------- -------

5,572 2,360

-------- -------

The holders of Common Stock arising from the issue of units on 21 June 2007 are

entitled to require the Company to repurchase their shares if at the time the

Company seeks approval for a business combination the stockholder votes against

the proposal. The holders of Common Stock are also entitled to require their

Company to repurchase their shares if the Company seeks approval to extend the

deadline for a qualifying business combination and the shareholder votes against

the proposal. The repurchase price will be a per share price equal to a pro-rata

share of the trust fund, including interest earned and net of expenses and taxes

thereon (see Note 4).

The Restricted Shares carry no rights to dividends except in the case of a

winding up of the Company. They convert on a one for one basis to Common Stock

if at any time within five years of their issue, and subsequent to a Business

Combination, the ten day average share price of the Common Stock exceeds $6.90.

No Preferred Stock had been issued at the balance sheet date and accordingly the

rights attaching to the Preferred Stock have not been set.

During the period the Company issued the following shares

Date Class Number Price Purpose

03/03/07 Common Stock 2,880,000 $0.07 Management incentive

03/03/07 Restricted Shares 720,000 $0.07 Management incentive

21/06/07 Units1 20,000,000 $6.00 Finance Acquisitions

1 Each Unit comprises one Common Stock and one warrant to subscribe for Common

Stock at $4.00 per share subsequent to a Qualifying Business Combination. There

were 20 million warrants in issue at the balance sheet date.

The Company issued an option over 2 million Units to the placing agent. The

option is exercisable at $6.60 following a Qualifying Business Combination.

NOTE 6 - Reserves

Profit & Loss Additional Paid Total

$000s in Capital $000s $000s

Brought forward at 2 February 2007 - - -

Retained loss for the year (60) - (60)

Arising from share issues - 53,289 53,289

(60) 53,289 53,229

NOTE 7 - Related parties

On March 2, 2007 the Company issued promissory notes to Siesta Key Capital LLC

(an affiliate of Mr.Sauickie), Integra Management Limited (an affiliate of Mr.

Parkin) and Mr. Wightman totalling up to approximately $435,000 in respect of

certain formation and other expenses repayable by the Company out of the

proceeds of the Units placed or subsequently out of working capital. $435,000

remains outstanding at the balance sheet date of which $385,000 is payable out

of the proceeds of the Units placed and $50,000 is payable from working capital.

The Company has agreed to pay a monthly administrative fee of $7,500 for office

and secretarial support to Siesta Key Capital, LLC (an affiliate of Mr.

Sauickie).

NOTE 8 - Post Balance Sheet Event

Subsequent to the period end the amount due from brokers of approximately $11

million, which was provided to the Company's listing broker for stabilisation

purposes, was paid into the trust fund.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SSAFMWSWSEEA

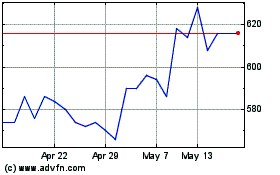

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

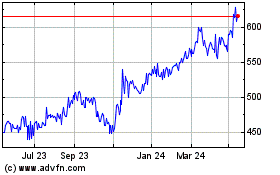

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024