TIDMSURE

RNS Number : 7744L

Sure Ventures PLC

17 May 2022

Sure Ventures plc ('Sure Ventures' or 'the Company')

Portfolio Update Q1 2022 and Director commentary

Sure Ventures is a London listed venture capital fund which

invests in early stage software companies in the rapidly growing

technology areas of Augmented Reality ('AR'), Virtual Reality

('VR'), Internet of Things ('IoT') and Artificial Intelligence

(AI). We are pleased to provide an update on the Company's

investment portfolio.

SURE VALLEY VENTURES FUND

Sure Ventures made a EUR7million commitment to Sure Valley

Ventures Fund ('Sure Valley') representing an interest in Sure

Valley of approximately 25.9%. This commitment was made at a price

of EUR1.00 per share. The current NAV of the Sure Valley Ventures

ICAV is EUR1.47 which is a 9.99% increase from its NAV as at Q4

2021.

Sure Valley has several investments across the AI, AR, VR and

IoT sectors and the major contributing factors and commentary on

underlying companies that has driven this NAV calculation are as

follows:

Getvisibility

Getvisibility successfully raised EUR10 million in equity from

new investors Alpha Intelligence Capital ("AIC"), a global venture

capital firm which invests in deep arti cial intelligence/machine

learning technology-based companies and Fortino Capital Partners

("Fortino"), a leading B2B software venture capital and growth

equity firm.

Certain existing investors, including Sure Valley Ventures and

Pires have also made follow-on investments alongside AIC and

Fortino and other additional new investors. As part of this funding

round, Sure Ventures PLC invested a further 310,773 Euros from

existing cash resources as part of the follow-on round.

Getvisibility has made significant progress in both winning

customers and identifying customer needs, in what is clearly a

requirement that has become "front and centre" to commercial

operations across the globe. This round of funding, based on the

post funding round valuation of Getvisibility, provides a 4x uplift

to our original investment and has been responsible for the NAV

uplift.

VIVIDQ

VividQ announced the launch of its latest cutting-edge

technology, unveiled for the first time at the SID Display Week

Conference in San Jose, California. VividQ's Alpha Optical Engine

Demonstrator displays high-resolution 3D visuals (60 PPD) with

excellent contrast and realistic focal depth using

Computer-Generated Holography (CGH), the process of engineering

light in software.

This new technology allows device manufacturers to test and

evaluate VividQ's innovations in Computer generated holography

(CGH) against their AR display specifications and image quality

requirements. VividQ is collaborating with device manufacturers

from the US, Japan and China to integrate CGH into the next

generation of AR devices soon to be available on the market.

Listed holdings

Equity markets have been volatile, and both Engage XR (EXR.L)

and Immotion PLC (IMMO.L) traded lower on a quarter-on-quarter

basis. The AIFM are happy with both positions and are long term

investors. Both listed entities are producing strong revenue growth

and market adoption.

During the quarter Immotion PLC signed a three-year agreement

for the installation of a 24 seat Gorilla Trek VR Theatre at

Pittsburgh Zoo & PPG Aquarium. The company also announced full

year results showing Revenues for the year increasing by 230% to

GBP9,391,000 and the Group achieved a full year positive adjusted

EBITDA([5]) result for the first time since its inception of

GBP908,000 (2020: GBP1,690,000 negative).

ENGAGE XR is also performing well despite the market volatility

and Engage platform revenue comprises 72% of total Group revenue.

Since the Group's interim results, ENGAGE has continued to grow,

including the recent signing of a contract with one of the world's

leading professional services groups to use the platform. Annual

ENGAGE revenue compound annual growth rate (CAGR) is in excess of

100%.

SURE VALLEY VENTURES ENTERPRISE CAPITAL FUND

During the quarter Sure Ventures PLC also made a commitment of

GBP5m to the Sure Valley Ventures Capital Fund. The fund has

launched, and the first investment was made in a company called

RETìníZE on the 16(th) of March 2022.

Retinize are developing an innovative software product called

Animotive that is harnessing the latest VR technologies to

transform the 3D animation production process. The proceeds of the

seed round will drive the next two-year step in its growth and the

global rollout of Animotive.

The seed round, led by the SVV Software Fund's GBP1 million

investment, marks the first investment from this fund which

recently announced its first close of GBP85 million, which included

a cornerstone GBP50 million investment from the British Business

Bank, an investment arm of the UK Government.

Sure Ventures PLC NAV

The funding round secured by Getvisability has had a significant

impact on the Company's NAV and despite a decline in value of the

listed assets, the NAV of Sure Ventures PLC has grown from 118.34p

a share to 128.9p a share, which represents a 8.923% uplift quarter

on quarter.

Forward looking statement & Director comment

When calculating the NAV for both Sure Valley Ventures and Sure

Ventures PLC we do not re-rate an unlisted investee company

valuation unless there is a funding round priced by another

investor. The nature and stage of the software companies that we

invest requires patience and we are now starting to see these

businesses mature at a strong pace. This quarter has seen another

portfolio company complete a follow on round with a 4x original

cash uplift and we look forward to updating the market with

progress of our portfolio as it continues to grow.

Gareth Burchell comment

"Sure Valley Ventures and its portfolio of deep technology

companies continue to perform in what are difficult economic

circumstances. The speed at which some of the growth is starting to

come through has the team excited for the future. The NAV is

beginning to reflect some of the achievements of our founders and

we look forward to updating shareholders with further progress"

For further information, please visit www.sureventuresplc.com or

contact:

Gareth Burchell

Sure Ventures plc

+44 (0) 20 7186 9918

Notes to Editors

Sure Ventures plc listed on the London Stock Exchange in January

2018 giving retail investors access to an asset class that is

usually dominated by private venture capital funds. Sure Ventures

is focusing on companies in the UK, Republic of Ireland and other

European countries, making seed and series A investments in

companies with first rate management teams, products which benefit

from market validation with target revenue run rates of at least

GBP400,000 over the next 12 months. Website:

https://www.sureventuresplc.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUBKOBDCBKKBPD

(END) Dow Jones Newswires

May 17, 2022 05:14 ET (09:14 GMT)

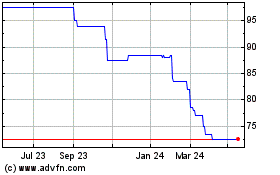

Sure Ventures (LSE:SURE)

Historical Stock Chart

From Nov 2024 to Dec 2024

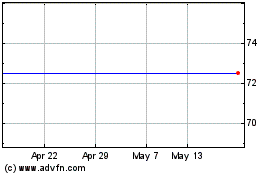

Sure Ventures (LSE:SURE)

Historical Stock Chart

From Dec 2023 to Dec 2024