TIDMSTX

RNS Number : 0361O

Shield Therapeutics PLC

28 September 2023

28 September 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION, OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE

OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS MADE FOR INFORMATION PURPOSES ONLY

AND DOES NOT CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN THE COMPANY OR CONTAIN ANY INVITATION, SOLICITATION,

RECOMMATION, OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR OR

OTHERWISE ACQUIRE SHARES IN SHIELD THERAPEUTICS PLC IN ANY

JURISDICTION.

Shield Therapeutics plc

("Shield", the "Group" or the "Company")

Successful completion of US$ 6.1m (GBP5.0m) Equity Fundraise

London, UK - 28 September 2023: Shield Therapeutics plc (LSE:

STX ), a commercial stage pharmaceutical company , is pleased to

announce the successful completion of the subscription (the

"Subscription") and placing (the "Placing") which were announced

earlier today. The Subscription and Placing have raised aggregate

gross proceeds of c. US$ 6.1 m (c. GBP 5.0 m). A total of

62,393,060 new ordinary shares to be allotted pursuant to the

Subscription and the Placing are to be issued at an issue price of

8.0 pence per share (the "Issue Price"). The Company also

announced, earlier today, details of a retail offer to raise up to

an additional c. US$1.4m (c. GBP 1.14 m) (the "Retail Offer", and

together with the Placing and the Subscription, the "Equity

Fundraising").

Pursuant to the Placing a total of 41,380,508 new ordinary

shares in the Company at the Issue Price (the "Placing Shares")

have been conditionally placed by Peel Hunt LLP ("Peel Hunt") and

Cavendish Capital Markets Ltd ("Cavendish") with new and existing

investors at the Issue Price.

Pursuant to the Subscription, AOP Health International

Management AG ("AOP"), a major shareholder in the Company, has

conditionally subscribed for a total of 21,012,552 new ordinary

shares in the Company at the Issue Price (the "Subscription Shares"

and, together with the Placing Shares, and the Retail Offer Shares,

the "New Shares"). The Placing Shares and the Subscription Shares

represent 8.0 per cent. of the existing issued ordinary share

capital of the Company. The Issue Price represents a discount of

17.9 per cent. to the closing price of 9.75 pence on 27 September

2023. Up to a further 14,260,720 new ordinary shares in the Company

may be issued pursuant to the Retail Offer (the "Retail Offer

Shares"). No part of the Equity Fundraising is underwritten.

Additionally, pursuant to the exercise of all of its outstanding

warrants with an exercise price of 6.75p per warrant, AOP has

subscribed for a further 5,147,754 new ordinary shares (the "AOP

Warrant Shares") for an aggregate exercise price of GBP347,473.40

conditional on the admission of (i) the New Shares, and (ii) such

number of Retail Offer Shares to be issued pursuant to the REX

Retail Offer, to trading on AIM becoming effective by means of the

issue by London Stock Exchange plc (the "London Stock Exchange") of

a dealing notice under Rule 6 of the AIM Rules.

The New Shares and the AOP Warrant Shares will, when issued, be

fully paid and will be issued subject to the Company's articles of

association and will rank pari passu in all respects with the

existing issued ordinary shares in the capital of the Company,

including the right to receive all dividends and other

distributions declared, made or paid on or in respect of such

shares by reference to a record date falling after their issue.

Application has been made to the London Stock Exchange for the

New Shares and the AOP Warrant Shares to be admitted to trading on

AIM ("Admission"). It is expected that Admission will occur at

08.00 a.m. on or around 4 October 2023 (or such later date as the

Company, Peel Hunt and Cavendish may agree, being no later than

8.00 a.m. on 13 October 2 023 ).

The Retail Offer through the REX platform is expected to remain

open until 10:00 a.m. on 3 October 2023. A further announcement

will be made in relation to the result of the Retail Offer.

For further information, please contact:

Shield Therapeutics plc +44 (0) 191 511 8500

Greg Madison (CEO)

Hans-Peter Rudolf (CFO)

Peel Hunt LLP - Nominated Adviser, Joint Broker and Bookrunner +44 (0) 20 7148 8900

James Steel / Patrick Birkholm (Investment Banking)

Sohail Akbar / Jock Maxwell Macdonald (ECM)

Cavendish Capital Markets Ltd - Joint Broker and Bookrunner +44

(0) 20 7148 8900

Geoff Nash / George Dollemore (Corporate Finance)

Nigel Birks / Harriet Ward (ECM)

Wallbrook PR - Public Relations +44 (0) 20 7933 8780

or Shield@walbrookpr.com

Paul McManus / Lianne Applegarth / Alice Woodings

About Accrufer(R)/Feraccru(R)

Accrufer(R)/Feraccru(R) (ferric maltol) is a novel, stable,

non-salt based oral therapy for adults with iron deficiency, with

or without anemia. Accrufer(R)/Feraccru(R) has a novel mechanism of

action compared to other oral iron therapies and has been shown to

be an efficacious and well-tolerated therapy in a range of clinical

trials. More information about Accrufer(R)/Feraccru(R), including

the product label, can be found at: www.accrufer.com and

www.feraccru.com

About Shield Therapeutics plc

Shield is a commercial stage specialty pharmaceutical company

with a focus on addressing iron deficiency with its lead product

Accrufer(R)/Feraccru(R) (ferric maltol). The Group has launched

Accrufer(R) in the US and Feraccru(R) is commercialized in the UK

and European Union by Norgine B.V., who also have the marketing

rights in Australia and New Zealand. Shield also has an exclusive

license agreement with Beijing Aosaikang Pharmaceutical Co., Ltd.,

for the development and commercialization of

Accrufer(R)/Feraccru(R) in China, Hong Kong, Macau and Taiwan, with

Korea Pharma Co., Ltd. in the Republic of Korea, and with KYE

Pharmaceuticals Inc. in Canada.

Accrufer(R)/Feraccru(R) has patent coverage until the

mid-2030s.

Accrufer(R)/Feraccru(R) are registered trademarks of the Shield

Group

IMPORTANT NOTICES AND DISCLAIMER

This announcement including its appendices (together, this

"Announcement") and the information contained in it is not for

publication, release, transmission distribution or forwarding, in

whole or in part, directly or indirectly, in or into the United

States, Australia, Canada, Japan or the Republic of South Africa or

any other jurisdiction in which publication, release or

distribution would be unlawful. This Announcement is for

information purposes only and does not constitute an offer to sell

or issue, or the solicitation of an offer to buy, acquire or

subscribe for shares in the capital of the Company in the United

States, Australia, Canada, Japan or the Republic of South Africa or

any other state or jurisdiction where to do so would be unlawful.

Any failure to comply with these restrictions may constitute a

violation of the securities laws of such jurisdictions. This

Announcement has not been approved by the London Stock Exchange or

by any other securities exchange.

The New Shares, have not been, and will not be, registered under

the US Securities Act of 1933, as amended (the "Securities Act") or

with any securities regulatory authority of any state or other

jurisdiction of the United States and may not be offered, sold,

pledged, taken up, exercised, resold, renounced, transferred or

delivered, directly or indirectly, in or into the United States

absent registration under the Securities Act, except pursuant to an

exemption from the registration requirements of the Securities Act

and in compliance with any applicable securities laws of any state

or other jurisdiction of the United States. The Placing Shares are

being offered and sold by the Company outside the United States in

offshore transactions as defined in, and pursuant to, Regulation S

under the Securities Act.

This announcement is being directed to persons in the United

Kingdom only in circumstances in which section 21(1) of the

Financial Services and Markets Act 2000, as amended ("FSMA") does

not apply.

This announcement is for information purposes only and is

directed only at persons who are: (1) in Member States of the

European Economic Area, qualified investors as defined in article

2(e) of the Prospectus Regulation (EU) 2017/1129 (the "EU

Prospectus Regulation"); (2) in the United Kingdom, qualified

investors as defined in article 2(e) of Prospectus Regulation (EU)

2017/1129 as it forms part of UK domestic law by virtue of the

European Union (Withdrawal) Act 2018, as amended ("EUWA") (the "UK

Prospectus Regulation"), who (A) fall within article 19(5)

("investment professionals") of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005, as amended (the

"Order"), or (B) fall within article 49(2)(a) to (d) ("high net

worth companies, unincorporated associations, etc.") of the Order;

or (3) are persons to whom it may otherwise be lawfully

communicated; (all such persons together being referred to as

"relevant persons"). This announcement and the terms and conditions

set out herein must not be acted on or relied on by persons who are

not relevant persons. Persons distributing this announcement must

satisfy themselves that it is lawful to do so. Any investment or

investment activity to which this announcement and the terms and

conditions set out herein relates is available only to relevant

persons and will be engaged in only with relevant persons.

The New Shares have not been approved, disapproved or

recommended by the US Securities and Exchange Commission, any state

securities commission in the United States or any other US

regulatory authority, nor have any of the foregoing authorities

passed upon or endorsed the merits of the offering of New Shares.

Subject to certain exceptions, the securities referred to herein

may not be offered or sold in the United States, Australia, Canada,

Japan or the Republic of South Africa or to, or for the account or

benefit of, any national, resident or citizen of the United States,

Australia, Canada, Japan or the Republic of South Africa.

No public offering of securities is being made in the United

Kingdom, the United States or any other jurisdiction. Offers of the

New Shares will either be made pursuant to an exemption under the

EU Prospectus Regulation and the UK Prospectus Regulation (as such

terms are defined above) from the requirement to produce a

prospectus or otherwise in circumstances not resulting in an offer

of transferable securities to the public under section 102B of

FSMA.

This Announcement has been issued by, and is the sole

responsibility of, the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by the

directors or the Company, or by any of its or their respective

partners, employees, advisers, affiliates or agents as to or in

relation to, the accuracy or completeness of this Announcement or

any other written or oral information made available to or publicly

available to any interested party or its advisers, and any

liability therefor is expressly disclaimed.

Peel Hunt, which is authorised and regulated in the United

Kingdom by the Financial Conduct Authority is acting as nominated

adviser and joint bookrunner to the Company and no one else in

connection with the Placing and is not acting for and will not be

responsible to any person other than the Company for providing the

protections afforded to its clients or for providing advice in

relation to the Placing. Peel Hunt's responsibilities as the

Company's nominated adviser under the AIM Rules for Nominated

Advisers are owed solely to the London Stock Exchange and are not

owed to the Company or to any Director or to any other person in

respect of his decision to acquire shares in the Company in

reliance on any part of this Announcement.

Cavendish, which is authorised and regulated by the FCA for the

conduct of regulated activities in the United Kingdom, is acting as

joint bookrunner to the Company and no one else in connection with

the Placing and is not acting for and will not be responsible to

any person other than the Company for providing the protections

afforded to its clients or for providing advice in relation to the

Placing.

Except as required under applicable law, neither Peel Hunt,

Cavendish nor any of their directors, officers, partners, members,

employees, advisers, affiliates or agents assume or accept any

responsibility whatsoever for the contents of the information

contained in this Announcement or for any other statement made or

purported to be made by or on behalf of Peel Hunt, Cavendish or any

of their affiliates in connection with the Company, the New Shares

or the Placing. Peel Hunt, Cavendish and each of their directors,

officers, partners, members, employees, advisers, affiliates and

agents accordingly disclaim all and any responsibility and

liability whatsoever, whether arising in tort, contract or

otherwise (save as referred to above) in respect of any statements

or other information contained in this Announcement and no

representation or warranty, express or implied, is made by Peel

Hunt, Cavendish or any of their directors, officers, partners,

employees, advisers, affiliates or agents as to the accuracy,

completeness or sufficiency of the information contained in this

Announcement.

The distribution of this Announcement and/or the Equity

Fundraising in certain jurisdictions may be restricted by law. No

action has been taken by the Company, Peel Hunt, Cavendish or any

of their respective affiliates that would, or which is intended to,

permit an offering of the New Shares in any jurisdiction or result

in the possession or distribution of this Announcement or any other

offering or publicity material relating to New Shares in any

jurisdiction where action for that purpose is required.

This Announcement does not constitute a recommendation

concerning any investor's option with respect to the Equity

Fundraising. Each investor or prospective investor should conduct

his, her or its own investigation, analysis and evaluation of the

business and data described in this Announcement and publicly

available information. The price and value of securities can go

down as well as up. Past performance is not a guide to future

performance. The contents of this Announcement are not to be

construed as legal, business, financial or tax advice. Each

investor or prospective investor should consult with his or her or

its own legal adviser, business adviser, financial adviser or tax

adviser for legal, financial, business or tax advice.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended, as it forms part of UK domestic

law by virtue of the EUWA ("MiFID II"); (b) Articles 9 and 10 of

Commission Delegated Directive (EU) 2017/593 supplementing MiFID

II, as amended, as it forms part of UK domestic law by virtue of

the EUWA; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Placing Shares have been subject to a product approval process,

which has determined that the Placing Shares are: (i) compatible

with an end target market of: (a) retail investors; (b) investors

who meet the criteria of professional clients; and (c) eligible

counterparties, each as defined in MiFID II; and (ii) eligible for

distribution through all distribution channels as are permitted by

MiFID II (the "Target Market Assessment"). Notwithstanding the

Target Market Assessment, distributors should note that: the price

of the Placing Shares may decline and investors could lose all or

part of their investment; the Placing Shares offer no guaranteed

income and no capital protection; and an investment in the Placing

Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without

prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Placing.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, Peel Hunt and Cavendish will only procure investors who

meet the criteria of professional clients and eligible

counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Placing Shares.

Forward Looking Statements

This Announcement contains "forward-looking statements" which

include all statements (other than statements of historical facts)

including, without limitation, those regarding the Group's

financial position, business strategy, plans and objectives of

management for future operations, and any statements preceded by,

followed by or that include the words "targets", "believes",

"expects", "aims", "intends", "will", "may", "anticipates",

"would", "could" or similar expressions or negatives thereof. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Company's

control that could cause the actual results, performance or

achievements of the Group to be materially different from future

results, performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are

based on numerous assumptions regarding the Group's present and

future business strategies and the environment in which the Group

will operate in the future. These forward-looking statements speak

only as at the date of this Announcement. The Company expressly

disclaims any obligation or undertaking to disseminate any updates

or revisions to any forward looking statements contained herein to

reflect any change in the Company's expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statements are based unless required to do so by

applicable law or the AIM Rules for Companies.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEPPUWCBUPWGGR

(END) Dow Jones Newswires

September 28, 2023 07:50 ET (11:50 GMT)

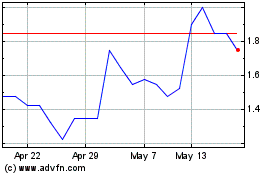

Shield Therapeutics (LSE:STX)

Historical Stock Chart

From Oct 2024 to Nov 2024

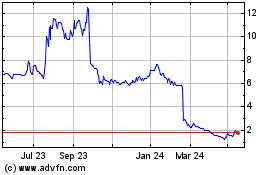

Shield Therapeutics (LSE:STX)

Historical Stock Chart

From Nov 2023 to Nov 2024