TIDMSPR

RNS Number : 3509C

Springfield Properties PLC

22 February 2022

22 February 2022

Springfield Properties plc

("Springfield", the "Company" or the "Group")

Interim Results

Excellent build and sales activity across the business and on

track for significant full year growth

Springfield Properties (AIM: SPR), a leading housebuilder in

Scotland delivering private, affordable and PRS housing, announces

its interim results for the six months ended 30 November 2021.

Financial Summary

H1 2022 H1 2021*

GBPm GBPm

Revenue 87.3 94.4

Private housing revenue 47.3 71.9

Affordable housing

revenue 31.7 18.3

Contract housing revenue 7.5 3.8

Other revenue 0.8 0.4

Gross margin** 18.5% 19.6%

Operating profit 6.7 9.3

Profit before tax 6.2 8.6

Basic EPS (p) 4.93 7.07

Interim dividend per

share (p) 1.5 1.3

* H1 2021 results reflect additional sales from completions

rolled over due to COVID-19

** Gross margin reflects sales mix, namely record revenue from

affordable housing in H1 2022

Operational Summary

-- On track to deliver full year results in line with market expectations

-- Private housing

o 197 private homes completed (H1 2021: 299), reflecting the

more normal seasonal phasing of completions across the financial

year, with H1 2021 being boosted by completions that had been

scheduled for the end of FY 2020, but delayed due to the public

lockdown

o Record order book to be delivered in H2 following strong sales

in the period

o Eight new private developments commenced completions post

period

-- Affordable housing

o 204 affordable homes completed (H1 2021: 126) reflecting

delivery against the Group's substantial contracted affordable

order book

o On track to deliver a record year in affordable housing, with

year-on-year revenue expected to increase by approximately 35%

-- Contract housing

o In contract housing, where the Group provides development

services to third party private organisations, 58 homes were

delivered (H1 2021: 18)

o Commenced generating revenue under private rented sector

("PRS") housing contract

-- Effectively managed cost and supply chain pressures with

gross margins maintained when excluding the impact of regional and

housing mix in private and affordable housing respectively

-- Planning approval received for 240 homes during the period

and the proportion of land bank with planning permission was 51.6%

(31 May 2021: 52.4%); post period submitted planning application

for a new, large development of up to 1,000 homes in Edinburgh

commuter belt

-- Total land bank of 15,308 plots at period end (31 May 2021:

15,281) with Gross Development Value ("GDV") of GBP3.1bn (31 May

2021: GBP3.1bn)

-- Post period, acquired Tulloch Homes, an Inverness-based

housebuilder focused on building high-quality private housing in

the Scottish Highlands and with a GDV of GBP375.4m, to accelerate

growth, enhance earnings and strengthen the Company's foothold in

an area of high demand

Innes Smith, Chief Executive Officer of Springfield Properties,

commented: "This was a strong period for Springfield. We continued

to experience high demand across the business and our total order

book grew to a record level. We maintained excellent build

activity, setting us up for an outstanding second half of the year

- with handovers starting on eight new private sites since period

end. I am pleased at how we effectively managed the material and

supply chain pressures facing our industry, and that we were able

to maintain impressive levels of customer satisfaction.

Sustainability continued to be a focus. We're proud that we already

deliver over 90% of our homes off-site from timber kits, and we

will be setting benchmarks for further measures across operations

in our ESG strategy later this year.

"We entered the second half on track for strong growth for FY

2022 in line with market expectations. This confidence is based on

homes completed, reserved and missived, and our highest ever

revenue in affordable housing, giving us significant visibility

over our revenue forecasts. Our position was further strengthened,

post period, with the acquisition of Tulloch Homes. This enhances

our foothold in the Highlands, an area of strategic importance, and

will accelerate our growth, being earnings enhancing from the

current year. Supported by long-term market drivers and with demand

continuing to outstrip supply, the Board continues to look to the

future with great confidence and to delivering sustainable value

for all of our stakeholders."

Enquiries

Springfield Properties

Sandy Adam, Chairman

Innes Smith, Chief Executive Officer +44 1343 552550

-----------------

Singer Capital Markets

-----------------

Shaun Dobson, Rachel Hayes, James Moat

(Investment Banking) +44 20 7496 3000

-----------------

Luther Pendragon

-----------------

Harry Chathli, Claire Norbury +44 20 7618 9100

-----------------

Analyst Presentation

Innes Smith, Chief Executive Officer, Michelle Motion, Chief

Financial Officer, and Martin Egan, Chief Operating Officer, will

be hosting a webinar for analysts at 9:00am GMT today. To register

to participate, please contact tanweersiddique@luther.co.uk.

Operational Review

The Group maintained strong build activity throughout the period

to 30 November 2021 with total completions increasing to 459 homes

(H1 2021: 443) and has substantial work-in-progress for delivery in

the second half. There was a significant increase in affordable and

contract housing completions, with the Group on track to deliver

record revenue in affordable housing this year. Private housing

completions were comparatively lower primarily due to H1 2021 being

boosted by completions that had been scheduled for handover in the

final two months of 2020, but rolled over due to the COVID-19

lockdown. It also reflects the timing of completions, with

handovers having started at eight new private developments since

period end. Sales activity continued to be strong with high demand

experienced across the business, including a significant increase

in private housing reservations leading to growth in the Group's

total order book for delivery over the next two years.

Springfield continued to advance the delivery of its strategy.

During the period construction commenced on, and the first revenue

was received for, its first PRS housing, which further diversifies

the Group's revenue streams. In addition, post period, in line with

its stated strategy of expanding via acquisition and into new

territories to accelerate growth, the Group acquired Tulloch Homes.

The acquisition expands the Group's land bank in the Highlands of

Scotland around Inverness, which is an area of high and growing

demand where Springfield has been organically building a presence

over the last few years.

The Group continued to effectively manage current industry-wide

material and labour supply constraints, with gross margins

maintained when excluding the impact of regional or housing mix.

The large proportion of fixed price contracts for materials that

the Group had in place during the period as well as house price

inflation served to mitigate the impact of increased costs.

Similarly, Springfield's strong, established relationships with

sub-contractors, together with its large directly employed

workforce, helped the Group maintain its labour force.

Land Bank

At 30 November 2021, the Group had 44 active developments (31

May 2021: 45 active developments) and during the period:

-- 8 developments were completed;

-- 7 new active developments were added to the land bank;

-- planning was granted on 240 plots on 2 developments, with the

proportion of the land bank with planning consent being 51.6% at 30

November 2021 (31 May 2021: 52.4%); and

-- the land bank consisted of 15,308 plots (31 May 2021: 15,281).

Post period, the land bank was further expanded with a planning

application being submitted for a new, large development of up to

1,000 homes in the Edinburgh commuter belt and in the Highlands

region of Scotland, with the acquisition of Tulloch Homes. On

acquisition, Tulloch Homes' land bank consisted of 1,791 plots of

which 91% was owned and paid for, and 87% with planning

permission.

Private Housing

During the period , the Group completed 197 private homes (H1

2021: 299). This primarily reflects H1 2021 being boosted by

completions that were scheduled to be handed over at the end of the

2020 financial year but were postponed until lockdown restrictions

were lifted. It also represents the timing of handovers, with eight

new private developments having started handing over homes in H2

2022, which will contribute significantly to full year revenue.

The average selling price for private housing was GBP240k (H1

2021: GBP240k). There was a general increase in sales prices on an

underlying basis, excluding regional and housing-type mix, with a

larger proportion of revenue and completions in regions of

Scotland, which typically have lower house prices.

The Group continued to experience excellent demand, with a

significant increase in the number of homes missived or reserved at

30 November 2021 compared with 31 May 2021, resulting in a record

order book in private housing at period end. In addition, the

proportion of available-for-sale homes that were missived or

reserved at 30 November 2021 was higher than at both 31 May 2021

and 30 November 2020.

The Group had 27 active private housing developments at 30

November 2021 (31 May 2021: 24), with six active developments added

during the period and three developments completed. In total, as at

30 November 2021, the private housing land bank was 10,562 plots on

59 developments (31 May 2021: 10,426 plots on 56 developments).

Planning consent was granted for 225 plots on two developments

for private housing. As at 30 November 2021, 49.4% (5,215 plots) of

private housing plots had planning consent (31 May 2021: 48.7%),

with 25.0% going through the planning process and 25.6% at the

pre-planning stage.

Post period, the Group submitted a planning application for a

new, large development of up to 1,000 homes. This development is to

be built on land that the Group purchased in the prior year in

Midlothian in the Edinburgh commuter belt. The proposed development

is designed as a new neighbourhood with a distinct identity which

will, following the Scottish government's 20-minute neighbourhood

model, integrate into existing settlements where residents can

easily access high quality services and amenities.

Village developments

Springfield Villages are standalone developments that include

infrastructure and neighbourhood amenities. Each Village is

designed to have up to approximately 3,000 homes, catering for

around 7,000 residents, with ample green space and community

facilities. They primarily offer private housing, but also include

affordable housing and, beginning with Bertha Park, include PRS

housing. Springfield has three Villages that are already home to

growing communities and two Village developments that are going

through the planning process. The Group delivers housing at Bertha

Park under contract as described in 'Contract Housing' below.

There were 51 private completions at the Group's Village

developments during the period (H1 2021: 56). This number increases

to a total of 74 private completions when Bertha Park is included

(H1 2021: 68). In addition, a contract was signed for a retail unit

at Bertha Park.

There was also a continued expansion of amenities and

strengthening of community engagement at the Village developments.

This includes the hosting of community events, the establishment of

a school bus route through Dykes of Gray and Bertha Park gaining

its own post box, being symbolic of a 'place' being created.

Affordable Housing

There was a significant increase in the number of affordable

home completions to 204 (H1 2021: 126). The growth in completions

reflects delivery against the Group's substantial contracted order

book, with the Group on track to achieve its highest ever revenue

in affordable housing this year. Average selling price increased to

GBP155k (H1 2021: GBP146k) as a result of a change in housing

mix.

The number of active affordable housing developments was 15 at

30 November 2021 (31 May 2021: 19), with one active development

added during the period and five developments completed. As at 30

November 2021, the total affordable housing land bank was 4,004

plots on 47 developments (31 May 2021: 4,055 plots on 48

developments).

The Group secured two new affordable housing contracts during

the period and one post period. The Group also expanded its

partnership network with the signing of its first contract with

Aberdeenshire Council, for 38 homes at Banff.

Springfield continued to make progress under its local authority

framework agreement with Moray Council for 10 affordable-only

developments. The handover of two developments was completed during

the period, bringing the total number delivered under this

agreement to five. Construction is underway on two new

developments, one of which began during the period, and contract

negotiations commenced for the remaining three developments under

this agreement.

In total, the Group expects to commence work on eight new

affordable housing contracts during the second half of the

year.

As at 30 November 2021, 48.7% (1,947 plots) of affordable

housing plots had planning (31 May 2021: 52.7%), with 27.7% of

plots going through the planning process and 23.6% at the

pre-planning stage.

Contract Housing

In contract housing, the Group provides development services to

third party private organisations (compared with affordable housing

where the Group's services are delivered to local authorities,

housing associations or other public bodies). At present, the

Group's contract housing delivery consists of services provided to

Bertha Park Limited, the developer of the Bertha Park Village,

under a framework agreement. The Group performs development

services and receives revenue based on costs incurred plus a fixed

mark up. At Bertha Park, the Group is delivering private,

affordable and PRS housing. The Group has introduced contract

housing as a segment because of the increased materiality of

revenue now being generated from the provision of development

services to Bertha Park Limited, particularly due to beginning the

delivery of PRS housing.

At 31 May 2021, the contract housing land bank with planning

consent consisted of 742 plots (31 May 2021: 800). The 58 homes

completed during the period (H1 2021: 18) comprised 23 private

homes, 17 affordable homes and 18 PRS homes at Bertha Park Village.

This represented the completion of the second phase of affordable

homes at Bertha Park. The Group also commenced construction on the

first Mid-Market Rent housing to be offered at Bertha Park, which

is a form of affordable housing for those in work where housing

associations utilise grants to enable market rents to be

discounted.

A key milestone was achieved with the commencement of revenue

received for the delivery of Springfield's first PRS housing, in

partnership with Sigma Capital Group plc ("Sigma"), a high-quality

PRS provider specialising in suburban, family homes. At Bertha

Park, the Group will deliver 75 purpose-built homes for families to

rent privately, which, following handover, will be owned, let and

managed by Sigma. This is expected to increase the build out rate

for the Village and underscores Springfield's commitment to develop

mixed-tenure Villages that meet everyone's housing needs. During

the period, the Group began construction on the PRS homes.

Acquisition of Tulloch Homes

As announced on 1 December 2021, post period, the Group acquired

Thistle SPV2 Limited, the owner of Tulloch Homes, an

Inverness-based housebuilder focused on building high-quality

private housing in the Scottish Highlands, for a net consideration

of GBP56.4m.

Tulloch Homes is a profitable, cash generative and well-run

housebuilder with significant land ownership in the Scottish

Highlands, in and around Inverness. On acquisition, Tulloch Homes'

land bank consisted of 1,791 plots (87% with planning permission)

across 11 active and 22 future developments with a total GDV of

GBP375.4m. In relation to the composition of its land bank, 91% is

owned and paid for and 9% is contracted.

The acquisition expands the Group's land bank in an area of high

and growing demand where the Group has been strategically building

a presence over the last few years. In particular, it strengthens

the Group's private housing land bank while creating opportunities

for affordable housing.

The Group is gaining a strong, established management team and

expects the acquisition to reinforce the Group's supply chain

capabilities with access to labour and subcontractors in the local

area.

Accordingly, the acquisition of Tulloch Homes is expected to

accelerate growth and enhance earnings per share from the current

year and significantly enhance earnings in its first full year of

ownership, before consideration of potential synergies.

Financial Review

Revenue for the six months to 30 November 2021 was GBP87.3m (H1

2021: GBP94.4m), with the largest portion continuing to be

generated by private housing but with a significant increase in the

contribution from affordable housing in particular.

Revenue H1 2022 H1 2021

GBP'000 % GBP'000 %

-------- ----- -------- -----

Private housing 47,257 54.2 71,884 76.1

-------- ----- -------- -----

Affordable

housing 31,670 36.3 18,342 19.5

-------- ----- -------- -----

Contract housing 7,510 8.6 3,805 4.0

-------- ----- -------- -----

Other* 833 0.9 391 0.4

-------- ----- -------- -----

TOTAL 87,270 94,422

-------- ----- -------- -----

*Primarily land sales

The lower Group revenue compared with the same period of the

previous year was due to additional sales in H1 2021 from

completions rolled over due to COVID-19.

As noted above, the reduction in private housing revenue

primarily reflects the more normal seasonal phasing of completions

of private homes across the financial year, with H1 2021 including

additional sales completions that had been scheduled for the end of

2020. It also represents the timing of handovers, with handovers on

eight new private developments having started after the period end,

which will contribute significantly to full year revenue. The

strong growth in affordable housing reflects delivery of the

Group's substantial contracted order book, with the Group having

entered the year with its highest ever order book in affordable

housing. In addition, the Group received its first revenue in

contract housing from delivery under its PRS contract.

Gross profit was GBP16.1m (H1 2021: GBP18.5m) and gross margin

was 18.5% (H1 2021: 19.6%), reflecting the increased contribution

of affordable housing compared to private housing in the period. On

an underlying basis, to exclude the impact of regional and housing

mix, gross margins were maintained across the business, reflecting

the Group's effective management of inflationary cost pressures and

supported by house price increases.

Total administrative expenses were GBP9.5m (H1 2021: GBP9.3m).

When adjusted to exclude exceptional items relating to the cost of

furloughed employees (largely offset in the prior year by grant

income received under the UK Government's Coronavirus Job Retention

Scheme, with no grant income being claimed during the period) and

redundancy costs from a rationalisation of the business,

administrative expenses were GBP9.4m compared with GBP8.9m for H1

2021. The increase reflects the fact that the prior period includes

almost two months of limited operations due to the pandemic

lockdown (which was longer in Scotland than in England).

The Group made an operating profit of GBP6.7m (H1 2021: GBP9.3m)

and profit before tax was GBP6.2m (H1 2021: GBP8.6m), primarily

reflecting the lower revenue and gross margin.

Tax expense was GBP1.2m (H1 2021: GBP1.6m) resulting in profit

after tax of GBP5.0m (H1 2021: GBP6.9m). The Group is not subject

to the Residential Property Developers Tax ('cladding tax') as it

is currently below the GBP25m profit threshold.

Basic earnings per share were 4.93 pence (H1 2021: 7.07

pence).

Net debt at 30 November 2021 was GBP43.0m (31 May 2021:

GBP20.8m). This reflects the significant work-in-progress at the

end of the period for delivery in the second half of the 2022

financial year as well as the contribution to the year ended 31 May

2021 of the receipt of revenues from homes where the majority of

build costs had been incurred in the prior year.

During the period, the Group secured an extension to its

GBP64.5m revolving credit facility ("RCF") to January 2025 on

similar terms to the existing facility. Post period, the amount

available under the RCF was increased to GBP87.5m, with the margin

and basis of interest calculation remaining the same. The majority

of this increase (GBP21.4m) was used to fund a portion of the

initial cash consideration in relation to the acquisition of

Tulloch Homes.

The Group also established new loan facilities post period,

totalling GBP43.2m, for the purposes of providing bridging funding

for the acquisition of Tulloch Homes. These bridging finance

facilities were fully repaid by the end of January 2022 using the

net cash of Tulloch Homes on completion of the acquisition and the

proceeds of the Group's fundraising that, in December 2021, raised

approximately GBP22.0m (excluding expenses) through the placing of

15,714,286 new ordinary shares.

Customer Satisfaction

The Group maintained its strong focus on customer satisfaction

and is pleased to report that, in customer surveys received in this

financial year to date, 94% of customers reported that they would

recommend the Group to a friend and the Group has an excellent

current Net Promoter Score of 61.1. The Customer Feedback Group,

introduced at the end of last year to consider the qualitative

feedback received in customer surveys, is making good progress. An

early outcome of this has been the piloting of 'Spaciable', an

online portal and app that allows customers to access paperwork

relating to their home, after sales information and instructional

videos.

Quality management systems have continued to be a focus with the

Group promoting continuous improvement and driving up standards

across the brands. ISO9001 was recertified within the Springfield

brand following an in-period audit and plans are in place for this

quality accreditation to be rolled out across Group operations.

The Group welcomed the publication, in December 2021, of the New

Homes Quality Board Code of Practice ("NHQB Code"), which aims to

improve consumer protections covering important aspects of the new

home construction, inspection and sales process. The Group is

well-placed to meet the requirements of the NHQB Code and become a

registered developer with the New Homes Quality Board well ahead of

the December 2022 deadline.

Sustainability

Springfield has always had sustainability at its core and

already has an excellent reputation within the sector as a

progressive builder. With a commitment to formalising its approach

to sustainability to capture and report on activities in support of

this philosophy, Springfield will publish a dedicated strategy for

ESG later this calendar year.

Springfield is taking a comprehensive approach to developing its

ESG strategy to establish a framework to inform shareholders,

partners and its employees of its performance and progress. During

the period, a Group Quality, Environment and Sustainability Manager

was appointed and a specialist consultant was engaged to work with

the wider Board and senior management team. Work has begun to

establish a baseline of activities across its operations, which

will be used to set targets, outline route maps and identify key

partners to collaborate with along the journey. Described as a

materiality assessment, the Group is reviewing how each and every

operational activity can contribute to the United Nations

Sustainable Development Goals.

The Group is well established on the route map to net zero with

timber frame construction already being used in over 90% of homes

and vast experience gained across over 60 developments in

delivering air-source heating as an alternative to fossil fuels.

Springfield has had its own off-site timber frame factory for

several years. With housebuilding peers striving to increase the

number of homes they deliver off-site and from timber, this is a

key differentiator for the Group. With the exception of some

bespoke apartment blocks delivered for affordable housing partners,

the Group is committed to constructing all homes from timber. In

addition, the timber used is sourced responsibly and accredited by

the Forest Stewardship Council or the Programme for the Endorsement

of Forest Certification.

During the period, the first electric van was introduced for the

Group's timber kit factory, as part of the phasing in of a fully

electric fleet, and the Group began providing the option of zero

emission electric vehicles for staff. The Group has also increased

its support for communities with the appointment, post period, of a

full-time Community Engagement Co-ordinator. This resource will

facilitate stronger engagement during the planning process and

support the creation of new communities within the Group's larger

developments, in particular the Villages.

Markets

The Group continues to be supported by strong short- and

long-term market drivers across its private and affordable

housing.

Demand for housing in Scotland continues to outstrip supply,

which is supported by a competitive mortgage market with a good

range of products. As a result, house price inflation in Scotland

was 11.4% in the year to November 2021. For new build homes, the

increase in house prices is largely offsetting the industry-wide

increases in material costs.

A further key trend is the increasing desirability for the type

of housing Springfield offers. Customers are prioritising homes

that are more spacious, with gardens and greenspace and, as

particularly provided by the Group's Village developments, which

have local amenities within walking distance.

Key differences in the Scottish legal system continue to provide

strong visibility. In particular, the Scottish missive system

ensures that customers are contracted into the purchase much

earlier in the build programme. In addition, with all homes sold on

freehold, where the buyer becomes the sole owner of both the

building and the land on which it stands, the Group is not impacted

by the ground rents investigations seen elsewhere in the UK.

The Scottish Government remains committed to the delivery and

funding of affordable housing. Following re-election in May 2021,

the Scottish Government established a target to deliver 110,000

energy efficient affordable homes by 2032 with almost GBP3.5bn

earmarked for affordable housing funding through to March 2026.

Springfield's continued strong partnerships with local authorities

and housing associations mean that it is well-placed to deliver

homes to help achieve this target.

The Scottish Government has also set out an increase in

affordable housing investment benchmarks from October 2021 and

confirmed that the benchmarks will be adjusted to account for

inflation on an annual basis. Additional grant funding will now

also be available for quality measures, which includes

specifications that Springfield's affordable housing already offer

as standard, such as space for home working. The Group and its

partners expect to benefit from these changes going forward.

Dividend

The Board is pleased to declare an increased interim dividend of

1.5p per share (H1 2021: 1.3p) with an ex-dividend date of 10 March

2022, a record date of 11 March 2022 and a payment date of 31 March

2022.

Outlook

Springfield entered the second half of the financial year with

substantial work-in-progress for delivery in H2 and with excellent

visibility over full year revenue forecasts based on homes

delivered, contracted (missived and affordable contracts) and

reserved. The Group also entered the second half with a record

total order book. The Group's position was further enhanced with

the acquisition of Tulloch Homes - strengthening the Group's

foothold in an area of strategic importance and further

accelerating growth. Accordingly, the Group is on track to deliver

its highest ever annual revenue.

In particular, the Group continues to expect a significantly

increased contribution to revenue from affordable housing, which is

on track for a record year. In private housing, the Group

anticipates delivering strong growth, reflecting the same level of

private housing sales year-on-year (despite the beneficial

contribution to FY 2021 from the large number of homes that were

rolled over due to the pandemic) on an underlying basis and

bolstered by the contribution from Tulloch Homes. Revenue from

contract housing is also expected to increase, supported by the

generation of revenue from PRS housing this year.

The Group is experiencing excellent demand across the business,

which is supported by strong market drivers in private and

affordable housing. There remains an undersupply of housing in

Scotland and the desirability of the type of housing Springfield

offers has increased. There is good mortgage availability and the

Scottish Government has restated its commitment to investing in the

delivery of more affordable homes.

The Group is well-positioned to manage the moderate inflationary

cost pressures that are being experienced across the industry

thanks to its robust supply chain, with a high proportion of

materials being procured directly. The Group also continues to

expect house price inflation to absorb any increased build costs

this year.

As a result, the Board remains confident of delivering growth

for the full year in line with market expectations.

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE HALF YEARED 30 NOVEMBER 2021

Unaudited Unaudited Audited

Period to Period to Year to

30 November 30 November 31 May

2021 2020 2021

Notes GBP000 GBP000 GBP000

Revenue 4 87,270 94,422 216,692

Cost of sales (71,151) (75,917) (177,895)

-------------

Gross profit 4 16,119 18,505 38,797

Administrative expenses

before exceptional items (9,386) (8,864) (19,422)

Exceptional items 5 (163) (472) (622)

------------- ------------- --------------

Total administrative expenses (9,549) (9,336) (20,044)

Other operating income 88 135 375

------------- ------------- --------------

Operating profit 6,658 9,304 19,128

Finance income 66 148 367

Finance costs (512) (894) (1,607)

------------- ------------- --------------

Profit before taxation 6,212 8,558 17,888

Taxation 6 (1,170) (1,640) (4,178)

------------- ------------- --------------

Profit for the period and

total comprehensive income 4 5,042 6,918 13,710

============= ============= ==============

Profit for the period and

total comprehensive income

is attributable to:

* Owners of the parent company 5,042 6,918 13,710

5,042 6,918 13,710

============= ============= ================

Earnings per share (pence

per share)

Basic earnings per share 7 4.93p 7.07p 13.79p

Diluted earnings per share 7 4.84p 6.96p 13.55p

The Group has no items of other comprehensive income.

The accompanying notes form an integral part of these financial

statements.

CONSOLIDATED BALANCE SHEET - AS AT 30 NOVEMBER 2021

Unaudited Unaudited Audited

30 November 30 November 31 May

2021 2020 2021

As restated

Non-current assets Notes GBP000 GBP000 GBP000

Property, plant and equipment 4,935 5,436 4,539

Intangible assets 1,649 1,655 1,649

Deferred taxation 524 198 539

Accounts receivable 5,324 563 5,411

------------- ------------- --------

12,432 7,852 12,138

------------- ------------- --------

Current assets

Inventories 185,809 155,066 156,774

Trade and other receivables 22,742 17,586 23,683

Corporation tax 191 - -

Cash and cash equivalents 70,887 1,748 15,826

------------- ------------- --------

279,629 174,400 196,283

------------- ------------- --------

Total assets 292,061 182,252 208,421

Current liabilities

Trade and other payables 57,996 34,622 51,646

Deferred consideration 10 - 2,167 -

Short term bank borrowings 43,200 18,000 34,000

Short-term obligations under

lease liabilities 902 941 760

Corporation tax - 494 901

------------- ------------- --------

102,098 56,224 87,307

------------- ------------- --------

Non-current liabilities

Long-term bank borrowings 67,422 16,000 -

Long-term obligations under

lease liabilities 2,322 2,046 1,854

Contingent consideration 11 3,900 3,848 3,900

Deferred taxation 2,861 2,419 2,920

Provisions 12 961 522 1,210

------------- ------------- --------

77,466 24,835 9,884

------------- ------------- --------

Total liabilities 179,564 81,059 97,191

Net assets 112,497 101,193 111,230

============= ============= ========

Equity

Share capital 9 128 122 128

Share premium 9 57,262 52,382 56,761

Retained earnings 55,107 48,689 54,341

------------- ------------- --------

Equity attributable to owners

of the parent company 112,497 101,193 111,230

============= ============= ========

At 30 November 2021, the directors reviewed the liabilities

included in the provisions line in the prior half year and have

concluded, in line with accounting standards, that contingent

consideration should be presented separately. The prior half year

was restated to reflect that. These presentation changes have no

impact on net assets.

The accompanying notes form an integral part of these financial

statements.

CONSOLIDATED Statement of Changes in Equity

FOR THE PERIODED 30 NOVEMBER 2021

Share Share Retained

Capital Premium earnings Total

Notes GBP000 GBP000 GBP000 GBP000

1 June 2020 122 52,330 43,412 95,864

Share issue - 52 - 52

Total comprehensive

income for the

period - - 6,918 6,918

Dividends 8 - - (1,958) (1,958)

Share based payments - - 317 317

--------- ------------- -------------- ------------

30 November 2020 122 52,382 48,689 101,193

Share issue 6 4,379 - 4,385

Total comprehensive

income for the

period - - 6,792 6,792

Dividends - - (1,316) (1,316)

Share based payments - - 176 176

--------- ------------- -------------- ------------

31 May 2021 128 56,761 54,341 111,230

Share issue 9 - 501 - 501

Total comprehensive

income for the period - - 5,042 5,042

Dividends 8 - - (4,558) (4,558)

Share based payments - - 282 282

--------- ------------- -------------- ------------

30 November 2021 128 57,262 55,107 112,497

========= ============= ============== ============

The share capital accounts record the nominal value of shares

issued.

The share premium account records the amount above the nominal

value for shares issued, less share issue costs.

Retained earnings represents accumulated profits less losses and

distributions. Retained earnings also includes share based

payments.

The accompanying notes form an integral part of these financial

statements.

CONSOLIDATED Statement of Cash Flows

PERIOD to 30 NOVEMBER 2021

Unaudited Unaudited Audited

Period Period Year to

to 30 November to 30 November 31 May

2021 2020 2021

Cash flows generated from operations GBP000 GBP000 GBP000

Profit for the period 5,042 6,918 13,710

Adjusted for:

Exceptional items 163 472 622

Taxation charged 1,170 1,640 4,178

Finance costs 512 894 1,607

Finance income (66) (148) (367)

---------------- ---------------- ---------

Adjusted operating profit before

working capital movement 6,821 9,776 19,750

Exceptional items - cash movements (163) (472) (541)

Gain on disposal of tangible fixed

assets (72) (39) (148)

Share based payments 282 317 493

Non-cash movement - 150 -

Amortisation of intangible fixed

assets - 56 61

Depreciation of tangible fixed

assets 826 1,138 2,175

----------------

Operating cash flows before movements

in working capital 7,694 10,926 21,790

(Increase)/decrease in inventory (29,035) 19,438 17,498

Increase in trade and other receivables (3,487) (4,125) (14,321)

Increase in trade and other payables 6,142 12,326 32,037

---------------- ---------------- ---------

Net cash (used in)/generated from

operations (18,686) 38,565 57,004

Taxation paid (2,305) (2,272) (4,227)

---------------- ----------------

Net cash (outflow)/inflow from

operating activities (20,991) 36,293 52,777

---------------- ---------------- ---------

Investing activities

Purchase of property, plant and

equipment (170) (49) (206)

Proceeds on disposal of property,

plant and equipment 124 87 218

Acquisition of subsidiary, net

of cash acquired - 304 304

Interest received 4 8 13

----------------

Net cash (used in)/from investing

activities (42) 350 329

---------------- ---------------- ---------

Financing activities

Proceeds from issue of shares 501 52 2,249

Proceeds from bank loans 76,622 - -

Repayment of bank loans - (35,000) (35,000)

Payment of lease liabilities (545) (753) (1,480)

Dividends paid - - (3,274)

Interest paid (484) (716) (1,297)

----------------

Net cash inflow/(outflow) from

financing activities 76,094 (36,417) (38,802)

---------------- ---------------- ---------

Net increase in cash and cash equivalents 55,061 226 14,304

Cash and cash equivalents at beginning

of period 15,826 1,522 1,522

---------------- ---------------- ---------

Cash and cash equivalents at end

of period 70,887 1,748 15,826

================ ================ =========

The accompanying notes form an integral part of these financial

statements.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE PERIODED 30 NOVEMBER 2021

1. Organisation and trading activities

Springfield Properties PLC ("the Group") is incorporated and

domiciled in Scotland as a public limited company and operates from

its registered office in Alexander Fleming House, 8 Southfield

Drive, Elgin, IV30 6GR.

The consolidated interim financial statements for the Group for

the six month period ended 30 November 2021 comprises the Company

and its subsidiaries. The basis of preparation of the consolidated

interim financial statements is set out in note 2 below.

The Group consists of Springfield Properties PLC and its

subsidiaries Glassgreen Hire Limited, DHomes 2014 Holdings Limited,

Walker Holdings (Scotland) Limited and SP Sub 2018 Limited.

The Group also indirectly includes Dawn Homes Limited, DHPL

Limited and DHHG 1 Limited who are subsidiaries of DHomes 2014

Limited.

The Group also indirectly includes Walker Group (Scotland)

Limited, Walker Residential (Scotland) Limited, Walker Contracts

(Scotland) Limited and Craig Developments Limited who are

subsidiaries of Walker Holdings (Scotland) Limited.

The financial information for six month period ended 30 November

2021 is unaudited. It does not constitute statutory financial

statements within the meaning of Section 434 of the Companies Act

2006. The consolidated interim financial statements should be read

in conjunction with the financial information for the year ended 31

May 2021, which has been prepared in accordance with International

Accounting Standards in conformity with the requirements of the

Companies Act 2006. The statutory accounts for year ended 31 May

2021 have been delivered to the Registrar of Companies. The

auditors' report on those accounts was unqualified, did not draw

attention to any matters by way of emphasis, and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

2. Basis of preparation

The interim financial statements have been prepared in

accordance with IAS 34 - Interim Financial Reporting and in

accordance with UK adopted international accounting standards.

The interim financial statements have been prepared on a going

concern basis and under the historical cost convention, except for

contingent consideration.

The Directors have considered the principal risks and

uncertainties the Group faces and other factors impacting the

Group's future performance such as the COVID-19 pandemic. The

actions taken in the period give the Directors comfort that the

Group has adequate resources to continue in operational existence

for the foreseeable future.

The interim financial statements have been presented in pounds

and all values are rounded to the nearest thousand (GBP'000),

except when otherwise indicated.

The preparation of financial information requires management to

make estimates and assumptions that affect the reported amounts of

assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the reporting

period. These are also disclosed in the May 2021 year end accounts

and there have not been any changes. Although these estimates are

based on management's best knowledge of the amounts, events or

actions, actual events may ultimately differ from those

estimates.

The interim financial statements do not include all financial

risk information and disclosures required in the annual financial

statements and they should be read in conjunction with the

financial information that is presented in the Group's audited

financial statements for the year ended 31 May 2021. There has been

no significant change in any risk management polices since the date

of the last audited financial statements.

3. Accounting Policies

The accounting policies used in preparing these interim

financial statements are the same as those set out and used in

preparing the Group's audited financial statements for the year

ended 31 May 2021.

The IASB and IFRIC have issued the following standards and

interpretations, which are considered relevant to the Group.

-- IAS 1 Presentation of Financial Statements and IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors

(Amendment - Disclosure Initiative - Definition of Material)

-- IFRS 3 Business Combinations (Amendment - Definition of Business)

-- Conceptual Framework for Financial Reporting (Revised)

-- IBOR Reform and its Effects on Financial Reporting - Phase 1

The above standards and interpretations will be adopted in

accordance with their effective dates. The Directors continue to

review the requirements of the standards and interpretations listed

above, however they are not expected to have a material impact on

the Group's financial statements in the period of initial

application.

Prior period restatement

The directors have reviewed the liabilities included in the

provisions line in the prior half year and have concluded, in line

with accounting standards, contingent consideration should be

presented separately. The prior half year have been restated to

reflect that. These presentation changes have no impact on net

assets.

Principal risks and uncertainties

As with any business, Springfield Properties PLC faces a number

of risks and uncertainties in the course of its day to day

operations.

The principal risks and uncertainties facing the Group are

outlined within our latest annual financial statements for the year

ended 31 May 2021. We have reviewed these risks and uncertainties

which remain relevant for both the 6 months to 30 November 2021 and

the full financial year to 31 May 2022. We continue to manage and

mitigate these where relevant.

Exceptional items

Exceptional items are those material items which, by virtue of

their size or incidence, are presented separately in the

consolidated profit and loss account to enable a full understanding

of the Group's financial performance.

Transactions that may give rise to exceptional items include

transactions relating to acquisitions, costs relating to changes in

share capital structure and restructuring costs.

With respect to the impact of COVID-19, the furlough grant

income received from the government has been separately disclosed

within the consolidated profit and loss account as exceptional, due

to its incremental nature. The direct furlough payroll costs are

considered abnormal costs in the current period and consistent with

previous periods, any direct payroll costs reflecting employee down

time (abnormal production) is expensed to the profit and loss

account.

Redundancy costs relate to a review of our business to identify

areas for greater efficiency and rationalisation including

consolidating our Livingston operations at our office in

Larbert.

4. Segmental Analysis

A segment is a distinguishable component of the Group's

activities from which it may earn revenues and incur expenses,

whose operating results are regularly reviewed by the Group's chief

operational decision makers to make decisions about the allocation

of resources and assessment of performance and about which discrete

financial information is available.

In identifying its operating segments, management generally

follows the Group's service line which represent the main products

and services provided by the Group. The Directors believe that the

Group operates in one segment:

-- Housing building activity

As the Group operates solely in the United Kingdom segment

reporting by geographical region is not required.

Unaudited Unaudited

Period to Period to Audited

30 November 30 November Year to 31

2021 2020 May 2021

Revenue GBP000 GBP000 GBP000

Private residential properties 47,257 71,884 138,646

Affordable housing 31,670 18,342 52,940

Contracting 7,510 3,807 8,692

Other 833 389 16,414

------------- ------------- ------------

Total Revenue 87,270 94,422 216,692

============= ============= ============

Gross Profit 16,119 18,505 38,797

Administrative expenses (9,386) (8,864) (19,422)

Exceptional items (163) (472) (622)

Other operating Income 88 135 375

Finance income 66 148 367

Finance expense (512) (894) (1,607)

Profit before tax 6,212 8,558 17,888

Taxation (1,170) (1,640) (4,178)

------------- ------------- ------------

Profit for the period 5,042 6,918 13,710

============= ============= ============

5. Exceptional items

Unaudited Unaudited

Period to Period to Audited

30 November 30 November Year to 31

2021 2020 May 2021

GBP000 GBP000 GBP000

Government grant income

(1) - 1,803 2,085

Wage cost for furloughed

employees (1) (22) (1,959) (2,318)

------------- ------------- ------------

(22) (156) (233)

Redundancy costs (2) (141) (316) (389)

Exceptional items (163) (472) (622)

============= ============= ============

(1) The GBP22k (p/e 30 November 2020: GBP1,959k; y/e 31 May

2021: GBP2,318k) is the Company cost of all employees who were on

furlough during the period to 30 November 2021. The GBPnil (p/e 30

November 2020: GBP1,803k; y/e 31 May 2021: GBP2,085) is the

furlough grant income received from the UK government in relation

to the furloughed employees for the period to 30 November 2021.

(2) Redundancy costs relate to a review of our business to

identify areas for greater efficiency and rationalisation including

consolidating our Livingston operations at our office in

Larbert.

6. Taxation

The results for the six month to 30 November 2021 include a tax

charge of 18.8% of profit before tax (30 November 2020: 19.2%; 31

May 2021: 23.4%), representing the best estimate of the average

annual effective tax rate expected for the full year, applied to

the pre-tax income of the six month period.

7. Earnings per share

The calculation of the basic (and diluted) earnings per share is

based on the following data:

Unaudited Unaudited Audited

Period to Period to Year to

30 November 30 November 31 May 2021

2021 2020

Earnings GBP000 GBP000 GBP000

Profit for the year attributable

to owners of the Company 5,042 6,918 13,710

Adjusted for the impact

of exceptional costs in

the year 163 472 622

------------- ------------- -------------

Normalised earnings 5,205 7,390 14,332

============= ============= =============

Unaudited Unaudited Audited

Period to Period to Year to

30 November 30 November 31 May

Number of Shares 2021 2020 2021

Weighted average number of

ordinary shares for the purpose

of basic earnings per share 102,306,694 97,885,334 99,436,929

Effect of dilutive potential

ordinary shares: share options 1,929,619 1,442,779 1,767,609

------------- ------------- ------------

Weighted average number of

ordinary shares for the purpose

of diluted earnings per share 104,236,313 99,328,113 101,204,538

============= ============= ============

Unaudited Unaudited Audited

Period to Period to Year to

30 November 30 November 31 May

2021 2020 2021

Pence Pence Pence

Earnings per ordinary share

(pence per share)

Basic earnings per share 4.93 7.07 13.79

Diluted earnings per share 4.84 6.96 13.55

Adjusted per ordinary share

(pence per share)

Basic earnings per share 5.09 7.55 14.41

Diluted earnings per share 4.99 7.44 14.16

8. Dividends

Unaudited Unaudited Audited

Period to Period to Year to

30 November 30 November 31 May 2021

2021 2020

GBP000 GBP000 GBP000

Final dividend - y/e 31

May 2020 - 1,958 1,958

Interim dividend - y/e

31 May 2021 - - 1,316

Final dividend - y/e 31 4,558 - -

May 2021

------------- ------------- -------------

4,558 1,958 3,274

============= ============= =============

The final dividend declared for the year ended 31 May 2021 is

4.5p per share amounting to GBP4,557,827. This dividend was

declared before 30 November 2021 and is included within liabilities

at 30 November 2021. The dividend was paid on 9 December 2021.

The interim dividend declared for the year ended 31 May 2022 is

1.5p per share amounting to GBP1,774,983.

The interim dividend for the year ended 31 May 2022 was declared

after 30 November 2021 and as such the liability (based on

118,332,225 ordinary shares in issue as at 17 February 2022) of

GBP1,774,983 has not been recognised at this date.

9. Share Capital

The company has one class of ordinary share which carry full

voting rights but no right to fixed income or repayment of capital.

Distributions are at the discretion of the company.

The share capital account records the nominal value of shares

issued. The share premium account records the amount above the

nominal value received for shares sold, less transaction costs.

Ordinary shares of GBP1 - Share Premium

a llotted, called up and fully Number of Share capital GBP000

paid shares GBP000

At 1 December 2020 97,922,282 122 52,382

Share issue 4,155,244 6 4,379

At 31 May 2021 102,077,526 128 56,761

Share issue 487,790 - 501

At 30 November 2021 102,565,316 128 57,262

============ ============== ==============

10. Deferred Consideration

As part of the purchase agreement of Walker Holdings (Scotland)

Limited, there was a further GBP4,375,000 of Deferred consideration

payable. This can be broken down into: (i) GBP2,187,500 payable on

the first anniversary of the acquisition date (31 January 2020);

(ii) GBP2,187,500 payable on the second anniversary of the

acquisition date (31 January 2021), The outstanding discounted

amount payable at the period end is GBPnil (30 November 2020:

GBP2,167,447; 31 May 2021: GBPnil).

Unaudited Unaudited Audited

Period to Period to Year to

30 November 30 November 31 May 2021

2021 2020

GBP000 GBP000 GBP000

Deferred consideration - 2,167 -

< 1 year

- 2,167 -

============= ============= =============

11. Contingent consideration and contingent liabilities

As part of the purchase agreement of Walker Holdings (Scotland)

Limited, there was a further GBP6,000,000 payable which was

included within Provisions. GBP4,000,000 was payable when outline

planning was granted at Carlaverock and GBP2,000,000 payable when

detailed planning is granted at Carlaverock with probability was

assessed at 98% and 95% respectively. This has been discounted at a

market value of interest. GBP4,000,000 was paid in December 2019.

The outstanding discounted amount payable at the period end is

GBP1,900,000 (30 November 2020: GBP1,848,243; 31 May 2021:

GBP1,900,000).

The remaining GBP100,000 (5% on the GBP2,000,000 still to be

paid) has been treated as a contingent liability due to the

uncertainty over the future payment.

As part of the purchase agreement of DHomes 2014 Limited there

is a further GBP2,500,000 payable for an area of land if (i) we

make a planning application when we reasonably believe the council

will recommend approval; or (ii) it is zoned by the council . The

directors have assessed the likelihood of the land being zoned and

have included provision of GBP2,000,000 based on 80% probability.

The outstanding amount payable at the period end included within

Provisions is GBP2,000,000 (30 November 2020: GBP2,000,000; 31 May

2021: GBP2,000,000).

The remaining GBP500,000 has been treated as a contingent

liability due to the uncertainty over the future payment.

Contingent consideration Unaudited Unaudited Audited

Period to Period to Year to

30 November 30 November 31 May

2021 2020 2021

GBP000 GBP000 GBP000

Walker (Scotland) Limited 1,900 1,848 1,900

DHomes 2014 Limited 2,000 2,000 2,000

------------- ------------- ---------

3,900 3,848 3,900

============= ============= =========

Contingent liabilities Unaudited Unaudited Audited

Period to Period to Year to

30 November 30 November 31 May

2021 2020 2021

GBP000 GBP000 GBP000

Walker (Scotland) Limited 100 100 100

DHomes 2014 Limited 500 500 500

------------- ------------- ---------

600 600 600

============= ============= =========

12. Provision

Dilapidation provisions are included for all rented buildings

within the Group. An onerous lease provision has been created due

to the closure of the Walker office in Livingston. Maintenance

provisions relate to costs to come on developments where the final

homes have been handed over.

Unaudited Unaudited Audited

Period to Period to Year to

30 November 30 November 31 May

2021 2020 2021

GBP000 GBP000 GBP000

Dilapidation provision 190 55 185

Onerous lease provision 100 - 200

Maintenance provision 671 467 825

------------- ------------- ---------

961 522 1,210

============= ============= =========

13. Transactions with related parties

Other related parties include transactions with a retirement

scheme in which the directors are beneficiaries, and close family

members of key management personnel. During the period dividends

totalling GBP1,933k (p/e November 2020: GBP892k; y/e May 2021:

GBP1,415k) were paid to key management personnel.

During the period the Group entered into the following

transactions with related parties:

Unaudited Unaudited Audited

Period to Period to Year

30 November 30 November to 31

Sale of goods 2021 2020 May 2021

GBP000 GBP000 GBP000

Bertha Park Limited (1) 7,726 3,959 8,989

Other entities which key management

personnel have control, significant

influence or hold a material

interest in 39 50 118

Key management personnel 10 19 44

Other related parties 2 15 121

------------- ------------- ----------

7,777 4,043 9,272

============= ============= ==========

Sales to related parties represent those undertaken in the

ordinary course of business.

Unaudited Unaudited Audited

Period to Period to Year

30 November 30 November to 31

Purchase of goods 2021 2020 May 2021

GBP000 GBP000 GBP000

Bertha Park Limited (1) 350 - -

Entities which key management

personnel have control, significant

influence or hold a material

interest in 196 8 33

Key management personnel - - -

Other related parties 42 109 313

------------- ------------- ----------

588 117 346

============= ============= ==========

Unaudited Unaudited

Period to Period Audited

30 November to 30 November Year to

2021 2020 31 May

2021

Rent paid to GBP000 GBP000 GBP000

Entities which key management

personnel have control, significant

influence or hold a material

interest in 80 86 176

Key management personnel 5 - 11

Other related parties 14 63 128

------------- ---------------- ----------

99 149 315

============= ================ ==========

13. Transactions with related parties (continued)

Unaudited Unaudited

Period to Period Audited

30 November to 30 November Year to

2021 2020 31 May

2021

Interest received from GBP000 GBP000 GBP000

Bertha Park Limited (1) 63 141 355

63 141 335

============= ================ ==========

The following amounts were outstanding at the reporting end

date:

Unaudited Unaudited

Period to Period Audited

30 November to 30 November Year to

2021 2020 31 May

2021

Amounts receivable GBP000 GBP000 GBP000

Bertha Park Limited (1) 6,566 6,856 6,772

Entities which key management

personnel have control, significant

influence or hold a material

interest in 56 19 3

Key management personnel 3 1 3

Other related parties - 5 3

------------- ---------------- ----------

6,625 6,881 6,781

============= ================ ==========

Unaudited Unaudited

Period to Period to Audited

30 November 30 November Year to

2021 2020 31 May

2021

Amounts payable GBP000 GBP000 GBP000

Entities which key management

personnel have control, significant

influence or hold a material

interest in 44 32 8

Key management personnel - - -

Other related parties - 48 58

------------- ------------- ----------

44 80 66

============= ============= ==========

Amounts owed to/from related parties are included within

creditors and debtors respectively at the year-end. No security has

been provided on any balances.

Transactions between the company and its subsidiary, which is a

related party, have been eliminated on consolidation and are not

disclosed in this note.

(1) Bertha Park Limited, a company in which Sandy Adam and Innes

Smith are shareholders and directors.

14. Analysis of net debt

Unaudited Unaudited Audited

Period to Period to Year to

30 November 30 November 31 May

2021 2020 2021

GBP000 GBP000 GBP000

Cash in hand and bank 70,887 1,748 15,826

Bank borrowings (110,622) (34,000) (34,000)

------------- ------------- ---------

Net bank debt (39,735) (32,252) (18,174)

Lease liability (3,224) (2,987) (2,613)

------------- ------------- ---------

Net debt (42,959) (35,239) (20,787)

============= ============= =========

Reconciliation of net cashflow to movement in net debt is as

follows:

At 1 December At 30 November

2020 New Leases Cashflow Fair Value 2021

GBP000 GBP000 GBP000 GBP000 GBP000

Cash in hand and

bank 1,748 - 69,139 - 70,887

Bank borrowings (34,000) - (76,622) - (110,622)

Lease (2,987) (1,407) 1,315 (145) (3,224)

-------------- ------------- ----------- ------------- ---------------

Net Debt (35,239) (1,407) (6,168) (145) (42,959)

============== ============= =========== ============= ===============

The majority of the large cash balance above relates to the

GBP64.6m of bank funding draw down on 30 November 2021 in order to

fund the acquisition of Thistle SPV2 Limited on 1 December

2021.

15. Post balance sheet events

On 1 December 2021, the Group purchased 100% of the share

capital of Thistle SPV2 Limited, the owner of Tulloch Homes, an

Inverness-based housebuilder focused on building high-quality

private housing in the Scottish Highlands, for a net consideration

of GBP56.4m, being gross consideration of GBP77.6m less expected

net cash in the Tulloch Homes business, on completion, of not less

than GBP21.2m. The GBP56.4m is comprised of initial cash

consideration of GBP43.4m and deferred cash consideration of

GBP13.0m. The projected net asset value acquired is approximately

GBP53.4m.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFIFFSILFIF

(END) Dow Jones Newswires

February 22, 2022 02:00 ET (07:00 GMT)

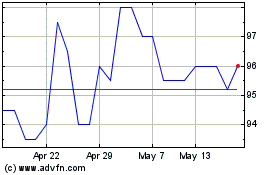

Springfield Properties (LSE:SPR)

Historical Stock Chart

From Sep 2024 to Oct 2024

Springfield Properties (LSE:SPR)

Historical Stock Chart

From Oct 2023 to Oct 2024