Tufton Oceanic Assets Ltd. Company Update and Unaudited 29 February 2020 NAV (8983E)

March 04 2020 - 2:00AM

UK Regulatory

TIDMSHIP

RNS Number : 8983E

Tufton Oceanic Assets Ltd.

04 March 2020

4 March 2020

Tufton Oceanic Assets Limited ("SHIP")

Company Update and Unaudited 29 February 2020 NAV

The Investment Manager (Tufton Oceanic Limited) has noted the

share price movements of publicly traded shipping companies and

would like to provide an update to investors. The Investment

Manager is pleased that its strategy of portfolio diversification

and strong charter coverage has insulated SHIP from the recent

market volatility caused primarily by Covid-19.

As of 29 February 2020, the estimated unaudited NAV of SHIP was

$0.976 per share compared to $0.992 per share as at 31 December

2019. Year to date, fair value losses in containerships and bulkers

have been largely offset by fair value gains in tankers. The fair

value decrease in the portfolio of $0.020 per share was more than

offset by operating profit of $0.021 per share over the period.

SHIP's dividend for the fourth quarter of $0.0175 per share was

paid out on 21 February 2020 resulting in a small estimated

decrease in NAV.

In line with our investment objectives, the average charter

length of the portfolio is three years which minimises spot market

exposure and portfolio volatility. Vessels which have charters

expiring in the next six months represent only c14% of NAV.

Including the newly acquired product tanker, the Investment

Manager recently fixed two tankers in the portfolio on time

charters for a minimum of three years to a major commodity trading

company at mid-teen yields. The Investment Manager also recently

extended the employment of one containership (Kale) for 7 to 12

months, albeit at a lower yield than previously, without any void

period between charters despite the vessel being positioned in

Asia.

The Investment Manager continues to monitor the evolving

situation but is very confident that its strategy will continue to

result in low volatility of cash flow and NAV. With the

transactions announced earlier this quarter, SHIP currently has

approximately $20m of investible cash.

For further information, please contact:

Tufton Oceanic Limited (Investment +44 (0) 20 7518 6700

Manager)

Andrew Hampson

Paulo Almeida

N+1 Singer +44 (0) 20 7496 3000

James Maxwell, Alex Bond (Corporate

Finance)

Alan Geeves, James Waterlow, Sam Greatrex

(Sales)

Hudnall Capital LLP +44 (0) 20 7520 9085

Andrew Cade

About the Company

Tufton Oceanic Assets Limited invests in a diversified portfolio

of secondhand commercial sea-going vessels with the objective of

delivering strong cash flow and capital gains to investors. The

Company's investment manager is Tufton Oceanic Ltd. The Company has

raised a total of approximately $250m (gross) through its Initial

Public Offering on the Specialist Fund Segment of the London Stock

Exchange, on 20 December 2017, a subsequent placing and offer in

October 2018, a placing in March 2019 and a placing in September

2019 .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCEASDDESNEEFA

(END) Dow Jones Newswires

March 04, 2020 02:00 ET (07:00 GMT)

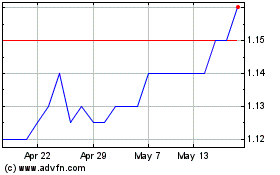

Tufton Oceanic Assets (LSE:SHIP)

Historical Stock Chart

From Apr 2024 to May 2024

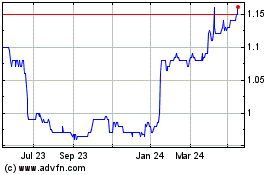

Tufton Oceanic Assets (LSE:SHIP)

Historical Stock Chart

From May 2023 to May 2024