TIDMRST

RNS Number : 9619T

Restore PLC

28 July 2022

28 July 2022

Restore plc

("Restore" or the "Group" or "Company")

Half Year Results 2022

Strategy delivering organic momentum and acquisition

expansion

Restore plc (AIM: RST), the UK's leading provider of digital and

information management and secure lifecycle services, is pleased to

announce its unaudited results for the six months ended 30 June

2022 ("H1" or "the period").

OVERVIEW

Restore continued to deliver strategic progress with substantial

revenue growth of 32% in the first half, driven by strong organic

momentum (+19%) and the successful integration of acquisitions made

in 2021 and H1 2022 (+13%).

Digital and Information Management achieved revenue growth of

41% as a result of strategic contract wins in the last 18 months

and excellent operational delivery in H1. Secure Lifecycle Services

grew revenue by 20% with Technology growing strongly (+40%) and

Datashred also performing well (+33%). The Group also successfully

managed inflationary cost pressures during the period through

proportionate price rises, whilst driving cost reductions across

the Group.

With strong organic momentum, three further acquisitions

completed in H1 and substantial financial capacity to make further

acquisitions, the Group continues to grow capability and scale and

management remain confident of delivering its stated objective to

reach annual revenues of GBP450 million and double EBITDA to

GBP150m in the medium term.

FINANCIAL SUMMARY H1 2022 H1 2021 Change

-------------------------------- ---------- ---------- -------

Revenue GBP140.3m GBP106.1m +32%

Adjusted Profit Before Tax* GBP21.2m GBP15.6m +36%

Statutory Profit Before Tax GBP14.1m GBP8.9m +58%

Adjusted EBITDA* GBP40.3m GBP33.2m +21%

Net Debt GBP103.5m GBP91.6m +13%

Adjusted* Earnings Per Share** 12.6p 9.8p +29%

Statutory Earnings Per Share 7.5p 1.5p +400%

Dividend per share 2.6p 2.5p +4%

--------------------------------- ---------- ---------- -------

* stated before exceptional items and amortisation

**calculated using a standard tax charge

HIGHLIGHTS

Strong business momentum and organic expansion resulting from

high customer satisfaction and innovation

-- Increasing demand and activity continuing from 2021

-- Major contract wins in Digital and Information Management

-- Substantial evolution of the Group's product range in Digital and Technology businesses

-- 'Restoring our World', ESG strategy on track

Excellent progress in acquisition strategy

-- Successful integration of prior year acquisitions, all on track or ahead of plan

-- Two bolt-on investments in Records Management for GBP0.7m during H1

-- Strategic acquisition of Ultratec for an enterprise value of GBP9.3m in May

-- Well developed pipeline of acquisition opportunities

Substantial financial growth

-- Revenue of GBP140.3m (+32%) from organic growth (+19%) and acquisitions (+13%)

-- Strong profit delivery of GBP21.2m (+36%) with price and

productivity mitigation of cost pressures

-- Adjusted EPS of 12.6p (+29%)

-- Annualised run rate revenue increased to c.GBP280m per annum

Strong cash management with leverage reduced to 1.7x as at 30

June 2022, with substantial headroom for further investment.

Interim dividend declared of 2.6p per share (2021:2.5p).

Management remain confident the Group will deliver strong growth

for FY22.

Growth strategy on track to double EBITDA to GBP150m.

OUTLOOK

The Board is pleased with the Group's strategic progress during

H1 and the delivery of sustained organic momentum and successful

integration of acquisitions made during the last 18 months.

Management remain confident that the Group will deliver strong

growth for FY22, with activity levels increasing and pricing

adjustments offsetting cost increases. However, rising interest

rates are leading to higher finance charges and it is anticipated

that interest costs will be GBP1.0 million to GBP2.0 million

greater than planned for the year.

Looking further ahead, the critical services that the Group

provides in digital transformation, information management and

secure lifecycle services are in high demand and Restore is in a

strong position to capitalise on its market leading positions. The

Group's strategy to grow through organic expansion, strategic

acquisition and margin improvement remains on track to deliver a

larger, responsible and highly profitable business in the medium

term.

CHARLES BLIGH, CEO, commented:

"I am delighted with the growth achieved in the first half which

demonstrates that our strategy and execution is on track. Across

the Group we are seeing increasing sales activity and significant

customer contract wins. Our staffing levels have grown

substantially in the last 6 months in order to support delivery and

I want to thank the whole team for doing such a great job and

ensuring customer experience continues to be at the heart of what

we do.

In addition to our confidence in future organic growth, we have

a well developed pipeline of acquisition opportunities and, with

our strong balance sheet, we are looking forward to completing

further investments in H2 and continuing to deliver great results

for our shareholders and customers."

For further information please contact:

Restore plc www.restoreplc.com

Charles Bligh, CEO

Neil Ritchie, CFO +44 (0) 207 409 2420

Investec (Nominated Adviser and Joint www.investec.com

Broker)

Carlton Nelson

James Rudd +44 (0) 207 597 5970

Canaccord Genuity (Joint Broker, Corporate www.canaccordgenuity.com

Advisor)

Max Hartley

Chris Robinson +44 (0) 207 523 8000

Citi (Joint Broker) www.citigroup.com

Stuart Field

Laura White +44 (0) 207 986 4074

Buchanan Communications (PR enquiries) www.buchanan.uk.com

Charles Ryland

Stephanie Whitmore +44 (0) 207 466 5000

BUSINESS PERFORMANCE

The Group achieved a strong performance in H1, with revenue up

32% vs the same period in 2021 and importantly showing sequential

improvement with an increase of 13% in Q2 over Q1.

Restore has a clear, high growth strategy, with ambitious but

achievable strategic growth objectives. The financial performance

of the business is clearly showing delivery against the stated

growth pillars of organic expansion, strategic acquisitions and

margin enhancement through scale and productivity, despite the

headwinds resulting from the global pandemic and macro-economic

uncertainty.

Digital and Information Management

Our Digital and Information Management division comprises

Restore Records Management and Restore Digital.

For the period, the division achieved an adjusted operating

profit of GBP24.6m (H1 2021: GBP18.8m) on turnover of GBP87.1m (H1

2021: GBP61.9m).

Restore Records Management - Revenue GBP55.9m up 17% YoY (H1

2021: GBP47.7m)

Revenue increased strongly at +17% YoY driven by organic growth

of 11% and acquisition related growth of 6%.

Activity levels increased YoY and are now above pre-covid

levels. Within this activity, BAU service levels (normal pickups

and file deliveries) are down on pre-covid levels which was

expected given part of the period was impacted by covid ways of

working but this was more than offset by the increase in projects

with customers. The contract with DWP (Department for Work and

Pensions) to audit and consolidate c.27million files started on the

1 April 2022 and is on track to be completed at the end of this

year.

Our insight from customers in the last six months is consistent

with pre-covid research that customers are still looking for long

term storage while they look to transform their businesses. They

find it difficult to know where to start in the digital

transformation and are looking to Restore to help them to

effectively use their highly valuable and long-term data held in a

physical form with new data held in a digital form.

Positive organic net box growth was achieved plus additional box

growth of 78k boxes through two 'pick and lift' storage

acquisitions. Restore is winning new business in the market with

c.140 new customers in H1 2022, which is three times the pre-covid

levels seen in 2019, clearly showing successful and strong sales

execution from the team. Of these new c.140 accounts, 70% are

customers with un-vended boxes. New Box intake and Organic growth

were up substantially from H1 2021 and destructions are back to

pre-covid levels while perm-out (where a customer permanently

checks out a box) have decreased vs pre-covid levels. Restore

started the year with 22m boxes in storage and we are expecting the

full year organic box growth to be between 1-2% plus acquisition

related increases in box storage driving strong revenue growth.

The storage utilisation rate of 91% reflects the addition of new

capacity (in H2 2021) which will cater for our organic growth over

the next 18 months plus ongoing consolidation of the property

estate. The Group emptied three sites with over 320k boxes moved in

H1 and is progressing the exit from a further three sites with over

500k boxes into existing, larger facilities. We are currently

working through further additional lease and warehouse expansion

opportunities to underpin the growth and consolidation strategy

including a planning application to significantly extend our

freehold site in Sittingbourne.

The pipeline of acquisitions continues to develop and we have

started H2 2022 strongly with a number of customer awards for large

projects.

Restore Digital - Revenue GBP31.2m up 120% YoY (H1 2021:

GBP14.2m)

As a result of the transformation of Restore Digital (scale and

scope of services) over the last two years, the business showed

exceptional revenue growth of 120%, and delivered turnover of

GBP31.2m for the period. This increase comprised of organic growth

of 65% from strong project revenues and underlying sales growth,

and acquisition related growth of 55% as a result of the EDM

acquisition in April 2021.

Strong growth in H1 2022 was underpinned by a substantial

contract award from HMRC, a successful Public Sector Government

contract delivered in partnership with APS Group, and the return of

the examination scanning activities for RM Education. To deliver

these contracts, over 500 staff were successfully onboarded during

H1. As Restore Digital exits the period, staffing levels are 26%

higher than H1 2021.

Last year's acquisition of EDM Group has extended the breadth of

services and the newly combined business has achieved three

significant pipeline additions to digital mailroom services during

the period. Integration of these businesses has progressed

according to plan and is delivering substantial synergies in line

with expectations. To support further growth plans, the Leadership

Team has recently been strengthened by the addition of senior

Finance and Service Delivery Directors.

Restore Digital won 226 deals in the period and total contract

value increased by 11% compared with H1 2021. This included two

significant public sector digitisation contracts. Our organic

growth strategy is underpinned by a significant pipeline (600

deals) of business, with over 17% of the pipeline consisting of

strategically important complex digital transformation projects.

Our sales focus continues to be on high volume complex contracts in

regulated sectors where customers value the high quality and

security of Restore's services. Customer retention levels are

excellent and three of our top ten customers signed contract

extensions in the period.

Further opportunity for growth is available through acquisitions

with a number of opportunities under consideration.

Secure Lifecycle Services

Our Secure Lifecycle Services division comprises Restore

Technology, which is now the market leader in IT Lifecycle

Services, Restore Datashred, a leading National shredding business,

and Restore Harrow Green, the UK's market leader in office and

commercial relocations.

For the period the division achieved an operating profit of

GBP5.6m up 19% (H1 2021: GBP4.7m) on turnover of GBP53.2m up 20%

(H1 2021: GBP44.2m).

Restore Technology - Revenue GBP17.2m up 40% YoY (H1 2021:

GBP12.3m)

Revenue significantly increased by 40% supported by strong

organic growth of 14% and acquisition related growth of 26%.

Restore Technology saw continued strong demand for IT investment

which requires customers to decommission older equipment in both

the office environment but also from the upgrade of data centres

and data networks. Although a significant proportion of our

services involve end of life activity, we are building out our

capability selectively in the pre and mid-life services area and in

H1 2022 pre & mid-life revenue was up 50% with a strong

pipeline of deals for the next 12 months.

With the transformed scale (we are four times larger compared

with three years ago) and increased breadth of capability, Restore

Technology is now competing for and winning much larger and longer

projects and also strengthening strategic partnerships. In H1 2022

a selection of the wins include a large IT infrastructure

contractor (GBP1.0m), an IT support and solutions consultancy

(GBP0.6m), a large investment bank for destruction work (GBP0.5m)

and a large telco contract renewal (GBP1.0m).

A strategic focus is building a strong channel (indirect

business) with IT Vendors and Resellers and Network vendors and

resellers and we are delighted with the growing pipeline of

business from this investment in people, capability and focus.

Feedback from customers shows a growing emphasis from direct

clients on assurance and governance as clients seek more

transparency around ESG (specifically supply chain risk, secure

erasure of data and disposal of assets). Many large clients require

completion of complex and detailed submissions with greater

assurance in bids and tenders which is a favourable trend for the

Group given our leading market position and credentials.

Restore Technology is also seeing significant interest to offer

its lifecycle services to partners to extend their services

propositions and it was pleasing to see large public sector clients

won recently in partnership with our channel as a result.

We continue to invest and transform the business as we grow. A

new Operations Director and Marketing Director are due to join in

early Q3 2022 to further strengthen the team. With a fleet of over

90 ICE vehicles (and growing), Restore Technology is working hard

to drive adoption of new EV vehicles as we optimise the routing of

the business. The Group is investing in a major upgrade of the IT

platform to be completed in H1 2023 to support the expected

significant growth in the business over the next few years.

Ultratec Ltd was acquired in May 2022 for an enterprise value of

GBP9.3m. Ultratec is the pre-eminent Hard Disk lifecycle business

in the UK with a unique capability from a product called Genesis

which is a software and appliance for the erasure and importantly

restoration of failed hard drives and also Nemesis, which has the

same capability for network devices (switches and routers) which is

a growing security concern for many organisations. We have a number

of acquisitions in the pipeline to continue to build our scale and

scope of services as the Group looks to double the size of Restore

Technology over the medium term.

Restore Datashred - Revenue GBP18.3m up 33% YoY (H1 2021:

GBP13.8m)

Revenue increased 33% YoY and vs H2 2021 revenue increased

sequentially by 12% which shows the continual increase in activity

levels and also stronger paper prices for recycled paper delivered

to the paper mills.

Activity levels increased c.30% YoY which is very encouraging,

although remain slightly lower (9%) than pre-covid levels. We

expect continued growth as more people return to work and even with

more work from home activity going forward, we believe the business

will continue to grow as a result of growing data management

requirements and that we are winning in the market.

The tonnage of paper collected is lower than pre-covid levels

but paper pricing remains high with the average price per tonne at

c.GBP230. It is extremely difficult to forecast paper pricing but

in the short term we expect to sustain these pricing levels given

the substitute of paper from virgin forests is less sustainable and

less competitive as shipping prices around the world remaining

high.

We continue to focus relentlessly on operational efficiency with

route density (number of visits per vehicle per day) improved 19%

YoY with mileage per visit down 21% which drove down fuel and

maintenance costs of the fleet. Restore Datashred also introduced

new online capability for new sales from existing customers which

enables them to increase self service, improving customer

experience and reducing costs. This additional functionality is

part of a wider IT platform upgrade which will enable Restore

Datashred to drive even greater optimisation of operations and

deliver further customer experience benefits.

The NPS customer experience continued to improve from 71 to 74

over the last 12 months, and we are seeing excellent Trustpilot

reviews from customers which is very encouraging given the

significant improvements that have been made. With the future plans

laid out and additional changes management have identified, we know

there is further potential to improve.

Restore Harrow Green - Revenue GBP17.7m down 2% YoY (H1 2021:

GBP18.1m)

Revenue was slightly lower at 2% YoY reflecting the loss of one

contract with Defence DAS (MoD staff relocations) but activity

levels overall remained stable. Restore Harrow Green saw good

performances in its regional locations but the London relocation

market remained soft with few large projects. This was mainly

offset by many small/medium projects. We have a number of large

relocations that have been delayed due to slower building works in

the last two years but indications from customers are they will

resume these relocations over the next 12 months.

Pricing in the market is competitive and Restore Harrow Green

has seen a number of large customers engage after having

experienced poor delivery with competitors who had offered lower

pricing during the pandemic. This recognition that certainty of

delivery is the key priority, positions Restore Harrow Green

strongly as the class leader in execution. With the labour market

remaining tight we are seeing increased costs but with price

increases and with a dedicated and well-established team, we are

confident that as the larger project activity returns, we will be

able to deliver for customers.

Proposal activity remains strong with companies looking at their

real estate footprint/usage and starting to make decisions about

what they change over the next several years. With a national

presence and pre-eminence in the market for large and complex moves

Restore Harrow Green is ideally placed over the next few years for

the significant changes in real estate locations and mix of use for

organisations.

Storage of items (largely large crate and pallet storage) has

increased with revenues up 12% to GBP2.2m. We store items in nine

locations across the UK with c.95% utilisation. This market will

increase in size and we are investing strongly to increase our

storage facilities.

We have invested heavily in specific high growth segments such

as the R&D and Pharmaceuticals industry and as a result we are

building key relationships and winning new types of contracts in

the sector. We are expanding our facility in Cambridge and looking

at further investments to meet the growth we are experiencing.

STRATEGIC UPDATE

To deliver the high growth strategy the Group is organised

across two divisions.

In the Digital and Information Management Division the growth

trends are strong with increasing demand for secure storage,

flexible work practices and the ongoing digitisation by

organisations to drive down costs and respond to changing demand.

As the number two in the Records Management sector and as the

number one Digital business Restore provides market leading

solutions to customers to solve their need for physical, hybrid

physical/digital or a pure digital service.

In Restore's Secure Lifecycle Services division, the market is

also large and growing with very positive underlying trends based

on organisations' requirements for assurance in securely destroying

data (on paper or technology assets), and ESG trends in recycling

and reusing IT assets as well as workplace transformation. We

service these markets as the leading provider with Restore

Datashred the number two national shredding business, Restore

Technology the number one IT lifecycle/recycling business and

Restore Harrow Green the number one commercial relocation and

storage business servicing mid-market, enterprise and public sector

customers.

Resilience with significant opportunity underpins our growth

strategy

Restore's business model is highly resilient and this is

particularly important in uncertain economic times. The Group

delivers essential services to mid-market, FTSE100 businesses and

public sector organisations, and their demand for our services is

increasing as they grow or restructure. Our services cannot be

delivered by in-house teams and we use the scale of our operations

to drive down costs and provide savings to customers which is

greatly valued in the currently uncertain economic backdrop.

Restore sees significant opportunity in all our markets to grow

share organically and acquire in highly fragmented markets. We

believe that continued organic growth is a foundation for

shareholder value and this underpins our acquisition strategy. When

acquiring businesses, a fundamental principle is to integrate the

acquisitions quickly into each business unit in order to enhance

customer experience and deliver synergies. As such, our acquisition

model is generally to acquire businesses in full at the transaction

date, subject to modest retentions for completion matters, and we

avoid earn-out deals which prevent strategic integration.

Organic Growth

The foundation of the organic growth strategy is to deliver

exceptional customer service at the right price using the scale of

our business to drive down costs. By delivering for customers every

day we have the opportunity to cross sell from the wider Group

services and so the virtuous circle continues which further drives

our growth. Our markets overall are growing at 3%+ and our plan is

to grow at a minimum of 4% per annum although we are investing with

a view to drive above this to 8%+ (before the effects of

potentially higher inflation). Restore has delivered consistent

growth giving confidence in the platform to reliably deliver and

during the pandemic we continued to grow and win new customers

which gives the Group assurance that we can continue this trend. We

are also expanding heavily into high growth segments such as in our

Digital and Technology business units.

Acquisition growth

We have a very strong M&A platform with a highly qualified

and dedicated M&A team and the business unit management teams

have the experience and structure to integrate acquisitions

quickly. Restore operates in large and extremely fragmented markets

where we look for companies that add scale to our business (which

means there are significant synergies) and/or add extra capability

to enhance our products and services and provide significant

synergy benefits. All acquisitions are earnings accretive and with

multiple opportunities in each market and, due to Restore's

well-earned reputation as a trusted buyer, we can buy good quality

business at fair prices with the sellers knowing we will complete a

deal and successfully integrate the acquired asset.

Margin Expansion

The focus as Restore grows is to improve margins and we have a

detailed plan to achieve this. With inflationary pressures costs

are increasing but we have significant ability to pass these on to

customers while being customer centric in how this is executed. At

the same time we are using our scale to drive down costs and market

test what we procure continually as one company with its total

scale versus each of the five business units independently

procuring services with lower buyer leverage. A hallmark of the

Company and the leadership team's focus is very tight cost

control.

A significant cost to the business is property where we operate

in 95 sites. We have a clear plan to ensure we drive significant

utilisation as we grow at the various operating sites and

rationalise the number of properties over time. This is especially

true in Restore Records Management where in a select number of

cases proximity is needed to deliver service levels but

increasingly for low activity records we can store in lower cost

and larger facilities. We currently have capacity for c.24m boxes

and we are planning on this being 30m+ boxes in the medium to long

term to meet growth objectives. We are adding larger capacity sites

(as we consolidate from smaller sites) with higher eaves heights

which will drive greater density and lower unit costs.

A main source of productivity is in the use of better technology

and the significant information we know about customer activity and

needs. This is enabling Restore to design more efficient routes,

improve SLAs and develop the profile of services which is driving

significant optimisation of the current operations, improve

productivity and enhance customer experience.

Compelling investment case delivering shareholder value

Our strategy is to drive significant increases in profitability

over the medium term and in the last three years we have

demonstrated this through especially challenging times. In addition

to this underlying growth momentum, we also have significant

defensive qualities due to the critical nature of the services we

provide, and the cash generative nature of our business model.

Our business model to deliver shareholder value is based on;

-- Highly recurring and long term contracted revenues with high

levels of customers satisfaction

-- Delivery of essential services that are growing with

outsourced services that in house teams cannot do at scale

-- Attractive and growing operating margins with strong free cash conversion

-- Competitive advantage through our scale leading to cost advantage

-- Significant barriers to entry with scale and security

-- Ambitious ESG Strategy 'Restoring our World'

-- Leading position in growth markets

-- Fragmented markets with significant acquisition opportunity

-- Strong management team with demonstrated delivery of results.

FINANCIAL PERFORMANCE

Financial overview

Restore delivered a strong financial performance in the first

half, with underlying organic expansion and accretive acquisitions

contributing to high levels of revenue and profit growth.

The increasing scale and capability of the Group were strongly

demonstrated in H1 with several major contract wins and expansion

of recurring business resulting in high levels of organic momentum.

Additionally, the Group continued to make strategic investments and

deployed GBP9.5 million (net of cash acquired) during the period

across the Records Management and Technology businesses. These

acquisitions continue to increase the scale of the Digital and

Information Management division and have added further capability

to our Secure Lifecyle Services business.

As a result of these factors, the Group's annualised run rate

revenues have increased to GBP280 million with further progress

anticipated in H2.

An interim dividend of 2.6p per share (2021: 2.5p) has been

declared and will be paid on 14 October 2022 to shareholders on the

register at 16 September 2022.

Income Statement

Revenue for the first half was GBP140.3 million, an increase of

32% compared with the corresponding period in the prior year. This

strong year on year growth reflects organic momentum of GBP20.1

million and acquisition related growth of GBP14.1 million.

The Group's organic expansion is the result of sustained box

growth in Restore Records Management, together with the benefit

from a number of large project wins in Digital and Records

Management, emphasising the division's increased capability to

provide complex project and business support services.

Acquisition expansion added further growth to Records

Management, Digital and Technology and reflects the successful

integration of the eight businesses acquired during 2021. The

Digital and Technology businesses also saw strong market demand and

continued to expand the variety of services they provide and their

capability to meet customer requirements.

In the other businesses, Restore Datashred has seen its

collection activity largely recover to pre-covid levels and

although paper volume is lower, this was offset by higher prices

for the bales of recycled paper it produces. Finally, Restore

Harrow Green transitioned out from a large Defence DAS (MoD staff

relocation) contract in H1 and largely offset lost revenue through

increased activity elsewhere particularly in Life Sciences sector

work and commercial storage income.

Revenue H1 H1 Organic Acquisition YoY

2022 YoY

GBPm 2021 % YoY %

GBPm %

----------------------------- ------- ------- --------- ------------- ------

Restore Records Management 55.9 47.7 11% 6% +17%

Restore Digital 31.2 14.2 65% 55% +120%

Digital and Information

Management 87.1 61.9 23% 18% +41%

Restore Technology 17.2 12.3 14% 26% +40%

Restore Datashred 18.3 13.8 32% 1% +33%

Restore Harrow Green 17.7 18.1 -2% - -2%

Secure Lifecycle Services 53.2 44.2 13% 7% +20%

----------------------------- ------- ------- --------- ------------- ------

Total 140.3 106.1 19% 13% +32%

----------------------------- ------- ------- --------- ------------- ------

Adjusted profit before tax for the period was GBP21.2 million

(2021: GBP15.6 million), an increase of 36% year on year. The

profit growth reflects the substantial growth in activity and net

effect of pricing and costs in the period.

GBPm

---------------------------------- ----------

H1 2021 Adjusted Profit Before

Tax 15.6

Interest (0.6)

Cost increases (2.2)

Price increases 1.6

Non-cash accounting adjustments (0.2)

Activity growth 7.0

---------------------------------- ----------

H1 2022 Adjusted Profit Before

Tax 21.2

---------------------------------- ----------

With significant cost pressures across the UK and the Global

economy, the Group has been active in managing pricing and costs in

the first half. Operating margin of 18.4% is consistent with H1

2021 with the Digital and Information Management division margin

down slightly from 30.4% to 28.2% as a result of dilution from the

increased digital mix whilst Secure Lifecyle Services at 10.5% is

broadly in line with H1 2021.

Prices to customers have been increased at higher than ordinary

rates across the businesses in 2022. The benefit of price increases

in H1 are estimated at +GBP1.6 million with cost increases

estimated at GBP2.2 million to give a net effect on profit for H1

of -GBP0.6 million. This gap reflects the time lag of pricing

increases when compared with the more immediate impact of cost

increases. Pricing remains a significant area of focus as

management look ahead.

In terms of cost exposure, the main areas of cost for the Group

are people, property and operation of the Group's fleet. As

highlighted above, the business has a number of pricing levers to

mitigate cost pressure in the short term and in the medium term the

Group has a number of strategic initiatives to improve margin

through productivity, scale, consolidation of property and

transition of the fleet.

During H1, progress has continued to be made on these strategic

objectives with property consolidation opportunities in the North

West and South East, increasing yields from operating facilities in

Restore Digital and Restore Technology and further increases in

network efficiency in Restore Datashred.

On a statutory basis, profit before tax was GBP14.1 million

(2021: GBP8.9 million). Statutory profit before tax is stated after

taking into account charges for amortisation of GBP5.9 million

(2021: GBP5.0 million) and exceptional items of GBP1.2 million

(2021: GBP1.7m).

Adjusted basic earnings per share increased by 29% to 12.6 pence

(2021: 9.8 pence) with statutory basic earnings per share increased

to 7.5 pence (2021: 1.5 pence).

Adjusting items

Due to the one-off nature of exceptional costs and the non-cash

nature of certain charges, the Directors believe that an adjusted

measure of profit before tax and earnings per share provides

shareholders with a useful representation of underlying earnings

from the Group's business.

The adjusting items in arriving at the underlying adjusted

profit before tax are as follows:

H1 2022 H1 2021 Change

GBPm GBPm

----------------------------------- -------- -------- -------

Exceptional items 0.9 1.7 -47%

Exceptional finance costs 0.3 - -

Amortisation of intangible assets 5.9 5.0 +18%

Total adjusting items 7.1 6.7 +6%

----------------------------------- -------- -------- -------

Exceptional items incurred in H1 2022 are primarily acquisition

related restructuring costs (GBP0.8 million), acquisition related

transaction costs (GBP0.1 million) and non-cash incremental

write-off of bank charges on refinancing of the RCF (GBP0.3

million).

Balance Sheet and Cashflow

The Balance Sheet as at 30 June 2022 remains strong, with key

ratios across working capital and trade debt consistent with prior

periods. The growth in scale of the business is shown in the

increase in net assets to GBP270.9 million. (2021: GBP259.2

million).

The Group continues to generate strong operating cashflows which

increased from GBP25.8 million in H1 2021 to GBP28.5 million for H1

2022 after increased working capital of GBP12.7 million (2021:

GBP6.6 million) to support revenue growth.

After investment in acquisitions of GBP9.5 million (net of cash

acquired) and increased finance charges, the Group net debt

increased from GBP100.8 million at 31 December 2021 to GBP103.5

million. As a result of the business expansion, the resulting net

debt to pro-forma EBITDA leverage has reduced from 1.8x at 31

December 2021 to 1.7x at 30 June 2022.

The Group refinanced in January 2022 and agreed a new credit

facility, increasing its credit line to GBP200 million with

improved terms and the potential to increase this by a further

GBP50 million through the activation of an accordion agreement.

FINANCIAL STATEMENTS

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2022

Unaudited Unaudited

six months six months Audited

ended ended year ended

30 June 30 June 31 December

Note 2022 2021 2021

GBP'm GBP'm GBP'm

------------------------------------- --------- ------------ ------------ --------------

Revenue - continuing operations 2 140.3 106.1 234.3

Cost of sales (78.7) (58.3) (127.1)

Gross profit 61.6 47.8 107.2

Administrative expenses (35.8) (28.2) (61.0)

Amortisation of intangible assets (5.9) (5.0) (10.7)

Exceptional items 3 (0.9) (1.7) (4.4)

Operating profit 19.0 12.9 31.1

------------------------------------- --------- ------------ ------------ --------------

Finance costs (4.6) (4.0) (8.1)

Exceptional finance costs 3 (0.3) - -

Profit before tax 14.1 8.9 23.0

------------------------------------- --------- ------------ ------------ --------------

Taxation 4 (3.8) (6.9) (11.5)

------------------------------------- --------- ------------ ------------ --------------

Profit after tax 10.3 2.0 11.5

Other comprehensive income - - -

------------------------------------- --------- ------------ ------------ --------------

Profit and total comprehensive

income for the period attributable

to owners of the parent 10.3 2.0 11.5

------------------------------------- --------- ------------ ------------ --------------

Earnings per share attributable

to owner of the parent (pence)

Total

- Basic 5 7.5p 1.5p 8.7p

- Diluted 5 7.3p 1.5p 8.4p

------------------------------------- --------- ------------ ------------ --------------

The reconciliation between the statutory results shown above and

the non-GAAP adjusted measures are shown below:

Operating profit - continuing

operations 19.0 12.9 31.1

-------------------------------- ------ ------ ------

Adjustments for:

Amortisation of intangible

assets 5.9 5.0 10.7

Exceptional items 3 0.9 1.7 4.4

Adjustments 6.8 6.7 15.1

-------------------------------- ------ ------ ------

Adjusted operating profit 25.8 19.6 46.2

-------------------------------- ------ ------ ------

Depreciation of property,

plant and equipment and

right-of-use assets 14.5 13.6 28.0

-------------------------------- ------ ------ ------

Earnings before interest,

taxation, depreciation,

amortisation, impairment

and exceptional items

(EBITDA) 40.3 33.2 74.2

-------------------------------- ------ ------ ------

Profit before tax 14.1 8.9 23.0

Adjustments (as stated

above) 6.8 6.7 15.1

Exceptional finance costs 3 0.3 - -

-------------------------------- ------ ------ ------

Adjusted profit before

tax 21.2 15.6 38.1

-------------------------------- ------ ------ ------

Condensed Consolidated Statement of Financial Position

As at 30 June 2022

Unaudited Audited

30 June Unaudited 31 December

2022 30 June 2021 2021

Note GBP'm GBP'm GBP'm

--------------- ------------- --------------------

ASSETS

Non-current assets

Intangible assets 330.7 320.6 327.2

Property, plant and equipment 78.6 74.0 78.8

Right-of-use assets 93.3 105.1 102.5

Deferred tax asset 5.3 4.5 5.9

-------------------------------------------- ------ --------------- ------------- --------------------

507.9 504.2 514.4

-------------------------------------------- ------ --------------- ------------- --------------------

Current assets

Inventories 2.3 1.2 1.4

Trade and other receivables 72.6 55.0 56.9

Corporation tax receivable - 0.1 -

Cash and cash equivalents 29.9 22.0 32.9

-------------------------------------------- ------ --------------- ------------- --------------------

104.8 78.3 91.2

-------------------------------------------- ------ --------------- ------------- --------------------

Total assets 2 612.7 582.5 605.6

-------------------------------------------- ------ --------------- ------------- --------------------

LIABILITIES

Current liabilities

Trade and other payables (55.7) (48.8) (45.5)

Financial liabilities - lease liabilities (20.2) (17.7) (18.2)

Other financial liabilities - - -

Current tax liabilities (2.6) - (1.5)

Provisions (1.4) (1.1) (0.9)

-------------------------------------------- ------ --------------- ------------- --------------------

(79.9) (67.6) (66.1)

-------------------------------------------- ------ --------------- ------------- --------------------

Non-current liabilities

Financial liabilities - borrowings 9 (133.4) (113.6) (133.7)

Financial liabilities - lease liabilities (87.4) (100.6) (98.8)

Deferred tax liabilities (33.2) (34.4) (33.9)

Provisions (7.9) (7.1) (7.9)

-------------------------------------------- ------ --------------- ------------- --------------------

(261.9) (255.7) (274.3)

-------------------------------------------- ------ --------------- ------------- --------------------

Total liabilities 2 (341.8) (323.3) (340.4)

-------------------------------------------- ------ --------------- ------------- --------------------

Net assets 270.9 259.2 265.2

-------------------------------------------- ------ --------------- ------------- --------------------

EQUITY

Share capital 6.8 6.8 6.8

Share premium account 187.9 187.9 187.9

Other reserves 8.8 7.3 7.0

Retained earnings 67.4 57.2 63.5

-------------------------------------------- ------ --------------- ------------- --------------------

Equity attributable to owners of

parent 270.9 259.2 265.2

-------------------------------------------- ------ --------------- ------------- --------------------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2022

Attributable to owners of the parent

------------------------------------------------------

Share Share Other Retained Total

capital premium reserves earnings equity

GBP'm GBP'm GBP'm GBP'm GBP'm

----------------------------- --------- --------- ---------- ---------- --------

Balance at 1 January

2021 (audited) 6.3 150.3 6.0 56.0 218.6

Loss for the period - - - 2.0 2.0

----------------------------- --------- --------- ---------- ---------- --------

Total comprehensive

loss for the period - - - 2.0 2.0

----------------------------- --------- --------- ---------- ---------- --------

Transactions with owners

Issue of shares during

the year 0.5 39.5 - - 40.0

Issue costs - (1.9) - - (1.9)

Share-based payments

charge - - 0.9 - 0.9

Deferred tax on share-based

payments - - (0.3) - (0.3)

Purchase of treasury

shares - - (0.1) - (0.1)

Disposal of treasury

shares - - 0.8 (0.8) -

----------------------------- --------- --------- ---------- ---------- --------

Balance at 30 June 2021

(unaudited) 6.8 187.9 7.3 57.2 259.2

----------------------------- --------- --------- ---------- ---------- --------

Balance at 1 July 2021 6.8 187.9 7.3 57.2 259.2

Profit for the period - - - 9.5 9.5

----------------------------- --------- --------- ---------- ---------- --------

Total comprehensive

income for the period - - - 9.5 9.5

----------------------------- --------- --------- ---------- ---------- --------

Transactions with owners

Dividends - - - (3.4) (3.4)

----------------------------- --------- --------- ---------- ---------- --------

Share-based payments

charge - - 1.3 - 1.3

Deferred tax on share-based

payments - - 0.9 - 0.9

Current tax on share-based

payments - - 0.2 - 0.2

Transfer* - - (0.2) 0.2 -

Purchase of treasury

shares - - (2.5) - (2.5)

----------------------------- --------- --------- ---------- ---------- --------

Balance at 31 December

2021 (audited) 6.8 187.9 7.0 63.5 265.2

----------------------------- --------- --------- ---------- ---------- --------

Balance at 1 January

2022 6.8 187.9 7.0 63.5 265.2

Profit for the period - - - 10.3 10.3

----------------------------- --------- --------- ---------- ---------- --------

Total comprehensive

income for the period - - - 10.3 10.3

----------------------------- --------- --------- ---------- ---------- --------

Transactions with owners

Dividends - - - (6.4) (6.4)

Share-based payments

charge - - 1.8 - 1.8

----------------------------- --------- --------- ---------- ---------- --------

Balance at 30 June

2022 (unaudited) 6.8 187.9 8.8 67.4 270.9

----------------------------- --------- --------- ---------- ---------- --------

* In 2021 a net amount of GBP0.2m was reclassified from

share-based payment reserve to retained earnings in respect of

lapsed and exercised options.

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2022

Note Unaudited Unaudited Audited

six months six months year ended

ended ended 31 December

30 June 2022 30 June 2021 2021

-------------------------------------- -----

GBP'm GBP'm GBP'm

-------------------------------------- ----- ---------------- --------------- ---------------

Cash generated from operations 7 28.5 25.8 59.9

Net finance costs* (5.9) (3.8) (7.0)

Income taxes paid (2.8) (2.4) (5.2)

-------------------------------------- ----- ---------------- --------------- ---------------

Net cash generated from operating

activities 19.8 19.6 47.7

Cash flows from investing

activities

Purchase of property, plant

and equipment and applications

software 2 (5.1) (2.8) (8.8)

Purchase of subsidiary, net

of cash acquired 8 (8.8) (71.1) (85.8)

Purchase of trade and assets 8 (0.7) - (0.9)

Cash flows used in investing

activities (14.6) (73.9) (95.5)

Cash flows from financing

activities

Dividends paid - - (3.4)

Net proceeds from share issue - 38.1 38.1

Purchase of treasury shares - (0.1) (2.6)

Repayment of revolving credit

facility - (45.0) (65.0)

Drawdown of revolving credit

facility 1.0 66.0 106.0

Principal element of lease

repayments (9.2) (9.1) (18.8)

-------------------------------------- ----- ---------------- --------------- ---------------

Net cash (used) / generated

in financing activities (8.2) 49.9 54.3

-------------------------------------- ----- ---------------- --------------- ---------------

Net (decrease) / increase

in cash and cash equivalents (3.0) (4.4) 6.5

Cash and cash equivalents

at start of period 32.9 26.4 26.4

-------------------------------------- ----- ---------------- --------------- ---------------

Cash and cash equivalents

at the end of period 9 29.9 22.0 32.9

-------------------------------------- ----- ---------------- --------------- ---------------

A reconciliation between the statutory results shown above and the

non-GAAP free cashflow measure is shown below:

-------------------------------------------------------------------------------------------------

Net cash generated from operations 19.8 19.6 47.7

-------------------------------------- ----- ---------------- --------------- ---------------

Less: Purchase of property,

plant and equipment and application

software (5.1) (2.8) (8.8)

Less: Principal element of

lease repayments (9.2) (9.1) (18.8)

Add: Exceptional costs 3 0.9 1.7 4.4

Add: One-off refinancing cash

outflow* 3 1.7 - -

-------------------------------------- ----- ---------------- --------------- ---------------

Free cashflow 8.1 9.4 24.5

-------------------------------------- ----- ---------------- --------------- ---------------

*Net finance costs include a one-off cash outflow of GBP1.7m in

relation to fees for the Group's refinancing in January 2022.

Notes to the Consolidated Interim report

For the six months ended 30 June 2022

1 Basis of Preparation

The half year report has been prepared in accordance with IAS

34, Interim Financial Reporting, adopting accounting policies that

are consistent with those of the previous financial year and

corresponding half year reporting period,

2 Segmental Analysis

The Group is organised into two main operating segments, Digital

and Information Management and Secure Lifecycle Services and incurs

central costs. The vast majority of trading of the Group is

undertaken within the United Kingdom. Segment assets include

intangibles, property, plant and equipment, right-of-use assets,

inventories, receivables and operating cash. Central assets include

deferred tax and head office assets. Segment liabilities comprise

operating liabilities. Central liabilities include income tax and

deferred tax, corporate borrowings and head office liabilities.

Capital expenditure comprises additions to computer software,

property, plant and equipment. Segment assets and liabilities are

allocated between segments on an actual basis.

Revenue - Continuing operations

====================================

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP'm GBP'm GBP'm

==================================== ---------- ---------- -------------

Restore Records Management 55.9 47.7 101.4

Restore Digital 31.2 14.2 36.9

==================================== ========== ========== =============

Digital and Information Management 87.1 61.9 138.3

==================================== ========== ========== =============

Restore Technology 17.2 12.3 28.1

Restore Datashred 18.3 13.8 30.2

Restore Harrow Green 17.7 18.1 37.7

------------------------------------ ---------- ---------- -------------

Secure Lifecycle Services 53.2 44.2 96.0

==================================== ========== ========== =============

Total revenue 140.3 106.1 234.3

==================================== ========== ========== =============

The revenue from external customers was derived from the Group's

principal activities primarily in the UK (where the Company is

domiciled).

Profit before tax

---------------------------------------

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP'm GBP'm GBP'm

--------------------------------------- ------------------- ---------------- ----------------------

Digital and Information Management 24.6 18.8 42.5

Secure Lifecycle Services 5.6 4.7 11.7

Head office (2.6) (2.7) (5.2)

Amortisation of intangible assets (5.9) (5.0) (10.7)

Share-based payment charge (including

related NI) (1.8) (1.2) (2.8)

Exceptional items (0.9) (1.7) (4.4)

Operating profit 19.0 12.9 31.1

Finance costs (4.6) (4.0) (8.1)

Exceptional finance costs (0.3) - -

--------------------------------------- ------------------- ---------------- ----------------------

Profit before tax 14.1 8.9 23.0

======================================= =================== ================ ======================

Segmental information

Unaudited

Digital and Information Secure Lifecycle 30 June 2022

Management Services Head Office Total

GBP'm GBP'm GBP'm GBP'm

============================== ======================= ================ =========== =============

Segment assets 441.3 152.3 19.1 612.7

Segment liabilities 117.2 52.6 172.0 341.8

Capital expenditure 3.9 1.2 - 5.1

Depreciation and amortisation 14.2 6.1 0.1 20.4

============================== ======================= ================ =========== =============

Unaudited

30 June 2021

============================== ======================= ================ =========== =============

Segment assets 444.9 125.0 12.6 582.5

Segment liabilities 76.8 37.8 208.7 323.3

Capital expenditure 2.0 0.6 0.2 2.8

Depreciation and amortisation 13.1 5.5 - 18.6

============================== ======================= ================ =========== =============

Audited

31 December

2021

============================== ======================= ================ =========== =============

Segment assets 447.5 146.3 11.8 605.6

Segment liabilities 121.0 51.8 167.6 340.4

Capital expenditure 5.7 2.7 0.4 8.8

Depreciation and amortisation 26.2 12.1 0.4 38.7

============================== ======================= ================ =========== =============

3 Exceptional items

For the six months ended 30 June 2022, exceptional costs were

GBP1.2m, including GBP0.8m acquisition related restructuring costs

and GBP0.1m acquisition related transaction costs. Exceptional

finance costs of GBP0.3m relate to the incremental deferred finance

write-off costs recognised in the income statement from the Group

extinguishing its GBP160m facility and replacing it with a new

GBP200m revolving credit facility in January 2022.

For the six months ended 30 June 2021, exceptional costs were

GBP1.7m, including GBP0.9m of acquisition related transaction

costs, GBP0.5m of acquisition related restructuring costs and

GBP0.3m in respect of a legacy legal liability.

For the year ended 31 December 2021, GBP4.4m of exceptional

costs were incurred, comprising of GBP1.2m acquisition related

costs, GBP2.4m acquisition related restructuring costs, and GBP0.8m

other exceptional items.

4 Taxation

The current tax charge for the period to 30 June 2022 is

anticipated to be GBP3.8m, based on the estimated effective tax

rate for the Group.

5 Earnings per ordinary share

Basic earnings per share have been calculated on the profit for

the period after taxation and the weighted average number of

ordinary shares in issue during the period.

Unaudited Unaudited Audited

six months six months year ended

ended ended 31 December

30 June 2022 30 June 2021 2021

GBP'm GBP'm GBP'm

----------------------------------- -------------- -------------- -------------

Weighted average number of

shares in issue 136,674,067 129,129,492 132,932,784

----------------------------------- -------------- -------------- -------------

Total profit for the period GBP10.3m GBP2.0m GBP11.5m

----------------------------------- -------------- -------------- -------------

Total basic earnings per ordinary

share 7.5p 1.5p 8.7p

----------------------------------- -------------- -------------- -------------

Weighted average number of

shares in issue 136,674,067 129,129,492 132,932,784

Share options 4,777,957 4,725,584 4,736,714

Weighted average fully diluted

number of shares in issue 141,452,024 133,855,076 137,669,498

----------------------------------- -------------- -------------- -------------

Total fully diluted earnings

per share 7.3p 1.5p 8.4p

----------------------------------- -------------- -------------- -------------

Adjusted earnings per share

The Directors believe that adjusted earnings per share provide a

more appropriate representation of the underlying earnings derived

from the Group's business. The adjusting items are shown in the

table below:

Unaudited Audited

Unaudited six months year ended

six months ended ended 31 December

30 June 2022 30 June 2021 2021

GBP'm GBP'm GBP'm

------------------------ ---------------------------------- --------------------------- ---------------------------

Continuing profit

before

tax 14.1 8.9 23.0

Adjustments:

Amortisation of

intangible

assets 5.9 5.0 10.7

Exceptional items 0.9 1.7 4.4

Exceptional finance 0.3 - -

costs

Adjusted continuing

profit for the period 21.2 15.6 38.1

------------------------ ---------------------------------- --------------------------- ---------------------------

The adjusted earnings per share, based on weighted average

number of shares in issue during the period, 136.7m (2021: 129.1m)

is calculated below:

Unaudited Unaudited Audited

six months six months year ended

ended ended 31 December

30 June 2022 30 June 2021 2021

----------------------------------- ------------- ------------- ------------

Adjusted profit before tax (GBP'm) 21.2 15.6 38.1

Tax at 19.0% (GBP'm) (4.0) (3.0) (7.2)

----------------------------------- ------------- ------------- ------------

Adjusted profit after tax (GBP'm) 17.2 12.6 30.9

----------------------------------- ------------- ------------- ------------

Adjusted basic earnings per share 12.6p 9.8p 23.2p

----------------------------------- ------------- ------------- ------------

Adjusted fully diluted earnings

per share 12.2p 9.4p 22.4p

----------------------------------- ------------- ------------- ------------

6 Dividends

In respect of the current period, the Directors declare an

interim dividend of 2.6p per share (2021: GBP2.5p). The estimated

dividend to be paid is GBP3.6m (2021: GBP3.4m) and will be paid to

shareholder on 14 October 2022 to shareholders on the register on

16 September 2022.

7 Cash generated from operating activities

Unaudited Unaudited

six months six months Audited year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

GBP'm GBP'm GBP'm

----------------------------------------- ----------- ----------- ------------

Continuing operations

Profit before tax 14.1 8.9 23.0

Depreciation of property, plant and

equipment and right-of-use assets 14.5 13.6 28.0

Amortisation of intangible assets 5.9 5.0 10.7

Net finance costs (including exceptional

finance costs) 4.9 4.0 8.1

Share-based payments charge 1.8 0.9 2.2

Increase in inventories (0.1) (0.1) (0.3)

Increase in trade and other receivables (14.8) (5.9) (7.8)

Increase / (decrease) in trade and other

payables 2.2 (0.6) (4.0)

----------------------------------------- ----------- ----------- ------------

Cash generated from operating activities 28.5 25.8 59.9

----------------------------------------- ----------- ----------- ------------

8 Business combinations

On 3 May 2022, the Group acquired 100% of the share capital of

Ultratec (Holdings) Limited, together with its subsidiaries

("Ultratec"). Ultratec is a Technology business that provides

secure data erasure and physical data destruction services, bespoke

technology recycling solutions, hard drive parts supply and Data

Centre focussed hardware maintenance services. As the Group is

still in the process of establishing the fair value of the assets

and liabilities acquired in respect of these acquisitions, the fair

values presented in the interim results are provisional. These

provisional fair values are set out below:

Ultratec

GBP'm

--------------------------------- --------

Intangibles - goodwill, customer

relationships and other 10.2

Property, plant and equipment 0.5

Right of use assets 0.9

Inventories 0.8

Trade and other receivables 0.7

Cash and cash equivalents 2.3

Trade and other payables (1.1)

Lease liabilities (0.9)

Deferred tax liabilities (1.7)

Provisions (0.2)

--------------------------------- --------

Net assets acquired 11.5

--------------------------------- --------

Consideration

Satisfied by:

Cash to vendors 10.8

Deferred consideration 0.7

Total consideration 11.5

--------------------------------- --------

On 4 May 2022 and 20 May 2022, the Group acquired the trade and

assets of Secure Records & Data Management Limited and UK

Archive Limited respectively, which are both Records Management

businesses. Total consideration of GBP0.7m was paid across both of

these trade and asset purchases. Customer relationships of GBP0.7m

were recognised on acquisition.

During the year, deferred consideration of GBP0.3m was paid in

relation to the 2021 acquisition of The Document Warehouse (UK)

Limited.

9 Financial liabilities - borrowings

Unaudited Audited

30 June Unaudited 31 December

2022 30 June 2021 2021

GBP'm GBP'm GBP'm

------------------------- ------------- ------------- -------------

Non-current

Bank loans - secured 135.0 114.0 134.0

Deferred financing costs (1.6) (0.4) (0.3)

------------------------- ------------- ------------- -------------

133.4 113.6 133.7

------------------------- ------------- ------------- -------------

Analysis of net debt

Cash at bank and in hand 29.9 22.0 32.9

Bank loans due within one year - - -

Bank loans due after one year (133.4) (113.6) (133.7)

------------------------------- -------------- -------------- --------------

(103.5) (91.6) (100.8)

------------------------------- -------------- -------------- --------------

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SESFDWEESEEW

(END) Dow Jones Newswires

July 28, 2022 02:00 ET (06:00 GMT)

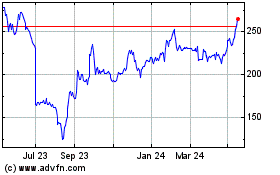

Restore (LSE:RST)

Historical Stock Chart

From Jun 2024 to Jul 2024

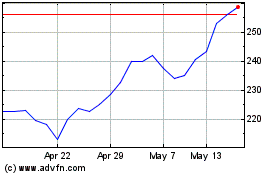

Restore (LSE:RST)

Historical Stock Chart

From Jul 2023 to Jul 2024