TIDMRKH

RNS Number : 0766B

Rockhopper Exploration plc

29 September 2022

29 September 2022

Rockhopper Exploration plc

("Rockhopper" or the "Company")

Half-Year Results for the Six Months Ended 30 June 2022

Rockhopper Exploration plc (AIM: RKH), the oil and gas company

with key interests in the North Falkland Basin, announces its

unaudited results for the six months ended 30 June 2022 ("H1

2022").

Year to date highlights

Sea Lion

-- Completion of transaction for Harbour Energy plc ("Harbour")

to exit and Navitas Petroleum LP (through its UK subsidiary)

"Navitas" to enter the North Falkland Basin with a 65% stake in,

and operatorship of, all of Rockhopper's North Falkland Basin

licences

-- Rockhopper retains material 35% working interest in North Falkland Basin licences

-- Extension of all North Falkland Basin licences to 1 November 2024

-- Improved alignment in the Sea Lion Joint Venture, with

Rockhopper benefitting from an attractive funding package from

Navitas

Ombrina Mare

-- Successful arbitration outcome with unanimous decision in Rockhopper's favour

-- Compensation of EUR190 million

-- Interest at EURIBOR + 4% accruing annually from 29 January 2016

-- Temporary four-month pause in interest from date of award

-- Italy has 120 days to apply for an annulment of the award,

which can only be annulled in limited circumstances

Corporate and financial

-- Successful capital raise of US$10.4 million by way of placing and open offer

-- Warrants issued to provide additional upside to holders and

future potential balance sheet strength

-- Continued focus on costs

Outlook

-- Lower upfront cost Sea Lion development being worked up and financing sought

-- Arbitration award, after collection, will make a material

contribution towards Rockhopper's share of Sea Lion development

costs

-- Sea Lion FID targeted 2023/24

Keith Lough, Chairman of Rockhopper, commented:

"Following completion of our transaction with Navitas, the

capital raise, and the successful arbitration outcome, we stand on

the cusp of what we believe will be the most exciting period at

Rockhopper for some years, culminating, we hope, in the development

of a material scale energy resource in a British Overseas

Territory.

We have a committed and capable partner with proven financing

capability, which has recruited an exceptional and highly

experienced development engineer to run the Sea Lion project.

Amidst continued global uncertainty and material domestic

pressures, we continue to believe a responsibly developed Sea Lion

oilfield could provide both a meaningful source of financial

benefit to the Falkland Islands, and a strategically and

financially important resource to the United Kingdom.

Furthermore, Sea Lion is not a one-off project. We have very

material low-risk exploration upside, providing potential

additional benefits to all stakeholders.

We thank our stakeholders and the Falkland Islands Government

for their continued support as we strive to reach project sanction

and unlock material value for all involved."

Enquiries:

Rockhopper Exploration plc

Sam Moody - Chief Executive Officer

Tel. +44 (0) 20 7390 0234 (via Vigo Consulting)

Canaccord Genuity Limited (NOMAD and Joint Broker)

Henry Fitzgerald-O'Connor/Gordon Hamilton

Tel. +44 (0) 20 7523 8000

Peel Hunt LLP (Joint Broker)

Richard Crichton/Georgia Langoulant

Tel. +44 (0) 20 7418 8900

Vigo Consulting

Patrick d'Ancona/Ben Simons/Kendall Hill

Tel. +44 (0) 20 7390 0234

CHAIRMAN AND CHIEF EXECUTIVE OFFICER'S REPORT

Introduction

Rockhopper's strategy is to create value for all our

stakeholders through the safe and responsible development of our

assets in the North Falkland Basin. The Company has been operating

offshore the Falkland Islands since 2004 and discovered the Sea

Lion oilfield in 2010. We are a long-term partner of the Falkland

Islands Government ("FIG"), and our aim has always been to support

the rights of the Falkland Islanders to develop their natural

resources.

Sea Lion development

We believe that the Sea Lion oilfield represents a material

strategic resource both for the Falkland Islands and the wider

United Kingdom. With more than 500 million barrels of recoverable

oil in the Rockhopper ERC audit and some 700 million barrels in the

Navitas NSAI CPR, we believe this field alone is larger than Cambo

and Rosebank combined.

Having spent many years as 100% owner and operator exploring and

appraising the field, we have an unrivalled depth of knowledge of

both Sea Lion and operating in the Falklands. In fact, we have

carried out more oil and gas operations in the Falklands than any

other company, all with an exemplary HSE record and strong

operational performance. Our track record in the Sea Lion area

includes eight successful wells from ten, which we believe stands

in comparison to many significantly larger companies in the

industry and provides encouragement for the potential for

additional discoveries in the region.

The years spent working with Premier Oil (now Harbour) in our

Joint Venture have not been wasted. Hundreds of millions of dollars

and tens of thousands of hours have been spent engineering Sea Lion

to a point where we are entirely confident that a responsible and

high-quality project is deliverable using proven industry

technology.

The addition of Navitas, with its exceptional recent track

record of financing offshore developments others believed would

never come to fruition, combined with a favourable oil price

outlook and increased focus on security of energy supply, brings

the potential value of the Sea Lion field into sharp focus.

Premier previously confirmed that the field could produce in

excess of 120,000 barrels per day over two phases, representing a

potential increase of between 10% and 15% in UKCS oil production

from Sea Lion alone. Many low-risk near field prospects have been

identified and the potentially large Isobel / Elaine discovery

approximately 30km to the south of Sea Lion provides additional

long-term potential. Shell's well 14/15-1, drilled in 1998,

encountered a large gas column in a low-quality reservoir. Although

not without risk, we have always believed that the potential exists

for a multi TCF gasfield in the Falkland Islands, with associated

strategic implications for the Falklands and the United Kingdom.

Significant UK content was planned by Premier in the development

potentially bringing billions of dollars of wider UK benefits.

We look forward to working with Navitas, with whom we have

already developed a strong relationship, as they build on all our

existing work and knowledge to engineer an appropriate development

concept and put together a financing package which could allow FID

to be taken at Sea Lion during late 2023 or 2024.

Ombrina Mare arbitration

The successful outcome of the Ombrina Mare arbitration is a

vindication of our belief in the strength of our case, which we

have articulated to shareholders since we commenced the arbitration

process back in 2017. The Panel unanimously decided in Rockhopper's

favour and awarded what we believe to be a fair and equitable

compensation for the loss of our asset which, at current oil

prices, would be enormously valuable. Compensation of some EUR190

million with appropriate interest has been awarded.

Under the relevant rules, Italy has 120 days to apply for an

annulment of the award; such awards can only be annulled in limited

circumstances. At the date of this report, we have not heard from

the Italian Republic regarding its intentions. For our part, we

have written requesting immediate payment and reminding Italy not

only of its obligation to settle the full amount, but of our rights

to pursue all available remedies against Italy and its

representatives in any forum without any further notice should they

fail to fulfil their obligations to us.

We hope and believe Italy will act in accordance with their

obligations but we will have no hesitation in seeking to enforce

this award in multiple jurisdictions should they fail to do so. The

entire situation is deeply regrettable as, had we been allowed to

develop the asset in accordance with Italy's own relevant

legislation, not only would we now be producing at high oil prices,

but, perhaps more importantly, Italy would have benefitted from

material local well-paid employment along with taxes and a domestic

source of oil at a challenging time for many. It should be noted

that Italy continues to produce material volumes of hydrocarbons

within 12 miles of its coastline.

Costs associated with the arbitration proceedings were funded on

a non-recourse ("no win - no fee") basis from a specialist

arbitration funder. After payments due to the arbitration funder

and success fees due to the Group's legal representation,

Rockhopper expects to retain approximately 80% of the award

(assuming full recovery of the award). Further analysis is required

to establish the tax treatment on any payments related to the

award.

Corporate Matters

We were delighted to receive the support of our existing and new

shareholders in the US$10.4 million capital raise completed in the

early part of the summer. We undertook the additional cost and

effort required to proceed with an open offer to ensure that

existing individual shareholders were given the opportunity to

participate in the capital raise on identical terms as

institutional investors. We offered those participating in the

capital raise warrants, giving them the right to purchase shares at

9p to be exercised at any point until 31 December 2023, providing

them with additional potential upside and Rockhopper a stronger

balance sheet should those warrants be exercised.

During what has been a difficult and challenging time for the

industry and for our business, we are delighted to have found what

we believe is the right way to balance a very significant cost

reduction with retaining the key knowledge we have accumulated in

the Falklands. Recurring G&A is now down over 70% when compared

to 2014, and we believe some further savings are possible as we

continue to run the business in the best interests of all

stakeholders.

Environmental, Social and Governance

ESG, and Corporate Responsibility more generally, continues to

be a key focus for Rockhopper.

As an oil and gas exploration and production business our role

is to discover and produce hydrocarbons in an environmentally

responsible manner.

As noted previously, the Falkland Islands Government established

an independent environment trust to receive and administer future

off-setting payments from the Sea Lion project and distribute those

funds for activities aimed at ensuring a positive environmental

legacy in the Falkland Islands.

Once FID on Sea Lion has been achieved, the Company commits to

defining measures, reporting transparently, and mitigating our own

emissions as far as practicable.

Outlook

Sea Lion is an oilfield with the scale and potential to create

very material value for Rockhopper, its partners, and the Falkland

Islands as a whole, in addition to providing the UK with a secure

and significant source of supply for years to come.

Since the start of this year, we have achieved three major

milestones which, when taken as a whole, puts the Company in the

best shape we have been in for many years.

We thank the Falkland Islands Government for its continued

support and we will continue to work closely with all stakeholders

to maximise the chance of unlocking the value within the project,

long-awaited by all stakeholders.

Keith Lough Sam Moody

Chairman Chief Executive

Officer

FINANCIAL REVIEW

Overview

From a finance perspective, the most significant events in 2022

to date are:

-- Detailed transaction terms agreed with Harbour and Navitas in

relation to the Sea Lion project (the "Transaction") - completed

post period end in September 2022

-- Successful fundraising through Placing and Subscription

raising net proceeds of US$6.3 million in June 2022

-- Additional US$2.8 million net proceeds raised post period end through Open Offer in July 2022

-- Successful ICSID arbitration award in respect of Ombrina

Mare. Compensation of EUR190 million plus interest at EURIBOR + 4%,

compounded annually from 29 January 2016 until time of payment

With the Transaction completing post period end the arrangements

with Navitas ensure that Rockhopper is funded going forward for all

pre-sanction costs related to the Sea Lion phase one development

(other than licence fees and taxes). This, combined with the

fundraising, materially strengthens the Group's financial position

in the short and medium term and significantly enhances the

prospects for a successful project financing for Sea Lion.

The arbitration award was made in September 2022 and, as such,

has no impact on the results for the period to 30 June 2022.

Assuming full recovery of the award, after payments due to the

arbitration funder and success fees due to the Group's legal

representation, the Group expects to retain approximately 80%

pre-tax. Further analysis has begun to establish the tax treatment

on any payments received.

Results for the period

For the period ended 30 June 2022, the Group reported revenues

of US$0.5 million (H1 2021: US$0.3 million) and a loss after tax of

US$0.7 million (H1 2021: loss of US$3.3 million). The reduction in

loss after tax was driven mainly by net foreign exchange gains on

GBP denominated balances. In particular, the weakening of the GBP

against the USD resulted in a US$4.4 million gain on the current

carrying value of the tax liability with FIG.

Revenue and cost of sales

The Group's revenues of US$0.5 million (H1 2021: US$0.3 million)

in H1 2022 relate entirely to the sale of natural gas in the

Greater Mediterranean (specifically Italy) region. Gas was sold at

a price linked to the Italian "PSV" (Virtual Exchange Point) gas

marker price.

Revenue and cost of sales are not expected to be material going

forward.

Operating costs

The Group continues to manage corporate costs and has achieved

significant reductions in recurring general and administrative

("G&A") costs over the last five years. The full benefit of

these cost reduction initiatives was realised last year resulting

in a relatively stable G&A cost of US$1.5 million in H1 2022

(H1 2021: US$1.6 million).

The foreign exchange gain in the period of US$3.4 million (2021:

loss of US$0.3 million) is mainly in relation to the tax balance

arising from the Group's farm-out to Premier in 2012 offset by a

loss on GBP denominated assets, such as cash and debtors. The

finance expense in the year of US$2.0 million (2021: US$nil) also

relates, in the main, to adjustments in relation to this tax

balance.

Cash movements and capital expenditure

At 30 June 2022, the Group had cash of US$9.1 million (31

December 2021: US$4.8 million).

Cash movements during the period:

US$m

----------------------------------------- ------

Opening cash balance (31 December 2021) 4.8

Revenues 0.5

Cost of sales (0.8)

Falkland Islands (0.9)

Administrative expenses (1.5)

Net proceeds of fundraising 6.3

Miscellaneous 0.7

Closing cash balance (30 June 2022) 9.1

----------------------------------------- ------

Miscellaneous includes foreign exchange and movements in working

capital during the period.

Oil and gas assets

The Sea Lion development remains central to the Group's plans

and we are excited at the prospect of bringing in a new industry

partner, Navitas, especially given their experience in financing

projects of a similar scale to Sea Lion.

As part of the Transaction to bring Navitas onto the licences we

have been granted a two-year licence extension from FIG. This

should allow the newly formed joint venture to leverage the

extensive engineering work carried out to date and pursue a lower

upfront cost development.

The Transaction aligns working interests across all the North

Falkland Basin petroleum licences - Rockhopper 35% / Navitas 65%.

Work between the Group and Navitas had already begun pre completion

and will continue with the aim to jointly develop and agree a

technical and financing plan for the Sea Lion project. Current work

targets delivering a project that achieves first oil on a lower

cost and expedited basis post sanction.

Navitas will provide loan funding to the Group to cover the

majority of its share of Sea Lion phase one related costs from

Transaction completion up to Final Investment Decision ("FID")

through a loan from Navitas with interest charged at 8% per annum

(the "Pre-FID Loan"). Subject to a positive FID, Navitas will

provide an interest free loan to fund two-thirds of the Group's

share of Sea Lion phase one development costs (for any costs not

met by third party debt financing).

Certain costs, such as licence costs, are excluded in both

instances. Funds drawn under the loans will be repaid from 85% of

Rockhopper's working interest share of free cash flow.

Taxation

On 8 April 2015, the Group agreed binding documentation ("Tax

Settlement Deed") with FIG in relation to the tax arising from the

Group's farm-out to Premier.

The Tax Settlement Deed confirms the quantum and deferment of

the outstanding tax liability and is made under Extra Statutory

Concession 16.

As a result of the Tax Settlement Deed and the Group receiving

the full Exploration Carry from Premier during the 2015/16 drilling

campaign, the outstanding tax liability is confirmed at GBP59.6

million. This is payable on the earlier of: (i) the first royalty

payment date on Sea Lion; (ii) the date of which Rockhopper

disposes of all or a substantial part of the Group's remaining

licence interests in the North Falkland Basin; or (iii) a change of

control of Rockhopper Exploration plc.

The outstanding tax liability is classified as non-current and

is discounted to a period-end value of US$40.7 million (31 December

2021 US$43.2 million).

Full details of the provisions and undertakings of the Tax

Settlement Deed are disclosed in note 7 of these consolidated

financial statements and these include "creditor protection"

provisions including undertakings not to declare dividends or make

distributions while the tax liability remains outstanding (in whole

or in part).

Liquidity, counterparty risk and going concern

The Group monitors its cash position, cash forecasts and

liquidity on a regular basis and takes a conservative approach to

cash management.

At 31 August 2022, the Group had cash resources of US$10.9

million (unaudited). While there are still some Transaction costs

and the Group's share of Harbour wind down costs to come, going

forward projected recurring expenditure is currently expected to be

around US$4.0 million per year.

Historically, the Group's largest annual expenditure has related

to pre-sanction costs associated with the Sea Lion development.

Following the completion of the Transaction, Navitas will provide

loan funding to the Group for its share of all Sea Lion

pre-sanction costs (other than licence fees and taxes). Based on

previous correspondence with FIG, management does not believe the

Transaction completion would constitute a substantial disposal and

therefore will not accelerate the deferred CGT liability related to

the 2012 farm-out.

Given the above, the Directors believe that the Group is

sufficiently funded and that the use of the going concern basis is

appropriate.

Principal risk and uncertainties

A detailed review of the potential risks and uncertainties which

could impact the Group are outlined in the Strategic Report of the

Group's annual consolidated financial statements. The Group

identified its key risks at the end of 2021 as being:

-- oil price volatility;

-- access to capital;

-- joint venture partner alignment; and

-- failure of joint venture partners to secure the requisite

funding to allow a Sea Lion Final Investment Decision.

In 2020, the environmental impact of oil and gas extraction

(e.g., climate change) was added to the risk register, reflecting

the increased focus on ESG issues which could have an adverse

impact on investor and lender sentiment towards the Group and the

Sea Lion project.

CONDENSED CONSOLIDATED income statement

for the six months ended 30 June 2022

Six months Six months

Ended Ended

30 June 30 June

2022 2021

Unaudited Unaudited

Notes $'000 $'000

------------------------------------------- ------ ----------- -----------

Revenue 2 523 347

------------------------------------------- ------ ----------- -----------

Other cost of sales (803) (571)

Depreciation and impairment of oil

and gas assets - (440)

Total cost of sales (803) (1,011)

------------------------------------------- ------ ----------- -----------

Gross loss (280) (664)

Exploration and evaluation expenses - (131)

Administrative expenses (1,461) (1,578)

Charge for share based payments (314) (637)

Foreign exchange movement 3,356 (262)

------------------------------------------- ------ ----------- -----------

Results from operating activities and

other income 1,301 (3,272)

Finance income 2 3

Finance expense (2,052) (32)

------------------------------------------- ------ ----------- -----------

Loss before tax (749) (3,301)

Tax 3 - -

------------------------------------------- ------ ----------- -----------

Loss for the period attributable to

the equity shareholders of the parent

company (749) (3,301)

------------------------------------------- ------ ----------- -----------

Loss per share attributable to the equity

shareholders of the parent company:

cents

------------------------------------------- --------------------------------

Basic 4 (0.16) (0.72)

Diluted 4 (0.16) (0.72)

------------------------------------------- ------ ----------- -----------

CONDENSED CONSOLIDATED statement of comprehensive income

for the six months ended 30 June 2022

Six months Six months

Ended Ended

30 June 30 June

2022 2021

Unaudited Unaudited

Notes $'000 $'000

--------------------------------------- ------- ----------- -----------

Loss for the period (749) (3,301)

Exchange differences on translation

of foreign operations 2,350 394

------------------------------------------------ ----------- -----------

TOTAL COMPREHENSIVE PROFIT/(Loss) FOR

THE period 1,601 (2,907)

------------------------------------------------ ----------- -----------

CONDENSED CONSOLIDATED balance sheet

as at 30 June 2022

As at As at

30 June 31 December

2022 2021

Unaudited Audited

----------------------------------------- ------ ---------- ------------

Notes $'000 $'000

NON CURRENT Assets

Exploration and evaluation assets 5 250,354 249,583

Property, plant and equipment 6 132 201

Finance lease receivable 554 730

CURRENT Assets

Other receivables 2,204 2,074

Finance lease receivable 259 288

Restricted cash 521 579

Cash and cash equivalents 9,082 4,822

Total assets 263,106 258,277

----------------------------------------- ------ ---------- ------------

CURRENT Liabilities

Other payables 3,698 2,000

Lease liability 235 286

NON-CURRENT Liabilities

Lease liability 552 842

Tax payable 7 40,701 43,204

Provisions 17,317 18,287

Deferred tax liability 39,137 39,137

----------------------------------------- ------ ---------- ------------

Total liabilities 101,640 103,756

----------------------------------------- ------ ---------- ------------

Equity

Share capital 8,223 7,218

Share premium 3,742 3,622

Share based remuneration 3,261 4,327

Owns shares held in trust (3,342) (3,342)

Merger reserve 78,237 74,332

Foreign currency translation reserve (7,332) (9,682)

Special reserve 175,281 175,281

Retained losses (96,604) (97,235)

----------------------------------------- ------ ---------- ------------

Attributable to the equity shareholders

of the company 161,466 154,521

----------------------------------------- ------ ---------- ------------

Total liabilities and equity 263,106 258,277

----------------------------------------- ------ ---------- ------------

These condensed consolidated interim financial statements were

approved by the directors and authorised for issue on 28 September

2022 and are signed on their behalf by:

Samuel Moody

Chief Executive Officer

CONDENSED CONSOLIDATED statement of changes in equity

for the six months ended 30 June 2022

Foreign

Shares currency

Share Share Share held Merger translation Special Retained Total

based

capital Premium remuneration in trust reserve reserve reserve losses Equity

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

----------------- -------- -------- ------------- --------- -------- ------------ -------- --------- --------

Balance

at 31 December

2021 7,218 3,622 4,327 (3,342) 74,332 (9,682) 175,281 (97,235) 154,521

Loss for

the year - - - - - - - (749) (749)

Other

comprehensive

profit

for the

year - - - - - 2,350 - - 2,350

----------------- -------- -------- ------------- --------- -------- ------------ -------- --------- --------

Total

comprehensive

loss for

the year - - - - - 2,350 - (749) 1,601

Shares

issued

in placing 1,005 120 - - 3,905 - - - 5,030

Share based

payments - - 314 - - - - - 314

Other transfers - - (1,380) - - - - 1,380 -

Balance

at 30 June

2022 8,223 3,742 3,261 (3,342) 78,237 (7,332) 175,281 (96,604) 161,466

----------------- -------- -------- ------------- --------- -------- ------------ -------- --------- --------

for the six months ended 30 June 2021

Foreign

Shares currency

Share Share Share held Merger translation Special Retained Total

based

capital Premium remuneration in reserve reserve reserve losses Equity

trust

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

--------------- -------- -------- ------------- -------- -------- ------------ -------- ---------- ----------

Balance

at 31

December

2020 7,218 3,622 5,973 (3,342) 74,332 (10,571) 188,028 (104,693) 160,567

Loss for

the year - - - - - - - (3,301) (3,301)

Other

comprehensive

profit

for the

year - - - - - 394 - - 394

--------------- -------- -------- ------------- -------- -------- ------------ -------- ---------- ----------

Total

comprehensive

loss for

the year - - - - - 394 - (3,301) (2,907)

Share based

payments - - 637 - - - - - 637

Other

transfers - - (2,261) - - - - 2,261 -

Balance

at 30 June

2021 7,218 3,622 4,349 (3,342) 74,332 (10,177) 188,028 (105,733) 158,297

--------------- -------- -------- ------------- -------- -------- ------------ -------- ---------- ----------

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHSED 30 JUNE 2022

Six months Six months

Ended Ended

30 June 30 June

2022 2021

Unaudited Unaudited

Notes $'000 $'000

------------------------------------------------ ------- ----------- -----------

Cash flows from operating activities

Net loss before tax (749) (3,301)

Adjustments to reconcile net losses

to cash:

Depreciation 64 654

Share based payment charge 314 637

Finance expense 2,050 31

Finance income (1) (1)

Foreign exchange (4,213) 208

--------------------------------------------------------- ----------- -----------

Operating cash flows before movements

in working capital (2,535) (1,772)

Changes in:

Other receivables 1,053 682

Payables 600 (728)

Cash utilised by operating activities (882) (1,815)

--------------------------------------------------------- ----------- -----------

Cash Flows from investing activities

Capitalised expenditure on exploration

and evaluation assets (877) (2,395)

Purchase of property, plant and equipment - (24)

Interest - 1

Cash flow from investing activities (877) (2,418)

--------------------------------------------------------- ----------- -----------

Cash flows from financing activities

Net proceeds of share placing and subscription 6,280 -

Lease liability payments (133) (327)

Finance paid - (3)

--------------------------------------------------------- ----------- -----------

Cash flow from financing activities 6,147 (330)

--------------------------------------------------------- ----------- -----------

Currency translation differences relating

to cash and cash equivalents (128) (24)

Net cash outflow 4,388 (4,563)

Cash and cash equivalents brought forward 4,822 11,680

--------------------------------------------------------- ----------- -----------

Cash and cash equivalents carried forward 9,082 7,093

--------------------------------------------------------- ----------- -----------

Notes to the condensed CONSOLIDATED group financial

statements

for the six months ended 30 June 2022

1 Accounting policies

1.1 Group and its operations

Rockhopper Exploration plc ("the Company"), a public limited

company quoted on AIM, incorporated and domiciled in the United

Kingdom ("UK"), together with its subsidiaries (collectively, "the

Group") holds interests in the Falkland Islands and the Greater

Mediterranean. T he Company's registered office address is Warner

House, 123 Castle Street, Salisbury, SP1 3TB.

The interim condensed consolidated financial statements for the

six months ended 30 June 2022 were authorised for issue in

accordance with a resolution of the directors on 28 September

2022.

1.2 Statement of compliance and basis of preparation

The interim condensed consolidated financial statements for the

six months ended 30 June 2022 have been prepared in accordance with

IAS 34 Interim Financial Reporting.

The Group has prepared the financial statements on the basis

that it will continue to operate as a going concern. The Directors

consider that there are no material uncertainties that may cast

significant doubt over this assumption. They have formed a

judgement that there is a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future, and not less than 12 months from the end of the

reporting period.

The interim condensed consolidated financial statements do not

include all the information and disclosures required in the annual

financial statements, and should be read in conjunction with the

Group's annual consolidated financial statements as at 31 December

2021.

1.3 New standards, interpretations and amendments adopted by the

Group

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the Group's annual

consolidated financial statements for the year ended 31 December

2021, except for the adoption of new standards effective as of 1

January 2022. The Group has not early adopted any standard,

interpretation or amendment that has been issued but is not yet

effective. Several amendments apply for the first time in 2022, but

do not have an impact on the interim condensed consolidated

financial statements of the Group.

1.4 Period end exchange rates

The period end rates of exchange actually used were:

30 June 2022 30 June 2021 31 December

2021

----------- ------------- ------------- ------------

GBP : US$ 1.21 1.38 1.35

EUR : US$ 1.05 1.19 1.13

----------- ------------- ------------- ------------

2 Revenue and segmental information

Six months ended 30 June 2022 (unaudited)

Falkland Greater

Islands Mediterranean Corporate Total

$'000 $'000 $'000 $'000

-------------------------------- --------- -------------- ---------- ----------

Revenue - 523 - 523

Cost of sales - (803) - (803)

-------------------------------- --------- -------------- ---------- ----------

Gross profit/(loss) - (280) - (280)

Administrative expenses - (332) (1,129) (1,461)

Charge for share based

payments - - (314) (314)

Foreign exchange movement 4,368 - (1,012) 3,356

-------------------------------- --------- -------------- ---------- ----------

Results from operating

activities and other income 4,368 (612) (2,455) (1,301)

Finance income - - 2 2

Finance expense (1,904) (140) (8) (2,052)

-------------------------------- --------- -------------- ---------- ----------

Loss before tax 2,464 (752) (2,461) (749)

Tax - - - -

-------------------------------- --------- -------------- ---------- ----------

Loss for period 2,464 (752) (2,461) (749)

-------------------------------- --------- -------------- ---------- ----------

Reporting segments assets 249,988 2,298 10,820 263,106

Reporting segments liabilities (83,878) (14,430) (3,332) (101,640)

There are no material additions to segment assets.

Six months ended 30 June 2021 (unaudited)

Falkland Greater

Islands Mediterranean Corporate Total

$'000 $'000 $'000 $'000

-------------------------------- --------- -------------- ---------- ---------

Revenue - 347 - 347

Cost of sales - (1,011) - (1,011)

-------------------------------- --------- -------------- ---------- ---------

Gross profit/(loss) - (664) - (664)

Exploration and evaluation

expenses - (4) (127) (131)

Administrative expenses - (412) (1,166) (1,578)

Charge for share based

payments - - (637) (637)

Foreign exchange movement (270) - 8 (262)

-------------------------------- --------- -------------- ---------- ---------

Results from operating

activities and other income (270) (1,080) (1,922) (3,272)

Finance income - 1 2 3

Finance expense - (3) (29) (32)

-------------------------------- --------- -------------- ---------- ---------

Loss before tax (270) (1,082) (1,949) (3,301)

Tax - - - -

-------------------------------- --------- -------------- ---------- ---------

Loss for period (270) (1,082) (1,949) (3,301)

-------------------------------- --------- -------------- ---------- ---------

Reporting segments assets 244,213 3,120 8,745 256,078

Reporting segments liabilities (80,110) (15,235) (2,436) (97,781)

There are no material additions to segment assets.

All of the Group's worldwide sales revenues of oil and gas

US$523 thousand (H1 2021: US$347 thousand) arose from contracts to

customers. Total revenue relates to revenue from one customer

(2021: one customer).

3 Taxation

Six months Six months

ended ended

30 June 30 June

2022 2021

$'000 $'000

Unaudited Unaudited

--------------------------------------- ----------- -----------

Current tax:

Overseas tax - -

Adjustment in respect of prior periods - -

--------------------------------------- ----------- -----------

Total current tax - -

--------------------------------------- ----------- -----------

Deferred tax:

Overseas tax - -

--------------------------------------- ----------- -----------

Total deferred tax - -

--------------------------------------- ----------- -----------

Tax on ordinary activities - -

--------------------------------------- ----------- -----------

4 Basic and diluted loss per share

Six months Six months

ended ended

30 June 30 June

2022 2021

Number Number

Unaudited Unaudited

-------------------------------------------- ------------ ------------

Shares in issue brought forward 458,482,117 458,482,117

Shares issued

- Issued 82,182,776 -

-------------------------------------------- ------------ ------------

Shares in issue carried forward 540,664,893 458,482,117

-------------------------------------------- ------------ ------------

Weighted average of Ordinary Shares 463,476,650 458,482,117

Shares held in Employee Benefit Trust (3,131,000) (3,131,000)

-------------------------------------------- ------------ ------------

Weighted average number of Ordinary

Shares for the purposes of basic earnings

per share 460,345,650 455,351,117

-------------------------------------------- ------------ ------------

$'000 $'000 $'000

-------------------------------------------- ------------ ------------

Net loss after tax for purposes of basic

and diluted earnings per share (749) (3,301)

-------------------------------------------- ------------ ------------

Earnings per share - cents

Basic (0.16) (0.72)

Diluted (0.16) (0.72)

-------------------------------------------- ------------ ------------

Shares issued in the period all relate to the Placing and

Subscription completed just prior to the period end. Numbers do not

reflect shares issued as part of the Open Offer as this complete

post period end. Details of the Open Offer are included in Note

8.

The weighted average number of Ordinary Shares takes into

account those shares which are treated as own shares held in trust.

As at the period end the Group had 3,131,000 Ordinary shares held

in an Employee Benefit Trust which have been purchased to settle

future exercises of options. As the Group is reporting a loss in

the year then in accordance with IAS33 the share options are not

considered dilutive because the exercise of the share options would

have the effect of reducing the loss per share.

At the period end, the Group had the following unexercised

options and share appreciation rights in issue.

Six months

ended

30 June

2022

Number

Unaudited

--------------------------- -----------

Long term incentive plan 7,132,537

Share appreciation rights 277,162

Share options 23,694,588

Warrants 41,091,388

---------------------------- -----------

Warrants were issued as part of the Placing. Each Warrant gives

the holder the right to subscribe for one new Ordinary Share at a

price of 9 pence per Ordinary Share at any time from the issue of

the Warrants up to (and including) 5.00 p.m. on 31 December

2023.

Additional Warrants were issued after the period end as part of

the Open Offer. Details of the number of warrants issued post

period end are included in note 8. These warrants have the same

exercise terms as those issued as part of the Placing.

5 Intangible exploration and evaluation assets

During the period there have not been any material additions.

The balance carried forward is predominantly in relation to the Sea

Lion project.

At 30 June 2022, the Group reviewed its intangible

exploration/appraisal assets for indicators of impairment, with no

indicators of impairment being identified. No impairment tests were

therefore performed.

6 Property, plant and equipment

During the period there have not been any material additions.

The movement in the period mainly relates to depreciation.

7 Tax payable

Six months Year

ended ended

30 June 31 December

2022 2021

$'000 $'000

Unaudited Audited

------------------------- ----------- ------------

Current tax payable - -

Non current tax payable 40,701 43,204

-------------------------- ----------- ------------

40,701 43,204

------------------------- ----------- ------------

On the 8 April 2015, the Group agreed binding documentation

("Tax Settlement Deed") with FIG in relation to the tax arising

from the Group's farm-out to Premier.

The Tax Settlement Deed confirms the quantum and deferment of

the outstanding tax liability and is made under Extra Statutory

Concession 16.

As a result of the Tax Settlement Deed the outstanding tax

liability is confirmed at GBP59.6 million and payable on the

earlier of: (i) the first royalty payment date on Sea Lion; (ii)

the date of which Rockhopper disposes of all or a substantial part

of the Group's remaining licence interests in the North Falkland

Basin; or (iii) a change of control of Rockhopper Exploration

plc.

Management in reviewing the carrying value of the tax liability

have had to make key judgements about both the timing of the

liability and the discount rate applied. Management believe the

most likely timing of payment is in line with the first royalty

payment. As such the tax liability has been classified as a non

current liability and has been discounted. At the period end

payment is anticipated to be in 5.0 years (31 December 2021: 5.5

years) and a discount rate of 12% (31 December 2021: 12%) has been

applied.

As completion of the Transaction happened post period end, no

adjustments were made to the liability in relation to this. Based

on correspondence with FIG, Management does not believe that the

Transactions completion would constitute a substantial disposal

under the Tax Settlement Deed and therefore will not accelerate any

liability.

The movement in the balance in the period is made up of a

finance expense of US$1.8 million offset by a foreign exchange gain

of US$4.4 million.

8 Post balance sheet events

Results of Open Offer

On 5 July 2022, the Company announced it had received valid

acceptances from Qualifying Shareholders in respect of 39,652,160

Open Offer Units, representing a take-up of over 69 per cent. of

the 57,310,264 available Open Offer Units. Accordingly, the Open

Offer has raised total gross proceeds of approximately US$3.4

million (GBP2.8 million).

Each Open Offer Unit subscribed for comprises one Open Offer

Share and, for every two Open Offer Shares subscribed for, one

Warrant. Accordingly, 39,652,160 Open Offer Shares and 19,825,849

Open Offer Warrants will be issued pursuant to the Open Offer.

Successful arbitration outcome

On 24 August 2022, the Company provided the following update on

its ICSID arbitration with the Republic of Italy:

-- Successful arbitration award

-- Compensation of EUR190 million

-- Plus interest at EURIBOR + 4%, compounded annually from 29 January 2016 until time of payment

-- Temporary four-month pause in interest from date of award

The arbitration panel unanimously held that Italy had breached

its obligations under the Energy Charter Treaty entitling

Rockhopper to compensation. The award is final and binding on the

parties. Italy has 120 days to apply for an annulment of the award,

which can only be annulled in limited circumstances. Under a legal

agreement with the Falkland Island Government Rockhopper is

prevented from making any form of distribution.

Costs associated with the arbitration proceedings were funded on

a non-recourse ("no win - no fee") basis from a specialist

arbitration funder. After payments due to the arbitration funder

and success fees due to the Group's legal representation,

Rockhopper expects to retain approximately 80% of the award

(assuming full recovery of the award). Further analysis is required

to establish the tax treatment on any payments related to the

award.

Transaction

On 23 September 2022 the Company announced the transaction

enabling Harbour to exit and Navitas to enter the North Falkland

Basin with a 65% stake in, and operatorship of, all of Rockhopper's

North Falkland Basin licences, has completed.

9 Related party transactions

Pursuant to the Subscription, the following Directors subscribed

for the following Units comprising Subscription Shares and

Warrants

Director Number of Number of Resultant Percentage Number of

Ordinary Shares Subscription shareholding of Ordinary Warrants held

held before Shares being after the Shares at after the

the Subscription subscribed for Subscription 30 June 2022 Subscription

Keith Lough 228,515 428,570 657,085 0.12% 214,285

Alison Baker 70,000 142,856 212,856 0.04% 71,428

John Summers 318,329 142,856 461,185 0.09% 71,428

Sam Moody 2,570,729 1,428,570 3,999,299 0.74% 714,285

Total 2,142,852

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KVLFLLKLFBBB

(END) Dow Jones Newswires

September 29, 2022 02:00 ET (06:00 GMT)

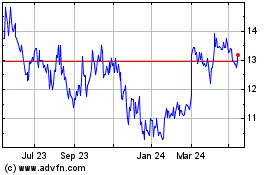

Rockhopper Exploration (LSE:RKH)

Historical Stock Chart

From Dec 2024 to Jan 2025

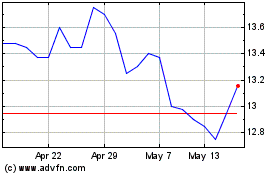

Rockhopper Exploration (LSE:RKH)

Historical Stock Chart

From Jan 2024 to Jan 2025