Pelatro Shares Drop After Profit Warning on Currency Costs

December 01 2022 - 4:42AM

Dow Jones News

By Elena Vardon

Shares in Pelatro PLC fell 30% on Thursday after the company

said its full-year Ebitda will be slightly below market

expectations due to currency fluctuations as well as some contract

delays that will be pushed into 2023.

The marketing software specialist said it expects revenue to be

between $700,000 and $800,000 lower in 2022 due to the weakened

Indian Rupee compared with the U.S. dollar.

This, as well as higher costs, will subsequently lead to

earnings before interest, taxes, depreciation and amortization for

2022 slightly missing market forecasts.

Pelatro also said it is likely to close the year with just under

$6 million in annual recurring revenue as some customers wish to

transfer to a license model, for which revenue is recognized in the

year of agreement.

Shares at 0856 GMT were down 6.0 pence at 13.75 pence.

Write to Elena Vardon at elena.vardon@wsj.com

(END) Dow Jones Newswires

December 01, 2022 04:27 ET (09:27 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

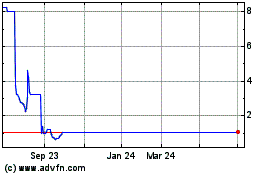

Pelatro (LSE:PTRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

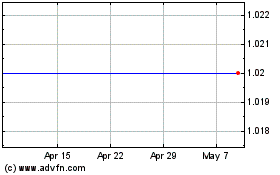

Pelatro (LSE:PTRO)

Historical Stock Chart

From Nov 2023 to Nov 2024