Premier Miton Group PLC Q3 AuM Update (9943F)

July 14 2023 - 2:00AM

UK Regulatory

TIDMPMI

RNS Number : 9943F

Premier Miton Group PLC

14 July 2023

Premier Miton Group plc

('Premier Miton', 'Group' or the 'Company')

Q3 AuM update

Premier Miton Group plc (AIM: PMI) today provides an update on

its unaudited statement of Assets under Management ('AuM') for the

third quarter of its current financial year (the 'Quarter' or

'Period').

-- GBP10.5 billion closing AuM at 30 June 2023 (31 March 2023: GBP11.0 billion)

-- GBP449 million of net outflows for the Quarter

-- Continued strong relative investment performance, with 81%

(2) of funds in the first or second quartile of their respective

sectors since launch or fund manager tenure

Mike O'Shea, Chief Executive Officer, commented:

" The Group's AuM ended the Quarter at GBP10.5 billion. We saw

outflows from across our fund range as investors retrenched against

a backdrop of higher inflation, higher interest rates and ongoing

market uncertainty. These outflows were principally driven by asset

allocation decisions in the wider market, with investors choosing

to reduce exposure to equities. Fixed income was a positive area,

we saw inflows of GBP175 million, although these were to some

extent offset by outflows of GBP70 million from our money market

fund. Year to date we have seen over GBP500 million of net inflow

into fixed income.

"We continue to focus heavily on building our profile with

advisers and wealth managers through our marketing and distribution

activity. We believe we have a suite of investment products that

will be attractive to investors and their advisers once they return

to having a more positive investment outlook."

Assets under Management:

Quarter

1 & 2 Quarter Year

Opening Quarter Year Market 3 Market to date Closing

AuM Quarter 3 to date / / Market AuM

1 Oct 1 & 2 net net investment investment / investment 30 Jun

2022 net flows flows flows performance performance performance 2023 (1,3)

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Equity

funds 5,631 (360) (458) (818) 366 4 370 5,183

Multi-asset

funds 3,263 (69) (62) (131) 80 (32) 48 3,180

Fixed income

funds 750 380 (13) 367 (2) (3) (5) 1,112

Investment

trusts 519 (2) (34) (36) (4) (24) (28) 455

Segregated

mandates 402 19 118 137 22 (11) 11 550

Total 10,565 (32) (449) (481) 462 (66) 396 10,480

(1) Comprising of 41 open-ended funds, four investment trusts

and two external segregated mandates.

(2) The quartile performance rankings are based on Investment

Association sector classifications where applicable. This covered a

total of 32 open-ended funds since manager inception. Data is

sourced from FE Analytics FinXL using the main representative

post-RDR share class, based on a total return, UK Sterling basis.

All data is as at 30 June 2023 and the performance period relates

to when the fund launched or the assumed tenure of the fund

manager(s).

(3) AuM and net flows are presented after the removal of AuM

invested in other funds managed by the Group. At the Period end

these totalled GBP264 million.

ENDS

For further information, please contact:

Premier Miton Group plc

Mike O'Shea, Chief Executive Officer 01483 306 090

Investec Bank plc (Nominated Adviser and

Broker)

Bruce Garrow / Ben Griffiths / Virginia

Bull / Harry Hargreaves 020 7597 4000

Edelman Smithfield Consultants (Financial

PR) 07785 275665 /

John Kiely / Latika Shah 07950 671948

Notes to editors:

Premier Miton Investors is focused on delivering good investment

outcomes for investors through relevant products and active

management across its range of investment strategies, which include

equity, fixed income, multi-asset and absolute return.

LEI Number: 213800LK2M4CLJ4H2V85

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFSDDTIVLIV

(END) Dow Jones Newswires

July 14, 2023 02:00 ET (06:00 GMT)

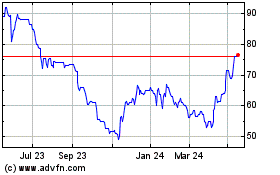

Premier Miton (LSE:PMI)

Historical Stock Chart

From Nov 2024 to Dec 2024

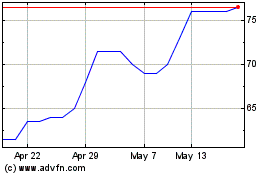

Premier Miton (LSE:PMI)

Historical Stock Chart

From Dec 2023 to Dec 2024