TIDMMXC

RNS Number : 4792Q

MGC Pharmaceuticals Limited

26 February 2021

26 February MGC Pharma

2021 Notice of Meeting and Incentive Share Plan

ASX Code:

MXC

LSE Code:

MXC

MGC Pharmaceuticals Ltd (ASX: MXC, 'MGC' or 'the Company'), is pleased

to provide a copy of its Notice of General Meeting, to be held at 4pm

WST 31 March 2021. Furthermore, in recognition of their contribution

to the Company's success, it intends to issue performance rights under

its proposed "Employee Securities Incentive Plan" ( Plan ) to its officers

and employees in mid-May 2021. The Company will make the offer if shareholders

approve the Company's Incentive Plan (Resolution 5) at the upcoming general

meeting. Shareholder approval will not be sought for the issue of the

performance rights themselves.

The Company has resolved to offer 14,800,000 performance rights in total

which will vest upon the eligible employees having either 18 months of

continuous service to the Company up to 30 June 2021, or if employment

commenced on or after 1 January 2020, continuous service from the relevant

commencement date up to 30 June 2021. None of the employees are related

parties of the Company. The performance rights will otherwise be issued

on terms consistent with the Plan. In addition, there will be 7,200,000

performance rights issued to the Directors of the Company on the same

terms as above. These performance rights to the Directors will be subject

to shareholder approval at a general meeting which will be held at a

later date.

The purpose of the proposed issue of performance rights is to further

align the interests of the recipients with that of the Company and as

a reward for loyalty and performance.

--Ends--

Authorised for release by the Board, for further information

please contact:

MGC Pharmaceuticals Ltd UK PR Advisors - Tavistock

Roby Zomer Charles Vivian

CEO & Managing Director Tim Pearson

+61 8 6382 3390 +44 207 920 3150

info@mgcpharma.com.au mgcpharma@tavistock.co.uk

UK Broker - Turner Pope Australian PR/IR Advisors - Media

Andy Thacker & Capital Partners

Andy.Thacker@TurnerPope.com Rod Hinchcliffe (IR) +61 412 277

Zoe Alexander 377

Zoe.Alexander@TurnerPope.com Rod.Hinchcliffe@mcpartners.com.au

+44 20 3657 0050

About MGC Pharma

MGC Pharmaceuticals Ltd (LSE: MXC, ASX: MXC) is a European based

bio-pharma company developing and supplying affordable standardised

phytocannabinoid derived medicines to patients globally. The

Company's founders were key figures in the global medical cannabis

industry and the core business strategy is to develop and supply

high quality phytocannabinoid derived medicines for the growing

demand in the medical markets in Europe, North America and

Australasia. MGC Pharma has a robust product offering targeting two

widespread medical conditions - epilepsy and dementia - and has

further products in the development pipeline.

Employing its 'Nature to Medicine' strategy, MGC Pharma has

partnered with renowned institutions and academia to optimise

cultivation and the development of targeted phytocannabinoid

derived medicines products prior to production in the Company's

EU-GMP Certified manufacturing facility.

MGC Pharma has a number of research collaborations with world

renowned academic institutions, and including recent research

highlighting the positive impact of using specific phytocannabinoid

formulations developed by MGC Pharma in the treatment of

glioblastoma, the most aggressive and so far therapeutically

resistant primary brain tumour.

MGC Pharma has a growing patient base in Australia, the UK,

Brazil and Ireland and has a global distribution footprint via an

extensive network of commercial partners meaning that it is poised

to supply the global market.

Follow us through our social media channels :

Twitter: @MGC_Pharma

Facebook: @mgcpharmaceuticals

LinkedIn: MGC Pharmaceuticals Ltd.

Instagram: @mgc_pharma

MGC Pharmaceuticals Ltd

ACn 116 800 269

NOTICE OF GENERAL MEETING

Notice is given that the Meeting will be held at:

TIME : 4:00 pm (WST)

DATE : 31 March 2021

PLACE : 1202 Hay Street

WEST PERTH WA 6005

and via Zoom

The business of the Meeting affects your shareholding and your

vote is important.

This Notice of Meeting should be read in its entirety. If Shareholders

are in doubt as to how they should vote, they should seek advice

from their professional advisers prior to voting.

The Directors have determined pursuant to Regulation 7.11.37

of the Corporations Regulations 2001 (Cth) that the persons

eligible to vote at the Meeting are those who are registered

Shareholders at 4:00pm on 29 March 2021.

business of the meeting

AGA

Resolution 1 - ratification of prior issue of LSE PLACEMENT

shares - LIsting Rule 7.1

To consider and, if thought fit, to pass, with or without

amendment, the following resolution as an ordinary resolution:

"That, for the purposes of Listing Rule 7.4 and for all other

purposes, Shareholders ratify the issue of 262,685,890 Shares on

the terms and conditions set out in the Explanatory Statement."

A voting exclusion statement applies to this Resolution. Please

see below.

Resolution 2 - ratification of prior issue of LSE PLACEMENT

shares - Listing RUle 7.1A

To consider and, if thought fit, to pass, with or without

amendment, the following resolution as an ordinary resolution:

"That, for the purposes of Listing Rule 7.4 and for all other

purposes, Shareholders ratify the issue of 177,992,107 Shares on

the terms and conditions set out in the Explanatory Statement."

A voting exclusion statement applies to this Resolution. Please

see below.

Resolution 3 - ratification of prior issue of ADVISER Shares

To consider and, if thought fit, to pass, with or without

amendment, the following resolution as an ordinary resolution:

"That, for the purposes of Listing Rule 7.4 and for all other

purposes, Shareholders ratify the issue of 4,761,905 Adviser Shares

on the terms and conditions set out in the Explanatory

Statement."

A voting exclusion statement applies to this Resolution. Please

see below.

Resolution 4 - APPROVAL TO ISSUE Lead Manager options

To consider and, if thought fit, to pass, with or without

amendment, the following resolution as an ordinary resolution:

"That, for the purposes of Listing Rule 7.1 and for all other

purposes, approval is given for the Company to issue up to

26,440,678 Lead Manager Options on the terms and conditions set out

in the Explanatory Statement."

A voting exclusion statement applies to this Resolution. Please

see below.

resolution 5 - ADOPTION of INCENTIVE PLAN

To consider and, if thought fit, to pass, with or without

amendment, the following resolution as an ordinary resolution:

"That, for the purposes of Listing Rule 7.2 (Exception 13(b))

and for all other purposes, approval is given for the Company to

adopt an employee incentive scheme titled Employee Securities

Incentive Plan and for the issue of Securities under that Incentive

Plan, on the terms and conditions set out in the Explanatory

Statement."

A voting exclusion statement and voting prohibition statement

apply to this Resolution. Please see below.

Dated: 25 February 2021

By order of the Board

Narelle Warren

Joint Company Secretary

Voting Prohibition Statements

Resolution 5 - A person appointed as a proxy must not vote,

Adoption of Incentive on the basis of that appointment, on this Resolution

Plan if:

(a) the proxy is either:

(i) a member of the Key Management Personnel;

or

(ii) a Closely Related Party of such a member;

and

(b) the appointment does not specify the way

the proxy is to vote on this Resolution.

However, the above prohibition does not apply

if:

(a) the proxy is the Chair; and

(b) the appointment expressly authorises the

Chair to exercise the proxy even though this

Resolution is connected directly or indirectly

with remuneration of a member of the Key Management

Personnel.

Voting Exclusion Statements

In accordance with Listing Rule 14.11, the Company will

disregard any votes cast in favour of the resolution set out below

by or on behalf of the following persons:

Resolutions 1 and A person who participated in the issue or is a counterparty

2 - Ratification to the agreement being approved (namely participants in

of prior issue of the LSE Placement) or an associate of that person or those

LSE Placement Shares persons.

Resolution 3 - A person who participated in the issue or is a counterparty

Ratification of to the agreement being approved (namely Shachar Shimony

prior issue of Shares Law Firm) or an associate of that person or those persons.

------------------------------------------------------------

Resolution 4 - A person who is expected to participate in, or who will

Approval to issue obtain a material benefit as a result of, the proposed

Lead Manager Options issue (except a benefit solely by reason of being a holder

of ordinary securities in the Company) Turner Pope or

an associate of that person (or those persons).

------------------------------------------------------------

Resolution 5 - A person who is eligible to participate in the employee

Adoption of Incentive incentive scheme or an associate of that person or those

Plan persons.

------------------------------------------------------------

However, this does not apply to a vote cast in favour of the

Resolution by:

(a) a person as a proxy or attorney for a person who is entitled

to vote on the Resolution, in accordance with the directions given

to the proxy or attorney to vote on the Resolution in that way;

or

(b) the Chair as proxy or attorney for a person who is entitled

to vote on the Resolution, in accordance with a direction given to

the Chair to vote on the Resolution as the Chair decides; or

(c) a holder acting solely in a nominee, trustee, custodial or

other fiduciary capacity on behalf of a beneficiary provided the

following conditions are met:

(i) the beneficiary provides written confirmation to the holder

that the beneficiary is not excluded from voting, and is not an

associate of a person excluded from voting, on the resolution;

and

(ii) the holder votes on the resolution in accordance with

directions given by the beneficiary to the holder to vote in that

way.

Voting by proxy

To vote by proxy, please complete and sign the enclosed Proxy

Form and return by the time and in accordance with the instructions

set out on the Proxy Form.

In accordance with section 249L of the Corporations Act,

Shareholders are advised that:

-- each Shareholder has a right to appoint a proxy;

-- the proxy need not be a Shareholder of the Company; and

-- a Shareholder who is entitled to cast two (2) or more votes

may appoint two (2) proxies and may specify the proportion or

number of votes each proxy is appointed to exercise. If the member

appoints two (2) proxies and the appointment does not specify the

proportion or number of the member's votes, then in accordance with

section 249X(3) of the Corporations Act, each proxy may exercise

one-half of the votes.

Shareholders and their proxies should be aware that:

-- if proxy holders vote, they must cast all directed proxies as directed; and

-- any directed proxies which are not voted will automatically

default to the Chair, who must vote the proxies as directed.

Voting in person

To vote in person, attend the Meeting at the time, date and

place set out above.

Depositary Interest holders

Persons Entitled to Vote

The Form of Instruction must be signed by the depositary

interest holder or an attorney duly authorised in writing and

deposited at the office of the Depositary, Computershare Investor

Services PLC, located at The Pavilions, Bridgewater Road, Bristol

BS99 6ZY by 4.00 pm GMT on the 24(th) of March 2021. Any Form of

Instruction received after that time will not be valid for the

Meeting.

CREST Voting

Holders of Depositary Interests in CREST may transmit voting

instructions by utilising the CREST voting service in accordance

with the procedures described in the CREST Manual. CREST personal

members or other CREST sponsored members, and those CREST members

who have appointed a voting service provider, should refer to their

CREST sponsor or voting service provider, who will be able to take

appropriate action on their behalf.

In order for instructions made using the CREST voting service to

be valid, the appropriate CREST message (a "CREST Voting

Instruction") must be properly authenticated in accordance with

Euroclear's specifications and must contain the information

required for such instructions, as described in the CREST

Manual (available via www.euroclear.com ).

To be effective, the CREST Voting Instruction must be

transmitted so as to be received by the Company's agent (3RA50) no

later than 4.00 p.m. (GMT) on 24(th) March 2021.

For this purpose, the time of receipt will be taken to be the

time (as determined by the timestamp applied to the CREST Voting

Instruction by the CREST applications host) from which the

Company's agent is able to retrieve the CREST Voting Instruction by

enquiry to CREST in the manner prescribed by CREST. Holders of

Depositary Interests in CREST and, where applicable, their CREST

sponsors or voting service providers should note that Euroclear

does not make available special procedures in CREST for any

particular messages. Normal system timings and limitations will

therefore apply in relation to the transmission of CREST Voting

Instructions. It is the responsibility of the Depositary Interest

holder concerned to take (or, if the Depositary Interest holder is

a CREST personal member or sponsored member or has appointed a

voting service provider, to procure that the CREST sponsor or

voting service provider takes) such action as shall be necessary to

ensure that a CREST Voting Instruction is transmitted by means of

the CREST voting service by any particular time. In this

connection, Depositary Interest holders and, where applicable,

their CREST sponsors or voting service providers are referred, in

particular, to those sections of the CREST Manual concerning

practical limitations of the CREST system and timings.

Should you wish to discuss the matters in this Notice of Meeting

please do not hesitate to contact the Company Secretary on +61 8

6382 3390.

EXPLANATORY STATEMENT

This Explanatory Statement has been prepared to provide

information which the Directors believe to be material to

Shareholders in deciding whether or not to pass the

Resolutions.

1. Resolutions 1 and 2 - ratification of prior issue of LSE

PLACEMENT Shares - Listing Rules 7.1 and 7.1A

General

The Company was admitted to the London Stock Exchange (LSE) on 9

February 2021 following completion of a strongly supported GBP6.5

million (approximately A$12 million) share placement to

institutional and professional investors (LSE Placement) through

the issue of 440,677,967 Shares at an issue price of GBP0.01475 per

Share (approximately A$0.0266 per Share) (LSE Placement

Shares).

262,685,860 Shares were issued pursuant to the Company's

capacity under Listing Rule 7.1 (the subject of Resolution 1 ) and

177,992,107 Shares were issued pursuant to the Company's 7.1A

mandate (the subject of Resolution 2 ). The Company's 7.1A mandate

was approved by Shareholders at the annual general meeting held on

4 November 2020.

The Company engaged the services of Turner Pope Investments

(TPI) Limited (an entity incorporated in the United Kingdom)

(Turner Pope) to act in the capacity of Sole and Exclusive Lead

Manager and Bookrunner in relation to the issue of the LSE

Placement Shares. Further details of the Company's arrangement with

Turner Pope in respect of the LSE Placement are set out in Section

3.2 .

Listing Rules 7.1 and 7.1A

Broadly speaking, and subject to a number of exceptions, Listing

Rule 7.1 limits the amount of equity securities that a listed

company can issue without the approval of its shareholders over any

12-month period to 15% of the fully paid ordinary securities it had

on issue at the start of that 12 month period.

Under Listing Rule 7.1A however, an eligible entity can seek

approval from its members, by way of a special resolution passed at

its annual general meeting, to increase this 15% limit by an extra

10% to 25%.

The Company obtained approval to increase its limit to 25% at

the annual general meeting held on 4 November 2020.

The issue of the LSE Placement Shares does not fit within any of

the exceptions set out in Listing Rule 7.2 and, as it has not yet

been approved by Shareholders, it effectively uses up part of the

25% limit in Listing Rules 7.1 and 7.1A, reducing the Company's

capacity to issue further equity securities without Shareholder

approval under Listing Rule 7.1 and 7.1A for the 12-month period

following the date of issue of the LSE Placement Shares.

Listing Rule 7.4

Listing Rule 7.4 allows the shareholders of a listed company to

approve an issue of equity securities after it has been made or

agreed to be made. If they do, the issue is taken to have been

approved under Listing Rule 7.1 and so does not reduce the

company's capacity to issue further equity securities without

shareholder approval under that rule.

The Company wishes to retain as much flexibility as possible to

issue additional equity securities in the future without having to

obtain Shareholder approval for such issues under Listing Rule 7.1.

Accordingly, the Company is seeking Shareholder ratification

pursuant to Listing Rule 7.4 for the issue of the LSE Placement

Shares.

Resolutions 1 and 2 seek Shareholder ratification pursuant to

Listing Rule 7.4 for the issue of the LSE Placement Shares.

Technical information required by Listing Rule 14.1A

If Resolutions 1 and 2 are passed, the LSE Placement Shares will

be excluded in calculating the Company's combined 25% limit in

Listing Rules 7.1 and 7.1A, effectively increasing the number of

equity securities the Company can issue without Shareholder

approval over the 12 month period following the date of issue of

the LSE Placement Shares.

If Resolutions 1 and 2 are not passed, the LSE Placement Shares

will be included in calculating the Company's combined 25% limit in

Listing Rules 7.1 and 7.1A, effectively decreasing the number of

equity securities the Company can issue without Shareholder

approval over the 12 month period following the date of issue of

the LSE Placement Shares.

Technical information required by Listing Rule 7.5

Pursuant to and in accordance with Listing Rule 7.5, the

following information is provided in relation to Resolutions 1 and

2 :

the LSE Placement Shares were issued to institutional,

professional and sophisticated investors who are clients of Turner

Pope. The recipients were identified through a bookbuild process,

which involved Turner Pope seeking expressions of interest to

participate in the capital raising from non-related parties of the

Company;

in accordance with paragraph 7.4 of ASX Guidance Note 21, the

Company confirms that none of the recipients were:

related parties of the Company, members of the Company's Key

Management Personnel, substantial holders of the Company, advisers

of the Company or an associate of any of these parties; and

issued more than 1% of the issued capital of the Company;

the LSE Placement Shares were issued on the following basis:

262,685,860 Shares issued pursuant to Listing Rule 7.1

(ratification of which is sought under Resolution 1 ); and

177,992,107 Shares issued pursuant to Listing Rule 7.1A

(ratification of which is sought under Resolution 2 );

the LSE Placement Shares issued were all fully paid ordinary

shares in the capital of the Company issued on the same terms and

conditions as the Company's existing Shares;

the LSE Placement Shares were issued on 10 February 2021;

the issue price was GBP0.01475 (approximately A$0.0266 based on

the GBP/AUD exchange rate on 23 February 2021) per LSE Placement

Share under both the issue of Shares pursuant to Listing Rule 7.1

and Listing Rule 7.1A. The Company has not and will not receive any

other consideration for the issue of the LSE Placement Shares;

the purpose of the issue of the LSE Placement Shares was to

raise approximately $12,000,000, which will be applied towards,

among other things:

meeting the costs associated with a Phase III clinical trial of

ArtemiC(TM).

meeting the costs associated with a Phase IIb clinical trial of

CannEpil(R).

increase distribution of the Group's product range and expansion

into new key markets to drive sales growth and future revenue,

including Brazil and major EU countries;

meet the registration costs for ArtemiC(TM) in new markets,

including Russia, the Middle East and Europe; and

for general working capital purposes, including completing

construction of the Group's proposed manufacturing facilities in

Malta.

the LSE Placement Shares were not issued under an agreement.

Resolution 3 - ratification of prior issue of Adviser Shares

General

On 24 November 2020, the Company issued 4,761,905 Shares to

Shachar Shimony Law Firm in consideration for legal work completed

and services provided to the Company in relation to the ArtemiC(TM)

licensing deal in 2020 (Adviser Shares).

As summarised in Section 1.2 above, Listing Rule 7.1 limits the

amount of equity securities that a listed company can issue without

the approval of its shareholders over any 12-month period to 15% of

the fully paid ordinary securities it had on issue at the start of

that 12 month period.

Under Listing Rule 7.1A, an eligible entity can seek approval

from its members, by way of a special resolution passed at its

annual general meeting, to increase this 15% limit by an extra 10%

to 25%.

The Company obtained approval to increase its limit to 25% at

the annual general meeting held on 4 November 2020.

The issue of the Adviser Shares does not fit within any of the

exceptions set out in Listing Rule 7.2 and, as it has not yet been

approved by Shareholders, it effectively uses up part of the 15%

limit in Listing Rule 7.1, reducing the Company's capacity to issue

further equity securities without Shareholder approval under

Listing Rule 7.1 for the 12-month period following the date of

issue of the Adviser Shares.

Listing Rule 7.4 allows the shareholders of a listed company to

approve an issue of equity securities after it has been made or

agreed to be made. If they do, the issue is taken to have been

approved under Listing Rule 7.1 and so does not reduce the

company's capacity to issue further equity securities without

shareholder approval under that rule.

The Company wishes to retain as much flexibility as possible to

issue additional equity securities in the future without having to

obtain Shareholder approval for such issues under Listing Rule 7.1.

Accordingly, the Company is seeking Shareholder ratification

pursuant to Listing Rule 7.4 for the issue of the Adviser

Shares.

Resolution 3 seeks Shareholder ratification pursuant to Listing

Rule 7.4 for the issue of the Adviser Shares.

Technical information required by Listing Rule 14.1A

If Resolution 3 is passed, the Adviser Shares will be excluded

in calculating the Company's combined 25% limit in Listing Rules

7.1 and 7.1A, effectively increasing the number of equity

securities the Company can issue without Shareholder approval over

the 12-month period following the date of issue of the Adviser

Shares.

If Resolution 3 is not passed, the Adviser Shares will be

included in calculating the Company's combined 25% limit in Listing

Rules 7.1 and 7.1A, effectively decreasing the number of equity

securities that the Company can issue without Shareholder approval

over the 12-month period following the date of issue of the Adviser

Shares.

Technical information required by Listing Rule 7.5

Pursuant to and in accordance with Listing Rule 7.5, the

following information is provided in relation to Resolution 3 :

the Adviser Shares were issued to Shachar Shimony Law Firm;

in accordance with paragraph 7.4 of ASX Guidance Note 21, the

Company confirms that none of the recipients were:

related parties of the Company, members of the Company's Key

Management Personnel, substantial holders of the Company, advisers

of the Company or an associate of any of these parties; and

issued more than 1% of the issued capital of the Company;

4,761,905 Adviser Shares were issued and the Adviser Shares

issued were all fully paid ordinary shares in the capital of the

Company issued on the same terms and conditions as the Company's

existing Shares;

the Adviser Shares were issued on 24 November 2020;

the Adviser Shares were issued at a nil issue price, in

consideration for legal work completed and introductory services

provided to the Company in relation to the ArtemiC(TM) licensing

deal in 2020 (at a deemed issue price of $0.021 per Adviser Share).

The Company has not and will not receive any other consideration

for the issue of the Adviser Shares;

the purpose of the issue of the Adviser Shares was to satisfy

amounts owing to $100,000 based off the 10 day volume weighted

average price on the date agreed, prior to issue; and

the Adviser Shares were not issued under an agreement.

Resolution 4 - APPROVAL TO ISSUE Lead Manager Options

Lead Manager Mandate and Option Agreement

On 3 February 2021, the Company and Turner Pope entered into a

placing agreement (Lead Manager Mandate), pursuant to which Turner

Pope agreed to use reasonable endeavours to procure subscribers for

Shares under the LSE Placement.

In consideration of Turner Pope's services under the Lead

Manager Mandate, the Company has agreed to pay Turner Pope the

following, plus VAT (if any) and disbursements (as well as any

reasonable out of pocket expenses incurred):

a fee of GBP10,000;

a cash commission equal to 6% of the aggregate amount raised by

Turner Pope under the LSE Placement;

a fee of 1% of the aggregate amount raised by third parties

(including the Directors) under the LSE Placement; and

the issue of options which equal 6% of the gross aggregate value

of the Shares issued pursuant to the LSE Placement (valued at the

issue price of the LSE Placement Shares), exercisable at the LSE

Placement Share issue price (i.e. GBP0.01475 each equivalent to

(approximately A$0.0266 based on the GBP/AUD exchange rate on 23

February 2021) (Lead Manager Options).

The Company notes that as a result of the significant increase

to the Company's Share price ($0.105 per Share as at the close of

trading on 23 February 2021) the Lead Manager Options are now "in

the money" and if the Lead Manager chose to exercise the Lead

Manager Options, the Lead Manager would receive Shares at a 74.67%

discount to the current market price of the Shares.

In addition, the Company has entered into an agreement with

Turner Pope for the issue of the Lead Manager Options (Option

Agreement). The Option Agreement sets out the terms and conditions

of the Lead Manager Options (set out at Schedule 1 ) will be issued

on, subject to the following conditions precedent:

(a) that the Company obtain Shareholder approval for the grant

of the Lead Manager Options (and the issue of any Shares arising

from the exercise of the Lead Manager Options) at its next general

meeting; and

(b) the LSE Placement Shares being admitted to official list of

financial conduct authority and to commence trading on the main

market for listed securities of the LSE by no later than 19

February 2021.

The Company notes that, as announced on 10 February 2021, the

Company has issued the LSE Placement Shares and commenced trading

on the LSE prior to 19 February 2021, satisfying the condition to

the Option Agreement set out in paragraph (b) above.

Accordingly, the Company is seeking Shareholder approval for the

issue of the Lead Manager Options for the purpose of, among other

reasons, satisfying the remaining condition to the Option Agreement

set out in paragraph (a) above.

General

Pursuant to the terms of the Lead Manager Mandate, the Company

is proposing to issue 26,440,678 Lead Manager Options the subject

of Resolution 5 to Turner Pope as part consideration for lead

manager services provided in connection with the LSE Placement

(Lead Manager Options).

As summarised in Section 1.2 above, Listing Rule 7.1 limits the

amount of equity securities that a listed company can issue without

the approval of its shareholders over any 12 month period to 15% of

the fully paid ordinary shares it had on issue at the start of that

period.

The proposed issue of the Lead Manager Options does not fit

within any of the exceptions set out in Listing Rule 7.2. While the

issue does not exceed the 15% limit in Listing Rule 7.1 and can

therefore be made without breaching that rule, the Company wishes

to retain as much flexibility as possible to issue additional

equity securities in the future without having to obtain

Shareholder approval under Listing Rule 7.1. Accordingly, the

Company is seeking Shareholder approval pursuant to Listing Rule

7.1 so that it does not use up any of its 15% placement capacity

under Listing Rule 7.1.

Technical information required by Listing Rule 14.1A

If Resolution 4 is passed, the Company will be able to proceed

with the issue of the Lead Manager Options. In addition, the issue

of the Lead Manager Options will be excluded from the calculation

of the number of equity securities that the Company can issue

without Shareholder approval under Listing Rule 7.1.

If Resolution 4 is not passed, the Company will not be able to

proceed with the issue of the Lead Manager Options as Shareholder

approval is a condition precedent to their issue pursuant to the

Option Agreement. In the event that Resolution 4 does not receive

Shareholder approval, the Company and the Lead Manager will make

alternative arrangements to satisfy the Company's obligations under

the Lead Manager Mandate in respect of consideration, which may

involve a cash payment out of the Company's cash reserves.

Resolution 4 seeks Shareholder approval for the purposes of Listing

Rule 7.1 for the issue of the Lead Manager Options.

Technical information required by Listing Rule 7.1

Pursuant to and in accordance with Listing Rule 7.3, the

following information is provided in relation to Resolution 4:

the Lead Manager Options will be issued to Turner Pope (or its

nominee).

in accordance with paragraph 7.2 of ASX Guidance Note 21, the

Company confirms that none of the recipients will be:

related parties of the Company, members of the Company's Key

Management Personnel, substantial holders of the Company, advisers

of the Company or an associate of any of these parties; and

issued more than 1% of the issued capital of the Company;

the maximum number of Lead Manager Options to be issued is

26,440,678. The terms and conditions of the Lead Manager Options

are set out in Schedule 1 ;

the Lead Manager Options will be issued no later than 3 months

after the date of the Meeting (or such later date to the extent

permitted by any ASX waiver or modification of the Listing Rules)

and it is intended that issue of the Lead Manager Options will

occur on the same date;

the Lead Manager Options will be issued at a nil issue price, in

consideration for lead manager services provided by Turner Pope

;

the purpose of the issue of the Lead Manager Options is to

satisfy the Company's obligations under the Lead Manager

Mandate;

the Lead Manager Options are being issued to Turner Pope under

the Option Agreement, the materials terms and conditions of which

are set out in Section 3.2 ; and

the Lead Manager Options are not being issued under, or to fund,

a reverse takeover.

resolution 5 - ADOPTION of INCENTIVE PLAN

General

Resolution 5 seeks Shareholder approval for the adoption of the

employee incentive scheme titled "Employee Securities Incentive

Plan" (Incentive Plan) and for the issue of Securities under the

Incentive Plan in accordance with Listing Rule 7.2 (Exception

13(b)).

The objective of the Incentive Plan is to attract, motivate and

retain key employees and the Company considers that the adoption of

the Incentive Plan and the future issue of Securities under the

Incentive Plan will provide selected employees with the opportunity

to participate in the future growth of the Company.

As summarised in Section 1.2 above, Listing Rule 7.1 limits the

amount of equity securities that a listed company can issue without

the approval of its shareholders over any 12-month period to 15% of

the fully paid ordinary shares it had on issue at the start of that

period.

Listing Rule 7.2 (Exception 13(b)) provides that Listing Rule

7.1 does not apply to an issue of securities under an employee

incentive scheme if, within three years before the date of issue of

the securities, the holders of the entity's ordinary securities

have approved the issue of equity securities under the scheme as

exception to Listing Rule 7.1.

Exception 13(b) is only available if and to the extent that the

number of equity securities issued under the scheme does not exceed

the maximum number set out in the entity's notice of meeting

dispatched to shareholders in respect of the meeting at which

shareholder approval was obtained pursuant to Listing Rule 7.2

(Exception 13(b). Exception 13(b) also ceases to be available if

there is a material change to the terms of the scheme from those

set out in the notice of meeting.

If Resolution 5 is passed, the Company will be able to issue

Securities under the Incentive Plan to eligible participants over a

period of 3 years. The issue of any Securities to eligible

participants under the Incentive Plan (up to the maximum number of

Securities stated in Section (c) below) will be excluded from the

calculation of the number of equity securities that the Company can

issue without Shareholder approval under Listing Rule 7.1.

For the avoidance of doubt, the Company must seek Shareholder

approval under Listing Rule 10.14 in respect of any future issues

of Securities under the Incentive Plan to a related party or a

person whose relationship with the company or the related party is,

in ASX's opinion, such that approval should be obtained.

If Resolution 5 is not passed, the Company will be able to

proceed with the issue of Securities under the Incentive Plan to

eligible participants, but any issues of Securities will reduce, to

that extent, the Company's capacity to issue equity securities

without Shareholder approval under Listing Rule 7.1 for the

12-month period following the issue of the Securities .

Technical information required by Listing Rule 7.2 (Exception

13)

Pursuant to and in accordance with Listing Rule 7.2 (Exception

13), the following information is provided in relation to

Resolution 5 :

a summary of the key terms and conditions of the Incentive Plan

is set out in Schedule 2 ;

the Company has not issued any Securities under the Incentive

Plan, as this is the first time that Shareholder approval is being

sought for the adoption of the Incentive Plan; and

the maximum number of Securities proposed to be issued under the

Incentive Plan, following Shareholder approval, is 121,635,932

Securities . It is not envisaged that the maximum number of

Securities for which approval is sought will be issued

immediately.

Glossary

$ means Australian dollars.

ASIC means the Australian Securities & Investments

Commission.

Associated Body Corporate means

(a) a related body corporate (as defined in the Corporations Act) of the Company;

(b) a body corporate which has an entitlement to not less than

20% of the voting Shares of the Company; and

(c) a body corporate in which the Company has an entitlement to

not less than 20% of the voting shares.

ASX means ASX Limited (ACN 008 624 691) or the financial market

operated by ASX Limited, as the context requires.

Board means the current board of directors of the Company.

Business Day means Monday to Friday inclusive, except New Year's

Day, Good Friday, Easter Monday, Christmas Day, Boxing Day, and any

other day that ASX declares is not a business day.

Chair means the chair of the Meeting.

Closely Related Party of a member of the Key Management

Personnel means:

(a) a spouse or child of the member;

(b) a child of the member's spouse;

(c) a dependent of the member or the member's spouse;

(d) anyone else who is one of the member's family and may be

expected to influence the member, or be influenced by the member,

in the member's dealing with the entity;

(e) a company the member controls; or

(f) a person prescribed by the Corporations Regulations 2001

(Cth) for the purposes of the definition of 'closely related party'

in the Corporations Act.

Company means MGC Pharmaceuticals Ltd (ACN 116 800 269).

Constitution means the Company's constitution.

Corporations Act means the Corporations Act 2001 (Cth).

Directors means the current directors of the Company.

Explanatory Statement means the explanatory statement

accompanying the Notice.

General Meeting or Meeting means the meeting convened by the

Notice.

Incentive Plan means the Employee Securities Incentive Plan to

be adopted by the Company, being the subject of Resolution 5 as

summarised in Schedule 2 .

Key Management Personnel has the same meaning as in the

accounting standards issued by the Australian Accounting Standards

Board and means those persons having authority and responsibility

for planning, directing and controlling the activities of the

Company, or if the Company is part of a consolidated entity, of the

consolidated entity, directly or indirectly, including any director

(whether executive or otherwise) of the Company, or if the Company

is part of a consolidated entity, of an entity within the

consolidated group.

Listing Rules means the Listing Rules of ASX.

Notice or Notice of Meeting means this notice of meeting

including the Explanatory Statement and the Proxy Form.

Option means an option to acquire a Share with the terms and

conditions set out in Schedule 1 .

Optionholder means a holder of an Option.

Performance Rights means a right to acquire a Share, subject to

satisfaction of any vesting conditions .

Proxy Form means the proxy form accompanying the Notice.

Resolutions means the resolutions set out in the Notice, or any

one of them, as the context requires.

Section means a section of the Explanatory Statement.

Share means a fully paid ordinary share in the capital of the

Company.

Shareholder means a registered holder of a Share.

Securities means a Share, Option, performance right or any other

type of security in the capital of the Company.

WST means Western Standard Time as observed in Perth, Western

Australia.

Schedule 1 - Terms and conditions of lead manager options

(a) Entitlement

Each Option entitles the holder to subscribe for one (1) Share

upon exercise of the Option.

(b) Exercise Price

Subject to paragraph (i), the amount payable upon exercise of

each Option will be GBP0.01475 (the Exercise Price)

(c) Expiry Date

Each Option will expire at 5:00 pm (WST) on the date which is

two years after the date of the last of the Conditions being

satisfied (Expiry Date). An Option not exercised before the Expiry

Date will automatically lapse on the Expiry Date.

(d) Exercise Period

The Options are subject to satisfaction of the Conditions,

exercisable at any time on or prior to the Expiry Date (Exercise

Period).

(e) Notice of Exercise

The Options may be exercised during the Exercise Period by

notice in writing to the Company (the Notice of Exercise) and

payment of the Exercise Price for each Option being exercised by

electronic funds transfer or other means of payment acceptable to

the Company.

(f) Exercise Date

A Notice of Exercise is only effective on and from the later of

the date of receipt of the Notice of Exercise and the date of

receipt of the payment of the Exercise Price for each Option being

exercised in cleared funds (the Exercise Date).

(g) Timing of issue of Shares on exercise

Within five Business Days (being a day when banks are usually

open for business in London, UK and Perth, Australia) after the

Exercise Date, the Company will:

issue the number of Shares required under these terms and

conditions in respect of the number of Options specified in the

Notice of Exercise and for which cleared funds have been received

by the Company;

if required, give ASX a notice that complies with section

708A(5)(e) of the Corporations Act, or, if the Company is unable to

issue such a notice, lodge with ASIC a prospectus prepared in

accordance with the Corporations Act and do all such things

necessary to satisfy section 708A(11) of the Corporations Act to

ensure that an offer for sale of the Shares does not require

disclosure to investors; and

if admitted to the official list of the FCA and to trading on

the main market for listed securities of London Stock Exchange plc,

or any other public exchange, make application of the Shares

arising on exercise of the Options.

(h) Shares issued on exercise

Shares issued on exercise of the Options rank equally with the

then issued shares of the Company.

(i) Reconstruction of capital

If at any time the issued capital of the Company is

reconstructed, all rights of the Option Holder are to be changed in

a manner consistent with the Corporations Act, the ASX Listing

Rules and/or the Listing Rules of the FCA at the time of the

reconstruction.

(j) Participation in new issues

There are no participation rights or entitlements inherent in

the Options and the Option Holder will not be entitled to

participate in new issues of capital offered to shareholders of the

Company during the currency of the Options without exercising the

Options.

(k) Change in exercise price

An Option does not confer the right to a change in Exercise

Price or a change in the number of underlying securities over which

the Option can be exercised.

(l) Transferability

The Options are transferable subject to any restriction or

escrow arrangements imposed by ASX or under applicable Australian

securities laws.

Schedule 2 - Terms and conditions of Incentive Plan

A summary of the terms of the Company's Employee Securities

Incentive Plan (Plan) is set out below.

(a) Eligible Participant

Eligible Participant means a person who is a full-time or

part-time employee, a non-executive Director, a contractor or a

casual employee of the Company, or an Associated Body Corporate (as

defined in ASIC Class Order 14/1000), or such other person who has

been determined by the Board to be eligible to participate in the

Plan from time to time.

The Company will seek Shareholder approval for Director and

related party participation in accordance with Listing Rule

10.14.

(b) Purpose

The purpose of the Plan is to:

(i) assist in the reward, retention and motivation of Eligible Participants;

(ii) link the reward of Eligible Participants to Shareholder value creation; and

(iii) align the interests of Eligible Participants with

shareholders of the Group (being the Company and each of its

Associated Bodies Corporate), by providing an opportunity to

Eligible Participants to receive an equity interest in the Company

in the form of Securities.

(c) Plan administration

The Plan will be administered by the Board. The Board may

exercise any power or discretion conferred on it by the Plan rules

in its sole and absolute discretion. The Board may delegate its

powers and discretion.

(d) Eligibility, invitation and application

The Board may from time to time determine that an Eligible

Participant may participate in the Plan and make an invitation to

that Eligible Participant to apply for Securities on such terms and

conditions as the Board decides.

On receipt of an Invitation, an Eligible Participant may apply

for the Securities the subject of the invitation by sending a

completed application form to the Company. The Board may accept an

application from an Eligible Participant in whole or in part.

If an Eligible Participant is permitted in the invitation, the

Eligible Participant may, by notice in writing to the Board,

nominate a party in whose favour the Eligible Participant wishes to

renounce the invitation.

(e) Grant of Securities

The Company will, to the extent that it has accepted a duly

completed application, grant the Participant the relevant number of

Securities, subject to the terms and conditions set out in the

invitation, the Plan rules and any ancillary documentation

required.

(f) Terms of Convertible Securities

Each 'Convertible Security' represents a right to acquire one or

more Shares (for example, under an option or performance right),

subject to the terms and conditions of the Plan. Prior to a

Convertible Security being exercised a Participant does not have

any interest (legal, equitable or otherwise) in any Share the

subject of the Convertible Security by virtue of holding the

Convertible Security. A Participant may not sell, assign, transfer,

grant a security interest over or otherwise deal with a Convertible

Security that has been granted to them unless otherwise determined

by the Board. A Participant must not enter into any arrangement for

the purpose of hedging their economic exposure to a Convertible

Security that has been granted to them.

(g) Vesting of Convertible Securities

Any vesting conditions applicable to the grant of Convertible

Securities will be described in the invitation. If all the vesting

conditions are satisfied and/or otherwise waived by the Board, a

vesting notice will be sent to the Participant by the Company

informing them that the relevant Convertible Securities have

vested. Unless and until the vesting notice is issued by the

Company, the Convertible Securities will not be considered to have

vested. For the avoidance of doubt, if the vesting conditions

relevant to a Convertible Security are not satisfied and/or

otherwise waived by the Board, that Convertible Security will

lapse.

(h) Exercise of Convertible Securities and cashless exercise

To exercise a Convertible Security, the Participant must deliver

a signed notice of exercise and, subject to a cashless exercise of

Convertible Securities (see below), pay the exercise price (if any)

to or as directed by the Company, at any time following vesting of

the Convertible Security (if subject to vesting conditions) and

prior to the expiry date as set out in the invitation or vesting

notice.

An invitation may specify that at the time of exercise of the

Convertible Securities, the Participant may elect not to be

required to provide payment of the exercise price for the number of

Convertible Securities specified in a notice of exercise, but that

on exercise of those Convertible Securities the Company will

transfer or issue to the Participant that number of Shares equal in

value to the positive difference between the Market Value of the

Shares at the time of exercise and the exercise price that would

otherwise be payable to exercise those Convertible Securities.

Market Value means, at any given date, the volume weighted

average price per Share traded on the ASX over the 5 trading days

immediately preceding that given date, unless otherwise specified

in an invitation.

A Convertible Security may not be exercised unless and until

that Convertible Security has vested in accordance with the Plan

rules, or such earlier date as set out in the Plan rules.

(i) Delivery of Shares on exercise of Convertible Securities

As soon as practicable after the valid exercise of a Convertible

Security by a Participant, the Company will issue or cause to be

transferred to that Participant the number of Shares to which the

Participant is entitled under the Plan rules and issue a substitute

certificate for any remaining unexercised Convertible Securities

held by that Participant.

(j) Forfeiture of Convertible Securities

Where a Participant who holds Convertible Securities ceases to

be an Eligible Participant or becomes insolvent, all unvested

Convertible Securities will automatically be forfeited by the

Participant, unless the Board otherwise determines in its

discretion to permit some or all of the Convertible Securities to

vest.

Where the Board determines that a Participant has acted

fraudulently or dishonestly; committed an act which has brought the

Company, the Group or any entity within the Group into disrepute,

or wilfully breached his or her duties to the Group or where a

Participant is convicted of an offence in connection with the

affairs of the Group; or has a judgment entered against him or her

in any civil proceedings in respect of the contravention by the

Participant of his or her duties at law, in equity or under

statute, in his or her capacity as an employee, consultant or

officer of the Group, the Board may in its discretion deem all

unvested Convertible Securities held by that Participant to have

been forfeited.

Unless the Board otherwise determines, or as otherwise set out

in the Plan rules:

(i) any Convertible Securities which have not yet vested will be

forfeited immediately on the date that the Board determines (acting

reasonably and in good faith) that any applicable vesting

conditions have not been met or cannot be met by the relevant date;

and

(ii) any Convertible Securities which have not yet vested will

be automatically forfeited on the expiry date specified in the

invitation or vesting notice.

(k) Change of control

If a change of control event occurs in relation to the Company,

or the Board determines that such an event is likely to occur, the

Board may in its discretion determine the manner in which any or

all of the Participant's Convertible Securities will be dealt with,

including, without limitation, in a manner that allows the

Participant to participate in and/or benefit from any transaction

arising from or in connection with the change of control event

provided that, in respect of Convertible Securities, the maximum

number of Convertible Securities (that have not yet been exercised)

that the Board may determine will vest and be exercisable into

Shares under this Rule is that number of Convertible Securities

that is equal to 10% of the Shares on issue immediately following

vesting under this Rule, which as far as practicable will be

allocated between holders on a pro-rata basis on the basis of their

holdings of Convertible Securities on the date of determination of

vesting.

(l) Rights attaching to Plan Shares

All Shares issued or transferred under the Plan or issued or

transferred to a Participant upon the valid exercise of a

Convertible Security, (Plan Shares) will rank pari passu in all

respects with the Shares of the same class. A Participant will be

entitled to any dividends declared and distributed by the Company

on the Plan Shares and may participate in any dividend reinvestment

plan operated by the Company in respect of Plan Shares. A

Participant may exercise any voting rights attaching to Plan

Shares.

(m) Disposal restrictions on Plan Shares

If the invitation provides that any Plan Shares are subject to

any restrictions as to the disposal or other dealing by a

Participant for a period, the Board may implement any procedure it

deems appropriate to ensure the compliance by the Participant with

this restriction.

For so long as a Plan Share is subject to any disposal

restrictions under the Plan, the Participant will not:

(i) transfer, encumber or otherwise dispose of, or have a

security interest granted over that Plan Share; or

(ii) take any action or permit another person to take any action

to remove or circumvent the disposal restrictions without the

express written consent of the Company.

(n) Adjustment of Convertible Securities

If there is a reorganisation of the issued share capital of the

Company (including any subdivision, consolidation, reduction,

return or cancellation of such issued capital of the Company), the

rights of each Participant holding Convertible Securities will be

changed to the extent necessary to comply with the Listing Rules

applicable to a reorganisation of capital at the time of the

reorganisation.

If Shares are issued by the Company by way of bonus issue (other

than an issue in lieu of dividends or by way of dividend

reinvestment), the holder of Convertible Securities is entitled,

upon exercise of the Convertible Securities, to receive an issue of

as many additional Shares as would have been issued to the holder

if the holder held Shares equal in number to the Shares in respect

of which the Convertible Securities are exercised.

Unless otherwise determined by the Board, a holder of

Convertible Securities does not have the right to participate in a

pro rata issue of Shares made by the Company or sell renounceable

rights.

(o) Participation in new issues

There are no participation rights or entitlements inherent in

the Convertible Securities and holders are not entitled to

participate in any new issue of Shares of the Company during the

currency of the Convertible Securities without exercising the

Convertible Securities.

(p) Compliance with applicable law

No Security may be offered, grated, vested or exercised if to do

so would contravene any applicable law. In particular, the Company

must have reasonable grounds to believe, when making an invitation,

that the total number of Plan Shares that may be issued upon

exercise of Convertible Securities offer when aggregated with the

number of Shares issued or that may be issued as a result of offers

made at any time during the previous three year period under:

(i) an employee incentive scheme of the Company covered by ASIC

Class Order 14/1000 (Class Order); or

(ii) an ASIC exempt arrangement of a similar kind to an employee

incentive scheme, but disregarding any offer made or securities

issued in the capital of the Company by way of or as a result

of:

(A) an offer to a person situated at the time of receipt of the offer outside Australia;

(B) an offer that did not need disclosure to investors because

of section 708 of the Corporations Act (exempts the requirement for

a disclosure document for the issue of securities in certain

circumstances to investors who are deemed to have sufficient

investment knowledge to make informed decisions, including

professional investors, sophisticated investors and senior managers

of the Company); or

(C) an offer made under a disclosure document, which would

exceed 5% (or such other maximum permitted under any applicable

law) of the total number of Shares on issue at the date of the

invitation.

(q) Maximum number of Securities

When relying on the Class Order relief, the Company will not

make an invitation under the Plan if the number of Plan Shares that

may be issued, or acquired upon exercise of Convertible Securities

offered under an invitation, when aggregated with the number of

Shares issued or that may be issued as a result of all invitations

under the Plan, will exceed 5% of the total number of issued Shares

at the date of the invitation.

(r) Amendment of Plan

Subject to the following paragraph, the Board may at any time

amend any provisions of the Plan rules, including (without

limitation) the terms and conditions upon which any Securities have

been granted under the Plan and determine that any amendments to

the Plan rules be given retrospective effect, immediate effect or

future effect.

No amendment to any provision of the Plan rules may be made if

the amendment materially reduces the rights of any Participant as

they existed before the date of the amendment, other than an

amendment introduced primarily for the purpose of complying with

legislation or to correct manifest error or mistake, amongst other

things, or is agreed to in writing by all Participants.

(s) Plan duration

The Plan continues in operation until the Board decides to end

it. The Board may from time to time suspend the operation of the

Plan for a fixed period or indefinitely and may end any suspension.

If the Plan is terminated or suspended for any reason, that

termination or suspension must not prejudice the accrued rights of

the Participants.

If a Participant and the Company (acting by the Board) agree in

writing that some or all of the Securities granted to that

Participant are to be cancelled on a specified date or on the

occurrence of a particular event, then those Securities may be

cancelled in the manner agreed between the Company and the

Participant.

(t) Income Tax Assessment Act

The Plan is a plan to which Subdivision 83A-C of the Income Tax

Assessment Act 1997 (Cth) applies (subject to the conditions in

that Act).

(u) Maximum number of equity securities proposed to be issued under the Plan

For the purposes of Listing Rule 7.2 (Exception 13(a)), the

maximum number of securities proposed to be issued under the Plan

is 121,635,392.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGDKABKOBKKQBB

(END) Dow Jones Newswires

February 26, 2021 02:17 ET (07:17 GMT)

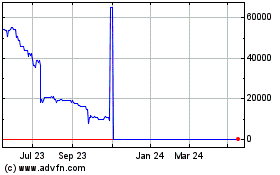

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Nov 2023 to Nov 2024