TIDMMILA

RNS Number : 2668O

Mila Resources PLC

02 October 2023

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR") as applied in

the United Kingdom. Upon publication of this Announcement, this

information is now considered to be in the public domain.

2 October 2023

Mila Resources Plc

("Mila" or the "Company")

Placing to Raise GBP2m & Appointment of Joint Broker

Mila Resources Plc (LSE:MILA), is delighted to announce that it

has raised GBP2,000,000 before expenses, through a conditional

placing by its existing broker SI Capital, and Shard Capital, which

has been appointed as joint broker with immediate effect, (the

"Placing"), of 200,000,000 new ordinary shares ("Placing Shares")

at the closing offer price of 1 pence per ordinary share ("Placing

Price"). The Placing Shares shall have one warrant attached with an

exercise price of 2 pence for a period of two years from the date

of admission ("Placing Warrants").

The Placing has not been underwritten and is conditional on,

amongst other things:

i) the publication of a Prospectus by the Company to be approved

by the Financial Conduct Authority of the United Kingdom ("FCA").

The Company and its advisers have been working on obtaining such

approvals from the FCA in recent weeks and anticipate being able to

publish the Prospectus in the next 10 days; and

ii) approval by Shareholders of resolutions, inter alia,

granting authority for the Directors to issue ordinary shares at a

General Meeting ("GM") expected to be held before the end of

October 2023.

The Placing Shares, when issued, will be credited as fully paid

and will be issued subject to the Articles of Association of the

Company and rank pari passu in all respects with the Ordinary

Shares currently in issue, including the right to receive all

dividends and other distributions declared, made or paid on or in

respect of the Ordinary Shares after the date of issue of the

Placing Shares and will, on issue, be free of all claims, liens,

charges and encumbrances.

Use of Proceeds

Further to the announcement of 27 July 2023 relating to the

option agreement with Liontown Resources Limited (ASX: LTR)

('Liontown'), the Liontown team are on the ground on the Mila's

Kathleen Valley licence area, and management expects that a lithium

work programme will commence shortly to identify drill targets, to

validate the theory that spodumene-bearing pegmatites occur within

the substantial pegmatite swarms already identified at surface. As

previously announced, Liontown will fund all lithium exploration

activities on Mila's Kathleen Valley licence area.

The Company intends to utilise the placing funds to conduct

further gold exploration work alongside Liontown's lithium

exploration in the northern part of the Kathleen Valley licence

area. By capitalising on work permits and heritage surveys that the

Company expects to be granted in the near future, drilling costs

will be significantly reduced, maximising drill metres and funds

into the ground at this exciting gold project.

Finally, the Company has received several proposals to partner

on other projects and funds will be applied to reviewing business

development opportunities. Alastair Goodship, an exploration

geologist, has joined the team as noted below to assist the board

and provide technical oversight on the current portfolio and new

opportunities.

Appointment of Exploration Geologist

The Company has appointed Alastair Goodship, an exploration

geologist with over 14 years of industry experience of leading

discovery-focussed exploration teams in a diverse range of

environments and jurisdictions globally.

Alastair has worked across the exploration spectrum from

greenfield and brownfield exploration to resource definition and

feasibility studies. Alistair most recently worked as a Senior

Exploration Consultant with RSCMME Ltd and technical advisor to

Trinity Metals Group.

Background to the Placing

Mila's principal activity is to develop mining projects

following initial exploration through to development with the aim

of creating value as the assets are de-risked and capable of

economic development.

The Company's portfolio currently consists of one project, being

a 30% interest in the Kathleen Valley gold project ("Kathleen

Valley Project" or the "Project") and the exploration licence

E36/876 in the Kathleen Valley ("Kathleen Valley Licence") located

in the +40Moz Wiluna Jundee gold belt which hosts some of

Australia's largest gold mines.

In December 2021, the Company commenced drilling at the Coffey

deposit ("Coffey") which already hosts an existing JORC Inferred

Resource of 21koz gold. Mila subsequently committed to a more

extensive drilling programme between February and April 2022

("First Stage"). With a total of 31 holes that encountered gold

mineralisation, the First Stage drilling results were considered a

success, reporting wide intersections of mineralisation and some

very high gold grades including 6.6m at 14.86g/t Au and 21.79g/t Ag

from 209.4m (reported 25/4/2022).

In October 2022, the Company followed up with the second stage

("Second Stage") of drilling at Coffey designed to test the mineral

deposit at further depths than those conducted in the First Stage.

Despite intersecting promising alteration and limited low grade

gold mineralisation, the drilling did not intersect the anticipated

high-grade gold mineralisation at this target depth. However, with

reference to the style of mineralisation at other major Western

Australian gold deposits such as Bellevue Gold's 3.1Moz Bellevue

project (contiguous to Mila's licence area), the Company believes

that these results could provide evidence of a 'ladder system',

commonly found in Western Australia, which is strongly encouraging

for further discovery potential at the project.

Since the beginning of 2023, the Company has been reviewing a

range of geological tools and data to build a more precise

geological model of the Coffey Deposit and enhance targeting in

order to mitigate risk ahead of its next exploration phase. Whilst

the Company awaits the results of six drill holes, designed to test

the thinner section of mineralisation, where it expects to find

narrower widths of mineralisation, progress has been made to

explore the target zones in the North, exploring the favoured part

of the acreage based on magnetic survey results.

Alongside this, on 27 July 2023 the Company announced that,

together with the other owners of the Kathleen Valley Licence, it

had entered into an option agreement with LBM (Aust) Pty Limited, a

subsidiary of Liontown, a A$6bn business currently subject to a

takeover bid by Albemarle. Liontown is developing the significant

Kathleen Valley lithium project nearby that is due to commence

production in 2024 and currently has offtake agreements signed with

Ford, Tesla and LG. The agreement grants Liontown the option to

explore for lithium on Mila's Kathleen Valley Licence area where,

despite being proximal to Liontown's project and having numerous

pegmatite swarms identified, the licence has not been

systematically explored for lithium.

Importantly this gives Mila a A$2.2m free carry over initial

exploration. If successful and all option agreements are taken up,

Mila will retain a 16% stake in the lithium rights, which could

prove significantly more valuable than the Company's current market

capitalisation.

Following the decision to grant the option to Liontown, the

Company has determined to continue exploration for gold by

completing a drill programme to the north of the Coffey deposit. By

capitalising on work permits and heritage surveys that it expects

to be granted in the near future, drilling costs will be

significantly reduced, maximising drill metres. The initial drill

programme will consist of up to eight holes to determine the

geological continuity of mineralisation. To date, the drilling has

focused on the Coffey deposit, and so it will be the first time

that a drilling programme has been conducted in the preferred

target zone which remains highly prospective based on geophysical

results.

Appointment of Joint Broker

The Company is pleased to announce the appointment of Shard

Capital Partners LLP as joint broker, alongside SI Capital, with

immediate effect. Tavira Financial Limited remains the Company's

financial adviser.

Admission

An application will be made for the Placing Shares to be

admitted to trading on the Official List and the London Stock

Exchange ("Admission") within two business days of the GM.

In accordance with the FCA's Disclosure Guidance and

Transparency Rules, the Company confirms that following Admission,

the Company's enlarged issued ordinary share capital will comprise

526,817,108 Ordinary Shares. The Company does not hold any Ordinary

Shares in Treasury. Therefore, following Admission, the above

figure may be used by shareholders in the Company as the

denominator for the calculations to determine if they are required

to notify their interest in, or a change to their interest in the

Company, under the FCA's Disclosure Guidance and Transparency

Rules.

Mark Stephenson, Chairman of Mila, commented:

"I am delighted with the strong level of support we've received

in this fundraising from both existing and new investors,

particularly given the difficult market conditions, and we are

grateful for the enthusiastic support from the market to continue

advancing our post-discovery exploration accelerator model.

"Our gold exploration activities at Kathleen Valley have been

encouraging, and, in tandem with the option agreement with Liontown

to explore and fund the lithium exploration at the project, our

initial asset has the potential to deliver significant value for

Mila.

"Our immediate objective now is to push forward with our gold

exploration work, specifically to fully understand the

mineralisation dynamics, particularly along the unexplored

north-western stretch. In addition, we will prioritise the

assessment of deeper mineralisation layers, which, investors will

remember, have already illuminated the presence of high-grade

mineralisation, and the continuation of a mineralising system at

significant depths, exemplified by instances like 1 metre @ 27.60

g/t Au and 47.50 g/t Ag down to a depth of 211 metres.

"Furthermore, this fundraising provides the Mila team with the

ability to evaluate and capitalise on new opportunities during what

remains a difficult market for junior exploration businesses. We

now have a strong balance sheet behind us, and a team of industry

experts to review and benefit from new value accretive business

development opportunities.

"I would like to thank our shareholders, both new and existing,

as we look to a highly active phase of our journey at Mila and I

look forward to reporting further news in the coming weeks."

A further announcement will be made on the publication of the

Company's prospectus.

**ENDS**

For more information visit www.milaresources.com or contact:

Mark Stephenson info@milaresources.com

Mila Resources Plc

Jonathan Evans

Tavira Financial Limited +44 (0) 20 7100 5100

Nick Emerson

SI Capital +44 (0) 20 3143 0600

Damon Heath

Shard Capital Partners LLP +44 (0) 20 3971 7000

Susie Geliher

St Brides Partners Limited +44 (0) 20 7236 1177

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUPGWPUUPWPUG

(END) Dow Jones Newswires

October 02, 2023 02:00 ET (06:00 GMT)

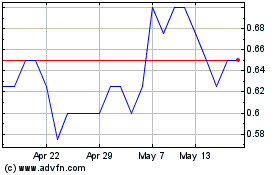

Mila Resources (LSE:MILA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mila Resources (LSE:MILA)

Historical Stock Chart

From Nov 2023 to Nov 2024