Interim Management Statement

November 13 2008 - 2:00AM

UK Regulatory

RNS Number : 0423I

Morgan Sindall PLC

13 November 2008

Morgan Sindall plc

13 November 2008

INTERIM MANAGEMENT STATEMENT

Morgan Sindall plc, the construction and regeneration group, announces today its Interim Management Statement covering the period 1 July

2008 to 12 November 2008.

Morgan Sindall remains on track to achieve its expectations for the current year and continues to be well positioned as a result of its

broad spread of activity across the construction sector. Our strategy remains one of developing market leadership in all the sectors in

which we operate.

Fit Out is delivering a strong second half performance. Its broad sector spread and market leadership in the quality of its project

delivery are helping to offset the impact of the downturn in the financial services sector. The order book is comparable with the level at

the start of the year although, as previously stated, we continue to expect a fall in demand in 2009.

Construction is performing in line with expectations and is well positioned to meet the challenges facing the sector. With around 50% of

its activity in the education sector, where the division has secured major contracts with North Lanarkshire Council (worth up to �100m) and

Bideford College (�44m) during the period, and a further 20% in other public sector work, the division is well placed to benefit from any

acceleration of the Government's spending plans. In addition, with around 70% of its workload arising from framework arrangements, the

division has good visibility on its expected revenues for 2009.

Infrastructure Services continues to trade positively, benefitting from a buoyant infrastructure market. Its major projects are

performing well and it continues to have a healthy order book. The division is currently targeting further major infrastructure

opportunities such as Crossrail, the AMP5 work streams in the water sector, and tunnelling projects in the utilities sector, in particular

taking advantage of the division's market leading position in tunnelling. The Government recently highlighted that infrastructure

investment is a spending priority, which is positive for the sector.

Affordable Housing's refurbishment and new build social housing contracting business has continued to perform robustly. The division has

secured significant new contracts, including a new build social housing project for Hounslow Homes (�53m) and has grown this business to

largely offset the impact of the downturn in the open market housing sector. The Government's reiteration of its commitment to the

affordable housing sector is encouraging and we continue to believe that mixed tenure regeneration will drive growth in the longer term.

The regeneration market continues to be subdued, although our Urban Regeneration division is pursuing a number of public sector

opportunities in the short term. As previously stated the division has limited exposure to the revaluation issues impacting the sector. It

has a long term pipeline of projects and is renegotiating a number of development agreements, ensuring the division is ideally positioned to

exploit opportunities when the regeneration market recovers.

The Group's forward order book has softened slightly to �4.0bn from �4.2bn at 30 June 2008. In the current economic climate each of our

divisions is putting an increased emphasis on cash management, cost reduction and supply chain improvements, as well as responding to market

growth opportunities where they present themselves.

The Group remains financially robust with average cash balances for the year to date above the level achieved for the corresponding

period in 2007 and with �75m of committed banking facilities in place, there having been no significant change in the Group's financial

position since the publication of the Interim Report for the six months to 30 June 2008.

In summary, Morgan Sindall is on track to achieve a record year in 2008 and is well placed to meet the challenges and opportunities we

face in 2009 and to deliver long term sustained growth.

There will be a short presentation, at 4pm today, by management to analysts at the Group's offices at Kent House, 14-17 Market Place,

London W1W 8AJ.

ENQUIRIES:

Morgan Sindall plc Tel: 020 7307 9200

Paul Smith, Chief Executive

David Mulligan, Finance Director

Blythe Weigh Communications Tel: 020 7138 3204

Tim Blythe

Paul Weigh

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSBLBDBIDBGGID

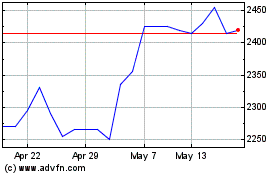

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

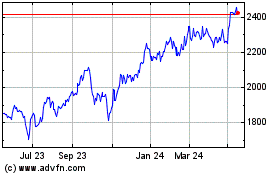

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jul 2023 to Jul 2024