RNS Number:5187R

Morgan Sindall PLC

20 February 2007

Morgan Sindall Plc

('Morgan Sindall' or 'the Group')

Preliminary results for the year ended 31 December 2006

Morgan Sindall plc, the construction group that operates within four divisions;

Fit Out, Construction, Infrastructure Services and Affordable Housing today

announces record preliminary results

2006 2005

Revenue #1,497m #1,297m + 15%

Operating profit #46.2m #39.9m + 16%

Profit before tax #47.6m #41.7m + 14%

Cash balance #95.4m #72.0m + 33%

Order book #3.3bn #2.8bn + 19%

Earnings per share 78.2p 70.7p + 11%

Final dividend per share 20.0p 18.0p + 11%

Group Highlights

* Strategy delivering long-term sustainable growth

* Growth continues to be driven by Fit Out and Affordable Housing

* Infrastructure Services secures #800m of new contracts

* Group's forward order book at a healthy #3.3bn in favourable market

conditions

* Group's margins maintained at 3.2% with strong cash generation

Divisional Highlights

Fit Out

* Record result with operating profit up 38% to #22.6m (2005 #16.4m)

reflecting increased revenue and margin

* Buoyed by strong market conditions, particularly in Financial and

Professional Services in London and the Technology sector in the

Thames Valley

* Specific focus on larger jobs

* Similar market conditions expected to prevail in 2007 with forward

order book of #187m (2005: #134m)

Construction

* Improved operating profit to #3.4m (2005 #3.2m)

* Success in winning new frameworks

* #491m forward order book for 2007: exciting prospects in health and

emergency services

Infrastructure Services

* Significantly increased revenue, however operating profit of #5.1m

impacted by restructuring and mobilisation of new contracts

* Strong underlying market evidenced by good order flow

* Forward order book of #1.2bn against #824m a year ago

* Anticipating strong growth in 2007

Affordable Housing

* Increased margin with record operating profit of #24.0m (2005 #18.7m)

* Government's Decent Homes programme underpins performance

* Continued success in mixed tenure developments

* Future growth to be driven by larger, more complex regeneration

schemes in the medium term

* 2007 order book of #1.4bn

John Morgan, Executive Chairman, commented:

"2006 has predominantly been driven by the excellent performance of both Fit Out

and Affordable Housing. At the same time we have had success at Construction

and in building the order book in Infrastructure Services. We are confident

that the foundations have been laid for 2007 to be another successful year."

20 February 2007

ENQUIRIES:

College Hill Tel: 020 7457 2020

Kate Pope

Matthew Smallwood

Morgan Sindall plc Tel: 020 7307 9200

John Morgan, Executive Chairman

Paul Smith, Chief Executive

David Mulligan, Finance Director

Preliminary Statement

In 2006 Morgan Sindall continued to make excellent progress. Profit before tax

increased by 14% to #47.6m (2005: #41.7m) on revenue that increased by 15% to

#1.5bn (2005: #1.3bn). Earnings per share increased by 11% to 78.2p (2005:

70.7p). Accordingly the Board recommends an increase in the final dividend to

20.0p (2005: 18.0p) giving a total dividend for the year of 28.0p (2005: 25.0p).

Our strategy remains the same. It is to develop a leading position in each of

our chosen market sectors. Our Fit Out and Affordable Housing divisions

demonstrate the value of this approach. Both had very successful years as a

result of their strong market positions and favourable trading conditions.

Construction continued with its strategy of focussing on key sectors and

framework contracts, and delivered an improved result. Infrastructure Services

secured a significant amount of new civil engineering and utilities work, which

should result in increased revenue and profit moving forward although

restructuring of the division and the mobilisation of new contracts during 2006

impacted its profit for the year.

Overall our margins have remained steady at 3.2% (2005: 3.2%) while cash

generation was particularly strong. The Group ended 2006 with net cash of #95m

(2005: #72m).

Board changes

Jack Lovell will retire from the Board as a non-executive director at the

forthcoming AGM in April. Jack, one of the founding directors of the Group, has

made a significant contribution to its development over the past 30 years and we

are extremely grateful for his input and guidance throughout that time.

Outlook

Morgan Sindall has made an encouraging start to 2007 with further exciting

opportunities being secured by all our divisions. The forward order book at the

start of the year stood at #3.3bn against #2.8bn last year and we are seeing

favourable market conditions across all of our chosen sectors.

In the coming year Fit Out will be seeking to further expand its larger projects

capability and Affordable Housing will be targeting more complex regeneration

schemes. Construction will continue with its focus on key sectors and framework

contracts while Infrastructure Services' priority will be on successfully

mobilising and delivering the work secured in 2006, as well as securing further

opportunities.

Overall we are very pleased with the progress made in 2006 and, given the

current strength of our divisions and the healthy market sectors in which they

operate, we expect to make further progress over the coming year.

Divisional performance

Fit Out

2006 2005

Revenue #426m #323m

Operating profit #22.6m #16.4m

Margin 5.3% 5.1%

Order book #187m #134m

Fit Out provides fit out and refurbishment services to the commercial property

market. It operates through four businesses, namely Overbury, Morgan Lovell,

Vivid Interiors and Backbone Furniture. It is a national business operating in

both the public and private sectors.

Against the backdrop of a buoyant commercial property sector Fit Out grew

strongly and increased its market share in 2006. Revenue increased by 32% to

#426m (2005: #323m) and the division delivered a record operating profit of

#22.6m (2005: #16.4m) which was an increase of 38% on the previous year. The

margin also strengthened to 5.3% (2005: 5.1%).

The division's geographic expansion continued with an increasing number of large

contracts being undertaken outside London. The division also strengthened its

presence in the hotel, retail, leisure and entertainment sectors thereby

extending the division's offering beyond the commercial offices sector.

The division starts 2007 with a forward order book of #187m (2005: #134m). The

continued strength of the fit out market has been an important contributor to

the past success of this division and our expectation is that similar market

conditions will continue in 2007.

Construction

2006 2005

Revenue #343m #336m

Operating profit #3.4m #3.2m

Margin 1.0% 1.0%

Order book #491m #504m

Bluestone operates through a network of 25 offices throughout England and Wales

serving the health, education, commercial and light industrial sectors,

delivering contracts principally through negotiated and framework arrangements.

The division made progress in 2006 in a generally favourable market. Operating

profit increased to #3.4m (2005: #3.2m) on revenue of #343m (2005: #336m). The

margin was maintained at 1.0%.

During 2006 the division was successful in securing a number of new framework

arrangements including those with South East Centres of Excellence and Dorset

County Council. In addition it was appointed construction partner for the Bury,

Glossop and Tameside NHS LIFT project which is anticipated to commence in the

first half of 2007.

Bluestone enters 2007 with a forward order book of #491m (2005: #504m). The

division also has a number of potential contracts driven by investment led

projects in the health and emergency services sectors which we expect will

underpin modest growth of this division in 2007.

Infrastructure Services

2006 2005

Revenue #324m #248m

Operating profit #5.1m #6.0m

Margin 1.6% 2.4%

Order book #1.2bn #824m

Infrastructure Services' business, Morgan Est, provides civil engineering and

utilities services to the water, gas, electricity and transport sectors across

the UK.

In 2006 the division delivered an operating profit of #5.1m (2005: #6.0m) on

revenue of #324m (2005: #248m). The margin was impacted by a restructuring of

the business during the year and also by mobilisation costs on a number of

recently won contracts.

In March the division acquired from M J Gleeson plc its non-track rail business

for #23m. This business, which specialises in station refurbishment and

underground works, has performed well and contributed an operating profit of

#1.0m on revenue of #21m.

In 2006 the division secured #800m of new orders which have contributed to a

significant increase in its forward order book starting the year at a record

#1.2bn (2005: #824m). This forward order book includes key projects such as the

A876 Upper Forth Crossing at Kincardine and Belfast sewer tunnels, M1 widening

at junctions 25 to 28, as well as frameworks with United Utilities, which runs

the gas mains system on behalf of Northern Gas Networks, and E.ON UK's power

distribution business Central Networks, which have helped to lengthen the order

book.

Overall the market outlook for infrastructure projects is much improved. The

recently secured contracts are continuing to mobilise and we anticipate strong

growth for this division in 2007.

Affordable Housing

2006 2005

Revenue #404m #390m

Operating profit #24.0m #18.7m

Margin 5.9% 4.8%

Order book #1.4bn #1.3bn

The Affordable Housing division operates through Lovell, a leading provider of

affordable housing and refurbishment services. The division delivers new build

social housing and new build open market affordable housing as well as the

refurbishment of social housing under framework arrangements. Its particular

expertise is mixed tenure urban regeneration schemes, which combine both its new

build and refurbishment skills and bring together private and public ownership

in a single development.

The division achieved a record operating profit in 2006 of #24.0m (2005: #18.7m)

on revenue of #404m (2005: #390m). During the year the division secured major

new schemes at Beswick and Garston-under-Bridge and was appointed preferred

bidder for a #200m PFI housing scheme in Manchester, which is expected to

commence in mid-2007. The Decent Homes programme also continues to account for a

significant proportion of the division's workload. The margin increased to 5.9%

(2005: 4.8%) as a result of a more favourable work mix.

Lovell starts 2007 with an order book of #1.4bn (2005: #1.3bn). While the

Decent Homes programme is expected to continue through to at least 2012, the

division anticipates growth in the medium term to be primarily driven by larger,

more complex urban regeneration schemes. Lovell's work mix is therefore

expected to move towards these larger schemes over the coming years.

Financial review

Revenue and operating profit

Revenue increased by 15% to #1.5bn (2005: #1.3bn), driven by growth in all

operating divisions. Fit Out's revenue increased by 32% to #426m; Construction

by 2% to #343m; Infrastructure Services by 31% to #324m; Affordable Housing by

4% to #404m.

Group operating profit increased by 16% to #46.2m (2005: #39.9m). This

improvement was due to strong growth at Affordable Housing and Fit Out with

modest progress also made by Construction, offset by a reduction in operating

profit at Infrastructure Services. Fit Out increased its operating profit by

38% to #22.6m (2005: #16.4m), Affordable Housing by 29% to #24.0m (2005: #18.7m)

and Construction by 4% to #3.4m (2005: #3.2m). Infrastructure Services'

operating profit reduced slightly to #5.1m (2005: #6.0m). The cost of Group

Activities was #8.1m (2005: #4.8m) reflecting principally increased costs of

share based payments, Information Technology and investment related activity.

The share of results of joint ventures was a loss of #0.8m (2005: profit of

#0.4m).

Profit before and after tax

Profit before tax of #47.6m was 14% ahead of last year's #41.7m. This includes

net interest of #1.4m (2005: #1.8m). Profit after tax was #32.8m (2005: #29.6m).

The tax charge was #14.8m (2005: #12.1m) giving an effective tax rate of 31%

(2005: 29%).

Earnings per share and dividends

Basic earnings per share increased by 11% to 78.2p (2005: 70.7p). The final

dividend is proposed at 20.0p (2005: 18.0p) giving a total dividend for the year

of 28.0p which is 12% higher than last year (2005: 25.0p). Earnings cover the

dividend 2.8 times (2005: 2.8 times). The proposed dividend will be paid on 2

May 2007 to shareholders on the register at 10 April 2007.

Equity and capital structure

Equity increased to #141.9m (2005: #116.6m). The number of shares in issue at

31 December 2006 was 42,520,090 (2005: 42,315,970). The increase of 204,120

shares was due to the exercise of options under employee share option schemes.

There were no other new issues during the year.

Cash flow and treasury

Net cash from operating activities was #47.9m (2005: #14.5m) as a result of

increased profitability and improvements in working capital. The net payment to

acquire a subsidiary was #18.2m (2005:nil), capital expenditure was #3.2m (2005:

#4.7m) and payments to increase our interests in joint ventures were #0.9m

(2005: #6.2m), reflecting ongoing investment in the business. After payments

for tax, dividends and servicing of finance the net increase in cash and cash

equivalents was #23.4m resulting in a year end balance of #95.4m. It is

anticipated that these resources will be used for the continued growth of the

Group's businesses.

Consolidated income statement (unaudited)

For the year ended 31 December 2006

Notes 2006 2005

#'000s #'000s

Continuing operations

Revenue 1 1,496,844 1,296,708

Cost of sales (1,331,423) (1,154,118)

Gross profit 165,421 142,590

Administrative expenses (118,401) (103,109)

Share of results of joint ventures (796) 425

Operating profit 1 46,224 39,906

Investment revenues 3,807 3,661

Finance costs (2,421) (1,867)

Profit before tax 47,610 41,700

Tax 2 (14,797) (12,125)

Profit for the year from continuing operations

attributable to equity holders of the parent company 32,813 29,575

Earnings per share

From continuing operations

Basic 4 78.2p 70.7p

Diluted 4 76.3p 68.8p

There are no discontinued activities in either the current or preceding year.

Consolidated balance sheet (unaudited)

At 31 December 2006

2006 2005

#'000s #'000s

Non current assets

Property, plant and equipment 16,623 16,403

Goodwill 72,705 56,729

Interests in joint ventures 5,200 10,881

Investments 103 103

Deferred tax 3,584 2,485

98,215 86,601

Current assets

Inventories 86,805 87,571

Trade and other receivables 280,945 235,056

Cash and cash equivalents 95,433 72,018

463,183 394,645

Total assets 561,398 481,246

Current liabilities

Trade and other payables (406,795) (352,156)

Current tax liabilities (6,403) (6,295)

Obligations under finance leases (1,314) (766)

(414,512) (359,217)

Net current assets 48,671 35,428

Non current liabilities

Retirement benefit obligation (2,534) (3,351)

Obligations under finance leases (2,457) (2,059)

(4,991) (5,410)

Total liabilities (419,503) (364,627)

Net assets 141,895 116,619

Equity

Share capital 2,126 2,116

Share premium account 26,169 26,014

Capital redemption reserve 623 623

Own shares (3,387) (1,775)

Hedging reserve (795) (2,238)

Retained earnings 117,159 (91,879)

Total equity 141,895 116,619

Consolidated statement of recognised income and expense (unaudited)

For year ended 31 December 2006

2006 2005

#'000s #'000s

Actuarial gains/(losses) on defined benefit liabilities 700 (1,284)

Income tax credit in respect of share options taken directly to 930 -

equity

Deferred tax on retirement benefit obligations (282) 312

Movement on hedged items on cash flow hedges 1,443 (2,238)

Net income/(expense) recognised directly in equity 2,791 (3,210)

Profit for the year from continuing operations 32,813 29,575

Total recognised income and expense for the year attributable to

equity shareholders 35,604 26,365

Consolidated cash flow statement (unaudited)

For the year ended 31 December 2006

Notes 2006 2005

#'000s #'000s

Net cash from operating activities 5 47,909 14,477

Investing activities

Interest received 3,775 3,686

Dividends received from joint ventures 7,225 336

Proceeds on disposal of property, plant and equipment 1,112 1,433

Purchases of property, plant and equipment (3,216) (4,680)

Payments to acquire interest in joint ventures (896) (6,190)

Acquisition of subsidiary (23,035) -

Net cash acquired on acquisition of subsidiary 4,809 -

Net cash used in investing activities (10,226) (5,415)

Financing activities

Payments to acquire own shares (1,612) (782)

Dividends paid (10,914) (8,459)

Repayments of obligations under finance leases (1,787) (1,354)

Repayment of loan notes (120) (240)

Proceeds on issue of share capital 165 344

Net cash used in financing activities (14,268) (10,491)

Net increase/(decrease) in cash and cash equivalents 23,415 (1,429)

Cash and cash equivalents at beginning of year 72,018 73,447

Cash and cash equivalents at end of year

Bank balances and cash 95,433 72,018

Notes (unaudited)

For the year ended 31 December 2006

1. Business segments

For management purposes, the Group is organised into four operating divisions:

Fit Out, Construction, Infrastructure Services and Affordable Housing. The

divisions are the basis on which the Group reports its primary segment

information.

Segment information about the Group's continuing operations is presented below:

2006 2005

Operating Operating profit/

Revenue profit/(loss) Revenue (loss)

#'000s #'000s #'000s #'000s

Fit Out 425,629 22,599 322,618 16,398

Construction 343,316 3,358 335,750 3,214

Infrastructure Services 323,735 5,098 247,938 5,974

Affordable Housing 404,164 24,013 390,402 18,682

Group Activities - (8,048) - (4,787)

1,496,844 47,020 1,296,708 39,481

Share of results of joint ventures (796) 425

Operating profit 46,224 39,906

Investment revenues 3,807 3,661

Finance costs (2,421) (1,867)

Profit before tax 47,610 41,700

Tax (14,797) (12,125)

Profit for the year from

continuing operations 32,813 29,575

All the Group's operations are carried out in the United Kingdom and the Channel

Islands.

2. Tax

2006 2005

#'000s #'000s

Current tax:

UK corporation tax at standard rate of 30% (2005: 30%) 14,653 12,241

Adjustment in respect of prior years 517 140

15,170 12,381

Deferred tax:

Current year (72) (214)

Adjustment in respect of prior years (301) (42)

Income tax expense for the year 14,797 12,125

Notes continued (unaudited)

For the year ended 31 December 2006

2. Tax (continued)

The charge for the year can be reconciled to the profit per the income statement

as follows:

2006 2005

#'000s % #'000s %

Profit before tax 47,610 41,700

Income tax expense at standard rate 14,283 30.0 12,510 30.0

Tax effect of:

Share of results of joint ventures 239 0.5 (128) (0.3)

Expenses that are not deductible in determining 227 0.5

taxable profits

107 0.3

Movements not reflected in the income statement (168) (0.4) (462) (1.1)

Adjustments in respect of prior years 216 0.5 98 0.2

Income tax expense and effective tax rate for the year 14,797 31.1 12,125 29.1

The total amount of deferred tax assets that are not recognised in the financial

statements in relation to losses carried forward amount to #165,000 (2005:

#402,000) due to the uncertainty of the availability of future profits against

which the losses can be recovered.

3. Dividends

2006 2005

#'000s #'000s

Amounts recognised as distributions to equity holders in the period:

Final dividend for the year ended 31 December 2005 of 18.00p

(2004: 13.25p) per share 7,549 5,551

Interim dividend for the year ended 31 December 2006 of 8.00p

(2005: 7.00p) per share 3,365 2,929

10,914 8,480

Proposed final dividend for the year ended 31 December 2006 of

20.00p (2005: 18.00p) per share 8,415 7,617

The proposed final dividend is subject to approval by shareholders at the annual

general meeting and has not been included as a liability in these financial

statements. The proposed dividend will be paid on 2 May 2007 to shareholders on

the register at 10 April 2007. The ex-dividend date will be 4 April 2007.

Notes continued (unaudited)

For the year ended 31 December 2006

4. Earnings per share

There are no discontinued operations in either the current or prior year.

The calculation of the basic and diluted earnings per share is based on the

following data:

Earnings

2006 2005

#'000s #'000s

Earnings for the purposes of basic and dilutive earnings per share 32,813 29,575

being net profit attributable to equity holders of the parent

company

Number of shares

2006 2005

No. '000s No. '000s

Weighted average number of ordinary shares for the purposes of 41,949 41,810

basic earnings per share

Effect of dilutive potential ordinary shares:

Share options 877 893

Long Term Incentive Plan shares - 265

Conditional shares not vested 179 -

Weighted average number of ordinary shares for the purposes of 43,005 42,968

diluted earnings per share

Notes continued (unaudited)

For the year ended 31 December 2006

5. Reconciliation of operating profit to net cash from operating

activities

2006 2005

#'000s #'000s

Operating profit 46,224 39,906

Adjusted for:

Share of results of joint ventures 796 (425)

Depreciation of property, plant and equipment 4,904 4,505

Expense in respect of share options 959 589

Defined benefit pension payment (240) (240)

Defined benefit pension charge 123 82

Gain on disposal of property, plant and equipment (121) (919)

Operating cash flows before movements in working 52,645 43,498

capital

Decrease/(increase) in inventories 766 (26,754)

Increase in receivables (35,761) (31,969)

Increase in payables 46,461 43,118

Cash generated from operations 64,111 27,893

Income taxes paid (13,937) (11,658)

Interest paid (2,265) (1,758)

Net cash from operating activities 47,909 14,477

Additions to property, plant and equipment during the year amounting to #2.1m

and additions to leasehold property amounting to #0.5m were financed by new

finance leases.

Cash and cash equivalents (which are presented as a single class of assets on

the face of the balance sheet) comprise cash at bank and other short-term highly

liquid investments with a maturity of three months or less.

6. Accounting policies

This announcement is prepared on the basis of accounting policies as stated in

the financial statements for the year ended 31 December 2006.

The financial information set out in the announcement does not constitute the

Company's statutory accounts for the years ended 31 December 2006 or 2005. The

financial statements for the year ended 31 December 2005 have been delivered to

the Registrar of Companies. The auditors reported on those accounts; their

report was unqualified and did not contain a statement under s237(2) or (3)

Companies Act 1985.

No accounts for the Company in respect of the year ended 31 December 2006 have

been delivered to the Registrar of Companies, nor have the auditors of the

Company made a report under Section 236 of the Companies Act 1985 in respect of

any accounts for that financial year.

The statutory accounts for the year ended 31 December 2006 will be finalised on

the basis of the financial information presented by the directors in this

preliminary announcement, will be posted to shareholders on or about the 14

March 2007 and will be delivered to the Registrar of Companies following the

Company's annual general meeting.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR DGGMZMLNGNZZ

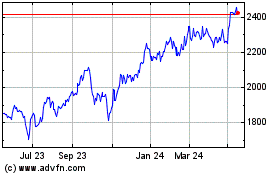

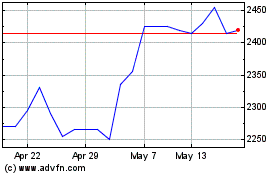

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jul 2023 to Jul 2024