Pre-Close Trading Update

December 19 2006 - 2:02AM

UK Regulatory

RNS Number:1748O

Morgan Sindall PLC

19 December 2006

Morgan Sindall plc

Pre-close Trading Update

The Board of Morgan Sindall plc today announces a trading update, prior to its

close period, for the year to 31 December 2006. The Group's preliminary results

will be announced in February 2007.

Trading

Overall the Group has made further progress during the year and is trading in

line with expectations and again seeing year on year growth.

Fit Out's market has remained buoyant and the division has traded strongly

throughout the current period. In November the division secured its biggest

contract to date with Deloitte, which is in line with its stated intention of

delivering larger scale projects. Overall the forward order book has been

maintained at a level similar to June 2006 and this order book supports our view

that the current market strength will continue well into 2007.

Construction continues to focus on its target sectors of health, education,

light industrial and commercial. Revenue and profit for 2006 are expected to

increase modestly on 2005 and the forward order book has been broadly

maintained.

Infrastructure Services has been very successful in securing #800m of new

contracts across the infrastructure, utilities, tunnelling and rail sectors,

which is expected to lead to increased revenue and profit in 2007. In

particular, the new rail business is performing well and is expected to

contribute significantly to this growth. However, as previously announced, the

combination of the reorganisation of the division in the first half of the year

and the commencement of new contracts will impact margins in 2006.

Affordable Housing's margin continues to grow strongly. Current workload is

balanced between new build and refurbishment activities, with the Decent Homes

frameworks continuing to be an important part of the division's workload.

However, we expect future growth to be increasingly driven by larger, more

complex mixed tenure schemes. The forward order book has been maintained and

there are also a number of larger scale opportunities in the pipeline.

Overall the forward order book stands at #3.4bn, an increase of 22% since the

beginning of the year. This reflects, in particular, the strong market

conditions in Fit Out and Infrastructure Services. Average cash balances will

be lower than in the previous year owing to the #23m acquisition in March of the

non-track rail business and further investment in working capital at Affordable

Housing. All of our markets continue to demonstrate growth and the outlook for

the Group remains positive.

19 December 2006

Enquiries:

Morgan Sindall plc Tel: 020 7307 9200

Paul Smith, Chief Executive

David Mulligan, Finance Director

College Hill Tel: 020 7457 2020

Matthew Smallwood

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTAKFKNOBDDFBD

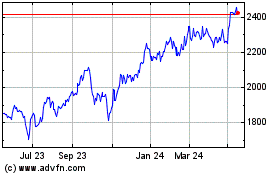

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

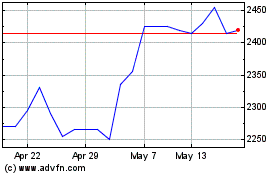

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jul 2023 to Jul 2024