TIDMPPC

RNS Number : 7137A

President Energy PLC

27 September 2022

27 September 2022

PRESIDENT ENERGY PLC

("President", "the Company" or "the Group")

Unaudited Half Year Results for H1 2022

Current trading

President (AIM:PPC), the oil and gas upstream company with a

diverse portfolio of production and exploration assets focused

primarily in Latin America, announces its unaudited half year

results for the six months ended 30 June 2022.

Selected Results Summary

All numbers in US$ '000 unless stated H1 2022 H1 2021

Profit / (loss) after tax but before

non-cash items 5,620 (2,132)

-------- --------

Adjusted EBITDA 5,678 4,536

-------- --------

Free cash flow generation from core

operations 6,805 6,192

-------- --------

Revenue 17,632 17,104

-------- --------

Average daily production, boe (oil

& gas) 1,969 2,648

-------- --------

Average realised price per boe (US$) 53.4 39.6

-------- --------

Group net debt 29,242 16,746

-------- --------

Administrative expenses US$ per boe 4.9 4.0

-------- --------

Well operating costs US$ per boe 20.3 15.4

-------- --------

Corporate and Financial Summary

-- Profit after tax before non-cash items* of US$5.6 million (H1 2021 loss of US$2.1 million)

-- Group turnover of US$17.7 million (H1 2021 US$17.1 million)

-- Free cash flow from core operations of US$6.8 million up 10%

over the same period in 2021 (H1 2021 US$6.2 million)

-- Adjusted EBITDA of US$5.7 million up 25% over the same period in 2021

-- Third party financial borrowings in Argentina non-recourse to

Group of US$22.9 million (H1 2021 US$5.9 million) with such

increased borrowings arising from material new capex spending,

including drilling and investments made in Argentina. All debt in

Argentina being serviced in accordance with terms. Group debt of

US$11.3 million (H1 2021 US$11.4 million) to the UK parent is

covenant lite, long-term debt from IYA, an affiliate of the largest

shareholder and Chairman under an open line of credit

-- Mark to market value of holding in Atome Energy PLC as at 20

September 2022 of GBP9.8m (2021: nil) all of which is not shown in

the accounts due to the vagaries of accounting reporting

standards

-- Due to currency exchange restrictions in Argentina, the

amount paid back to the UK by its Argentina subsidiary was, and

still is, limited to servicing interest for part of the

intercompany loan with no capital repayments currently permitted by

law. By way of illustration, currently this monthly interest

payment back to Group amounts to some US$ 115k

Operational Summary

-- Average Group net daily production in the period of 1,969

boepd, down 26% on the previous year, impacted by production

outages in Argentina, delay in new wells coming on-stream and

Louisiana being offline for more than half of the period

-- Group production split 69% oil and 31% gas (H1 2021: 64% oil and 36% gas)

-- Group well operating costs per boe in the core Argentine

business increased by 27% over same period last year due to lower

production

-- In Louisiana, disappointing issues with workovers and

procuring of equipment resulted in no material contribution to

results in the period with wells shut-in for more than half the

period and sub-optimal flow levels for a longer period.

Accordingly, during that period of inactivity, no monies were

repaid to the Group and in fact, over US$ 1 million was paid by the

Group out of central resources in connection with workover

activities

-- In Paraguay, work continued in relation to preparation for

drilling of the exploration well with our partner CPC, the State

Energy Company of Taiwan

-- Green House Capital has been created with the purpose of

becoming the alternative energy division of President. That

division has taken first steps with potential Lithium

investment

-- Average price per barrel received during the Period was US$

64.75 in Argentina and US$104.44 in Louisiana

Current trading and developments

-- Further to the recent fire in our Puesto Flores Facility in

Rio Negro Argentina as announced on 11 August, the disruption has

impacted on production from the Puesto Flores oil field in August

and September with full and normal production there expected in the

first part of October. The Company has insurance coverage and there

were no injuries to personnel

-- All other of the Company's fields in Rio Negro, including gas

production, and Puesto Guardian have continued to produce normally

without disruption, with Salta, Argentina, production for August

showing an increase of over 70 % compared to the level of

production as at 1 January 2022

-- Sales price for oil in Argentina improving with current price

receivable in Rio Negro approximately US$65 per barrel and in Salta

US$68. The recent reduction in international oil prices has to date

not affected these levels

-- At the current time, the Company has no visibility as to when

principal loan repayments can start to be made to the Group from

Argentina with timing completely out of the hands of President

-- In Louisiana full production is now expected to resume in

October after final installation of the necessary gas lift

equipment with the wells having being offline for approximately 90%

of the time since the start of H2 2022 due to complications in

finalising agreements for the gas buyback and sourcing available

barges. Once online, profits can start to be repatriated to the

Group

-- In September new management in Louisiana have been installed

at operational level which has started to have a noticeable effect

in moving things forward. Until such a time as full production is

re-started it is imprudent to project steady state levels of flow

as this will be the first time that gas lift will be utilised in

the Triche well albeit, in theory, this is designed to stabilise

and enhance production levels and mitigate the annoying stop start

of recent periods.

-- In Paraguay, preparations for the new exploration well have

continued satisfactorily with all contractual payments by the

partner being paid on time and good relations enjoyed. The position

with the Rig contract remains to be fully resolved due to internal

complications with the current owner although this is expected to

be resolved by the end of November. At that stage, a spud date will

be determined

-- Green House Capital having taken first steps in relation to

Lithium in Argentina and is now seeking to expand its interests in

alternative energies and related technologies outside of that

country . This is an ongoing process.

-- The name of the Company is proposed to be changed to

Molecular Energies PLC together with consolidation of shares and

increase in authorities. General Meeting of shareholders due to be

held on 29 September 2022 .

Commenting on today's announcement, Peter Levine, Chairman

said:

"President has delivered a period of solid profits but we

recognise the difficulties of the Group's current reliance on

cashflow from its Argentine centric main business when it is not

possible to repatriate such profits to Group level. The formation

of Green House Capital, which intends to replicate the success of

the Atome transaction for the benefit of President shareholders, is

the first step in a diversification programme that is subject to

active internal debate.

"The disruption in hydrocarbon production in Argentina and

Louisiana has not in any event been helpful to our existing

business the effect of which is being felt in the second part of

this year. I have ordered action and change at country, field and

local management level to get us back on a consistent growth path

which is a necessity in any event. Notwithstanding my continuing

financial support for what will soon be Molecular Energies through

my private investment group, reducing the Group debt level

including at parent level is a priority over the next months. This

will place the Group in a stronger position whilst supporting its

evolution into more fertile fields of business where the prospects

are re-invigorating and exciting after the frustrating and

unrewarding battles of the last years.

"The change of name, image and related matters including the

creation of Green House Capital are evidence of our determination

to carry out the evolution as soon as possible. The appreciation of

approximately 30% in the Atome Energy share price since the start

of the year achieved with the right management team we put in place

is beneficial to our investment assets and is a precedent pointing

to our capability to enhance shareholder value by our evolved

strategy.

"The Group has a solid base, is profitable on a post-tax basis

excluding non-cash items and is operationally cash-flow positive.

As the board continues to implement its new strategy we look

forward to our future as Molecular Energies PLC capitalising and

repeating the success of Atome with a significant originated value

generation for shareholders".

Peter Levine

Chairman

27 September 2022

* Adjusted EBITDA means Operating Profit before depreciation,

depletion and amortisation, adjusted for non-cash share-based

expenses and certain non-recurring items. Non-recurring items

include where relevant workovers.

* Profit after tax after non-cash items which comprise

depletion, depreciation, amortisation, impairment, non-operating

gains/losses and deferred tax.

* Cost per boe metrics are adjusted for costs management

consider are exceptional and non-recurring in nature

* Free cash flow from core operations is defined in the 2021

Annual Report. The treasury income which has been included is the

exchange (losses)/gains on cash and cash equivalents as detailed in

the Consolidated Statement of Cashflows

This announcement contains inside information for the purposes

of article 7 of Regulation 596/2014.

Notes to Editors

President Energy is an oil and gas company listed on the AIM

market of the London Stock Exchange (PPC.L) primarily focused in

Argentina, with a diverse portfolio of operated onshore producing

and exploration assets.

The Company has operated interests in the Puesto Flores,

Estancia Vieja, Puesto Prado and Las Bases Concessions, and the

Angostura exploration contract, all of which are situated in the

Río Negro Province in the Neuquén Basin of Argentina and in the

Puesto Guardian Concession, in the Noroeste Basin in NW Argentina.

Alongside this, President Energy has cash generative production

assets in Louisiana, USA and further significant exploration and

development opportunities through its acreage in Paraguay and

Argentina.

It has also a 27.9% investment interest in Atome Energy PLC a

green hydrogen and ammonia producer whose shares are traded on AIM

of the London Stock Exchange.

With a strong strategic and institutional base of support,

including the international commodity trader and logistics company

Trafigura, an in-country management team as well as the Chairman

whose interests as the largest shareholder are aligned to those of

its shareholders, President Energy gives UK investors access to an

energy growth story combined with world class standards of

corporate governance, environmental and social responsibility.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR"). The person who arranged for the release of this

announcement on behalf of the Company was Peter Levine,

Chairman.

For further information, please visit www.presidentenergy.com or

contact:

President Energy PLC +44 (0)20 7016 7950

Rob Shepherd, Finance Director info@presidentpc.com

Nikita Levine, Investor Relations

finnCap (Nominated Advisor and broker)

Christopher Raggett, Tim Harper +44 (0)20 7220 0500

Tavistock (financial PR)

Simon Hudson, Nick Elwes, Charles Baister +44 (0)20 7920 3150

Glossary of terms

Boe(pd) Barrels of oil equivalent (per day)

Bopd Barrels of oil per day

DDA Depletion, depreciation and. amortisation

EV Enterprise value meaning market capitalisation plus debt

MMbbls Million barrels of oil

MMboe Million barrels of oil equivalent

MMBtu Million British Thermal Units (gas)

M(3) /d Cubic metres of production of gas or oil per day (as the case may be)

Condensed Consolidated Statement of Comprehensive Income

Six months ended 30 June 2022

6 months 6 months Year to

to 30

to 30 June June 31 Dec

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

Note US$000 US$000 US$000

Continuing Operations

Revenue 17,632 17,104 34,147

Cost of sales

Depletion, depreciation & amortisation (4,374) (5,108) (11,374)

Other cost of sales (11,026) (11,493) (22,057)

------------ ------------ ----------

Total cost of sales 3 (15,400) (16,601) (33,431)

------------ ------------ ----------

Gross profit/(loss) 2,232 503 716

Administrative expenses 4 (1,741) (1,942) (5,764)

Operating gain/(loss) 500 - -

Operating profit / (loss) before

impairment charge

------------ ------------ ----------

and non-operating gains / (losses) 991 (1,439) (5,048)

Presented as:

Adjusted EBITDA 5,678 4,536 7,526

Non-recurring items (199) (581) (751)

EBITDA excluding share options 5,479 3,955 6,775

Depreciation, depletion & amortisation (4,415) (5,134) (11,456)

Share based payment expense (73) (260) (367)

Operating profit / (loss) 991 (1,439) (5,048)

------------------------------------------ ----- ------------ ------------

Impairment charge 5 - - (51)

Profit / (loss) in associate undertaking (25) - -

Non-operating gains /(losses) 6 351 2 14,494

Profit/(loss) after impairment

and non-operating

------------ ------------ ----------

gains and (losses) 1,317 (1,437) 9,395

Finance income 7 3,259 855 1,633

Finance costs 7 (3,045) (2,418) (5,324)

Profit / (loss) before tax 1,531 (3,000) 5,704

Income tax (charge)/credit

Current tax income tax (charge)/credit - - -

Deferred tax being a provision

for future taxes 2,036 (376) (1,125)

Total income tax (charge)/credit 2,036 (376) (1,125)

Profit/(loss) for the period

from continuing operations 3,567 (3,376) 4,579

Other comprehensive income

Total comprehensive profit/(loss)

for the period

attributable to the equity holders

of the Parent Company 3,567 (3,376) 4,579

============ ============ ==========

Earnings/ (loss )per share from

continuing operations US cents US cents US cents

Basic earnings/ (loss) per share 8 0.17 (0.17) 0.23

Diluted earnings / (loss) per

share 8 0.17 (0.17) 0.22

============ ============ ==========

Condensed Consolidated Statement of Financial Position

As at 30 June 2022

30 June 30 June 31 Dec

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

ASSETS Note

Non-current assets

Intangible exploration and evaluation

assets 9 54,304 52,794 54,304

Goodwill 705 705 705

Investment in associate - - 25

Property, plant and equipment 9 74,071 56,787 59,148

------------ ------------ ----------

129,080 110,286 114,182

Deferred tax 356 507 350

Other non-current assets 103 103 103

129,539 110,896 114,635

------------ ------------ ----------

Current assets

Trade and other receivables 10 7,350 6,299 11,887

Inventory - 1,336 1,336

Cash and cash equivalents 4,970 555 2,014

12,320 8,190 15,237

------------ ------------ ----------

TOTAL ASSETS 141,859 119,086 129,872

============ ============ ==========

LIABILITIES

Current liabilities

Trade and other payables 11 22,891 14,897 17,424

Borrowings 12 12,521 1,584 7,014

35,412 16,481 24,438

------------ ------------ ----------

Non-current liabilities

Trade and other payables 11 4,059 4,631 4,580

Long-term provisions 7,963 6,985 7,480

Borrowings 12 21,691 15,717 22,250

Deferred tax 253 1,691 2,283

33,966 29,024 36,593

------------ ------------ ----------

TOTAL LIABILITIES 69,378 45,505 61,031

============ ============ ==========

EQUITY

Share capital 36,179 35,868 36,179

Share premium 48 258,162 48

Translation reserve (50,240) (50,240) (50,240)

Profit and loss account 78,712 (178,007) 75,145

Other reserve 7,782 7,798 7,709

TOTAL EQUITY 72,481 73,581 68,841

============ ============ ==========

TOTAL EQUITY AND LIABILITIES 141,859 119,086 129,872

============ ============ ==========

Condensed Consolidated Statement of Changes in Equity

Share Share Translation Profit Other Total

capital premium reserve and loss reserve

account

US$000 US$000 US$000 US$000 US$000 US$000

Balance at 1 January

2021 35,708 257,992 (50,240) (174,631) 7,538 76,367

--------- ---------- ------------ ---------- --------- ---------

Share-based payments - - - - 260 260

Subscriptions 160 170 - - - 330

Transactions with owners 160 170 - - 260 590

Loss for the period - - - (3,376) - (3,376)

Total comprehensive

income/(loss) - - - (3,376) - (3,376)

Balance at 30 June 2021 35,868 258,162 (50,240) (178,007) 7,798 73,581

Share-based payments - - - - 107 107

Debt conversion 82 58 - - - 140

Subscription 81 84 - - - 165

Exercise of options 148 48 - - (196) -

Capital reduction - (258,304) - 258,304 -

Dividend in specie - - - (13,130) (13,130)

Transactions with owners 311 (258,114) - 245,174 (89) (12,718)

Profit for the period - - - 7,955 - 7,955

Exchange differences on

translation - - 23 - - 23

Reclassified to profit

and loss - - (23) 23 - -

Total comprehensive

income/(loss) - - - 7,978 - 7,978

Balance at 1 January

2022 36,179 48 (50,240) 75,145 7,709 68,841

Share-based payments - - - - 73 73

Transactions with owners - - - - 73 73

Loss for the period - - - 3,567 - 3,567

Total comprehensive

income/(loss) - - - 3,567 - 3,567

Balance at 30 June 2022 36,179 48 (50,240) 78,712 7,782 72,481

========= ========== ============ ========== ========= =========

Condensed Consolidated Statement of Cash Flows

Six months ended 30 June 2022

6 months 6 months Year to

to 30

June to 30 June 31 Dec

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

Cash flows from operating activities

- (Note 13)

Cash generated/(consumed) by operations 8,639 3,571 11,078

Interest received 83 39 145

Taxes paid - - -

8,722 3,610 11,223

------------ ------------ ----------

Cash flows from investing activities

Expenditure on exploration and evaluation

assets - (91) (1,652)

Expenditure on development and production

assets

(excluding increase in provision for

decommissioning) (10,021) (2,446) (19,431)

Expenditure on decommissioning costs - - -

Proceeds from asset sales - 31 29

Proceeds from Paraguay farm out - - 4,000

Acquisition & licence extension in

Argentina - (284) (284)

Release of bond with state authorities - - (1)

(10,021) (2,790) (17,339)

------------ ------------ ----------

Cash flows from financing activities

Proceeds from issue of shares (net

of expenses) - 330 495

Loan drawdown 8,120 1,410 11,731

Repayment of borrowings (3,018) (1,965) (3,130)

Payment of loan interest and fees (1,539) (857) (1,338)

Repayment of obligations under leases (703) (638) (1,332)

2,860 (1,720) 6,426

------------ ------------ ----------

Net increase/(decrease) in cash and

cash equivalents 1,561 (900) 310

Opening cash and cash equivalents at

beginning of year 2,014 1,144 1,144

Exchange (losses)/gains on cash and

cash equivalents 1,395 311 560

Closing cash and cash equivalents 4,970 555 2,014

============ ============ ==========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2022

1 Nature of operations and general information

President Energy PLC and its subsidiaries' (together, "the

Group") principal activities are the exploration for and the

evaluation and production of oil and gas.

President Energy PLC is the Group's ultimate parent company. It

is incorporated and domiciled in England. The Group has onshore oil

and gas production and reserves in Argentina and the USA. The Group

also has onshore exploration assets in Paraguay and Argentina. The

address of President Energy PLC's registered office is Carrwood

Park, Selby Road, Leeds, LS15 4LG. President Energy PLC's shares

are listed on the Alternative Investment Market of the London Stock

Exchange.

These condensed consolidated interim financial statements (the

interim financial statements) have been approved for issue by the

Board of Directors on 26(th) September 2022. The financial

information for the year ended 31 December 2021 set out in this

interim report does not constitute statutory accounts as defined in

Section 434 of the Companies Act 2006. The financial information

for the six months ended 30 June 2022 and 30 June 2021 was neither

audited nor reviewed by the auditor. The Group's statutory

financial statements for the year ended 31 December 2021 have been

filed with the Registrar of Companies. The auditor's report on

those financial statements was unqualified and did not draw

attention to any matters by way of emphasis and did not contain a

statement under section 498(2) or (3) of the Companies Act 2006

2 Basis of preparation

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2021, which

have been prepared under IFRS.

These financial statements have been prepared under the

historical cost convention, except for any derivative financial

instruments which have been measured at fair value. The accounting

policies adopted in the 2022 interim financial statements are the

same as those adopted in the 2021 Annual report and accounts.

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

3 Cost

of Sales

Depreciation 4,374 5,108 11,374

Royalties & production

taxes 3,575 3,535 6,031

Well operating costs 7,451 7,958 16,026

15,400 16,601 33,431

============ ============ ==========

4 Administrative expenses

Directors and staff cost 1,102 1,306 2,530

Share-based payments 73 260 367

Depreciation 41 26 82

Other 525 350 2,785

1,741 1,942 5,764

============ ============ ==========

5 Impairment (credit) / charge

Matorras & Ocultar in Argentina

(intangible) - - 51

- - 51

============ ============ ==========

6 Non-operating (gains) / losses

Gain on dividend in specie

of Atome shares - - (13,130)

Reversal of provision for

doubtful taxes - 29 -

Arising on lease modifications 4 - (18)

Other (gains) / losses (355) (31) (29)

Gain on Atome transition

to an associate investment - - (1,317)

(351) (2) (14,494)

============ ============ ==========

7 Finance income & costs

Interest income 83 39 145

Exchange gains 3,176 816 1,488

Finance income 3,259 855 1,633

============ ============ ==========

Interest & similar charges 3,045 2,418 5,324

Finance costs 3,045 2,418 5,324

============ ============ ==========

8 Earnings / (loss) per share

Net profit / (loss) for

the period attributable

to the equity holders

of the

Parent Company 3,567 (3,376) 4,579

============ ============ ==========

Number Number Number

'000 '000 '000

Weighted average number

of shares in issue 2,058,074 2,030,951 2,031,855

============ ============ ==========

Earnings /(loss) per share US cents US cents US cents

Basic 0.17 (0.17) 0.23

Diluted 0.17 (0.17) 0.22

============ ============ ==========

9 Non-current assets

Property

Plant

E&E and Total

Assets Equipment

US$000 US$000 US$000

Cost

At 1 January 2021 145,124 147,289 292,413

Additions 91 5,968 6,059

Acquisition in USA - - -

Right of use assets (IFRS16) - 1,464 1,464

At 30 June 2021 145,215 154,721 299,936

Additions 1,510 8,732 10,242

Disposals - (256) (256)

At 1 January 2022 146,725 163,197 309,922

Additions - 18,961 18,961

Right of use assets (IFRS16) - 377 377

At 30 June 2022 146,725 182,535 329,260

======== ========== ========

Depreciation/Impairment

At 1 January 2021 92,421 92,800 185,221

Charge for the period - 5,134 5,134

-------- ---------- --------

At 30 June 2021 92,421 97,934 190,355

Impaired - - -

Disposals - (207) (207)

Charge for the period - 6,322 6,322

-------- ---------- --------

At 1 January 2022 92,421 104,049 196,470

Impaired - - -

Charge for the period - 4,415 4,415

At 30 June 2022 92,421 108,464 200,885

======== ========== ========

Net Book Value 30 June 2022 54,304 74,071 128,375

======== ========== ========

Net Book Value 30 June 2021 52,794 56,787 109,581

======== ========== ========

Net Book Value 31 December 2021 54,304 59,148 113,452

======== ========== ========

30 June 30 June 31 Dec

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

10 Trade and other receivables

Trade and other receivables 6,092 6,155 6,406

Due from Atome - - 1,291

Prepayments 1,258 144 4,190

7,350 6,299 11,887

============ ============ ==========

11. Trade and other payables

Current

Trade and other payables 9,176 8,997 10,679

Drilling, workover and

operation accruals 8,268 5,026 1,959

Paraguay drilling obligations

and accruals 4,251 - 4,000

Current portion of leases 1,196 874 786

22,891 14,897 17,424

============ ============ ==========

Non-current

Non-current trade and other

payables 2,409 1,990 2,399

Non-current portion of

leases 1,650 2,641 2,181

4,059 4,631 4,580

============ ============ ==========

Total carrying value 26,950 19,528 22,004

============ ============ ==========

12 Borrowings

Current

Bank loan 1,680 84 2,053

Promissory notes & bonds 10,841 1,500 4,961

12,521 1,584 7,014

Non-Current

IYA Loan 11,289 11,442 11,284

Bank loan 2,342 4,275 2,016

Promissory notes & bonds 8,060 - 8,950

21,691 15,717 22,250

------------ ------------ ----------

Total carrying value of

borrowings 34,212 17,301 29,264

============ ============ ==========

13 Reconciliation of operating profit to net

cash outflow from operating activities

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

Profit/(loss) from operations before

taxation 1,531 (3,000) 5,704

Interest on bank deposits (83) (39) (145)

Interest payable and loan fees 3,045 2,418 5,324

Depreciation and impairment of property,

plant and equipment 4,415 5,134 11,456

Impairment charge - - 51

Loss on associate investment 25 - -

Gain on non-operating transaction (351) (2) (14,494)

Share-based payments 73 260 367

Foreign exchange difference (3,176) (816) (1,488)

Operating cash flows before movements

in working capital 5,479 3,955 6,775

(Increase)/decrease in receivables 1,638 (1,933) (2,430)

(Increase)/decrease in inventory 1,687 - -

(Decrease)/increase in payables (165) 1,549 6,733

Net cash generated by/(used in)

operating activities 8,639 3,571 11,078

============= ============= ==========

14 Atome Energy plc

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

Selected key financial extracts US$000 US$000 US$000

Group Statement of Comprehensive

Income

Include in Administrative expense - - (1,397)

Gain / (loss) on Atome associate

investment (25) - 1,317

Gain on dividend in specie of Atome

shares - - 13,130

(25) - 13,050

============ ============ =============

Group Statement of Financial position

Non-current Investment in associate

at cost - - 25

============ ============ =============

Current receivable due from Atome - 405 1,291

============ ============ =============

Company Profit & Loss Statement

Gain on dividend in specie of Atome

shares - - 13,096

Gain arising on mark to market of

investment 1,600 - 10,150

Foreign exchange loss on valuation

of investment (1,020) - -

580 - 23,246

============ ============ =============

Company Statement of Financial position

Investment in Atome Energy plc at

market value 10,755 - 10,175

============ ============ =============

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCGDCXXDDGDL

(END) Dow Jones Newswires

September 27, 2022 02:01 ET (06:01 GMT)

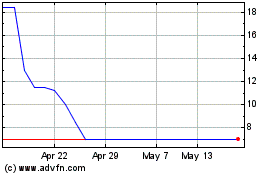

Molecular Energies (LSE:MEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Molecular Energies (LSE:MEN)

Historical Stock Chart

From Jul 2023 to Jul 2024