TIDMLGRS

RNS Number : 2453S

Loungers PLC

13 July 2022

13 July 2022

Loungers plc

("Loungers" or the "Group")

Audited results for the 52 weeks ended 17 April 2022

A record year of financial and operational progress

Recently opened our 200(th) site, with ambitious roll-out plans

now expanding to 30 sites per year

Loungers, a leading operator of all day café/bar/restaurants

across the UK under the Lounge and Cosy Club brands, is pleased to

announce its audited results for the 52 weeks ended 17 April 2022

("FY22").

Finance Summary

52 weeks 52 weeks 52 weeks

ended 17 ended 18 ended 19

April 2022 April 2021 April 2020

GBP'000 GBP'000 GBP'000

Revenue 237,291 78,346 166,502

Adjusted EBITDA 53,639 13,913 28,767

Adjusted EBITDA margin (%) 22.6% 17.8% 17.3%

Adjusted EBITDA (IAS17) 42,319 3,530 18,813

Adjusted EBITDA (IAS17) margin

(%) 17.8% 4.5% 11.3%

Operating profit / (loss) 28,437 (7,728) (6,716)

Adjusted operating profit / (loss) 34,001 (3,946) 11,965

Adjusted operating profit margin

(%) 14.3% (5.0%) 7.2%

Profit / (loss) before tax 21,605 (14,722) (14,781)

Diluted earnings / (losses) per

share (p) 17.0 (10.9) (14.0)

Cash generated from operating activities 69,626 12,031 24,397

17 April 18 April 19 April

2022 2021 2020

GBP'000 GBP'000 GBP'000

Non-property net debt 1,025 34,245 34,956

Financial and Operational Highlights

-- Achieved record revenue of GBP237.3m (up 203% from FY21) and

Adjusted EBITDA of GBP53.6m (up 286% from FY21)

-- Consistent out-performance of the wider sector by more than

15% over the year, according to the Peach Tracker (the established

industry sales monitor for the UK pub, bar and restaurant

sectors)

-- A record 27 new sites opened in the year, with our 200(th) site just opened

-- Balance sheet strength significantly enhanced, with

non-property net debt reduced by GBP33.2m to GBP1.0m

-- Increased to five build teams and now have the capacity to

open around 32 new sites per year

-- Very strong operational performance facing down the

challenges of the "pingdemic", recruitment, and Omicron

-- Continuous evolution: re-working of the Cosy Club menu and

elevation of the Cosy Club proposition, ongoing kitchen investment

and completion of the kitchen management system roll-out

-- App ordering now accounts for over 40% of Lounge sales and is

leading to higher average spend and faster service

-- Further investment in the leadership team and operational

structure to ensure we can continue to deliver operational

intensity and growth

-- Continued investment in and focus on our employer proposition

Current Trading and Outlook

Since the year end our LFL sales have been +17.9% on a three

year basis, representing a 15% out-performance of the Peach

Tracker. We are delighted with how the business is trading and,

despite the well-documented macroeconomic challenges, have not yet

seen any shift in how our customers are behaving.

Whilst the short-term outlook is of course uncertain, we remain

confident in the future prospects for Loungers given the quality

and value of our all-day offering. In addition, our pipeline of new

openings is well-developed and we continue to see a wealth of

excellent opportunities to occupy prime pitches on the high street.

This, combined with our recently expanded fit-out teams, means that

we now have the capacity to roll-out over 30 sites a year and

expect to have at least 500 sites in the UK across both of our

brands in the future.

Nick Collins, Chief Executive Officer of Loungers said:

"These results demonstrate the extent to which Loungers has

thrived over the past year, achieving a record number of openings,

record underlying like for like sales growth and a record level of

profits. We are benefitting from changes in consumer behaviour,

with more people staying local, working from home, and supporting

their local community and high street. We are delighted to have

just opened our 200(th) site, and to be announcing today that we

are increasing our roll-out target for site openings to 30 for this

year.

Whilst the short-term economic outlook is challenging, we are in

an excellent position to weather the storm and to take advantage of

growth opportunities coming out of it. We have a strong balance

sheet, a very capable and highly motivated team and an affordable,

value for money all-day offer with enormous scope for further

expansion across the UK."

Analyst Presentation Webcast

An analyst presentation will be held today, Wednesday 13 July

2022, at 9:30am (BST). Participants wishing to join the webcast

should contact loungers@powerscourt-group.com to request

details.

(1) Adjusted EBITDA is calculated as operating profit before

depreciation, pre-opening costs, exceptional costs, and share-based

payment charges.

For further information please contact:

Loungers plc Via Powerscourt

Nick Collins, Chief Executive Officer

Gregor Grant, Chief Financial Officer

Houlihan Lokey UK Limited (Financial Adviser Tel: +44 (0) 20

and NOMAD) 7484 4040

Sam Fuller / Tim Richardson

Liberum Capital Limited (Joint Broker) Tel: +44 (0) 20

Andrew Godber / John Fishley 3100 2000

Peel Hunt LLP (Joint Broker) Tel: +44 (0)20 7418

Dan Webster / George Sellar 8900

Powerscourt (Financial Public Relations) Tel: +44 (0) 207

Rob Greening / Nick Hayns / Elizabeth Kittle 250 1446

Notes to Editors

Loungers operates through its two complementary brands - Lounge

and Cosy Club - in the UK hospitality sector. A Lounge is a

neighbourhood café/bar combining elements of coffee shop culture,

the British pub and dining. There are 169 Lounges nationwide.

Lounges are principally located in secondary suburban high streets

and small town centres. The sites are characterised by informal,

unique interiors with an emphasis on a warm, comfortable

atmosphere, often described as a "home from home". Cosy Clubs are

more formal bars/restaurants offering reservations and table

service but share many similarities with the Lounges in terms of

their broad, all-day offering and their focus on hospitality and

culture. Cosy Clubs are typically located in city centres and large

market towns. Interiors tend to be larger and more theatrical than

for a Lounge, and heritage buildings or first-floor spaces are

often employed to create a sense of occasion. There are 32 Cosy

Clubs nationwide.

Chairman's Statement

Overview

A record year of financial and operational progress

FY22 was a record year for Loungers, with sales of GBP237.3m,

Adjusted EBITDA of GBP53.6m (IFRS16), and 27 new sites opened. We

have come through the challenges of the Covid period with flying

colours, and we are a stronger, more resilient and indeed more

ambitious business than ever before. All in all, our performance

during the year was a truly outstanding achievement against an

extraordinarily challenging and changeable backdrop.

At the start of the financial year, we only had roughly a third

of our estate open - and even then those sites were only able to

trade outside. On 17 May 2021 the entire estate recommenced

trading, which for some of our sites was the first time that they

had been able to welcome customers since early November 2020. We

had planned meticulously to ensure that we hit the ground running

as quickly as possible, and as a result our sites were busy

straight from the off.

However, as we went into a very busy summer, the 'pingdemic',

rising Covid cases, and significant recruitment challenges caused

severe disruption to our ability to trade normally. We found

ourselves having to take extremely difficult decisions and to make

compromises about how we operated. Throughout this time, the

commitment, professionalism and dedication of our teams never

wavered, and it was humbling to witness the way in which they

helped to navigate the business through the unprecedented

challenges of that summer.

As we went into autumn, a certain amount of stability returned

and we regrouped with a sense of optimism that the pandemic and its

consequences might finally be behind us. However, we could already

see then the warning signs of economic trouble ahead as inflation

started to soar, and we began to plan accordingly.

As it transpired, Covid was far from over and the Omicron

variant wreaked havoc throughout the Christmas season, which is of

course a critically important time for the hospitality sector.

Whilst sales at Lounge held up well during December, we saw

widespread Christmas party cancellations at our 31 Cosy Clubs.

Although some of those parties rebooked with us in the new year, it

clearly wasn't enough to compensate for the momentum that was lost

in December. We are hopeful that, given the pent-up consumer demand

after two years of lost Christmas party celebrations, December 2022

should be a bumper month.

As we entered 2022, we found ourselves up against a new set of

challenges, and the short-term outlook is looking exceptionally

uncertain for many businesses. However, in the case of Loungers,

our consistent outperformance relative to the wider hospitality

sector is evidence of a team and a business that knows how to

deliver on its strategic objectives whilst having to deal with all

manner of challenges and distractions. Our performance in FY22 is

clear evidence of that ability, and I see absolutely no reason why

this will be any different in FY23 and beyond - especially as we

have emerged from Covid as a more resilient, agile and adaptive

business than ever before.

Looking ahead

Further challenges on the horizon, but well placed to take

advantage given previous experience of trading successfully through

a downturn

The next few months will undoubtedly be challenging, albeit at

the time of writing we are not seeing much in our trading

performance to suggest that there has been any change to consumer

sentiment.

However, we have been planning for these headwinds for months

now and I believe we are not only positioned to weather a

significant decline in consumer spending - or even a recession -

but that we can actually take advantage of the circumstances.

The reason for this confidence is that as a business we have

experience of dealing with a seismic economic shock before, having

traded successfully through the 2008 financial crisis. In 2005/06

the economy was buoyant and consumer spending was elastic, which

was exploited by the sector, and specifically by casual dining

operators who confidently increased their prices. As a small

management team at the time, we took the view then that we should

minimise any price increases and hold on to our value for money

credentials. We resisted making short-term gains in exchange for

being fully prepared should a recession happen. Ultimately this

approach paid dividends, and when recession hit in the autumn of

2008 we didn't need to alter our proposition or change our pricing

as the consumer recognised that we already offered great value for

money.

By contrast, many of our peers found they had driven price

increases too strongly and resorted to discounting in a desperate

attempt to drive volume, which ultimately ended up undermining

their offer for years afterwards.

By early 2009 we were confident that we would not only continue

to trade well - and ahead of our peers - but also that we should

continue to accelerate our rate of growth. As our peers retrenched

we expanded, taking advantage of an uncompetitive landscape for new

sites and attracting talent to a business that was recognised to be

winning. In September 2008 we had nine sites and by the end of 2011

we had 20 sites, with a further nine new sites planned for 2012. We

were brave, ambitious, creative, and believed that we could build

something special, and these same attributes have never been more

alive in the business as they are today.

In my view, there are similar trends at play as we sit here 14

years on. Following the end of the third lockdown in 2021 we have

seen prices in the hospitality sector surge. While some of these

increases have been driven by a degree of necessity as supplier

prices increased, some have also been driven by businesses trying

to make up for months of lockdown. We have had to increase our

prices in a targeted way, but by nowhere near as much as our peers.

We have deliberately held back from doing so because we remember

our experience in 2008 and how offering great value for money in an

environment where the consumer is squeezed puts you at a distinct

advantage. We are also extremely well placed to meet the challenges

of incoming cost pressures to the business, as detailed in the CEO

report.

We have just opened our 200(th) site - a Cosy Club in Chester -

and on 27 August the business will celebrate 20 years since we

opened our first tiny 10-table café/bar called Lounge on North

Street in Bedminster, Bristol. After two decades of sustained

growth, we now employ over 6,000 people and we have a remarkably

talented team lead by CEO Nick Collins and supported by a really

engaged Board. Despite the near-term challenges, we remain hugely

optimistic and ambitious for the future - particularly as it

genuinely feels as if we are still just getting started.

Alex Reilley

Chairman

13 July 2022

Chief Executive's Statement

Introduction

I am pleased to report on a very successful year for Loungers.

One in which we, on the whole, had the opportunity to put Covid

behind us and begin to truly demonstrate the strength of the

Loungers offer, the quality of both our brands, and the expertise

of our people. To pick just a few highlights from what was a record

year, we:

-- Delivered a sector leading three year LFL sales performance

of 22.1% (including VAT benefit)

-- Opened a record 27 new sites

-- Reduced net debt (excluding IFRS16 lease liabilities) to GBP1.03m

-- Delivered IFRS16 Adjusted EBITDA of GBP53.6m, a record for the business

Whilst we continue to face a number of well-publicised

headwinds, Loungers is uniquely well-placed within the leisure

sector to thrive through a period of economic uncertainty and

emerge stronger on the other side. Our key strengths include:

-- Broad appeal across all parts of the day

-- Value for money offer benefits from trading down

-- Community driven offer benefitting from working from home and staying local

-- Scale purchasing opportunities and operational gearing mitigating margin pressure

-- Excellent property opportunities driving roll-out

-- Self-financing roll-out

-- Best in class management team, and outstanding talent across the entire business

Record sales performance

Throughout the year the business consistently out-performed the

sector by in excess of 15%, delivering robust like for like sales

growth in both our Lounge and Cosy Club brands. This

out-performance shouldn't be a surprise - Loungers has consistently

out-performed the market for more than seven years. The table below

shows our LFL sales performance for the 48 weeks from full

re-opening on 17 May 2021 to 17 April 2022 on both a net (including

the benefit of the VAT reduction) and gross (excluding the one-off

benefit of the VAT reduction) basis.

Three year LFL

48 weeks to

17 April 2022

Net - including VAT

benefit +22.1%

Gross - excluding VAT

benefit +14.2%

The reasons for this out-performance are simple, we are serving

more customers than we were pre-Covid and our customers are on

average spending more. This isn't a post-Covid blip; it is the

product of our relentless focus on our strategic priorities,

combined with shifts in consumer behaviour.

-- We continue to innovate and evolve our food and drink menus,

with our focus on value for money remaining at the forefront of our

thinking.

-- We continue to benefit from our focus on hospitality,

atmosphere and community at a time when other operators are finding

it more difficult to maintain standards in the face of recruitment

difficulties.

-- We continue to benefit from an increase in average spend as a

result of the introduction of our order at table app, which now

accounts for 40% of all Lounge sales.

-- We are serving our customers more quickly and more

consistently as a result of our focus on kitchen systems, processes

and training, and

-- We are benefitting from changes in consumer behaviour, with

more people staying local, working from home, and supporting their

local community and local high street.

While there is little doubt we are entering into a period in

which consumer discretionary spending will come under pressure we

remain confident that we are well-placed to continue to grow our

sales within this environment:

-- We remain excellent value for money. Over the past 12 months

we have taken considerably less price than the sector in general as

we recognise value is a key differentiator.

-- We have a broad, all-day offer in both Lounge and Cosy Club,

with customers enjoying both venues for a variety of occasions

across the day and evening. We are not overly reliant on any

specific day-part or celebration spend.

-- We know from the 2008 recession that we benefit from people

being more discerning about their leisure spend, and people staying

local.

Scale and operational flexibility

Along with the rest of the sector, we are experiencing

significant input cost inflation. We aren't immune to this

pressure, but we believe we are better placed than most to mitigate

it.

Our continued growth means we are attractive to suppliers and

can benefit from increasing scale. During FY23 we will tender some

of our food purchasing as we seek to consolidate our supply chain

and take logistics costs out of the business. This is an ongoing

process as we move over the medium-term towards a fully

consolidated model. In addition, our food development teams

continue to evolve the menu in the face of ingredient shortages and

price increases. We don't have a reliance on any single cuisine, we

can sell whatever we want, and this allows us to move with trends

and be very fleet of foot. We have significant expertise in both

food and drink development and can engineer our menus away from

ingredients that have seen short-term cost increases and use

stretch to protect our margin whilst maintaining value for money.

Added to this, we continue to see the benefit from our investment

in our 'kitchen Resets' and the margin upside from increased

uniformity across the estate.

Our utility costs were hedged in May 2020 until September 2024,

giving us protection from price rises in the medium term. Elsewhere

on the P&L we expect to benefit from operational gearing as our

central costs are spread over an increasing number of sites.

Loungers has a fantastic track record of delivering consistent

like for like sales growth across the whole estate, in both older

and newer sites. We have achieved this via an unwavering focus on

the customer, our product and our hospitality. This will remain

unchanged in FY23, and I anticipate that any resulting margin

impacts will be modest, short-term and compensated for by our sales

performance.

Investing in our team

It has been an important year in the evolution of our People

strategy. Covid and the various lockdowns (and to a lesser degree

Brexit) have resulted in a shift in attitudes towards working in

hospitality. As a result of this Loungers, along with the rest of

the hospitality sector, had to re-evaluate both our role as an

employer and how we make ourselves more attractive as an employer,

in particular to the younger generations. During the year it became

apparent that there was a real recruitment and retention challenge

in our sector, varying in impact across England and Wales. It

rarely impacted our ability to trade at full capacity, and it did

not impact our roll-out and the opening of new sites.

During the year we launched 'the Commitments' setting out very

publicly to our team (and prospective employees) the values that we

want to represent as an employer. Included within these were

commitments to (i) respect everyone's time off, (ii) to pay fairly,

(iii) to rota fairly, (iv) to focus on everyone's development and

progression and (v) to ensure everyone is made welcome. These

weren't new values to Loungers, but we wanted to make sure everyone

in the business knew what we stood for and to be held to account.

There are no easy wins here - the sense we get from our team is

that it is not about pay. It is about flexibility, working hours,

team environment, progression and development, fairness and

respect. By setting out our values, we want our team to hold us to

account, which will allow us to become an even better employer.

Towards the end of the year we significantly restructured the

operations team within the Lounge business. With the continued

growth of the business, this is necessary every two to four years.

The restructure saw us add one Operations Director, two Regional

Operations Managers and five Operations Managers/Chefs. It also saw

us reduce the 'site to ops team ratio' at every level. At the

Operations Managers/Chefs level we now have a ratio of 5:1, which

is unprecedented in our sector. This consistently low ratio has

allowed for our intensity of operation and our focus on detail.

Pleasingly all of the new roles were filled with internal promotion

candidates. We continue to lead the way in providing outstanding

career progression opportunities within our sector.

New site openings and roll-out

During the year we opened 27 sites, a record number of new

openings, and after an enforced pause due to Covid, our roll-out

programme is very much back on track. We are opening

high-performing sites, achieving above average levels of sales and

EBITDA. This reflects the market for new sites and we continue to

see really strong opportunities for prime pitch Lounges and Cosy

Clubs in target high street locations where we know we will trade

well. The year saw a bias towards Lounge openings - of which there

were 26 vs one Cosy Club - which is a reflection of how Lounges can

thrive in different location types. Highlights include openings

in:

-- Smaller towns such as Matlock (Ostello Lounge) and Pontypridd (Gatto Lounge)

-- Larger towns such as Basildon (Orleto Lounge) and Shrewsbury (Floro Lounge)

-- Greater London locations such as Ealing (Castano Lounge)

-- Retail centres such as Fosse Park in Leicester (Volpo Lounge)

-- Coastal locations benefiting from staycations such as

Aberystwyth (Athro Lounge) and Bognor Regis (Bonito Lounge)

The pipeline is well-developed and we continue to see a wealth

of excellent opportunities, whilst maintaining our sector-leading

sub 6% rent to revenue ratio. It remains the case that we typically

convert former retail units or bank units, occupying prime pitches

on the high street. As a result of our confidence in both our

operational performance in opening sites and the range of

opportunities we are seeing, we have decided to increase the rate

of roll-out. We have recently been opening at a rate of around 25

sites per year, using four in-house site fit-out teams. In the

coming weeks we will be increasing to five fit-out teams and this

will give us annual capacity of around 32 sites a year. For this

year (FY23) we expect to open around 30 sites given the mid-year

introduction of the additional team. We continue to have real

confidence over the potential scale of the business, with the

capacity to open at least 500 sites across both brands in the

UK.

In the current year we anticipate opening at least four Cosy

Clubs (including Chester, Milton Keynes, Harrogate and Canterbury).

Operating in city centres and larger market towns, there are fewer

Cosy Club opportunities overall than Lounge and as a result, the

number of Cosy Club openings each year can vary. The Cosy Clubs

continue to go from strength to strength and this year is an

opportune time to have several openings to capitalise on the

momentum within the brand. We are particularly pleased with the

impact of the Project Finesse roll-out, which incorporated a more

elevated menu and guest experience alongside more sophisticated

design and furniture that is more fitting for the Cosy Club

surroundings.

Innovation and evolution

The most significant change during the year was the re-working

of the Cosy Club food menu. We saw the opportunity to elevate the

proposition and take even greater pride in the offer. The new menu

launched across the business last autumn, and saw the introduction

of small plates on the menu, wider stretch with more expensive

dishes at one end whilst retaining our value for money at the

other. The menu launch was accompanied by an overhaul of our steps

of service and an investment in our furniture which has altogether

really pushed the brand on. We are delighted with the impact this

is having across the Cosy Club estate.

Right at the end of the year we saw a considerable menu change

in Lounge with some 40% of the dishes either being replaced or

improved.

Our investment in the kitchens continues, with the final 60

Lounges now being improved via our Reset programme, benefitting

from the new equipment and standardised layouts.

We have also more formally defined our ESG strategy. I believe

it is important that this is driven by our teams rather than purely

in the boardroom and as such it is based around four core

pillars:

1. Looking after our teams well and being an inclusive employer

2. Bringing joy to local places across the country

3. Delivering our hospitality sustainably

4. Being proud of what we put on the plate

We already achieve a great deal within these categories, but

importantly have identified areas where we can improve and are

building a framework to allow us to deliver.

Management team

We remain very focused in evolving and building the strongest

management team in the sector to facilitate the successful roll-out

of our brands. During the year Tom Trenchard, Property Director,

took over responsibility for the construction side of the business,

joining together the site acquisitions and build businesses under

one leader. I am also delighted to announce the appointment of Guy

Youll as Chief People Officer. Guy joins the business in the autumn

and will lead the people side of the business and build on the

important work we have done this year. We continue to focus a great

deal on developing our employees' careers and there continue to be

many positive internal success stories as we grow.

Nick Collins

Chief Executive Officer

13 July 2022

Financial Review

Overview

The year to 17 April 2022 represents the first year in our three

years as a public company where we have ended the year with all our

sites open, trading, and free of Covid restrictions. Indeed, if we

exclude the first four weeks of the year where we could trade

external areas only, and excepting the impact of Omicron on our

Christmas trading, then the past year has very much seen a return

to normality.

The financial highlights below demonstrate the underlying

resilience and relevance of the Loungers business, and the positive

benefits of that return to normality.

IFRS 16

Year ended Year ended

17 April 18 April

2022 2021

GBP000 GBP000

Revenue 237,291 78,346

Operating profit / (loss) 28,437 (7,728)

Operating margin (%) 12.0% (9.9%)

Profit / (loss) before tax 21,605 (14,722)

Fully diluted earnings /

(losses) per share (p) 17.0 (10.9)

Net cash generated from operating

activities 69,626 12,031

Net debt 120,627 144,823

Year on year revenue was up by GBP158.9m to a record GBP237.3m.

Whilst Covid restrictions meant our sites could only trade in 34%

of the available weeks in the comparative year, strong like for

like ("LFL") sales growth and the strength of our new site openings

also played a significant role in delivering the year on year sales

uplift. Accompanying the sales growth, operating profit increased

to GBP28.4m from an operating loss of GBP7.7m in the prior year,

with operating margins growing to 12.0%. We continued to benefit

from various government support measures during the year (notably

the VAT reduction) and they played a part in delivering our strong

operating margin performance.

The strong trading and profit performance, allied to the

recovery in the Group's negative working capital position that the

resumption of full trading allowed, resulted in net cash generated

from operations of GBP69.6m. Post investing and financing outflows

net cash balances increased by GBP26.3m and were instrumental in

the reduction in net debt of GBP24.2m.

Throughout this document we use a range of financial and

non-financial measures to assess our performance. A number of the

financial measures, for example Like for Like ("LFL") sales and

Adjusted EBITDA are not defined under IFRS and accordingly they are

termed Alternative Performance Measures ("APMs"). The Group

believes that these APMs provide stakeholders with additional

useful information on the underlying trends, performance and

position of the Group and are consistent with how business

performance is measured internally. Adjusted EBITDA is also the

measure used by the Group's banks for the purposes of assessing

covenant compliance.

The table below summarises the key APM's under both IFRS16 and

IAS17 and covers the past three financial years. The negative

impact of Covid restrictions and the positive impact of government

support continues to make comparisons difficult. The year ended 19

April 2020 is arguably a more sensible comparator in that its

broadly five weeks of total lockdown and two weeks of Covid impact

is not wholly dissimilar to the four weeks of limited external

trading and the Omicron impacted December 2021 that was suffered in

the year to 17 April 2022.

Year ended Year ended Year ended

17 April 18 April 19 April

2022 2021 2020

GBP000 GBP000 GBP000

Sites at year end 195 168 165

New sites opened 27 3 21

Revenue 237,291 78,346 166,502

Adjusted EBITDA - IFRS16 53,639 13,913 28,767

Adjusted EBITDA margin (%)

- IFRS16 22.6% 17.8% 17.3%

Adjusted EBITDA - IAS17 42,319 3,530 18,813

Adjusted EBITDA margin (%)

- IAS17 17.8% 4.5% 11.3%

Net debt - IAS17 1,025 34,245 34,956

Revenue of GBP237.3m compares to GBP166.5m in the year to 19

April 2020 and reflects the positive impacts of strong LFL sales

performance, a record 27 new sites opened during the financial

year, and the reduced VAT rates on food and non-alcoholic drinks

that ran to 31 March 2022, and delivered a benefit of GBP15.1m. The

Group has delivered consistently strong LFL sales, whether measured

on a two year (40 weeks where trading not impacted by lockdown in

the current or comparative year) or three year basis (48 weeks

where trading not impacted by lockdown in the current year) and

whether including or excluding the benefit of the VAT

reduction:

Two year LFL Three year LFL

40 weeks to 48 weeks to

20 February 2022 17 April 2022

Net - including VAT

benefit +17.7% +22.1%

Gross - excluding VAT

benefit +9.3% +14.2%

Adjusted EBITDA (IAS17) of GBP42.3m compares to GBP18.8m in the

year to 19 April 2020, with a corresponding increase in Adjusted

EBITDA margin from 11.3% to 17.8%. The reduction in the VAT rate on

food and non-alcoholic drink was the most substantial part of that

margin expansion, contributing 5.6% to the margin growth of

6.5%.

Non-property net debt reduced to GBP1.0m, a year on year

reduction of GBP33.2m. This reflects not only the strong trading

and EBITDA performance but also the rebuilding of the Group's

negative working capital position.

Impact of UK Government Support Initiatives

In addition to the VAT reduction referenced above the Group

benefited over the year from the continuation of a number of UK

Government initiatives introduced to mitigate the impact of

Covid-19, notably:

-- The Coronavirus Job Retention Scheme ("CJRS") - The Group

continued to benefit from the CJRS through to the ending of the

scheme on 30 September 2021. During the year under review the Group

received a total of GBP4.1m of funding under the CJRS. A total of

GBP2.1m was recognised in the statement of comprehensive income in

the year, offsetting site payroll costs on the cost of sales line

and head office payroll costs on the administrative expenses line.

Cash receipts included GBP2.0m that was recognised in the FY21

results.

-- Business Rates Relief - The Group's sites have benefitted

from the business rates holiday that ran to 30 June 2021, and

subsequently from the 66% reduction (capped at GBP2.0m) that ran to

31 March 2022. During the year to 17 April 2022 the Group has

benefitted by GBP3.3m.

-- Support Grant Funding - In the year under review the Group

has recognised GBP2.5m of grant funding received under the Restart

Grant scheme. This income has been recognised under other

income.

The Corporate Insolvency and Governance Bill provided a range of

protections for tenants and allowed the Group to continue to work

collaboratively with all of its landlords, seeking to reach

agreement over an equitable share of the pain of lockdowns and

trading restrictions. The Group has recognised GBP0.8m in the year

in respect of rent waivers.

Long Term Employee Incentives

The focus on employee engagement and retention has been

unstinting throughout the year, and share awards continue to play a

significant role in these efforts. During the year the Group

granted further share awards under the employee share plan (574,000

shares) and the senior management restricted share plan (435,334

shares). These awards were made to a total of 1,206 employees who

work across the business, predominantly at site level, and in

hourly paid and salaried positions. In addition, awards covering

673 employees and in respect of 338,664 shares vested in the

year.

The Group recognised a share based payment charge in the year of

GBP3.2m (2021: GBP2.0m), the charge covering the employee share

plan, the senior management restricted share plan and the value

creation plan.

Finance Costs and Net Debt

Finance costs of GBP6.9m (2021: GBP7.0m) include IFRS 16 lease

liability finance costs of GBP5.7m (2021: GBP5.6m) and bank

interest payable of GBP1.2m (2021: GBP1.4m).

Net debt at the year end including property leases of GBP120.6m

(2021: GBP144.8m) represented a significant decrease over the prior

year, with strong trading and profitability, allied to the

rebuilding of the Group's negative working capital position,

offsetting the impact of adding new lease liabilities of

GBP16.4m.

The Group's capital structure includes a GBP32.5m term loan due

for repayment in July 2024. The Group entered into an interest rate

hedge to fix SONIA at 0.7% until July 2022. Whilst the Group's

significant positive cash balances provide an element of natural

interest rate hedge the Board continues to consider the options for

hedging the interest rate risk on the outstanding term loan.

In April 2020 the Group entered into an incremental GBP15m RCF

facility to provide additional liquidity should it be required

during the Covid lockdowns. It is envisaged that this facility,

which has never been drawn upon, will be allowed to expire at its

term date in October 2022.

Taxation

The Group has reported a tax charge of GBP3.7m for the year to

17 April 2022 (2021: credit of GBP3.6m) and at year end carried a

corporation tax receivable of GBP0.1m (2021: GBPnil payable or

receivable) and a deferred tax asset of GBP1.4m (2021: GBP3.8m).

The corporation tax payable in respect of the year of GBP1.3m

benefits from the introduction of the 130% capital allowance super

deduction. During the year corporation tax payments on account of

GBP1.4m were made.

Cash Flow and Capital Expenditure

Net cash generated from operating activities of GBP69.6m (2021:

GBP12.0m) reflects a working capital cash inflow of GBP19.7m (2021:

cash outflow of GBP1.3m). The working capital cash inflow has been

achieved in spite of a significant reduction in deferred Covid

liabilities. At year end the Group had settled all bar GBP1.4m of

its deferred Covid liabilities in respect of outstanding rents and

all of its HMRC liabilities (2021: GBP12.9m outstanding).

Cash outflows in the year in respect of capital expenditure

totalled GBP22.8m (2021: GBP7.8m) and compare to the cost of fixed

asset additions (excluding right of use assets) recognised in the

year of GBP26.2m. The lower cash outflow reflects the rebuild of

capital expenditure creditors as the new site opening programme

returned to its pre Covid pace during the year. Capital expenditure

in the year of GBP26.2m (2021: GBP5.1m) included GBP19.6m (2021:

GBP2.8m) in respect of new site openings.

Key Performance Indicators ("KPI's")

The KPI's, both financial and non-financial, that the Board

reviews on a regular basis in order to measure the progress of the

Group are as follows:

Year ended Year ended Year ended

17 April 18 April 19 April

2022 2021 2020

GBP000 GBP000 GBP000

Growth Growth / Growth

(decline)

New site openings 27 3 21

Capital expenditure (IAS GBP26.2m GBP5.1m GBP22.8m

16 PPE excluding IFRS

RoU assets)

LFL sales growth (excluding

lockdown periods) +22.1%(1) +13.3% +4.4%

Total sales growth 302.9% (52.9%) 8.8%

Adjusted EBITDA margin

(IFRS 16) 22.6% 17.8% 17.3%

(1) Three year LFL calculated over 48 weeks from 17 May 2021 and

including VAT benefit

Going Concern

In concluding that it is appropriate to prepare the financial

statements for the year to 17 April 2022 on the going concern basis

attention has been paid both to the potential impact of further

Covid-19 outbreaks on the Group and also to the current sector

headwinds in terms of consumer confidence and inflationary

pressures.

The Group has very successfully navigated the Covid-19

challenges of the past two years and has emerged with a

significantly strengthened balance sheet, with IAS17 net debt

reduced to GBP1.0m at 17 April 2022 and total liquidity, excluding

the incremental GBP15m RCF which is assumed to expire in October

2022, of GBP41.3m.

In order to assess the Group's going concern position the Board

has considered three downside scenarios of the Group's business

plan.

- The first scenario assumes a re-emergence of Covid-19 in

similar fashion to the Omicron outbreak of 2021. A sales decline of

20% relative to the FY23 budget for 12 weeks across December 2022,

January and February 2023 has been modelled. This is significantly

worse than the impact felt from the 2021 Omicron variant.

- The second scenario looks to model a weakening in consumer

confidence, commencing in July 2022 and accelerating in October

2022 with sales between 5% and 10% below budget, allied to

continuing cost of goods sold and labour inflation reducing gross

margins by 1%.

- The third scenario combines both the above scenarios,

resulting, for example, in sales being 30% below budget across

December 2022 to February 2023.

The impact of reflecting the third scenario is to reduce

expectations of Adjusted EBITDA by approximately 54% for FY23

relative to the Group's budget. Under this scenario the Group is

forecast to remain comfortably within its borrowing facilities and

to be in compliance with its covenant obligations, and accordingly

the Directors have concluded that it is appropriate to prepare the

financial statements for the year ending 17 April 2022 on the going

concern basis.

Gregor Grant

Chief Financial Officer

13 July 2022

Consolidated Statement of Comprehensive Income

For the 52 Weeks Ended 17 April 2022

Year ended Year ended

Note 17 April 18 April

2022 2021

GBP000 GBP000

Revenue 237,291 78,346

Cost of sales (134,369) (46,178)

Gross profit 102,922 32,168

Gross profit before exceptional items 102,922 32,609

Exceptional items included in cost

of sales 6 - (441)

---------------------------------------------- ----- ----------- -----------

Administrative expenses (76,975) (43,950)

Other income 4 2,490 4,054

Operating profit / (loss) 4 28,437 (7,728)

Operating profit / (loss) before exceptional

items 28,437 (6,401)

Exceptional items included in cost

of sales 6 - (441)

Exceptional items included in administrative

expenses 6 - (886)

---------------------------------------------- ----- ----------- -----------

Finance income 44 46

Finance costs 5 (6,876) (7,040)

Profit / (loss) before taxation 21,605 (14,722)

Tax (charge) / credit on profit /

(loss) 7 (3,727) 3,580

Profit / (loss) for the year 17,878 (11,142)

=========== ===========

Other comprehensive income:

Items that may be reclassified to

profit or loss

Cash flow hedge - change in value

of hedging instrument 269 101

Other comprehensive income for the

year 269 101

Total comprehensive income / (expense)

for the year 18,147 (11,041)

=========== ===========

Earnings / (losses) per share Year ended Year ended

Note 17 April 18 April

2022 2021

Pence Pence

Basic earnings / (losses) per share 8 17.4 (10.9)

Diluted earnings / (losses) per share 8 17.0 (10.9)

Consolidated Statement of Financial Position

As at 17 April 2022

Note At 17 April At 18 April

2022 2021

GBP000 GBP000

Assets

Non-current

Intangible assets 113,227 113,227

Property, plant and equipment 9 188,363 165,443

Deferred tax assets 1,355 3,816

Finance lease receivable 579 668

------------ ------------

Total non-current assets 303,524 283,154

Current

Inventories 1,919 774

Trade and other receivables 5,466 2,619

Derivative financial instruments 38 -

Cash and cash equivalents 31,250 4,912

------------ ------------

Total current assets 38,673 8,305

Total assets 342,197 291,459

============ ============

Liabilities

Current liabilities

Trade and other payables (56,214) (28,576)

Lease liabilities (8,475) (6,921)

Derivative financial instruments - (231)

------------ ------------

Total current liabilities (64,689) (35,728)

Non-current liabilities

Borrowings 10 (32,275) (39,157)

Lease liabilities (111,127) (103,657)

Total liabilities (208,091) (178,542)

============ ============

Net assets 134,106 112,917

============ ============

Called up share capital 1,127 1,124

Share premium 8,066 8,066

Hedge reserve 38 (231)

Other reserve 14,278 14,278

Retained earnings 110,597 89,680

------------ ------------

Total equity 134,106 112,917

============ ============

Consolidated Statement of Changes in Equity

For the 52 Weeks Ended 17 April 2022

(Accumulated

Called losses)

up share Share Hedge Other / retained Total

capital premium reserve reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 19 April 2020 1,025 - (332) 14,278 99,011 113,982

Ordinary shares issued 99 8,066 - - (6) 8,159

Share based payment charge - - - - 1,817 1,817

Total transactions with

owners 99 8,066 - - 1,811 9,976

Loss for the year - - - - (11,142) (11,142)

Other comprehensive income - - 101 - - 101

Total comprehensive expense

for the 52 week year - - 101 - (11,142) (11,041)

At 18 April 2021 1,124 8,066 (231) 14,278 89,680 112,917

---------- --------- --------- --------- ------------- ---------

Ordinary shares issued 3 - - - (3) -

Share based payment charge - - - - 3,042 3,042

---------- --------- --------- --------- ------------- ---------

Total transactions with

owners 3 - - - 3,039 3,042

Profit for the year - - - - 17,878 17,878

Other comprehensive income - - 269 - - 269

Total comprehensive income

for the 52 week year - - 269 - 17,878 18,147

At 17 April 2022 1,127 8,066 38 14,278 110,597 134,106

========== ========= ========= ========= ============= =========

Consolidated Statement of Cash Flows

For the 52 Weeks Ended 17 April 2022

Year ended Year ended

17 April 18 April

2022 2021

GBP000 GBP000

Cash flows from operating activities

Profit / (loss) before tax 21,605 (14,722)

Adjustments for:

Depreciation of property, plant and

equipment 11,187 10,288

Depreciation of right of use assets 8,451 7,567

Share based payment transactions 3,220 2,034

Loss on disposal of tangible assets - 4

Finance income (44) (46)

Finance costs 6,876 7,040

Changes in inventories (1,146) 41

Changes in trade and other receivables (2,698) 3,108

Changes in trade and other payables 23,593 (4,414)

----------- -----------

Cash generated from operations 71,044 10,900

Tax (paid) / reclaimed (1,418) 1,131

Net cash generated from operating

activities 69,626 12,031

Cash flows from investing activities

Purchase of property, plant and equipment (22,837) (7,808)

Net cash used in investing activities (22,837) (7,808)

=========== ===========

Cash flows from financing activities

Issue of ordinary shares - 8,158

Shares issued on exercise of employee

share awards (135) (79)

Bank loans repaid (7,000) -

Interest paid (1,101) (1,260)

Interest received 3 -

Principal element of lease payments (6,903) (5,303)

Interest paid on lease liabilities (5,315) (4,910)

Net cash used in financing activities (20,451) (3,394)

=========== ===========

Net increase in cash and cash equivalents 26,338 829

Cash and cash equivalents at beginning

of the year 4,912 4,083

Cash and cash equivalents at end

of the year 31,250 4,912

=========== ===========

NOTES TO THE PRELIMINARY FINANCIAL INFORMATION

1. General information

Loungers plc ("the company") and its subsidiaries ("the Group")

operate café bars and café restaurants through two complementary

brands, Lounge and Cosy Club.

The Company is a public company limited by shares whose shares

are publicly traded on the Alternative Investment Market ("AIM") of

the London Stock Exchange and is incorporated and domiciled in the

United Kingdom and registered in England and Wales.

The registered address of the Company is 26 Baldwin Street,

Bristol, United Kingdom, BS1 1SE.

2. Basis of preparation

The consolidated financial statements of the Loungers plc Group

have been prepared in accordance with UK adopted International

Accounting Standards and with the requirements of the Companies Act

2006 as applicable to companies reporting under those

standards.

The financial statements have been prepared under the historical

cost convention, as modified by the revaluation of financial assets

and liabilities (including derivatives) at fair value through

profit and loss. The financial statements are presented in

thousands of pounds sterling ('GBP000') except where otherwise

indicated.

The accounting policies adopted in the preparation of the

Financial Statements are consistent with those applied in the

preparation of the financial statements of the Group for the year

ended 18 April 2021.

The auditors' reports on the accounts for the 52 weeks ended 17

April 2022 and 18 April 2021 for Loungers plc were unqualified, did

not draw attention to any matters by way of emphasis, and did not

contain a statement under section 498(2) or 498(3) of the Companies

Act 2006.

The financial statements for Loungers plc for the year to 17

April 2022 will be delivered to the Registrar of Companies shortly.

The financial information contained within this preliminary

announcement for the periods ended 17 April 2022 and 18 April 2021

does not comprise the statutory financial statements of Loungers

plc.

In concluding that it is appropriate to prepare the financial

statements for the year to 17 April 2022 on the going concern basis

attention has been paid both to the potential impact of further

Covid-19 outbreaks on the Group and also to the current sector

headwinds in terms of consumer confidence and inflationary

pressures.

The Group has very successfully navigated the Covid-19

challenges of the past two years and has emerged with a

significantly strengthened balance sheet, with IAS17 net debt

reduced to GBP1.0m at 17 April 2022 and total liquidity, excluding

the incremental GBP15m RCF which is assumed to expire in October

2022, of GBP41.3m.

In order to assess the Group's going concern position the Board

have considered three downside scenarios of the Group's business

plan.

- The first scenario assumes a re-emergence of Covid-19 in

similar fashion to the Omicron outbreak of 2021. A sales decline of

20% relative to the FY23 budget for 12 weeks across December 2022,

January and February 2023 has been modelled. This is significantly

worse than the impact felt from the 2021 Omicron variant.

- The second scenario looks to model a weakening in consumer

confidence, commencing in July 2022 and accelerating in October

2022 with sales between 5% and 10% below budget, allied to

continuing cost of goods sold and labour inflation reducing gross

margins by 1%.

- The third scenario combines both the above scenarios,

resulting, for example, in sales being 30% below budget across

December 2022 to February 2023.

The impact of reflecting the third scenario is to reduce

expectations of Adjusted EBITDA by approximately 54% for FY23

relative to the Group's budget. Under this scenario the Group is

forecast to remain comfortably within its borrowing facilities and

to be in compliance with its covenant obligations, and accordingly

the Directors have concluded that it is appropriate to prepare the

financial statements for the year ending 17 April 2022 on the going

concern basis.

3. New standards, amendments and interpretations adopted

Amendments to accounting standards applied from 19 April 2021

were as follows:

-- Interest Rate Benchmark Reform - Phase 2 impacts on IFRS9,

IAS39, IFRS 7, IFRS4 and IFRS16 (effective 1 January 2021).

The application of the above did not have a material impact on

the group's accounting treatment and has therefore not resulted in

any material changes.

4. Operating profit / (loss)

The operating profit / (loss) is stated after charging /

(crediting):

Year ended Year ended

Note 17 April 18 April

2022 2021

GBP000 GBP000

Depreciation of tangible fixed assets 9 11,187 10,288

Depreciation of right of use assets 9 8,451 7,567

Inventories - amounts charged as

an expense 53,815 16,804

Fees payable to the company's auditors

and its associates:

* For statutory audit services (parent and consolidated

accounts)

75 60

* for statutory audit services (subsidiary companies) 75 66

* for tax compliance services - 71

* for tax advisory services - 37

Staff costs (excluding share based

payments) 95,779 69,599

CJRS Grant income (2,045) (33,157)

Government support grant income (2,490) (4,054)

Pre-opening costs 2,344 421

Exceptional costs 6 - 1,327

=========== ===========

Government support grant income of GBP2,490,000 relates to

income received under the Re-Start Grant Scheme. The prior year

total of GBP4,054,000 also included income received under the

Retail, Leisure and Hospitality Scheme, and The Local Restrictions

Support Grant Scheme.

5. Finance Costs

Year ended Year ended

17 April 18 April

2022 2021

GBP000 GBP000

Bank interest payable 1,190 1,398

Other interest payable 4 -

Finance cost on lease liabilities 5,682 5,642

6,876 7,040

=========== ===========

6. Exceptional Items

Year ended Year ended

17 April 18 April

2022 2021

GBP000 GBP000

Included in cost of sales

Covid-19 related - 441

Included in administrative expenses

Covid-19 related - 886

- 1,327

=========================================================== ===========

The Covid-19 related costs included in cost of sales are in

respect of the write-off of food and drink inventories resulting

from the forced closure of all sites on 4 November 2020, and 30

December 2020.

The Covid-19 related costs included in administrative expenses

include the costs of the removal and storage of furniture and soft

furnishings to enable compliance with social distancing and

professional fees incurred in respect of the amendments made to the

Group's banking facilities.

7. Tax credit on loss

The income tax credit is applicable on the Group's operations in

the UK.

Year ended Year ended

17 April 18 April

2022 2021

GBP000 GBP000

Taxation charged / (credited) to the

income statement

Current income taxation 1,266 -

Total current income taxation 1,266 -

=========== ===========

Deferred Taxation

Origination and reversal of temporary

timing differences 2,408 (2,600)

Adjustments to tax charge in respect of

prior years 109 (980)

Adjustment in respect of change of rate (56) -

of corporation tax

----------- -----------

Total deferred tax 2,461 (3,580)

=========== ===========

Total taxation charge / (credit) in the

consolidated income statement 3,727 (3,580)

=========== ===========

The above is disclosed as:

Income tax credit - current year 3,618 (2,600)

Income tax credit - prior year 109 (980)

----------- -----------

3,727 (3,580)

=========== ===========

Year ended Year ended

17 April 18 April

2022 2021

GBP000 GBP000

Profit / (loss) before tax 21,605 (14,722)

At UK standard rate of corporation taxation

of 19% (2021: 19%). 4,105 (2,797)

Expenses not deductible for tax purposes 384 206

Fixed asset permanent differences (815) (9)

Adjustments to tax charge in respect of

prior years 109 (980)

Adjustment in respect of change of rate (56) -

of corporation tax

Total tax charge / (credit) for the year 3,727 (3,580)

=========== ===========

8 Earnings / (losses) per share

Year ended Year ended

17 April 18 April

2022 2021

GBP000 GBP000

Profit / (loss) for the year after tax 17,878 (11,142)

Basic weighted average number of shares 102,728,430 102,291,621

Adjusted for share awards 2,464,588 2,076,783

Diluted weighted average number of shares 105,193,018 104,368,404

Basic earnings / (losses) per share (p) 17.4 (10.9)

Diluted earnings / (losses) per share

(p) 17.0 (10.9)

The share awards are not considered to be dilutive in the year

ended 18 April 2021 as they would have the impact of reducing the

losses per share.

9 Property, plant and equipment

Leasehold Motor Fixtures Right Total

Building Vehicles and Fittings of use

Improvements asset

GBP000 GBP000 GBP000 GBP000 GBP000

Cost

At 20 April 2020 54,498 81 53,147 121,480 229,206

Additions 2,330 - 2,790 11,735 16,855

Disposals (160) - (147) (238) (545)

At 18 April 2021 56,668 81 55,790 132,977 245,516

Accumulated depreciation

At 20 April 2020 10,525 22 16,961 35,251 62,759

Provided for the year 3,553 31 6,704 7,567 17,855

Disposals (159) - (144) (238) (541)

At 18 April 2021 13,919 53 23,521 42,580 80,073

Net book value

At 18 April 2021 42,749 28 32,269 90,397 165,443

============== ========== ============== ======== ========

Cost

At 19 April 2021 56,668 81 55,790 132,977 245,516

Additions 11,190 148 14,816 16,404 42,558

Disposals - (19) - - (19)

At 17 April 2022 67,858 210 70,606 149,381 288,055

Accumulated depreciation

At 19 April 2021 13,919 53 23,521 42,580 80,073

Provided for the year 4,018 32 7,137 8,451 19,638

Disposals - (19) - - (19)

At 17 April 2022 17,937 66 30,658 51,031 99,692

Net book value

-------------- ---------- -------------- -------- --------

At 17 April 2022 49,921 144 39,948 98,350 188,363

============== ========== ============== ======== ========

Impairment of property, plant and equipment and right of use

assets

The Group has determined that each site is a separate CGU for

impairment testing purposes. Each CGU is tested for impairment at

the balance sheet date if there exists at that date any indicators

of impairment. All sites were reviewed in FY20 following the first

national lockdown and an impairment of GBP9.8m was booked in the

FY20 financial statements. All sites have been tested for

impairment in FY22, however following the successful reopening of

all sites in April and May 2021, no further impairment has been

booked.

The value in use of each CGU is calculated based upon the

Group's latest three-year forecast. The site cash flows include an

allocation of central costs and ongoing capital expenditure to

maintain the sites. The cash flows exclude any growth capital. Cash

flows beyond the three-year period are extrapolated using the

Group's estimate of the long-term growth rate, currently 2.0%

(2021: 2.0%).

The key assumptions in the value in use calculations are the

like for like sales projections for each site, changes in the

operating cost base, the long-term growth rate and the pre-tax

discount rate. The post-tax discount rate is derived from the

Group's WACC and is currently 9.0% (2021: 8.0%).

On the basis of the impairment test undertaken the Group has not

recognised any impairment charge in the year to 17 April 2022

(2021: GBPnil). The cash flows used within the impairment model are

based upon assumptions which, while prudent, are sources of

estimation uncertainty. Management has performed sensitivity

analysis on the key assumptions in the impairment model using

reasonably possible changes in the key assumptions. A reduction in

site cash flows of 10% in each year would result in an impairment

charge of GBP2,984,000. A 100 basis point increase in the discount

rate would result in an impairment charge of GBP1,431,000 and a 50

basis point reduction in the terminal growth rate would result in

an impairment charge of GBP295,000.

10 Borrowings

17 April 18 April

2022 2021

GBP000 GBP000

Long term borrowings:

Secured bank loans 32,500 39,500

Loan arrangement fees (225) (343)

32,275 39,157

==================== =========

Secured bank loans

The Group's bank borrowings are secured by way of fixed and

floating charges over the Group's assets.

The facilities entered into at the time of the IPO provide for a

term loan of GBP32,500,000 and a revolving credit facility ("RCF")

of GBP10,000,000. The term loan is a five-year non-amortising

facility with a margin of 2% above SONIA. A three-year interest

rate swap through to July 2022 was entered into that fixes SONIA on

the full term loan facility at 0.7%.

As a consequence of Covid-19, on 22 April 2020 the Group agreed

an incremental GBP15,000,000 RCF with its lenders, providing a

total RCF of GBP25,000,000. This incremental facility was

originally due to expire in October 2021, however, given the

prolonged Covid-19 lockdowns on 16 April 2021 the facility was

extended for a further 12 months to October 2022. It is not

anticipated that this facility will be renewed in October 2022.

The term loan and RCF are subject to financial covenants

relating to leverage and interest cover. The agreement reached with

lenders on 16 April 2021 included a waiver of the covenant tests

due at 18 April 2021 and amendment of the covenant tests scheduled

for 11 July 2021, 3 October 2021 and 26 December 2021. There were

no breaches of these tests in the year to 17 April 2022.

At 17 April 2022 the term loan was fully drawn while nothing was

drawn on either of the revolving facilities (2021: term loan fully

drawn and GBP7,000,000 drawn under the RCF).

11 Analysis of changes in net debt

20 April Cash flows Non-cash 18 April

2020 movement 2021

GBP000 GBP000 GBP000 GBP000

Cash in hand 4,083 829 - 4,912

---------- ----------- ---------- ----------

Bank Loans - due after one

year (39,039) - (118) (39,157)

Lease liabilities (104,939) 10,213 (15,852) (110,578)

Net debt (139,895) 11,042 (15,970) (144,823)

Derivatives

Interest-rate swaps liability (332) - 101 (231)

Total derivatives (332) - 101 (231)

Net debt after derivatives (140,227) 11,042 (15,869) (145,054)

========== =========== ========== ==========

19 April Cash flows Non-cash 17 April

2021 movement 2022

GBP000 GBP000 GBP000 GBP000

Cash in hand 4,912 26,338 - 31,250

---------- ----------- ---------- ----------

Bank Loans - due after one

year (39,157) 7,000 (118) (32,275)

Lease liabilities (110,578) 12,218 (21,242) (119,602)

Net debt (144,823) 45,556 (21,360) (120,627)

Derivatives

Interest-rate swaps liability (231) - 269 38

Total derivatives (231) - 269 38

Net debt after derivatives (145,054) 45,556 (21,091) (120,589)

========== =========== ========== ==========

Non-cash movements in bank loans due after one year relate to

the amortisation of bank loan issue costs.

12 Reconciliation of statutory results to alternative performance measures

Year ended Year ended

17 April 18 April

2022 2021

GBP000 GBP000

Operating profit / (loss) 28,437 (7,728)

Exceptional items - 1,327

Share based payment charge 3,220 2,034

Site pre-opening costs 2,344 421

Adjusted operating profit / (loss) 34,001 (3,946)

Depreciation (pre IFRS 16 right of

use asset charge) 11,187 10,288

IFRS 16 Right of use asset depreciation 8,451 7,567

Loss / (profit) on disposal of fixed

assets - 4

Adjusted EBITDA (IFRS 16) 53,639 13,913

Adjusted EBITDA Margin % (IFRS 16) 22.6% 17.8%

IAS 17 Rent charge (11,745) (10,889)

IAS 17 Rent charge included in IAS

17 pre-opening costs 425 506

Adjusted EBITDA (IAS 17) 42,319 3,530

Adjusted EBITDA Margin (IAS 17) 17.8% 4.5%

Profit / (loss) before tax (IFRS

16) 21,605 (14,722)

IAS 17 Rent charge (11,745) (10,889)

IAS 17 Leasehold depreciation (re

landlord contributions) (675) (531)

IFRS 16 Right of use asset depreciation 8,451 7,567

IFRS 16 Lease interest charge 5,682 5,642

IFRS 16 Lease interest income (41) (46)

Loss before tax (IAS 17) 23,277 (12,979)

=========== ===========

Net debt (IFRS16) 120.627 144,823

Property lease liability (119,602) (110,578)

Net debt (IAS17) 1,025 34,245

=========== ===========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BKBBNOBKDPOD

(END) Dow Jones Newswires

July 13, 2022 02:00 ET (06:00 GMT)

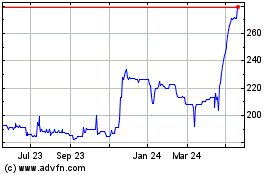

Loungers (LSE:LGRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

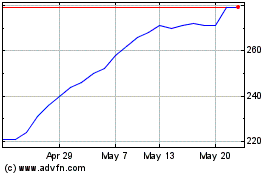

Loungers (LSE:LGRS)

Historical Stock Chart

From Jul 2023 to Jul 2024