Keller Group PLC Full Year Results -6-

March 03 2014 - 2:01AM

UK Regulatory

interest - - - - - - - - 1.7 1.7

Acquisition of

non-controlling

interest - - - - - - - - (0.2) (0.2)

----------------- -------- -------- ----------- ------------ -------- -------- --------- ------------- ---------------- -------

At 31 December

2012

and 1 January

2013 6.6 38.1 7.6 36.6 - - 236.7 325.6 10.1 335.7

Profit for the

period - - - - - - 29.3 29.3 0.8 30.1

----------------- -------- -------- ----------- ------------ -------- -------- --------- ------------- ---------------- -------

Other

comprehensive

income

Exchange

differences

on translation

of foreign

operations - - - (23.6) - - - (23.6) (0.3) (23.9)

Net investment

hedge

losses - - - (3.0) - - - (3.0) - (3.0)

Cash flow hedge

gains

taken to equity - - - - - 1.8 - 1.8 - 1.8

Cash flow hedge

transfers

to income

statement - - - - - (1.8) - (1.8) - (1.8)

Remeasurements

of defined

benefit pension

schemes - - - - - - (5.7) (5.7) - (5.7)

Tax on

remeasurements

of defined

benefit

pension schemes - - - - - - 1.1 1.1 - 1.1

----------------- -------- -------- ----------- ------------ -------- -------- --------- ------------- ---------------- -------

Other

comprehensive

income for the

period,

net of tax - - - (26.6) - - (4.6) (31.2) (0.3) (31.5)

----------------- -------- -------- ----------- ------------ -------- -------- --------- ------------- ---------------- -------

Total

comprehensive

income for the

period - - - (26.6) - - 24.7 (1.9) 0.5 (1.4)

Dividends - - - - - - (15.4) (15.4) (0.2) (15.6)

Share-based

payments - - - - - - 1.9 1.9 - 1.9

Share capital

issued 0.7 - - - 56.9 - - 57.6 - 57.6

Acquisition of

non-controlling

interest - - - - - - - - (5.6) (5.6)

At 31 December

2013 7.3 38.1 7.6 10.0 56.9 - 247.9 367.8 4.8 372.6

----------------- -------- -------- ----------- ------------ -------- -------- --------- ------------- ---------------- -------

Consolidated cash flow statement

For the year ended 31 December 2013

2013 2012

GBPm GBPm

------------------------------------------------------ -------- -------

Cash flows from operating activities

Operating profit before exceptional items 77.8 48.3

Depreciation of property, plant and equipment 45.0 42.1

Amortisation of intangible assets 1.4 1.5

(Profit)/loss on sale of property, plant and

equipment (0.3) 0.8

Other non-cash movements 7.1 2.5

Foreign exchange losses - (1.0)

------------------------------------------------------ -------- -------

Operating cash flows before movements in working

capital 131.0 94.2

Increase in inventories (22.5) (5.2)

Increase in trade and other receivables (37.4) (21.3)

Increase in trade and other payables 65.5 44.2

Change in provisions, retirement benefit and

other non-current liabilities (4.6) (3.5)

------------------------------------------------------ -------- -------

Cash generated from operations 132.0 108.4

Interest paid (5.4) (4.6)

Income tax paid (21.5) (10.7)

------------------------------------------------------ -------- -------

Net cash inflow from operating activities 105.1 93.1

------------------------------------------------------ -------- -------

Cash flows from investing activities

Interest received 0.4 0.5

Proceeds from sale of property, plant and equipment 3.6 1.9

Acquisition of subsidiaries, net of cash acquired (200.4) -

Acquisition of property, plant and equipment (44.8) (33.7)

Acquisition of intangible assets (1.4) (0.9)

Net cash outflow from investing activities (242.6) (32.2)

------------------------------------------------------ -------- -------

Cash flows from financing activities

Proceeds from the issue of share capital 57.6 -

Capital contribution from non-controlling interest - 1.7

New borrowings 118.5 20.5

Repayment of borrowings (24.2) (60.0)

Payment of finance lease liabilities (0.7) (0.7)

Dividends paid (15.6) (15.4)

------------------------------------------------------ -------- -------

Net cash inflow/(outflow) from financing activities 135.6 (53.9)

------------------------------------------------------ -------- -------

Net (decrease)/increase in cash and cash equivalents (1.9) 7.0

Cash and cash equivalents at beginning of period 54.8 43.3

Effect of exchange rate fluctuations (2.2) 4.5

------------------------------------------------------ -------- -------

Cash and cash equivalents at end of period 50.7 54.8

------------------------------------------------------ -------- -------

1. Basis of preparation

The Group's 2013 results have been prepared in accordance with

International Financial Reporting Standards ('IFRS') as adopted by

the EU.

The same accounting policies and presentation are followed in

the financial statements that were applied in the preparation of

the Company's published consolidated financial statements for the

year ended 31 December 2012, except for:

-- the adoption of amendments to IAS 19, 'Employee benefits'.

There is no material change as a result of adopting the amendments

to IAS 19. The financial impact of adopting this standard has been

reflected in the current period statement of comprehensive income.

The comparative period has therefore not been restated to reflect

the financial impact of adopting this standard but the comparative

period finance income and finance costs have been reclassified in

the income statement to net the expected return on pension scheme

assets and pension interest cost into a single net pension interest

cost line.

-- the adoption of amendments to IAS 1, 'Financial statement

presentation' which requires items within Other Comprehensive

Income to be classified as whether they may be reclassified

subsequently to profit or loss or not.

There were no other new standards, interpretations or amendments

to standards issued and effective for the year which materially

impacted the Group's financial statements.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 December 2013

or 2012 but is derived from the 2013 accounts. Statutory accounts

for 2012 have been delivered to the Registrar of Companies. Those

for 2013, prepared under IFRS as adopted by the EU, will be

delivered to the Registrar of Companies and made available on the

Company's website at www.keller.co.uk in April 2014. The auditors

have reported on those accounts; their reports were (i)

unqualified, (ii) did not include references to any matters to

which the auditors drew attention by way of emphasis without

qualifying their reports and (iii) did not contain statements under

section 498(2) or (3) of the Companies Act 2006.

2. Foreign currencies

The exchange rates used in respect of principal currencies

are:

Average for Period end

period

------------------- -------------- -------------

2013 2012 2013 2012

------------------- ------ ------ ------ -----

US dollar 1.56 1.58 1.65 1.62

Canadian dollar 1.61 1.58 1.76 1.60

Euro 1.18 1.23 1.20 1.22

Singapore dollar 1.96 1.98 2.09 1.98

Australian dollar 1.62 1.53 1.86 1.56

------------------- ------ ------ ------ -----

3. Segmental analysis

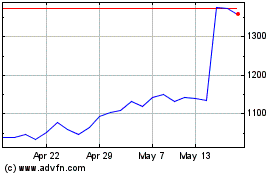

Keller (LSE:KLR)

Historical Stock Chart

From Jun 2024 to Jul 2024

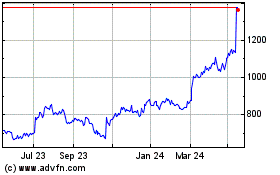

Keller (LSE:KLR)

Historical Stock Chart

From Jul 2023 to Jul 2024