Trap Oil Group plc Settlement agreement with principal creditors (1524R)

June 25 2015 - 2:00AM

UK Regulatory

TIDMTRAP

RNS Number : 1524R

Trap Oil Group plc

25 June 2015

25 June 2015

Trap Oil Group Plc

("Trapoil",the "Company" or the "Group")

Settlement agreement with principal creditors

Trapoil (AIM: TRAP), the independent oil and gas exploration,

appraisal and production company focused on the UK Continental

Shelf ("UKCS") region of the North Sea, announces an update in

respect of its discussions with the Group's principal

creditors.

As a result of detailed negotiations and discussions that have

taken place between Trapoil's management and the Group's principal

creditors, being CGG Services (UK) Limited ("CGG") and its partners

in the Athena partnership group (the "Athena Consortium"), it has

been agreed that in return for an aggregate payment of GBP2m to CGG

and the Athena Consortium, all of the Company's contractual

liabilities to these parties will be ring fenced and/or

expunged.

Following payment of the abovementioned GBP2m settlement amount,

Trapoil will no longer have any outstanding debt due to CGG. In

addition an agreement has been reached with the Athena Consortium

whereby all future liabilities (including decommissioning costs)

owed to the Athena Consortium will be met by Trap's partners in the

Athena Consortium and repayment will only be sought by way of any

realisations stemming from Trapoil's existing licences, being

P.1610 Block 13/23a (Magnolia), P.1666 Block 30/11c (Romeo), P.1889

Blocks 12/26b & 27 (Niobe), P.1989 Blocks 14/11, 12 & 16

(Homer) and P.2170 Blocks 20/5b & 21/1d (Cortina). In summary,

60 per cent. of any petroleum sales or net disposal proceeds from

these licences will be passed over to the Athena Consortium as well

as all future revenue generated from our interest in the Athena Oil

Field and when 125 per cent. of the outstanding debt obligation has

been met, no further amounts will be due to the Athena Consortium.

Should Trapoil not have repaid the outstanding debt obligation by

the time the Athena field is fully decommissioned the remaining

debt will be written off by the Athena Consortium. With respect to

the future decommissioning liabilities associated with the Athena

field, Trapoil's share of such liabilities is to be satisfied from

the cash already held in trust and put in place to cover such

costs. In the event of any potential insolvency, or similar

proceedings, being commenced by Trapoil in the future, the rights

of the Athena Consortium will revert to those in place prior to

this settlement agreement.

Subsequent to the abovementioned GBP2m payment being made, the

Company's net unrestricted cash reserves will amount to

approximately GBP0.4m. The Company will remain exposed to any

residual cost over runs on the drilled Niobe well should there be

any, as announced on 8 June 2015, and accordingly the Company's

directors, in conjunction with the Company's advisers, remain in

discussions with shareholders and potential investors to secure

additional funding.

A further announcement will be made in due course as

appropriate.

Commenting on the settlement agreement, Marcus Stanton,

Non-Executive Chairman of Trapoil, said:

"I am pleased that we have been able to achieve a pragmatic

solution with our principal creditors. This settlement agreement

enables Trapoil to remain solvent in the short term and assess

additional funding options for the Company going forward.

Although the Company's future is still far from certain, we are

now at least in a better position to be able to move forwards,

potentially realise value from our existing asset base and seek to

identify the best means for creating maximum value for our

shareholders."

Enquiries:

Trap Oil Group Scott Richardson Brown, Finance Tel: 020 3691 2015

plc Director www.trapoil.com

Strand Hanson James Harris Tel: 020 7409 3494

Limited Matthew Chandler

James Spinney

FirstEnergy Capital Hugh Sanderson Tel: 020 7448 0200

LLP David van Erp

Cardew Group Shan Shan Willenbrock Tel: 020 7930 0777

Tom Horsman trapoil@cardewgroup.com

**ENDS**

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSEFFMLFISELM

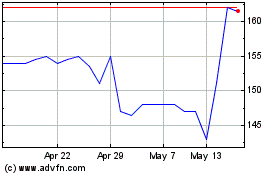

Jersey Oil And Gas (LSE:JOG)

Historical Stock Chart

From Jun 2024 to Jul 2024

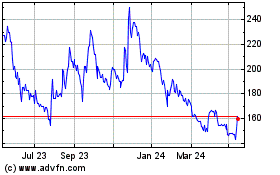

Jersey Oil And Gas (LSE:JOG)

Historical Stock Chart

From Jul 2023 to Jul 2024