TIDMJHD

RNS Number : 2460O

James Halstead PLC

02 October 2023

2 October 2023

JAMES HALSTEAD PLC

("James Halstead", the "Group" or the "Company")

PRELIMINARY ANNOUNCEMENT OF AUDITED RESULTS

FOR THE YEARED 30 JUNE 2023

James Halstead plc, the AIM listed manufacturer and

international distributor of commercial flooring, announces its

results for the year ended 30 June 2023:

Financial highlights

-- Revenue at GBP303.6 million (2022: GBP291.9 million)

- up 4%

-- Profit before tax of GBP52.1 million (2022: GBP52.1 million)

- a small increase

-- Profit after tax of GBP42.4 million (2022: GBP40.3 million)

- up 5.1%

-- Earnings per 5p ordinary share of 10.2p (2022: 9.7p)

- up 5.2%

-- Final dividend per ordinary share proposed of 5.75p (2022:

5.50p) - up 4.5%

-- Cash of GBP63.2 million (2022: GBP52.1 million)

Mr Mark Halstead, Chief Executive, commenting on the results,

said :

"Against a challenging backdrop, I am pleased to announce a very

respectable performance across the Group and another record sales

performance. Good demand across a number of our key markets has

continued to drive the positive top line. Consequently, we are also

pleased to report a record level of profit and record EPS, creating

even more value for our shareholders.

We continue to invest in driving process improvement and

developing our product offering, with a view to also improve output

efficiency. It is this approach and our tested business model which

position us resiliently in the inflationary environment that has

been seen across global markets.

We ended the year with a robust balance sheet and in a position

to propose a record dividend to our shareholders. Whilst

inflationary issues and spending constraints remain, I and the

Board remain confident in the Group's progress going forward and

look ahead to the future with confidence".

Enquiries:

James Halstead:

Mark Halstead, Chief Executive Telephone: 0161 767 2500

Gordon Oliver, Finance Director

Hudson Sandler:

Nick Lyon Telephone: 020 7796 4133

Nick Moore

Panmure Gordon (NOMAD & Joint Broker):

Dominic Morley Telephone: 020 7886 2500

WH Ireland (Joint Broker):

Ben Thorne Telephone: 020 7220 1666

CHAIRMAN'S STATEMENT

Results

Revenue for the year at GBP303.6m (2022: GBP291.9m) is 4% ahead

of the comparative year largely driven by increased demand across a

number of our key markets. This is a record level of sales.

The reported profit before tax for the year of GBP52.1m (2022:

GBP52.1m) is a fraction over the comparative. Nevertheless, profit

after tax is GBP42.4m (2022: GBP40.3m) - an increase of 5.1%. A

record level of profit. Furthermore, earnings per share are at

10.2p (2022: 9.7p) which is an increase of 5.2% and a record level

of EPS.

The financial year was one of contrast, with the earlier months

having encountered escalating energy costs, severe difficulties as

a result of the lack of timely availability of international

shipping and increased transportation costs. However, the latter

months of the year were much more positive with the easing of

energy costs and a great improvement in shipping and transportation

costs. In addition, our export sales in many markets developed as

demand increased. The breadth of projects stretches from The Media

Centre for the Paris 2024 Olympics, Castlerock Farm in British

Columbia to The Centre for Autism Research (CFAR) at the King

Faisal Specialist Hospital & Research Centre in Riyadh.

Sales growth has, on the whole, proved positive with the UK, the

Americas, Australia, New Zealand and Malaysia all reporting

increased demand, although Central Europe sales were lower than

last year. As the year progressed, gross margins improved for the

reasons already noted helped by the price increases and also by a

swing in the mix of sales to pure commercial ranges as opposed to

light commercial/heavy domestic. The core focus of our flooring

ranges in healthcare, education and retail infrastructure, rather

than private residential, remains a key benefit to our business

model. Nevertheless, in Germany we have seen recent successes in

new residential apartment buildings such as Quartier Möllner Straße

in Rostock ( Mecklenburg-Vorpommern ) and York-Quartier in Münster

( North Rhine-Westphalia ).

The Company and our strategy

James Halstead is a group of companies involved in the

manufacture and supply of flooring for commercial and domestic

purposes, based in Bury, UK. James Halstead plc has been listed on

the London Stock Exchange for 75 years. The Group was established

in 1914 and continues to operate out of the original premises in

Bury. In its factories in Bury and Teesside it manufactures

resilient flooring for distribution in the UK and worldwide.

The Company's strategy is to constantly develop its brand

identity and its reputation for quality, product innovation,

durability and availability, thereby enhancing and maintaining

goodwill with the aim of achieving repeat business. Our focus is to

work with stockists who in turn distribute those bulk deliveries

whilst promoting and representing the products to the end users and

specifiers who will purchase the stock from those stockists.

This approach is designed to increase and secure revenue streams

and drive profitability and cash flow which enables the

continuation of dividends, in turn creating shareholder value. In

the normal course of business one key element of the Company ethos

is having dedicated sales personnel to present our product to our

customers' clientele.

Over many years our strategy has also included a policy of

continual investment in both process improvement and in product

development to improve output efficiency and our product

offering.

Sustainability, social responsibility and the environment

We have in recent weeks published our 18(th) sustainability

report that details our actions and ambitions in the areas of the

environment, sustainability and social responsibility. Climate

change has led to a greater focus on carbon dioxide levels but

climate change it is not, in our view, a matter of trying to

highlight any one single measure such as carbon emissions or net

zero targets. As a manufacturer in the UK there are basic levels of

environmental legislation that far exceed the standards of many

countries. However we look to go far beyond that. Further

information on the actions that we have taken are included further

down in this report.

Dividend

Our cash balances stand at GBP63.2 million (2022: GBP52.1

million) with one of the major reasons for the increase being

decreased stock. The finished goods inventory at the year-end is

GBP77.1 million (2022: GBP101.9 million) which is about 24.3% lower

than the prior year comparative.

Also of note regarding the cash flow for the year is taxation

paid of GBP11.9 million (2022: GBP9.9 million), fixed asset

additions of GBP2.9 million (2022: GBP3.2 million) and equity

dividends paid of GBP32.3 million (2022: GBP32.3 million).

The interim dividend of 2.25p (2022: 2.25p) was paid in June

2023. The Board, having regard to the cash balances and

profitability, is proposing a final dividend of 5.75p (2022: 5.50p)

which will mean a total dividend for the year of 8.0p (2022: 7.75p)

an increase of 3.23%. This is a record level of dividend.

Acknowledgements

Once again, I would like to thank our colleagues for their

continued efforts in achieving this year's result.

Our thanks also to the UK Contract Flooring Association for

their members' accolades with Polyflor being awarded the 2023

Manufacturer of the Year, as well as the best use of flooring in a

charitable initiative with the community interest company House of

Books and Friends, Manchester.

Outlook

Trading from the year-end to date, overall, has been positive.

Flooring has been supplied to diverse end customers from Medica

Sur, which is recognised as the best hospital in Mexico, the Giant

Flagship Store, Düsseldorf (one of the world's largest

manufacturers of high-end bicycles) and the new headquarters of

Deloitte in Milan (a NZEB - "Nearly Zero Energy Building"), helped

by our flooring rated with both LEED "Platinum" status and WELL

"Gold" certified. While both four-letter acronyms have similar

requirements and standards, the two certifications are very

different. WELL Certification focuses on people's health and

wellness, while LEED is a certification that focuses on

environmental impact and sustainability.

In the UK demand has been slightly less buoyant. Our UK business

is far more focused on commercial flooring and repair, renewal and

refurbishment and consequently less exposed to consumer spending.

Nevertheless, there are budgetary constraints on renewal spending.

Indeed, the Chairman's report of September 2016 noted UK government

spending restrictions on refurbishment in the education sector and

this continues to be case.

We welcome the Comprehensive and Progressive Agreement for

Trans-Pacific Partnership (CPTPP) and note that we already trade

with 10 of the 11 countries that now have a free trade agreement

with the UK.

Overall overseas turnover is 60-65% of total turnover and

growing. With greater availability of global shipping, a strong

balance sheet and a proven business model, we are confident in the

prospects of the year ahead and progress across the Group.

Anthony Wild

Chairman

CHIEF EXECUTIVE'S REVIEW

Our business is, in essence, really simple. We create a

floorcovering fit for purpose, we manufacture in volume and

efficiently, we present the product to wholesalers, architects and

end-users then sell the product, collect payment, make a profit and

repeat the process.

It has been a record year for sales for the Group but the year

had its challenges, disappointments and successes and overall must

be considered as satisfactory. We have supplied flooring from the

Van der Valk Hotel in Sneek, Netherlands to the Hospital de Bosa in

Bogota, Colombia whilst supplying innumerable small projects in

schools, offices, cafes, care homes, ships and hospitals across the

world. Our own distribution teams and those of our very many

stockists are despatching constantly and it is our delivery,

availability and quality that keeps this show on the road. Our

sales tomorrow are the orders we receive today as we are not in the

"make to order" sector. Our sales are what we have in the

warehouse.

Sustainability and environmental consideration have been a key

part of buying decisions for many end users for very many years and

increasingly part of listed company accounts. I echo the Chairman's

comment to look at the audited sustainability report that is in its

18(th) annual version. We are proud of our record in this area and

the annual accounts will have fuller details including the

ubiquitous SECR (streamlined energy and carbon reporting) and the

Companies (Strategic Report) (Climate-related Financial Disclosure)

Regulations 2022 statements which are often referred to as the very

similar "TCFD" (task force on climate related change financial

disclosures). The ESG element of our business is a part of the

presentation to end users and their purchase decision process

whether it is Wendy's Restaurants, Ontario or the new Louis

Vuitton's headquarters just steps away from La Samaritaine in

Paris.

Environment and sustainability are as much about marginal gains

with each 1% adding to the amassed improvements to offset the

effects of anthropogenic climate change. Sustainable manufacturing

has, to us, always been important and we look to minimise use of

scarce resources, recycle and recover materials, and leave as small

a footprint by our manufacturing as possible.

Perhaps one point I would make on the subject of social

responsibility is that we are deeply involved in many trade bodies

across Europe and in our markets globally. Rather than hire

consultants to represent us we feel that trade bodies act not only

as a representative body for the industry/market that they

characterise, putting forward the collective view and position of

its members, but probably more importantly the members set and

raise standards to promote and improve best practices, whilst

highlighting common areas of concern. The results over time are

that end users and consumers gain confidence in the product. In

addition, a trade body can give the 'industry voice'. Trade

associations speak on behalf of their members with the 'industry

voice', especially when communicating with related industries

(suppliers, customers and end-users), governments, agencies,

regulators and on occasion the media.

Objectflor / Karndean and James Halstead France, our European

operations

It was a difficult year for our Central European business (based

in Cologne) with sales down 7.9% in the year. Sales in Germany are

more exposed to the retail and domestic market than any other

subsidiary. The French market saw a 12.6% increase in sales where

the effects from the Ukraine crisis were lower due to greater

government intervention in the cost of living crisis. We moved to a

new warehouse in France during the year, reduced our costs, whilst

also improving our service to customers.

Inflation, uncertainty from the conflict in Ukraine, and some

destocking by customers all played a part in a clearly challenging

economic environment. Given interest rates and construction costs,

many new build projects were put on hold or cancelled. The housing

market in Germany has been poor. Even though demand for

accommodation is large the supply has fallen significantly. A 32%

fall in residential housing construction in Germany has driven

negative sentiment which is reported to be at levels last seen

after the global financial crisis.

In France, the sales were raised by particular successes in

increasing loose lay tile products (albeit these tend to be at

lower margin than many other ranges), a 29% increase in own label

collections to distributors and growing success in the healthcare

sector. Healthcare was targeted in France last year by the

introduction of dedicated sales representation to this end user

segment and the success against economic conditions was clearly the

result of taking increased market share in this area.

Margins remained suppressed during the year, driven by the

overhang of cost surcharges and price increases in the stock value.

There have been improvements in the latter half of the year as

stock is replenished and sea freight surcharges have reduced.

Stocks within Objectflor have been reduced by 25.2% which

resulted from a combination of reduction from last year's strategic

increases and also a reaction to the lower sales in the year. The

management team have placed focus on costs to mitigate the drop off

in sales and profitability. Just one example was that Objectflor

withdrew from major exhibitions along with many other flooring

manufacturers which did the same, reflecting the negative sentiment

of the industry against market conditions. The headcount was

reduced as staff leaving were not replaced on sales-facing

roles.

The business remains very profitable and the re-launch of the

Expona Domestic luxury vinyl tile collection in January 2023 was

very successful. The business supplied new flooring to the Ford

factory in Cologne.

Polyflor APAC - encompassing Australia, New Zealand and Asia

Our APAC region is made up of four distinct areas including

Australia, New Zealand, North Asia and Southeast Asia. To give a

better strategic focus in the region a new reporting structure has

been established to oversee the region as a whole. These changes

are aimed at enhancing collaboration, aligning strategies and

ensuring efficient decision making across the region creating a

stronger network, promoting regional initiatives and leveraging

resources effectively.

One immediate example of this is the implementation of a new ERP

system. Our Malaysian business was the first to move over to this

software during 2022, led by the Australian team who then supported

New Zealand in their switch at the start of 2023. Australia

successfully went live on the same system on 1 July 2023 and whilst

all separate reporting entities, now have a common system where

shared resources can be utilised.

Sales in the region were affected by international shipping

delays that depleted stock holdings and the cost of shipping

affected margins.

Looking individually at each of these regions, we have seen

Australia grow gross sales by a further 3.8% to a record level, an

excellent achievement. The increase this year has been driven

largely through price increases with volumes 4.5% down in the

year.

Despite price increases, margins are down on last year with the

sales growth for the period coming from more commercial flooring

than domestic, adversely affecting the product mix in terms of

margin. Stocks, including goods in transit, are 13% down on the

previous years.

New Zealand saw another solid year. Sales were ahead by 20% but

the ongoing high freight and product cost affected margins. During

the early part of the year we experienced significant shipping

delays which gradually eased from January 2023 onwards. Stock

levels were reduced 17%. There remains traffic congestion locally

holding up shipments. There were some one-off costs in the year,

such as the ERP implementation noted above, but overall

profitability remained level despite this.

Our Malaysian business which services the Southeast Asia region

has gone from strength to strength increasing sales by 78%. We are

starting to see the benefits of our investment in salespeople

across the region as more projects are secured, although Malaysia

remains the biggest market. Sales into Singapore were boosted by

obtaining SGBC (Singapore Green Building Council) certification

which helped sales of Polyflor products into the government

sector.

All sales to date in this region are from products manufactured

in our UK factories, however, now we have established ourselves in

the market, we will look to introduce a small range of luxury vinyl

tile products during the next financial year, sourced regionally.

Interest has been positive.

Unfortunately, our North Asia sales continue to underperform.

Extended Covid shutdowns in China, lack of projects, surplus

capacity from competing Chinese factories and delays in

manufacturing and shipping our product have all contributed. None

of the countries covered by this area showed any growth. Following

a review of the North-Asia region at the end of the year, a change

in management has occurred and with all travel restrictions now

over, our APAC management will take a more strategic view of the

whole region and focus resources to best achieve growth. There will

not be an immediate turn around given the nature of the business,

but we believe it will succeed.

Polyflor and Riverside Flooring, based in UK

Undoubtedly, it was overall a commendable year at our UK

manufacturing sites. These businesses supply not only the UK, where

turnover was 4.2% ahead of last year, but also our overseas

subsidiaries and direct export customers. Profits were also ahead

of the prior year despite the challenges of increased input cost,

massive energy cost increases and industrial action by part of the

workforce in Radcliffe.

Riverside output and sales increased with a near 14% increase in

turnover. In the UK the increase was 10%, sales to our own overseas

subsidiaries were down 10% but sales to the rest of the world

increased by 36%.

Export demand was restricted for the early part of the year by

availability of timely shipping though this was greatly improved by

the year end. It was also the case that the "bottlenecks" of

international transport delayed and restricted supplies to our

overseas subsidiaries; local stock helped to minimise the effects

on sales but opportunities for greater sales were lost.

Significant product launches in the year were undertaken. Camaro

(our light commercial heavy domestic luxury tile range) in

September 2022 was relaunched with new designs and tiles. The

market reception was extremely positive. Expona Commercial (our

project focused luxury vinyl tile) was relaunched in July 2022 was

extremely well received. The marketing support for these launches

in terms of sampling, product presenters, and display materials was

impressive, and costly, but will stand the ranges in good stead

over the next 2-3 years before we again refresh designs. The Aztech

Soccer Arena in Guernsey was just one project that Expona

commercial was used in.

Raw material costs and availability were difficult in the early

months of the year but improved and from January 2023, when

combined with sales price increases, led to improved margins.

Energy cost increases were a severe problem in the first half of

the year and though this eased in the second half, the costs are

still very high when compared to prior year comparatives. In this

we are not alone but in the global market place, outside Europe,

energy costs have not been so severe. Inflationary pressures

affected all costs. Wages, services and costs across all areas were

challenging. Cost control was a constant focus for the Group.

Our stock levels were drastically reduced as concerns over

energy abated, indeed the industrial action on part of our plant

helped reduce stock levels more rapidly than we might otherwise has

chosen. The stock reduction was generally very good for cash

generation but as a result we have struggled to supply certain

product ranges and have been out of stock in some lines.

Unfulfilled demand to a manufacturer is far from desirable.

Shift patterns and overtime in part helped alleviate some of the

difficulties but on several key ranges stock levels remained

persistently low. The export departments ended the year with

outstanding orders that were unfulfilled by production and, whilst

the second half of the year saw much greater ability to get exports

to the end markets, our manufacturing capability lagged. Against

the economic environment, the balance between prudence and

increasing manufacturing headcount was assessed and prudence

prevailed.

Polyflor Nordic comprising Polyflor Norway based in Oslo and

Polyflor Sweden based in Gothenburg

After a strong performance in the previous financial period, we

saw a flat year for our Nordic markets with combined sales

marginally down by 1.8% in the year. An increase in costs saw the

region fall back in terms of profitability, but our investment in

extra sales personnel across the region, this year more

concentrated on Sweden, should return us to further growth next

year.

Our Norwegian business had some key project success in hospital

projects and introduced a new high-end commercial carpet from

Germany.

Whilst the sales have remained flat overall, the mix has

improved with an increase in UK manufactured product which benefits

the Group as a whole. Growth remains the focus in both markets.

As with other markets, overall stocks have been reduced in the

region (by approximately 10%), but with the greater cooperation

between the countries, a more balanced approach should lead to

improved delivery times and lower freight costs as we progress.

Polyflor Canada, based in Toronto

Our Canadian business saw a record year for sales and a

significant increase in net profit against a generally sluggish

economy. It was another strong performance with sales ahead of last

year by 30%. We have seen growth in both LVT volumes (+24%) and UK

manufactured product (10%). The Canadian sales of product supplied

by our Teesside plant increased by 30%.

The business supplied flooring to the Huawei Offices in

Vancouver and to the Toronto Dominion Bank, the latter being in

Expona commercial luxury vinyl tile (newly re-launched by Polyflor

UK).

As we noted last year, Covid-19 resulted in restricted travel so

with a greater ability to visit distributors and specifiers we have

seen an uplift in trading. There has also been an improvement in

the logistic bottlenecks that hampered previous years helping to

ensure product was available for projects. It was clear that

increased interest rates and input costs have noticeably affected

customer confidence and building projects were keenly

contested.

Stocks have been reduced by 8.3%, despite the decision to

purchase more LVT direct rather than relying on the UK stock

holdings and this strategy will continue as we see continued growth

from our LVT ranges. We continue to invest in growth in the region

with further recruitment in sales personnel planned for the coming

year.

Rest of the World

Our products are sold in many markets across the globe and the

preceding sections cover some of the key markets where we have a

local presence and warehousing. These markets have been long

established for the sales of our flooring and there has also been

significant growth in several other markets when compared to last

year. Our products are available and sold across the globe and we

continue to make strides in our export markets. Whilst our European

neighbours have remained subdued with more of an impact from the

Ukraine crisis affecting energy inflation and spending power than

other countries, we have seen good sales growth in the USA (+36%),

Latin America (+31%), the Middle East (+38) and the Mediterranean

(+20%).

We are actively looking to increase our presence in both the

Middle East and Latin America by increasing the number of

salespeople on the ground.

In India we continue to control costs. This remains a market

where freight costs remain problematical and our focus is now

mainly on pharmaceutical and healthcare sectors. There were

projects such as the Serum Institute and the Hazrat Shahjalal

International Airport in Dhaka Bangladesh.

Sustainability, social responsibility and the environment

As highlighted in the Chairman's Statement, we recently

published our 18th sustainability report for the Company. In this

we detail the actions and ambitions that we have taken to

addressing environment impact, sustainability and social

responsibility. I would like to note just a few of the many areas

of focus covered by our independently audited sustainability

report:

Water usage

Water is a natural resource that must be protected.

Manufacturing can result in a high use of water but at Polyflor we

collect rainwater and store it for use in cooling during the

manufacturing process (and have done so for over 50 years). This

stored water is returned to storage after use and largely avoids

the use of mains water supply, just 4% of the water that we use

comes from the mains supply. We have expanded collection of

rainwater from our factories guttering to underground storage and

this will enable us to further reduce mains water usage. We have

added filtration so that we can use the collected water for other

uses on site such as jet washing.

Waste

I have noted over the years our Recofloor after sale vinyl take

back scheme. However, waste comes in other forms notably packaging.

At Polyflor we minimise waste to landfill and have an onsite waste

collection, segregation and re-purposing team with a dedicated part

of the site. Cardboard, wood and metals are separated for recycling

and waste liquids sent for treatment to extract for alternative

uses.

Training for the skill shortage

Fifteen years ago we created the Polyflor Training Academy based

on the Radcliffe site to add to the skills set of our end users

(the contract floor layers). The academy delivers 1-4 day training

courses for a nominal charge with basic skills training to advanced

level training. Last year we ran 27 courses in Radcliffe for 275

participants. In addition, the training academy offers product

training to our own employees and undertakes off site training.

This facility has been replicated in our European business with the

Objectflor Campus. The Campus held 17 courses in the last year with

around 500 delegates and a further 12 related industry courses with

around 400 delegates. Smaller events have taken place in Australia,

New Zealand and Canada. We see this as a key part of our social

responsibility to bridge the skills gap even though these delegates

are not directly our customers. Our stockists should, over time,

benefit and do take confidence from these commitments.

Environmental product declarations (EPD)

With many green labels and accreditations across the globe the

proliferation can be confusing for end consumers. The abundance of

"green washing" is known to many. The Centre for European Standards

(CEN) created a European standard (EN) with the aim of a worldwide

standard for environmental performance. The EPDs that Polyflor has

attained are independently verified and are environmentally

assessed based on global warming potential, ozone depletion

potential as well as five other environmental impact indicators.

The benefit is that EPDs support the environmental goals of

stakeholders from design stage to use whether in new build

construction or retrofit.

ESG is not supposed to be "boiler plate" nor "tick box" and each

element of our place in our locality, in our wider community and

our industry is important. Each facet is so much more important to

the future and needs to be much broader than one measure or

targeting "net zero" at some future point. Environmental

sustainability is not the responsibility of one person or committee

but the work of the whole team across the Group looking at the

different facets and focusing on the components that should each

combine for a more cohesive strategy.

In conclusion

Given the circumstances we can only be pleased with the results

for the year. The hard work, dedication and experience of our

subsidiary directors and management has been a key factor in this

achievement.

The recent years since "Brexit" (January 2020) have seen our

businesses rise to the many challenges since that time and it is

perhaps worth a glance at our performance since the 2020 year end.

Our sales since then are 27% higher (+49% in the UK, +10% in

Europe, + 22% in Australasia and +42% in the rest of the world);

our profit before tax some 19% higher. Notwithstanding these

figures our progress in global markets has been hampered by many

factors however these are now behind us and though we have

inflationary issues and in many markets spending constraints I and

our teams feel confident of the Group's progress in the global

markets. We look ahead with confidence across the business.

Mark Halstead

Chief Executive

Audited Consolidated Income Statement

for the year ended 30 June 2023

Year Year

ended ended

30.06.23 30.06.22

GBP'000 GBP'000

Revenue 303,562 291,860

Cost of sales (188,099) (178,355)

----------------- -----------------

Gross profit 115,463 113,505

Selling and distribution costs (53,338) (50,316)

Administration expenses (10,514) (10,931)

Operating profit 51,611 52,258

Finance income 748 42

Finance cost (260) (237)

Profit before income tax 52,099 52,063

Income tax expense (9,695) (11,735)

Profit for the year attributable to equity shareholders 42,404 40,328

----------------- -----------------

Earnings per ordinary share of 5p:

-basic 10.2p 9.7p

-diluted 10.2p 9.7p

All amounts relate to continuing operations.

Audited Consolidated Statement of Comprehensive Income

for the year ended 30 June 2023

Year Year

ended ended

30.06.23 30.06.22

GBP'000 GBP'000

Profit for the year 42,404 40,328

----------- -----------

Other comprehensive income net of tax:

Items that will not be reclassified subsequently to the income statement:

Remeasurement of the net defined benefit liability (7,237) 7,090

----------- -----------

(7,237) 7,090

----------- -----------

Items that could be reclassified subsequently to the income statement if specific

conditions

are met

Foreign currency translation differences (1,818) 926

Fair value movements on hedging instruments (135) (111)

(1,953) 815

----------- -----------

Other comprehensive income for the year (9,190) 7,905

Total comprehensive income for the year 33,214 48,233

=========== ===========

Attributable to equity holders of the

company 33,214 48,233

=========== ===========

Items in the statement above are disclosed net of tax.

Audited Consolidated Balance Sheet

as at 30 June 2023

As at As at

30.06.23 30.06.22

GBP'000 GBP'000

Non-current assets

Intangible assets 3,232 3,232

Property, plant and equipment 35,887 36,671

Right of use assets 7,164 5,634

Retirement benefit obligations - 6,144

Deferred tax 114 234

---------- ------------------

46,397 51,915

---------- ------------------

Current assets

Inventories 87,440 112,279

Trade and other receivables 46,979 51,171

Derivative financial instruments 773 2,166

Current tax 699 -

Cash and cash equivalents 63,222 52,144

---------- ------------------

199,113 217,760

---------- ------------------

Total assets 245,510 269,675

---------- ------------------

Current liabilities

Trade and other payables 60,738 84,507

Derivative financial instruments 213 517

Current income tax liabilities 422 2,097

Lease liabilities 2,696 2,166

64,069 89,287

---------- ------------------

Non-current liabilities

Retirement benefit obligations 1,460 -

Other payables 400 453

Lease liabilities 4,582 3,548

Preference shares 200 200

Deferred tax 585 2,929

7,227 7,130

---------- ------------------

Total liabilities 71,296 96,417

---------- ------------------

Net assets 174,214 173,258

---------- ------------------

Equity

Equity share capital 20,838 20,837

Equity share capital (B shares) 160 160

---------- ------------------

20,998 20,997

Share premium account 13 -

Currency translation reserve 4,094 5,912

Hedging reserve 806 941

Retained earnings 148,303 145,408

Total equity attributable to shareholders of the parent 174,214 173,258

---------- ------------------

Audited Consolidated Cash Flow Statement

for the year ended 30 June 2023

Year Year

ended ended

30.06.23 30.06.22

GBP'000 GBP'000

Profit for the year attributable to equity shareholders 42,404 40,328

Income tax expense 9,695 11,735

-------------- -------------

Profit before income tax 52,099 52,063

Finance cost 260 237

Finance income (748) (42)

-------------- -------------

Operating profit 51,611 52,258

Depreciation of property, plant and equipment 3,461 3,794

Depreciation of right of use assets 3,060 3,139

Profit on sale of plant and equipment (84) (198)

Defined benefit pension scheme service cost 178 500

Defined benefit pension scheme employer contributions paid (1,942) (1,970)

Change in fair value of financial instruments (776) 703

Share based payments expense 26 6

Decrease/(increase) in inventories 22,966 (50,272)

Decrease/(increase) in trade and other receivables 3,031 (7,451)

(Decrease)/increase in trade and other payables (20,365) 15,905

Cash inflow from operations 61,166 16,414

Taxation paid (11,900) (9,879)

Cash inflow from operating activities 49,266 6,535

-------------- -------------

Interest received 467 42

Purchase of property, plant and equipment (2,854) (3,248)

Proceeds from disposal of property, plant and equipment 134 280

-------------- -------------

Cash outflow from investing activities (2,253) (2,926)

-------------- -------------

Interest paid (36) (20)

Lease interest paid (224) (143)

Lease capital paid (3,015) (3,233)

Equity dividends paid (32,298) (32,298)

Shares issued 14 823

-------------- -------------

Cash outflow from financing activities (35,559) (34,871)

-------------- -------------

Net increase/(decrease) in cash and cash equivalents 11,454 (31,262)

-------------- -------------

Effect of exchange differences on cash and cash equivalents (376) 145

Cash and cash equivalents at start of year 52,144 83,261

Cash and cash equivalents at end of year 63,222 52,144

============== =============

NOTES

1. The final dividend of 5.75p per ordinary share will be paid, subject to the approval of the

shareholders, on 15 December 2023 to shareholders on the register as at 17 November 2023.

The annual report and accounts will be posted to shareholders on 13 October 2023.

2. The financial information in this statement does not represent the statutory accounts of the

Group. Statutory accounts for the year ended 30 June 2022 have been delivered to the Registrar

of Companies, carrying an unqualified audit report and no statement under section 498 (2)

or (3) of the Companies Act 2006.

3. Statutory accounts for the year ended 30 June 2023 have not yet been delivered to the Registrar

of Companies. They will carry an unqualified audit report and no statement under section 498

(2) or (3) of the Companies Act 2006.

4. Earnings per ordinary share

2023 2022

GBP'000 GBP'000

Profit for the year attributable to equity shareholders 42,404 40,328

-------------- --------------

Weighted average number of shares in issue 416,752,764 416,586,675

-------------- --------------

Dilution effect of outstanding share options 21,390 201,425

Diluted weighted average number of shares 416,774,154 416,788,100

-------------- --------------

Basic earnings per ordinary share 10.2p 9.7p

Diluted earnings per ordinary share 10.2p 9.7p

The earnings per 5p ordinary share are attributable to equity

shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR ZZGZLVLMGFZM

(END) Dow Jones Newswires

October 02, 2023 02:00 ET (06:00 GMT)

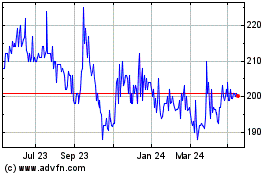

James Halstead (LSE:JHD)

Historical Stock Chart

From Nov 2024 to Dec 2024

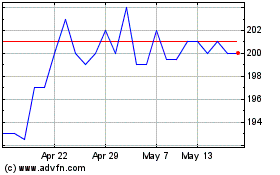

James Halstead (LSE:JHD)

Historical Stock Chart

From Dec 2023 to Dec 2024