TIDMING

RNS Number : 0246B

Ingenta PLC

18 September 2018

18 September 2018

Ingenta plc

Interim Results

Ingenta plc (AIM: ING), ("Ingenta", the "Company" or the

"Group") a leading provider of world-class software and services to

the global publishing industry, today announces its unaudited

interim results for the six months to 30 June 2018.

During the period, the Group has largely completed a substantial

restructuring exercise to improve the operational efficiency of the

business. The new structure aligns processes across all product

sets whilst delivering annual cost savings of more than GBP2m along

with improved cash generation.

Financial Key Points

-- Group revenues GBP6.4m (2017: GBP7.75m)

-- Adjusted EBITDA(*) GBP449K (2017: GBP659K)

-- Cash inflow from operations GBP459K (2017: outflow GBP466K)

-- Cash at 30 June 2018: GBP2.1m (2017: GBP1.3m)

-- China Joint Venture non-cash impairment charge of GBP320K (2017: GBPnil)

-- Exceptional restructuring costs of GBP537K (2017: GBP112K)

-- Operating loss after impairment and exceptional charges is GBP588K (2017: profit GBP321K)

-- Strong cash conversion and balances are stated after dividend

payments, acquisition and exceptional costs

Operational Key Points

-- Substantial progress made in business combination and operational efficiency plan

-- Ingenta Open launched

-- Significant Commercial go live with 3 more projected in the second half of the year

-- All software implementations remain on track

-- Advertising customer base expanded into retail market with Sainsburys implementation

-- Growth in digital capabilities and reach with new advertising partnerships

-- Good sales pipeline growth with 2 Content deals closed in Q3

(*) Earnings before Interest, Tax, Depreciation and Amortisation

is calculated before foreign exchange differences and restructuring

costs.

Martyn Rose, Chairman of Ingenta plc, commented:

"The first half of 2018 has seen a decisive and constructive

move by the Board and management to execute the final stage of

Ingenta's transformation into a unified software company providing

a coherent set of products and services under a single, simplified

structure and branding.

"The exceptional costs in the period relate to this

restructuring effort and include GBP537K of staff costs and GBP320K

of non-cash impairment charges against the Group's joint venture

investment in China. The Company has no further cash or balance

sheet exposure to China and expects a materially lower level of

staff restructuring costs of approximately GBP250K in the second

half of the year.

"During this period of change, cash conversion and underlying

EBITDA profitability remained strong. The resulting shape of the

business following the reorganisation is simpler, leaner and better

positioned for growth in both revenues and profits. Annualised

costs have been reduced by over GBP2m to an ongoing run rate of

approximately GBP11m and our simplified structure allows easier

cross-selling to clients and better career progression for our

people.

"Going forward, the business has over 200 customers across all

our product sets with recurring revenues representing approximately

75% of the total income. As we move into the second half of the

year, the new systems and processes will put the business in a

better position to service its loyal customer base and accelerate

our new business acquisition.

"The Board believes the Group's restructuring efforts have

significantly de-risked the business and will allow it to more

easily convert its revenue into profit and cash, producing a higher

quality earnings stream whereby the fixed costs of the business are

at least met by the highly visible revenues of the Group.

"The Board expects to see a further improvement in the operating

fundamentals in the second half of the year. In addition, the Board

is pleased to note that concurrent with the restructuring, our

future sales pipeline growth has been accelerating which gives us

cause for cautious optimism in this financial year and beyond."

For further information please contact:

Ingenta plc Tel: 01865 397 800

Scott Winner / Jon Sheffield

Cenkos Securities plc Tel: 0207 397 8900

Nicholas Wells / Harry Hargreaves

Ingenta business

During the first half of 2018, the Group initiated the final

stage of its long-term business combination and operational

efficiency strategy. The changes have been far reaching. We have

moved away from a divisional product siloed structure to a modern,

product and services company providing robust software and a

product agnostic professional services and support framework. With

successful customer go lives across all product lines, the Group

has now been able to merge fragmented teams to provide a wider

range of more flexible and responsive services to its customers and

offer broader opportunities to Ingenta staff.

In the 2017 financial statements, the Group outlined it has been

actively engaged in discussions to sell or dispose of its

shareholding in the Chinese Joint Venture and had reclassified it

as an asset held for sale. These discussions are ongoing, but the

Board does not believe a deal is imminent and have subsequently

reclassified the Group's holding in the Joint Venture as an

investment. Given the inherent uncertainty around valuing a Chinese

non-listed, minority shareholding combined with flat earnings and

an increasingly uncertain mechanism to repatriate funds, the Group

have decided to fully impair the investment. The Group's strategy

going forward is to concentrate on its core product set and given

the lack of control it exerts over the Joint Venture, it will not

continue to consolidate results into the Group.

As announced in March, Ingenta plc has also completed a capital

reduction of its share premium account. The parent company now has

distributable reserves of GBP8.3m after payment of the latest full

year dividend.

Financial review

Revenues in the first half are down on the prior period due to

several factors. Firstly, there was a significant GBP600K licence

sale in the prior period. Secondly, there were a number of projects

in full flight last year, earning significant implementation

revenue, that have now been completed or are at the final stages of

delivery in 2018. Thirdly, contractual negotiations on new business

have taken longer to finalise, although 2 new wins have been signed

during Q3 with further opportunities being progressed for later in

the year.

Administrative expenses during the first half have been impacted

by the decision to fully impair the GBP320K value attributed to the

Group's 49% shareholding in its Chinese Joint venture. In addition,

the Group incurred GBP537K of exceptional costs related to its

business realignment and improved operational efficiency

strategy.

The Group's adjusted EBITDA is GBP449K (2017: 659K) and

excluding last year's licence sale, like for like EBITDA gives the

Board optimism that its restructuring strategy is having the

desired effects on the efficiency of the Group's core

operations.

Cash flow

Further evidence of the Group's improved operational efficiency

can be seen in the cash performance of the business. The Group

generated GBP459K of positive cash inflows from operations (2017:

outflow GBP466K) which helped finance the final GBP248K contingent

payment on acquisition of the advertising business plus the payment

of an increased dividend of GBP254K (2017: GBP169K) and still

retain cash balances of GBP2.1m (2017: GBP1.3m) at half year.

As in the prior year, the R&D tax credit of GBP174K (2016:

GBP143K) is due for receipt in the second half of the year and did

not impact the first half cash flow.

Scott Winner

Acting Chief Executive Officer

Condensed Consolidated Interim Statement of Comprehensive

Income

Unaudited Unaudited

Six months Six months

ended ended

30 June 2018 30 June 2017

Note GBP'000 GBP'000

Group revenue 6,404 7,747

Cost of sales (3,921) (4,860)

------------- -------------

Gross profit 2,483 2,887

Sales and marketing expenses (602) (655)

Administrative expenses (2,469) (1,911)

(Loss) / profit from operations (588) 321

Share of (loss) / profit from equity

accounted investment 4 - (150)

Finance costs (6) (20)

(Loss) / profit before tax (594) 151

Tax (1) (5)

Retained (loss) / profit for the

period (595) 146

Other comprehensive expenses which

will be reclassified subsequently

to profit or loss:

Exchange differences on translating

foreign operations (25) (46)

Total comprehensive (loss) / income

for the period (620) 100

Basic (loss) / profit per share -

pence 5 (3.67) 0.59p

------------- -------------

Diluted (loss) / profit per share

- pence 5 (3.61) 0.58p

Analysis of (loss) / profit from

operations:

Profit before net finance costs,

tax, depreciation and foreign exchange

gains and losses (EBITDA) 449 659

Depreciation (432) (132)

Foreign exchange (loss) (68) (94)

Restructuring costs (537) (112)

------------- -------------

(Loss) / profit from operations (588) 321

Condensed Consolidated Interim Statement of Financial

Position

Unaudited Unaudited

30 June 2018 30 June 2017

Note GBP'000 GBP'000

Non-current assets

Goodwill 3 4,900 4,900

Other intangible assets 3 308 408

Property, plant & equipment 220 172

Investments accounted for using

the equity method 4 - 218

-------------- --------------

5,428 5,698

Current assets

Trade and other receivables 6 2,767 3,790

Research and development tax credit

receivable 174 143

Cash and cash equivalents 2,051 1,255

4,992 5,188

Total assets 10,420 10,886

-------------- --------------

Equity

Share capital 1,692 1,692

Share premium - 8,999

Merger reserve 11,055 11,055

Reverse acquisition reserve (5,228) (5,228)

Translation reserve (870) (917)

Share option reserve 51 80

Retained earnings (1,274) (10,263)

5,426 5,418

Non-current liabilities

Deferred tax liability 62 82

Finance leases 76 21

-------------- --------------

138 103

Current liabilities

Trade and other payables 7 3,037 3,538

Deferred income 1,819 1,827

-------------- --------------

4,856 5,365

Total equity and liabilities 10,420 10,886

-------------- --------------

Unaudited Condensed Consolidated Interim Statement of Changes in

Equity

Share Share Merger Reverse Translation Share Retained Total

capital premium reserve acquisition reserve option Earnings

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2018 1,692 8,999 11,055 (5,228) (845) 51 (9,373) 6,300

Dividends paid - - - - - - (254) (254)

Share premium

reduction - (8,999) - - - 8,999 -

--------- --------- --------- ------------- ------------ --------- ---------- --------

Transactions

with owners - (8,999) - - - 8,745 (254)

--------- --------- --------- ------------- ------------ --------- ---------- --------

Loss for the

period - - - - - - (595) (595)

Other comprehensive

income:

Exchange differences

on translation

of foreign operations - - - - (25) - - (25)

--------- --------- --------- ------------- ------------ --------- ---------- --------

Total comprehensive

income / (expense)

for the period - - - - (25) - (595) (620)

--------- --------- --------- ------------- ------------ --------- ---------- --------

Balance at 30

June 2018 1,692 - 11,055 (5,228) (870) 51 (1,224) 5,426

--------- --------- --------- ------------- ------------ --------- ---------- --------

Share Share Merger Reverse Translation Share Retained Total

capital premium reserve acquisition reserve option Earnings

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2017 1,692 8,999 11,055 (5,228) (871) - (10,240) 5,407

Dividends paid - - - - - - (169) (169)

Share based

payment expense - - - - - 80 - 80

--------- --------- --------- ------------- ------------ --------- ---------- --------

Transactions

with owners - - - - - 80 (169) (89)

--------- --------- --------- ------------- ------------ --------- ---------- --------

Profit for the

period - - - - - - 146 146

Other comprehensive

income:

Exchange differences

on translation

of foreign operations - - - - (46) - - (46)

--------- --------- --------- ------------- ------------ --------- ---------- --------

Total comprehensive

income / (expense)

for the period - - - - (46) - 146 100

--------- --------- --------- ------------- ------------ --------- ---------- --------

Balance at 30

June 2017 1,692 8,999 11,055 (5,228) (917) 80 (10,263) 5,418

--------- --------- --------- ------------- ------------ --------- ---------- --------

Condensed Consolidated Interim Statement of Cash Flows

Unaudited Unaudited

Six months Six months

ended ended

30 June 2018 30 June 2017

Note GBP'000 GBP'000

(Loss) / profit before tax (594) 151

Adjustments for:

Share of loss / (profit) from equity

accounted investment 4 - 150

Depreciation 432 132

Share based payment expense - 80

Interest expense 6 20

Unrealised foreign exchange differences (25) (46)

Decrease in trade and other receivables 1,927 1,600

Decrease in trade and other payables (1,287) (2,553)

Cash inflow / (outflow) from operations 459 (466)

Tax Paid (1) (5)

Net cash outflow from operating activities 458 (471)

Cash flows from financing activities

Dividends paid (254) (169)

Payment of finance leases (29) (61)

Interest paid (6) (20)

------------- -------------

Net cash used in financing activities (289) (250)

Cash flows from investing activities

Acquisition of subsidiaries, contingent

consideration (248) -

Purchase of property, plant and equipment (1) (52)

Net cash used in investing activities (249) (52)

Net decrease in cash and cash equivalents (80) (773)

Cash and cash equivalents at beginning

of period 2,131 2,028

Cash & cash equivalents at end of period 2,051 1,255

------------- -------------

Notes to the Unaudited Interim Report for the six months ended

30 June 2018

1. Nature of operations and general information

Ingenta plc (the "Company") and its subsidiaries (together 'the

Group') is a provider of technology and supporting services to

content providers and publishers. The nature of the Group's

operations and its principal activities are set out in the full

annual financial statements.

The Company is incorporated in the United Kingdom under the

Companies Act 2006. The Company's registration number is 837205 and

its registered office is 8100 Alec Issigonis Way, Oxford OX4 2HU.

The condensed consolidated interim financial statements were

authorised for issue by the Board of Directors on 18 September

2018.

The financial information set out in this interim report does

not constitute statutory accounts as defined in section 404 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 31 December 2017, prepared under IFRS as adopted by

the European Union, have been filed with the Registrar of

Companies. The auditor's report on those financial statements was

unqualified and did not contain a statement under section 498 (2)

or section 498 (3) of the Companies Act 2006.

2. Basis of preparation

These unaudited condensed consolidated interim financial

statements are for the six months ended 30 June 2018. They have

been prepared following the recognition and measurement principles

of IFRS as adopted by the European Union. They do not include all

of the information required for full annual financial statements

and should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2017.

These condensed consolidated interim financial statements have

been prepared on the going concern basis under the historical cost

convention and have been prepared in accordance with the accounting

policies adopted in the last annual financial statements for the

year ended 31 December 2017.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of these

consolidated interim financial statements.

A detailed set of accounting policies can be found in the annual

accounts available on our website, www.ingenta.com or by writing to

the Company Secretary at the registered office as above.

3. Goodwill and Intangibles

Full details of the Group's policies on Goodwill and Intangibles

is presented in the financial statements for the year ended 31

December 2017.

4. Equity accounted investment

The Group holds a 49% voting and equity interest in Beijing

Ingenta Digital Publishing Technology Ltd (BIDPT), a joint venture

company registered in the People's Republic of China.

In the 2017 financial statements, the Group outlined it has been

actively engaged in discussions to sell or dispose of its

shareholding in the Chinese Joint Venture and had reclassified it

as an asset held for sale. These discussions are ongoing, but the

Board does not believe a deal is imminent and have subsequently

reclassified the Group's holding in the Joint Venture as an

investment. Given the inherent uncertainty around valuing a Chinese

non-listed, minority shareholding combined with flat earnings and

an uncertain mechanism to repatriate funds, the Group have decided

to fully impair the investment. The Group's strategy going forward

is to concentrate on its core product set and given the lack of

control it exerts over the Joint Venture, it will not continue to

consolidate results into the Group.

5. Profit / (loss) per share

Basic profit / (loss) per share is calculated by dividing the

profit / (loss) attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during the

period.

For diluted profit / (loss) per share, the weighted average

number of ordinary shares in issue is adjusted to assume conversion

of all dilutive potential ordinary shares.

Six months Six months

ended ended

30 June 2018 30 June 2017

Attributable profit (GBP'000) 100

Weighted average number of

ordinary basic shares (basic) 16,919,609 16,919,609

Weighted average number of

ordinary shares (diluted) 17,191,942 17,375,609

(Loss) / profit per share

(basic) arising from both

total and continuing operations (3.67)p 0.59p

(Loss) / profit per share

(dilutive) arising from both

total and continuing operations (3.61)p 0.58p

6. Trade and other receivables

Trade and other receivables comprise the following:

30 June 2018 30 June 2017

GBP'000 GBP'000

Trade receivables - gross 1,918 2,712

Less: provision for impairment

of trade receivables (31) (12)

------------- -------------

Trade receivables - net 1,887 2,700

Other receivables 115 117

Prepayments and accrued income 765 973

2,767 3,790

7. Trade and other payables

Trade payables comprise the following:

30 June 2018 30 June 2017

GBP'000 GBP'000

Trade payables 475 423

Social security and other

taxes 344 396

Other payables 1,299 1,083

Accruals 919 1,636

3,037 3,538

8. Contingencies and commitments

There were no contingencies and commitments at the end of this

or the comparative period.

9. Post balance sheet events

There were no material events subsequent to the end of the

interim reporting period that have not been reflected in the

interim financial statements.

10. Copies of the Interim Financial Statements

A copy of the interim statement is available on the Company's

website, www.ingenta.com, and from the Company's registered office,

8100 Alec Issigonis Way, Oxford OX4 2HU.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR KMGMLKNGGRZM

(END) Dow Jones Newswires

September 18, 2018 02:00 ET (06:00 GMT)

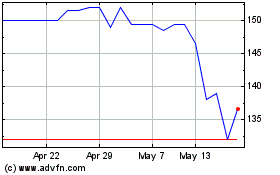

Ingenta (LSE:ING)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ingenta (LSE:ING)

Historical Stock Chart

From Jul 2023 to Jul 2024