By Simon Constable

Exchange-traded funds specializing in emerging markets have been

drawing tens of billions of dollars in new investment lately. But

not all countries are getting equal love from investors.

Over a period of about 16 months through mid-April,

exchange-traded funds specializing in emerging-markets stocks have

attracted about $84 billion in cash inflows. However, a cool 80% of

that went to stocks of companies in just five countries: China,

South Korea, India, Brazil and Taiwan, according to statistics from

financial-data provider EPFR, a subsidiary of U.K. events and

publishing company Informa PLC. (Some investors view Taiwan and

South Korea as developed markets.)

Another takeaway: China's haul amounted to 41% of the total,

versus 11% for India, and 0.6% for Russia. ETFs specializing in

Chinese stocks include SPDR S&P China (GXC) and iShares MSCI

China (MCHI).

In other words, investors aren't throwing money at this part of

the market blindly. Some countries are getting a lot more of the

action than others.

"Rather than buying broadly diversified funds, investors realize

that there will be winners and losers," says Jack Ablin, founding

partner, and chief investment officer at Chicago-based

wealth-management firm Cresset Capital Management. "They are

picking sides."

The proportion of ETF money betting on China during the 16

months in question was far larger than the country's current 31%

weighting in the MSCI Emerging Markets Index, a benchmark used

across the investing world. The same is true for India, whose 11%

share of the inflows compared with the country's MSCI index

weighting of only 9.5%.

Mr. Ablin says it makes sense for investors to choose countries

like India and China, which both feature large, fast-growing

economies. China, the world's second-largest economy, grew at an

annualized 6.4% in the latest reported quarter, compared with 3.2%

for the U.S. in the first quarter, according to data collated by

Tradingeconomics.com. India's recent GDP data, meanwhile, showed

annualized growth of 5.8%.

Given the similarity in the growth rates of India and China, it

could be seen as surprising that China ETFs took in $34.6 billion,

almost four times the $9.2 billion that India-focused ETFs drew.

But one big reason for the discrepancy is that China's stock market

became attractive again after a period of cooling off caused by

investor worries about signs of weakening in China's economy.

The narrative around the Chinese economy "is more compelling of

late," says Arthur Hogan, chief market strategist at

investment-banking firm National Securities Corp. While the

Shanghai Composite Index (China's version of the S&P 500) sold

off around 30% during 2018, says Mr. Hogan, that caused Chinese

stocks to fall to more attractive prices. That didn't happen in

India.

Mr. Hogan notes that the Chinese selloff was caused by slower

GDP growth, and worries that threats of tariffs between U.S. and

China were suggesting the start of possibly a "long, drawn-out

trade war."

Then two things happened. Earlier this year, the trade talks

appeared to be going well, and it became clear that the Chinese

government would boost the country's economy with a huge economic

stimulus.

"The improving narrative around both the U.S.-China trade talks

and the Chinese economy has acted like a magnet to emerging market

investors," says Mr. Hogan.

Economic overhauls, or the promise of them, also helped make

China attractive again to investors, says Kristina Hooper, chief

global-markets strategist at New York-based asset management firm

Invesco. Ms. Hooper contrasts the Chinese approach with that of

Russia, which appears to have done the opposite of wooing foreign

money.

Russia, Ms. Hooper says, "doesn't seem to have done anything

material to attract investors." The country also faces possible

retaliation from the U.S. after Moscow's reported interference in

the 2016 presidential election. That may help explain why investors

committed a mere $488 million to ETFs focused on Russia, 0.6% of

the total, during the recent 16-month period.

The lack of interest in Russia-focused ETFs is less surprising

than the indifference investors showed during the period for some

other countries.

Ms. Hooper says that Brazil, the largest emerging-markets

economy in the Western Hemisphere, would have attracted more ETF

investment if it were not for the elections held there last fall.

Uncertainty about a new government's economic policies generally

causes investors to feel cautious about committing capital.

Brazil's 6% of the inflows to emerging-markets ETFs over the 16

months was lower than its 7.6% MSCI index weighting.

Mexico also seems to have been overlooked by many

emerging-markets investors for reasons of uncertainty.

Mexico-focused ETFs attracted $2.8 billion, or 3% of the whole.

Still, that seems small when the economy of its major trading

partner just next door has been so strong.

"Mexico is certainly benefiting from the U.S. economic

situation, and that is likely to continue," says Ms. Hooper.

She says one likely reason for the subdued interest was

President Trump's desire to replace the North American Free Trade

Agreement with a renegotiated deal with better terms for the U.S.

The White House worked out a replacement pact, the

U.S.-Mexico-Canada Agreement, but that agreement has run into

resistance in Congress and has yet to be ratified by Canada or

Mexico.

Another country that Ms. Hooper thinks deserves more investment

than it is getting: Vietnam.

"Vietnam is a very strong growth story, and they are benefiting

from the U.S.-China trade war," she says. "It has very high growth

levels, and its economy has benefited from shifts out of

China."

The Southeast Asian nation's economy grew 6.8% in the first

quarter. It is also seeing outside direct investment into its

economy because companies are switching production from China to

Vietnam where labor is cheaper.

ETFs focused on Vietnam attracted $587 million over the period,

or 0.6% of the total inflows into emerging-markets ETFs.

Mr. Constable is a writer in Edinburgh, Scotland. He can be

reached at reports@wsj.com.

(END) Dow Jones Newswires

June 09, 2019 22:17 ET (02:17 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

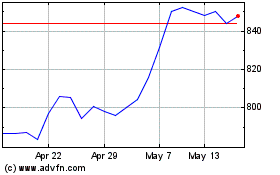

Informa (LSE:INF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Informa (LSE:INF)

Historical Stock Chart

From Nov 2023 to Nov 2024