TIDMIHP

RNS Number : 1697D

IntegraFin Holdings plc

18 October 2022

LEI Number: 213800CYIZKXK9PQYE87

18 October 2022

IHP Group quarterly update - Q4 of financial year 2022

Resilient Transact platform performance in spite of volatile

markets

Headlines

-- Highly resilient Transact platform gross inflows for the

quarter of over GBP1.5bn, with solid net inflows during the quarter

of over GBP0.7bn.

-- Net inflows to the Transact platform for the financial year

ended 30 September 2022 of GBP4.4bn.

-- Growth of the Transact platform's adviser base - at the end

of the financial year (30 September 2022) there were 7.5k advisers

registered on the Transact platform (an increase of over 5% from 30

September 2021).

-- At the end of the financial year (30 September 2022) there

were 224.7k clients on the Transact platform (an increase of 8%

from 30 September 2021).

-- The average (daily) funds under direction (FUD) on the

Transact platform during the financial year ended 30 September 2022

was GBP52.5bn. This compares with an average during the prior

financial year of GBP47.2bn.

-- Other than the cost implications from the HMRC VAT decision

(RNS issued on 20 September 2022), the detailed cost guidance,

which we disclosed in the Q3 market update (19 July 2022), remains

unchanged.

-- The development of Time4Advice's CURO 365 software remains on

schedule, and is planned for release to a beta client for live

testing by the end of the year.

-- The Transact-BlackRock Model Portfolio Service (MPS) was

launched in September 2022. This is available exclusively to

Transact platform clients.

GBPm Financial Financial

Quarter Quarter year year

ended ended ended ended

30 September 30 September 30 September 30 September

2022 2021 2022 2021

------------------------ -------------- -------------- -------------- --------------

Opening FUD 50,300 50,310 52,112 41,093

Inflows 1,505 1,967 7,275 7,695

Outflows -785 -660 -2,873 -2,744

Net Flows 720 1,307 4,402 4,951

Market movements -927 553 -6,248 6,297

Other movements(1) -23 -58 -196 -229

------------------------ -------------- -------------- -------------- --------------

Closing FUD 50,070 52,112 50,070 52,112

------------------------ -------------- -------------- -------------- --------------

Average daily FUD

for the period (GBPm) 52,217 51,647 52,544 47,240

------------------------ -------------- -------------- -------------- --------------

Number of registered

advisers 7,537 7,161 7,537 7,161

Number of platform

clients 224,705 208,611 224,705 208,611

------------------------ -------------- -------------- -------------- --------------

Notes:

(1) Includes fees, taxes and investment income.

Alex Scott, Chief Executive Officer, commented:

"I am very pleased with the strength of our business performance

during the financial year ended 30 September 2022.

The Transact platform is utilised by clients and advisers for

long term financial planning. Therefore, Transact platform outflows

have remained relatively stable during the course of the year. This

has contributed to our continued very high retention rate of funds

under direction on the Transact platform of 94% for the financial

year.

At a time of economic uncertainty, clients rely even more on the

support and knowledge of their financial adviser. Our business

model is centred on providing long term support for our clients and

their financial advisers. We will continue to advance the

development of our proprietary software, and we will train users in

how to best use the extensive functionality now available. All of

this will enable our clients, with their advisers, to stay on track

with their long term financial plans.

We are mindful of the difficult economic environment and the

significant volatility in asset markets, however we expect the

performance of the Transact platform to remain robust during the

forthcoming financial year, with new clients and advisers joining,

and continued resilient flows onto the Transact platform."

Historical information

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

GBPm FY21 FY21 FY21 FY21 FY22 FY22 FY22 FY22

------------------------- -------- -------- -------- -------- -------- -------- ------------ ------------

Opening FUD 41,093 44,824 46,929 50,310 52,112 54,539 53,500 50,300

Inflows 1,581 2,153 1,994 1,967 1,976 2,092 1,703 1,505

Outflows -741 -686 -657 -660 -688 -697 -703 -785

Net Flows 840 1,467 1,337 1,307 1,288 1,395 1,000 720

Market movements 2,938 694 2,112 553 1,207 -2,376 -4,152 -927

Other movements (1) -47 -56 -68 -59 -68 -58 -48 -23

-------------------------

Closing FUD 44,824 46,929 50,310 52,112 54,539 53,500 50,300 50,070

------------------------- -------- -------- -------- -------- -------- -------- ------------ ------------

Average daily FUD

for the period (GBPm) 42,905 45,873 48,677 51,647 53,514 52,551 51,889 52,217

------------------------- -------- -------- -------- -------- -------- -------- ------------ ------------

Number of registered

advisers 6,836 6,962 7,056 7,161 7,278 7,356 7,469 7,537

Number of platform

clients 194,857 201,104 205,532 208,611 213,178 218,787 221,992 224,705

------------------------- -------- -------- -------- -------- -------- -------- ------------ ------------

Notes:

(1) Includes fees, taxes and investment income.

Enquiries

Investors

Luke Carrivick, IHP Head of Investor

Relations +44 020 7608 5463

Media

Lansons: Tony Langham +44 (0)7979692287

Lansons: Maddy Morgan-Williams +44 (0)7947364578

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCMRBRTMTMBBLT

(END) Dow Jones Newswires

October 18, 2022 02:00 ET (06:00 GMT)

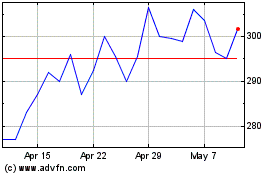

Integrafin (LSE:IHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

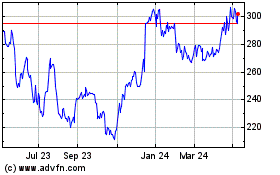

Integrafin (LSE:IHP)

Historical Stock Chart

From Jul 2023 to Jul 2024