By Kimberly Chin and Frances Yoon

HSBC Holdings PLC will stop serving mass-market individual

customers and smaller businesses in the U.S., exiting the bulk of a

retail business that has long struggled to compete with America's

big banks.

The bank said late Wednesday that it will sell 90 of its 148

branches in the U.S., and plans to wind down another 35 to 40. HSBC

agreed to sell parts of its business to two U.S. regional banks,

Citizens Financial Group Inc.'s Citizens Bank and Cathay General

Bancorp's Cathay Bank.

HSBC said it will retain around two dozen locations, which will

become international wealth centers providing banking and

wealth-management services to high-net-worth clients. A spokeswoman

said these centers would be in cities such as New York, Washington,

D.C., San Francisco, Seattle, Los Angeles and Miami.

It will go from about 1.4 million customers to roughly 300,000

in the U.S. It will no longer service customers with basic bank

accounts, or those with balances below $75,000, and businesses with

turnover of $5 million or less.

The shift will let HSBC focus on its competitive strengths, HSBC

Group Chief Executive Noel Quinn said, adding that the bank's U.S.

mass retail operations are good businesses but lack the scale to

compete.

The London-based lender, which makes most of its profit in Hong

Kong and mainland China, is more than a year into an overhaul to

refocus its operations in Asia. In February, the bank said that it

was considering selling its unprofitable U.S. retail operations and

pouring about $6 billion of investment into Asia in the next five

years.

HSBC is also in talks to sell its unprofitable French retail

bank.

Cindy Wang, research director for DBS Bank in Hong Kong, said

HSBC might unload more bank branches in Europe, to reinvest in Hong

Kong and mainland China. "It's a trend for the global banking

industry -- to cut offline branches and leverage mobile and digital

banking to save costs," Ms. Wang said.

The bank will sell its East Coast mass-market and

retail-business-banking operations, which include 80 branches and

around 800,000 customer accounts, as well as its online bank

portfolio to Citizens Bank. Those accounts had about $9.2 billion

in deposits and $2.2 billion in outstanding loans as of the end of

March.

Cathay Bank will buy 10 branches, with about 50,000 customer

accounts, on the West Coast.

The deals, which are subject to regulatory approval, are

expected to close in the first quarter of 2022. HSBC said it

expects the deals to incur about $100 million in pretax costs, and

foresees no material impact to its capital base, as measured by its

core-equity Tier 1 capital ratio.

HSBC established a big U.S. branch presence in the 1980s and

1990s, first by buying Marine Midland Banks Inc. and later adding

Republic New York Corp. The takeovers were part of a string of

deals that transformed the Hong Kong-focused lender into a global

banking giant.

As recently as a decade ago, HSBC had close to 500 retail

outposts in America, with a filing for 2011 disclosing 461

branches.

But HSBC has more recently retrenched. In 2012, the lender sold

its U.S. credit-card business to Capital One Financial Corp., and

sold some branches, mostly in upstate New York, to First Niagara

Financial Group Inc.

HSBC's broader U.S. wealth and personal-banking operations

generated about $1 billion of operating income last year. HSBC said

the businesses it is exiting made up about 13% of that wider

business's customer loans, and 21% of deposits, as of

end-March.

HSBC said the latest pullback wouldn't disrupt its plans to grow

in Asia, adding that many wealthier clients in the region valued

the U.S. as a destination for studying, doing business, buying

property or diversifying their investments.

"The U.S. plays a large role in HSBC's Asia growth strategy,

particularly in support of our ambitions to become the leading

wealth manager in Asia," said Greg Hingston, the bank's regional

head of wealth and personal banking.

On Thursday afternoon in Hong Kong, HSBC's locally traded stock

rose 0.3% to 49.25 Hong Kong dollars per share, equivalent to about

$6.34. As of Wednesday's close, the bank's Hong Kong-listed stock

had risen 20.5% so far this year.

Write to Kimberly Chin at kimberly.chin@wsj.com and Frances Yoon

at frances.yoon@wsj.com

(END) Dow Jones Newswires

May 27, 2021 03:01 ET (07:01 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

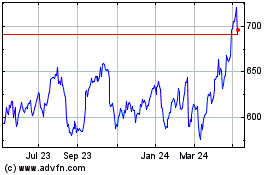

Hsbc (LSE:HSBA)

Historical Stock Chart

From Jun 2024 to Jul 2024

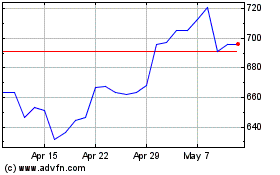

Hsbc (LSE:HSBA)

Historical Stock Chart

From Jul 2023 to Jul 2024