TIDMGSC

RNS Number : 8595U

GS Chain PLC

31 March 2023

31 March 2023

GS CHAIN PLC

("GS Chain " or the "Company")

Half-Year Results

GS Chain (LSE: GSC) announces is pleased to announce its

Half-Year results for the Period Ended 31 December 2022. The full

unaudited financial statements will be uploaded to the Company

website: https://gschain.world/

IMPORTANT EVENTS

The Company continued with its quest to analyse a list of

potential acquisition targets throughout the period. The Company

also submitted its application to list on the OTCQB market, aiming

to facilitate participation for US investors.

The directors also provided a cash injection post period end of

GBP400,000 to ensure sufficient cash reserves were available to the

Company. This has been disclosed under Note 15 below.

The directors have also assessed the principal risks and

uncertainties and have disclosed this under Note 7 below.

This announcement contains information which, prior to its

disclosure, constituted inside information as stipulated under

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310 (as amended).

The directors of GS Chain plc accept responsibility for this

announcement.

For further information please contact:

GS Chain plc

Alan Austin, CEO alan@gschain.world

+44 20 3989 2217

--------------------------

Leon Filipovic, Chairman leon@gschain.world

--------------------------

First Sentinel (Corporate Adviser)

--------------------------

Brian Stockbridge brian@first-sentinel.com

+44 7876 888 011

--------------------------

UNAUDITED CONDENSED STATEMENT OF COMPREHENSIVE

INCOME FOR THE PERIODED 31 DECEMBER

2022

Period Ended Period Ended

31 December 22 31 December

Notes GBP 21

GBP

CONTINUING OPERATIONS

Revenue - -

Administrative expenses (681,879) (582)

------------

OPERATING LOSS (681,879) (582)

------------

LOSS BEFORE INCOME

TAX (681,879) (582)

Income tax 4 - -

------------

LOSS FOR THE PERIOD (681,879) (582)

------------

Earnings per share

expressed in pence

per share: 5

Basic - -

Diluted - -

UNAUDITED CONDENSED STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME FOR THE PERIODED 31 DECEMBER 2022

Period Ended Period Ended

31 December 22 31 December 21

GBP GBP

LOSS FOR THE PERIOD (681,879) (582)

OTHER COMPREHENSIVE INCOME - -

TOTAL COMPREHENSIVE INCOME

FOR THE PERIOD (681,879) (582)

UNAUDITED CONDENSED STATEMENT OF FINANCIAL POSITION 31 DECEMBER

2022

31 December 30 June

Notes 2022 2022

ASSETS GBP GBP

CURRENT ASSETS

Cash and cash equivalents 8 221,604 953,838

-------------- -----------

TOTAL ASSETS 221,604 953,838

-------------- -----------

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 9 66,798 66,798

Share premium Account 10 927,802 927,802

Retained earnings 10 (985,283) ( 303,404)

-------------- -----------

TOTAL EQUITY 9,317 691,196

-------------- -----------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 11 (212,287) (262,642)

-------------- -----------

TOTAL LIABILITIES (212,287) (262,642)

-------------- -----------

TOTAL EQUITY AND LIABILITIES (221,604) (953,838)

============== ===========

The unaudited condensed interim financial statements were

approved by the Board of Directors and authorized for issue on 30

March 2023 and were signed on its behalf by:

L Filipovic - Director

UNAUDITED CONDENSED STATEMENT OF CHANGES IN EQUITY FOR THE

PERIODED 31 DECEMBER 2022

The unaudited statement of changes in equity of the Company for

the period from 1 July 2021 to 31 December 2021is set out

below:

Called up Share premium

share Retained Account Total equity

capital earnings

GBP GBP GBP GBP

Changes in equity

Issue of share capital 66,798 - 927,002 993,800

Total comprehensive loss - (582) - (582)

--------------- ----------------- ---------------------- -----------------------

Balance at 31 December 2021 66,798 (582) 927,002 993,218

=============== ================= ====================== =======================

The unaudited statement of changes in equity of the Company for

the period from 01 July 2022 to 31 December 2022 is set out below:

Called up Share premium

share Retained Account Total equity

capital earnings

GBP GBP GBP GBP

Changes in equity

Issue of share capital 66,798 - 927,802 994,600

Brought forward - (303,404) - (303,404)

Total comprehensive loss - (681,879) - (681,879)

--------------- ----------------- ---------------------- -----------------------

Balance at 31 December 2022 66,798 (985,283) 927,802 9,317

=============== ================= ====================== =======================

UNAUDITED CONDENSED STATEMENT OF CASH FLOWS

FOR THE PERIODED 31 DECEMBER 2022

Period Ended Period Ended

31 December 22 31 December

GBP 21

GBP

Cash flows from operating

activities

Cash generated from operations A (469,592) (582)

Net cash from operating

activities (469,592) (582)

Cash flows from financing (219,070) -

activities

Payment of loan creditors

Amount introduced by 18,980 -

directors

Amount withdrawn by directors (62,552) 66,798

Net cash from financing

activities (262,642) 66,798

(Decrease)/increase in cash and cash equivalents

Cash and cash equivalents at beginning of (732,234) 66,216

period B 953,838 -

--------- -------

Cash and cash equivalents at end of period

B 221,604 993,218

--------- -------

NOTES TO THE UNAUDITED CONDENSED STATEMENT OF CASH FLOWS FOR THE

PERIODED 31 DECEMBER 2022

A. RECONCILIATION OF LOSS BEFORE INCOME TAX TO CASH GENERATED

FROM OPERATIONS

Period Ended Period Ended

31 December 31 December

22 21

GBP GBP

Loss before income tax (681,879) (582)

(Increase)/Decrease in trade

and other payables 212,287 -

Cash generated from operations (469,592) (582)

B. CASH AND CASH EQUIVALENTS

The amounts disclosed on the Statement of Cash Flows in respect

of cash and cash equivalents are in respect of these Statement of

Financial Position amounts:

Period ended 31 December 2022

31 December 1 July

22 22

Cash and cash equivalents GBP 221,604 GBP953,838

Period ended 31 December 2021

31 December 1 July

21 21

GBP GBP

Cash and cash equivalents 993,218 -

NOTES TO THE CONDENSED FINANCIAL STATEMENTS FOR THE PERIODED 31

DECEMBER 2022

1. STATUTORY INFORMATION

GS Chain Plc is a public company, limited by shares, registered

in England and Wales. The Company's registered number and

registered office address can be found on the Company Information

page.

The presentation currency of the financial statements is the

Pound Sterling (GBP).

2. ACCOUNTING POLICIES

Basis of preparation

The unaudited interim condensed unaudited financial statements

for the period ended 31 December 2022 have been prepared in

accordance with IAS 34 Interim Financial Reporting. They do not

include all the information required for a complete set of IFRS

financial statements. However, selected explanatory notes are

included to explain events and transactions that are significant to

an understanding of the changes in the Company's financial position

and performance since the last annual consolidated financial

statements as at the year ended 30 June 2022. The results for the

period ended 31 December 2022 are unaudited.

The unaudited condensed interim financial statements for the

period ended 31 December 2022 have adopted accounting policies

consistent with those followed in the preparation of the Company's

annual financial statements for the year ended 30 June 2022.

Going Concern

The directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future and therefore continues to adopt the going

concern basis in preparing its financial Information.

Critical accounting judgements and key sources of estimation

uncertainty

The preparation of these financial statements requires

management to make judgments and estimates and form assumptions

that affect the reported amounts of assets and liabilities at the

date of the financial statements and reported amounts of expenses

during the reporting period. On an ongoing basis, management

evaluates its judgments and estimates in relation to assets,

liabilities and expenses. Management uses historical experience and

various other factors it believes to be reasonable under the given

circumstances as the basis for its judgments and estimates. Actual

outcomes may differ from these estimates.

The most significant judgment relates to the adoption of the

going concern basis given the Company is newly incorporated and has

not recorded any revenue since the date of incorporation.

The directors consider the Company's cash balances to be

sufficient given the cash burn rate of the Company since listing on

London Stock Exchange to ensure the Company will be able to

continue as a going concern for a period of at least 12 months from

the authorization of these financial statements.

Cash and cash equivalents

Cash represents cash in hand and deposits held on demand with

financial institutions. Cash equivalents are short-term, highly

liquid investments with original maturities of three months or less

(as at their date of acquisition). Cash equivalents are readily

convertible to known amounts of cash and subject to an

insignificant risk of change in that cash value.

In the presentation of the Statement of Cash Flows, cash and

cash equivalents also include bank overdrafts. Any such overdrafts

are shown within borrowings under 'current liabilities' on the

Statement of Financial Position.

2. ACCOUNTING POLICIES - continued Taxation

Tax on profit or loss for the period comprises current and

deferred tax. Tax is recognized in the statement of loss.

and comprehensive loss except to the extent that it relates to

items recognized directly in equity, in which case it is recognized

in equity.

Current tax is the expected tax payable on the taxable income

for the period, using tax rates enacted or substantively enacted at

the reporting date, and any adjustment to tax payable in respect of

previous periods.

Deferred tax is provided on temporary differences between the

carrying amount of assets and liabilities for financial reporting

purposes and the amounts used for taxation purposes.

The following temporary differences are not provided for: the

initial recognition of assets or liabilities that affect neither

accounting nor taxable profit other than in a business combination.

The amount of deferred tax provided is based on the expected manner

of realization or settlement of the carrying amount of assets and

liabilities, using tax rates enacted or substantively enacted at

the statement of financial position date.

A deferred tax asset is recognized only to the extent that it is

probable that future taxable profits will be available against

which the asset can be utilized.

3. EMPLOYEES AND DIRECTORS

The average number of employees during the period were 4:

Period Ended Period Ended

31 December 22 31 December

21

GBP GBP

Directors' remuneration 110,976 -

4. INCOME TAX

Analysis of tax expense

No liability to UK corporation tax arose for the period ended 31

December 2022 nor for the period ended 31 December 2021.

Factors affecting the tax expense

The tax assessed for the period is higher than the standard rate

of corporation tax in the UK. The difference is explained

below:

Period Ended Period Ended

31 December 22 31 December

21

GBP GBP

Loss before income tax (681,880) (582)

Loss multiplied by the standard rate

of corporation tax in the UK of 19%

(2021 - 19%) (129,557) (111)

Effects of:

Unrecognized deferred tax assets 129,557 111

Tax expense - -

4. INCOME TAX - continued

No liability to UK corporation tax arose for the period ended 31

December 2022.

At the period end, there were unrecognized deferred tax assets

of GBP129,557 in respect of unutilised tax losses. These have not

been recognised as their recovery cannot be determined with

reasonable certainty.

Deferred tax assets in respect of carried forward losses are not

recognised in the financial statements.

5. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Diluted earnings per share is calculated using the weighted

average number of shares adjusted to assume the conversion of all

dilutive potential ordinary shares.

Reconciliations are set out below.

Basic EPS Earnings 2022 Per-share

Weighted average amount

Number Per-share pence

of amount shares

GBP GBP GBP

Earnings attributable to ordinary (681,879) - -

shareholders

Effect of dilutive securities - - -

---------- ------------------ ----------

Diluted EPS

Adjusted earnings (681,879) - -

========== ================== ==========

Basic EPS Earnings 2021 Per-share

Weighted average amount

Number Per-share pence

of amount shares

GBP GBP GBP

Earnings attributable to ordinary (582) - -

shareholders

Effect of dilutive securities - - -

--------- ------------------ ----------

Diluted EPS

Adjusted earnings (582) - -

========= ================== ==========

6. OPERATING SEGMENTS

The Board considers that during the period ended 31 December

2022 the Company does not have a specific segment of operating

given the recent listing.

Going forward the Company intends to focus on acquisitions in

the technology space; specifically targeting companies that

leverage state of the art technology in automotive, fintech, real

estate, banking, finance, telecommunications, and blockchain

industries.

7. FINANCIAL INSTRUMENTS

Categories of financial assets and liabilities

The following table categorizes the carrying value of the

financial assets and liabilities at the balance sheet date. In each

case the fair value is not materially different to the carrying

value

31 December

Financial assets 2022

GBP

Cash at bank 221,604

Total 221,604

The contractual maturities of financial assets are all within 1

period of the balance sheet date.

Financial liabilities 31 December 2022

GBP

Trade and other current payables

excluding accruals and deferred

income 189,273

Total 189,273

The contractual maturities of financial liabilities, including

estimated interest payments are all within 1 period of the balance

sheet date.

Risks arising from financial assets and liabilities

The following summarises the principal risks associated with the

Company's financial assets and liabilities and how those risks are

managed.

Liquidity and capital risk management

The Company's capital structure consists of items in

shareholders' equity (deficiency). The Company's objectives when

managing capital are to safeguard the Company's ability to continue

as a going concern in order to provide returns for shareholders and

benefits for other stakeholders and to maintain an optimal capital

structure to reduce the cost of capital.

This is done primarily through equity financing. Future

financings are dependent on market conditions. There were no

changes to the Company's approach to capital management during the

period.

The Company has adequate sources of capital to complete its

business plan, current obligations and ultimately the development

of its business over the long term and will need to raise adequate

capital by obtaining equity financing and/or incurring debt.

Liquidity risk is the risk that the Company will not be able to

meet its financial obligations as they fall due. As at 31 December

2022, the Company had a cash balance of GBP221,604 to settle

current liabilities of GBP212,287. The Company's current financial

liabilities have contractual maturities of 30 days or are due on

demand and are subject to normal trade terms.

Interest rate risk

The Company does not currently have financial instruments that

expose the Company to significant interest rate risk as the Company

does not have any debt that bears variable interest rate.

Currency risk

The Company's financial instruments are currently all

denominated in British Pounds.

Price risk

The Company does not hold any equity securities and therefore is

not exposed to price risk.

Credit risk

The Company does not currently have any receivable and therefore

is not exposed to credit risk.

8. CASH AND CASH EQUIVALENTS

31 December 2022 30 June 2022

GBP GBP

Bank accounts 221,604 953,838

Cash and cash equivalents consist of cash on hand and short-term

deposits held with banks with an A-1+ rating. The carrying value of

these approximates their fair value. Cash and cash equivalents

included in the cash flow statement comprise the following balance

sheet amounts.

9. CALLED UP SHARE CAPITAL

Allotted, issued and fully paid:

Number: Class: Nominal 2022 2022

value: GBP GBP

399,985,888 Ordinary 0.000167 66,798 66,798

10. RESERVES

Retained earnings Share premium Account Totals

GBP GBP GBP

At 1 June 2022 (303,404) 927,802 624,398

Deficit for the

period (681,879) - (681,879 )

At 31 December

2022 (985,283) 927,802 (57,481)

11. TRADE AND OTHER PAYABLES

31 December 2022 30 June 2022

Current: GBP GBP

Trade payable 108,629 56,859

Other loan payable 62,460 -

Accrued expenses 23,014 10,608

Director's current account 18,184 195,175

212,287 262,642

The amounts due to directors represent management fees and other

amounts accrued since the listing of the Company.

12. ULTIMATE PARENT COMPANY

There is no one shareholder that owns greater than 50% of the

issued share capital of GS Chain Plc. Therefore, the Company does

not have an ultimate controlling party.

13. CONTINGENT LIABILITIES

As at 31 December 2022 the Company had no material contingent

liabilities.

14. RELATED PARTY DISCLOSURES

There were no related party transactions except for the payments

of directors' transactions disclosed in the interim financial

statements.

15. EVENTS AFTER THE REPORTING PERIOD

There have been no subsequent events since the reporting period

end date other than a cash injection by the directors of GBP400,000

on 14(th) March 2023 to ensure that there was sufficient cash

available to cover the Company's 1-year runway projections.

16. SHARE-BASED PAYMENT TRANSACTIONS

There have been no share-based payment schemes or share option

compensation since the Company was incorporated.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EADDEDEDDEAA

(END) Dow Jones Newswires

March 31, 2023 02:00 ET (06:00 GMT)

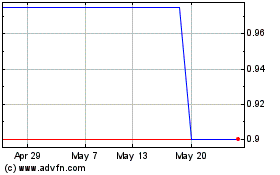

Gs Chain (LSE:GSC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gs Chain (LSE:GSC)

Historical Stock Chart

From Dec 2023 to Dec 2024