Software Circle PLC Update re. the sale of Works Manchester Limited (9413V)

December 07 2023 - 2:00AM

UK Regulatory

TIDMSFT

RNS Number : 9413V

Software Circle PLC

07 December 2023

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

7 December 2023

Software Circle plc

("Software Circle" or "the Company" or the "Group")

Further update regarding the sale of Works Manchester

Limited

Software Circle plc (AIM:SFT) announces the following update

regarding the sale of Works Manchester Limited ("Works

Manchester"), which was first announced on 19 May 2022.

Works Manchester has informed the Company that it has filed a

notice of intention to appoint administrators.

As announced on 1 June 2023, the Company had not received the

first instalment of deferred consideration from Rymack Sign

Solutions Limited ("Rymack"), which was due on 31 May 2023 in

respect of the purchase of Works Manchester. Furthermore, as

announced in the Company's interim results on 27 November 2023, due

to the reduced confidence of receiving payment of any deferred

consideration from Rymack, the carrying value of the GBP2.81m due

under the sale and purchase agreement has been reduced to GBP0.35m.

The Company is in the process of taking steps to recover the sums

due and will update the market again in due course.

The Nettl Systems management team have been making arrangements

with alternative suppliers so that continuity of supply is in place

for products available through the Nettl Systems platform to

minimise any impact on the Nettl partner network. Migration of

product supply has begun and will be completed in the coming

days.

As announced on 15 September 2023, the Group raised GBP23.4m to

continue its acquisition strategy and drive long term shareholder

value. The Group's focus remains steadfastly on this. We are

currently in exclusive discussions with acquisition targets with a

collective turnover of approximately GBP3.6m and an adjusted EBITDA

of GBP1.2m. These are progressing through the due diligence

process. Software Circle will continue to update the market as its

acquisition strategy progresses.

For further information:

Software Circle plc

Gavin Cockerill (CEO) 07968 510 662

Allenby Capital Limited (Nominated Adviser and Broker)

David Hart / Piers Shimwell (Corporate Finance) 0203 328

5656

Stefano Aquilino / Joscelin Pinnington (Sales and Corporate

Broking)

Notes to editors:

Software Circle plc is a UK based acquirer of vertical market

software businesses. Our aim is to help founders find the right

exit strategy, without fuss or drama. Continuing operations in an

independent, decentralised way. Keeping the entrepreneurial spirit

and culture that exists in the businesses we acquire. Providing a

permanent home for their teams, management talent and culture.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBIBDDSGGDGXL

(END) Dow Jones Newswires

December 07, 2023 02:00 ET (07:00 GMT)

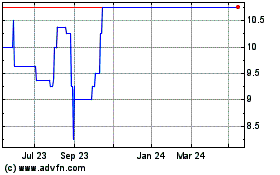

Grafenia (LSE:GRA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Grafenia (LSE:GRA)

Historical Stock Chart

From Dec 2023 to Dec 2024