TIDMGLR

RNS Number : 8320M

Galileo Resources PLC

26 January 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the C ompany's obligations under Article 17 of MAR.

For immediate release

26 January 2021

Galileo Resources Plc

("Galileo" or "the Company")

Sale of 9 Kalahari Copper Belt Licences for US$3 million

to Sandfire Resources Ltd ("Sandfire") and

US$1.5 million subscription into Galileo by Sandfire

Galileo Resources plc ("Galileo" or the "Company") is pleased to

announce that on 25 January 2021 it entered into two legally

binding agreements with ASX listed Sandfire Resources Limited (

ASX:SFR) ("Sandfire").

The first agreement is a conditional licence sale agreement (the

"Licence Sale Agreement") which provides for;

i) The Sale of licences and right of first refusal: the sale to

Sandfire of 9 of the Company's Kalahari Copper Belt Licences (the

"Included Licences") which the Company acquired in May and October

2020. Sandfire to have a first right of refusal in relation to the

acquisition of the 15 Kalahari Copper Belt Licences being retained

by the Company (the "Excluded Licences") ("ROFR: Excluded

Licences") for an aggregate consideration of US$3 million payable

on the Settlement Date of which US$1.5 million will be paid in cash

and US$1.5 million by the issue of 370,477 Sandfire ordinary shares

to the Company (the "Consideration Shares") at an issue price of

A$5.227 per share, being the VWAP of the Sandfire share price for

the 10 trading days prior to the date of signing the Licence Sale

Agreement;

ii) An Exploration Commitment: Sandfire to spend US$4 million on

the Included Licences (the "Exploration Commitment") within two

years of settlement (the "Exploration Period") and if the US$4

million is not spent, any shortfall will be paid to the Company;

and

iii) A Success Payment: a one-off success payment to be paid to

the Company for the first ore reserve reported under JORC Code 2012

edition on the Included Licences which exceeds 200,000 tonnes of

contained copper (the "First Ore Reserve") in the range of US$10

million to US$80 million depending on the amount of contained

copper in the First Ore Reserve (the "Success Payment"). US$2

million of the Success Payment will be held in escrow for up to

three years pending any claim by Sandfire under the Licence Sale

Agreement. Note: given the limited exploration conducted on the

Included Licences to date and the many years that it could take to

establish an Ore Reserve, there can be no guarantee that any such

Success Payment will be forthcoming.

The second agreement is a share subscription agreement (the

"Share Subscription Agreement") which provides for;

i) Sandfire's Share Subscription: Sandfire to acquire US$1.5

million 41,100,124 ordinary shares of 0.1 p in the Company

("Galileo Shares") ("Sandfire's Shares") at a subscription price of

2.68 pence per Galileo Share, being a 25% premium to the 10 day

VWAP of the Company's share price as at 22 January 2021, being the

day before the signing of the Share Subscription Agreement.

Sandfire's Shares will be issued at a premium of 17 % to the

closing mid-price of the Galileo Shares on 25 January 2021, being

the last practical date before the issue of this announcement. This

will represent a 4.62% interest in Galileo.

ii) Sandfire to have participation rights: Sandfire's Shares

will represent 4.62% of the Company's issued shares as enlarged by

the issue of Sandfire's Shares ("Initial Voting Power"). Whilst

Sandfire's shareholding percentage is equal to or greater than the

Initial Voting Power, Sandfire will have participation rights (the

"Participation Rights") to participate in new Galileo share issues

/ issues of rights to acquire Galileo shares by the Company on the

same terms as other participants in a new Galileo share issue /

issues of rights to acquire Galileo shares to at least maintain

Sandfire's shareholding save that the Participation Rights cannot

increase Sandfire's shareholding over 20%; and

iii) Sandfire to have a right to nominate a director: If

Sandfire's percentage Galileo shareholding increases to 15% then it

will have the right to nominate a director to the Board of Galileo,

whose appointment would be subject to customary due diligence on

them prior to their appointment.

Colin Bird Chairman & CEO said:

"This transaction with Sandfire represents a major step forward

for Galileo in its Kalahari Copper Belt endeavours.

We are pleased to be working with Sandfire Resources, who are an

Australian listed company and have an enviable track record of

copper/gold discovery, development execution and operation. They

have a commanding position in the Kalahari Copper Belt and hence we

feel that this arrangement will benefit both parties to further

enhance their positions. The transaction allows Sandfire to explore

the Included Licences, which are in close proximity to their major

mine build, and also allows Galileo to carry out exploration on the

Excluded Licences.

We look forward to implementing the transaction and working

alongside Sandfire in a region, where in my opinion, discovery and

mine build has only just started."

Overview of transactions with Sandfire

Upon completion of the Licence Sale Agreement the Company will

have in aggregate an additional US$3.0 million cash (including the

Sandfire Share Subscription) to invest in the Excluded Licences

which include the highly prospective PL 039/2018 and PL 040/2018,

the Company's other projects and other opportunities plus will have

secured a US$4 million investment by Sandfire in the Included

Licences with the prospect of a very significant Success Payment if

the First Ore Reserve is greater than 200,000 tonnes of contained

copper. US$2 million of the Success Payment will be held in escrow

for up to three years pending any claim by Sandfire under the

Licence Sale Agreement. Note: given the limited exploration

conducted on the Included Licences to date and the many years that

it could take to establish an Ore Reserve, there can be no

guarantee that any such Success Payment will be forthcoming or if

it is the amount .

Under the Share Subscription Agreement, Sandfire will make a

US$1.5 million strategic equity investment at a 25% premium with

participation rights to retain their shareholding but not to

increase it beyond 20%, and the right to nominate a director to the

Galileo Board were they to increase their shareholding to 15% whose

appointment would be subject to customary due diligence on them

prior to their appointment.

Application to trading on AIM : Application will be made to the

London Stock Exchange for a total of 41,100,124 new Galileo Shares

to be admitted to trading on AIM, being Sandfire's Shares

("Admission") which will rank pari passu to the existing ordinary

shares in the Company . It is expected that Admission will become

effective and that dealings in the new Galileo Shares will commence

at 8.00 a.m. on Tuesday 9 February 2021. The issue of the shares

will be made under the Company's existing share authorities.

Total Voting Rights after Share Issue : Following the issue of

Sandfire's Shares, the Company's total issued share capital will

consist of 889,801,317 Galileo Shares with voting rights. The

Company does not hold any Ordinary Shares in treasury and

accordingly there are no voting rights in respect of any treasury

shares.

On Admission, the abovementioned figure of 889,801,317 Galileo

Shares (the "Enlarged Share Capital") may be used by shareholders

in the Company as the denominator for the calculations by which

they will determine if they are required to notify their interest

in, or a change to their interest in, Galileo under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Significant Shareholder Notification: Sandfire will on Admission

own 41,100,124 Galileo Shares representing 4.62% of the Enlarged

Share Capital.

Further Information on Assets being sold and purchaser

The Company acquired all its Kalahari Copper Belt Licences which

includes the Included Licences and Excluded Licences (as shown in

the tables below) on 21 May 2020 by acquiring Crocus-Serv Resources

Pty Ltd and Virgo Business Solutions Pty Ltd for GBP173,848 and on

16 October 2020 by acquiring Africibum Co. Pty Ltd ("Africibum")

for GBP290,220, the issue of 10,000,000 2 year warrants with an

exercise price of 2 pence and the granting of a 1.5% Net Smelter

Royalty (NSR) to the sellers of Africibum to the Company ( the

"Sellers") which the Company has the right to acquire from the

Sellers at any time for total consideration of GBP1.5 million,

which can be payable in Galileo Shares or cash at the absolute

election of the Company. The Company will remain liable to pay the

NSR. In the event that the Company chooses to buy back the NSR by

the issue of Galileo Shares, it shall do so by issuing Galileo

Shares calculated at a price per share equal to the volume weighted

average price of Galileo Shares during the period of 30 days prior

to the date upon which the Galileo Shares are to be issued.

Included Licences Title Holder

PL 044/2018 Virgo Business Solutions Pty Ltd

---------------------------------

PL 045/2018 Virgo Business Solutions Pty Ltd

---------------------------------

PL 122/2020 Africibum Co Pty Ltd

---------------------------------

PL 154/2020 Africibum Co Pty Ltd

---------------------------------

PL 250/2018 Crocus-Serv Resources Pty Ltd

---------------------------------

PL 251/2018 Crocus-Serv Resources Pty Ltd

---------------------------------

PL 366/2018 Africibum Co Pty Ltd

---------------------------------

PL 367/2018 Africibum Co Pty Ltd

---------------------------------

PL 368/2018 Africibum Co Pty Ltd

---------------------------------

Excluded Licence Title Holder

PL 039/2018 Virgo Business Solutions Pty Ltd

---------------------------------

PL 040/2018 Virgo Business Solutions Pty Ltd

---------------------------------

PL 001/2018 Crocus-Serv Resources Pty Ltd

---------------------------------

PL 002/2018 Crocus-Serv Resources Pty Ltd

---------------------------------

PL 003/2018 Crocus-Serv Resources Pty Ltd

---------------------------------

PL 004/2018 Crocus-Serv Resources Pty Ltd

---------------------------------

PL 005/2018 Crocus-Serv Resources Pty Ltd

---------------------------------

PL 041/2018 Virgo Business Solutions Pty Ltd

---------------------------------

PL 042/2018 Virgo Business Solutions Pty Ltd

---------------------------------

PL 046/2018 Virgo Business Solutions Pty Ltd

---------------------------------

PL 047/2018 Virgo Business Solutions Pty Ltd

---------------------------------

PL 123/2020 Africibum Co Pty Ltd

---------------------------------

PL 252/2018 Crocus-Serv Resources Pty Ltd

---------------------------------

PL 253/2018 Crocus-Serv Resources Pty Ltd

---------------------------------

PL 254/2018 Crocus-Serv Resources Pty Ltd

---------------------------------

Approximately GBP10,000 was spent on the Included Licences in

the six months to 30 September 2020 and no income has been

generated from the Included Licences. The Company will record a

profit on disposal of the Included Licences and this will be

reported in the audited accounts for the year ended 31 March

2021.

Sandfire Resources Ltd is an ASX-listed company which, as at 30

June 2020, had net assets of A$750.2 million, declared a final 30

June 2020 dividend of A$14 cents per share, and as at 25 January

2021 had a market capitalisation of approximately A$900

million.

Summary of Licence Sale Agreement:

Parties On the one part the Company and its three wholly

owned subsidiaries Virgo Business Solutions Pty

Ltd, Africibum Co Pty Ltd, Crocus-Serv Resources

Pty Ltd and on the other part Sandfire Resources

Ltd and its wholly owned subsidiary Tshukudu Metals

Botswana (Pty) Ltd.

------------------ -----------------------------------------------------------------------

Consideration US$1.5M for the sale of the Included Licences payable

in cash (the "Licence Purchase Price") and US$1.5M

for the right of first refusal granted to Sandfire

in relation to the Excluded Licences (the "Right

of First Refusal Fee") payable by the issue of

the Consideration Shares to the Company, both amounts

are payable on the Settlement Date as defined below.

------------------ -----------------------------------------------------------------------

Settlement The latter of:

Date 1. 30 Business Days after execution of the Licence

Sale Agreement; or 2. 5 Business Days after the

Condition Precedents are met,

or such later date as is agreed between the Parties.

------------------ -----------------------------------------------------------------------

Consideration The issue by Sandfire of 370,477 of its ordinary

Shares shares to the Company as settlement of the Right

of First Refusal Fee at an issue price of A$5.227

per share, being the 10 day VWAP of the Sandfire

share price as at the date before the signing of

the Licence Sale Agreement. The Consideration Shares

are not subject to any sale restrictions.

------------------ -----------------------------------------------------------------------

Exploration Sandfire, through its 100% owned Botswana subsidiary

Commitment Tshukudu Metals Botswana (Pty) Ltd, to spend US$4

million on exploration activities within the Exploration

Period, with a minimum of 60% on drilling and assay

costs on the Included Licences (the "Qualifying

Exploration Expenditure") of which a minimum if

US$1 million, of the Exploration Commitment is

to be spent on PL 250/2018 and PL 251/2018 ("Agreed

Licence Expenditure").

If Sandfire fails to meet the Exploration Commitment

within the Exploration Period, it will pay any

remaining shortfall amount of the Exploration Commitment

to the Company, in Immediately Available Funds,

at the expiry of the Exploration Period.

------------------ -----------------------------------------------------------------------

Technical During the Exploration Period there will be a technical

Committee committee chaired by Sandfire with two representatives

from Sandfire and two from the Company to provide

advice on the exploration of the Included Licences

and collaboratively review technical data at quarterly

technical meetings, or more frequently as decided

by the technical committee. This will provide the

Company with an active participation in the exploration

strategy for the Included Licences, working closely

with Sandfire who are experienced in the Kalahari

Copper Belt where they have two projects: i) the

T3 (Motheo) Copper-Silver Project, which announced

a Definitive Feasibility Study (DFS) in December

2020 on an initial Base Case 3.2Mtpa processing

capacity and open pit development of the T3 Deposit;

and ii) the A4 discovery, for which Sandfire have

announced a maiden Inferred Mineral Resource containing

100,000 tonnes of copper at an average grade of

1.5% Cu.

------------------ -----------------------------------------------------------------------

Success Payment The Success Payment is only triggered if the First

Ore Reserve is > 200,000 tonnes of contained copper.

Given the Included Licences have had limited exploration

to date, if an Ore Reserve is determined this may

take several years and there is no certainty that

an Ore Reserve would be established or that any

such reserve would exceed 200,000 tonnes of contained

copper. The one-off Success Payment will be calculated

in accordance with the table below and US$2 million

of the Success Payment will be held in escrow for

up to three years pending any claim by Sandfire

under the Licence Sale Agreement.

Contained copper (Cu) in Success Payment

first Ore Reserve (USD)

Between the following: payable

>200Kt Cu and <400Kt Cu $10,000,000

----------------

>400Kt Cu and <600Kt Cu $20,000,000

----------------

>600Kt Cu and <750Kt Cu $40,000,000

----------------

>750Kt Cu $80,000,000

----------------

The Success Payment is due to be paid in cash within

30 days from the date Sandfire announces an Ore

Reserve which triggers the payment of the Success

Payment (the "Success Payment Completion Date").

Sandfire have the option to elect to settle the

Success Payment by the issue by Sandfire of its

ordinary shares to the Company based on the 10

day VWAP for Sandfire shares prior to, but excluding

the Success Payment Completion Date.

------------------ -----------------------------------------------------------------------

First Ore Means the first ore reserve defined on the Licences,

Reserve which is compliant with the Australasian Code for

Reporting of Ore Reserves (JORC Code, 2012 edition)

and results in a declared ore reserve for a single

Deposit containing at least 200,000 tonnes of contained

copper.

------------------ -----------------------------------------------------------------------

Conditions Settlement is conditional upon: 1. The parties

Precedent having executed the Share Subscription Agreement

(which has been done); 2. ministerial consent for

the transfer of the Included Licences by the Botswana

Minister of the Ministry of Minerals, Energy and

Water Resources ("Ministerial Consent") ; 3. all

ASX and AIM regulatory approvals; 4. approval of

the acquisition of the Included Licences by the

Competition Authority of Botswana (or confirmation

from such authority or from either party's Botswana

legal counsel that such approval is not required)

("Competition Approval") ; and 5. duly executed

transfers of the Included Licences in the form

required by the Mining Act under which a 100% interest

in the Included Licences may be transferred.

If the Ministerial Consent and / or the Competition

Approval is not granted by the Long Stop Date the

agreement shall automatically terminate and cease

to have effect and no Party shall have any obligation

or liability to any other Party.

------------------ -----------------------------------------------------------------------

Long Stop 31 July 2021 or such later date is agreed to be

Date the parties to the Licence Sale Agreement.

------------------ -----------------------------------------------------------------------

Included Licences PL 044/2018 PL 154/2020 PL 366/2018

to be sold PL 045/2018 PL 250/2018 PL 367/2018

PL 122/2020 PL 251/2018 PL 368/2018

------------------ ----------------------- ---------------------- ----------------------

Excluded Licences PL 039/2018 PL 004/2018 PL 047/2018

not to be PL 040/2018 PL 005/2018 PL 123/2020

sold PL 001/2018 PL 041/2018 PL 252/2018

PL 002/2018 PL 042/2018 PL 253/2018

PL 003/2018 PL 046/2018 PL 254/2018

------------------ ----------------------- ---------------------- ----------------------

Included Licences If Sandfire wishes to transfer or sell part of

Right of First or one or more of the Included Licences then the

refusal Company has a right of first refusal to buy the

Included Licence (s) on the term of the Included

Licence Right of First Refusal which has to be

exercised by the Company within 30 days.

------------------ -----------------------------------------------------------------------

ROFR: Excluded If the Company wishes to transfer or sell part

Licences of or one or more of the Excluded Licences then

Sandfire has a right of first refusal to buy the

Excluded Licence (s) on the term of the Excluded

Licence Right of First Refusal which has to be

exercised by Sandfire within 30 days.

------------------ -----------------------------------------------------------------------

Governing The agreement is governed by and construed under

Law the law in the State of Western Australia.

------------------ -----------------------------------------------------------------------

Disputes Where a dispute occurs in relation to the First

Ore Reserve or any other matter the Company and

Sandfire shall within 21 days each nominate one

person (a "Nominated Representative") to represent

them to resolve the dispute and the Nominated Representative

shall be empowered by their own Board to negotiate

terms of a settlement of the dispute which shall

be binding on all the parties. If after 30 days

of their appointment the Nominated Representatives

have been unable to reach an agreement then in

relation to a dispute in respect of the First Ore

Reserve it shall be referred to an expert and a

dispute if respect of any matter other than the

First Ore Reserve the parties are free to direct

it to an expert or take legal or any other action

to resolve the matter.

------------------ -----------------------------------------------------------------------

Representations The parties have given customary representations

& Warranties and warranties for an agreement of this nature.

------------------ -----------------------------------------------------------------------

Further information in relation to the Share Subscription

Agreement

Parties The Company and Sandfire Resources Limited

------------------- ------------------------------------------------------------

Share Subscription Sandfire will acquire US$1.5 million 41,100,124

ordinary shares of 0.1 p in the Company ("Galileo

Shares") ("Sandfire's Shares") at a subscription

price of 2.68 pence per Galileo Share, being a

25% premium to the 10 day VWAP of the Company's

share price as at 22 January 2021 being the day

before the signing of the Share Subscription Agreement.

Sandfire's Shares will be issued at a premium of

17 % to the closing mid-price of the Galileo Shares

on 25 January 2021, being the last practical date

before the issue of this announcement. Sandfire's

Shares are not subject to any sale restrictions.

------------------- ------------------------------------------------------------

Participation Sandfire's Shares will represent 4.62% of the Company's

Rights issued shares as enlarged by the issue of Sandfire's

Shares ("Sandfire's Initial Voting Power"). Whilst

Sandfire's shareholding percentage is equal to

or greater than the Initial Voting Power Sandfire

will have participation rights (the "Participation

Rights") to participate in new Share issues/ issues

of rights to acquire Galileo Shares by the Company

on the same terms as other participants in a new

Galileo share issue / issues of rights to acquire

Galileo shares to at least maintain its shareholding

save that the Participation Rights cannot increase

its shareholding over 20%.

------------------- ------------------------------------------------------------

Right to Nominate If Sandfire's percentage shareholding increases

a director to 15% then it will have the right to nominate

a director to the Board of Galileo whilst its shareholding

equals or exceeds 15% whose appointment would be

subject to customary due diligence on them prior

to their appointment.

------------------- ------------------------------------------------------------

Conditions The only condition precedent to the Share Subscription

Precedent Agreement is that the parties enter into the Licence

Sale Agreement and this condition has been met.

------------------- ------------------------------------------------------------

Governing The agreement is governed by and construed under

Law the law in the State of Western Australia.

------------------- ------------------------------------------------------------

Representations The parties have given customary representations

& Warranties and warranties for an agreement of this nature.

------------------- ------------------------------------------------------------

The information on Sandfire referred to in this announcement t

was sources from its public announcements and website at

https://www.sandfire.com.au/site/content/

You can also follow Galileo on Twitter: @GalileoResource

For further information, please contact: Galileo Resources

PLC

Colin Bird, Chairman Tel +44 (0) 20 7581

4477

---------------------------------- ----------------------

Beaumont Cornish Limited - Nomad Tel +44 (0) 20 7628

Roland Cornish/James Biddle 3396

---------------------------------- ----------------------

Novum Securities Limited - Joint

Broker

Colin Rowbury /Jon Belliss +44 (0) 20 7399 9400

---------------------------------- ----------------------

Shard Capital Partners LLP - Tel +44 (0) 20 7186

J oint Broker 9952

Damon Heath

---------------------------------- ----------------------

Technical Glossary:

An 'Ore Reserve' is the economically mineable part of a Measured

and/or Indicated Mineral Resource. It includes diluting materials

and allowances for losses, which may occur when the material is

mined or extracted and is defined by studies at Pre-Feasibility or

Feasibility level as appropriate that include application of

Modifying Factors. Such studies demonstrate that, at the time of

reporting, extraction could reasonably be justified.

A 'Mineral Resource' is a concentration or occurrence of solid

material of economic interest in or on the Earth's crust in such

form, grade (or quality), and quantity that there are reasonable

prospects for eventual economic extraction. The location, quantity,

grade (or quality), continuity and other geological characteristics

of a Mineral Resource are known, estimated or interpreted from

specific geological evidence and knowledge, including sampling.

Mineral Resources are sub-divided, in order of increasing

geological confidence, into Inferred, Indicated and Measured

categories.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBAMLTMTMTBBB

(END) Dow Jones Newswires

January 26, 2021 02:00 ET (07:00 GMT)

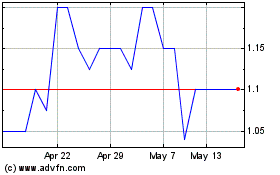

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Jun 2024 to Jul 2024

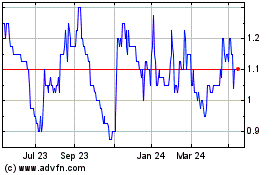

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Jul 2023 to Jul 2024