TIDMGIF

RNS Number : 8803B

Gulf Investment Fund PLC

25 September 2018

The following amendment has been made to the 'Annual Financial

Report' announcement released on 25 September 2018 at 7.00 under

RNS No 7690B.

The payment date for the proposed dividend within the 'Proposed

dividend' paragraph of the Chairman's Statement has been changed

from 21 December 2019 to 21 December 2018.

All other details remain unchanged.

The full amended text is shown below.

Gulf Investment Fund plc

Annual Report for the year ended 30 June 2018

-- Gulf Investment Fund's (GIF) net asset value (NAV) +7.8%, MSCI Emerging Markets Index +5.8%

-- GIF share price +13%

-- Recommended dividend of 3.0 cents per share

-- GCC markets have outperformed other global markets

Nicholas Wilson, Chairman of Gulf Investment Fund plc,

commented:

"This year has been one of improving fortune and significant

development for the Gulf Investment Fund; in December the fund's

investment strategy and name changed. The widening of our

investment universe and the benefit of strong economic growth

across the Gulf region has led to improved performance for the

fund's net asset value and share price.

"We're confident that this growth will continue to provide

opportunities for us in the region. We are well positioned to take

advantage of them. At the year-end we held positions in the

financial services, energy and utilities across Saudi Arabia,

Qatar, Kuwait and the United Arab Emirates. Our investment adviser

believes that medium to-long term growth prospects should remain

healthy across the region, driven by a strong infrastructure

development pipeline, supportive demographics as populations

increase and as stockmarkets in the region are upgraded to emerging

market status."

For further information:

Qatar Investment Fund Plc +44 (0) 1624 622 851

Nicholas Wilson

Panmure Gordon +44 (0) 20 7886 2500

Andrew Potts

Maitland +44 (0) 20 7379 5151

William Clutterbuck / Finlay Donaldson

Chairman's Statement

On behalf of the Board, I am pleased to present your Company's

eleventh Annual Report and Financial Statements for the year to 30

June 2018.

During the 12 months, your Company's Net Asset Value per Share

("NAV") rose by 7.8% to US$1.1982 which compares with a gain of

8.6% in the S&P GCC composite index and 5.8% in the MSCI

Emerging Markets Index. Following a narrowing of the discount at

which the shares trade to NAV, the shares rose by from US$0.8990 to

US$1.0150 for a gain of 13.0%. Shareholders received a dividend of

3.0 cents per share which was paid on 9 February 2018 to ordinary

shareholders on the register as at 5 January 2018.

Results

Results for the period under review showed a profit US$9.68m

generated from fair value adjustments, realised losses and dividend

income. This is equivalent to a basic profit per share of 9.95

cents.

Following the actions taken on 5 June 2017 against Qatar by

Saudi Arabia, UAE, Bahrain and Egypt, Qatar acted swiftly to

implement alternative international trading arrangements. Although

there was an initial negative impact on the Qatar economy and the

stock market, by December it became apparent that the economy was

recovering aided by a stronger oil price. Accordingly, since the

change in Investment Policy referred to below, the Company remained

overweight Qatar relative to the informal benchmark, the S&P

GCC composite index.

At the end of the period, we had a total of 43 holdings: 24 in

Saudi Arabia, 9 in Qatar, 5 in the UAE and 5 in Kuwait. The

geographical split based on valuation, was Saudi Arabia 39.2%,

Qatar 36.7%, Kuwait 10%, and UAE 9.6%. We also had 4.5% in

cash.

The Company's Ongoing Charges (formerly Total Expense Ratio)

rose to 1.95% from 1.70% in the previous year. The charges were

calculated in accordance with the methodology recommended by the

Association of Investment Companies.

Proposed dividend

The Board is pleased to recommend to shareholders a dividend of

3 cents a share. Subject to shareholder approval at the forthcoming

Annual General Meeting, the dividend will be paid on 21 December

2018 with a record date of 16 November and an associated ex-date of

15 November 2018, the last day for currency elections will be 30

November 2018.

Change in investment policy

On 16 October 2017, the Board announced its intention to change

the investment policy of the Company from a largely Qatar-focused

investment strategy to a broader Gulf Cooperation Council ("GCC")

investment strategy.

Previously, the investment policy enabled the Company to invest

up to 15% of the Company in GCC countries (namely Saudi Arabia,

Kuwait, UAE, Oman and Bahrain) other than Qatar.

The proposed change in investment policy removed the 15% limit

and enabled the Company to increase its investment allocation to

other GCC countries and provide the Investment Adviser with a wider

investment universe and more flexibility to identify attractive

opportunities in the GCC region.

Alongside the Amended Investment Policy the Board resolved to

put forward a number of proposals including:

(i) making a tender offer for up to 10% of the issued Share Capital of the Company

(ii) cancelling the discontinuation vote currently scheduled for

the 2018 annual general meeting and replacing it with a

continuation vote for the 2021 annual general meeting and every

three years thereafter;

(iii) making a tender offer to shareholders for up to 100% of

the Company's share capital in 2020 subject to Shareholder approval

to be sought in 2020; and

(iv) proposing to change the name of the Company to Gulf Investment Fund PLC.

All of these changes were approved by shareholders at an

Extraordinary General Meeting (EGM) on 7 December 2017, other than

the tender offer in 2020 which will be subject to shareholder

approval in 2020.

Tender offer

Following the passing of the resolutions at the EGM on 7

December 2017 to give effect to the 10% Tender Offer, 10,273,471

Shares were tendered under the Tender Offer at the tender offer

price of USD0.9933 per share. These shares were cancelled leaving

the Company with 92,461,242 Shares in issue (excluding treasury

shares).

Related Party Transactions

Details of any related party transactions are contained in note

10 of this report.

Post balance sheet events

Details of these can be found in note 14 following the

accompanying financial statements.

Outlook, risks and uncertainties

Fluctuations in oil and gas prices will continue to impact GCC

economies, as countries deal with budget challenges. The

geopolitics of the region and, in particular, the dispute between

Qatar and other members of the GCC brings continuing economic

uncertainty.

The Board believes that the principal risks and uncertainties

faced by the Company continue to fall in the following categories;

geopolitical events, market risks, investment and strategy risks,

accounting, legal and regulatory risks, operational risks and

financial risks. Information on each of these is given in the

Business Review section of our Annual Report each year.

The Board continues to view the future of the Company with

confidence expecting healthy if slower growth in the region as a

whole, as growth in the non-hydrocarbon sector in a number of GCC

members helps to balance their economies.

Annual General Meeting

I look forward to welcoming shareholders to out eleventh Annual

General Meeting on 7 November 2018, which will be held at 11.00 am

at the Company's registered office at Millennium House, 46 Athol

Street, Douglas, Isle of Man.

Nicholas Wilson

Chairman

21 September 2018

Business Review

The following review is designed to provide information

primarily about the Company's business and results for the year

ended 30 June 2018. It should be read in conjunction with the

Report of the Investment Manager and the Investment Adviser on

pages 7 to 14 which gives a detailed review of the investment

activities for the year and an outlook for the future.

Investment Objective and Strategy

The Company's investment objective is to capture the

opportunities for growth offered by the expanding GCC economies by

investing in listed companies on one of the GCC exchanges or

companies soon to be listed on one of the GCC exchanges. The

Company may also invest in listed companies, or pre-IPO companies,

in other GCC countries.

The Company applies a top-down screening process to identify

those sectors which should most benefit from sector growth trends.

Fundamental industry and company analysis, rather than

benchmarking, forms the basis for both stock selection and

portfolio construction.

The Company's investment policy is on pages 15 to 16.

Performance Measurement and Key Performance Indicators

In order to measure the success of the Company in meeting its

objectives and to evaluate the performance of the Investment

Manager, the Directors take into account the following key

performance indicators:

Returns and Net Asset Value

At each quarterly Board meeting the Board reviews the

performance of the portfolio versus the Qatar Exchange (QE) Index

(local benchmark) as well as the net asset value, income, share

price and expense ratio for the Company.

Discount/Premium to Net Asset Value

On a weekly basis, the Board monitors the discount/premium to

net asset value. The Directors renew their authority at the annual

general meeting in order to be able to make purchases through the

market where they believe they can assist in narrowing the discount

to net asset value and where it is accretive to net asset value per

share.

On 22 February 2017, the Company announced the details of its

annual share buy-back programme. Pursuant to, and during the term

of this share buy-back programme, the Company may purchase ordinary

shares provided that:

1) the maximum price payable for an ordinary share on the London

Stock Exchange is an amount equal to the higher of:

a. 105 per cent. of the average market value of the Company's

ordinary shares as derived from the London Stock Exchange Daily

Official List for the five business days immediately preceding the

day on which such share is contracted to be purchased; and

b. In order to benefit from the exemption laid down in Article

5(1) of Regulation (EU) No 596/2014, the Company will not purchase

shares at a price higher than the higher of the price of the last

independent trade and the highest current independent purchase bid

on the trading venue where the purchase is carried out; and

2) the aggregate number of ordinary shares which may be acquired

on behalf of the Company in connection with this share buy-back

programme shall not exceed 17,548,355 ordinary shares.

Due to the limited liquidity in the ordinary shares, a buy-back

of ordinary shares pursuant to the share buy-back programme on any

trading day is likely to represent a significant proportion of the

daily trading volume in the ordinary shares on the London Stock

Exchange (and is likely to exceed the 25% limits of the average

daily trading volume as laid down in Article 5(1) of Regulation

(EU) No 596/2014 and as such the Company will not benefit from this

exemption). The share buy authority resolution is for up to 14.99%

of the Company's issued share capital. The Board has no present

intention to exercise the authority in full but will keep the

matter under review, taking into account the overall financial

position of the Company and the discount to net asset value at

which the Company's shares trade.

Whilst the Company has the requisite shareholder authority to

conduct share buy-backs, the Company has not announced a share

buy-back programme since the above programme which expired on 17

November 2017, however this is under regular review by the

Board.

A Board member is responsible for close monitoring of our share

price, and working with our broker to buy back shares when we

believe appropriate so as to manage any discount to net asset

value.

Yield

The Board monitors the dividend income of the portfolio and the

amount available for distribution and considers the impact on the

Company's annual dividend policy of future progressive dividend

payments, subject to the absence of exceptional market events.

Principal Risks and Uncertainties

The Board confirms that there is an on-going process for

identifying, evaluating and managing or monitoring the key risks to

the Company. These key risks have been collated in a risk matrix

document which is reviewed and updated on a quarterly basis by the

Directors. The risks are identified and graded in this process,

together with the policies and procedures for the mitigation of the

risks.

The key risks which have been identified and the steps taken by

the Board to mitigate these are as follows:

Market

The Company's investments consist of listed companies. There are

no investments in companies soon to be listed. Market risk arises

from uncertainty about the future prices of the investments. This

is commented on in Note 1(a) and 2 on pages 47 to 51.

Investment and Strategy

The achievement of the Company's investment objective relative

to the market involves risk. An inappropriate asset allocation may

result in underperformance against the local index. Monitoring of

these risks is carried out by the Board which, at each quarterly

Board meeting, considers the asset allocation of the portfolio, the

ratio of the larger investments within the portfolio and the

management information provided by the Investment Manager and

Investment Adviser, who are responsible for actively managing the

portfolio in accordance with the Company's investment policy. The

net asset value of the Company is published weekly.

Accounting, legal and regulatory

The Company must comply with the provisions of the Isle of Man

Companies Acts 1931 to 2004 and since its shares are listed on the

London Stock Exchange, the UK Listing Authority's Listing Rules and

Disclosure Guidance and Transparency Rules ("UKLA Rules")' A breach

of company law could result in the Company and/or the Directors

being fined or the subject of criminal proceedings. A breach of the

UKLA Rules could result in the suspension of the Company's shares.

The Board relies on its Company Secretary and advisers to ensure

adherence to company law and UKLA Rules. The Board takes legal,

accounting or compliance advice, as appropriate, to monitor changes

in the regulatory environment affecting the Company.

From 3 July 2016 the Company must also comply with the Market

Abuse Regulation (MAR) which contains prohibitions for insider

dealing and market manipulation, and provisions to prevent and

detect these.

Operational

Disruption to, or the failure of, the Investment Manager, the

Investment Adviser, the Custodian or Administrator's accounting,

payment systems or custody records could prevent the accurate

reporting or monitoring of the Company's financial position.

Details of how the Board monitors the services provided by the

Investment Manager and its other suppliers, and the key elements

designed to provide effective internal control, are explained

further in the internal control section of the Corporate Governance

Report on pages 19 to 25.

Financial

The financial risks faced by the Company include market price

risk, foreign exchange risk, credit risk, liquidity risk and

interest rate risk. Further details are disclosed in Notes 1(a), 2,

6 and 8.

Report of the Investment Manager and Investment Adviser

Regional Market Overview

In FY 2018, GCC Markets outperformed its global peers, led by

increase in oil prices and index upgradation to EM status by FTSE

and MSCI. Diverging global growth and looming trade war concerns

have shaken investor confidence, triggering flow to safe heavens,

with china suffering the most, as a result, global markets remained

almost flat in 1H18.

29-Jun-17 31-Dec-17 2H17 29-Jun-18 1H18 LTM

Qatar (QE) 9,030.4 8,523.4 -5.6% 9,024.0 5.9% -0.1%

---------------- ---------------- ------ ---------------- ------- -------

Saudi Arabia (TASI) 7,425.7 7,226.3 -2.7% 8,314.2 15.1% 12.0%

---------------- ---------------- ------ ---------------- ------- -------

Dubai (DFMGI) 3,392.0 3,370.1 -0.6% 2,821.0 -16.3% -16.8%

---------------- ---------------- ------ ---------------- ------- -------

Abu Dhabi (ADI) 4,425.4 4,398.4 -0.6% 4,560.0 3.7% 3.0%

---------------- ---------------- ------ ---------------- ------- -------

Kuwait (KWSE) NA NA NA 4,890.4 NA NA

---------------- ---------------- ------ ---------------- ------- -------

Oman (MSI) 5,118.3 5,099.3 -0.4% 4,571.8 -10.3% -10.7%

---------------- ---------------- ------ ---------------- ------- -------

Bahrain (BAX) 1,310.0 1,331.7 1.7% 1,311.0 -1.6% 0.1%

---------------- ---------------- ------ ---------------- ------- -------

S&P GCC Composite 100.1 99.0 -1.1% 108.7 9.8% 8.6%

---------------- ---------------- ------ ---------------- ------- -------

MSCI World 1,916.4 2,103.5 9.8% 2,089.3 -0.7% 9.0%

---------------- ---------------- ------ ---------------- ------- -------

MSCI EM 1,008.8 1,158.5 14.8% 1,069.5 -7.7% 6.0%

---------------- ---------------- ------ ---------------- ------- -------

Brent 47.4 66.9 41.1% 77.9 16.4% 64.3%

---------------- ---------------- ------ ---------------- ------- -------

Source: Bloomberg

During 2H17, most GCC markets underperformed their global peers,

affected by regional tensions, with the S&P GCC Composite index

declining by 1.1 per cent. Performance of individual markets within

the GCC was mixed. Crude prices closed 14.8 per cent higher

supported by the OPEC's production cut agreement and its extension

till December 2018.

Saudi Arabia was the major contributor to the regional

performance during the period (YTD 2018), largely because investors

looked ahead to its inclusion in EM indices. Dubai lagged the

region, amid concerns about its Real Estate & Construction

sector. The S&P GCC has gained 9.8 per cent while emerging

markets generally have fallen (MSCI EM index is down 7.7 per

cent).

GCC diversification and recovering oil prices

GCC nations are encouraging private sector participation and

improving the efficiency and transparency of the public sector.

Investor friendly regulations are being adopted, such as

allowing 100 per cent foreign ownership of businesses, and 10-year

residency visas in the UAE.

Social reforms such as Saudi women being permitted to drive and

set up their own businesses will stimulate female participation in

the economy. This should boost job creation and consumer spending,

potentially benefitting sectors such as Services, Automobile and

Insurance.

Stronger oil prices this year have bolstered the reserves of GCC

nations, facilitating fiscal reforms and helping their spending

programs. The IMF reduced its estimate for this year's GCC fiscal

deficit to 3.6 per cent of GDP (October 2017: 5.0 per cent of GDP),

and expects a 2019 deficit of 2.2 per cent.

Economic growth in the region is expected to accelerate in

2018-19, largely reflecting the continued recovery in oil prices

and slowing pace of fiscal consolidation. The IMF has estimated

aggregate growth for the region at 1.9 per cent and 2.6 per cent

for 2018 and 2019, respectively. In June, major global oil

producers agreed to increase crude output from July, this should

support GDP growth.

Saudi Arabia's production increase should boost growth in its

oil sector, adding nearly 2 per cent to GDP growth. Non-oil growth

is expected to pick up as reforms take a back seat and focus shifts

towards implementation of megaprojects. Current mega projects

include the Grand Mosque redevelopment (US$26.6 billion),

development of the Riyadh and Jeddah Metro transit system (US$34.5

billion) and Expansion of King Abdulaziz Int'l Airport (US$7.2

billion). Upcoming mega projects include the US$500 billion NEOM

Mega City, King Abdullah Economic City (US$100 billion) and

commissioning of the world's largest solar project (US$200

billion).

Embedded image removed - please refer to the Company's website

www.gulfinvestmentfundplc.com for a chart depicting GCC Fiscal

Balances.

In June 2018, Fitch Ratings revised Qatar's Outlook to "Stable"

from "Negative" stating that Qatar has successfully managed the

effect from last year's blockade by reconfiguring supply chains and

injecting public sector liquidity. The IMF expects Qatar's real GDP

growth to quicken to 2.6 per cent in 2018 from 2.1 per cent in

2017, with the economy benefitting from continued infrastructure

investment, a slower pace of fiscal consolidation and the scaling

up of LNG production.

Kuwait delayed implementation of VAT until 2021 and the

Investment Adviser expects it has little immediate need for fresh

revenues at the current oil price. Kuwait is expected to report a

fiscal surplus for 2018 and 2019 at 7.0 per cent and 6.1 per cent

of GDP, respectively.

The UAE government eased visa and investment rules to attract

new businesses. Experts in medical, scientific, research and

technical fields as well as top students will be able to get a

residency of up to 10 years.

Dubai unveiled various plans to stimulate foreign investment.

These plans include the reduction and cancellation of some

government fees to support investors' ability to do business. Dubai

Municipality fees and those related to investment in the aviation

sector will be lowered.

To benefit from the higher oil price environment and encourage

economic growth, the Abu Dhabi government approved a 3-year AED50

billion (US$13.6 billion) economic stimulus program. The

authorities intend to make it easier to do business, spur

employment growth and increase tourism.

In April, the Central Bank of Oman eased capital and credit

exposure rules in an effort to boost economic growth. The most

prominent measure was the reduction in the capital adequacy ratio.

This should free up close to OMR2.6 billion to stimulate credit

growth.

MSCI EM Inclusion

Saudi Arabia's inclusion in the MSCI EM index from May 2019

brings its US$500 billion stock market to a wider group of

international investors. It could trigger US$40 - US$45 billion of

inflows.

MSCI also added Kuwait to its 2019 watch list for a potential

upgrade to EM, with the decision to be announced next June, further

bringing GCC nations under the investment radar of global

investors.

Embedded image removed - please refer to the Company's website

www.gulfinvestmentfundplc.com for a chart depicting Future

Potential of GCC on the MSCI EM Index.

These developments would also have a positive impact on the

broader region. In addition to increased foreign inflows, the

intangible benefits of attracting newer set of sophisticated

investors should result in improved standards of financial

disclosure and corporate governance.

Other Recent Developments

Saudi Arabia to be included in FTSE Secondary Emerging Market

Index

The Kingdom is likely to have a weight of 2.7 per cent in the

index, which could rise to about 4.6 per cent on listing of the

proposed 5 per cent IPO of state oil giant Saudi Aramco. Saudi

Arabia could see a total of US$30-US$45 billion of inflows in the

next two years if it reaches the foreign ownership levels of peer

GCC markets like UAE and Qatar.

Rising interest rates to benefit GCC banks

Most GCC central banks, including the UAE, Qatar, Kuwait and

Bahrain, hiked their benchmark interest rates in line with the US

Federal Reserve's move. Moody's expects that rising interest rate

would benefit GCC banks through higher NIM's, as banks are expected

to gradually reprice their loan books. Consensus sees further 3 to

4, 25 bps rate hikes by the US Fed.

Kuwait segmented its market to attract investors and increase

listings

Boursa Kuwait transformed its market in to a three-tiered,

segmented market along with entirely new listing requirements and

introduction of new market-capitalised indices and circuit breakers

to curb volatility. The market is segmented to create three new

markets, a Premier, a Main and an Auction market. The amendments

are expected to build a liquid, reliable and sound capital market,

providing issuers with efficient access to capital, and investors

with diverse return opportunities.

FTSE to upgrade Kuwait to emerging market in two tranches

Kuwait's stock market will be included in FTSE Russell's

emerging market index in two equal tranches in September and

December this year. FTSE projects that Kuwait would have a final

weighting of 0.4 per cent in the index. The consensus expects

around US$800 million of passive inflows to the Kuwaiti market from

global index-linked funds.

Saudi Arabia launched privatization programme

Saudi Arabia aims to generate SAR35 to 40 billion (US$10

billion) in non-oil revenues from its privatisation programme by

2020 and create up to 12,000 jobs. National Center for

Privatization & PPP (NCP's) privatization programme aims to

help increase the percentage of private sector contribution to GDP

from 40 per cent to 65 per cent.

Bahrain makes largest oil discovery in its history

Bahrain announced its biggest hydrocarbons discovery since 1932

and is expected to increase its existing reserves. Bahrain ranks

57th on the US Energy Information Administration's world list.

Currently, Bahrain's operational oil field pumps out around 50,000

barrels a day. It also shares the Abu Safah oil field with Saudi

Arabia, which produces around 150,000 barrels a day. The kingdom

raises around 80 per cent of its revenues from oil.

UAE economy to grow at 3.9 per cent in 2018

The UAE economy is expected to grow at 3.9 per cent in 2018 as

per UAE Central Bank, spurred by inflow of foreign direct

investment (FDI) as well as growth in tourism and travel sectors.

The country is expecting a growth of around 2 to 3 per cent in FDI

in 2018. Recent rollout of VAT in UAE and growth of its

construction sector, supported by demand related to the upcoming

Expo 2020, are expected to drive in more government revenues for

UAE.

British Petroleum (BP) to develop second phase of Oman's giant

Khazzan gas field

BP is set to develop second phase of Oman's giant Khazzan gas

field along with Oman Oil Company Exploration & Production. The

Ghazeer project is expected to come onstream in 2021 and deliver an

additional 0.5 bcf/d and over 15,000 bpd condensate production. The

first phase is producing at design capacity of around 1 bcf/d and

around 35,000 bpd of condensate.

Kuwait set to spend US$113 billion in 5 years

Kuwait plans to invest a massive KWD34 billion (US$113 billion)

over the next five years mainly to boost oil exploration and

production activity both inside and outside the country. This

includes raising production of non-associated gas to nearly 500

million standard cu ft per day by the end of 2018.

Kuwait added to MSCI EM watchlist

MSCI included Kuwait in MSCI EM watchlist for a potential

upgrade to EM status in June 2019, with implementation in May 2020.

According to Boursa Kuwait, Kuwait would have a potential weight of

0.3 per cent in the MSCI EM index.

UAE 7(th) most competitive in the world

The UAE has jumped three places to become the 7th most

competitive economy in the world, according to the IMD World

Competitiveness Centre's 2018 data. The UAE surpassed Norway (8),

Sweden (9), Canada (10), Germany (15), Australia (19), UK (20),

Japan (25), France (28) and Italy (42) in the rankings. Also, Qatar

(14) was ranked the 2nd most competitive economy in the GCC,

followed by Saudi Arabia (39).

Moody's changed Qatar's Outlook from Negative to Stable

Moody's changed the Outlook on the Qatar to "Stable" from

"Negative" and affirmed ratings at Aa3. Moody's believes that Qatar

has the ability to withstand the economic, financial and diplomatic

blockade by the neighbors in its current form for an extended

period of time without a material deterioration of the sovereign's

credit profile.

Saudi Arabia economy expanded by 1.2 per cent in 1Q18

Saudi Arabia reported 1.2 per cent YoY economic growth in 1Q18

following four quarter long negative real growth. The headline rate

accelerated on the back of a pick-up in oil GDP, supported by

higher oil production (but within the OPEC agreement quota) and

improved non-oil activity. The non-oil sector grew 1.6 per cent

YoY, helped by expansion in both the private (1.1 per cent YoY) and

the government (2.7 per cent YoY) sectors.

Qatar reported 1.4 per cent GDP growth in 1Q18 led by

non-hydrocarbon

Qatar's economic recovery seems to be continuing at a healthy

pace, with 1Q18 real GDP output expanding by 1.4 per cent YoY. The

non-hydrocarbon sector reported growth of 4.9 per cent YoY, driven

by gains in the construction, financial services, manufacturing and

transport and storage sectors among others. Oil and gas output,

however, declined by 2.3 per cent YoY, which partly reflects the

country's compliance with its OPEC production cut target.

Portfolio Structure

Country Allocation and Portfolio Rebalancing

Under the new GCC-wide investment policy the Investment Adviser

is monitoring a broader universe of investment opportunities across

the Gulf Cooperation Council region comprising Saudi Arabia,

Kuwait, UAE, Oman, Qatar and Bahrain. Following the adoption of

this new in investment policy, the Investment Adviser changed the

proportion of the Company invested outside Qatar from 10 per cent

(31st December 2017) to 59 per cent (30th June 2018); adding

holdings in Saudi Arabia, the UAE and Kuwait.

GIF is actively managed, so weightings in different GCC markets

will depend on the Investment Adviser's views on the investment

outlook and valuations of the GCC economies. GIF remains overweight

Qatar (36.7 per cent of NAV), as Qatar trades at attractive

valuations compared to other GCC markets. Holdings in Saudi,

Kuwaiti and the Emirati companies were 39.2 per cent, 10 per cent

and 9.6 per cent of the fund, respectively. Reflecting the

portfolio rebalancing, 4.5 per cent of the Company was in cash as

at 30th June 2018(1Q18: 10.3 per cent) awaiting reinvestment.

Embedded image removed - please refer to the Company's website

www.gulfinvestmentfundplc.com for a chart depicting Country

Allocation as at 30 June 2018.

As of 30th June 2018, GIF has 43 holdings: 24 in Saudi Arabia, 9

in Qatar, 5 in the UAE and 5 in Kuwait.

Sector Allocation

Embedded image removed - please refer to the Company's website

www.gulfinvestmentfundplc.com for a chart depicting Sector

Allocation as at 30 June 2018.

Financials is GIF's largest sector at 46.4 per cent of NAV. GCC

banks have strong balance sheets and government backing and should

benefit from resurgent infrastructure spending. Recent interest

rate rises should allow them to gradually reprice their loan

books.

Other major sectors include: Energy (14.0 per cent), Materials

(8.7 per cent) and Real Estate (8.2 per cent). Recovery in oil

prices should spur growth of the Energy and Materials industry

while tighter demand should help pricing. Rising population,

investment in infrastructure and regulatory reforms should

stimulate growth in the Real Estate sector.

Top 5 Holdings

Company Name Country Sector % share of NAV

Commercial Bank of Qatar Qatar Financials 9.7%

-------------- ------------ ---------------

Qatar Gas Transport Qatar Energy 8.4%

-------------- ------------ ---------------

Qatar Electricity & Water Co Qatar Utilities 7.8%

-------------- ------------ ---------------

Al Rajhi Bank Saudi Arabia Financials 5.1%

-------------- ------------ ---------------

National Bank of Kuwait Kuwait Financials 4.1%

-------------- ------------ ---------------

Source: QIC; as of 30(th) June 2018

The stake in Qatar Gas Transport Company was increased (8.4 per

cent of NAV vs. 3.3 per cent in 1Q18) as valuations look

attractive. Holdings in Qatar National Bank and Qatar Islamic bank

were sold tactically in 2Q18 to take advantage of sharp share price

increases as their respective weights in EM indices were

increased.

The Investment Adviser took new positions primarily in the

Materials sector including National Petrochemical (1.4 per cent of

NAV) and Yanbu National Petrochemical (1.4 per cent). Other new

holdings include Kuwait International Bank (2.0 per cent).

Profile of Top Five Holdings

Commercial Bank of Qatar (9.7% of NAV)

Commercial Bank of Qatar (CBQ) is the second largest commercial

bank in Qatar established in 1975 offering banking solutions

worldwide, with primary focus on corporate and retail banking. The

Bank's nationwide network includes 31 full service branches and 174

ATMs. Under its diversification strategy, CBQ has expanded its GCC

footprint through strategic partnerships with associated banks -

the National Bank of Oman (NBO) in Oman, United Arab Bank (UAB) in

the UAE and subsidiary Alternatifbank in Turkey. Under the 5-year

turnaround strategy, the Bank is strengthening its balance sheet by

prudently managing the risks. Bottom line is expected to improve

substantially once the high provision cycle comes to an end,

moreover, ongoing cost optimisation will also add to the

bottom-line. For 1H18, CBQ reported net profit of US$235 million

(vs. US$49 million in 1H17) reflecting effective execution of the

strategy. As of 30th June 2018, the Bank has total assets of

US$38.4 billion.

Qatar Gas Transport (8.4% of NAV)

Qatar Gas Transport Company (Nakilat), established in 2004, is a

key midstream player in the hydrocarbon sector in the state of

Qatar. Nakilat owns 69 LNG and LPG vessels, making it one of the

largest LNG ship owners in the world. Out of the 65 LNG vessels, 25

are wholly owned and 40 are under joint ventures (JV). It also has

four jointly owned LPG vessels. Nakilat also provides shipping and

marine-related services to a range of participants within the

Qatari hydrocarbon sector. Nakilat is an integral component of the

supply chain of some of the largest, most advanced energy projects

in the world undertaken by Qatar Petroleum, Qatargas, Ras Gas and

their joint venture partners for the State of Qatar. For 1H18,

Nakilat reported a net profit of US$122 million compared to US$112

million during the same period in FY17, an increase of 9%. Going

forward, Qatar's North Field expansion plan paves the way for

increased transportation of gas, which may benefit the Company in

the longer run.

Qatar Electricity & Water Co. (7.8% of NAV)

Qatar Electricity & Water Co. (QEWS) was established in 1990

as the first private sector company engaged in electricity

production and water desalination businesses. The Company is the

second largest utility company in the North Africa and Middle East

region. In Qatar, the Company enjoys 60% market share in the

electricity business, while in the water desalination business, it

commands 80% market share. Over the past decade, the Company has

been the key beneficiary of rapid development in Qatar, coupled

with the growth in population, resulting in increased demand for

electricity and water. Additionally, the Company is setting up

presence overseas, with the establishment of Nebras Power Company

(60% owned by QEWS), which invests globally in new and existing

power generation and water desalination projects. QEWS has long

term purchase agreements with government-owned Kahramaa; hence, the

Company has a low-risk business model, with secure and visible

earnings and cash flows. For 1H18, the Company reported net profit

of US$223 million.

Al Rajhi Bank (5.1% of NAV)

Established in 1957, Al Rajhi Bank is one of the largest Islamic

banks in the world with 17 per cent market share in Saudi Arabia's

financing and deposits. The Bank operates through 550 branches,

4,854 ATM's, 76,453 POS terminals installed with merchants and 234

remittance centers across the Kingdom. The Bank has an asset base

of US$92.9 billion and enjoys strong capital adequacy, lower cost

of borrowing, low NPAs and high provisioning coverage. With a

strong retail focus, the Bank is set to benefit from consumption

growth and increasing interest rates. For 1H18, the Bank reported

net profit of US$1.3 billion, an increase of 12.4 per cent. The

improvement in the Saudi economy could see better consumption

growth, benefitting the Bank going forward.

National Bank of Kuwait (4.1% of NAV)

Founded in 1952, National Bank of Kuwait (NBK) is Kuwait's

largest banking group with a dominant market position in loans and

deposits. It operates through international network with more than

140 branches covering the world's financial centers in 15

countries. The Bank is set to benefit from demand for credit from

Kuwait's development plans and from economic recovery in Egypt. As

of 30th June 2018, NBK has total assets of US$89 billion. For 1H18,

the Bank reported net profit of US$614 million (vs. US$545 million

in 1H17).

GIF Performance

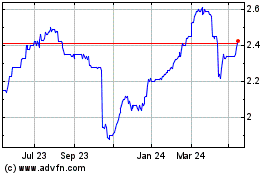

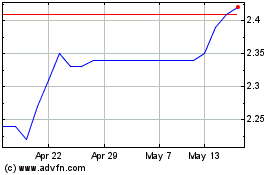

YTD 2018, GIF's NAV is up 12.3 per cent whilst the S&P GCC

index rose 9.8 per cent. Since the change in investment policy in

December, GIF's NAV is 21.7 per cent higher and the S&P GCC

index is 13.0 per cent higher.

Embedded image removed - please refer to the Company's website

www.gulfinvestmentfundplc.com for a chart depicting GIF

Performance.

GCC Outlook

The GCC nations are adapting to changing global economic

conditions, but challenges remain, including relatively high local

unemployment in certain states, a heavy reliance on expatriate

workers, and the ongoing dependency on the government sector to

drive growth.

Diversification and reducing the budget deficits are positive

developments. If GCC companies can weather the near-term impacts of

the many government reforms that are underway, they could

outperform global peers in the near to medium term.

Valuations

Market Market PE (x) PB (x) Dividend Yield

Cap. (%)

US$ billion 2018E 2019E 2018E 2019E 2018E 2019E

------------ ------ ------ ------ ------ -------- -------

Qatar 110.1 13.20 11.46 1.49 1.41 4.49 4.72

------------ ------ ------ ------ ------ -------- -------

Saudi Arabia 532.4 15.67 13.99 1.82 1.73 3.33 3.57

------------ ------ ------ ------ ------ -------- -------

Dubai 79.0 7.89 7.09 1.01 0.94 5.51 5.74

------------ ------ ------ ------ ------ -------- -------

Abu Dhabi 129.1 11.44 10.39 1.56 1.48 5.36 5.73

------------ ------ ------ ------ ------ -------- -------

Kuwait 97.6 12.57 10.77 1.51 1.42 NA NA

------------ ------ ------ ------ ------ -------- -------

S&P GCC 885.6 13.89 12.37 1.61 1.52 3.85 4.14

------------ ------ ------ ------ ------ -------- -------

MSCI EM 13,519.6 12.04 10.79 1.57 1.44 2.83 3.18

------------ ------ ------ ------ ------ -------- -------

MSCI World 59,907.8 15.61 14.23 2.20 2.05 2.49 2.69

------------ ------ ------ ------ ------ -------- -------

Source: Bloomberg, as of 12th July 2018

Epicure Managers Qatar Limited Qatar Insurance Company

S.A.Q.

21 September 2018 21 September 2018

Investment Policy

Investment Objective

The Company's investment objective is to capture the

opportunities for growth offered by the expanding GCC economies by

investing in listed companies on one of the GCC exchanges or

companies soon to be listed on one of the GCC exchanges. The

Company may also invest in listed companies, or pre-IPO companies,

in other GCC countries.

The Company applies a top-down screening process to identify

those sectors which should most benefit from sector growth trends.

Fundamental industry and company analysis, rather than

benchmarking, forms the basis of both stock selection and portfolio

construction.

Assets or companies in which the Company can invest

The Company invests in listed companies on any GCC Exchanges in

addition to companies soon to be listed. The Company may also

invest in listed companies, or pre-IPO companies, in other GCC

countries. The Company will also be permitted to invest in

companies listed on stock markets not located in the GCC which will

have a significant economic exposure to and/or derive a significant

amount of their revenues from GCC countries.

Whether investments will be active or passive investments

In the ordinary course of events, the Company is not an activist

investor, although the Investment Adviser will seek to engage with

investee company management where appropriate.

Holding period for investments

In the normal course of events, the Company expects to be

fully-invested, although the Company may hold cash reserves pending

new IPOs or when it is deemed financially prudent. Although the

Company is a long term financial investor, it will actively manage

its portfolio.

Spread of investments and maximum exposure limits

The Company will invest in a portfolio of investee companies.

The following investment restrictions are in place to ensure a

spread of investments and to ensure that there are maximum exposure

limits in place (see investment guidelines under Investing

Restrictions).

Policy in relation to gearing and derivatives

Borrowings will be limited, as at the date on which the

borrowings are incurred, to 5% of NAV. Borrowings will include any

financing element of a swap. The Company will not make use of

hedging mechanisms.

The Company may utilise derivative instruments in pursuit of its

investment policy subject to:

-- such derivative instruments being designed to offer the

holder a return linked to the performance of a particular

underlying listed equity security;

-- a maximum underlying equity exposure limit of 15 per cent of

NAV (calculated at the time of investment); and

-- a policy of entering into derivative instruments with more

than one counterparty in relation to an investment, where possible,

to minimise counterparty risk.

Policy in relation to cross-holdings

Cross-holdings in other listed or unlisted investment funds or

ETFs that invest in Qatar or other countries in the GCC region will

be limited to 10 per cent. of Net Asset Value at any time

(calculated at the time of investment).

Investing Restrictions

The investing restrictions for the Company are as follows:

(i) Foreign ownership restrictions

Investments in most GCC listed companies by persons other than

citizens of that specific GCC country have an ownership restriction

wherein the law precludes persons other than citizens of that

specific GCC country from acquiring a certain proportion of a

company's issued share capital. It is possible that the Company may

have problems acquiring stock if the foreign ownership interest in

one or more stocks reaches the allocated upper limit. This may

adversely impact the ability of the Company to invest in certain

companies listed on the GCC exchanges.

(ii) Investment guidelines

The Company has established certain investment guidelines. These

are as follows (all of which calculated at the time of

investment):

-- No single investment position in the S&P GCC Composite

constituent may exceed the greater of: (i) 15 per cent. of the Net

Asset Value of the Company; or (ii) 125 per cent. of the

constituent company's index capitalisation divided by the index

capitalisation of the S&P GCC Composite Index, as calculated by

Bloomberg (or such other source as the Directors and Investment

Manager may agree):

-- No single investment position in a company which is not a

S&P GCC Composite Index constituent may at the time of

investment exceed 15 per cent. of the NAV of the Company; and

-- No holding may exceed 5 per cent. of the outstanding shares

in any one company (including investment in Saudi Arabian listed

companies by way of derivative investment in P-Note or Swap

structured financial products); and

(iii) Conflicts management

The Investment Manager, the Investment Adviser, their officers

and other personnel are involved in other financial, investment or

professional activities, which may on occasion give rise to

conflicts of interest with the Company. The Investment Manager will

have regard to its obligations under the Investment Management

Agreement to act in the best interests of the Company, and the

Investment Adviser will have regard to its obligations under the

Investment Adviser Agreement to act in the best interests of the

Company, so far as is practicable having regard to their

obligations to other clients, where potential conflicts of interest

arise. The Investment Manager and the Investment Adviser will use

all reasonable efforts to ensure that the Company has the

opportunity to participate in potential investments that each

identifies that fall within the investment objective and strategies

of the Company. Other than these restrictions set out above, and

the requirement to invest in accordance with its investing policy,

there are no other investing restrictions.

Returns and distribution policy

The Company's primary investment objective is to achieve capital

growth. However, the Company has instituted an annual dividend

policy to return to Shareholders distributions at least equal to

reported income for each reporting period. Shareholders should note

that this cannot be guaranteed and the level of distributions for

any period remains a matter to be determined at the discretion of

the Board.

Life of the Company

The Company currently does not have a fixed life but the Board

considers it desirable that Shareholders should have the

opportunity to review the future of the Company at appropriate

intervals. Accordingly, at the annual general meeting of the

Company in 2021, a resolution will be proposed that the Company

continues in existence. More than 50 per cent. of Shareholders

voting must vote in favour for this resolution to be passed. If the

resolution is passed, a similar resolution will be proposed at

every third annual general meeting thereafter. If the resolution is

not passed, the Directors will be required to formulate proposals

to be put to Shareholders to reorganise, unitise or reconstruct the

Company or for the Company to be wound up.

Report of the Directors

The Directors hereby submit their annual report together with

the audited consolidated and Company financial statements of Gulf

Investment Fund plc (the "Company") for the year ended 30 June

2018.

The Company

The Company is incorporated in the Isle of Man and has been

established to invest primarily in quoted equities of Qatar and

other Gulf Co-operation Council countries. The Company's investment

policy is detailed on pages 15 to 16.

Results and Dividends

The results of the Company for the year and its financial

position at the year- end are set out on pages 36 to 46 of the

financial statements.

The Directors manage the Company's affairs to achieve capital

growth and the Company has instituted an annual dividend policy.

The quantum of the dividend is calculated based on a proportion of

the dividends received during the year, net of the Company's

attributable costs. Any undistributed income will be set aside in a

revenue reserve in order to facilitate the Company's policy of

future progressive dividend payments. This policy will be subject

to the absence of exceptional market events.

For the year ended 30 June 2017, the Directors declared a

dividend of US$2,773,837 (3.0c per share) which was approved by

Shareholders and paid by the Company in February 2018. The

Directors recommend a dividend of 3 cents per share in respect of

the year ended 30 June 2018.

Directors

Details of Board members at the date of this report, together

with their biographical details, are set out on page 26.

Director independence and Directors' and other interests have

been detailed in the Directors' Remuneration Report on pages 30 and

31.

Creditor Payment Policy

It is the Company's policy to adhere to the payment terms agreed

with individual suppliers and to pay in accordance with its

contractual and other legal obligations.

Gearing Policy

Borrowings will be limited, as at the date on which the

borrowings are incurred, to 5% of NAV (or such other limit as may

be approved by the Shareholders in general meeting). The Company

will not make use of any hedging mechanisms.

There were no borrowings during the year (2017: US$ nil).

Donations

The Company has not made any political or charitable donations

during the year (2017: US$ nil).

Adequacy of the Information Supplied to the Auditors

The Directors who held office at the date of approval of this

Directors' Report confirm that, so far as each is aware, there is

no relevant audit information of which the Company's auditors are

unaware; and each Director has taken all steps that he ought to

have taken as a Director to make himself aware of any relevant

audit information and to establish that the Company's auditors are

aware of that information.

Statement of Going Concern

The Directors are satisfied that the Company and the Group have

adequate resources to continue to operate as a going concern for

the foreseeable future and have prepared the financial statements

on that basis, however Shareholders will be given the opportunity

to vote for a 100% tender in 2020 and to vote for the continued

existence of the Company at the annual general meeting (AGM) in

2021 and every third AGM thereafter.

Independent Auditors

KPMG Audit LLC has expressed its willingness to continue in

office in accordance with Section 12 (2) of the Companies Act

1982.

Annual General Meeting

The Annual General Meeting of the Company will be held on 7

November 2018 at the Company's registered office.

A copy of the notice of Annual General Meeting is contained

within this Annual Report. As well as the business normally

conducted at such a meeting, Shareholders will be asked to renew

the authority to allow the Company to continue with share

buy-backs.

The notice of the Annual General Meeting and the Annual Report

are also available at www.gulfinvestmentfundplc.com.

Corporate Governance

Full details are given in the Corporate Governance Report on

pages 19 to 25, which forms part of the Report of the

Directors.

Substantial Shareholdings

As at the date of publication of this annual report, the Company

had been notified, or the Company is aware of the following

significant holdings in its Share Capital.

Ordinary Shares

Name %

----------------

City of London Investment Management

Company 28.80

----------------

Qatar Insurance Company S.A.Q. 18.73

----------------

1607 Capital Partners LLC 15.12

----------------

Qatar Investment Authority 11.66

----------------

Lazard Asset Management 6.10

----------------

BCV Asset Management 3.01

----------------

The above percentages are calculated by applying the

Shareholdings as notified to the Company or the Company's awareness

to the issued Ordinary Share Capital as at 31 August 2018.

On behalf of the Board

Nicholas Wilson

Chairman

21 September 2018

Millennium House

46 Athol Street

Douglas

Isle of Man

IM1 1JB

Corporate Governance Report

Compliance with Companies Acts

As an Isle of Man incorporated company, the Company's primary

obligation is to comply with the Isle of Man Companies Acts 1931 to

2004. The Board confirms that the Company is in compliance with the

relevant provisions of the Companies Acts.

Compliance with the Association of Investment Companies (AIC)

Code of Corporate Governance

The Company is committed to high standards of corporate

governance. The Board is accountable to the Company's shareholders

for good governance and this statement describes how the Company

applies the principles identified in the UK Corporate Governance

Code which is available on the Financial Reporting Council's

website: www.frc.org.uk. The Board confirms that the Company has

complied throughout the accounting period with the relevant

provisions contained within the UK Code.

The Board of the Company has considered the principles and

recommendations of the AIC 2014 Code of Corporate Governance (AIC

Code) by reference to the AIC Corporate Governance Guide for

investment Companies (AIC Guide). The AIC Code, as explained by the

AIC Guide, addresses all the principles set out in the UK Corporate

Governance Code, as well as setting out additional principles and

recommendations on issues that are of specific relevance to QIF

plc.

The Board considers that reporting against the principles and

recommendations of the AIC Code, and by reference to the AIC Guide

(which incorporates the UK Corporate Governance Code), will provide

better information to shareholders.

The Company has complied with the recommendations of the AIC

Code and the relevant provisions of the UK Corporate Governance

Code, except as set out below.

The UK Corporate Governance Code includes provisions relating

to:

-- the role of the chief executive

-- executive directors' remuneration

-- the need for an internal audit function

For the reasons set out in the AIC Guide, and as explained in

the UK Corporate Governance Code, the Board considers these

provisions are not relevant to the position of the Company, being

an externally managed investment company. In particular, all of the

Company's day-to-day management and administrative functions, with

the exception of portfolio management, risk management and service

provider performance management, are outsourced to third parties.

As a result, the Company has no executive directors, employees or

internal operations. The Company has therefore not reported further

in respect of these provisions.

Directors

The Directors are responsible for the determination of the

Company's investment policy and strategy and have overall

responsibility for the Company's activities including the review of

the investment activity and performance.

All of the Directors are non-executive. The Board considers each

of the Directors to be independent of, and free of any material

relationship with, the Investment Manager and Investment

Adviser.

The Board of Directors delegates to the Investment Manager

through the Investment Management Agreement the responsibility for

the management of the Company's assets in GCC securities in

accordance with the Company's investment policy and for retaining

the services of the Investment Adviser. The Company has no

executives or employees.

The Articles of Association require that all Directors submit

themselves for election by Shareholders at the first opportunity

following their appointment and shall not remain in office longer

than three years since their last election or re-election without

submitting themselves for re-election.

The Board meets formally at least 4 times a year and between

these meetings there is regular contact with the Investment

Manager. Other meetings are arranged as necessary. The Board

considers that it meets regularly enough to discharge its duties

effectively. The Board ensures that at all times it conducts its

business with the interests of all Shareholders in mind and in

accord with Directors' duties. Directors receive the relevant

briefing papers in advance of Board and Board Committee meetings,

so that should they be unable to attend a meeting they are able to

provide their comments to the Chairman of the Board or Committee as

appropriate. The Board meeting papers are the key source of regular

information for the Board, the contents of which are determined by

the Board and contain sufficient information on the financial

condition of the Company. Key representatives of the Investment

Manager attend each Board meeting. All Board and Board Committee

meetings are formally minuted.

Board Composition and Succession Plan

Objectives of Plan

-- To ensure that the Board is composed of persons who

collectively are fit and proper to direct the Company's business

with prudence, integrity and professional skills

-- To define the Board Composition and Succession Policy, which

guides the size, shape and constitution of the Board and the

identification of suitable candidates for appointment to the

Board.

Methodology

The Board is conscious of the need to ensure that proper

processes are in place to deal with succession issues and the

Nomination Committee assists the Board in the Board selection

process, which involves the use of a Board skills matrix.

The matrix incorporates the following elements: finance,

accounting and operations; familiarity with the regions into which

the Company invests; diversity (gender, residency, cultural

background); Shareholder perspectives; investment management;

multijurisdictional compliance and risk management. In adopting the

matrix, the Nomination Committee acknowledges that it is an

iterative document and will be reviewed and revised periodically to

meet the Company's on-going needs.

The Nomination Committee monitors the composition of the Board

and makes recommendations to the Board about appointments to the

Board and its Committees.

Directors may be appointed by the Board, in which case they are

required to seek election at the first AGM following their

appointment and triennially thereafter. Directors who are not

regarded as independent are required to seek re-election annually.

In making an appointment the Board shall have regard to the Board

skills matrix.

A Director's formal letter of appointment sets out, amongst

other things, the following requirements:

-- bringing independent judgment to bear on issues of strategy,

performance, resources, key appointments and standards of conduct

and the importance of remaining free from any business or other

relationship that could materially interfere with independent

judgement;

-- having an understanding of the Company's affairs and its

position in the industry in which it operates;

-- keeping abreast of and complying with the legislative and

broader responsibilities of a Director of a company whose shares

are traded on the London Stock Exchange;

-- allocating sufficient time to meet the requirements of the

role, including preparation for Board meetings; and

-- disclosing to the Board as soon as possible any potential conflicts of interest.

The Board authorises the Nomination Committee to:

-- recommend to the Board, from time to time, changes that the

Committee believes to be desirable to the size and composition of

the Board;

-- recommend individuals for nomination as members of the Board;

-- review and recommend the process for the election of the

Chairman of the Board, when appropriate; and

-- review on an on-going basis succession planning for the

Chairman of the Board and make recommendations to the Board as

appropriate.

The Plan will be reviewed by the Board annually and at such

other times as circumstances may require (e.g. a major corporate

development or an unexpected resignation from the Board). The Plan

may be amended or varied in relation to individual circumstances at

the Board's discretion.

Board Committees

The Board has established the following committees to oversee

important issues of policy and maintain oversight outside the main

Board meetings:

-- Audit Committee

-- Remuneration Committee

-- Nomination Committee

-- Management Engagement Committee

Throughout the year the Chairman of each committee provided the

Board with a summary of the key issues considered at the meeting of

the committees and the minutes of the meetings were circulated to

the Board.

The committees operate within defined terms of reference. They

are authorised to engage the services of external advisers as they

deem necessary in the furtherance of their duties, at the Company's

expense.

Audit Committee

The Board has established an Audit Committee made up of at least

two members and comprises Paul Macdonald, Nicholas Wilson, Neil

Benedict and David Humbles. The Audit Committee is responsible for,

inter alia, ensuring that the financial performance of the Company

is properly reported on and monitored. The Audit Committee is

chaired by Paul Macdonald. The Audit Committee normally meets at

least twice a year when the Company's interim and final reports to

Shareholders are to be considered by the Board but meetings can be

held more frequently if the Audit Committee members deem it

necessary or if requested by the Company's auditors. The Audit

Committee will, amongst other things, review the annual and interim

accounts, results announcements, internal control systems and

procedures, preparing a note in respect of related party

transactions and reviewing any declarations of interest notified to

the Committee by the Board each on six monthly basis, review and

make recommendations on the appointment, resignation or dismissal

of the Company's auditors and accounting policies of the Company.

The Company's auditors are advised of the timing of the meetings to

consider the annual and interim accounts and the auditors shall be

asked to attend the Audit Committee meeting where the annual

audited accounts are to be considered. The Audit Committee chairman

shall report formally to the Board on its proceedings after each

meeting and compile a report to Shareholders on its activities to

be included in the Company's annual report. At least once a year,

the Audit Committee will review its performance, constitution and

terms of reference to ensure that it is operating at maximum

effectiveness and recommend any changes it considers necessary to

the Board for approval.

The terms of reference for the Audit Committee are available on

the Company's website www.gulfinvestmentfundplc.com.

Significant Issues

During its review of the Company's financial statements for the

year ended 30 June 2018, the Audit Committee considered the

following significant issues, in particular those communicated by

the auditor during their reporting:

Carrying value of quoted equity investments

The valuation of investments is undertaken in accordance with

the accounting policies, disclosed in note 1(a) to the financial

statements. The audit includes independent confirmation of the

existence of all investments from the Company's custodian. All

investments are considered liquid and quoted in active markets and

have been categorised as Level 1 within the IFRS 13 fair value

hierarchy and can be verified against daily market prices. The

portfolio is reviewed and verified by the Manager on a regular

basis and management accounts including a full portfolio listing

are prepared each month and circulated to the Board. The Company

uses the services of an independent Custodian HSBC Bank Middle East

Limited to hold the assets of the Company. The investment portfolio

is reconciled regularly by the Manager and a reconciliation is also

reviewed by the Auditor.

Carrying value of Parent Company's loan to and investment in

subsidiary

The carrying value of the Parent Company's loan to and

investment in subsidiary represents 98.9% (2017: 99.1%) of the

Parent Company's total assets. The assessment of carrying value is

not at a high risk of significant misstatement or subject to

significant judgement as the carrying value is equal to the audited

net asset value of the subsidiary. However, due to its materiality

in the context of the Parent Company financial statements, this is

considered to be the area that had the greatest effect on the

Parent Company balance sheet.

Remuneration Committee

The Company has established a Remuneration Committee. The

Remuneration Committee is made up of at least two non-executive

Directors who are identified by the Board as being independent. Its

members are Neil Benedict (Chairman), Nicholas Wilson, Paul

Macdonald and David Humbles. The Remuneration Committee normally

meets at least once a year and at such other times as the chairman

of the Remuneration Committee shall require. The Remuneration

Committee reviews the performance of the Directors and sets the

scale and structure of their remuneration and the basis of their

letters of appointment with due regard to the interests of

Shareholders. In determining the remuneration of Directors, the

Remuneration Committee seeks to enable the Company to attract and

retain Directors of the highest calibre. No Director is permitted

to participate in any discussion of decisions concerning their own

remuneration. The Remuneration Committee reviews at least once a

year its own performance, constitutions and terms of reference to

ensure it is operating at maximum effectiveness and recommend any

changes it considers necessary to the Board for approval.

The terms of reference for the Remuneration Committee are

available on the Company's website

www.gulfinvestmentfundplc.com

Nomination Committee

The Company has established a Nomination Committee which shall

be made up of at least two members and which shall comprise all

independent non-executive Directors. The Nomination Committee

comprises Nicholas Wilson (Chairman), Neil Benedict, Paul Macdonald

and David Humbles. The Nomination Committee meets at least once a

year prior to the first quarterly Board meeting and at such other

times as the Chairman of the committee shall require. The

Nomination Committee is responsible for ensuring that the Board

members have the range of skills and qualities to meet its

principal responsibilities in a way which ensures that the

interests of Shareholders are protected and promoted and regularly

review the structure, size and composition of the Board. The

Nomination Committee shall, at least once a year, review its own

performance, constitution and terms of reference to ensure that it

is operating at maximum effectiveness and recommend any changes it

considers necessary to the Board for approval.

The Nomination Committee will assess potential candidates on

merit against a range of criteria including experience, knowledge,

professional skills and personal qualities as well as independence,

if this is required for the role. Candidates' ability to commit

sufficient time to the business of the Company is also key,

particularly in respect of the appointment of the Chairman. The

Chairman of the Nomination Committee is primarily responsible for

interviewing suitable candidates and a recommendation will be made

to the Board for final approval.

Management Engagement Committee

The Company has established a Management Engagement Committee

which is made up of at least two members who are independent

non-executive Directors. The Management Engagement Committee

members are Neil Benedict (Chairman), Paul Macdonald, Nicholas

Wilson and David Humbles. The Management Engagement Committee will

meet at least quarterly and is responsible for reviewing the

performance of the Investment Manager and other service providers,

to ensure that the Company's management contract is competitive and

reasonable for the Shareholders and to review and make

recommendations to the Board on any proposed amendment to or

material breach of the management contract and contracts with other

service providers.

Board Attendance

The number of formal meetings during the year of the Board, and

its Committees, and the attendance of the individual Directors at

those meetings, is shown in the following table:

Board Audit Committee Remuneration Nomination Management

Committee Committee Engagement

Committee

Total number

of meetings

in year 8(8) 6(6) 1(1) 2(2) 4(4)

------ ---------------- ------------------------- ----------- ------------

Meetings Attended (entitled to attend)

------------------------------------------------------------------------------

Nicholas Wilson

(Chairman and

Chairman of

Nomination Committee) 7 (8) 6 (6) 1 (1) 2 (2) 4 (4)

------ ---------------- ------------------------- ----------- ------------

Neil Benedict

(Chairman of

Remuneration

Committee and

Chairman of

Management Engagement

Committee) 8 (8) 6 (6) 1 (1) 2 (2) 4 (4)

------ ---------------- ------------------------- ----------- ------------

David Humbles 8 (8) 6 (6) 1 (1) 2 (2) 4 (4)

------ ---------------- ------------------------- ----------- ------------

Paul Macdonald

(Chairman of

Audit Committee) 8 (8) 6 (6) 1 (1) 2 (2) 4 (4)

------ ---------------- ------------------------- ----------- ------------

The Annual General Meeting was held on 16 November 2017.

Internal Control

The Board is responsible for the Company's system of internal

control and for reviewing its effectiveness. Its review takes place

at least once a year. Such a system is designed to manage rather

than eliminate the risk of failure to achieve business objectives

and can only provide reasonable and not absolute assurance against

material mis-statement or loss. The Board also determines the

nature and extent of any risks it is willing to take in order to

achieve its strategic objectives.

The Board has contractually delegated to external agencies,

including the Investment Manager and the Investment Adviser, the

management of the investment portfolio, the custodial services

(which include the safeguarding of the assets), the registration

services and the day-to-day accounting and Company Secretarial

requirements. Each of these contracts was entered into after full

and proper consideration by the Board of the quality and cost of

services offered including the control systems in operation in so

far as they relate to the affairs of the Company.

Internal Control continued

The Board, assisted by the Investment Manager and Investment

Adviser, has undertaken regular risk and controls assessments. The

business risks have been analysed and recorded in a risk and

internal controls report which is regularly reviewed. The Board has

reviewed the need for an internal audit function. The Board has

decided that the systems and procedures employed by the Investment

Manager and Investment Adviser, including its internal audit

function provide sufficient assurance that a sound system of

internal control, which safeguards Shareholders' investments and

the Company's assets, is maintained. An internal audit function,

specific to the Company, is therefore considered unnecessary.

The Board confirms that there is an on-going process for

identifying, evaluating and managing the Company's principal

business and operational risks that have been in place for the year

ended 30 June 2018 and up to the date of approval of the annual

report and financial statements.

Accountability and Relationship with the Investment Manager, the

Custodian and the Administrator

The Statement of Directors' Responsibilities is set out on page

27.

The Board has delegated contractually to external third parties,

including the Investment Manager, the Investment Adviser, the

Custodian and the Administrator, the management of the investment

portfolio, the custodial services (which include the safeguarding

of the assets), the day to day accounting, company secretarial and

administration requirements. Each of these contracts was entered

into after full and proper consideration by the Board of the

quality and cost of the services provided, including the control

systems in operation in so far as they relate to the affairs of the

Company.

The Investment Manager, the Investment Adviser and the

Administrator ensure that all Directors receive, in a timely

manner, all relevant management, regulatory and financial

information. Representatives of the Investment Manager and the

Administrator attend each Board meeting enabling the Directors to

probe further on matters of concern.

Continued Appointment of the Investment Manager

The Board considers the arrangements for the provision of

investment management and other services to the Company on an

on-going basis. The Board reviews investment performance at each

Board meeting and a formal review of the Investment Manager (and

Investment Adviser) is conducted annually. As a result of their

annual review, NAV performance has been found to be satisfactory

and it is the opinion of the Directors that the continued

appointment of the current Investment Manager (and Investment

Adviser) on the terms agreed is in the interests of the Company's

Shareholders as a whole.

Relations with Shareholders

The Chairman is responsible for ensuring that all Directors are

made aware of Shareholders' concerns. The Shareholder profile of

the Company is regularly monitored and the Board liaises with the

Investment Manager to canvass Shareholder opinion and communicate

views to Shareholders. The Company is concerned to provide the

maximum opportunity for dialogue between the Company and

Shareholders. It is believed that Shareholders have proper access

to the Investment Manager at any time and to the Board if they so

wish. All Shareholders are encouraged to attend annual general