TIDMQIF

RNS Number : 9084M

Qatar Investment Fund PLC

26 January 2016

27 January 2016

Qatar Investment Fund plc ("QIF" or the "Company")

Q4 2015 Investment Report

Qatar Investment Fund plc (LSE: QIF), today issues its Q4 2015

Investment Report for the period 1 October 2015 to 31 December

2015, a pdf copy of which can be obtained from QIF's website at:

www.qatarinvestmentfund.com.

QIF was established to capitalize on the investment

opportunities in Qatar and the Gulf Cooperation Council ("GCC")

region, arising from the economic growth being experienced in the

area. The Company invests in quoted Qatari equities listed on the

Qatar Exchange ("QE") in addition to companies soon to be listed,

with a possible allocation of up to 15% in other listed companies

elsewhere in the GCC region. The Investment Adviser invests using a

top-down screening process combined with fundamental industry and

company analysis.

QIF Quarterly Report - Q4 2015

3 months ended 31 December 2015

Highlights

Ø Qatar Investment Fund Plc's ("QIF") net asset value (NAV) per

share net of dividends fell 14.6% in 2015 while Qatar Exchange

Index (QE) fell 15.1%.

Ø In Q4 2015, QIF's NAV per share before dividends fell

7.7%.

Ø Qatar expected to report its first fiscal deficit in 15

years.

Ø Qatar's economy continues to grow, with real GDP up 3.8% in Q3

2015, driven by 7.8% growth in the non-hydrocarbon sector. GDP is

expected to grow 4.7% in 2015 and 6.4% in 2016 and similar in

2017.

Ø Qatar's 2016 budget focuses on long term infrastructure

development with the government committed to spending despite low

oil prices.

Ø For the first nine months of 2015, profits of Qatari listed

companies rose 6.4%.

Ø Valuations are compelling. Qatar Index now at a significant

discount to its 10-year historic average PE.

Ø Credit growth strong - up 13.8% in 11 months to November

2015.

Ø Qatar's economy expected to perform better than other GCC

countries, as macroeconomic fundamentals remain strong.

Performance and Portfolio Structure

Please refer to the IMS on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting the NAV per share compared to the QIF share

price.

QIF's NAV before dividends decreased by 7.7% in Q4 2015, while

QE was down 9.0%.

As at 31 December 2015, QIF shares traded at a 12.7% discount to

NAV.

Historic Performance against the QE Index

2007 2008 2009 2010 2011 2012 2013 2014 2015

5M

----------- ------ ------- ------ ------ ------ ------ ------ ------ -------

QIF NAV* 13.9% -36.4% 10.4% 29.9% 1.3% -4.7% 24.2% 20.6% -14.6%

----------- ------ ------- ------ ------ ------ ------ ------ ------ -------

QE Index 27.0% -28.8% 1.1% 24.8% 1.1% -4.8% 24.2% 18.4% -15.1%

----------- ------ ------- ------ ------ ------ ------ ------ ------ -------

QIF Share

Price 15.5% -67.5% 97.3% 23.0% -2.3% 2.4% 26.4% 17.4% -17.0%

----------- ------ ------- ------ ------ ------ ------ ------ ------ -------

*Net of dividends paid

Source: Bloomberg, Qatar Insurance Company

Portfolio Structure

Top 10 Holdings

Company Name Sector % Share of

NAV

-------------------- ------------------- -----------

Qatar National Banks & Financial

Bank Services 18.2%

-------------------- ------------------- -----------

Industries Qatar Industry 11.9%

-------------------- ------------------- -----------

Banks & Financial

Masraf Al Rayan Services 11.0%

-------------------- ------------------- -----------

Gulf International

Services Industry 8.4%

-------------------- ------------------- -----------

Qatar Electricity

& Water Co Industry 7.7%

-------------------- ------------------- -----------

Qatar Islamic Banks & Financial

Bank Services 7.3%

-------------------- ------------------- -----------

Commercial Bank Banks & Financial

of Qatar Services 5.7%

-------------------- ------------------- -----------

Qatar Insurance

Company Insurance 5.1%

-------------------- ------------------- -----------

Barwa Real Estate Real Estate 5.1%

-------------------- ------------------- -----------

Ooredoo Telecoms 4.7%

-------------------- ------------------- -----------

In Q4, Qatar Insurance Company and Ooredoo replaced Qatar Gas

Transport (Nakilat) and Doha Bank in QIF's top 10 holdings. The

Investment Adviser allocated funds to Nakilat in the last quarter,

ahead of the MSCI index review in November 2015. The strategy

worked as MSCI then included Nakilat in its Emerging Markets index

in the review, with the share price rising 4.9% over the quarter.

The Investment Adviser took profits and reduced the portfolio

weighting. Exposure to Doha Bank has been reduced. The stock fell

11.4% during the quarter.

Country Allocation

At 31 December, QIF had 17 holdings, all in Qatar. At the end of

Q3 QIF had 18 holdings in Qatar and two in UAE. The Investment

Adviser closed two positions in the UAE, mainly due to the

weakening macroeconomic environment.

Sector Allocation

Please refer to the IMS on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting the overall portfolio allocation by sector as at 31

December 2015.

QIF remains overweight the Qatari banking sector (including

financial services) at 43.2% of NAV (Q3 2015: 53.7%) compared to a

QE banking sector weighting of 40.5%. According to Qatar Central

Bank data published in November 2015, banking sector assets have

grown 9.3% in 2015, mainly driven by a 13.8% rise in loans. The

sector is expected to continue to benefit from government spending,

international expansion of Qatari banks and a growing

population.

Industrials remain QIF's second largest exposure at 28.0% (Q3

2015: 24.6%), mainly in Industries Qatar (11.9% of NAV). The

Investment Adviser reduced exposure to Industries Qatar, while

increasing exposure in Gulf International Services, as the latter

stock fell 20.8% during the quarter and valuations started looking

attractive. QIF also increased exposure to Qatar Electricity &

Water Co.

QIF's weighting in the real estate sector increased from 6.6% in

Q3 to 9.0%. Exposure to the telecom sector increased to 4.7%,

following substantial improvement in Ooredoo's financial

performance in Q3. QIF added exposure to the insurance sector with

a 5.1% weighting in Qatar Insurance Company (QIC), as valuations

started looking attractive. Further, QIF marginally reduced

exposure to transportation and consumer goods & services.

Regional Market Overview

During Q4, all GCC markets fell as oil prices continued to

reduce. The Bloomberg GCC index was down 6.0%. Dubai was the worst

performer, down 12.3%, with Saudi Arabia, Oman and Kuwait down

6.7%, 6.6% and 1.9%, respectively.

The Qatar market declined 9.0%, led by double digit declines in

the real estate, insurance, banking & financial and consumer

sectors. In November 2015, the Qatar market reported the steepest

fall in the GCC region, down 13% month-on-month. This was led by

Gulf International Company with a decline of 26.7% following its

exclusion from MSCI's Emerging Markets Index. In October and

December the Qatari market rose.

Taken as a whole 2015 proved to be challenging for GCC markets:

Qatar fell 15.1% albeit less than Saudi (down 17.1%) and Dubai

(down 16.5%). Over the year, the banking sector declined 12.4%,

while the industrials were down 21.1%. Telecoms fell 34%. However,

transportation, real estate and insurance sectors gained 4.9%, 3.9%

and 1.9%, respectively.

The Qatar market showed resilience compared to other GCC

markets. In the 18 months to 31 December 2015, Qatar fell 9.2% and

was the second best performer after Abu Dhabi (down 5.4%). In this

period the price of a barrel of Brent crude fell 66.8%. Over the 18

months Saudi fell 27.3%, Dubai 20.1% and the Oman and Kuwait fell

22.9% and 19.5%, respectively.

The Investment Adviser believes the Qatar market sell-off is

overdone and remains optimistic on Qatar over the medium to longer

term because of its superior growth prospects and an expanding

non-hydrocarbon sector.

Please refer to the IMS on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting the performance of markets since end of June

2014.

On the ground: a period of adjustment

Increased worries about the regional as well as global economy,

together with falling oil prices continue to weigh on stock markets

across the GCC. Oil prices have also hit state finances across the

GCC, including Qatar. Qatari companies have started taking cost

cutting measures.

The impact on Qatar's state revenues has raised concerns about

liquidity. Public sector deposits started to decline, especially

through the second half of the year. Loan growth has been

significant at 13.8% in the year to November 2015, while total

deposits have risen by just 5.5%, resulting in liquidity pressures

in the banking system. Consequently, loans to deposit ratio stood

at 117%, compared to 109% at the end of December 2014. Overall,

loan growth is expected to remain healthy at 15% on a run-rate

basis for 2015. Further, cost of funding is likely to increase due

to liquidity concerns, leading to compression in net interest

margins (NIMs). Asset prices in Qatar are already at high levels

and liquidity tightening might result in increased payment cycles

for the contractors segment.

(MORE TO FOLLOW) Dow Jones Newswires

January 26, 2016 02:00 ET (07:00 GMT)

In November 2015, the government of Qatar initiated talks with

banks for syndicated loans of US$10 billion to bolster state

finances depleted by low oil prices. Recently, the government

announced a loan of US$5.5 billion from a consortium of banks,

which is expected to ease illiquidity issues to some extent.

Moreover, the Investment Adviser expects Qatar may tap

international markets for additional sources of funds and issue

international bonds.

The Investment Adviser believes that the liquidity concerns in

the Qatari banking system are likely to continue in the near term.

However, Qatari banks are expected to slowly overcome these by

issuing bonds and as public sector deposits coming back to Qatari

banks. The Investment Adviser reassessed valuations in the banking

sector and performed its own stress testing on banking models and

found that despite liquidity concerns, banking sector valuations

appear attractive.

Qatar is well positioned to weather the current oil price

environment

As a consequence of oil price falls, GCC countries are opting

for reforms such as lowering subsidies and increasing fuel prices.

According to reports, energy subsidies account for 3.4% of GDP for

GCC countries.

In July last year, the UAE government deregulated fuel prices

and introduced a new pricing policy linked to global prices.

Recently, Saudi Arabia increased fuel prices by 50%, as the country

posted a US$98 billion budget deficit in 2015. Oman is likely to

follow suit with the cabinet recently approving, in principle,

spending cuts, tax rises and fuel subsidy reforms to cope with the

compression of state finances as a result of low oil prices.

Over the past 12 months, LNG spot prices in Asia have declined

from around US$10 per million British thermal units (mmbtu) to

around US$6.5 per mmbtu, tracking the fall in oil prices together

with lower demand from Asia and Europe. This drop in spot market

prices for LNG is likely to put additional pressure on long-term

LNG contract prices for Qatar. Although majority of the Qatari LNG

production is still bound to long-term contracts, the recent

decline in spot market LNG prices has increased the proportion of

short-term agreements. Moreover, the recent fall in oil and gas

prices has put some pressure on Qatari hydrocarbon revenues.

However, Qatar is well positioned to weather the current low oil

price environment due to its comparative advantages such as low

production cost, long term nature of contracts, excellent

geographic location which results in lower transportation costs,

and easy access to Asian and European markets.

Qatar State Budget for 2016 - focuses on long term

infrastructure development

Qatar announced its state budget for 2016 which is aimed at

achieving a balance between revenues and expenditure to improve

financial stability and achieve economic expansion. It ensures the

continued implementation of development projects based on the

planned schedule. With an announcement of the budget for 2016,

Qatar has shifted its fiscal year end from 31 March to 31

December.

The 2016 budget focuses on long term infrastructure development

ahead of the FIFA 2022 event. The budget assumes an oil price of

US$48 per barrel, lower than the US$65 per barrel previously,

translating into budgeted revenue of QAR156 billion, a decrease of

30.9% from FY2014-15 (April 2014 to March 2015). Total government

spending is expected to decrease 7.3% to QAR202.5 billion, compared

to QAR218.4 billion planned in the FY2014-15 budget. As a result,

Qatar is expected to report its first fiscal deficit in 15 years

estimated at QAR46.5 billion, about 4.8% of GDP. The shortfall is

likely to be covered by issuing local and international debt.

The latest budget shows a commitment to sustainable development,

with allocation to major projects growing by QAR3.3 billion to

QAR90.8 billion in 2016. The majority of capital outlay is for the

infrastructure, health and education sectors, representing over 45%

of total budgeted expenditure. The budget allocates QAR50.6 billion

to the infrastructure sector, about 25% of total expenditure, while

the education sector has an increased outlay of QAR20.4 billion.

The Qatari government has also earmarked QAR20.9 billion for the

health sector, with funds allotted to Sidra Medical and Research

Center, Hamad General Hospital and Hamad Medical City. The budget

has also allocated QAR2 billion for housing loans through Qatar

Development Bank.

Qatar State Budget Highlights

QAR Billion FY 14-15 Apr-Dec Apr 14- CY 2016

15 Dec 15

(12 months) (9 months) (21 months)

---------------------- ------------- ------------ ------------- --------

Total Revenues 225.7 169.3 395.0 156.0

---------------------- ------------- ------------ ------------- --------

Total Expenditures 218.4 163.8 382.2 202.5

---------------------- ------------- ------------ ------------- --------

Surplus / Deficit 7.3 5.5 12.8 (46.5)

---------------------- ------------- ------------ ------------- --------

Oil Price Assumption

($/bbl) 65.0 65.0 65.0 48.0

---------------------- ------------- ------------ ------------- --------

Note: From 2016, Qatar will follow the Gregorian calendar

Source: Qatar Ministry of Finance, The Peninsula

Please refer to the IMS on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting the reduction in budgeted expenditure and budget

balance as a % of GDP (Year 2016).

Qatar is better positioned compared to other GCC nations, on

account of its better fiscal position. Despite low energy prices,

Qatar has maintained its investment spending in the 2016 budget and

has not opted for any major subsidy cuts. Funding for major

projects increased 3.8% to QAR90.8 billion (US$24.9 billion).

Moreover, Qatar has over QAR261 billion of government projects

(excluding private sector and energy sector projects) underway, of

which over 50% of projects are in the transportation and

infrastructure sectors. Furthermore, the deficit remains lower

compared to other GCC states.

Please refer to the IMS on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting Qatar's accumulated budget surplus.

The Investment Adviser believes that Qatar is well positioned to

weather the depressed oil price environment on the back of strong

historic fiscal balances, low gearing and low breakeven oil prices.

Additionally, ongoing infrastructure spending should continue to

fuel the non-hydrocarbon growth and attract new expatriate workers,

keeping the population rising. This in turn should maintain impetus

for domestic consumption growth.

Qatar: corporate profits up 6.4% during 9M 2015

Qatari listed companies grew profits 6.4% in the first nine

months of 2015, driven by growth in the banking & financial,

transportation and the real estate sectors. However, profits

declined in Q4 by 5.3% compared to Q4 2014.

Sector profitability (net profit/loss in US$000s)

Sectors 9M 2014 9M 2015 % Change Q3 2014 Q3 2015 % Change

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Banking & Financial 4,072,410 4,306,486 5.7% 1,440,854 1,458,461 1.2%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Insurance 310,740 269,148 -13.4% 80,167 42,483 -47.0%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Industrial 2,640,435 2,187,986 -17.1% 966,010 781,280 -19.1%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Services &

Consumer Goods 381,777 383,008 0.3% 126,243 128,810 2.0%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Real Estate 641,591 1,506,455 134.8% 231,130 154,112 -33.3%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Telecoms* 571,151 483,005 -15.4% 103,010 207,624 101.6%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Transportation 443,748 508,228 14.5% 160,560 170,637 6.3%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Total 9,061,851 9,644,315 6.4% 3,107,975 2,943,407 -5.3%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

* Excluding Vodafone Qatar because of 31 March year end

Source: Qatar Exchange

Banking and financial services sector profit grew 5.7% for the

first nine months of 2015, led by a 7.0% rise in banking sector

profits. Growth in lending, up 9.1% to September 2015, primarily in

the private sector (+17.6%), drove the rise. Qatar National Bank

reported an advance in profit of 9.0%, while Qatar Islamic Bank's

profits rose 24.8%.

The Qatari banking sector growth is expected to remain healthy,

driven by increased lending due to project financing and higher

demand from a growing population. With the Qatari government

maintaining high project spending credit growth is anticipated to

remain healthy. Despite strong growth in lending, asset quality is

expected to remain good.

(MORE TO FOLLOW) Dow Jones Newswires

January 26, 2016 02:00 ET (07:00 GMT)

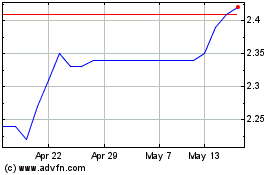

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Jul 2024 to Aug 2024

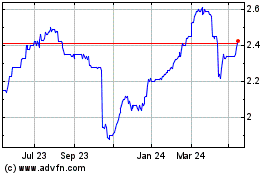

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Aug 2023 to Aug 2024