RNS Number:3887X

Gooch & Housego PLC

18 June 2002

FOR IMMEDIATE RELEASE 18 June 2002

For further information :

Ian Bayer 01460 52271

Gooch & Housego PLC

Tim Thompson 020 7466 5000

Buchanan Communications

GOOCH & HOUSEGO PLC

INTERIM RESULTS FOR THE SIX MONTHS ENDED 31 MARCH 2002

CHAIRMAN'S STATEMENT

The Board of Gooch & Housego PLC would like to update the market on the current

trading position.

Following last year's record profit, it was disappointing to issue the trading

statement in March. It set out the reasons for the anticipated reduction in

current year sales and profits for the Group, and the interim results announced

today reflect that position. As previously stated parts of the Group have

performed to budget but a decline for acousto-optic products and in particular

for the Group's Q-switches, has resulted in overall lower profits for the

half-year. The G&H UK order book for Q-switches is currently in excess of £1m

and the monthly input for orders has been growing.

During this period the group has been subject to the impact of the global

recession, particularly in the United States. Whilst we have not experienced

major problems in respect to order cancellations, we have been subjected to our

customers exercising options to re-schedule their deliveries in order to reduce

their inventory levels. As a result of these changes we have revised our

projections and future expectations. Primary causes relating to this

re-alignment by customers resulted from a slow down in the marker business,

semi-conductor and laser equipment markets. The UK Company was however only

affected from January to March 2002, a total of 3 months. By end of March 2002,

an increasing number of orders were being placed and with re-scheduling taking

place, we have now increased production from 500 per month to 800 per month.

I am delighted to have welcomed Mr Ian Davidson as Chief Executive in January

2002. His management skills will be of considerable value. I feel patience has

been rewarded, having interviewed at least 8 applicants who were not considered

suitable for the position. I am extremely pleased with Ian's contribution in

his first few months with the Group.

FINANCIAL RESULTS

For the six months to 31st March 2002 the Group is reporting operating profits,

before amortisation of goodwill, of £0.77m (2001: £2.28m). Profit before

taxation was £0.54m (2001: £1.99m), achieved on a turnover of £7.01m (2001:

£10.24m).

Earnings per share for the period were 1.8p (restated 2001: 6.5p).

The Group's financial position remains strong. Gearing at the half year stood at

15% (2001: 25%) while interest was covered 7 times (2001: 14 times).

DIVIDENDS

The Directors are declaring an interim dividend of 1.0p to be paid on 26 July

2002 to all shareholders on the register on 26 June 2002. This represents an

increase of 11% when compared to the 0.9p paid last year.

UNITED KINGDOM

GOOCH & HOUSEGO

Sales for Gooch & Housego (G&H) for the period under review were £2.58m (2001:

£3.64m) while operating profits, before goodwill amortisation were £0.59m (2001:

£1.22m).

As highlighted in the trading statement of 25 March 2002, the principal reason

for the trading statement was as a significant fall off in demand for

Q-switches. This had been caused by orders being deferred rather than

cancelled.

Apart from the Q-switch problem the scientific optical section has not felt the

recession. Indeed the order book is growing and we are working on three new

products. In addition the £1.2m order for the proximity switch has now been

received and development work on two other confidential projects are at the

prototype stage.

We intend to invest in our lens manufacturing facility to include, in the new

factory, another machine titled MRF (Magneto Rhelogical Finishing), to carry out

production of aspheric lens, using this to improve quality. The new US$0.5m MRF

machine corrects finished optics to accuracies our competitors will find

difficult to achieve. It is the first machine in the UK, with only 10 at this

time of writing in the world.

UNITED STATES

OPTRONIC LABORATORIES INC

Optronic Laboratories Inc (OLI) has experienced a downturn in sales of 33% to

£1.21m (2001:£1.74m) during the first six months of the financial year resulting

in an operating loss of £220,000 (2001: £148,000 profit).

In a difficult trading time I am pleased to report OLI have developed a new

light measuring instrument. Pre-production of the basic instrument is completed

and sales are beginning to be received. There is considerable sales activity

and we have already received orders for 10 units. We expect a number of further

orders by the year-end. The cost per basic machine is $20,000. I believe that

the market is crying out for this type of unit, and I am grateful to the OLI

management and staff for their hard work in preparing this machine for the

market. Other products are showing satisfactory activity. Shipments are good

and I believe that by the year-end we will move away from the difficulties we

have experienced since acquisition of OLI.

To strengthen our technical ability Professor Chris Pannell will take the

position of Chief Scientist for the Group and will operate in Orlando. I have

recommended his appointment. He has advised G&H UK over a number of years.

NEOS TECHNOLOGIES INC

It is apparent from the results now reported that NEOS Technologies Inc (NEOS),

with their reliance on Q-switch orders, has suffered the greatest decline in

sales within the Group with a 44% reduction in sales for the half-year. This

follows their record results in the year ended 30 September 2001. Sales for the

six months to 31 March 2002 were £1.72m (2001: £2.94m) with operating profits of

£ 0.52m (2001: £0.80m).

The NEOS order book is however now growing as orders are received. Their

recovery is well in hand and satisfactory.

CLEVELAND CRYSTALS INC

Cleveland Crystals Inc (CCI) has experienced a slow start to the current

financial year with an operating loss of £120,000 (2001:profit £116,000) from

sales of £1.64m (2001: £2.14m). The reduction in profit was expected and is in

line with budget.

The shortfall was due to the severity of the decline in semiconductor and

optical communications equipment markets. A year on year revenue decline was

projected as the National Ignition Facility (NIF) related large KDP crystals

sales were lower than normal because of facility preparation activities and

downtime from machinery moves. The new 10,500 sq.ft. fabrication and finishing

facility for large KDP crystals started pilot production in February.

Second half results should be much stronger. Billings for NIF related large KDP

crystals will be up significantly as a crystal growth milestone is reached and

the pilot production for finishing continues. Sales of materials for infra-red

applications are accelerating due to demand from defence programs. In addition,

pro-active sales and marketing, pricing adjustments, and timely deliveries are

yielding increased shipments of laser components (frequency converters and

pockels' cell Q-switches) in a flat market.

There has been an interchange of production within the Group's US businesses to

improve efficiency. NEOS have undertaken the entire production of RF Drivers

and have invested in a specialised plant called Pick & Place to increase

production considerably. NEOS have transferred manufacture of engineered metal

components to OLI, and have placed considerable orders with OLI. NEOS have also

transferred to G&H (UK) all manufacture of crystal transducers. The transfer has

made an improvement in NEOS production. G&H hope to be manufacturing quartz

bodies on modern equipment we have installed in the G&H (UK) facility. These

were previously purchased overseas.

NEW FACTORY

We have now identified a suitable site for a new factory for G&H in the UK and

have acquired an option that will be exercised when we receive full planning

approval. We hope to start building as soon as possible, with completion

estimated to take 9 - 10 months. The factory area will be 50,000 sq.ft., as

opposed to our present 25,000 sq.ft factory. Our investment programme on

modernisation is continuing. OLI's optical capability will be transferred to

Ilminster on completion of the new factory.

I hope this report shows faith we have in the future growth and success of the

Group. Despite the difficulties in the first half of this year, we are now

seeing a greater level of enquiries and an improving order book. We therefore

look forward with confidence that our revised financial budget will be achieved.

I thank all Shareholders for their support and finally I am grateful for the

Presidents (USA) and Directors (UK) for their untiring contribution. I

appreciate our Bank, Royal Bank of Scotland, for so readily agreeing the

necessary funds to invest in all our proposals, our advisor,

PricewaterhouseCoopers and Burges Salmon, Solicitor for their support.

A W Gooch MBE JP

Chairman

18 June 2002

UNAUDITED CONSOLIDATED PROFIT AND LOSS ACCOUNT

For the six months ended 31 March 2002. 6 months ended 6 months ended 12 months

ended

31 March 2002 31 March 2001 30 September 2001

(unaudited) (unaudited) (audited)

(restated) (restated)

£'000 £'000 £'000

Turnover 7,012 10,240 19,146

Operating Profit 619 2,138 4,312

Net interest payable (83) (153) (256)

Profit on ordinary activities before taxation 536 1,985 4,056

Tax on profit on ordinary activities (217) (814) (1,663)

Profit on ordinary activities after taxation 319 1,171 2,393

Dividends on equity shares (180) (162) (504)

Retained profit for the financial period 139 1,009 1,889

Earnings per ordinary share 1.8p 6.5p 13.3p

Dividend per share 1.0p 0.9p 2.8p

CONSOLIDATED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

6 months ended 6 months ended 12 months ended

31 March 2002 31 March 2001 30 September 2001

(unaudited) (unaudited) (audited)

(restated) (restated)

£'000 £'000 £'000

Profit for the financial period 319 1,171 2,393

Currency translation differences on foreign

currency net investments 233 93 (11)

Taxation on retranslation gains/losses on

foreign currency loans hedged against foreign

currency investments - 44 3

Total recognised gains and losses for the

financial period 552 1,308 2,385

Prior year adjustment (179)

Total gains and losses recognised 373

since the last annual report

RECONCILIATION OF MOVEMENTS IN EQUITY SHAREHOLDERS' FUNDS

6 months ended 6 months ended 12 months ended

31 March 2002 31 March 2001 30 September 2001

(unaudited) (unaudited) (audited)

(restated) (restated)

£'000 £'000 £'000

Profit on ordinary activities after taxation 319 1,171 2,393

Dividends in year (180) (162) (504)

139 1,009 1,889

Other recognised gains and losses 233 93 (11)

Taxation on retranslation gains on foreign - 44 3

currency loans

Net addition to shareholders' funds 372 1,146 1,881

Opening shareholders' funds as previously 11,962 10,024 10,024

stated

Prior year adjustment - Increase in provision (179) (122) (122)

for deferred tax

Restated opening shareholders' funds 11,783 9,902 9,902

Closing shareholders' funds 12,155 11,048 11,783

UNAUDITED CONSOLIDATED BALANCE SHEET

As at As at As at

31 March 2002. 31 March 2001 30 September

2001.

(unaudited) (unaudited) (audited)

(restated) (restated)

£'000 £'000 £'000

FIXED ASSETS

Intangible assets 5,480 5,481 5,463

Tangible assets 3,614 3,742 3,710

9,094 9,223 9,173

CURRENT ASSETS

Stock 4,060 3,457 3,759

Debtors 2,636 4,134 3,524

Cash at Bank and in hand 1,971 2,056 2,481

8,667 9,647 9,764

CREDITORS

Amounts falling due within one year (3,053) (4,253) (4,112)

NET CURRENT ASSETS 5,614 5,394 5,652

TOTAL ASSETS LESS CURRENT LIABILITIES 14,708 14,617 14,825

CREDITORS

Amounts falling due after more than one (2,494) (3,562) (2,978)

year

PROVISIONS FOR LIABILITIES AND CHARGES (59) (7) (64)

12,155 11,048 11,783

CAPITAL AND RESERVES

Called up share capital 3,600 3,600 3,600

Share premium 3,404 3,404 3,404

Revaluation reserve 308 308 308

Profit and loss account 4,843 3,736 4,471

12,155 11,048 11,783

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

For the six months ended 31 March 2002

6 months 6 months 12 months

ended ended ended

31 March 2002 31 March 2001 30 September 2001

(unaudited) (unaudited) (audited)

£'000 £'000 £'000

Net cash inflow from operating activities (i) 977 2,222 4,352

Returns on investments and servicing of

finance

Interest received 19 45 76

Interest paid (100) (197) (327)

Interest element of hire purchase contracts (2) (1) (5)

Net cash outflow from returns on investments (83) (153) (256)

and servicing of finance

Taxation

UK tax paid (261) (164) (434)

Overseas tax paid (129) (664) (1,092)

Cash outflow from taxation (390) (828) (1,526)

Capital expenditure

Purchase of tangible fixed assets (136) (295) (597)

Sale of tangible fixed assets 6 - 29

Net cash outflow from capital expenditure and (130) (295) (568)

financial investment

Acquisitions

Acquisition of subsidiary - NEOS Technologies - (239) (266)

Inc

Net cash outflow from acquisition - (239) (266)

Equity dividends paid (342) (279) (441)

Net cash inflow before financing 32 428 1,295

Financing

Repayment of bank loan (550) (248) (744)

Capital element of hire purchase repayments (12) (20) (50)

Net cash outflow from financing (562) (268) (794)

Increase in cash in the period (ii) (530) 160 501

GROUP CONSOLIDATED ACCOUNTS

Notes to the cash flow statement

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

2002 2001 2001

(unaudited) (unaudited) (audited)

£'000 £'000 £'000

( i ) Reconciliation of operating profit to net

cash inflow from operating activities

Operating profit 619 2,138 4,312

Amortisation of goodwill & licenses 155 148 301

Amortisation of debt issue costs 8 11 15

Depreciation 254 284 496

(Increase) in (153) (86) (508)

stock

Decrease / (increase) in debtors 954 (565) (69)

(Decrease) / increase in creditors (860) 292 (195)

977 2,222 4,352

(ii) Reconciliation of net cash inflow / (outflow) to

movement in net debt (Decrease) / increase in cash in the

period (530) 160 501

Cash outflow from decrease in debt and lease financing 562 268 794

Changes in net debt resulting from cash flows 32 428 1,295

New hire purchase contracts (59) - -

Movement in debt issue costs (8) (11) (15)

Translation difference (83) (186) 26

Movement in net debt in the period (118) 231 1,306

Net debt at 1 October 2001 (1,761) (3,067) (3,067)

Net debt at 31 March 2002 (1,879) (2,836) (1,761)

(iii) Analysis of net debt

At Cash flow Non-cash At

Exchange 3 March 2002

1 October 2001 Movement

£'000 £'000 £'000 £'000 £'000

Cash at Bank and in hand 2,481 (530) 20 - 1,971

Debt due after one year (2,978) - (37) 563 (2,452)

Debt due within one year (1,236) 550 (66) (571) (1,323)

Hire purchase (28) 12 - (59) (75)

(1,761) 32 (83) (67) (1,879)

NOTES TO THE INTERIM STATEMENT

1. The financial information set out above does not constitute statutory

accounts within the meaning of Section 240 of the Companies Act 1985. The

summarised results for the six months ended 31 March 2002 and the comparative

figures for the six months ended 31 March 2001 are unaudited. The figures for

the year ended 30 September 2001 have been extracted from the Group statutory

accounts, which have been filed with the Registrar of Companies and contain an

unqualified audit report.

2. Following the adoption of FRS19, deferred tax is now provided in full. Prior

to the introduction of FRS19, deferred tax was provided using the liability

method, on all material timing differences to the extent that the liability or

asset was expected to crystalise in the forseeable future. The figures for

March 2001 and September 2001 have been restated by means of a prior year

adjustment to reflect a full provision for deferred tax for those periods.

Taxation for the six months ended 31 March 2002 and 31 March 2001 has been

estimated at prevailing rates. Taxation for the year ended 30 September 2001 is

the actual provision for that year.

3. Earnings per share for the six months to 31 March 2002 and for prior periods

have been calculated using a total of 17,999,162 shares, being the average

number of shares in issue in those periods.

4. All of the amounts above are in respect of continuing operations

5. Accounting policies are consistent with those applied in previous years

and are as set out in the Group's audited accounts at 30 September 2001

6. The interim dividend will be paid on 26 July 2002 to shareholders on the

register at close of business on 26 June 2002.

7. Copies of the Interim Statement will be dispatched to Shareholders during

the week commencing 1 July 2002 and are available from the Company Secretary,

Gooch & Housego PLC, The Old Magistrates Court, Ilminster, Somerset, TA18 OAB.

This information is provided by RNS

The company news service from the London Stock Exchange

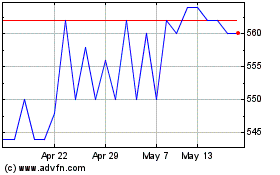

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jul 2024 to Aug 2024

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Aug 2023 to Aug 2024