TIDMGEMD

RNS Number : 0608F

Gem Diamonds Limited

17 March 2022

Thursday, 17 March 2022

Gem Diamonds Limited

Full Year 2021 Results

Gem Diamonds Limited (LSE: GEMD) ("Gem Diamonds", the "Company"

or the "Group") announces its Full Year Results for the year ending

31 December 2021 (the "Period").

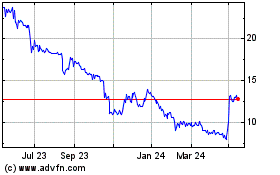

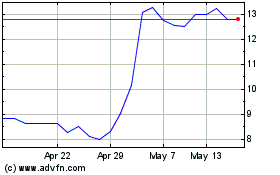

FINANCIAL RESULTS:

-- Revenue of US$201.9 million (US$189.6 million in 2020)

-- Underlying EBITDA from continuing operations of US$57.4 million (US$53.2 million in 2020)

-- Profit for the year from continuing operations US$31.1 million (US$27.5 million in 2020)

-- Attributable profit from continuing operations US$18.5 million (US$16.9 million in 16.9)

-- Earnings per share from continuing operations 13.2 US cents (12.1 US cents in 2020)

-- Cash on hand of US$31.1 million as at 31 December 2021

(US$23.5 million attributable to Gem Diamonds)

DIVID

-- Ordinary dividend of 2.7 US cents per share proposed by the

Directors and subject to approval by the shareholders at the 2022

AGM

-- The dividend will be paid on 21 June 2022 to shareholders who

are on the register of members on the record date of 20 May 2022

(ex-div date 19 May 2022)

OPERATIONAL RESULTS:

Letšeng

-- Carats recovered of 115 335 (100 780 carats in 2020)

-- Waste tonnes mined of 18.7 million tonnes (15.6 million tonnes in 2020)

-- Ore treated of 6.2 million tonnes (5.4 million tonnes in 2020)

-- Average value of US$1 835 per carat achieved (US$1 908 in 2020)

-- The highest dollar per carat achieved for a white rough

diamond during the year was US$47 574 per carat

COVID-19

One of the Group's priorities in 2021 was to safeguard its

employees, contractors and surrounding communities from COVID-19

and, in doing so, it was able to operate uninterrupted throughout

the year. Almost 100% of the Group's workforce has now been fully

vaccinated against COVID-19.

TCFD and Climate

The Group adopted the recommendations of the Task Force on

Climate-related Financial Disclosures during the year and concluded

Phase 1 of its three-year TCFD roadmap. The Group took a measured

and science-based approach to conclude its Group-wide climate

change scenario analysis and to develop a climate change strategy,

and will continue to do so while setting targets, metrics and

setting its decarbonisation strategy.

Commenting on the results today, Clifford Elphick, Chief

Executive Officer of Gem Diamonds, said:

"Gem Diamonds has delivered positive operational and financial

results notwithstanding the continued challenges brought about by

the COVID-19 pandemic on the availability of skills, equipment,

spares and other aspects of the supply chain. One of our priorities

remains the safety of our employees, contractors and surrounding

communities and we are pleased that we were able to assist the

Lesotho Government in its fight against COVID-19 with a donation of

20 000 vaccines and a new 4x4 ambulance capable of reaching remote

communities. To date, nearly 100% of the Group's workforce has been

vaccinated.

The Group has continued with its climate change journey and

we're pleased with the progress made in 2021. Our science-based

approach will stand us in good stead over the coming years in

managing the physical and transition risks. We are also continuing

to explore the opportunities that climate change might bring to our

operations.

The continuing recovery of the diamond market in 2021 was

evidenced by the robust prices achieved for Letšeng's large,

high-value diamonds and there was also a significant improvement in

the prices achieved for smaller diamonds. This resulted in positive

cash flows and allowed Gem Diamonds to end the year in a strong

financial position.

We are pleased to announce that based on the results achieved in

2021, the Board has proposed the payment of an ordinary dividend of

2.7 US cents per share."

The Company will host a live audio webcast presentation of the

full year results today, 17 March 2022, at 9:30 GMT. This can be

viewed on the Company's website: www.gemdiamonds.com

The page references in this announcement refer to the Annual

Report and Accounts 2021, which can be found on the Company's

website: www.gemdiamonds.com .

The Gem Diamonds Limited LEI number is 213800RC2PGGMZQG8L67

FOR FURTHER INFORMATION:

Gem Diamonds Limited

ir@gemdiamonds.com

Celicourt Communications

Mark Antelme / Felicity Winkles

Tel: +44 (0)20 8434 2643

ABOUT GEM DIAMONDS:

Gem Diamonds is a leading global diamond producer of high value

diamonds. The Company owns 70% of the Letšeng mine in Lesotho. The

Letšeng mine is famous for the production of large, top colour,

exceptional white diamonds, making it the highest dollar per carat

kimberlite diamond mine in the world.

CHAIRPERSON'S STATEMENT

The Board took measures in 2021 to enhance risk management,

improve stakeholder relations and meet the board independence

requirements of the UK Governance Code.

Dear shareholders,

On behalf of your Board of Directors, I am pleased to share the

Gem Diamonds Annual Report and Accounts for 2021, which describes

both the Group's performance during the past year and the progress

we have made against our longer-term strategic objectives.

2021 was certainly not without its challenges, with a

combination of the impact of renewed COVID-19 waves and

restrictions, planned periods of mining in lower grade areas of the

resource and extreme weather conditions. Pleasingly,

notwithstanding these challenges, operational stability improved

significantly towards the end of the year. We also saw the positive

effect of several important safety interventions (including a

24-hour 'Stop for Safety' campaign in June 2021) returning the

operation to its usual strong level of safety performance following

a number of disappointing safety incidents in the first half of the

year. In parallel, robust global demand for our large high-value

diamonds resulted in a solid financial performance of EBITDA of

US$57.4 million, an increase of 8% on 2020, and revenue of US$201.9

million.

CONTINUOUSLY IMPROVING OUR GOVERNANCE APPROACH

As stewards of the interests of all stakeholders of the Group,

the Directors strive to continuously improve governance and

oversight. Good governance is the bedrock upon which the Group's

reputation rests and it underpins operational efficiency, the

relationships we have with employees, local communities and

governments, and the respect we have for and in which we are held

by our shareholders and the wider market. Ultimately, good

governance is a crucial element in the sustainability of our

business and the preservation of value for all stakeholders.

The Board's priorities in 2021:

-- Ensuring safe and stable operations during the COVID-19 pandemic.

-- Enhancing risk management systems and processes.

-- Overseeing the adoption of the TCFD recommendations and Group climate change strategy.

-- Resolving certain shareholder concerns regarding the Board's independence.

-- Overseeing the renewal of the Group's funding arrangements.

-- Overseeing the pending sale of the Ghaghoo mine.

"Good governance is a crucial element in the sustainability of

our business and the preservation of value for all

stakeholders"

- Harry Kenyon-Slaney -

During the past year, we worked hard to further refine our risk

management systems and processes. This has enabled us to improve

the identification, quantification and mitigation of operational

and wider environmental and societal risks, and to assess their

potential impact against the risk tolerance levels we judge

appropriate for the Group. Practical examples include the

restructuring of our insurance cover to mitigate the substantial

recent increase in insurance cost and further refinement of our

tailings management systems to align them fully with the ICMM's

GISTM. Effective risk management and ongoing stakeholder engagement

ensure that the Board is kept appraised of issues as they emerge

and evolve, and that new opportunities are brought to the Board's

attention.

As part of our governance process, we continually review our

approaches to combatting systemic challenges. This year we have

again reassessed and refreshed our positions on human rights,

modern slavery, corruption and climate change. I am pleased that

all employees and contractors have reaffirmed their commitment to

these statements.

ADDRESSING SAFETY AND CLIMATE CHANGE

We regard the safety and health of our workforce as our highest

priority and, while we are not complacent and can always do better,

our track record over recent years has been solid. It was therefore

a concern to the Board that our safety performance deteriorated

during the first six months of 2021, but management took swift

action to turn the situation around. The Letšeng mine was shut down

for a full day in a 'Stop for Safety' campaign to allow the

workforce to be addressed. A new safety culture programme was

launched to reinforce the message that production must happen

safely or not at all. Pleasingly the second half of the year showed

a sharp recovery. The AIFR for the full year was 0.93.

Letšeng is located in a remote and pristine region of the world

and the Board has always been sensitive to the need to operate in

an environmentally responsible manner. In 2021, the existential

threat of climate change moved to the centre of the public's

consciousness and is top of mind for political and business

leaders. As a mining company that is necessarily a sizeable

consumer of energy, we have commenced the process of both

understanding our contribution to greenhouse gas emissions and what

we can do to limit it. Climate change is now a topic of discussion

at every Board meeting and is a top priority in our risk management

system.

Gem Diamonds has adopted six priority goals from the 17 UN SDGs

and our ongoing inclusion in the FTSE4Good index is an external

validation that our positive ESG practices align with global

standards and expectations. There were no major or significant

environmental incidents reported at any of our operations during

the year.

VALUING DIVERSITY, SKILLS AND EXPERIENCE

While ours is a small Board, appropriate for the size of the

Group, we are committed to aligning with the requirements of the UK

Corporate Governance Code. In May, Johnny Velloza (previously

deputy CEO) stepped down from the Board to ensure that the Board

meets the independence requirements of the Code. We are grateful to

Johnny for his significant contribution and commitment over the

last five years and we continue to benefit from his technical

expertise as a strategic adviser.

We welcomed Rosalind Kainyah MBE to the Board. Rosalind has

decades of experience in corporate and environmental law,

government relations, political risk management and sustainability.

Her experience in diamond mining includes an Executive Director

position at the De Beers Group and she adds valuable ESG and

leadership skills to the Board.

The Nominations Committee oversees board and senior management

succession planning, and this important work ensures that the

Group's leadership is appropriately sized, regularly refreshed,

diverse and equipped with the necessary skills. We believe that the

Board, as currently constituted, contains the right balance of

critical thinking capabilities, skills and experience and that the

complementary perspectives included ensure appropriate independent

oversight of the Group.

We are proud of our track record of local appointments and

promotions with a representation of nearly 98% Lesotho nationals at

Letšeng and steadily improving gender diversity throughout the

Group.

LISTENING TO OUR STAKEHOLDERS

As the operator and 70% owner of the Letšeng mine, we regard

ourselves as guests of the people of Lesotho. We endeavour to

always maintain constructive, open and honest dialogue with local

communities and government partners. We consider their priorities

and ensure that they in turn understand the nature of our business

and Letšeng's significant contribution to the national economy.

Since joining the Board in July 2019, Mazvi Maharasoa has been

the designated non-Executive Director for workforce engagement. She

engages directly with employee representatives and provides the

Board with an unfiltered view on issues that people wish to raise.

This engagement process has broadened our understanding of various

concerns and has enhanced the channels via which employees can

communicate with management and see their issues being resolved.

The Board values this process as it gives us reassurance that

employee voices are heard at the top of the organisation and has

helped to strengthen our relationships with them. These

interactions have been particularly important while access to the

mine has been restricted during the COVID-19 pandemic.

ENTRENCHING AN ETHICAL CULTURE

Gem Diamonds has always maintained a strong set of ethical

principles that remain the firm foundation of everything we do. We

insist on transparency and have no tolerance for fraud, theft,

modern slavery, child labour or any other wrongdoing. The culture

espoused by the Board and senior management is one of transparency,

openness, a willingness to challenge and to change, and these

principles promote high standards of ethical behaviour throughout

the Group. To support these principles we maintain a rigorous

system of internal controls, a comprehensive internal audit

programme and an anonymous whistleblowing facility.

SUSTAINABLE RETURNS FOR OUR SHAREHOLDERS

In line with our dividend policy to pay a dividend to

shareholders when the financial strength of the Group allows, we

are pleased to propose that a dividend of 2.7 US cents per share be

declared for the 2021 financial year.

ACKNOWLEDGING OUR STAKEHOLDERS' CONTRIBUTIONS

Operating a large mine high in the Maluti Mountains of Lesotho

under the constraints of COVID-19-related travel and access

restrictions once again provided a considerable test for everyone

at Gem Diamonds during 2021. Management's ability to oversee the

operation remotely for extended periods is a testament first and

foremost to the ability and fortitude of our workforce, to the

quality of the systems and culture in place at the mine and the

strength of our relationships with local community leaders and with

the Government of the Kingdom of Lesotho.

On behalf of the Board, I therefore want to thank everyone who

has contributed to the Group's success this past year despite

considerable disruption to their lives and those of their families.

We thank our employees, contractors, our community partners, the

Government of the Kingdom of Lesotho and our shareholders for their

ongoing support. Finally, I wish to thank my fellow Directors for

the dedication and commitment they showed and the valuable

contributions they made during the year.

BEING CONFIDENT ABOUT THE FUTURE

While there are some signs that the COVID-19 pandemic may be

starting to wane, there remains a risk of further resurgences. The

success of our efforts to largely shield our people over the past

two years has given us confidence that we have the systems and

processes in place to deal with this risk, to keep our people safe

and maintain the supply chain that our operations depend on.

2021 marked the end of the four-year period over which we

delivered in excess of the target of US$100 million by achieving

US$110.0 million in revenue, productivity and cost savings

generated through the Business Transformation programme launched in

2017. In 2022, our goal is to build on the success of this effort

by further improvement of our operational consistency through the

focused implementation of a rigorous continuous improvement

culture. In addition, we vigorously continue to exploit

opportunities to optimise the mine plan and to reduce our waste

profile, investigate future options to explore underground mining

at Letšeng and progress several technological innovations in our

processing plants.

The climate change scenario analysis that the Group undertook in

2021 provides a strong foundation to incorporate climate

change-related risks and opportunity considerations into future

business plans, strategies and feasibility studies.

Diamond prices have recovered steadily since the second half of

2020 due to an improving market outlook and declining supply.

Prices increased further in 2021 and it is pleasing to note that

this trend has continued into 2022. While predicting the frequency

of the recovery of large diamonds is impossible in the short term,

consistent delivery of plant throughput volumes is the best way to

yield results over time.

Harry Kenyon-Slaney

Chairperson

16 March 2022

RISK MANAGEMENT

HOW WE APPROACH RISK

The Group's risk management framework, which is fully integrated

within strategic and operational planning, aims to identify, manage

and mitigate the risks and uncertainties to which the Group is

exposed and combines top-down and bottom-up approaches with

appropriate governance and oversight, as shown in the graphic

below.

Oversight BOARD OF DIRECTORS Top-down approach -

The Board is responsible for risk management in the Group and sets the risk appetite and

provides stakeholders with assurance tolerances, strategic

that key risks are properly identified, assessed, mitigated and objectives and accountability

monitored. The Board maintains for the management

a formal risk management framework for the Group and formally of the framework

evaluates the effectiveness

of the Group's risk management process. It confirms that the

process is accurately aligned

with the Group's strategy and performance objectives.

At the quarterly risk review meeting, the Board reviews the risk

register, assesses management's

scenarios and plans, interrogates the most critical risks in

detail and debates mitigating

plans with management.

Governance AUDIT COMMITTEE SUSTAINABILITY COMMITTEE

The Audit Committee monitors The Sustainability Committee

the Group's risk management provides assurance to the Board

processes, reviews the status that appropriate systems are

of in place to identify and manage

risk management, and reports to health, safety, social and

the Board on a biannual basis. environmental risks. It monitors

It is responsible for the Group's performance within

addressing these categories and drives

the corporate governance proactive risk mitigation

requirements of risk management strategies

and for monitoring risk to secure the safe and

management responsible operations and the

at each operation. social licence to operate in the

future.

-------------------------------- ---------------------------------

Responsibility MANAGEMENT Bottom-up approach -

Management develops, implements, communicates and monitors risk ensures a sound risk management

management processes and integrates process and establishes formal

them into the Group's day-to-day activities. It identifies risks reporting structures

affecting the Group, including

internal and external, current and emerging risks. It implements

appropriate risk responses

consistent with the Group's risk appetite and tolerance.

GROUP INTERNAL AUDIT

Group Internal Audit formally reviews the effectiveness of the

Group's risk management processes.

The outputs of risk assessments are used to compile the strategic

three-year rolling and annual

internal audit coverage plan and evaluate the effectiveness of

controls.

------------------------------------------------------------------- --------------------------------

Risk management framework

The Board and its Committees oversee the most relevant and

significant current and emerging risks facing the Group which

include strategic, operational and external risks. These risks are

actively monitored, managed and mitigated to the extent possible as

their impact, individually or collectively, could affect the

Group's ability to achieve its objectives.

While Gem Diamonds' risk management framework focuses on risk

identification and mitigation, many factors that give rise to these

risks also offer opportunities. The Group monitors existing and

emerging opportunities and incorporates them into the strategy

where they support the Group's vision.

The learnings from COVID-19 led to increased emphasis on

identifying the possible implications of external macro risks and

low-probability and high-consequence events to inform appropriate

contingency plans. These risks are mitigated by building resilience

and flexibility into our leadership and operational processes, and

ensuring the Group is equipped to quickly quantify the size and

scale of the emerging issue and adapt accordingly. Insurance cover

plays an important role in risk mitigation, enabling the transfer

of certain risk elements within the primary risk categories of the

Group. While it does not eliminate the need for operational

controls to manage and mitigate risk, it offsets the financial loss

should the risk materialise.

Insurers have continued to decrease their exposure to the mining

industry due to the risk perception created by the COVID-19

pandemic, as well as claims in the industry due to the looting

experienced in South Africa in July 2021. As a result, the renewal

of appropriate insurance has become challenging, leading to

additional exclusions, reduced cover, increasing deductibles or

excesses payable and increasing premiums. Reduced cover

consequently directly impacts the Group's cash management risk. In

response to these challenges, the Group has decided to adopt a new

risk transfer strategy to address the substantial changes in the

insurance market by developing a sustainable insurance solution for

the Group in the medium to long term.

1. Climate Risk: Climate Risk Response: Risk type:

Change change-related * TCFD adoption and climate change strategy Strategic,

risks development. Operational

(transitional and External

and physical

risks) are * Governance and management practices implemented. Strategic

recognised as impact:

top Preparing for

global risks and * Structured TCFD Adoption Committee meetings. our future.

investors are

increasingly Working

focused on the * New reporting standards adopted. responsibly

management of and

these risks. maintaining

Climate * Adoption of UN SDG framework our social

change presents licence.

significant

present and * GHG emissions monitoring and reporting. Business model

future risks and impact:

opportunities to Affects the

the Group, that entire

if not business

identified and model.

managed

responsibly

could negatively

impact the

organisation's

long-term

resilience.

Opportunity:

Opportunities

for improvements

in energy and

operational

efficiency,

innovation

and growth.

2. Diamond Risk: Risk Response: Risk type :

damage Letšeng's * Continuous diamond damage monitoring and analysis to Strategic and

valuable Type identify opportunities to reduce diamond damage. Operational

IIa diamonds are

highly Strategic

susceptible to * Optimising blasting and processing activities to impact:

damage during reduce possible diamond damage. Extracting

the maximum value

mining and from our

recovery * Development of early identification and improved operations.

process. This liberation technology.

affects revenue Preparing for

generated by the our future.

Group's large,

high-value Business model

diamonds impact:

resulting in Reduces

reduced cash financial

flow and inputs,

profitability. increases

diamond prices

Related realised and

opportunities: output of

Reduction in carats

diamond damage recovered,

will result in increasing

higher prices financial

achieved, outputs.

resulting in

improved cash

flow and

profitability.

----------------- ---------------------------------------------------------------- ---------------

3. Diamond Risk: Risk Response: Risk type:

Resources and Letšeng's * Gathering geological evidence on variations within External and

Reserves low-grade the resource (lithology, density, volume/tonnage, Operational

orebodies makes grade, diamond population size and value

the operation distributions), applying industry best practice and Strategic

sensitive to engaging independent experts to audit and advise. impact:

resource Extracting

variability. maximum value

Inadequate * Ongoing pit mapping, petrography, drilling, and 3D from our

information on modelling. operations.

the geological

continuity, Preparing for

distribution, * Grade control, bulk sampling, density and moisture our future.

grade, and content measurements (on-site and independent lab

quality of verification), dilution control, stockpile management Business model

diamonds , impact:

within the data management, quality control and internal Affects

orebodies auditing of production data (including geological, natural

increases the processing, recovery and sales data). capital inputs

risk that and outputs of

production carats

targets may not * Managing the Diamond Accounting System and Mineral recovered.

be achieved and Resource Management (MRM) database, monitoring Life of mine

reduces recovery data on daily and monthly basis, as well as affects the

confidence in per export period, to follow trends in diamond long-term

the performance distributions, large stone frequencies and average viability of

of the resource. diamond prices per kimberlite domain. the business

Unexpected model.

variability in

key

resource/reserve

criteria, such

as volume,

tonnage, grade

and price, can

significantly

impact the

operation's

forecasting and

financial

stability, both

in the short and

medium term, and

can influence

decisions

regarding future

growth.

Related

opportunity:

Having access to

adequately

detailed and

reliable

exploration,

sampling

and testing data

enables the

operation to

reasonably

assume

geological,

grade and

quality

continuity

within defined

domains, and

improves

planning and

forecasting

accuracy.

----------------- ---------------------------------------------------------------- ---------------

4. Security of Risk: Theft is Risk Response: Risk type:

product an inherent risk * Zero tolerance on non- conformance to policy and Strategic and

in the diamond regulations. Operational

industry. The

high-value Strategic

nature of the * Advanced security access control and surveillance impact:

product system in Extracting

at Letšeng maximum value

makes it from our

susceptible to * place, complemented by off-site surveillance. operations.

theft and

significant Working

losses, which * Monitoring of security process effectiveness by the responsibly

would negatively Diamond Recovery Protection Committee (subcommittee and

affect revenue of the Letšeng Board). maintaining

and cash flows. our social

licence.

Related * Appropriate diamond specie insurance cover in place.

opportunities: Business model

Advanced impact:

security control * Regular vulnerability assessments complemented by Affects

measures internal and independent third-party assurance audits outputs of

increase undertaken. carats

employee and recovered,

product safety which

and improves increases

revenue. financial

outputs.

Improves human

capital

and safety

outcomes.

----------------- ---------------------------------------------------------------- ---------------

5. Variability Risk: Risk Response: Risk type:

in cash Variability in * Appropriate treasury management procedures and External and

generation cash flows from framework to enter into short-term hedging Strategic

operational instruments are implemented to mitigate the effects

activities and of currency volatility on cash flows. Strategic

currency impact:

fluctuations can Extracting

negatively * Rigorous cost and capital discipline is in place. maximum value

affect the from our

Group's ability operations.

to effectively * Funding facilities are in place to manage any

operate, repay variability in the short to medium term. Preparing for

debt and fund our future.

capital

projects. This * Ongoing CI programme to drive operational Business model

risk is directly efficiencies. impact:

impacted by Affects

other principal funding and

risks such as financial

rough diamond capital inputs

demand and outcomes.

and prices,

diamond damage,

and diamond

resources and

reserves.

Related

opportunities:

Cash constraints

drive more

efficient

capital

allocation and

cost discipline.

Consistent and

regular cash

flows provides

predictability

to maintain an

appropriate

capital

allocation

strategy.

----------------- ---------------------------------------------------------------- ---------------

6. Information Risk : The Risk Response: Risk type :

Technology (IT) Group's * Application of technical and process IT controls in Strategic and

and Operational operations rely line with industry- accepted standards. Operational

Technology (OT) on secure IT and

systems, and OT systems to Strategic

cybersecurity process and * Appropriate back-up procedures, firewalls and other impact:

record financial appropriate security applications in place. Extracting

and operating maximum value

data in its from our

information * Regular testing of back-up restorations. operations.

management

systems. If Preparing for

these systems * IT management policies. our future.

are compromised,

there could be a Business model

material adverse impact:

impact on the Affects the

Group. entire

business

Related model.

opportunities:

Stability to the

business with no

production

interruption.

----------------- ---------------------------------------------------------------- ---------------

7. Health Risk: The Risk Response: Risk type:

Safety and probability of a * Appropriate health and safety policies and practices Strategic and

Wellness major health or are in place. Operational.

safety incident

occurring within Strategic

the Group is * Corrective actions identified from incident impact:

inherent in investigations and internal and external audits Extracting

mining implemented timeously. maximum value

operations. from our

These incidences operations.

could impact the * Dam safety management framework implemented and

wellbeing of alignment with the GISTM. Working

employees, PACs, responsibly

our licence to and

operate, the * ISO 45001 accreditation maintained. maintaining

Company's our social

reputation and licence.

compliance with * Safety management and leadership programme; detection

its mining lease and prevention strategies are developed and Business model

agreement. implemented. impact:

Affects the

Related entire

opportunities: * Training and awareness campaigns. business

Improving model.

employee health

and wellness can * Psychological support considerations for the full

increase morale, workforce.

reduce

absenteeism and

improve * Continually assess organisational health to address

productivity. current and emerging issues.

Effective safety

policies and * Flexible shift configuration to assess alternatives

processes in to limit community transmission and transfer to the

place reduces workplace.

risk to our

workforce,

strengthens

our

relationships

with employees

and regulators,

and safeguards

our reputation.

----------------- ---------------------------------------------------------------- ---------------

8. Production Risk: Material Risk Response: Risk type:

interruption mine and/or * Continuous review of business continuity plans. Operational

plant shutdowns, and External

pit closures or

periods of * Bespoke contract management role fulfilled to ensure Strategic

decreased proper contract management and minimise potential for impact:

production disputes and disruptions. Extracting

could arise due maximum value

to various from our

events. These * Appropriate insurance maintained. operations.

events could

lead to personal Working

injury or death, * Appropriate levels of resources maintained (fuel, responsibly

environmental stockpiles, etc) to mitigate certain production and

impacts, damage interruptions. maintaining

to our social

infrastructure licence.

and delays in * Improvements implemented in the management of

mining and contractors' procurement practices. Business model

processing impact:

activities and Reduced

could operational

result in activity could

financial losses lead to a

and possible decline in

legal liability. financial

capital and

The Group relies outputs.

on the use of Negative

external outcomes

contractors in decrease

its mining and natural and

processing human capital

activities. .

Disputes with

these

contractors

could materially

impact the

Group's

operations.

Related

opportunities:

Focused contract

management

supports

operating at or

near

steady-state

levels which

improves

efficiencies due

to stability of

production.

Robust business

continuity plans

are in place

which results in

limited delays

due to

disruptions.

----------------- ---------------------------------------------------------------- ---------------

9. Rough Risk: Numerous Risk Response: Risk type:

diamond demand factors beyond * Monitoring of market conditions and trends. External

and prices the control of

the Group may Strategic

affect the price * Flexibility in sales processes and utilisation of impact:

and demand for multiple sales and marketing channels, and increased Extracting

diamonds. These viewing opportunities. maximum value

factors include from our

international operations.

economic and * Ability to enter into partnership agreements with

political manufacturers to share in the upside of the polished Preparing for

trends, as well diamonds. our future.

as consumer

trends. Medium- Business model

to long-term * Maintaining the integrity of the tender process. impact:

demand is Affects

forecast to funding of the

outpace supply, * Reduction in supply in the market with greater demand business

but short-term for Letšeng goods caused by current offtake model, sales

uncertainty agreement between a diamond trader and a competitive and marketing

and liquidity mine. activities and

constraints chosen

within the distribution

diamond sector channels.

may affect rough

diamond pricing.

Related

opportunities:

Reduced supply

and increased

demand may

result in

improved revenue

resulting in

positive cash

flows

----------------- ---------------------------------------------------------------- ---------------

10. Creating Risk: The Risk Response: Risk type:

and preserving volatility of The Groups strategy review has the objective of improving the Strategic

value for the Group's share price through:

shareholders share price and * Continuous Improvement initiatives. Strategic

lack of growth impact:

negatively Working

impacts the * Investigating early identification and anti-breakage responsibly

Group's market technology. and

capitalisation. maintaining

Constrained cash our social

flows could * Assessing mergers and acquisitions and licence.

impact on diversification opportunities.

returns to Preparing for

shareholders. our future.

The Group

currently relies Business model

on a single mine impact:

with a finite Affects the

life for its entire

revenues, business

profits and model.

cash flows.

Related

opportunities:

Focusing on

existing

operations could

unlock further

value through

rationalisation

and efficiency

improvements.

----------------- ---------------------------------------------------------------- ---------------

11. Workforce Risk: Achieving Risk Response: Risk type :

the Group's * Human resources practices are designed to identify Strategic and

objectives and skills shortages and implement development programmes Operational

sustainable and succession planning for employees.

growth depend on Strategic

the ability to impact:

attract * Incentives are in place to retain key individuals Extracting

and retain through performance- based bonus and long-term share maximum value

suitably awards. from our

qualified and operations.

experienced key

employees. Gem * Remuneration practices are in place which review Working

Diamonds current remuneration policies, skills and succession responsibly

operates in an planning. and

environment maintaining

and industry our social

where shortages * Development of training plans to address areas where licence.

in experience skills shortages are identified, in conjunction with

and skills are government agencies. Preparing for

prevalent. our future.

Related Business model

opportunities : impact:

Skills retention Affects human,

and Continuous intellectual

Improvement and financial

initiatives capital inputs

build the into the

Group's human business

capital and can model.

create a

competitive

advantage.

----------------- ---------------------------------------------------------------- ---------------

12. Risk: Risk Response: Risk type:

Environmental Environmental * Implemented appropriate Sustainability and External and

issues are Environmental policies which are subject to a Operational

recognised as continuous improvement review.

top global risks Strategic

by the World impact:

Economic Forum * The current behaviour-based care programme instils Extracting

and investors environmental stewardship. maximum value

are increasingly from our

focused on operations.

environmental * A dam safety management framework has been

performance. implemented. Working

Failure to responsibly

manage vital and

natural * Annual social and environmental management plan audit maintaining

resources, programme has been implemented. our social

environmental licence.

regulations and

pressure from * ISO 14001 accreditation maintained. Preparing for

neighbouring our future.

communities can

affect the * Adopted a UN SDG framework. Business model

Group's ability impact:

to operate Affects

sustainably. * Rehabilitation and closure management strategy natural

adopted and updated annually. capital inputs

Related into the

opportunities: business model

Responsible * Implementation of the water management framework. and negative

environmental outcomes in

stewardship the case of

improves * Concurrent rehabilitation strategy implemented. environmental

relationships incidents.

with

regulators and * Group shared natural resources management strategy

communities implemented.

while

strengthening

our brand.

Increased focus

on environmental

responsibility

could translate

into a

competitive

advantage.

----------------- ---------------------------------------------------------------- ---------------

13. Social Risk: The Risk Response Risk type:

licence to Group's social * Appropriate CSI strategy based on community needs Strategic and

operate licence to analysis which provides infrastructure, access to Operational.

operate is education and healthcare, and supports local economic

underpinned by development. Strategic

the support of impact:

its Working

stakeholders, * Adoption of relevant standards, best practices and responsibly

particularly strategies. and

employees, maintaining

regulators, PACs our social

and society. * Appropriate Governance structures across all levels licence.

This support is of the Group.

an outcome of Preparing for

the way our future.

the Group * Regular engagement with government and regulators.

manages issues Business model

such as ethics, impact:

labour practices Affects social

and capital and

sustainability the viability

in our wider of the

environment, as business

well as our risk model.

management and

engagement

activities with

stakeholders.

Related

opportunities:

Realising the

Group's vision

to make a

meaningful and

sustainable

contribution to

the countries in

which we operate

builds the

Group's

reputation with

employees,

government,

regulators,

communities and

investors.

----------------- ---------------------------------------------------------------- ---------------

EMERGING RISKS

The Group risk framework includes an assessment of emerging

risks which are indicators of future conditions from which new

opportunities and threats can arise.

The Group's consideration of emerging risk includes those risks

that:

-- are likely to materialise or impact over a longer time frame than existing risks.

-- do not have much reference from prior experience.

-- are likely to be assessed and monitored against

vulnerability, velocity and preparedness when determining

likelihood and impact.

The current emerging risks and opportunities being monitored by

the Group are:

-- although the invasion of Russia into the Ukraine and

consequential sanctions applied is a current event; the social,

political and economic effect of this on commodity prices, supply

chains and market conditions is unknown..

-- lab-grown diamonds.

-- generational shifts in consumer preferences - social influencers.

-- the rate of advancement of digital technologies such as blockchain.

-- future workforce (automation, skills for the future, etc).

-- uncertainty around carbon tax.

VIABILITY STATEMENT

The Board has assessed the viability of the Group over a period

significantly longer than 12 months from the approval of the

financial statements in accordance with the UK Corporate Governance

Code. The Board considers three years from the approval of the

financial statements to be the most relevant period for

consideration for this assessment, given the Group's current

position and the potential impact of the principal risks documented

on pages 37 to 44 on the Group's viability.

While the Group maintains a full business model, based

predominantly on the life of mine plan for Letšeng, the Group's

annual business and strategic planning process also uses a

three-year time horizon. This process is led by the CEO and

involves all relevant functions including operations, technology

and innovation, sales and marketing, finance, treasury and risk.

The Board participates in the annual review process through

structured Board meetings and annual strategy review sessions. A

three-year period provides sufficient and realistic visibility in

the context of the industry and environment in which the Group

operates, even though the life of mine, the mining lease tenure and

available estimated reserves exceed three years.

The business and strategic plan reflects the Directors' best

estimate of the Group's prospects. The Directors evaluated several

additional scenarios to assess the potential impact on the Group by

quantifying their financial impact and overlaying this on the

detailed financial forecasts in the plan.

The Board's assessment of the Group's viability focused on the

critical principal risks categorised within the strategic, external

and operational risk types, together with the effectiveness of the

potential mitigations that management reasonably believes would be

available to the Group over this period.

REFINANCING OF GROUP FACILITIES

The refinancing of the Group's facilities which was completed in

December 2021, significantly increased the Group's available

facilities from US$67.6 million immediately before the refinancing

to US$83.3 million thereafter, when fully unutilised. US$77.0

million of these facilities mature in December 2024, with the

balance of US$6.3 million being a general banking facility with no

set expiry date, but which is reviewed annually.

COVID-19

While there are promising signs that the impact of the COVID-19

pandemic may be dissipating, there remains a potential risk of

further resurgences. The Group is confident in its ability to

manage through any such resurgence given its experience and success

to date, especially following the successful roll-out of

vaccinations at Letšeng. The Group predominantly holds viewings for

its rough tender sales in Antwerp, although viewings have been held

in Tel Aviv and more recently in Dubai. Although international

travel has been subject to changing levels of restrictions, the

main diamond sales market in Antwerp has remained open. Diamond

sales are concluded on Gem Diamonds' electronic tender platform

which can be accessed from anywhere in the world. The Group is

confident that it will be able to continue to hold tender viewings

in Antwerp despite any potential COVID-19 travel restrictions.

CLIMATE CHANGE

The Board is cognisant of the risks presented by climate change

and conscious of the need to minimise emissions. A Group-specific

climate change scenario analysis has been conducted whereby the

short- to medium- and longer-term physical and transitional risks

were assessed. The short- to medium-term impacts fall within the

viability period. The physical risks identified for Letšeng, such

as drought, strong winds, extreme precipitation and cold, is

similar to its current operating conditions. The operation is

therefore well-geared to manage these conditions within its current

and medium term operational activities, cost structure and business

planning. Additional cash investment required in the event of these

short- to medium-term physical risks materialising has been

assessed as low with no material impact on the current operations

and viability of the Group.

In terms of transitional risks, as users of grid-supplied and

fossil fuel energy, the short-term focus is on improving energy

efficiencies in our operational processes and reducing

combustion-related fossil fuel use. Options are being assessed in

the context of the size, nature and location of the Group's

operations, the required investment and the expectations of our

main stakeholders. Any material investment during the viability

period is considered unlikely. Due to the uncertainty of the cost

and timing of implementation of carbon-related taxes, the impact of

such taxes on the Group's operations and cash flows has been

excluded from the viability assessment and scenario stress testing.

Management and the Board will continue to assess these impacts as

the information becomes more certain.

STRESS TESTS

The scenarios tested considered the Group's revenue, EBITDA(1) ,

cash flows and other key financial ratios over the three-year

period. The scenarios tested included the compounding effect of the

factors below and were applied independently of each other.

1 Refer Note 4, Operating profit on page 179 for the definition

of non-GAAP measures.

Effect Extent of sensitivity Related principal risks Area of business model affected

analysis

A decrease in 20%

forecast * Rough diamond demand and prices. * Entire business model ie inputs, activ

rough diamond ities, outputs

revenue from and outcomes.

reduced * Production interruption.

market prices

or production

volumes * Diamond damage.

caused by

unforeseen

production * Diamond resources and reserves.

disruption

due to either

COVID-19

restrictions

or climate-

related

events.

--------------------------- --------------------------------------- ---------------------------------------------

A 23%

strengthening * Variability in cash generation. * Financial capital inputs and outcomes.

of local

currencies to

the US dollar

from expected

market

forecasts.

--------------------------- --------------------------------------- ---------------------------------------------

CONCLUSION

The Group's current net cash(1) position of US$20.9 million as

at 31 December 2021 and available facilities of US$74.3 million

would enable it to withstand the impact of these scenarios over the

three-year period. The revolving credit facilities which expire on

22 December 2024, has a 24-month extension period and the Group

will follow all necessary processes to extend the facilities for

this available period, as it has in the past. This position is

supported by the cash-generating nature of the Group's core asset,

Letšeng, and its flexibility in adjusting its operating plans

within the normal course of business. Based on the robust

assessment of the principal risks, prospects and viability of the

Group, the Board confirms that it has a reasonable expectation that

the Group will be able to continue in operation and meet its

liabilities as they fall due over the three-year period ending 31

December 2024.

(1) Net cash is calculated as cash and short-term deposits less

drawn down bank facilities (excluding asset-based finance facility

and insurance premium financing).

CHIEF EXECUTIVE'S REVIEW

We performed strongly in 2021 and operated in a safe and

responsible manner to protect the wellbeing of our workforce.

Letšeng has a unique ore body with diamonds that are of the

highest value of any kimberlite mine, and the most beautiful found

anywhere in the world. Despite the many COVID-19-related challenges

encountered during the year, the Group ended the year in a strong

cash position (net cash of US$20.9 million) with the average price

of Letšeng goods exceeding US$2 000 per carat in Q4. This robust

pricing for Letšeng's large, high-quality diamonds has continued

into 2022.

We aim to extract maximum value for our stakeholders by

operating safely, responsibly and efficiently and exploring new

technologies to reduce diamond damage during the diamond liberation

process. Achieving the highest average prices of any kimberlite

mine in the world requires an effective, transparent and

competitive tender sales process which we boast in Antwerp and,

more recently, in Dubai. In addition, the Group adheres to

internationally recognised systems and processes which provide our

clients and their customers the assurance that our diamonds are

ethically mined.

EXTRACTING MAXIMUM VALUE FROM OUR OPERATIONS

The strategy during the second year of COVID-19 impact on our

operations focused on driving the extraction of greater value from

our assets.

The Group's Letšeng operation delivered a solid operating

performance, despite the significant challenges presented by travel

restrictions, supply chain constraints, extreme weather conditions

and intermittent external power outages on site.

Tonnes treated increased 15% year on year as operations returned

to normal after the COVID-19 shutdowns in 2020. Carats recovered

increased 14% to 115 335 (2020: 100 780).

Six diamonds greater than 100 carats were recovered during the

year, which is comparable to the 13-year average of eight, albeit

lower than the 16 such diamonds recovered in 2020. Exceptional

recoveries during the year included the two large high-quality Type

IIa white diamonds of 367 and 245 carats which sold for US$26 160

per carat and US$40 139 per carat, respectively. Letšeng's

operational performance is discussed in more detail on page 60.

The diamond market has recovered to levels not seen in some time

and demand for the high-quality white diamonds produced at Letšeng

is particularly strong. 21 diamonds sold for more than US$1 million

each, generating revenue of US$64.5 million (2020: 34 diamonds

contributing US$72.6 million). The average price achieved during

the year decreased 4% to US$1 835 per carat (2020: US$1 908 per

carat) from the sale of 109 697 carats (2020: 99 172). The decrease

in the prices achieved compared to 2020 relates mainly to fewer

large and exceptional diamond recoveries, and the overall quality

of the diamonds recovered as a result of the areas of the resource

mined during the year. The Group successfully hosted its first

trial tender viewing in Dubai in September, making it easily

accessible for important clients from the UAE, India and Israel to

participate in the tender. The viewings were well-attended and

contributed to the robust prices achieved. The Group will hold its

next Dubai viewing in March 2022.

"We are committed to operating in an environmentally responsible

way."

- Clifford Elphick -

Group revenue increased 6% to US$201.9 million (2020: US$189.6

million), which translates to underlying EBITDA(1) of US$57.4

million and earnings per share of 10.5 US cents. Operational cash

generated amounted to US$71.3 million resulting in a net cash(2)

position of US$20.9 million at the end of 2021. The Group-wide debt

refinancing was successfully concluded during the year. An

additional funder joined the lender group, bringing the total

number of lenders to three. The Group's revolving credit facilities

were increased from US$61.3 million to US$77.0 million, in dollar

equivalent, and renewed for a three-year period.

Based on the positive financial performance of the Group in

2021, we are pleased to announce that the Board has proposed a

dividend of 2.7 US cents per share. More information regarding the

Group's financial results is included in the CFO review on page

52.

WORKING RESPONSIBLY AND MAINTAINING OUR SOCIAL LICENCE

Gem Diamonds aims to sustain a workplace safety culture founded

on mutual care and collaboration across the workforce. We continue

to roll out programmes to drive a behavioural, organisational and

culture ethos of safe conduct in the workplace.

In the past year, there were no fatalities (2020: none), six

LTIs (2020: 1), and we achieved an overall AIFR of 0.93.

We are committed to operating in an environmentally responsible

way. Our tailings storage facility management process aligns with

the ICMM's GISTM which ensures the responsible management and

monitoring of the tailings storage and freshwater facilities with

regular inspections by external experts.

We invest in our surrounding communities through our well-

established CSI programme to improve educational outcomes, develop

infrastructure and stimulate local enterprises to create

self-sustaining employment independent of the mine. Implementing

these programmes was a significant highlight in 2021 as we were

able to successfully implement a number of 2020 projects delayed by

the COVID-19 lockdowns, while also commencing with those projects

planned for 2021. In addition, we were active in repairing roads,

footbridges and other PAC infrastructure damaged by the

extraordinary flooding in the Patiseng valley in the first quarter

of the year.

We are particularly proud of the pipeline of in-country mining

skills we have developed that will serve Letšeng, and Lesotho as a

country, well into the future. We started operations with 250

people in 2006, more than half of whom were expatriates. There are

now 1 591 people working at Letšeng, of whom 98% are Basotho. This

is due to our significant investment in transferring of skills,

sponsoring the studies of students in mining and business-related

disciplines, and in coaching initiatives specific to our needs.

Responsible social and environmentally sourced diamonds are a

consumer priority. We have adopted six of the UN SDGs and continue

to support the GIA's use of blockchain technology to assure

consumers of our diamonds' ethical footprint.

There were no major or significant stakeholder incidents

reported during the year.

GEM DIAMONDS' CONTRIBUTION TO LESOTHO

-- Jobs for 1 591 employees and contractors of which 98% are Basotho nationals.

-- Local procurement US$158.7 million.

-- Local procurement directly from PACs US$3.4 million.

-- Local procurement from regional communities US$31.4 million.

-- Investment in training to improve individual skills.

-- 48 bursaries and scholarships for local students.

-- Vaccine and ambulance donations.

1 Refer Note 4, Operating profit on page 179 for the definition

of non-GAAP (Generally Accepted Accounting Principles)

measures.

2 Net cash/(debt) is a non-GAAP measure and calculated as cash

and short-term deposits less drawn down bank facilities (excluding

the asset-based finance facility and insurance premium

financing).

OPERATING THROUGH COVID-19

The challenge for our business over the last two years has been

to keep our workforce safe, find ways to run efficiently and

uninterrupted during COVID-19 and generate a return for our

shareholders. We demonstrated our care and agility at the start of

the pandemic by quickly establishing a testing laboratory, strict

controls and protocols, giving confidence to employees,

contractors, communities and the Government of the Kingdom of

Lesotho that we were serious about keeping our people safe. The

Group has incurred significant expenditure in implementing its

COVID-19 protocols with the majority being spent at Letšeng, where

an estimated LSL26.4 million (LSL17 375 per employee) was spent on

COVID-19 management and prevention to date.

When vaccinations started in Lesotho in the second half of 2021,

we acquired and donated 20 000 vaccines to the Lesotho Department

of Health. As part of the national vaccination programme, we worked

with the Department of Health to allow our workforce the

opportunity to be vaccinated on site. We are proud to report that

99% of our workforce is fully vaccinated to date.

As a result of our early and proactive interventions, the mine

operated continuously throughout 2021. However, travel restrictions

made it challenging for Group management, contractors and certain

technical skills to access the mine, and ongoing supply chain

disruptions affected the timeous replenishment of essential spares

and equipment. We remain alert to the effects of the pandemic on

mental health and in response targeted wellness initiatives have

been rolled out at the Johannesburg office and a full-time

psychologist was appointed at Letšeng to support the workforce at

the mine.

Focusing on climate change

We are cognisant of the risks presented by climate change and

conscious of the need to minimise emissions and our environmental

impact more broadly. Letšeng's physical location exposes the

operation to extreme weather conditions including drought, strong

wind, heavy rain, extreme cold and snow. The operation is well set

up to manage these conditions and is experienced in sheltering and

supporting our PACs when necessary.

We held climate change workshops and completed a Group-specific

climate change scenario analysis to deepen our understanding of

climate-related risks and its likely impacts on the Group. The TCFD

framework is proving to be a useful tool to identify and assess

climate change- related issues.

As users of grid and fossil fuel energy, our short-term focus is

on improving energy efficiencies in our operating processes and

reducing combustion-related fossil fuel use. We are assessing our

options in the context of the size, nature and location of our

operations, the required investment and the expectations of our

main stakeholders.

The Group has appointed independent external subject matter

experts to provide input into the climate change considerations

that will inform governance, risk management and strategy decisions

as well as climate change-related targets for the Group. Our

approach to climate change is included on page 26.

PREPARING FOR THE FUTURE

The four-year BT target of US$100 million was exceeded by the

end of the year with the achievement of US$110.0 million, and many

of the embedded initiatives will continue to create value for the

Group. We continue to foster a culture of continuous improvement to

identify and execute value driving initiatives and look forward to

realising the benefits thereof in the near future.

Our capital plans include funding for projects that will sustain

growth and value creation. Advancing technologies to reduce diamond

damage during processing is a focus and while the potential is

clear, the slow pace of progress during the year was

disappointing.

The current open pit mine plan for both Main and Satellite pipes

extends to 2036. In preparing for the future, we are exploring the

trade-off between the next cutback in Satellite pipe versus an

earlier underground access to this ore body in a safe and efficient

manner. To inform our decision in this regard, we deepened our

knowledge of the resource body in 2021 through an extensive

resource drilling programme and will continue this process into

2022.

OUTLOOK

The current strong diamond demand and the ongoing decrease in

the number of diamond producers, suggests that the fundamentals are

supportive for achieving higher diamond prices in the future. We

will prioritise stable and consistent production while driving

efficiencies and managing costs to maximise cash flows, sustain an

appropriate capital return to shareholders and maintain our status

as a responsible, safe and low-cost operation.

Russia's recent invasion of the Ukraine has created political

turmoil and the impact on the global economy, and the diamond

market in particular, is uncertain at this stage.

Our future success depends on ensuring access to the requisite

technical expertise, which will require further investments in

skills development and retention initiatives, as well as effective

succession planning. We remain focused on safeguarding the health

of employees and contractors against COVID-19 for as long as it

persists. We will continue to support our PACs and assist the

Government of the Kingdom of Lesotho in its efforts to manage the

impact of the pandemic.

APPRECIATION

In closing, I thank the Board and our Chairperson for their

leadership during the year. The management teams once again

demonstrated their commitment to the Group, and I thank them for

their exceptional efforts during another difficult year.

We thank our customers for their continued trust and patronage,

and our shareholders for their support. I would like to acknowledge

the Government of the Kingdom of Lesotho for allowing us to

continue to operate in a safe and responsible manner through three

COVID-19 waves during the year.

Clifford Elphick

Chief Executive Officer

16 March 2022

CHIEF FINANCIAL OFFICER'S REVIEW

Gem Diamonds generated positive cash flow and ended the year in

a strong financial position, proposing a shareholder dividend for

the second consecutive year.

-- Underlying EBITDA from continuing operations increased 8% to

US$57.4 million from US$53.2 million in 2020

-- Earnings per share from continuing operations: 13.2 US cents

-- Profit attributable to shareholders from continuing operations: US$18.5 million

-- Group's attributable profit: US$14.8 million

-- The Group ended the year in a net cash position of US$20.9 million (2020: US$34.6 million)

-- Unutilised available facilities of US$74.3 million

"The successful refinancing of our facilities, which includes a

sustainability-linked loan, further embeds our commitment to

delivering the Group's ESG strategy."

- Michael Michael -

We generated another strong set of results and positive cash

flows in 2021, against the backdrop of ongoing COVID-19 challenges.

Our effective and early interventions in response to COVID-19

enabled operations to continuing uninterrupted throughout 2021,

with an ongoing focus on protecting employees and contractors

against infection whilst maximising production and continues to

sell our diamonds at the highest obtainable market price.

Production throughput was constrained during the year with three

waves of COVID-19 impacting the availability of equipment, spares,

skills and supply chain management. This resulted in the Group

resetting some of its full year production targets, although the

strong performance in Q4 resulted in some of those metrics being

exceeded. The diamond market showed significant recovery and we

achieved US$1 835 per carat for the year.

We successfully concluded the Group-wide debt refinancing during

the year by renewing our revolving credit facilities at an amount

of US$77.0 million for a three-year period. US$32.3 million of this

amount is a Sustainability Linked Loan (SLL) which links the margin

and resultant interest rate on the loans to the Group's ESG

performance, which is aligned to its sustainability strategy.

In further support of our commitment to sustainability and

climate change-related matters, Phase 1 of our TCFD Adoption

Strategy was concluded during the year by establishing the

necessary foundations to support meaningful, science-based decision

making. The TCFD-related workstreams completed during 2021

included:

-- Establishing robust board and management governance structures;

-- Strengthening the enterprise risk management processes to

ensure the full ambit of climate risk are considered and

managed;

-- Concluding our climate change scenario analysis; and

-- Identifying, assessing and plotting the impact of our

physical and transition risks over the short-, medium- and

long-term.

Underlying EBITDA(2) from continuing operations increased to

US$57.4 million, from US$53.2 million in 2020. Profit attributable

to shareholders from continuing operations for the year was US$18.5

million, equating to earnings per share from continuing operations

of 13.2 US cents on a weighted average number of shares in issue of

140.3 million.

The Group ended the year with a cash balance of US$31.1 million

and drawn down facilities of US$10.2 million, resulting in a net

cash position of US$20.9 million (2020: net cash of US$34.6

million) and unutilised facilities of US$74.3 million.

Summary of financial performance

Refer to the full annual financial statements starting on page

147.

US$ million 2021 2020

------------------------------------------------------------- ------------

Revenue 201.9 189.6

Royalty and selling costs (21.9) (19.8)

Cost of sales(1) (113.0) (104.7)

COVID-19 costs/standing costs (0.7) (3.9)

Corporate expenses (8.9) (8.0)

------------------------------------------------------------- ------------- ------------

Underlying EBITDA(2) from continuing operations 57.4 53.2

------------------------------------------------------------- ------------- ------------

Depreciation and mining asset amortisation (8.6) (9.1)

Share-based payments (0.4) (0.6)

Other income 0.1 -

Foreign exchange gain/(loss) 1.9 (0.9)

Net finance costs (3.7) (4.4)

------------------------------------------------------------- ------------- ------------

Profit before tax from continuing operations 46.7 38.2

------------------------------------------------------------- ------------- ------------

Income tax expense (15.6) (10.7)

------------------------------------------------------------- ------------- ------------

Profit for the year from continuing operations 31.1 27.5

------------------------------------------------------------- ------------- ------------

Non-controlling interests (12.6) (10.6)

------------------------------------------------------------- ------------- ------------

Attributable profit from continuing operations 18.5 16.9

------------------------------------------------------------- ------------- ------------

Loss from discontinued operations (3.7) (3.3)

------------------------------------------------------------- ------------- ------------

Attributable net profit 14.8 13.6

------------------------------------------------------------- ------------- ------------

Earnings per share from continuing operations (US cents) 13.2 12.1

Loss per share from discontinued operations (US cents) (2.7) (2.3)

Dividends per share (US cents) 2.7 2.5

------------------------------------------------------------- ------------- ------------

1 Including waste stripping costs amortisation but excluding

depreciation and mining asset amortisation.

2 Underlying EBITDA as defined in Note 4, Operating profit of

the notes to the consolidated financial statements.

Revenue

Rough diamond revenue of US$201.3 million was generated at

Letšeng, achieving an average price of US$1 835 per carat (2020:

US$1 908 per carat). The Group sold 21 diamonds for more than

US$1.0 million each, contributing US$64.5 million to revenue.

The Group's increased revenue was mainly driven by higher

volumes through normalised production (following the

COVID-19-related disruptions in 2020) and improved market

conditions. The overall dollar per carat achieved was negatively

impacted by a decrease in large diamond recoveries during the year

when compared to 2020.

Letšeng entered into partnership arrangements during the year

that allows them to share in the margin uplift on the sale of the

resultant polished diamonds. In 2021, additional revenue of US$0.3

million (2020: US$0.6 million) was generated from these partnership

arrangements.

Letšeng Unit Cost Analysis

Waste cash

Total direct Non-cash Total costs per

Unit cost per Direct cash Third plant cash operating accounting operating waste tonne

tonne treated costs(1) operator costs costs charges(2) cost mined

---------------- --------------- --------------- --------------- --------------- --------------- ---------------

2021 (LSL) 185.59 15.53 201.12 70.63 271.75 44.44

2020 (LSL) 185.73 15.73 201.46 118.74 320.20 43.70

% change - (1) - (41) (15) 2

---------------- --------------- --------------- --------------- --------------- --------------- ---------------

2021 (US$) 12.55 1.05 13.60 4.78 18.38 3.00

2020 (US$) 11.28 0.95 12.23 7.21 19.44 2.65

% change 11 11 11 (33) (5) 13

---------------- --------------- --------------- --------------- --------------- --------------- ---------------

1 Direct cash costs represent all operating costs, excluding

royalties and selling costs.

2 Non-cash accounting charges include waste stripping amortised,

inventory and ore stockpile adjustments, finance lease costs and

exclude depreciation and mining asset amortisation.

US$ million 2021 2020

Group revenue summary

Letšeng sales - rough 201.3 189.1

Sales - polished margin 0.3 0.6

Impact of movement in inventory 0.3 (0.2)

--------------------------------- ------ ------

Group revenue 201.9 189.6

--------------------------------- ------ ------

Expenditure

OPERATING EXPITURE

Group cost of sales increased by 8% to US$113.0 million from

US$104.7 million in 2020. In 2021, the Group incurred US$0.7

million to manage and maintain protocols to contain the spread of

COVID-19 at its operations (2020: US$1.0 million). In 2020, an

additional US$2.9 million standing charges were incurred during the

shutdown and ramp-up periods at Letšeng. Total waste-stripping

costs amortised increased by 8% to US$46.8 million compared to

US$43.4 million in 2020.

Total operating costs in local currency decreased by 4% to LSL1

677.4 million compared to LSL1 740.8 million in 2020 which includes

the impact of non-cash accounting charges.

The unit cost per tonne treated decreased 15% to LSL271.75

(2020: LSL320.20 per tonne treated) due to more consistent

operational throughputs and an increase in tonnes treated compared

to 2020.

-- Direct cash costs (excluding waste) increased by 13% to LSL1

241.4 million in line with the increase of ore tonnes treated to

6.2 million, a 15% increase compared to 2020. Waste cash costs

increased by 22% to LSL829.4 million which was also in line with

the 20% increase in waste tonnes mined (18.7 million tonnes

compared to 15.4 million tonnes in 2020). Direct cash costs per

tonne treated of LSL185.59 which is similar to 2020. Waste cash

cost per waste tonne mined increased marginally to LSL44.44 (2020:

LSL43.70).

-- Third plant operator costs reflect payments to the contractor

which are calculated from revenue generated by the sales from

diamonds recovered through the contractor plant. In 2021, the total

cash costs in local currency increased by 12% in line with the

increase in carats recovered and sold.

-- Non-cash accounting charges: comprise waste amortisation,

stockpile and diamond inventory movements and finance lease costs.

The total impact of these charges in 2021 was LSL436.0 million