Energean PLC RE-ADMISSION OF SHARES (1854J)

December 18 2020 - 7:15AM

UK Regulatory

TIDMENOG

RNS Number : 1854J

Energean PLC

18 December 2020

Energean plc

("Energean" or the "Company")

RE-ADMISSION OF SHARES

London, 18 December 2020 - Energean plc (LSE: ENOG, TASE: )

announces that, further to the announcement on 17 December 2020

regarding the completion of the acquisition of Edison Exploration

& Production S.p.A., its entire issued share capital of

177,089,406 ordinary shares has today been re-admitted to the

premium listing segment of the Official List of the Financial

Conduct Authority and to trading on the main market for listed

securities of the London Stock Exchange plc.

Energean maintains its Secondary Listing on the Tel Aviv Stock

Exchange and its shares remain fully transferrable and fungible

between the two markets.

Enquiries

Energean

Investors and analysts

Kate Sloan, Head of IR & ECM Tel: +447917 608645

Media

Sotiris Chiotakis, Corporate communications and Tel: +30 6932663877

media relations

Morgan Stanley (Sole Sponsor, Financial Adviser and Joint Corporate

Broker) Tel: +4420 7425 8000

Andrew Foster

Michael O'Dwyer

Mutlu Guner

About Energean plc

Established in 2007, Energean is a London Premium Listed FTSE

250 and Tel Aviv 35 Listed E&P company with operations in nine

countries across the Mediterranean and UK North Sea. Since IPO,

Energean has grown to become the leading independent, gas-focused

E&P company in the Eastern Mediterranean, with a strong

production and development growth profile. The Company explores and

invests in new ideas, concepts and solutions to produce and develop

energy efficiently, at low cost and with a low carbon

footprint.

Energean's production comes mainly from the Abu Qir field in

Egypt, and fields in Southern Europe and the UK. The company's

flagship project is the 3.5 Tcf Karish, Karish North and Tanin

development offshore Israel, where it intends to use the only FPSO

in the Eastern Mediterranean to produce first gas, commencing

4Q-2021. Energean has signed firm contracts for 7.4 Bcm/yr of gas

sales into the Israeli domestic market, which have floor pricing,

take-or-pay and/or exclusivity provisions that largely insulate the

project's revenues against global commodity price fluctuations and

underpin Energean's goal of paying a meaningful and sustainable

dividend.

With a strong track record of growing reserves and resources,

Energean is focused on maximising production from our large-scale

gas-focused portfolio to deliver material free cash flow and

maximise total shareholder return in a sustainable way. ESG and

health and safety are paramount to Energean; it aims to run safe

and reliable operations, whilst targeting carbon neutrality across

its operations by 2050. These aspirations have been significantly

advanced with the completion of the Edison E&P acquisition in

December 2020.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFIFFLLTLII

(END) Dow Jones Newswires

December 18, 2020 07:15 ET (12:15 GMT)

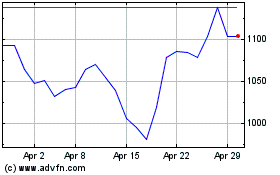

Energean (LSE:ENOG)

Historical Stock Chart

From Apr 2024 to May 2024

Energean (LSE:ENOG)

Historical Stock Chart

From May 2023 to May 2024