Edenville Energy PLC Rukwa Coal to Power Project Update (7748R)

December 14 2016 - 2:00AM

UK Regulatory

TIDMEDL

RNS Number : 7748R

Edenville Energy PLC

14 December 2016

14 December 2016

EDENVILLE ENERGY PLC

("Edenville" or the "Company")

Rukwa Coal to Power Project Update

Edenville Energy plc (AIM:EDL), the Company developing an

integrated coal to power project in western Tanzania, is pleased to

provide an update on the current status of EPC (Engineering,

Procurement and Construction) work at the Rukwa Coal to Power

Project.

Key Points:

-- Proposals for 120-135 MW power plant construction obtained

from several EPC Groups, including an option for lower cost, near

term construction;

-- At this stage, the Company has not tied itself to a

particular group in order to draw on the knowledge and experience

of different groups before finalising the most appropriate deal for

Edenville;

-- Independently produced financial model supports previous

estimates and demonstrates a robust project;

-- The Company continues to pursue opportunities for early

small-scale mining and is in discussions with several potential

off-take buyers of Rukwa coal; and

-- The Project was visited by the Tanzanian Deputy Commissioner

of Mines in early December to discuss enlargement of the Mkomolo

Mining Licence.

Power Plant

Edenville has recently received several technical and financial

proposals for EPC work to construct a power plant of between 120MW

and 135MW at the Rukwa Coal to Power Project site. Whilst the

Company's Rukwa coal resource could support a larger power plant it

is currently envisaged that a plant in this range will be the best

option to establish power generation in the shortest possible

timescale.

Much of the work has centred on using standard well tested "off

the shelf" technology and where possible these are based on

previous contracts to build similar sized plants in other parts of

the world and in East Africa.

The proposals received include contributions from Runh Power,

with whom we have had a collaboration agreement through 2016.

Another major international EPC group, who wish to be unnamed for

now, but who are already active in East Africa, has also completed

a comprehensive independent financial review as part of their

project proposal. Their financial review supports the projects

viability, adds to the previous work carried out by Lahmeyer India

in 2015 and provides a framework to move forward with development

options.

Throughout this process, the Company has remained autonomous and

has not been contractually tied to one particular EPC group. This

has enabled Edenville to draw on the knowledge and experience from

different parties and has resulted in several options being put

forward and assessed, something that would be difficult to achieve

should we have been in an exclusive agreement at this stage of the

project.

The differences in EPC costs between various proposals have been

significant. Considerable cost savings have been identified which

could potentially be applied to the construction and operation of

the power plant and particularly, options for plant acquisition

could result in a material reduction of overall project costs.

These proposals mean that the Company will be able to select the

most financially viable route to construct the power plant project

whilst also meeting the requirements of the Tanzanian

Government.

Although our Collaboration Agreement with Runh Power officially

came to an end on 1 December 2016, the Company continues to work

alongside Runh to further progress suggested suitable options for

construction and funding. We are also continuing to work in a

similar manner alongside the EPC group that developed the

independent financial model to look at the most appropriate next

steps forward for the project.

In parallel with the work completed by the EPC groups and the

continuing work the Company is undertaking to explore financing

options, the project has recently gone through extensive review by

the Tanzanian authorities. We are now awaiting further directives

from senior government representatives on how they wish to proceed

with the power development and will update our shareholders on

further developments as they occur.

Opportunities for Early Mining

As part of its strategy the Company is also looking at

opportunities to start small scale mining to satisfy growing

domestic coal demand related to the banning of imported coal into

Tanzania.

The Company is currently talking to several potential off-take

buyers and is selecting suitable areas and coal seams for

extraction. As previously announced it remains the Company's

intention to establish mining operations in 2017.

The Company will update its shareholders again when these

discussions reach a conclusion.

Visit to Site by Commissioner of Mines

In early December a visit was conducted to our Rukwa site by

Eng. Ngowi, Tanzanian Deputy Commissioner of Mines. Mr Ngowi met

with Edenville staff and discussed the pending enlargement of the

mining licence at Mkomolo.

The Company is pleased to report that the discussion was

positive and the Tanzanian Ministry of Energy and Minerals ("MEM")

continue in their support for the project.

Rufus Short, CEO of Edenville, commented: "We are delighted by

the support we are receiving from various EPC groups. The extensive

work that they have undertaken in conjunction with Edenville staff

has validated the potential for our coal to power project. We are

now investigating detailed proposals to advance the project

alongside the Tanzanian government. These ongoing discussions,

coupled with the work we are doing to secure early stage mining at

Rukwa mean these are very busy and exciting times for

Edenville."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

For further information please contact:

Edenville Energy Plc

Jeff Malaihollo - Chairman +44 (0) 20 7652

Rufus Short - CEO 9788

Northland Capital Partners Limited

(Nominated Adviser)

Gerry Beaney +44 (0) 20 3861

David Hignell 6625

Optiva Securities Limited

(Broker)

Jeremy King +44 (0) 20 3137

Graeme Dickson 1902

IFC Advisory

(Financial PR and IR)

Tim Metcalfe

Graham Herring

Heather Armstrong +44 (0) 20 3053

Miles Nolan 8671

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLFFSVFLLVLIR

(END) Dow Jones Newswires

December 14, 2016 02:00 ET (07:00 GMT)

Edenville Energy (LSE:EDL)

Historical Stock Chart

From Apr 2024 to May 2024

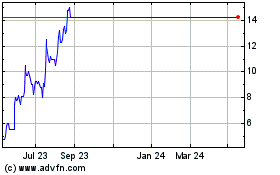

Edenville Energy (LSE:EDL)

Historical Stock Chart

From May 2023 to May 2024