TIDMDPEU

RNS Number : 8249M

DP Eurasia N.V

26 January 2021

For Immediate Release 26 January 2021

DP Eurasia N.V.

("DP Eurasia" or the "Company", and together with its

subsidiaries, the " Group ")

Trading Update for the Year Ended 31 December 2020

Continued growth in online channels drives robust

performance

For the year ended 31

December

---------------------------------

2020 2019 Change

------------ ------------------- ---------

(in millions of TRY,

unless otherwise indicated)

Number of stores 771 765 6

Group system sales (1)

Turkey 1,069.1 845.7 26.4%

Russia 471.6 503.3 -6.3%

Azerbaijan & Georgia 29.2 21.2 37.9%

Total 1,569.9 1,370.3 14.6%

Group system sales like-for-like

growth(2)

Group(5) 17.4% 10.7%

Turkey 26.0% 13.1%

Russia (based on RUB) -12.6% 0.7%

Highlights

-- Group system sales increased 14.6%, despite Covid-19 related

operational constraints and increased competition in Russia due to

aggregators

o Turkish systems sales growth of 26.4%

o Russian system sales decrease of 6.3% (15.3% based on RUB)

-- Group online system sales(4) growth of 40.3%

o Turkish online system sales growth of 55.2%

o Russian online system sales growth of 20.3% (8.8% based on

RUB)

-- Online delivery system sales(3) as a share of delivery system

sales surpassed 75% (2019: 70%), reflecting our strong online

offering and positioning

-- Strong liquidity position - TRY 128 million of cash on hand

and additional available bank lines of TRY 142 million as at 31

December 2020

-- Robust franchisee demand in Turkey more than offset the store

closures in Turkey and Russia due to Covid-19 - 33 new store

openings vs. 27 store closures in 2020

Commenting on the update, Chief Executive Officer, Aslan Saranga

said:

"The strong trading environment continued in Turkey through the

last two months of the year. Despite ongoing operational

constraints, such as weekend and nightly curfews that were put in

place from the middle of November, our Turkish operations have

maintained a high like-for-like growth rate of 38.6% in

November/December. This was in part driven by the tailwinds from a

temporary reduction in the VAT rate to 1% from 8%, which the

government extended until 1 June 2021. However, there has also been

a Covid-19 inspired shift to home delivery across all consumer

sectors, which has brought us new customers. Provided that we give

a good service and provide an appealing product, we hope to grow

customer loyalty in a post Covid-19 market.

"The recovery in Russia has also been continuing where our

November/December like-for-like growth rate has been -1.9%, in line

with our October performance. Television advertising is highly

regionalised in Russia and our recently launched new and improved

pizza enjoyed a targeted television campaign in Greater Moscow that

has been effective in driving delivery sales; however, our take

away/eat in channel has been lagging in its recovery so far due to

ongoing Covid-19 restrictions.

"The strong trading in Turkey has resulted in very encouraging

interest from both existing and new franchisees. In 2020, we

successfully opened 33 new stores in total, more than offsetting

the 27 Covid-19 related store closures across Turkey and

Russia.

"In 2020, we also reached important milestones in our digital

delivery system sales in both Turkey and Russia as well as at the

Group level. Our Turkish and Russian operations have reached 75%

and 90%, respectively, in digital delivery sales as a percentage of

total delivery sales, signifying improvements of six and eight

percentage points from 2019, respectively. At the Group level 75%

of our delivery system sales originated from digital channels.

"As previously announced, the Board is considering an additional

listing on a major stock exchange to complement its current listing

on the Main Market of the London Stock Exchange. Upon its initial

review, the Board has taken the decision to further investigate the

dual listing of DP Eurasia at the Borsa Istanbul and will provide a

further update in due course.

"Whilst the Board is conscious of the risks posed by the

on-going uncertainty due to the pandemic, these trading results

give us confidence regarding our market positioning and the

prospects for our business in the long term."

Enquiries

DP Eurasia N.V.

Selim Kender, Chief Strategy Officer &

Head of Investor Relations +90 212 280 9636

Buchanan (Financial Communications)

Richard Oldworth / Giles Stewart / Tilly +44 20 7466 5000

Abraham dp@buchanan.uk.com

A conference call for investors and analysts will be held at

9.00am this morning, which will be accessible using the following

details:

Conference call: UK Toll Free: 08003589473

UK Toll: 03333000804

Participant PIN code: 27680520#

URL for international dial in numbers:

http://events.arkadin.com/ev/docs/NE_W2_TF_Events_International_Access_List.pdf

A recording of the conference call will subsequently be

available at www.dpeurasia.com .

Notes to Editors

DP Eurasia N.V. is the exclusive master franchisee of the

Domino's Pizza brand in Turkey, Russia, Azerbaijan and Georgia. The

Company was admitted to the premium listing segment of the Official

List of the Financial Conduct Authority and to trading on the main

market for listed securities of the London Stock Exchange plc on 3

July 2017. The Company (together with its subsidiaries, the " Group

" ) is the largest pizza delivery company in Turkey and the third

largest in Russia. The Group offers pizza delivery and takeaway/

eat-in facilities at its 771 stores (568 in Turkey, 190 in Russia,

nine in Azerbaijan and four in Georgia as at 31 December 2020), and

operates through its owned corporate stores (29%) and franchised

stores (71%). The Group maintains a strategic balance between

corporate and franchised stores, establishing networks of corporate

stores in its most densely populated areas to provide a development

platform upon which to promote best practice and maximise

profitability. The Group has adapted the Domino's Pizza globally

proven business model to its local markets.

Performance Review

Store count As at 31 December

------------------------------------------------------------------------------

2020 2019

Corporate Franchised Total Corporate Franchised Total

Turkey 106 462 568 123 427 550

Russia 115 75 190 121 82 203

Azerbaijan - 9 9 - 8 8

Georgia - 4 4 - 4 4

Total 221 550 771 244 521 765

Delivery channel mix and online like-for-like growth

The following table shows the Group's delivery system sales (3)

, broken down by ordering channel and by the Group's two largest

countries in which it operates, as a percentage of delivery system

sales for the periods ended 31 December 2020 and 2019:

For the year ended 31 December

--------------------------------------------------

2020 2019

------------------------ ------------------------

Turkey Russia Total Turkey Russia Total

Store 28.5% 10.3% 23.9% 32.0% 18.0% 27.8%

Group's online

Online platform 25.9% 71.4% 40.0% 28.5% 80.5% 47.0%

Aggregator 44.3% 18.3% 35.3% 35.7% 1.5% 22.8%

Total online 70.2% 89.7% 75.3% 64.2% 82.0% 69.9%

Call centre 1.3% - 0.9% 3.8% - 2.1%

Total 100% 100% 100% 100% 100% 100%

The following table shows the Group's online like-for-like

growth (2) , broken down by the Group's two largest countries in

which it operates, for the periods ended 31 December 2020 and

2019:

For the year ended 31

December

------------------------

2020 2019

----------- -----------

Group online system sales like-for-like

growth(2)

Group(5) 45.2% 29.0%

Turkey 54.4% 32.6%

Russia (based on RUB) 13.1% 15.4%

Liquidity

The Group continues to have a strong liquidity position, having

access to cash on hand and additional borrowing capacity available

from its Turkish banks. As at 31 December 2020, the Group had TRY

128 million of cash on hand and additional available bank lines of

TRY 142 million.

The Group's strong liquidity position enables it to prepay its

bank borrowings in Russia if required, and still maintain a strong

liquidity position. The Group obtained a waiver from Sberbank with

respect to its covenants for the first and second quarters of 2021

and is in negotiations to reset the covenants or repay the

remaining loan. The principal outstanding under the Sberbank loan

currently amounts to RUB 1.0 billion, of which RUB 0.2 billion is

supported by a cash collateral deposit.

Notes

(1) System sales are sales generated by the Group's corporate

and franchised stores to external customers and do not represent

revenue of the Group.

(2) Like-for-like growth is a comparison of sales between two

periods that compares system sales of existing system stores. The

Group's system stores that are included in like-for-like system

sales comparisons are those the Group considers to be mature

operations. The Group considers mature stores to be those stores

that have operated for at least 52 weeks preceding the beginning of

the first month of the period used in the like-for-like comparisons

for a certain reporting period, assuming the relevant system store

has not subsequently closed or been "split" (which involves the

Group opening an additional store within the same map of an

existing store or in an overlapping area).

(3) Delivery system sales are system sales of the Group

generated through the Group's delivery distribution channel.

(4) Online system sales are system sales of the Group generated

through its online ordering channel.

(5) Group like-for-like growth is a weighted average of the

country like-for-like growths based on store numbers as described

in Note (2).

Appendices

Exchange Rates

For the year ended 31 December

----------------------------------------------------------

2020 2019

---------------------------- ----------------------------

Currency Period End Period Average Period End Period Average

----------- --------------- ----------- ---------------

EUR/TRY 9.008 8.014 6.651 6.348

RUB/TRY 0.098 0.096 0.096 0.087

EUR/RUB 90.682 82.408 69.341 72.513

Delivery - Take away / Eat in mix

For the year ended 31 December

--------------------------------------------------

2020 2019

------------------------ ------------------------

Turkey Russia Total Turkey Russia Total

Delivery 72.5% 77.7% 74.0% 63.8% 62.2% 63.1%

Take away / Eat

in 27.5% 22.3% 26.0% 36.2% 37.8% 36.9%

Total(2) 100% 100% 100% 100% 100% 100%

Forward looking statements

This press release includes forward-looking statements which

involve known and unknown risks and uncertainties, many of which

are beyond the Group's control and all of which are based on the

Directors' current beliefs and expectations about future events.

They appear in a number of places throughout this press release and

include all matters that are not historical facts and include

predictions, statements regarding the intentions, beliefs or

current expectations of the Directors or the Group concerning,

among other things, the results of operations, financial condition,

prospects, growth and strategies of the Group and the industry in

which it operates.

No assurance can be given that such future results will be

achieved; actual events or results may differ materially as a

result of risks and uncertainties facing the Group. Such risks and

uncertainties could cause actual results to vary materially from

the future results indicated, expressed, or implied in such

forward-looking statements.

Forward-looking statements contained in this press release speak

only as of the date of this press release. The Company and the

Directors expressly disclaim any obligation or undertaking to

update these forward-looking statements contained in this press

release to reflect any change in their expectations or any change

in events, conditions, or circumstances on which such statements

are based.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSEEFWIEFSEEF

(END) Dow Jones Newswires

January 26, 2021 02:00 ET (07:00 GMT)

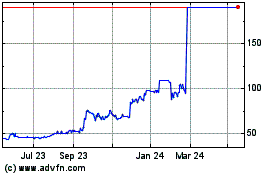

Dp Eurasia N.v (LSE:DPEU)

Historical Stock Chart

From Jul 2024 to Jul 2024

Dp Eurasia N.v (LSE:DPEU)

Historical Stock Chart

From Jul 2023 to Jul 2024