TIDMCORA

RNS Number : 1104A

Cora Gold Limited

22 May 2023

Cora Gold Limited / EPIC: CORA.L / Market: AIM / Sector:

Mining

22 May 2022

Cora Gold Limited ('Cora' or the 'Company')

2022 Final Results

and

Notice of Annual General Meeting

Cora Gold Limited, the West African focused gold company, is

pleased to announce its final audited results for the year ended 31

December 2022, and to give notice of the Company's Annual General

Meeting ('AGM') which will be held at 12:00pm on the 28 June 2023

at the offices of Hannam & Partners, 3rd Floor, 7-10 Chandos

Street, London, W1G 9DQ, United Kingdom and online.

Highlights

Ahead of construction, targeted to start in 2023, Cora's

flagship Sanankoro Gold Project delivered significant highlights

throughout 2022, including:

-- Updated Mineral Resource Estimate ('MRE') provided a 14%

increase in total MRE ounces for 24.9 Mt at 1.15 g/t Au for 920

koz, including a 22% increase in oxide Indicated Mineral Resources

to 509 koz.

-- Environmental Permit awarded in October 2022 following the

completion and submission of the Environmental and Social Impact

Assessment ('ESIA').

-- Optimised Project Economics , published November 2022 (using

a US$1,750 gold price), which included:

o 52.3% internal rate of return ('IRR')

o 1.2-year payback period

o US$71.8 million first full year Free Cash Flow ('FCF')

o US$234 million FCF over life of mine

o US$997/oz All-in Sustaining Costs ('AISC')

o 6.8 years Reserve mine life

o 56,000 oz annual average production

o US$90 million pre-production capital

Post year end, during Q1 2023 the Company closed a fundraising

through equity and convertible loan notes ('CLN') for US$19.8

million to support the commencement of development at Sanankoro

during 2023.

Bert Monro, CEO of Cora, commented: "2022 has been a significant

year for Cora as we approach construction readiness at our

Sanankoro Gold Project. The bulk of our attention focused on the

delivery of our Definitive Feasibility Study and Optimised Project

Economics, which were published in November. This work underlined

the robust technical and economic fundamentals of the Sanankoro

Project and highlighted in particular the potential strong free

cash flow of US$71.8 million in the first full year, based on a

US$1,750 gold price. Equally important is the low technical risk

with an open-pit free digging oxide operation, we have the benefit

of lower operating costs and also a low strip ratio.

"Our ongoing commitment to the responsible and sustainable

development of Sanankoro has been supported by the appointment of

an ESG manager in January 2022. The ESG team have continued their

important work to support and engage with local communities near

the Sanankoro Project, and strengthening communication channels as

we approach construction.

"2023 is set to be a pivotal year for Cora and we remain focused

on commencing construction in as short a time frame as practicable

once permitting and financing is completed. I would like to thank

Cora's shareholders for their continued strong support and patience

throughout this year."

Annual General Meeting

The AGM will be held at 12.00 p.m. (United Kingdom time) on 28

June 2023 at the offices of Hannam & Partners, 3rd Floor, 7-10

Chandos Street, London, W1G 9DQ, United Kingdom plus, in the

interest of allowing as many shareholders as possible to attend,

the AGM will also take place online. There are two ways in which

attendees may join the AGM online:

Option 1 By dial in. Use one of the telephone numbers and Meeting ID set out below:

-- telephone number: +44-(0)20-3481-5240

+44-(0)131-460-1196

+44-(0)330-088-5830

-- other local telephone numbers: https://us02web.zoom.us/u/kbDDvV7Ly4

-- Meeting ID: 831 9560 2852 #

Option 2 Over the internet. This requires the use of a device

(computer, laptop, tablet or smartphone) connected to the internet.

The device will need to have video switched on for the attendee to

be seen, and speakers and microphone capability activated in order

to be able to speak. Use the hyperlink set out below:

-- hyperlink: https://us02web.zoom.us/j/83195602852

Shareholders should note that if they elect to attend the AGM

online using Option 1 above, they will not, in accordance with the

articles of association of the Company, be counted as being present

at the meeting and will not be entitled to vote. The Company's

board of directors (the 'Board' or the 'Board of Directors')

strongly advises shareholders who wish to attend online to use

Option 2 above and ensure their video, microphone and speakers are

switched on.

The Board strongly advises shareholders to submit their votes by

proxy prior to the AGM. Shareholders who have submitted a proxy may

still attend the AGM. However, submitting a proxy means

shareholders know that their vote will be counted. Copies of proxy

forms (both Form of Proxy and Form of Instruction) can be

downloaded via the Company's website at

www.coragold.com/category/company-reports .

The Company always welcomes questions from its shareholders at

its general meetings. On this occasion the Board would rather

shareholders submit their questions beforehand in order that the

Board may ensure questions are answered either at the AGM or

afterwards. Questions should be submitted by email to

secretary@coragold.com no later than 12.00 p.m. (United Kingdom

time) on 23 June 2023.

The Company's Notice of AGM and Forms of Proxy will be

dispatched to shareholders shortly and will be available on the

website at https://www.coragold.com .

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) No 596/2014 ('MAR'), which is part of

UK law by virtue of the European Union (Withdrawal) Act 2018, until

the release of this announcements

**S**

For further information, please visit http://www.coragold.com or

contact:

Bert Monro Cora Gold Limited info@coragold.com

Craig Banfield

Christopher Raggett finnCap Ltd

Charlie Beeson Nomad & Broker +44 (0)20 7220 0500

--------------------- ---------------------

Susie Geliher St Brides Partners pr@coragold.com

Isabelle Morris Financial PR

Will Turner

--------------------- ---------------------

Notes

Cora is a West African gold developer with two de-risked project

areas within two known gold belts in Mali and Senegal covering

c.600 sq km. Led by a team with a proven track record in making

multi-million ounce gold discoveries that have been developed into

operating mines, its primary focus is on developing the Sanankoro

Gold Project in the Yanfolila Gold Belt, southern Mali, into an

open pit oxide mine. Based on a gold price of US$1,750/oz and a

Maiden Probable Reserve of 422 koz at 1.3 g/t Au the project has

strong economic fundamentals, including 52% IRR, US$234 million

Free Cash Flow over life of mine and all-in sustaining costs of

US$997/oz.

CHAIR'S STATEMENT

I am pleased to present the Annual Report of Cora Gold Limited

('Cora' or 'the Company') and its subsidiaries (together the

'Group') for the year ended 31 December 2022.

Cora is a gold company focused on two world class gold regions

in Mali and Senegal in West Africa, being the Yanfolila Gold Belt

(south Mali) and the Kédougou-Kéniéba Inlier gold belt (also known

as the 'Kenieba Window'; west Mali / east Senegal).

The strategy of the Company is, through systematic exploration,

to discover, delineate and develop economic ore bodies. Historical

exploration has resulted in the highly prospective Sanankoro Gold

Discovery ('Sanankoro', 'Sanankoro Gold Project' or the 'Project')

in the Yanfolila Gold Belt. Cora's highly experienced and

successful management team has a proven track record in making

multi-million ounce gold discoveries which have been developed into

operating mines. Cora's primary focus is on further developing its

flagship Sanankoro Gold Project, which the Company believes has the

potential for a standalone mine development.

Highlights

2022 has been a milestone year for Cora. Having completed work

on a Definitive Feasibility Study ('DFS') for Sanankoro, Cora can

now look towards mine development. Highlights for Sanankoro

included:

-- During Q1 2022 a drill programme got underway at Sanankoro

focused on enhancing the November 2021 Mineral Resource Estimate

('MRE') of 809.3 koz at 1.15 g/t Au. The drill programme was

completed in Q2 2022 and comprised 6,992 metres of reverse

circulation plus 897 metres of aircore drilling.

-- In Q3 2022 Cora announced an updated MRE for 24.9 Mt at 1.15

g/t Au for 920 koz, comprising Indicated Mineral Resources of 16.1

Mt at 1.27 g/t Au for 657 koz and Inferred Mineral Resources of 8.7

Mt at 0.94 g/t Au for 263 koz. This represented a 14% increase in

total MRE ounces compared to the November 2021 MRE, including a 22%

increase in oxide Indicated Mineral Resources to 509 koz from 419

koz. In addition, the 2022 drilling programme identified two new

discoveries, at Fode 1 and Target 6, close to existing Mineral

Resources.

-- On 14 October 2022 an Environmental Permit was awarded in

relation to mine development at the Sanankoro Gold Project. This

followed the completion and submission of an Environmental and

Social Impact Assessment on Sanankoro in July 2022, with all

environmental work having been completed in alignment with the

International Finance Corporation Performance Standards. Following

the award of the Environmental Permit and completion of the DFS

(see below) the Company is able to submit an application for a

Mining Permit over Sanankoro. On 28 November 2022 the Mali

government announced the suspension of issuing new mining permits.

When this moratorium is lifted then formal submission of the DFS

and the application for a Mining Permit will be submitted to the

Mali government. Further updates on this will be provided in due

course.

-- In November 2022 Cora announced completion of the DFS for

Sanankoro and the results of subsequent Optimised Project

Economics, notably:

-- JORC-compliant Maiden Probable Reserves of 10.1 Mt at 1.30

g/t Au for 422 koz for the Selin, Zone A and Zone B deposits;

-- post tax and based on a gold price of US$1,750/oz:

-- 52.3% internal rate of return

-- 1.2 year payback period

-- US$71.8 million first full year free cash flow ('FCF')

-- US$234 million FCF over life of mine

-- US$997/oz all-in sustaining cost

-- 6.8 years Reserve mine life

-- 56,000 oz annual average production

o US$90m pre-production capital (including mining pre-production

& contingencies); and

o solar hybrid power option incorporated into the plant design,

delivering savings in both operating costs and carbon

emissions.

-- In addition, the Company announced that:

-- further infill drilling should, in time, enable the

conversion of MRE Inferred Resources into Indicated with a view to

them then being added to the inventory of Reserves for the mine

schedule; and

-- an independently completed Exploration Target estimate

contains between 26.0 Mt and 35.2 Mt with a grade range of 0.58 g/t

Au - 1.21 g/t Au for a potential gold content of 490 koz - 1,370

koz, giving significant potential upside.

In Q4 2022 Cora provided an update on a regional exploration

programme carried out across all of Cora's southern Mali permits in

the Yanfolila Project Area. Most notably the results of this

programme identified over 12 km of pre-drilling gold structures

discovered from early stage exploration work across all permits in

the Yanfolila Project Area.

Outlook for 2023

2023 has already been busy for Cora with the closing of a

fundraising in Q1 2023 for aggregate investments of US$19.8

million, comprising US$3.9 million for ordinary shares in the

capital of the Company plus US$15.9 million for convertible loan

notes. We are very pleased with the strong support received for

this fundraising and over the coming months we look forward to

providing progress updates on our flagship Sanankoro Gold Project,

including submission of the application for a Mining Permit once

the current moratorium is lifted.

Cora's primary focus is on further developing Sanankoro and

following a review of projects in 2023 the board of directors

decided to terminate the Farani, Farassaba III, Siékorolé and

Tékélédougou projects in the Yanfolila Project Area.

Finally, I'd like to take this opportunity to thank the Cora

team for their hard work and thank Cora's shareholders for their

continued support. 2022 was a milestone year for the Company and I

am confident Cora will make further significant progress during

2023 and beyond.

Edward Bowie

Non-Executive Director & Chair of the Board of Directors

19 May 2023

Consolidated Statement of Financial Position

as at 31 December 2022

All amounts stated in thousands of United States dollar

2022 2021

Note(s) US$'000 US$'000

Non-current assets

Intangible assets 9 23,826 21,574

________ ________

Current assets

Trade and other receivables 10 91 208

Cash and cash equivalents 11 461 5,376

________ ________

552 5,584

________ ________

Total assets 24,378 27,158

________ ________

Current liabilities

Trade and other payables 12 (193) (570)

________ ________

Total liabilities (193) (570)

________ ________

Net current assets 359 5,014

________ ________

Net assets 24,185 26,588

________ ________

Equity and reserves

Share capital 14 28,202 28,202

Retained deficit (4,017) (1,614)

________ ________

Total equity 24,185 26,588

________ ________

The consolidated financial statements were approved and

authorised for issue by the board of directors of Cora Gold Limited

on 19 May 2023 and were signed on its behalf by

Robert Monro

Chief Executive Officer & Director

19 May 2023

The attached notes form an integral part of the Consolidated

Financial Statements.

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2022

All amounts stated in thousands of United States dollar (unless

otherwise stated)

2022 2021

Note(s) US$'000 US$'000

Overhead costs 6 (1,502) (1,296)

Impairment of intangible assets 9 (1,012) (466)

________ ________

Loss before income tax (2,514) (1,762)

Income tax 7 - -

________ ________

Loss for the year (2,514) (1,762)

Other comprehensive income - -

________ ________

Total comprehensive loss for the (2,514) (1,762)

year ________ ________

Earnings per share from continuing

operations attributable to owners

of the parent

Basic and fully diluted earnings

per share 8 (0.0087) (0.0076)

(United States dollar) ________ ________

The attached notes form an integral part of the Consolidated

Financial Statements.

Consolidated Statement of Changes in Equity

for the year ended 31 December 2022

All amounts stated in thousands of United States dollar

Share Retained Total

capital deficit equity

US$'000 US$'000 US$'000

As at 01 January 2021 18,118 (96) 18,022

________ ________ ________

Loss for the year - (1,762) (1,762)

________ ________ ________

Total comprehensive loss for - (1,762) (1,762)

the year ________ ________ ________

Proceeds from shares issued 10,063 - 10,063

Issue costs (126) - (126)

Proceeds from share options

exercised 147 - 147

Share based payments - share - 244 244

options ________ ________ ________

Total transactions with owners,

recognised directly in equity 10,084 244 10,328

________ ________ ________

As at 31 December 2021 28,202 (1,614) 26,588

________ ________ ________

As at 01 January 2022 28,202 (1,614) 26,588

________ ________ ________

Loss for the year - (2,514) (2,514)

________ ________ ________

Total comprehensive loss for - (2,514) (2,514)

the year ________ ________ ________

Share based payments - share - 111 111

options ________ ________ ________

Total transactions with owners,

recognised directly in equity - 111 111

________ ________ ________

As at 31 December 2022 28,202 (4,017) 24,185

________ ________ ________

The attached notes form an integral part of the Consolidated

Financial Statements.

Consolidated Statement of Cash Flows

for the year ended 31 December 2022

All amounts stated in thousands of United States dollar

2022 2021

Note(s) US$'000 US$'000

Cash flows from operating activities

Loss for the year (2,514) (1,762)

Adjustments for:

Share based payments - share options 111 244

Impairment of intangible assets 9 1,012 466

Decrease / (increase) in trade and

other receivables 117 (149)

(Decrease) / increase in trade and (377) 354

other payables ________ ________

Net cash used in operating activities (1,651) (847)

________ ________

Cash flows from investing activities

Additions to intangible assets 9 (3,264) (8,375)

________ ________

Net cash used in investing activities (3,264) (8,375)

________ ________

Cash flows from financing activities

Proceeds from shares issued 14 - 10,063

Issue costs 14 - (126)

Proceeds from share options exercised 14 - 147

________ ________

Net cash generated from financing - 10,084

activities ________ ________

Net (decrease) / increase in cash

and cash equivalents (4,915) 862

Cash and cash equivalents at beginning 11 5,376 4,514

of year ________ ________

Cash and cash equivalents at end of 11 461 5,376

year ________ ________

The attached notes form an integral part of the Consolidated

Financial Statements.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

All tabulated amounts stated in thousands of United States

dollar (unless otherwise stated)

1. General information

The principal activity of Cora Gold Limited ('the Company') and

its subsidiaries (together the 'Group') is the exploration and

development of mineral projects, with a primary focus in West

Africa. The Company is incorporated and domiciled in the British

Virgin Islands. The address of its registered office is Rodus

Building, Road Reef Marina, P.O. Box 3093, Road Town, Tortola

VG1110, British Virgin Islands.

2. Accounting policies

The principal accounting policies applied in the preparation of

financial statements are set out below ('Accounting Policies' or

'Policies'). These Policies have been consistently applied to all

the periods presented, unless otherwise stated.

2.1. Basis of preparation

The consolidated financial statements of Cora Gold Limited have

been prepared in accordance with International Financial Reporting

Standards ('IFRS') and IFRS Interpretations Committee ('IFRS IC')

as adopted by the European Union ('EU'). The consolidated financial

statements have been prepared under the historical cost

convention.

The financial statements are presented in United States dollar

(currency symbol: USD or US$), rounded to the nearest thousand,

which is the Group's functional and presentational currency.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It also

requires management to exercise its judgement in the process of

applying the Group's accounting policies. The areas involving a

higher degree of judgement or complexity, or areas where

assumptions and estimates are significant to the financial

statements are disclosed in Note 4.

(a) New and amended standards mandatory for the first time for

the financial period beginning 01 January 2022

New standards and amendments to standards and interpretations

which were effective for the financial period beginning on or after

01 January 2022 were not material to the Group or the Company.

(b) New standards, amendments and interpretations in issue but

not yet effective or not yet endorsed and not early adopted

The following standards have been published and are mandatory

for accounting periods beginning after 01 January 2023 but have not

been early adopted by the Group or the Company and could have

impact on the Group and the Company financial statements:

Effective

Title date

Amendments to IAS 1: Presentation of Financial 01 January

Statements: Classification of Liabilities 2023 ^

as Current or Non-current

Amendments to IAS 1: Classification of

Liabilities as Current or Non-current -

Deferral of Effective Date

Amendments to IAS 1: Presentation of Financial 01 January

Statements and IFRS Practice Statement 2023

2: Disclosure of Accounting Policies

Amendments to IAS 8: Accounting policies, 01 January

Changes in Accounting Estimates and Errors 2023

- Definition of Accounting Estimates

Key:

^ Not yet endorsed in the EU.

The Group is evaluating the impact of the new and amended

standards above. The directors believe that these new and amended

standards are not expected to have a material impact on the Group's

results or shareholders' funds.

2.2. Basis of consolidation

The consolidated financial statements incorporate those of the

Company and its subsidiary undertakings for all periods

presented.

Subsidiaries are entities over which the Group has control. The

Group controls an entity when the Group is exposed to, or has

rights to, variable returns from its involvement with the entity

and has the ability to affect those returns through its power over

the entity. Subsidiaries are fully consolidated from the date on

which control is transferred to the Group. They are deconsolidated

from the date that control ceases.

The Group applies the acquisition method of accounting to

account for business combinations. The consideration transferred

for the acquisition of a subsidiary is the fair values of the

assets transferred, the liabilities incurred to the former owners

of the acquiree and the equity interests issued by the Group. The

consideration transferred includes the fair value of any asset or

liability resulting from a contingent consideration arrangement.

Identifiable assets acquired and liabilities and contingent

liabilities assumed in a business combination are measured

initially at their fair values at the acquisition date.

Acquisition-related costs are expensed as incurred unless they

result from the issuance of shares, in which case they are offset

against the premium on those shares within equity.

Where necessary, adjustments are made to the financial

information of subsidiaries to bring the accounting policies used

into line with those used by other members of the Group. All

intercompany transactions and balances between Group entities are

eliminated on consolidation.

As at 31 December 2022 and 2021 the Company held:

-- a 100% shareholding in Cora Gold Mali SARL (registered in the

Republic of Mali; the address of its registered office is Rue 224

Porte 1279, Hippodrome 1, BP 2788, Bamako, Republic of Mali);

-- a 100% shareholding in Cora Exploration Mali SARL (the

address of its registered office is Rue 224 Porte 1279, Hippodrome

1, BP 2788, Bamako, Republic of Mali);

-- a 95% shareholding in Sankarani Ressources SARL (the address

of its registered office is Rue 841 Porte 202, Faladie SEMA, BP

366, Bamako, Republic of Mali). The remaining 5% of Sankarani

Ressources SARL can be purchased from a third party for US$1

million; and

-- Cora Resources Mali SARL (registered in the Republic of Mali;

the address of its registered office is Rue 841 Porte 202, Faladie

SEMA, BP 366, Bamako, Republic of Mali) was a wholly owned

subsidiary of Sankarani Ressources SARL.

2.3. Interest in jointly controlled entities

Joint venture arrangements that involve the establishment of a

separate entity in which each venturer has joint control are

referred to as jointly controlled entities. The results and assets

and liabilities of jointly controlled entities are included in

these financial statements for the period using the equity method

of accounting.

2.4. Going concern

As part of the Definitive Feasibility Study ('DFS') for the

Sanankoro Gold Project (completed in November 2022) cash flow

forecasts for the life of mine have been prepared. The forecasts

include the costs of developing the Sanankoro Gold Project,

including a construction period of 21 months (including

pre-construction engineering work and commissioning the plant) plus

related corporate and operational overheads. On 28 November 2022

the Mali government announced the suspension of issuing new mining

permits. When this moratorium is lifted then formal submission of

the DFS and the application for a Mining Permit will be submitted

to the Mali government, and construction will formally commence. In

addition, the Company has an unsecured obligation in relation to

issued and outstanding Convertible Loan Notes for a total of

US$15,875,000. The Mandatory Conversion of the Convertible Loan

Notes is subject to the conclusion of definitive binding agreements

in respect of senior debt in relation to the Sanankoro Gold Project

and such agreements being unconditional. If not converted then the

Convertible Loan Notes are repayable on their maturity date of 09

September 2023 at a 5% premium to the total amount outstanding. The

directors are confident in the ability of the Company to make such

repayment, if required, as well as fund working capital

requirements over the 12 month period from the date of

approval of these financial statements, using its current

balance of cash and cash equivalents. The forecasts demonstrate

that in the event that development of the Sanankoro Gold

Project:

-- is deferred, then: the Group has the ability to meet all

ongoing working capital requirements and committed payments during

the 12 month period from the date of approval of these financial

statements; and the directors are confident in the ability of the

Group to raise additional funding in subsequent periods from the

issue of equity or the sale of assets as and when this is

required.

-- continues, then: the Group will require additional funds

during the going concern period in order to undertake all the

planned discretionary exploration, evaluation and development

activities; and the directors are confident in the ability of the

Group to raise additional funding when required from the issue of

equity or the sale of assets, and from secured debt finance.

Any delays in the timing and / or quantum of raising additional

funds can be accommodated by deferring discretionary exploration,

evaluation and development expenditure.

The directors have a reasonable expectation that the Group will

have adequate resources to continue in operational existence for

the foreseeable future. Thus they continue to adopt the going

concern basis of accounting in preparing the financial

statements.

2.5. Segment reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the board of directors (the

'Board' or the 'Board of Directors') that makes strategic

decisions.

2.6. Foreign currencies

(i) Functional and presentational currency

Items included in the financial statements of the Group's

entities are measured using the currency of the primary economic

environment in which the entity operates (the 'functional

currency'). The financial statements are presented in United States

dollar, rounded to the nearest thousand, which is the Company's and

Group's functional and presentational currency.

(ii) Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions or valuation where such items are re-measured. Foreign

exchange gains and losses resulting from the settlement of such

transactions and from the translation at year-end exchange rates of

monetary assets and liabilities denominated in foreign currencies

are recognised in profit or loss.

2.7. Investments

Investments in subsidiary companies are stated at cost less

provision for impairment in value, which is recognised as an

expense in the period in which the impairment is identified in the

Company accounts. These investments are consolidated in the Group

consolidated accounts.

2.8. Intangible assets

The Group has adopted the provisions of IFRS 6 Exploration for

and Evaluation of Mineral Resources.

The Group capitalises expenditure as project costs, categorised

as intangible assets, when it determines that those costs will be

successful in finding specific mineral resources. Expenditure

included in the initial measurement of project costs and which are

classified as intangible assets relate to the acquisition of rights

to explore, topographical, geological, geochemical and geophysical

studies, exploratory drilling, trenching, sampling and activities

to evaluate the technical feasibility and commercial viability of

extracting a mineral resource. Capitalisation of pre-production

expenditure ceases when the mining property is capable of

commercial production. Project costs are recorded and held at cost.

An annual review is undertaken of each area of interest to

determine the appropriateness of continuing to capitalise and carry

forward project costs in relation to that area of interest.

Accumulated capitalised project costs in relation to (i) an expired

permit, (ii) an abandoned area of interest and / or (iii) a joint

venture over an area of interest which is now ceased, will be

written off in full as an impairment to profit or loss in the year

in which (i) the permit expired, (ii) the area of interest was

abandoned and / or (iii) the joint venture ceased.

Exploration and evaluation costs are assessed for impairment

when facts and circumstances suggest that the carrying amount of an

asset may exceed its recoverable amount.

2.9. Financial assets

Classification

The Group's financial assets consist of financial assets held at

amortised cost. The classification depends on the purpose for which

the financial assets were acquired. Management determines the

classification of its financial assets at initial recognition.

Financial assets held at amortised cost

Assets that are held for collection of contractual cash flows,

where those cash flows represent solely payments of principal and

interest, are measured at amortised cost. Any gain or loss arising

on derecognition is recognised directly in profit or loss and

presented in other gains / (losses) together with foreign exchange

gains and losses. Impairment losses are presented as a separate

line item in the statement of profit or loss.

They are included in current assets, except for maturities

greater than 12 months after the reporting date, which are

classified as non-current assets. The Group's financial assets at

amortised cost comprise trade and other current assets and cash and

cash equivalents at the year-end.

Recognition and measurement

Regular purchases and sales of financial assets are recognised

on the trade date - the date on which the Group commits to

purchasing or selling the asset. Financial assets are initially

measured at fair value plus transaction costs. Financial assets are

de-recognised when the rights to receive cash flows from the assets

have expired or have been transferred, and the Group has

transferred substantially all of the risks and rewards of

ownership.

Financial assets are subsequently carried at amortised cost

using the effective interest method.

Impairment of financial assets

The Group assesses, on a forward-looking basis, the expected

credit losses associated with its financial assets carried at

amortised cost. For trade and other receivables due within 12

months the Group applies the simplified approach permitted by IFRS

9. Therefore, the Group does not track changes in credit risk, but

rather recognises a loss allowance based on the financial asset's

lifetime expected credit losses at each reporting date.

A financial asset is impaired if there is objective evidence of

impairment as a result of one or more events that occurred after

the initial recognition of the asset, and that loss event(s) had an

impact on the estimated future cash flows of that asset that can be

estimated reliably. The Group assesses at the end of each reporting

period whether there is objective evidence that a financial asset,

or a group of financial assets, is impaired.

The criteria that the Group uses to determine that there is

objective evidence of an impairment loss include:

-- significant financial difficulty of the issuer or

obligor;

-- a breach of contract, such as a default or delinquency in

interest or principal repayments;

-- the Group, for economic or legal reasons relating to the

borrower's financial difficulty, granting to the borrower a

concession that the lender would not otherwise consider;

-- it becomes probable that the borrower will enter bankruptcy

or other financial reorganisation.

The Group first assesses whether objective evidence of

impairment exists.

The amount of the loss is measured as the difference between the

asset's carrying amount and the present value of estimated future

cash flows (excluding future credit losses that have not been

incurred), discounted at the financial asset's original effective

interest rate. The asset's carrying amount is reduced and the loss

is recognised in profit or loss.

If, in a subsequent period, the amount of the impairment loss

decreases and the decrease can be related objectively to an event

occurring after the impairment was recognised (such as an

improvement in the debtor's credit rating), the reversal of the

previously recognised impairment loss is recognised in profit or

loss.

2.10. Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand, and

are subject to an insignificant risk of changes in value.

2.11. Share capital

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of new shares or options are

shown in equity as a deduction, net of tax, from the proceeds.

2.12. Reserves

Retained (deficit) / earnings - the retained (deficit) /

earnings reserve includes all current and prior periods retained

profit and losses, and share based payments.

2.13. Financial liabilities at amortised cost

Trade payables are obligations to pay for goods or services that

have been acquired in the ordinary course of business from

suppliers. Accounts payable are classified as current liabilities

if payment is due within one year or less. If not, they are

presented as non-current liabilities.

Trade payables are recognised initially at fair value, and

subsequently measured at amortised cost using the effective

interest method.

Other financial liabilities are initially measured at fair

value. They are subsequently measured at amortised cost using the

effective interest method.

Financial liabilities are de-recognised when the Group's

contractual obligations expire or are discharged or cancelled.

2.14. Provisions

The Group provides for the costs of restoring a site where a

legal or constructive obligation exists. The estimated future costs

for known restoration requirements are determined on a site-by-site

basis and are calculated based on the present value of estimated

future costs. All provisions are discounted to their present

value.

2.15. Taxation

Tax is recognised in the Income Statement, except to the extent

that it relates to items recognised in other comprehensive income

or directly in equity. In this case, the tax is also recognised in

other comprehensive income or directly in equity, respectively.

Current tax is calculated using tax rates that have been enacted or

substantively enacted by the reporting end date.

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profit, and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised.

2.16. Share based payments

Equity-settled share based payments with employees and others

providing services are measured at the fair value of the equity

instruments at the grant date. Fair value is measured by use of an

appropriate pricing model. The Company has adopted the

Black-Scholes Model for this purpose.

Equity-settled share based payment transactions with other

parties are measured at the fair value of the goods and services,

except where the fair value cannot be estimated reliably in which

case they are valued at the fair value of the equity instrument

granted.

3. Financial risk management

3.1. Financial risk factors

The Group's activities expose it to a variety of financial

risks: market risk, credit risk and liquidity risk. The Group's

overall risk management programme focuses on the unpredictability

of financial markets and seeks to minimise potential adverse

effects on the Group's financial performance.

Risk management is carried out by the management team under

policies approved by the Board.

(i) Market risk

The Group is exposed to market risk, primarily relating to

interest rate, foreign exchange and commodity prices. The Group

does not hedge against market risks as the exposure is not deemed

sufficient to enter into forward contracts. The Group has not

sensitised the figures for fluctuations in interest rates, foreign

exchange or commodity prices as the directors are of the opinion

that these fluctuations would not have a significant impact on the

financial statements of the Group at the present time. The

directors will continue to assess the effect of movements in market

risks on the Group's financial operations and initiate suitable

risk management measures where necessary.

(ii) Credit risk

Credit risk arises from cash and cash equivalents as well as

outstanding receivables. To manage this risk, the Group

periodically assesses the financial reliability of customers and

counterparties.

The amount of exposure to any individual counterparty is subject

to a limit, which is assessed by the Board.

The Group considers the credit ratings of banks in which it

holds funds in order to reduce exposure to credit risk.

(iii) Liquidity risk

Cash flow and working capital forecasting is performed for all

entities in the Group for regular reporting to the Board. The

directors monitor these reports and forecasts to ensure the Group

has sufficient cash to meet its operational needs.

3.2. Capital risk management

The Group's objectives when managing capital are to safeguard

the Group's ability to continue as a going concern, in order to

enable the Group to continue its exploration and evaluation

activities, and to maintain an optimal capital structure to reduce

the cost of capital.

The Group defines capital based on the total equity of the

Company. The Group monitors its level of cash resources available

against future planned operational activities and may issue new

shares in order to raise further funds from time to time.

4. Judgements and key sources of estimation uncertainty

The preparation of the financial statements in conformity with

IFRSs requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amount of expenses during the

year. Actual results may vary from the estimates used to produce

these financial statements.

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

Significant items subject to such estimates and assumptions

include, but are not limited to:

(i) Intangible assets (see Note 9)

An annual review is undertaken of each area of interest to

determine the appropriateness of continuing to capitalise and carry

forward project costs in relation to that area of interest.

Accumulated capitalised project costs in relation to (i) an expired

permit, (ii) an abandoned area of interest and / or (iii) a joint

venture over an area of interest which is now ceased, will be

written off in full as an impairment to the statement of income in

the year in which (i) the permit expired, (ii) the area of interest

was abandoned and / or (iii) the joint venture ceased.

Each exploration project is subject to review by a senior Group

geologist to determine if the exploration results returned to date

warrant further exploration expenditure and have the potential to

result in an economic discovery. This review takes into

consideration long-term metal prices, anticipated resource volumes

and grades, permitting and infrastructure. The directors have

reviewed each project with reference to these criteria and have

made adjustments for any impairment as necessary.

5. Segmental analysis

The Group operates principally in the UK and West Africa, with

operations managed on a project by project basis. Activities in the

UK are administrative in nature whilst the activities in West

Africa relate to exploration and evaluation.

An analysis of the Group's overhead costs, and reportable

segment assets and liabilities is as follows:

UK Africa Total

US$'000 US$'000 US$'000

Year ended 31 December 2022

Overhead costs 1,502 - 1,502

Impairment of intangible assets - 1,012 1,012

_______ _______ _______

Loss from operations per reportable 1,502 1,012 2,514

segment _______ _______ _______

As at 31 December 2022

Reportable segment assets 512 23,866 24,378

Reportable segment liabilities (94) (99) (193)

_______ _______ _______

UK Africa Total

US$'000 US$'000 US$'000

Year ended 31 December 2021

Overhead costs 1,288 8 1,296

Impairment of intangible assets - 466 466

_______ _______ _______

Loss from operations per reportable 1,288 474 1,762

segment _______ _______ _______

As at 31 December 2021

Reportable segment assets 5,463 21,695 27,158

Reportable segment liabilities (77) (493) (570)

_______ _______ _______

6. Expenses by nature

2022 2021

US$'000 US$'000

Employees' and directors' remuneration

(see below) 584 574

Legal and professional 149 324

General administration 104 68

Investor relations and conferences 72 64

Auditor's remuneration (see below) 33 39

Travel 19 11

Consultants - 8

_______ _______

961 1,088

Share based payments - share options 111 244

Foreign exchange loss / (gain) 430 (36)

_______ _______

Overhead costs 1,502 1,296

_______ _______

Employees' and directors' remuneration

The average monthly number of employees and directors was as

follows:

2022 2021

Non-executive directors 4 4

Employees 32 36

_______ _______

Total average number of employees 36 40

and directors _______ _______

Employees' and directors' remuneration comprised:

2022 2021

US$'000 US$'000

Non-executive directors' fees 129 109

Wages and salaries 1,078 1,494

Social security costs 142 119

Pension contributions 16 16

_______ _______

Total employees' and directors'

remuneration 1,365 1,738

Capitalised to project costs (intangible (781) (1,164)

assets) _______ _______

Employees' and directors' remuneration 584 574

expensed _______ _______

Auditor's remuneration

Expenditures relating to the Company's auditor, PKF Littlejohn

LLP, in respect of both audit and non-audit services were as

follows:

2022 2021

US$'000 US$'000

Audit fees: audit of the Group and

the Company's financial statements 33 39

_______ _______

Auditor's remuneration expensed 33 39

_______ _______

7. Income tax

The Company is tax resident in the British Virgin Islands, where

corporate profits are taxed at 0%. The Group's subsidiaries in Mali

are taxed at 30%. For the years ended 31 December 2022 and 2021 no

current or deferred tax arose, and no deferred tax asset has been

recognised due to the uncertainty of future taxable profits.

The tax on the Group's loss before tax differs from the

theoretical amount that would arise as follows:

2022 2021

US$'000 US$'000

Loss before tax (2,514) (1,762)

_______ _______

Tax at standard rate of 0% (2021: 0%) - -

Effects of:

Impairment of intangible assets 304 140

Other - 2

Difference in overseas tax rates (304) (142)

_______ _______

Income tax - -

_______ _______

8. Earnings per share

The calculation of the basic and fully diluted earnings per

share attributable to the equity shareholders is based on the

following data:

2022 2021

US$'000 US$'000

Net loss attributable to equity shareholders (2,514) (1,762)

_______ _______

Weighted average number of shares for

the purpose of 289,557 231,393

basic and fully diluted earnings per _______ _______

share (000's)

Basic and fully diluted earnings per

share (0.0087) (0.0076)

(United States dollar) _______ _______

As at 31 December 2022 and 2021 the Company's issued and

outstanding capital structure comprised a number of ordinary shares

and share options (see Note 14).

9. Intangible assets

Intangible assets relate to exploration and evaluation project

costs capitalised as at 31 December 2022 and 2021, less

impairment.

2022 2021

US$'000 US$'000

As at 01 January 21,574 13,665

Additions 3,264 8,375

Impairment (1,012) (466)

_______ _______

As at 31 December 23,826 21,574

_______ _______

Additions to project costs during the years ended 31 December

2022 and 2021 were in the following geographical areas:

2022 2021

US$'000 US$'000

Mali 3,256 8,292

Senegal 8 83

_______ _______

Additions to projects costs 3,264 8,375

_______ _______

Impairment of project costs during the years ended 31 December

2022 and 2021 relate to the following terminated projects:

2022 2021

US$'000 US$'000

Tagan (Yanfolila Project Area, Mali) 891 -

Satifara Sud (Diangounté Project

Area, Mali) 116 -

Winza (Yanfolila Project Area, Mali) 5 193

Kakadian (Diangounté Project Area,

Mali) - 145

Satifara Ouest (Diangounté Project

Area, Mali) - 79

Karan Ouest (Sanankoro Project Area, - 49

Mali) _______ _______

Impairment of project costs 1,012 466

_______ _______

Those projects which were terminated were considered by the

Board to be no longer prospective.

Project costs capitalised as at 31 December 2022 and 2021

related to the following geographical areas:

2022 2021

US$'000 US$'000

Mali 23,318 21,074

Senegal 508 500

_______ _______

As at 31 December 23,826 21,574

_______ _______

After the reporting date certain projects were terminated (see

Note 19).

10. Trade and other receivables

2022 2021

US$'000 US$'000

Other receivables - 113

Prepayments 91 95

_______ _______

91 208

_______ _______

11. Cash and cash equivalents

Cash and cash equivalents held as at 31 December 2022 and 2021

were in the following currencies:

2022 2021

US$'000 US$'000

British pound sterling (GBPGBP) 421 5,358

CFA franc (XOF) 34 8

United States dollar (US$) 5 7

Euro (EUREUR) 1 3

_______ _______

461 5,376

_______ _______

External ratings of cash at bank and short-term deposits as at

31 December 2022 and 2021 were as follows:

2022 2021

US$'000 US$'000

A1 427 5,368

A2 34 8

_______ _______

461 5,376

_______ _______

12. Trade and other payables

2022 2021

US$'000 US$'000

Trade payables 58 408

Other payables 30 -

Accruals 105 162

_______ _______

193 570

_______ _______

13. Financial instruments

2022 2021

US$'000 US$'000

Financial assets at amortised

cost

Trade and other receivables - 113

Cash and cash equivalents 461 5,376

_______ _______

461 5,489

_______ _______

Financial liabilities at amortised

cost

Trade and other payables 193 570

_______ _______

193 570

_______ _______

14. Share capital

The Company is authorised to issue an unlimited number of no par

value shares of a single class.

As at 31 December 2020 the Company's issued and outstanding

capital structure comprised:

-- 205,382,159 ordinary shares;

-- share options over 1,900,000 ordinary shares in the capital

of the Company exercisable at 16.5 pence (British pound sterling)

per ordinary share expiring on 18 December 2022;

-- share options over 6,200,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023; and

-- share options over 7,200,000 ordinary shares in the capital

of the Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025.

During the year ended 31 December 2021:

-- on 09 June 2021 the Company closed a subscription for

40,425,000 ordinary shares in the capital of the Company at a price

of 7.75 pence (British pound sterling) per ordinary share for total

gross proceeds of GBPGBP3,132,937.50 - certain directors of the

Company participated in this subscription (see Note 18);

-- on 15 June 2021 share options over 275,000 ordinary shares in

the capital of the Company exercisable at 16.5 pence (British pound

sterling) per ordinary share expiring on 18 December 2022 were

cancelled;

-- on 30 June 2021 share options over 100,000 ordinary shares in

the capital of the Company exercisable at 10 pence (British pound

sterling) per ordinary share expiring on 12 October 2025 were

cancelled;

-- on 06 September 2021 share options were exercised over

1,250,000 ordinary shares in the capital of the Company at a price

of 8.5 pence (British pound sterling) per ordinary share expiring

on 09 October 2023 for total gross proceeds of GBPGBP106,250;

-- on 08 December 2021:

-- the Company closed a placing and subscription for 42,500,000

ordinary shares in the capital of the Company at a price of 10

pence (British pound sterling) per ordinary share for total gross

proceeds of GBPGBP4,250,000 - certain directors of the Company

participated in this subscription (see Note 18);

-- the Board granted and approved share options over 7,850,000

ordinary shares in the capital of the Company exercisable at 10.5

pence (British pound sterling) per ordinary share expiring on 08

December 2026;

-- on 31 December 2021:

-- share options over 400,000 ordinary shares in the capital of

the Company exercisable at 16.5 pence (British pound sterling) per

ordinary share expiring on 18 December 2022 were cancelled;

-- share options over 2,500,000 ordinary shares in the capital

of the Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025 were cancelled;

-- share options over 1,200,000 ordinary shares in the capital

of the Company exercisable at 10.5 pence (British pound sterling)

per ordinary share expiring on 08 December 2026 were cancelled.

As at 31 December 2021 the Company's issued and outstanding

capital structure comprised:

-- 289,557,159 ordinary shares;

-- share options over 1,225,000 ordinary shares in the capital

of the Company exercisable at 16.5 pence (British pound sterling)

per ordinary share expiring on 18 December 2022;

-- share options over 4,950,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023;

-- share options over 4,600,000 ordinary shares in the capital

of the Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025; and

-- share options over 6,650,000 ordinary shares in the capital

of the Company exercisable at 10.5 pence (British pound sterling)

per ordinary share expiring on 08 December 2026.

During the year ended 31 December 2022:

-- on 14 May 2022 share options over 100,000 ordinary shares in

the capital of the Company exercisable at 10.5 pence (British pound

sterling) per ordinary share expiring on 08 December 2026 were

cancelled; and

-- on 18 December 2022 share options over 1,225,000 ordinary

shares in the capital of the Company exercisable at 16.5 pence

(British pound sterling) per ordinary share expired.

As at 31 December 2022 the Company's issued and outstanding

capital structure comprised:

-- 289,557,159 ordinary shares;

-- share options over 4,950,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023;

-- share options over 4,600,000 ordinary shares in the capital

of the Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025; and

-- share options over 6,550,000 ordinary shares in the capital

of the Company exercisable at 10.5 pence (British pound sterling)

per ordinary share expiring on 08 December 2026.

Movements in capital during the years ended 31 December 2022 and

2021 were as follows:

Share options

over number of ordinary shares

(exercise price per ordinary

share; expiring date)

------------ ---------

Number 16.5 pence; 8.5 pence; 10 pence; 10.5 pence;

of ordinary 18 December 09 October 12 October 08 December Proceeds

shares 2022 2023 2025 2026 US$'000

------------ ---------

As at 01 January

2021 205,382,159 1,900,000 6,200,000 7,200,000 - 18,118

Placing and subscriptions 82,925,000 - - - - 10,063

Exercise of share

options 1,250,000 - (1,250,000) - - 147

Granting of share

options - - - - 7,850,000 -

Cancellation of

share options - (675,000) - (2,600,000) (1,200,000) -

Issue costs - - - - - (126)

__________ _________ _________ _________ _________ ________

As at 31 December

2021 289,557,159 1,225,000 4,950,000 4,600,000 6,650,000 28,202

Cancellation of

share options - - - - (100,000) -

Expiry of share - (1,225,000) - - - -

options __________ _________ _________ _________ _________ ________

As at 31 December 289,557,159 - 4,950,000 4,600,000 6,550,000 28,202

2022 __________ _________ _________ _________ _________ ________

The fair value of share options and warrants issued to a broker

of a placing has been calculated using the Black-Scholes Model, the

inputs into which were as follows:

-- for share options granted on 09 October 2019:

-- strike price 8.5 pence (British pound sterling);

-- share price 7.47 pence (British pound sterling);

-- volatility 34.7%;

-- expiring on 09 October 2023;

-- risk free rate 0.6%; and

-- dividend yield 0%;

-- for share options granted on 12 October 2020:

-- strike price 10 pence (British pound sterling);

-- share price 10.5 pence (British pound sterling);

-- volatility 25.9%;

-- expiring on 12 October 2025;

-- risk free rate 0.6%; and

-- dividend yield 0%;

-- for share options granted on 08 December 2021:

-- strike price 10.5 pence (British pound sterling);

-- share price 9.6 pence (British pound sterling);

-- volatility 22.2%;

-- expiring on 08 December 2026;

-- risk free rate 0.6%; and

-- dividend yield 0%.

The cost of share based payments relating to share options has

been recognised in the consolidated statement of comprehensive

income and in retained (deficit) / earnings.

15. Ultimate controlling party

The Company does not have an ultimate controlling party.

As at 31 December 2022 the Company's largest shareholder was

Brookstone Business Inc ('Brookstone') which held 82,796,025

ordinary shares, being 28.59% of the total number of ordinary

shares issued and outstanding. Brookstone is wholly owned and

controlled by First Island Trust Company Ltd as Trustee of The Nodo

Trust, being a discretionary trust with a broad class of potential

beneficiaries. Patrick Quirk, father of Paul Quirk (Non-Executive

Director of the Company), is a potential beneficiary of The Nodo

Trust.

Brookstone, Key Ventures Holding Ltd ('KVH') and Paul Quirk

(Non-Executive Director of the Company) (collectively the

'Investors'; as at 31 December 2022 their aggregated shareholdings

being 33.32% of the total number of ordinary shares issued and

outstanding) entered into a Relationship Agreement on 18 March 2020

to regulate the relationship between the Investors and the Company

on an arm's length and normal commercial basis. In the event that

Investors' aggregated shareholdings becomes less than 30% then the

Relationship Agreement shall terminate. KVH is wholly owned and

controlled by First Island Trust Company Ltd as Trustee of The

Sunnega Trust, being a discretionary trust of which Paul Quirk

(Non-Executive Director of the Company) is a potential

beneficiary.

16. Contingent liabilities

A number of the Company's project areas have potential net

smelter return royalty obligations, together with options for the

Company to buy out the royalty. At the current stage of

development, it is not considered that the outcome of these

contingent liabilities can be considered probable or reasonably

estimable and hence no provision has been recognised in the

financial statements.

17. Capital commitments

There were no capital commitments as at 31 December 2022.

During 2020 and 2021 the Company entered into contracts with a

number of contractors in respect of the DFS for the Sanankoro Gold

Project. Total estimated costs in respect of the DFS contractors

were approximately US$2,000,000. As at 31 December 2021, under the

terms of the contracts, the Company had incurred costs of

approximately US$1,080,000. Accordingly, as at 31 December 2021 the

balance of outstanding capital commitments was approximately

US$920,000. The DFS was completed in 2022.

18. Related party transactions

There were no reportable related party transactions during the

year ended 31 December 2022.

During the year ended 31 December 2021:

-- GBPGBP162,667 was paid to Norman Bailie, the Company's Head

of Exploration, and Mr Bailie's consultancy business, Phoenix (PPM)

Consultants, for exploration services. This arrangement with Mr

Bailie and Phoenix (PPM) Consultants terminated on 31 December

2021;

-- on 09 June 2021 the Company closed a subscription for

40,425,000 ordinary shares in the capital of the Company at a price

of 7.75 pence (British pound sterling) per ordinary share for total

gross proceeds of GBPGBP3,132,937.50. The following directors of

the Company participated in this subscription:

-- Edward Bowie, Non-Executive Director of the Company &

Chair of the Board of Directors, subscribed for 64,000 ordinary

shares for total gross proceeds of GBPGBP4,960;

-- Andrew Chubb, Non-Executive Director of the Company,

subscribed for 129,000 ordinary shares for total gross proceeds of

GBPGBP9,997.50;

-- Robert Monro, Chief Executive Officer & Director of the

Company, subscribed for 182,000 ordinary shares for total gross

proceeds of GBPGBP14,105; and

-- Key Ventures Holding Ltd, which is wholly owned and

controlled by First Island Trust Company Ltd as Trustee of The

Sunnega Trust being a discretionary trust of which Paul Quirk

(Non-Executive Director of the Company) is a potential beneficiary,

subscribed for 1,820,000 ordinary shares for total gross proceeds

of GBPGBP141,050;

-- on 07 September 2021 the Company entered into a US$25 million

mandate and term sheet with Lionhead Capital Advisors Proprietary

Limited ('Lionhead') to fund the development of the Sanankoro Gold

Project. This was conditional on, among other matters, the

completion of a DFS on the Sanankoro Gold Project. Paul Quirk

(Non-Executive Director of the Company) is a director of Lionhead.

Following completion of the DFS in November 2022 the mandate and

term sheet with Lionhead was renegotiated, and this resulted in a

new mandate and term sheet being entered into on 09 February 2023

(see Note 19);

-- on 08 December 2021 the Company closed a placing and

subscription for 42,500,000 ordinary shares in the capital of the

Company at a price of 10 pence (British pound sterling) per

ordinary share for total gross proceeds of GBPGBP4,250,000. The

following directors of the Company participated in this

subscription:

-- Edward Bowie, Non-Executive Director of the Company &

Chair of the Board of Directors, subscribed for 100,000 ordinary

shares for total gross proceeds of GBPGBP10,000;

-- Andrew Chubb, Non-Executive Director of the Company,

subscribed for 200,000 ordinary shares for total gross proceeds of

GBPGBP20,000; and

-- Robert Monro, Chief Executive Officer & Director of the

Company, subscribed for 300,000 ordinary shares for total gross

proceeds of GBPGBP30,000.

19. Events after the reporting date

On 09 February 2023 the Company entered into an up to US$30

million mandate and term sheet (the 'Term Sheet') with Lionhead to

fund the development of the Sanankoro Gold Project (the 'Project

Financing'). This Term Sheet replaces the previous one entered into

with Lionhead on 07 September 2021 (see Note 18). Paul Quirk

(Non-Executive Director of the Company) is a director of

Lionhead.

On 13 March 2023 the Company closed a subscription for:

-- 80,660,559 ordinary shares in the capital of the Company at a

price of US$0.0487 per ordinary share for total gross proceeds of

US$3,928,169.26 (the 'Equity Financing'); and

-- convertible loan notes ('CLN' or 'Convertible Loan Notes')

convertible into ordinary shares in the capital of the Company in

accordance with the Convertible Loan Note Instrument dated 28

February 2023 for a total of US$15,875,000 (the 'Convertible

Financing')

(together the 'Fundraising'). The Fundraising is part of the

Project Financing arrangement with Lionhead. The following

directors of the Company participated in the Fundraising:

-- Edward Bowie, Non-Executive Director of the Company &

Chair of the Board of Directors, subscribed for 100,000 ordinary

shares for total gross proceeds of US$4,870 plus CLN with a value

of US$20,000;

-- Andrew Chubb, Non-Executive Director of the Company,

subscribed for CLN with a value of US$20,000; and

-- Robert Monro, Chief Executive Officer & Director of the

Company, subscribed for 206,000 ordinary shares for total gross

proceeds of US$10,032.20 plus CLN with a value of US$30,000.

In accordance with the Term Sheet a total fee of US$567,902.39

was paid to Lionhead in relation to the Fundraising.

The Convertible Loan Note Instrument dated 28 February 2023 sets

out the terms of the CLN, which are principally as follows:

-- Maturity Date: 09 September 2023.

-- Coupon: 0%.

-- Mandatory Conversion: In the event of conclusion of

definitive binding agreements in respect of senior debt and such

agreements being unconditional:

-- on or prior to 11 June 2023, at the lower of (a) US$0.0596

per ordinary share, (b) the market price per ordinary share as at

the date of the Mandatory Conversion and (c) the price of any

equity issuance by the Company in the prior 60 days (excluding

shares issued pursuant to the Company's Share Option Scheme or

pursuant to terms of any other agreement entered into prior to 13

March 2023);

-- after 11 June 2023, at the lower of (a) US$0.0542 per

ordinary share, (b) the market price per ordinary share as at the

date of the Mandatory Conversion and (c) the price of any equity

issuance by the Company in the prior 60 days (excluding shares

issued pursuant to the Company's Share Option Scheme or pursuant to

terms of any other agreement entered into prior to 13 March

2023).

-- Optional Conversion: At the election of the holder at any

time after 11 June 2023, at US$0.0569 per ordinary share.

-- Repayment: Repayable on Maturity Date, if not converted, or

earlier, at the option of the holder, in the case of a (i) a change

of control of the Company (ii) the merger or sale of the Company

(including the sale of substantially all of the assets), at a 5%

premium to the total amount outstanding under the CLN.

-- Net Smelter Royalty: Holders of CLN have proportionate

participation in a Net Smelter Royalty ('NSR') of 1% in respect of

all ores, minerals, metals and materials containing gold mined and

sold or removed from the Sanankoro Gold Project, until 250,000 ozs

of gold has been produced and sold from the Sanankoro Gold Project,

provided that the Company may purchase and terminate the NSR, in

full and not in part, at any time for a value of US$3 million.

-- Other: CLN are issued fully paid in amount and are fully transferable.

Immediately upon closing of the Fundraising on 13 March

2023:

-- the total number of ordinary shares issued was 370,217,718;

-- Brookstone, the Company's largest shareholder, held

103,329,906 ordinary shares (being 27.91% of the total number of

ordinary shares issued and outstanding); and

-- the aggregated shareholdings of the Investors (see Note 15)

were 31.60% of the total number of ordinary shares issued and

outstanding.

On 13 March 2023 the Board granted and approved share options

over 14,350,000 ordinary shares in the capital of the Company

exercisable at 4 pence (British pound sterling) per ordinary share

expiring on 13 March 2028.

As at the date of these consolidated financial statements the

Company's issued and outstanding capital structure comprised:

-- 370,217,718 ordinary shares;

-- share options over 4,950,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023;

-- share options over 4,600,000 ordinary shares in the capital

of the Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025;

-- share options over 6,550,000 ordinary shares in the capital

of the Company exercisable at 10.5 pence (British pound sterling)

per ordinary share expiring on 08 December 2026; and

-- share options over 14,350,000 ordinary shares in the capital

of the Company exercisable at 4 pence (British pound sterling) per

ordinary share expiring on 13 March 2028.

In addition, the Company had an unsecured obligation in relation

to issued and outstanding Convertible Loan Notes for a total of

US$15,875,000, being convertible into ordinary shares in accordance

with the Convertible Loan Note Instrument dated 28 February 2023.

These Convertible Loan Notes were issued on 13 March 2023 and have

a maturity date of 09 September 2023.

Cora's primary focus is on further developing Sanankoro and

following a review of projects in 2023 the board of directors

decided to terminate all projects in the Yanfolila Project Area

(southern Mali), being the Farani, Farassaba III, Siékorolé and

Tékélédougou permits. Intangible assets relating to exploration and

evaluation project costs capitalised as at 31 December 2022 and

2021 in respect of such terminated projects were as follows:

2022 2021

US$'000 US$'000

Siékorolé (Yanfolila Project

Area, Mali) 784 760

Tékélédougou (Yanfolila

Project Area, Mali) 513 494

Farassaba III (Yanfolila Project Area,

Mali) 417 393

Farani (Yanfolila Project Area, Mali) 49 37

_______ _______

1,763 1,684

_______ _______

Subsequent to 31 December 2022 an impairment adjustment has been

made in respect of the exploration and evaluation project costs

capitalised to the above terminated projects.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR ABMJTMTJTBAJ

(END) Dow Jones Newswires

May 22, 2023 02:00 ET (06:00 GMT)

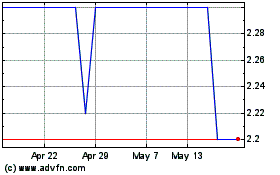

Cora Gold (LSE:CORA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cora Gold (LSE:CORA)

Historical Stock Chart

From Dec 2023 to Dec 2024