RNS Number:7526W

Civica PLC

11 January 2006

Not for release, distribution or publication in whole or in part in, into or

from the United States, Canada, Australia, Ireland or Japan or any other

jurisdiction if to do so would constitute a violation of the relevant laws of

such jurisdiction.

Recommended cash offer by Investec on behalf of Civica plc for the entire issued

and to be issued share capital of Comino Group plc

Levels of acceptances and extension of the Offer

Level of Acceptances

On 13 December 2005, Civica plc ("Civica") announced the terms of a recommended

cash offer to purchase the entire issued and to be issued share capital of

Comino Group plc ("Comino") for 335p per Comino Share. The Offer was made by

Investec on behalf of Civica. The Offer Document was posted to Comino

Shareholders on 20 December 2005.

Civica announces that, as at 1.00 p.m. on 10 January 2006, being the first

closing date of the Offer, valid acceptances of the Offer had been received in

respect of a total of 10,298,580 Comino Shares representing approximately 73.3

per cent. of the issued share capital of Comino.

Prior to making the Offer, Civica obtained irrevocable undertakings to accept,

or procure the acceptance of, the Offer from certain Comino Shareholders in

respect of 4,141,591 Comino Shares, representing in aggregate approximately 29.5

per cent. of the issued share capital of Comino. In respect of the Comino Shares

which are the subject of irrevocable undertakings, Civica had at 1.00 pm on 10

January 2006 received valid acceptances in respect of all such shares.

Prior to the making of the Offer, Civica had also received a letter of intent in

respect of 1,577,286 Comino Shares representing 11.2 per cent. of the issued

share capital of Comino. Valid acceptances have been received in respect of all

such shares.

The acceptances received pursuant to the irrevocable undertakings and letter of

intent are included in the total number of valid acceptances referred to above.

Save as disclosed above, neither Civica nor any person deemed to be acting in

concert with Civica for the purpose of the Offer: (a) owned or controlled any

Comino Shares, or any rights over such Comino Shares immediately prior to 7

December 2005, being the commencement of the Offer Period; (b) has acquired or

agreed to acquire any Comino Shares (or rights over Comino Shares) during the

Offer Period, (c) is interested in or has any rights to subscribe for Comino

Shares (d) holds any short position under a derivative referenced to Comino

Shares, (e) is a party to any agreement to sell or any delivery obligation or

right to require another person to purchase or take delivery of any Comino

Shares, or (f) has borrowed or lent, save for borrowed shares which have been

either on-lent or sold, any Comino Shares.

Extension of the Offer

Civica also announces that the Offer is being extended for 14 days and will

remain open for acceptance until the next closing date which will be 1.00 p.m.

on 24 January 2006. The Offer remains subject to the terms and conditions set

out in the Offer Document dated 20 December 2005 and, in the case of Comino

Shares held in certificated form, the Form of Acceptance.

Comino Shareholders who have not yet accepted the Offer, and wish so to do, are

urged to do so as soon as possible.

Comino Shareholders who hold their Comino Shares in certificated form, who wish

to accept the Offer and have not done so, should complete their Forms of

Acceptance and return them by post or (during normal business hours only) by

hand to Capita Registrars, Corporate Actions, PO Box 166, The Registry, 34

Beckenham Road, Beckenham, Kent BR3 4TH as soon as possible and, in any event,

so as to be received no later than 1.00 p.m. on 24 January 2006, by following

the procedure set out in paragraph 16(a) of Part II of the Offer Document.

Additional Forms of Acceptance are available from Capita Registrars by telephone

on 0870 162 3121 (or +44 20 8639 2157 if telephoning from outside the UK) or at

the address referred to above.

Comino Shareholders who hold their Comino Shares in uncertificated form (that

is, in CREST), who wish to accept the Offer and have not done so, should make

their acceptance electronically through CREST so that the TTE instruction

settles no later than 1.00 p.m. on 24 January 2006, by following the procedure

set out in paragraph 16(b) of Part II of the Offer Document. Comino Shareholders

who are CREST sponsored members, should refer to their CREST sponsor before

taking any action as only their CREST sponsor will be able to send the necessary

TTE instruction to CRESTCo in relation to their Comino Shares.

The expressions used in this announcement, unless the context otherwise

requires, bear the same meaning as in the Offer Document dated 20 December 2005.

This announcement does not constitute an offer to sell or the solicitation of an

offer to subscribe for or buy any security, nor is it a solicitation of any vote

or approval in any jurisdiction, nor shall there be any sale, issuance or

transfer of the securities referred to in this announcement in any jurisdiction

in contravention of applicable law.

Investec, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting for Civica and no one else in connection

with the Offer and will not be responsible to anyone other than Civica for

providing the protections afforded to clients of Investec nor for providing

advice in connection with the Offer or the contents of this announcement, or any

matter referred to herein.

Close Brothers, which is authorised and regulated in the United Kingdom by the

Financial Services Authority, is acting for Comino and no one else in connection

with the Offer and will not be responsible to anyone other than Comino for

providing the protections afforded to clients of Close Brothers nor for

providing advice in connection with the Offer or the contents of this

announcement, or any matter referred to herein.

The release, publication or distribution of this announcement in jurisdictions

other than the United Kingdon may be restricted by law and therefore persons in

such jurisdictions into which this announcement is released, published or

distributed should inform themselves about, and observe, such restrictions. And

failure to comply with the restrictions may constitute a violation of securities

laws of any such jurisdiction.

Unless otherwise determined by Civica and permitted by applicable law and

regulation, the Offer is not being, and will not be, made, directly or

indirectly, in, into or from, or by use of the mails of, or by any means or

instrumentality (including, without limitation, facsimile transmission, telex,

telephone or email) of interstate or foreign commerce of, or by any facility of

a national securities exchange of, nor will it be made in, into or from the

United States, Canada, Australia, Ireland or Japan or any other jurisdiction if

to do so would constitute a violation of the relevant laws of such jurisdiction

and the Offer will not be capable of acceptance by any such use, means,

instrumentality or facilities. Accordingly, copies of this announcement, the

Offer Document, the Form of Acceptance and any other documents relating to the

Offer are not being, and must not be, directly or indirectly, mailed,

transmitted or otherwise forwarded, distributed or sent, in whole or in part,

in, into or from the United States, Canada, Australia, Ireland or Japan or any

other jurisdiction if to do so would constitute a violation of the relevant laws

of such jurisdiction and persons receiving such documents (including custodians,

nominees and trustees) must not directly or indirectly mail, transmit or

otherwise forward, distribute or send them in, into or from any such

jurisdiction as to do so may invalidate any purported acceptance of the Offer.

Dealing Disclosure Requirements

Under the provisions of Rule 8.3 of the City Code, if any person is, or becomes,

"interested" (directly or indirectly) in 1 per cent. or more of any class of

"relevant securities" of Comino all "dealings" in any "relevant securities" of

Comino (including by means of an option in respect of, or a derivative

referenced to, any such "relevant securities") must be publicly disclosed by not

later than 3.30 p.m. (London time) on the London business day following the date

of the relevant transaction. This requirement will continue until the date on

which the offer becomes, or is declared, unconditional as to acceptances, lapses

or is otherwise withdrawn or on which the Offer Period otherwise ends. If two or

more persons act together pursuant to an agreement or understanding, whether

formal or informal, to acquire an "interest" in "relevant securities" of Comino,

they will be deemed to be a single person for the purpose of Rule 8.3. Under the

provisions of Rule 8.1 of the City Code, all "dealings" in "relevant securities"

of Comino by Civica or Comino, or by any of their respective "associates", must

be disclosed by no later than 12.00 noon (London time) on the London business

day following the date of the relevant transaction. A disclosure table, giving

details of the companies in whose "relevant securities" "dealings" should be

disclosed, and the number of such securities in issue, can be found on the

Takeover Panel's website at

www.thetakeoverpanel.org.uk.

"Interests in securities" arise, in summary, when a person has long economic

exposure, whether conditional or absolute, to changes in the price of

securities. In particular, a person will be treated as having an "interest" by

virtue of the ownership or control of securities, or by virtue of any option in

respect of, or derivative referenced to, securities. Terms in quotation marks

are defined in the City Code, which can also be found on the Panel's website. If

you are in any doubt as to whether or not you are required to disclose a

"dealing" under Rule 8, you should consult the Panel.

Enquiries

Civica plc - Simon Downing / Mike Stoddard 020 7760 2800

Buchanan Communications - Tim Thompson / Nicola Cronk 020 7466 5000

Investec - Andrew Pinder / David Currie 020 7597 5970

Comino Group plc - Garth Selvey / Paul Clifford 01628 525 433

Binns & Co PR Ltd - Peter Binns / Paul McManus 020 7153 1485

Close Brothers - Peter Alcaraz / James Davies 020 7655 3100

This information is provided by RNS

The company news service from the London Stock Exchange

END

OUPAKKKNDBKBODD

Cmo (LSE:CMO)

Historical Stock Chart

From Sep 2024 to Oct 2024

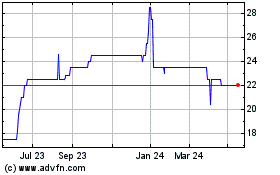

Cmo (LSE:CMO)

Historical Stock Chart

From Oct 2023 to Oct 2024