TIDMCCP

RNS Number : 3111B

Celtic PLC

19 September 2018

Celtic PLC

Results for the year ended 30 June 2018

SUMMARY OF THE RESULTS

Operational Highlights

-- Winner of the Scottish Domestic "Double Treble" and our

seventh consecutive SPFL Premiership title

-- Qualified for the UEFA Champions League group stages for the second consecutive season

-- Finished third in the UEFA Champions League group stage,

qualifying for the round of 32 of the Europa League

-- 32 home matches (including the Scott Brown Testimonial) played at Celtic Park (2017: 31)

Financial Highlights

-- Group revenue increased by 12.1% to GBP101.6m (2017: GBP90.6m)

-- Operating expenses including labour increased by 14.1% to GBP87.1m (2017: GBP76.3m)

-- Gain on sale of player registrations of GBP16.5m (2017: GBP2.3m)

-- Acquisition of player registrations of GBP16.6m (2017: GBP13.8m)

-- Profit before taxation of GBP17.3m (2017: GBP6.9m)

-- Year-end cash net of bank borrowings of GBP36.1m (2017: GBP17.9m)

-- Year-end net cash, net of debt and debt like items, of GBP27.0m (2017: GBP13.4m)(1)

(1) net cash, net of debt like items, is represented by cash net

of bank borrowings of GBP36.1m (2017: GBP17.9m) further adjusted

for other debt like items, namely the net player trading balance,

other loans and remuneration balances owed to certain personnel at

the balance sheet date.

For further information contact:

Celtic plc

Ian Bankier, Celtic Tel: 0141 551 4235

plc

Peter Lawwell,

Celtic plc

Iain Jamieson,

Celtic plc

Canaccord Genuity Limited, Nominated

Adviser

Simon Bridges Tel: 0207 523 8000

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

CHAIRMAN'S STATEMENT

These results, which declare record sales revenue of GBP101.6m

(2017: GBP90.6m) and a profit before taxation of GBP17.3m (2017:

GBP6.9m), reflect a financial year in which everything went

well.

On behalf of the Board I congratulate Brendan Rodgers, his staff

and the players on making history for a second successive year,

achieving a historic "Double Treble", a seventh consecutive League

Championship and consecutive qualifications for the group stages of

the UEFA Champions League. Everything that happens on the pitch is

supported across the Club and I also congratulate the executive

management team and all the staff at the Club.

The Board considers that the Group's proven strategy of

investment in football operations, whilst maintaining a

self-sustaining financial model, has provided a stable platform for

the success enjoyed in the year under review. This approach remains

entirely appropriate for us, as we seek to continue to deliver

football success and, in turn, shareholder value.

The year-end cash net of bank borrowings was GBP36.1m (2017:

GBP17.9m), which equates to a net funding position of GBP27.0m

(2017: GBP13.4m) when adjusted for debt and debt like items (as

defined in the Summary of the Results). This allows the Board to

plan for the unexpected and manage the immediate disappointment of

failing to qualify for the Group Stages of the Champions

League.

In my last annual report I referred to our vulnerability to the

growing financial power of a number of key constituencies within

the European Game. These circumstances are unchanged and we remain

watchful of events that unfold. Through Peter Lawwell's continued

involvement in the Board of the European Club Association, the Club

Competitions Committee at UEFA and the Professional Football

Strategy Council of UEFA, the Club and the game in Scotland are

well represented in this very important arena.

During the year, we made prudent and considered investments in

our infrastructure at Celtic Park, including the completion of a

new playing surface to suit the manager's desired style of play,

new LED floodlighting to comply with the UEFA elite requirements

and an updated sound system. Celtic Park's reputation as one of the

foremost football arenas in the world, with our supporters

recognised as the best in the world by FIFA, is something we can

all be proud of.

The Club continues to support the important work of Celtic FC

Foundation and we all share the same sense of pride in the

generosity of Celtic supporters, which the Foundation harnesses to

help so many people at home and abroad. It is often said that

Celtic is a club like no other and the efforts of Celtic supporters

and the Foundation is the best example of that.

I thank all of our supporters, shareholders, sponsors, partners

and colleagues for their contribution to another successful year

for the Club. We will continue to work together to develop our club

for the long term.

Ian P Bankier

19 September 2018

Chairman

CHIEF EXECUTIVE'S REVIEW

Each year, our key football objective is success in all three

domestic competitions and in the UEFA Champions League. Building on

the remarkable Invincible season last year, the Club made history

again this year by winning the "Double Treble" for the first time

in Scottish football history. Added to that, the team qualified for

and performed well in the group stages of the UEFA Champions

League, competing with two of the strongest teams in the world and

qualifying for the last 32 of the UEFA Europa League. I

congratulate Brendan, his staff, the players and everyone at the

Club for these remarkable achievements.

The Club recognises that success on the pitch leads to success

off the pitch, which is why the Board is committed to investing in

our football operations. Our ambition remains to create a world

class football club. Our success on the pitch this year has allowed

us to commit, not only to fees for the transfer of player

registrations (GBP16.6m, rising from GBP13.8m in 2017), but also to

player, football management, coaching, recruitment, medical,

performance, sports science and the youth academy costs. Total

labour costs in 2018 increased by GBP7.1m, from GBP52.2m in 2017 to

GBP59.3m (14%), largely due to increases in the football

department. This has allowed the Club to retain key football

personnel including Kristoffer Ajer, Kieran Tierney, Calum

McGregor, Tom Rogic and Leigh Griffiths on long term contracts.

We continue to search the world for talented players to play the

Celtic way, such as Odsonne Edouard who joined the Club for a Club

record transfer fee. Player recruitment and development continues

to be fundamental to the Club. Our objective is always to bring

players to the Club who will improve the squad. Given the quality

of our existing squad that is a challenging task, made more

difficult by hyper-inflation in transfer fees and player salaries

in the market. Nevertheless, our objective is to invest everything

that we can into the football operation without putting the Club at

risk.

For season 2018/19, everyone at the Club was disappointed not to

qualify for the Group Stages of the Champions League. As we shared

the successes of the last two seasons, we share in that

disappointment, but given the Club's strategy over many years we

have financial reserves to rely upon as we continue to look to the

future with ambition and optimism.

Our long term strategy enables us to continue to invest in

player retention, player recruitment, stadium infrastructure and

everything that is needed to develop the Club for future

generations and to continue to deliver success. We have an

excellent first team squad and in the Youth Academy we have the

next generation of exciting young players such as Mikey Johnston,

Karamoko Dembele and many others, all of whom are eager to follow

in the footsteps of Kieran Tierney, James Forrest and Calum

McGregor in becoming Champions League players for Celtic Football

Club.

In closing I would like to record my continued appreciation for

our Club captain, Scott Brown, who celebrated his Testimonial

Season during the year. Scott has served Celtic brilliantly over

the past decade. He has been a fantastic Celtic captain, doing so

much for the Club on and off the pitch in this role. Scott's

dedication and commitment is an inspiration to everyone at the Club

as we work to deliver success for the Celtic support.

Peter Lawwell

19 September 2018

Chief Executive

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

2018 2017

Note GBP000 GBP000

CONTINUING OPERATIONS:

Revenue 2 101,573 90,639

Operating expenses (before intangible asset

transactions and exceptional items) 2 (87,083) (76,329)

Profit from trading before intangible asset

transactions and exceptional items 14,490 14,310

Exceptional operating expenses 3 (4,141) (1,526)

Amortisation of intangible assets (8,768) (7,546)

Profit on disposal of intangible assets 16,454 2,279

Operating profit 18,035 7,517

Finance income 216 204

Finance expense (980) (824)

Profit before tax 17,271 6,897

Income tax expense 5 (1,848) -

--------- ---------

Profit and total comprehensive income for the

year 15,423 6,897

Basic earnings per Ordinary Share for the year 6 16.47p 7.38p

Diluted earnings per Share for the year 6 11.72p 5.46p

CONSOLIDATED BALANCE SHEET

2018 2017

GBP000 GBP000

Assets

Non-current assets

Property, plant and equipment 58,265 56,332

Intangible assets 20,963 13,927

Trade receivables 4,397 -

83,625 70,259

======== ========

Current assets

Inventories 2,407 2,414

Trade and other receivables 21,261 12,284

Cash and cash equivalents 42,563 24,505

-------- --------

66,231 39,203

======== ========

Total assets 149,856 109,462

======== ========

Equity

Issued share capital 27,132 27,107

Share premium 14,720 14,657

Other reserve 21,222 21,222

Accumulated profits/ (losses) 9,860 (5,563)

-------- --------

Total equity 72,934 57,423

======== ========

Non-current liabilities

Borrowings 6,250 6,450

Debt element of Convertible Cumulative

Preference Shares 4,208 4,232

Trade and other payables 10,302 5,940

Provisions 2,309 1,543

Deferred income 86 115

-------- --------

23,155 18,280

======== ========

Current liabilities

Trade and other payables 27,005 10,435

Current borrowings 300 304

Provisions 2,442 658

Deferred income 24,020 22,362

-------- --------

53,767 33,759

======== ========

Total liabilities 76,922 52,039

======== ========

Total equity and liabilities 149,856 109,462

======== ========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Other Capital Retained

capital premium reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Equity shareholders'

funds

as at 1 July 2016 24,316 14,611 21,222 2,781 (12,460) 50,470

Share capital issued 1 46 - - - 47

Reduction in debt element

of convertible cumulative

preference shares following

conversion 9 - - - - 9

Transfer from capital

reserve 2,781 - - (2,781) - -

Profit and total comprehensive

income for

the year - - - - 6,897 6,897

Equity shareholders'

funds

as at 30 June 2017 27,107 14,657 21,222 - (5,563) 57,423

Share capital issued 1 63 - - - 64

Reduction in debt element

of convertible cumulative

preference shares following

conversion 24 - - - - 24

Profit and total comprehensive

income for the year - - - - 15,423 15,423

Equity shareholders'

funds

as at 30 June 2018 27,132 14,720 21,222 - 9,860 72,934

======== ======== ======== ======== ========= ======

CONSOLIDATED CASH FLOW STATEMENT

2018 2017

Note GBP000 GBP000

Cash flows from operating activities

Profit for the year 15,423 6,897

Income tax expense 5 1,848 -

Depreciation 1,977 1,664

Amortisation of intangible assets 8,768 7,546

Impairment of intangible assets 214 287

Reversal of prior period impairment charge - (64)

Profit on disposal of intangible assets (16,454) (2,279)

Loss on disposal of property, plant and

equipment - 198

Net Finance costs 764 620

--------- --------

12,540 14,869

(Increase) / decrease in inventories 7 (525)

(Increase) in receivables (6,142) (687)

Increase in payables and deferred income 17,378 2,435

--------- --------

Cash generated from operations 23,783 16,092

Tax paid (707) -

Net Interest paid (47) (95)

--------- --------

Net cash flow from operating activities 23,029 15,997

--------- --------

Cash flows from investing activities

Purchase of property, plant and equipment (3,461) (2,737)

Purchase of intangible assets (10,645) (9,889)

Proceeds from sale of intangible assets 9,821 11,382

--------- --------

Net cash used in investing activities (4,285) (1,244)

--------- --------

Cash flows from financing activities

Repayment of debt (200) (200)

Dividend on Convertible Cumulative Preference

Shares (486) (498)

--------- --------

Net cash used in financing activities (686) (698)

--------- --------

Net increase in cash equivalents 18,058 14,055

Cash and cash equivalents at 1 July 2017 24,505 10,450

--------- --------

Cash and cash equivalents at 30 June

2018 42,563 24,505

========= ========

NOTES TO THE FINANCIAL STATEMENTS

1. BASIS OF PREPARATION

The financial information in this preliminary announcement has

been prepared in accordance with the recognition and measurement

requirements of International Financial Reporting Standards as

adopted for use in the EU (IFRSs) but does not include all of the

disclosures that would be required under IFRSs. The accounting

policies applied by the Group in this financial information are the

same as those applied by the Group in its financial statements for

the year ended 30 June 2017 and are those which will form the basis

of the 2018 financial statements.

2. REVENUE

2018 2017

GBP000 GBP000

The Group's revenue comprised:

Football and Stadium Operations 43,587 37,571

Merchandising 17,717 16,479

Multimedia and Other Commercial Activities 40,269 36,589

-------- --------

101,573 90,639

======== ========

3. EXCEPTIONAL OPERATING EXPENSES

The exceptional operating expenses of GBP4.14m (2017: GBP1.53m)

can be analysed as follows:

Exceptional operating expenses comprised 2018 2017

GBP000 GBP000

Impairment of intangible assets and other

prepaid costs 511 287

Reversal of prior period impairment charges - (64)

Onerous employment contracts 3,549 1,004

Compromise payments on contract termination 81 299

4,141 1,526

======== ========

The impairment of intangible assets, and the reversal of

impairment charges, relate to adjustments required as a result of

management's assessment of the carrying value of certain player

registrations relative to their current market value.

Onerous employment contact costs result from a situation where

the committed costs under that contract are assessed as exceeding

the economic benefits expected to be received by the Group over the

term of the contract.

Settlement agreements on contract termination are costs in

relation to exiting certain employment contracts.

4. DIVIDEND ON CONVERTIBLE CUMULATIVE PREFERENCE SHARES

A 6% non-equity dividend of GBP0.51m (2017: GBP0.51m), was paid

on 31 August 2018 to those holders of Convertible Cumulative

Preference Shares on the share register at 28 July 2018. A number

of shareholders elected to participate in the Company's scrip

dividend reinvestment scheme for the financial year to 30 June

2018. Those shareholders have received new Ordinary Shares in lieu

of cash. No dividends were payable or proposed to be payable on the

Company's Ordinary Shares.

During the year, the Company reclaimed GBPnil (2017: GBP0.02m)

in respect of statute barred preference dividends in accordance

with the Company's Articles of Association.

5. TAX ON ORDINARY ACTIVITIES

The provision for corporation tax as at 30 June 2018 is GBP1.14m

(2017: nil) which reflects a tax charge of GBP1.85m with payments

of GBP0.70m made in the year. There are no tax losses carried

forward (2017: GBP7.64m) and the available capital allowances pool

is approximately GBP10.50m (2017: GBP9.52m). These estimates are

subject to the agreement of the current and prior years'

corporation tax computations with H M Revenue and Customs.

6. EARNINGS PER SHARE

2018 2017

GBP000 GBP000

Reconciliation of earnings to basic earnings:

Net earnings attributable to equity holders

of the parent 15,423 6,897

Basic earnings 15,423 6,897

======== ========

Reconciliation of basic earnings to diluted

earnings:

Basic earnings 15,423 6,897

Non-equity share dividend 573 577

Reclaim of statute barred non-equity share

dividends - (19)

Diluted earnings 15,996 7,455

======== ========

No.'000 No.'000

Reconciliation of basic weighted average

number of ordinary shares to

diluted weighted average number of ordinary

shares:

Basic weighted average number of ordinary

shares 93,663 93,403

Dilutive effect of convertible shares 42,803 43,041

-------- --------

Diluted weighted average number of ordinary

shares 136,466 136,444

======== ========

Earnings per share of 16.47p (2017: 7.38p) has been calculated

by dividing the profit for the period of GBP15.4m (2017: GBP6.90m)

by the weighted average number of Ordinary Shares of 93.7m (2017:

93.4m) in issue during the year. Diluted earnings per share of

11.72p (2017: 5.46p) as at 30 June 2018 has been calculated by

dividing the profit for the period by the weighted average number

of Ordinary Shares, Convertible Cumulative Preference Shares and

Convertible Preferred Ordinary Shares in issue, assuming conversion

at the balance sheet date, if dilutive.

7. ANNUAL REPORT & FINANCIAL STATEMENTS

Copies of the Annual Report & Financial Statements together

with the Notice and Notes of the 2018 AGM will be issued to all

shareholders in due course.

The financial information set out above does not constitute the

Company's statutory financial statements for the years ended 30

June 2018 or 30 June 2017. The Independent Auditor's Reports on the

statutory financial statements for 2018 and 2017 were unqualified,

did not draw attention to any matters by way of emphasis, and did

not contain a statement under 498(2) or 498(3) of the Companies Act

2006. The statutory financial statements for 2017 have been filed

with the Registrar of Companies and those for 2018 will be

delivered to the Registrar of Companies in due course.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR EASNNFFEPEFF

(END) Dow Jones Newswires

September 19, 2018 11:15 ET (15:15 GMT)

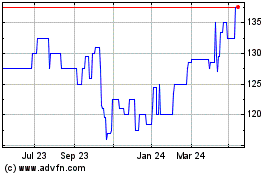

Celtic (LSE:CCP)

Historical Stock Chart

From Jan 2025 to Feb 2025

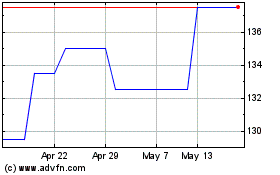

Celtic (LSE:CCP)

Historical Stock Chart

From Feb 2024 to Feb 2025