Computacenter PLC Q1 2016 Trading Update (8503V)

April 21 2016 - 2:00AM

UK Regulatory

TIDMCCC

RNS Number : 8503V

Computacenter PLC

21 April 2016

Computacenter plc

Q1 2016 Trading Update

21 April 2016

Computacenter plc ("Computacenter" or the "Group"), the provider

of IT infrastructure services that enables users, today publishes a

trading update for the first quarter to 31 March 2016. Figures

below are based on unaudited financial information for that

period.

The revenue results in the text below exclude the impact of our

subsidiary R.D. Trading Limited ("RDC") in 2016 and 2015, following

the Group's disposal of RDC on 2 February 2015. For comparison

purposes, results including RDC are shown within the table included

in the Appendix to this trading update.

Financial Performance

Revenue for the first quarter, on an as reported basis,

increased by 2% to GBP730.2 million (2015: GBP715.8 million). In

constant currency, this was flat on the prior year, with Group

Services revenue down by 1% and Group Supply Chain revenue growing

by 1%.

UK

Overall revenue in the UK was down 4% in the first quarter to

GBP348.5 million (2015: GBP361.3 million). Supply Chain revenue

reduced by 2% and Services revenue reduced by 5%. The Services

revenue decline was broadly in-line with our expectations and is

due to two factors. Firstly, the end of a large contract at the end

of Q1 last year, which has been highlighted previously, and

secondly, the large volume of new business take-on activity in the

first half of 2015. We expect our comparative performance against

2015 to improve as we go through 2016.

Germany

Total revenue in our German business increased by 7% in constant

currency to GBP281.2 million (2015: GBP261.8 million), with

Services revenue growing by 7% and Supply Chain revenue growing by

8%. As indicated previously we are expecting growth in our Services

business in Germany due to major contract wins in 2015 starting up

in the first half of 2016. We are also enthusiastic about potential

further wins in 2016 which would contribute to growth in the

future.

France

Revenue in France declined by 6% in constant currency to GBP88.7

million (2015: GBP94.2 million), with Supply Chain revenue

declining by 5% and Services revenue declining by 9%. Our French

business has continued the improved pre-tax profit performance seen

last year and while much work remains to be done, significant

progress is being achieved.

Financial Position

At the end of Q1 2016, Group net funds were GBP102.5 million

compared to GBP26.0 million at the end of Q1 2015. The GBP97.9

million return of value to shareholders was carried out prior to

the end of Q1 2015, therefore these figures are directly

comparable. This represents a cash out-flow of GBP18.3 million

since the 2015 year end (Q1 2015: Cash out-flow of GBP50 million)

which is lower than expected, partly due to foreign exchange

revaluation benefit for net funds denominated in EUR Euro, and

partly due to strong performance of our debtor collections which

were aided by the quarter end timing.

Group Outlook

As we highlighted in our 2015 final results we expect 2016 to be

a year of progress and we also expect to end the year with record

levels of net funds.

Our momentum in Germany and pleasing performance compared to the

past in France, looks set to continue. While the UK will have a

more challenging year particularly in the first half as previously

indicated, the new business pipeline is beginning to build.

Our next scheduled trading update will be the announcement of

the Group's Interim Results on 26 August 2016.

Enquiries

Computacenter plc

Mike Norris, Chief Executive 01707 631601

Tony Conophy, Finance Director 01707 631515

Tulchan Communications 020 7353 4200

James Macey White

Matt Low

APPENDIX

Change vs Q1 Change Q1 Change Q1 Change Q1 Change

2015 As Reported Constant As Reported Constant

* Currency * Currency

(incl ** (excl **

RDC) (incl RDC) (excl

RDC) RDC)

------------------ ------------- ---------- ------------- ----------

Supply Chain

Revenue

UK (4%) (4%) (2%) (2%)

Germany 12% 8% 12% 8%

France (2%) (5%) (2%) (5%)

Group 2% (0%) 3% 1%

------------------- ------------- ---------- ------------- ----------

Services Revenue

UK (6%) (6%) (5%) (5%)

Germany 11% 7% 11% 7%

France (6%) (9%) (6%) (9%)

Group 1% (1%) 1% (1%)

------------------- ------------- ---------- ------------- ----------

Total Revenue

UK (4%) (4%) (4%) (4%)

Germany 11% 7% 11% 7%

France (2%) (6%) (2%) (6%)

Group 2% (0%) 2% 0%

------------------- ------------- ---------- ------------- ----------

* Change vs Q1 revenues reported

at 2015 exchange rates

** Change vs Q1 revenues reported

at 2016 exchange rates

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTDBLFLQZFEBBZ

(END) Dow Jones Newswires

April 21, 2016 02:00 ET (06:00 GMT)

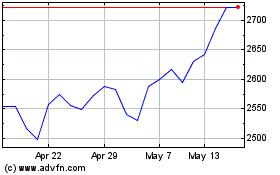

Computacenter (LSE:CCC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Computacenter (LSE:CCC)

Historical Stock Chart

From Jul 2023 to Jul 2024