Acquisition

November 28 2002 - 2:02AM

UK Regulatory

RNS Number:3922E

Computacenter PLC

28 November 2002

Computacenter plc

Proposed Acquisition of GE CompuNet in Germany

and GECITS in Austria from GE

Computacenter plc, the IT infrastructure and services provider, today announces

it has reached agreement with GE to acquire the businesses of GE CompuNet in

Germany and GECITS in Austria for an initial consideration of Euro 57 million

(#36.5 million).

Highlights of the Transaction:

* The acquisition fits well with Computacenter's strategy of expanding into

the major markets of continental Europe, enhancing its services capability

and growing its higher margin services business.

* On completion, Computacenter will have leading positions in the UK, France

and Germany and will be well positioned in Austria, Belgium and Luxembourg.

* GE CompuNet and GECITS Austria have strong relationships with major

corporate and public sector customers including many of the companies in the

DAX30 index.

* Initial consideration of Euro 57 million (#36.5 million) will be payable

at completion, with up to a further Euro 64 million (#41.0 million) being

payable contingent on the financial performance of the businesses being

acquired over 2003 and 2004.

* The acquisition, on a debt and cash free basis, will be financed from

Computacenter's internal cash resources. Completion of the acquisition,

which is subject to Computacenter shareholder and certain regulatory

approvals, is expected in early 2003.

* The businesses being acquired had combined 2001 revenues of Euro 1.2

billion (#770 million). GE CompuNet has approximately 4,000 employees and

GECITS Austria has approximately 250 employees.

* The acquisition is expected to be marginally earnings enhancing, even

after integration costs, in the year to 31 December 2003 and has the

potential to add significant shareholder value over the longer term.

Computacenter today confirms that its profit expectations for the year to 31

December 2002 remain unchanged.

Mike Norris, Chief Executive of Computacenter plc, commented:

"GE CompuNet is the German equivalent of Computacenter. It has a strong services

element in its portfolio and this supports Computacenter's strategy of growing

its services base and building contracted revenue streams. This acquisition

represents an important step forward in establishing Computacenter as Europe's

leading IT infrastructure services provider."

An analyst presentation will be held today at 10:00am at HSBC's offices,

Vintners Place, 68 Upper Thames Street, London EC4V 3BJ.

Enquiries:

Computacenter plc:

Mike Norris, Chief Executive 01707 631601

Tony Conophy, Finance Director 01707 631515

Investor Relations Enquiries:

Tessa Freeman, Computacenter plc 01707 631514

Media Enquiries:

Julie Foster, Tulchan Communications 020 7353 4200/07799 894262

HSBC:

Alastair Moreton, Corporate Finance 020 7336 9376

John Hannaford, Corporate Broking 020 7336 2006

Introduction

The Board of Computacenter plc announces that it has reached agreement with GE

to acquire GE CompuNet in Germany and GECITS in Austria (together referred to as

"GECITS" in this announcement), leading providers of IT infrastructure and

related services to corporate and public sector customers in Germany and Austria

(the "Acquisition").

The Acquisition will give Computacenter a leading position in the German market

and a significant presence in Austria, complementing Computacenter's existing

strengths in the UK and France. It will also enhance Computacenter's quality

portfolio of customer and vendor relationships and increase the scale of

Computacenter's services business.

The initial consideration for the Acquisition is Euro 57 million (#36.5 million)

on a cash and debt free basis, and is subject to downward adjustment on final

determination of the net asset value of GECITS at completion. Contingent

payments of up to a further Euro 64 million (#41.0 million) may also be payable,

depending on GECITS' financial performance in the years ending 31 December 2003

and 2004. These payments may be reduced by up to Euro 3 million (#1.9 million)

to cover integration costs incurred by Computacenter. Total consideration will

therefore be up to a maximum of Euro 121 million (#77.5 million). The

consideration for the Acquisition will be paid in cash and will be financed from

Computacenter's internal cash resources.

A circular will be posted to Computacenter shareholders as soon as practicable

to provide them with details of the Acquisition and to convene the Extraordinary

General Meeting expected to be held in late December to seek their approval for

the Acquisition.

Information on GECITS

GECITS is the largest vendor-independent provider of IT infrastructure and

related services in Germany and has a strong competitive position in Austria. GE

CompuNet is headquartered in Kerpen, near Cologne and GECITS Austria is

headquartered in Vienna. In the year ended 31 December 2001, GE CompuNet

accounted for 92% of the combined revenues of the two businesses.

For the year ended 31 December 2001, GECITS had revenues of Euro 1,242 million

and operating profits of Euro 17.2 million. As at 31 December 2001, GECITS had

net assets of Euro 82.7 million. The Acquisition agreement provides that the net

assets of GECITS at completion will be not less than Euro 95 million.

GECITS designs, implements and manages IT infrastructures for corporate and

public sector clients. Around a quarter of GECITS' revenues originate from the

delivery of services such as technology asset management, installation,

configuration, integration and the maintenance, management and operational

support of distributed IT infrastructures. The balance of GECITS' revenues

arises from the supply of IT hardware and software.

GE CompuNet has long-standing relationships with its major customers, including

many of Germany's leading companies. Its customer base is well spread across

industry sectors, including manufacturing, financial services, retail,

distribution, chemicals, pharmaceuticals and telecommunications as well as major

public sector institutions. GECITS Austria has also established a strong

position at the upper end of the corporate/public sector market in Austria.

Although the business is focused on large corporate accounts, no single customer

contributed more than 5% to GECITS' total annual revenue for the year ended

December 2001.

GECITS maintains strong relationships with leading IT manufacturers including

Compaq/HP, IBM, Toshiba and Fujitsu Siemens. It has also significantly developed

its position in the enterprise technology market over recent years, partnering

with key vendors such as Cisco, Sun Microsystems and EMC. The specialist

publication 'ComputerPartner' names GE CompuNet as Germany's largest

vendor-independent IT corporate reseller ('Systemhaus'). GECITS is highly

accredited by leading vendors for its breadth and depth of technical expertise.

GE CompuNet has approximately 4,000 permanent employees, while GECITS Austria

has approximately 250 permanent employees. Approximately two thirds of the total

workforce is employed in service-related or customer support roles.

In the recent past, GECITS has undertaken a number of significant initiatives

aimed at further strengthening its market position, including:

* Building its expertise in areas such as security, web computing, directory

services, digital document solutions, server/storage consolidation, voice/

data integration and desktop managed services. As a result the business has

achieved various manufacturers' distinctions, including the award of Cisco's

prestigious 'Gold Partner of the Year' to GE CompuNet in 2002.

* Integrating the back office operations of its regional offices to generate

scale efficiencies and greater management visibility and control.

* Acquiring a 37.5% stake from Computacenter in the International Computer

Group (ICG), a leading worldwide network of IT infrastructure services

providers. This network has enabled GECITS to develop its pan-European

capability and build working relationships with international partners.

Financial information on, and current trading of, GECITS

In the three years ended 31 December 2001, GECITS has achieved financial results

as follows:

Euro million 1999 2000 2001

Revenue 1,510.0 1,358.2 1,242.1

Operating profit 44.0 (35.2) 17.2

The 1999 performance in Germany reflected strong corporate demand, driven

primarily by the renewal cycle as companies replaced their IT infrastructures

prior to the year 2000. GE CompuNet added significant resources to cope with the

upswing in service activity and anticipated that this would continue in 2000.

In 2000, business slowed dramatically in the first half of the year, partly as a

result of a reduction in spending following the high IT infrastructure spending

in 1999 and partly due to lack of Y2K problems requiring support by GE

CompuNet's service engineers. GE CompuNet slipped into significant losses driven

by lower volumes and a high cost base built up in 1999. This excess capacity was

reduced in the second half of 2000 with a large reduction in staff numbers and

significantly reduced usage of external subcontractors. Combined with some

volume recovery, this led to an improved trading position by the end of 2000.

In 2001, despite difficult market conditions, GE CompuNet benefited from tighter

management controls, a significantly lower cost base and particular success in

the enterprise technology market. As a consequence it returned to profitability.

Despite the overall IT market trends from 1999 to 2001 in Austria being similar

to those experienced in Germany, management of GECITS Austria were able to

achieve a more stable earnings profile over this period. Profitability improved

significantly in 2001 driven largely by tighter control of costs.

In common with other major European countries, economic conditions in GECITS'

markets have been weaker in 2002 than in 2001 and this has been reflected in

activity levels within GECITS' business.

Background to and reasons for the Acquisition

Computacenter is a leading provider of vendor-independent IT infrastructure

services. It holds the number one position in the UK, the number two position in

France and has smaller operations in Belgium and Luxembourg. Since the late

1990s, a core element of Computacenter's stated strategy has been to strengthen

its services activities to complement its core product logistics business.

Average annual services growth has been over 20% per annum since 1998. For the

year ended 31 December 2001, Computacenter reported profit before tax and

exceptional items of #51.1 million on turnover of #2.0 billion.

In October 2001, Computacenter announced the acquisition of the UK operations

and the French services business of GE Capital IT Solutions. The acquisition

strengthened Computacenter's leading position in the UK and significantly

enhanced its service capability in France. At the same time Computacenter

announced the sale of its German operations to GE Capital IT Solutions. The

Directors believed that this business, which reported turnover of #63 million in

the eleven months to 30 November 2001, lacked the scale to compete effectively

in the German market.

The Directors of Computacenter consider GECITS to be a sound and attractive

business. It has a stable base of core customers who have continued to increase

their spend with GECITS, it has substantial recurring services revenues and it

benefits from experienced and capable management.

Nevertheless, Computacenter believes that there is potential to improve GECITS'

performance over the longer term, through the application of Computacenter's

considerable experience in this industry. Opportunities for improvement include

sales force refocussing, margin improvement and transfer of best practice in

contracted services.

While cost saving synergies will be small, the Directors believe the Acquisition

will strengthen Computacenter's relationships with IT vendors and improve its

offering to multinational customers.

The Directors expect that, even after integration costs, the Acquisition will be

marginally earnings enhancing in the year ended 31 December 2003 and has the

potential to add significant shareholder value over the longer term.

Terms of the Acquisition

The initial consideration for the Acquisition is Euro 57 million, payable at

completion. Such initial consideration is subject to subsequent downward

adjustment on a Euro for Euro basis upon final determination of the net asset

value of GECITS at completion, on a cash and debt free basis, to the extent that

it is less than Euro 95 million.

A contingent amount of up to a further Euro 64 million is also payable depending

on GECITS' financial performance in the years ending 31 December 2003 and 31

December 2004. The contingent payments for 2003 and 2004 will amount to 3 times

the excess of GECITS' EBIT for the relevant year over an EBIT threshold. For

2003 the threshold is Euro 10 million and for 2004 the threshold is Euro 10

million plus the amount (if any) by which 2003 EBIT falls short of Euro 10

million. The 2004 contingent payment would be made after deducting integration

costs (which fall within certain specific categories set out in the Acquisition

agreement) incurred by Computacenter in relation to GECITS over 2003 and 2004,

in aggregate up to a maximum deduction of Euro 3 million.

Total consideration will therefore be up to Euro 121 million, or up to Euro 118

million if Computacenter incurs the maximum Euro 3 million of integration costs.

The consideration for the Acquisition will be paid in cash and will be financed

from Computacenter's internal cash resources.

Completion of the Acquisition, which is subject to Computacenter shareholder and

certain regulatory approvals, is expected in early 2003.

Current trading and prospects

In its 2002 interim results announcement issued on 5 September 2002,

Computacenter made the following statement:

"As regards the outlook for the remainder of the year, we anticipate that market

conditions in both the UK and France will remain challenging. Whilst a further

deterioration in demand is unlikely, we are not yet detecting any signs of an

upturn. If current conditions continue, we expect profit performance for the

full year to be similar to the #51.1 million achieved last year, with any profit

growth being dependent upon an improvement in the market."

Computacenter's profit expectations for the year ending 31 December 2002 remain

unchanged.

Extraordinary General Meeting

Under the Listing Rules of the UK Listing Authority, in view of its size, the

Acquisition requires the approval of Computacenter shareholders in general

meeting. Accordingly a Circular and Notice of Extraordinary General Meeting,

expected to take place in late December, will be sent to shareholders as soon as

practicable.

Recommendation

The Computacenter Board of Directors, which has been advised by HSBC, considers

the Acquisition to be in the best interests of Computacenter and its

shareholders as a whole. In providing advice to the Board, HSBC has placed

reliance upon the Directors' commercial assessments of the Acquisition.

Accordingly, the Directors will be recommending unanimously that shareholders

vote in favour of the resolution to be proposed at the Extraordinary General

Meeting, as they have undertaken to do in respect of interests totalling

71,268,128 Computacenter shares representing 38.59 per cent. of Computacenter's

current issued share capital.

This announcement does not constitute an offer or invitation to purchase shares

or securities.

This press announcement contains certain 'forward-looking' statements including

statements about the feasibility and benefits of the acquisition of GECITS by

Computacenter. These statements are naturally subject to uncertainty and changes

in circumstances. Because these forward-looking statements are subject to risks

and uncertainties, actual results may vary materially from the expectations

contained in this announcement. Many of the risks and uncertainties relate to

factors that are beyond Computacenter's ability to control or estimate

precisely. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only at the date of this announcement.

Computacenter does not undertake any obligation to publicly release any

revisions to these forward-looking statements to reflect events or circumstances

after the date of this announcement.

Nothing in this press announcement should be construed or be interpreted to mean

that the earnings of Computacenter for the current or future years will

necessarily match or exceed the historical or published earnings of

Computacenter.

HSBC Bank plc, which is regulated in the United Kingdom by the Financial

Services Authority Limited, is acting exclusively for Computacenter and no one

else in relation to the matters referred to in this press announcement and will

not be responsible to anyone other than Computacenter for providing the

protections afforded to customers of HSBC, or for providing advice in relation

to the matters referred to in this press announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQIFFVFLDLDFIF

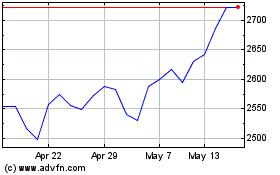

Computacenter (LSE:CCC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Computacenter (LSE:CCC)

Historical Stock Chart

From Jul 2023 to Jul 2024