TIDMBRK

RNS Number : 4569M

Brooks Macdonald Group PLC

12 January 2023

12 January 2023

BROOKS MACDONALD GROUP PLC

Quarterly Announcement of Funds under Management and Half Year

Trading Update

Notice of Half Year results

"FUM up 4.5% to GBP16.2 billion with net flows at an annualised

4.0% for the quarter"

Brooks Macdonald Group plc ("Brooks Macdonald" or "the Group")

today publishes an u pdate on its Funds under Management ("FUM")

for its second quarter ended 31 December 2022, together with a

Trading Update for the half year .

FUM update

For the quarter ended 31 December 2022, the Group's FUM was up

4.5% with net inflows of GBP0.2 billion (an annualised rate of

4.0%), reflecting continued momentum in new business, and positive

investment performance of GBP0.5 billion, leading to a closing FUM

of GBP16.2 billion (30 September 2022: GBP15.5 billion).

Highlights for the quarter included:

-- Within UKIM, Platform MPS (including BM Investment Solutions)

continued to gain market share, recording strong net flows in the

period (annualised rate of 52.5%), and has a robust pipeline;

-- UK BPS experienced net outflows in the quarter due primarily

to continued economic uncertainty making clients more cautious and

therefore taking longer to commit funds;

-- The Group completed two acquisitions in the quarter -

Integrity Wealth Solutions and Adroit Financial Planning -

demonstrating its ability to identify and integrate high quality

businesses that build capability and broaden the offering;

-- Investment performance for the quarter was 3.5%, in line with

the benchmark MSCI PIMFA Private Investor Balanced Index.

Trading update

The Group traded solidly in the first half, despite the

difficult prevailing macroeconomic environment and market

conditions, and underlying profit and underlying profit margin

(year to date and full year forecast) are running in line with

current market expectations.

Andrew Shepherd, CEO of Brooks Macdonald commented:

"I am pleased to report that we have delivered c.GBP350m of

positive net flows so far this financial year, demonstrating the

continuing demand from our clients and intermediaries for high

quality investment management, despite the challenging

macroeconomic environment and difficult market conditions. It has

been a solid half year for the Group, with positive organic growth

and two acquisitions completed in the period, underlining our

continued progress towards our strategic ambitions. We remain in a

strong position to take advantage of the great opportunities ahead

for Brooks Macdonald."

Analysis of fund flows by service over the period

Quarter to 31 December 2022 (GBPm)

Opening Organic Investment Closing Organic Total

FUM net new performance FUM net new mvmt

1 Oct 22 business in the period 31 Dec business

22

---------- ---------- --------------- -------- ---------- -------

BPS 8,344 (82) 297 8,559 (1.0)% 2.6%

---------- ---------- --------------- -------- ---------- -------

MPS Custody 948 2 25 975 0.2% 2.8%

MPS Platform 2,262 297 73 2,632 13.1% 16.4%

---------- ---------- --------------- -------- ---------- -------

MPS total 3,210 299 98 3,607 9.3% 12.4%

---------- ---------- --------------- -------- ---------- -------

UKIM discretionary 11,554 217 395 12,166 1.9% 5.3%

---------- ---------- --------------- -------- ---------- -------

Funds - DCF 407 (17) 14 404 (4.2)% (0.7)%

Funds - Other 1,404 (24) 29 1,409 (1.7)% 0.4%

---------- ---------- --------------- -------- ---------- -------

Funds total 1,811 (41) 43 1,813 (2.3)% 0.1%

---------- ---------- --------------- -------- ---------- -------

UKIM total 13,365 176 438 13,979 1.3% 4.6%

---------- ---------- --------------- -------- ---------- -------

International 2,159 (20) 108 2,247 (0.9)% 4.1%

---------- ---------- --------------- -------- ---------- -------

Total 15,524 156 546 16,226 1.0% 4.5%

---------- ---------- --------------- -------- ---------- -------

Total investment performance 3.5%

----------------------------------------------------------------------- -------------------

MSCI PIMFA Private Investor Balanced Index(1) 3.5%

----------------------------------------------------------------------- -------------------

Six months to 31 December 2022 (GBPm)

Opening Organic net new Total Closing Organic Total

FUM business Inv. FUM net new mvmt

Perf. business

-------- -------------------- ------- -------- ---------- -------

1 Jul Q1 Q2 Total 31 Dec

22 22

-------- ------ ----- ----- ------- -------- ---------- -------

BPS 8,581 (6) (82) (88) 66 8,559 (1.0)% (0.3)%

-------- ------ ----- ----- ------- -------- ---------- -------

MPS Custody 960 (3) 2 (1) 16 975 (0.1)% 1.6%

MPS Platform 2,053 243 297 540 39 2,632 26.3% 28.2%

-------- ------ ----- ----- ------- -------- ---------- -------

MPS total 3,013 240 299 539 55 3,607 17.9% 19.7%

-------- ------ ----- ----- ------- -------- ---------- -------

UKIM discretionary 11,594 234 217 451 121 12,166 3.9% 4.9%

-------- ------ ----- ----- ------- -------- ---------- -------

Funds - DCF 439 (14) (17) (31) (4) 404 (7.1)% (8.0)%

Funds - Other 1,418 (20) (24) (44) 35 1,409 (3.1)% (0.6)%

-------- ------ ----- ----- ------- -------- ---------- -------

Funds total 1,857 (34) (41) (75) 31 1,813 (4.0)% (2.4)%

-------- ------ ----- ----- ------- -------- ---------- -------

UKIM total 13,451 200 176 376 152 13,979 2.8% 3.9%

-------- ------ ----- ----- ------- -------- ---------- -------

International 2,216 (9) (20) (29) 60 2,247 (1.3)% 1.4%

-------- ------ ----- ----- ------- -------- ---------- -------

Total 15,667 191 156 347 212 16,226 2.2% 3.6%

-------- ------ ----- ----- ------- -------- ---------- -------

Total investment performance 1.4%

----------------------------------------------------------------------- -------------------

MSCI PIMFA Private Investor Balanced Index(1) (0.3)%

----------------------------------------------------------------------- -------------------

(1) Capital-only index.

Notice of Half Year results

The Group intends to issue its preliminary statement of half

year results for the period ended 31 December 2022 on Thursday 2

March 2023.

An analyst meeting will be held at 9.30am on Thursday, 2 March

2023. Please contact Katherine Bell at FTI Consulting on 07976

870961 or e-mail brooksmacdonald@fticonsulting.com for further

details.

Enquiries to:

Brooks Macdonald Group plc www.brooksmacdonald.com

Andrew Shepherd, CEO 020 7659 3492

Ben Thorpe, Chief Financial Officer

Peel Hunt LLP (Nominated Adviser and

Broker)

Paul Shackleton / Andrew Buchanan / John

Welch 020 7418 8900

FTI Consulting brooksmacdonald@fticonsulting.com

Edward Berry / Laura Ewart / Katherine 07703 330199 / 07711

Bell 387085 / 07976 870961

Notes to editors

Brooks Macdonald Group plc, through its various subsidiaries,

provides leading investment management services in the UK and

internationally. The Group, which was founded in 1991 and began

trading on AIM in 2005, had discretionary Funds under Management of

GBP16.2 billion as at 31 December 2022.

Brooks Macdonald offers a range of investment management

services to private high net worth individuals, pension funds,

institutions, charities and trusts. The Group also provides

financial planning as well as international investment management,

and acts as fund manager to a range of onshore and international

funds.

The Group has fifteen offices across the UK and Crown

Dependencies including London, Birmingham, Cheltenham, East Anglia,

Exeter, Leeds, Manchester, Nuneaton, Southampton, Tunbridge Wells,

Scotland, Wales, Jersey, Guernsey and Isle of Man.

LEI: 213800WRDF8LB8MIEX37

www.brooksmacdonald.com / @BrooksMacdonald

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPUPAGUPWGRG

(END) Dow Jones Newswires

January 12, 2023 02:00 ET (07:00 GMT)

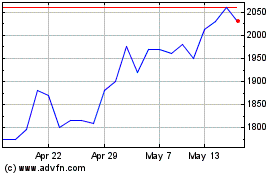

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Jul 2023 to Jul 2024